Drone Software Market by Solution (Application, System), Platform (Defense & Government, Commercial, Consumer, Architecture (Open Source, Closed Source), Deployment (Onboard Drone, Ground-Based), and Region- Global Forecast to 2027

Updated on : Oct 22, 2024

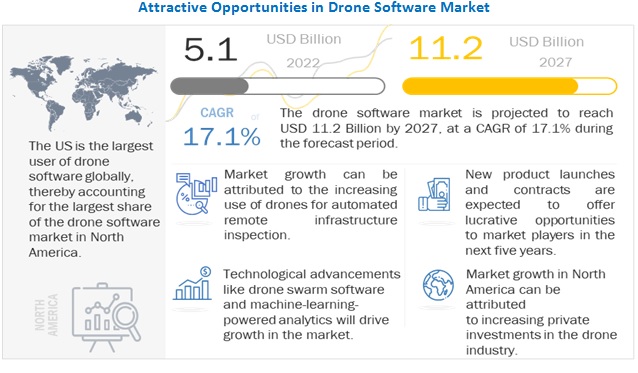

The Drone Software Market size is projected to grow from USD 5.1 billion in 2022 to USD 11.2 billion by 2027, at a compound annual growth rate (CAGR) of 17.1% from 2022 to 2027.

Revolutionizing agriculture with drone-powered solutions and Increasing private investments in drone industry are some of the factors fueling the growth of the market. Companies operating in the data processing, workflow analytics, flight planning, operation & fleet management, data capture and SDK’s sectors are making efforts to integrate application software into the drone for the smooth and successful execution of various drone applications.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic has been unprecedented on a global scale. The consequences have been wide-reaching, particularly for aviation. The COVID-19 pandemic has fueled the growth of the market for drone software for applications such as mapping, package delivery, and inspection During the COVID-19 pandemic, various countries have realized the potential of drone technologies and have provided relaxation in terms of their regulation. In addition, the hardware, technology, and services being cost-efficient and easy to access compared to traditional methods have led to the emergence of drone startups and drone service providers in the aviation industry. The increasing growth in the e-commerce sector and the rising demand from consumers for same-day delivery have led to a rise in the number of drone delivery companies. In addition, various industrial sectors such as logistics & transportation, retail & food, and healthcare & pharmaceuticals have started to realize the importance of drone deliveries, ultimately giving rise to new entrant

Drone software Market Dynamics:

How growth of Infrastructure Inspection affect the drone softtware companies?

Inspection is becoming an important part of the UAS industry. Drone pilots primarily use cameras to visually inspect the equipment, but photogrammetry software assists in the inspection. On a small scale, drones can help create a detailed map of a roof, and RGB and IR sensors can help to detect areas with leaks or poor insulation coverage. On a bigger scale, for example, the energy industry can use aerial maps to inspect solar farms, spotting problem spots in the solar panels with the aid of infrared imagery. The photogrammetry software uses node points to map the area, which is then developed into a 3D model using the software.

Until now, inspecting a vertically high industrial infrastructure, such as cell towers and wind turbines, and a large area spanning structures, such as pipelines, required transporting heavy equipment to remote areas as well as climbing towers for manned inspections, making the inspection tasks vulnerable to fatal injuries and liable for high insurance costs. Even with manual single drone operations, there are cases of inconsistencies in captured data. The following are the advantages of automated remote infrastructure inspection using drones:

- Consistent data – Often with manually captured images, the processed data is incomplete, or worse, requires the whole process to be repeated. Some inspection applications do use a single drone for image capturing but those are manually operated, often resulting in inconsistencies. This can be avoided using an automated drone.

- Less cost & increased efficiency – The deployment of automated drones offers minimal capital expenditures and increased operational efficiency. For instance, FlytBase, Inc. (India) provides commercial-off-the-shelf drones, enabling the customers to deploy drones at scale.

- Time efficiency – Manual inspection is a lengthy process. It may take multiple weeks for an inspector to write the field reports, identify and purchase the necessary materials, and schedule repair appointments for the damaged infrastructure. All these can be avoided using automated drone software.

How is increasing use of drone a concern for cyber security?

The illegal usage of drones has become a squeezing security worry across the world. Cybercriminals and other activists are embracing drone innovation and growing newly refined manners to perpetrate wrongdoing and psychological oppression. The utilization of drones for hostile reconnaissance has increased. These drones may also be adapted to carry Improvised Explosive Devices (IEDs).

