Disposable Medical Device Sensors Market by Product (Biosensor, Image sensor, Accelerometer), Type (Strip Sensors, Invasive Sensors, Wearable Sensors), Application(Diagnostic Testing, Therapeutics, Patient Monitoring, Imaging) - Global Forecast to 2026

Updated on : June 26, 2023

The global disposable medical device sensors market in terms of revenue was estimated to be worth $6.5 billion in 2021 and is poised to reach $9.4 billion by 2026, growing at a CAGR of 7.7% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Disposable medical device sensors industry growth is largely driven by rising concerns over hospital-acquired infections and contamination, the increasing incidence of target conditions, the growing demand for home-based medical care devices, significant technological advancements in the last few years, and government support for R&D activities for these devices. The emerging markets in developing countries are also expected to provide growth opportunities for players in the market.

However, the vulnerability of connected medical devices in terms of data leakages, government regulations, and the long certification and approval cycles are major challenges faced by the disposable medical device sensors industry.

To know about the assumptions considered for the study, Request for Free Sample Report

Disposable medical device sensors Market Dynamics

Driver: Rising concerns over hospital-acquired infections and contamination

Over the years, hospital-acquired infections (HAIs) have become a major challenge for hospitals and the medical community. In the last two decades, the prevalence of HAIs has increased significantly; the wide use of reusable devices like sphygmomanometer cuffs, thermometers, catheters, and stethoscopes in hospitals is a major factor contributing to this rising prevalence. The use of contaminated medical devices in hospitals also contributes to the rising prevalence of HAIs, especially among newborn babies and other inpatients. This ultimately results in high morbidity and mortality rates, prolonged hospital stays, and increased healthcare and patient costs.

According to the CDC, up to 1.7 million hospitalized patients in the US annually acquire healthcare-associated infections (HCAIs) while being treated for other health issues, and more than 98,000 of these patients (one in 17) die due to HCAIs. 32% of all HAIs in the country are urinary tract infections, 22% are surgical-site infections, 15% are lung (pneumonia) infections, and 14% are bloodstream infections.

Opportunity: Emerging markets in developing countries

Emerging markets, such as China, India, Brazil, and Mexico, offer significant growth opportunities for disposable medical device sensors. This can be attributed to the rising incidence of infectious and lifestyle diseases in these countries.

- According to the IDF Diabetes Atlas report 2019, the number of individuals with diabetes in Southeast Asia was 88 million in 2019 and is projected to reach 153 million by 2045 (a 74% increment).

- According to the CCDC India, more than 2 million people die every year in the country due to cardiovascular disorders (CVDs), and it is projected to increase to 4.8 million by 2020.

- The IDF Diabetes Atlas report 2019 stated that the number of diabetics in the Middle East and North Africa was estimated at 55 million in 2019 and is expected to increase to 105 million by 2045 (a 96% increment).

Challenge: Vulnerability of connected medical devices in term of data leakages

Data security and privacy have become major areas of concern for patients and healthcare service providers due to the increasing global adoption of wireless medical devices. The vulnerability of connected medical devices in terms of personal information leakages acts as a challenge for the growth of the disposable medical device sensors industry.

With the proliferation of IoT-based connected medical devices in the global healthcare sector, these medical devices are exposed to the threats of cyberattacks. The connected nature of medical devices makes certain medical devices prone to hacking. Therefore, manufacturers of these medical devices are required to adhere to stringent standards to ensure patient data privacy and safety.

Biosensors accounted for the larger share of the share of global disposable medical device sensors industry in 2020

Based on products, the disposable medical device sensors market is segmented into biosensors, accelerometers, temperature sensors, image sensors, and other sensors. The biosensors segment accounted for the largest share in 2020. The large share of this segment can be attributed to the wide usage of these sensors in glucose test strips, infectious disease test strips, pregnancy test strips, drug and alcohol test strips, and continuous blood glucose monitoring.

Ingestible Sensor segment of the disposable medical device sensors industry accounted for the highest CAGR

Based on type, disposable medical device sensors market are segmented into strip sensors, wearable sensors, invasive sensors, and ingestible sensors. In 2020, ingestible sensors accounted for accounted for the highest growth rate. The major factors driving the growth is the increasing demand for technologically advanced smart pills and capsule endoscopy for diagnostic applications.