Drones outfitted with unique hardware and software may likewise be utilized to introduce noxious malware on frameworks or upset framework’s activities, especially gadgets that are vulnerable to wireless protocols like Bluetooth.

To commit digital interruptions, cybercriminals may park drones on the top of a structure or other disguised area, including those that are in encased regions, generally beyond reach on foot and vehicle traffic which depicts many defense area establishments. Customary safety efforts including all actual insurance and biometric section frameworks are futile against drone-based network assaults

What opportunity can drone as airborne communication nodes bring in military missions?

Besides being sensor and shooter platforms, drones can also act as airborne communications nodes, similar to satellites, offering mobile network coverage for maneuvering military forces. This frees up manned systems to focus on higher-value missions while still providing a cost-effective way to maintain secure communications.

Drones will follow the paradigm change toward a network-centric warfare concept, seamlessly integrating into all three main areas of defense systems: sensor, shooter, and C2 network. By providing platforms for deploying sensors, weapons, and communications architecture, drones can enable the force commander to see first, understand first, act first, and finish decisively.

How stringent government regulations and lack of air traffic management challenges the drone software market?

Unmanned aerial systems (UAS) flight operations involve high-risk air travel, especially beyond the visual line of sight. Their operations over long distances increase the probability of accidents, property damage, and economic losses for companies. Hence, several countries have stringent regulations for the deployment of UAVs near airports, international borders, government buildings, no-fly zone areas, and temporary flight restriction areas due to a lack of air traffic management as well as safety and security issues. For instance, according to the Air Traffic Control Association (ATCA) of the US, the use of drones in civil airspace is one of the major challenges faced by the aviation industry of the country. Presently, drones are prohibited from flying in civil airspace except for certain drone software companies that have received exemptions to conduct tests and carry out demonstration flights.

In addition to regulation, the UAS industry has a lack of trained professionals to operate drones due to a low number of training and certification institutes. Also, the complex terrains and extreme environmental conditions in various parts of the globe make it difficult to deploy air transportation services. These factors hamper the growth of the drone software market.

Based on Platform, the commercial segment is projected to grow at the highest CAGR during the forecast period.

Based on platform, the drone software market has been segmented into defense & government, commercial, and consumer. The drone software market share has evolved over the recent years, with the increasing usage of drones in the commercial and defense sectors. The US Department of Defense currently operates more than 11,000+ drones in support of domestic training events and overseas contingency missions. These aircraft range in size, from the small RQ-11B Raven to the largest RQ/MQ-4 Global Hawk/Triton, which weighs more than 32,000 pounds.

Various companies in the drone software market are focusing on the development of industry-specific drones for use in agriculture, construction, and logistics. In the military sector, drones are increasingly being used in various tactics, including path spying, target detection, communication monitoring, and electronic disturbances. Companies such as Northrop Grumman (US) and General Atomics (US) provide military drones, along with the required software. Companies that provide software for commercial drones are expected to introduce innovative software for fleet management and autopilot functionalities.

Based on Architecture, the open source segment is projected to lead the drone software market from 2022 to 2027.

The drone software market has been segmented based on architecture into open source and closed source. Open-source software is available publicly and can be modified according to the requirements of the end user. Many drone users prefer this software because of the flexibility it offers. Drone building communities, such as Paparazzi UAV, Dronecode/PX4, and OpenDroneMap, offer open-source software, which allows the user to develop, customize, and repair drone functioning. This software is cheaper to build and generally does not require the user to depend on the company developing the software for any customizations. Closed source software is proprietary software that is available as a licensed subscription. End users get technical support from software developing companies. For instance, PrecisionHawk Inc. (US) developed closed source software— PrecisionAnalytics Agriculture —which is an aerial mapping and agronomy software that automatically processes all data to create 2D or 3D models, which can be analyzed with on-demand tools.

The North American region is projected to account for largest share of drone software during the forecast period.

The drone software market in the North American region is expected to witness substantial growth and register the highest CAGR during the forecast period. The growth of the drone software market in North America can be attributed to the increasing adoption of drones for commercial and defense applications. In recent years, drone software providers have been focusing on the development of software that are cost-effective and efficient, as, without the right software, one cannot manage a fleet of drones, perform automated BVLOS flights, or maintain the required flight data log for compliance purposes. n Canada, drones are used in diverse and risky environments to carry out atmospheric research such as weather and atmospheric gas sampling; emergency & disaster monitoring; cartography & mapping; agricultural spraying; and promotion & advertising. They are also used for oceanographic research; geophysical research; mineral exploration; imaging spectrometry; telecommunication relay platforms; reconnaissance activities; traffic & accident surveillance; search & rescue operations; aerial photography; weather reconnaissance; and flight research; along with surveying and inspecting remote power lines and pipelines.

To know about the assumptions considered for the study, download the pdf brochure

Top Drone Software Companies - Key Market Players

The major players in the drone software market are DJI (China), ESRI (US), Pix4D SA (Switzerland), DroneDeploy Inc. (US), PrecisionHawk, Inc. (US).

These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to further expand their presence in the drone software market.

Scope of the Drone Software Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 5.1 Billion |

|

Projected Market Size |

USD 11.2 Billion |

|

CAGR |

17.1% |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Solution, By Platform, By Architecture, By Deployment, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, Latin America, and Africa |

|

Companies covered |

DJI (China), ESRI (US), Pix4D SA (Switzerland), DroneDeploy Inc. (US), PrecisionHawk, Inc. (US), Skydio, Inc. (US), Skyward IO (US), Yuneec (China), Inc., AirMap Inc. (US), Delair (France), Sky-Future Ltd. (UK), Kespry (US) and DroneBase Inc. (US) among others |

|

Companies covered (Drone start-ups and drone software ecosystem) |

Altitude Angel (UK), DreamHammer Products LLC (US), Propeller Aerobotics Pty Ltd (Australia), Aloft Technologies, Inc. (US), Cyberhawk (UK), among others |

This research report categorizes the Drone software Market based on solution, platform, architecture, deployment, and region.

By Solution

- System

- Application

By Platform

- Defense & Government,

- Commercial

- Consumer

By Architecture

- Open Source

- Closed Source

By Deployment

- Onboard drones

- Ground-based

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Latin America

- Africa

Recent Developments

- In April 2022, ESRI launched StoryMaps, using ESRI’s mapping technology, this new software brings the geographic approach to any content that creators are passionate about. From documenting their ancestral journey to capturing aspects of daily life or planning a first big post-pandemic trip.

- In April 2022, DroneDeploy, Inc. partnered with Skydio, which combines DroneDeploy’s software with the dynamic capabilities of Skydio drones.

- In March 2022 Pix4D was awarded a competitive tender for Deutsche Bahn to provide solutions and services for upcoming railway infrastructure projects through the analysis and visualization of drone images. Pix4D will be using its products PIX4Dcloud, PIX4Dmapper, and PIX4Dmatic for processing and analyzing drone imagery for construction progress monitoring and quality assurance.

- In March 2022, PrecisionHawk partnered with ESRI, the global leader in location intelligence. This relationship will bring the very best in geospatial intelligence by integrating PrecisionHawk’s industry-leading AI with ESRI’s ArcGIS technology, the world’s most powerful mapping and spatial analytics software

- In March 2022, Skycatch and Ultimate Positioning Group Pty Ltd signed an exclusive partnership to distribute RPAS (remotely piloted aircraft system) technology in Australia and New Zealand.

Frequently Asked Questions (FAQ):

What is the current size of the drone software market?

The drone software market is projected to grow from USD 5.1 Billion in 2022 to USD 11.2 Billion by 2027, at a CAGR of 17.1% from 2022 to 2027

Who are the winners in the drone software market?

DJI (China), ESRI (US), Pix4D SA (Switzerland), DroneDeploy Inc. (US), PrecisionHawk, Inc. (US) are some of the winners in the market.

What is the COVID-19 impact on drone software market?

The impact of the COVID-19 pandemic has been unprecedented on a global scale. The consequences have been wide-reaching, particularly for aviation. The COVID-19 pandemic has fueled the growth of the market for drone software for applications such as mapping, package delivery, and inspection During the COVID-19 pandemic, various countries have realized the potential of drone technologies and have provided relaxation in terms of their regulation. In addition, the hardware, technology, and services being cost-efficient and easy to access compared to traditional methods have led to the emergence of drone startups and drone service providers in the aviation industry. The increasing growth in the e-commerce sector and the rising demand from consumers for same-day delivery have led to a rise in the number of drone delivery companies. In addition, various industrial sectors such as logistics & transportation, retail & food, and healthcare & pharmaceuticals have started to realize the importance of drone deliveries, ultimately giving rise to new entrant.