By Application, diagnostic testing accounted for the largest share of the disposable medical device sensors industry

Based on applications, the disposable medical device sensors market is divided into four segments, namely, patient monitoring, diagnostic testing, therapeutics, and imaging. The diagnostic testing segment accounted for the largest share in 2020. The large share of this application segment can primarily be attributed to the rising incidence of lifestyle diseases across the globe. The widespread usage of glucose test strips, infectious disease test strips, and pregnancy test strips in homes as well as in clinics is another factor driving the market growth.

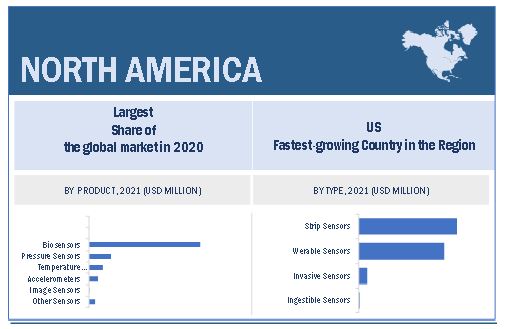

North America accounted for the largest share of the disposable medical device sensors industry

The disposable medical device sensors market is divided into five regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America dominated the disposable medical device sensors market. The large share of the North American region is mainly attributed to the rising incidence of HAIs and chronic diseases in the region. Further, the availability of technologically advanced sensor-based disposable medical devices due to the presence of major players in the North American region also support the market growth.

Some of the major players operating in this market are Abbott (US), F. Hoffmann-La Roche Ltd. (Switzerland), Medtronic (Ireland). In 2020, Abbott held the leading position in the disposable medical device sensors market. The company offer biosensors which are widely used by people across globe for diagnostic testing and patient monitoring. F. Hoffmann-La Roche Ltd. held the second position in the disposable medical device sensors market in 2020.

Scope of the Disposable Medical Device Sensors Industry

|

Report Metrics |

Details |

|

Market Revenue in 2021 |

$6.5 billion |

|

Projected Revenue in 2026 |

$9.4 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 7.7% |

|

Market Driver |

Rising concerns over hospital-acquired infections and contamination |

|

Market Opportunity |

Emerging markets in developing countries |

This research report categorizes the disposable medical device sensors market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Biosensors

- Accelerometers

- Pressure Sensors

- Temperature Sensors

- Image Sensors

- Other Sensors

By Type

- Strip Sensors

- Wearable sensors

- Invasive sensors

- Ingestible sensors

By Application

-

Diagnostic Testing

- Blood Glucose Test Strip Sensors

- Pregnancy Test Strip Sensors

- Drug and Alcohol Test Strip Sensors

- Infectious Disease Test Strip Sensors

-

Patient Monitoring

- Continuous Blood Pressure Monitors

- Pulse Oximeters

- Cardiac Monitors

- Continuous Glucose Monitoring (CGM) Devices

- Smart Pills

- Other Patient Monitoring Devices

-

Patient Monitoring

- Continuous Blood Pressure Monitors

- Pulse Oximeters

- Cardiac Monitors

- Continuous Glucose Monitoring (CGM) Devices

- Smart Pills

- Other Patient Monitoring Devices

-

Therapeutics

- Dialysis Device Sensors

- Cardiac Catheter Sensors

- Insulin Pump Sensors

-

Imaging

- Capsule Endoscope Sensors

- Disposable Endoscope Sensors

Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific (RoAPAC)

-

Rest of the World

- Latin America

- Middle East & Africa

Recent Developments of Disposable Medical Device Sensors Industry

- In 2021, Abbott received FDA Emergency Use Authorization (EUA) for the over the counter, non-prescription, asymptomatic use of its BinaxNOW COVID-19 AG self-test for the detection of COVID-19 infections.

- In 2020, Medtronic received FDA approval for its MiniMed 770G hybrid closed loop system. It consists of Guardian Sensor 3, the MiniMed Mobile app.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global disposable medical device sensors market?

The global disposable medical device sensors market boasts a total revenue value of $9.4 billion by 2026.

What is the estimated growth rate (CAGR) of the global disposable medical device sensors market?

The global disposable medical device sensors market has an estimated compound annual growth rate (CAGR) of 7.7% and a revenue size in the region of $6.5 billion in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH APPROACH

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

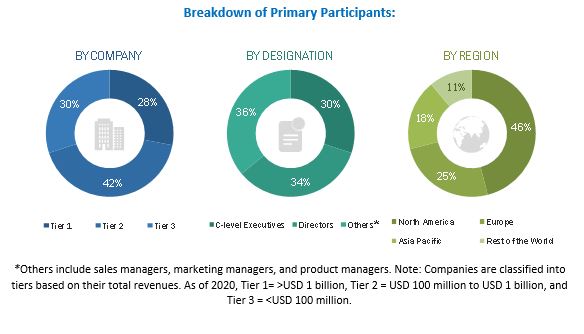

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE,DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 6 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 COVID-19 ECONOMIC ASSESSMENT

2.6.1 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 8 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 9 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 10 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2021 VS. 2026 (USD MILLION)

FIGURE 11 MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GEOGRAPHIC SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 DISPOSABLE MEDICAL DEVICE SENSORS MARKET OVERVIEW

FIGURE 14 INCREASING NUMBER OF TARGET DISEASES TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY TYPE & COUNTRY (2020)

FIGURE 15 STRIP SENSORS ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 CHINA TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 KEY MARKET DYNAMICS

FIGURE 17 DISPOSABLE MEDICAL DEVICE SENSORS MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Rising concerns over hospital-acquired infections and contamination

5.2.1.2 Increasing incidence of target conditions

5.2.1.3 Growing demand for home-based medical care devices

5.2.1.4 Government support to boost research & development

5.2.1.5 Significant technological advancements in the last few years

5.2.2 OPPORTUNITIES

5.2.2.1 Emerging markets in developing countries

5.2.3 CHALLENGES

5.2.3.1 Vulnerability of connected medical devices in term of data leakages

5.2.3.2 Government regulations—long certification and approval cycles

5.3 COVID-19 IMPACT ON THE MARKET

6 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT (Page No. - 58)

6.1 INTRODUCTION

TABLE 1 GLOBAL DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

6.2 BIOSENSORS

6.2.1 INCREASING NUMBER OF TARGET DISEASES AND RISING HEALTH AWARENESS TO PROPEL MARKET GROWTH

TABLE 2 BIOSENSORS OFFERED BY MARKET PLAYERS

TABLE 3 DISPOSABLE BIOSENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.3 PRESSURE SENSORS

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN PRESSURE SENSORS TO BOOST THE MARKET GROWTH

TABLE 4 PRESSURE SENSORS OFFERED BY MARKET PLAYERS

TABLE 5 DISPOSABLE PRESSURE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.4 TEMPERATURE SENSORS

6.4.1 COST-EFFECTIVENESS OF TEMPERATURE SENSORS TO DRIVE THE DEMAND FOR THESE DEVICES

TABLE 6 TEMPERATURE SENSORS OFFERED BY MARKET PLAYERS

TABLE 7 DISPOSABLE TEMPERATURE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.5 ACCELEROMETERS

6.5.1 RISING GERIATRIC POPULATION TO SUPPORT THE GROWTH OF THE ACCELEROMETERS MARKET

TABLE 8 ACCELEROMETERS OFFERED BY MARKET PLAYERS

TABLE 9 DISPOSABLE ACCELEROMETERS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.6 IMAGE SENSORS

6.6.1 INNOVATIONS IN IMAGE SENSORS TO BOOST THE MARKET GROWTH

TABLE 10 IMAGE SENSORS OFFERED BY MARKET PLAYERS

TABLE 11 DISPOSABLE IMAGE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

6.7 OTHER SENSORS

TABLE 12 OTHER DISPOSABLE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

7 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY TYPE (Page No. - 68)

7.1 INTRODUCTION

TABLE 13 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY TYPE, 2019–2026 (USD MILLION)

7.2 STRIP SENSORS

7.2.1 RISING NUMBER OF DIABETIC PATIENTS ACROSS THE GLOBE TO SUPPORT THE MARKET GROWTH

TABLE 14 DISPOSABLE STRIP SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.3 WEARABLE SENSORS

7.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN WEARABLE DEVICES TO BOOST THE MARKET GROWTH

TABLE 15 DISPOSABLE WEARABLE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.4 INVASIVE SENSORS

7.4.1 INCREASED PREFERENCE FOR WEARABLE DEVICES MAY NEGATIVELY IMPACT THE MARKET FOR INVASIVE SENSORS

TABLE 16 DISPOSABLE INVASIVE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