What are some of the technological advancements in the market?

Fog computing is the next step in conventional cloud computing. Fog computing is a decentralized computing technology that selects and moves compute, communication, storage, and control closer to the source of data generation, which is expected to help drone delivery service providers in drone hub management, collision prevention and safety, and handling security updates in mid-flight. It offers advantages such as virtualization, manageability, and efficiency. Current infrastructure restrictions can be solved by using fog computing, wherein security, network, compute, storage, and some other functions are distributed across the fog nodes.

Open-source software are source codes that are accessible for re-use, modification, and re-distribution. Open-source operating systems are platforms that can be customized according to the requirements of end-users. These kinds of operating systems are being increasingly used in the commercial and defense sectors. In the commercial sector, open-source operating systems are being used in various applications such as precision agriculture, inspections, and mapping. In the defense sector, open-source architecture is being used extensively, as military drone requires integrations of various payloads as per the requirement of the mission. Drone manufacturers provide customized software or make the required changes for the defense sector.

What are the factors driving the growth of the market?

Increasing use of drones for automated remote infrastructure inspection, revolutionizing agriculture with drone-powered solutions and use of drones to create digital replicas of sites and assets in renewable energy sector is driving the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

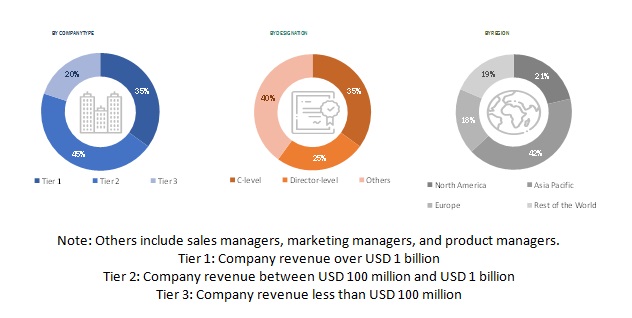

This research study on the drone software market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the drone software market as well as assess its growth prospects.

Secondary Research

The secondary sources referred for this research study on the drone software market included financial statements of drone software companies offering delivery drones software, drone software services, and software solution providers, along with various trade, business, and professional associations, among others. The secondary data was collected and analyzed to arrive at the overall size of the drone software market share, which was validated by primary respondents.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as chief X officers (CXOs), vice presidents (VPs), directors, regional managers, and business development and product development teams, distributors, and vendors.

Extensive primary research was conducted to obtain qualitative and quantitative information such as market statistics, average selling price, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to platform, solution, technologies, and regions. Stakeholders from the demand side include logistics companies, end consumers, healthcare industry, and quick-service restaurants who are willing to adopt drone delivery by participating in various trials. These interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market size forecasting, and data triangulation. These interviews also helped analyze the solution, platform, architecture, and deployment segments of the market for six key regions.

To know about the assumptions considered for the study, download the pdf brochure

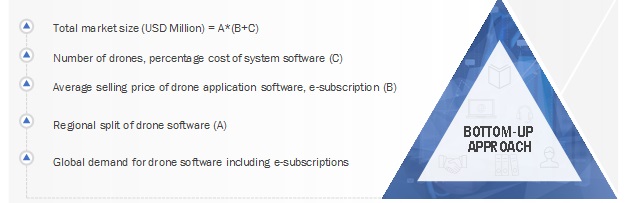

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the total size of the drone software market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the drone software market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the drone software market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the drone software market.

Report Objectives

- To define, describe, segment, and forecast the size of the drone software market based on solution, platform, architecture, deployment, and region

- To forecast the size of different segments of the market with respect to various regions, including North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa, along with key countries in each of these regions

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify technology trends that are currently prevailing in the drone software market

- To provide an overview of the tariff and regulatory landscape with respect to the drone regulations across regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as acquisitions, new product launches, new service launches, contracts, and partnerships, adopted by leading market players

- To identify detailed financial positions, key products, and unique selling points of leading drone software companies in the market

- To provide a detailed competitive landscape of the drone software market, along with a ranking analysis, market share analysis, and revenue analysis of key players

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Drone Software Market

Hello, we require details about software developments related to drones. Particularly interested in drones flying in war zones and also the ones doing package deliveries.