7.5 INGESTIBLE SENSORS

7.5.1 TECHNOLOGICAL ADVANCEMENTS IN INGESTIBLE SENSORS TO DRIVE THE DEMAND FOR THESE DEVICES IN THE COMING YEARS

TABLE 17 DISPOSABLE INGESTIBLE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY APPLICATION (Page No. - 73)

8.1 INTRODUCTION

TABLE 18 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 DIAGNOSTIC TESTING

TABLE 19 MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 20 MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8.2.1 BLOOD GLUCOSE TEST STRIP SENSORS

8.2.1.1 High prevalence of diabetes to drive market growth

TABLE 21 GLOBAL DIABETES PREVALENCE AMONG INDIVIDUALS AGED 20–79 YEARS (MILLION)

TABLE 22 BLOOD GLUCOSE TEST STRIP SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.2 PREGNANCY TEST STRIP SENSORS

8.2.2.1 Increasing demand for testing strips for home use to drive market growth

TABLE 23 PREGNANCY TEST STRIP SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.3 INFECTIOUS DISEASE TEST STRIP SENSORS

8.2.3.1 High burden of infectious diseases to propel the market growth

TABLE 24 INFECTIOUS DISEASE TEST STRIP SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.2.4 DRUG AND ALCOHOL TEST STRIP SENSORS

8.2.4.1 A majority of drug and alcohol tests are not easily available over the counter; this may hinder the growth of this market

TABLE 25 DRUG AND ALCOHOL TEST STRIP SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3 PATIENT MONITORING

TABLE 26 MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 27 MARKET FOR PATIENT MONITORING APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8.3.1 CARDIAC MONITORS

8.3.1.1 Sedentary lifestyles causing an increase in cardiovascular disease prevalence—a key factor driving market growth

TABLE 28 CARDIAC MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.2 PULSE OXIMETERS

8.3.2.1 COVID-19 pandemic to boost the demand for pulse oximeters

TABLE 29 PULSE OXIMETERS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.3 CONTINUOUS BLOOD PRESSURE MONITORS

8.3.3.1 Increasing prevalence of hypertension to drive market growth

TABLE 30 CONTINUOUS BLOOD PRESSURE MONITORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.4 CONTINUOUS GLUCOSE MONITORING (CGM) DEVICES

8.3.4.1 Increased preference for home-use devices to drive growth in this market segment

TABLE 31 CONTINUOUS GLUCOSE MONITORING DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.5 SMART PILLS

8.3.5.1 Ease of use and reduced expenditure associated with smart pills to drive market growth

TABLE 32 SMART PILLS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.3.6 OTHER PATIENT MONITORING DEVICES

TABLE 33 OTHER PATIENT MONITORING DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4 THERAPEUTICS

TABLE 34 MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 35 MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8.4.1 DIALYSIS DEVICE SENSORS

8.4.1.1 Rising urology disorders to drive market growth

TABLE 36 DIALYSIS DEVICE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4.2 CARDIAC CATHETER SENSORS

8.4.2.1 High prevalence of cardiac diseases to boost the market growth

TABLE 37 CARDIAC CATHETER SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.4.3 INSULIN PUMP SENSORS

8.4.3.1 High cost of insulin pumps can limit the market growth

TABLE 38 INSULIN PUMP SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

8.5 IMAGING

TABLE 39 MARKET FOR IMAGING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 40 MARKET FOR IMAGING APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

8.5.1 CAPSULE ENDOSCOPE SENSORS

8.5.1.1 Capsule endoscopes are easy to use and cost-effective—key factors driving market growth

8.5.2 DISPOSABLE ENDOSCOPE SENSORS

8.5.2.1 Increased preference for disposable endoscopes for COVID-19 treatment to drive market growth

9 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY REGION (Page No. - 90)

9.1 INTRODUCTION

TABLE 41 DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 18 NORTH AMERICA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.2.1 US

9.2.1.1 Increasing funding and investments in the field of medical sensors to drive market growth in the US

TABLE 49 US: KEY MACROINDICATORS

TABLE 50 US: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 51 US: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 52 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 53 US: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 54 US: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 55 US: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.2.2 CANADA

9.2.2.1 High prevalence of HAIs is a major factor driving the demand for disposable medical device sensors in Canada

TABLE 56 CANADA: KEY MACROINDICATORS

TABLE 57 CANADA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 58 CANADA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 59 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 60 CANADA: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 61 CANADA: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 62 CANADA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 63 EUROPE: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 67 EUROPE: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 69 EUROPE: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.3.1 GERMANY

9.3.1.1 Increasing demand for safer diagnostic devices to drive market growth in Germany

TABLE 70 GERMANY: KEY MACROINDICATORS

TABLE 71 GERMANY: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 72 GERMANY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 74 GERMANY: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 75 GERMANY: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 76 GERMANY: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.3.2 FRANCE

9.3.2.1 Growing geriatric will increase the demand for disposable medical device sensors

TABLE 77 FRANCE: KEY MACROINDICATORS

TABLE 78 FRANCE: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 79 FRANCE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 80 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 81 FRANCE: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 82 FRANCE: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 83 FRANCE: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.3.3 UK

9.3.3.1 Rising incidence of target diseases to support the market growth in the country

TABLE 84 UK: KEY MACROINDICATORS

TABLE 85 UK: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 86 UK: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 88 UK: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 89 UK: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.3.4 ITALY

9.3.4.1 Rising age-related disorders to aid market growth in Italy

TABLE 90 ITALY: KEY MACROINDICATORS

TABLE 91 ITALY: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 92 ITALY: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 93 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 94 ITALY: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 95 ITALY: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 96 ITALY: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.3.5 SPAIN

9.3.5.1 Need for single-use, contamination-free, fast, and accurate medical devices to support market growth in Spain

TABLE 97 SPAIN: KEY MACROINDICATORS

TABLE 98 SPAIN: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 99 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 100 SPAIN: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 101 SPAIN: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 102 ROE: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 103 ROE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 ROE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 ROE: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 106 ROE: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

FIGURE 19 APAC: DISPOSABLE MEDICAL DEVICE SENSORS MARKET SNAPSHOT

TABLE 107 APAC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 108 APAC: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 109 APAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 110 APAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 111 APAC: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 112 APAC: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 113 APAC: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.4.1 CHINA

9.4.1.1 Government initiatives to develop innovative healthcare products to propel the market growth

TABLE 114 CHINA: KEY MACROINDICATORS

TABLE 115 CHINA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 116 CHINA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 117 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 118 CHINA: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 119 CHINA: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 120 CHINA: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 High prevalence of HAIs to create demand for disposable medical device sensors

TABLE 121 JAPAN: KEY MACROINDICATORS

TABLE 122 JAPAN: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 123 JAPAN: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 125 JAPAN: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 126 JAPAN: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 127 JAPAN: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.4.3 INDIA

9.4.3.1 High burden of chronic diseases to support market growth

TABLE 128 INDIA: KEY MACROINDICATORS

TABLE 129 INDIA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 130 INDIA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 131 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 132 INDIA: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 133 INDIA: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 134 INDIA: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.4.4 REST OF APAC

TABLE 135 ROAPAC: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 136 ROAPAC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 137 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 138 ROAPAC: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 139 ROAPAC: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 140 ROAPAC: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.5 ROW

TABLE 141 ROW: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 142 ROW: MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 143 ROW: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 ROW: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 145 ROW: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 146 ROW: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 147 ROW: DISPOSABLE MEDICAL DEVICE SENSORS MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.5.1 LATIN AMERICA

9.5.1.1 Increasing healthcare expenditure to support the market growth in the region

TABLE 148 LATIN AMERICA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 High prevalence of infectious diseases to boost the market growth in the region

TABLE 154 MIDDLE EAST & AFRICA: DISPOSABLE MEDICAL DEVICE SENSORS MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 155 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 157 MIDDLE EAST & AFRICA: MARKET FOR DIAGNOSTIC TESTING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: MARKET FOR THERAPEUTIC APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: MARKET FOR PATIENT MONITORING APPLICATIONS, BY DEVICE TYPE, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 144)

10.1 OVERVIEW

FIGURE 20 KEY DEVELOPMENTS IN THE DISPOSABLE MEDICAL DEVICE SENSORS MARKET, JANUARY 2018–MAY 2021

10.2 MARKET SHARE ANALYSIS

TABLE 160 DISPOSABLE MEDICAL DEVICE SENSORS INDUSTRY SHARE, BY KEY PLAYER (2020)

10.2.1 PRODUCT LAUNCHES

TABLE 161 PRODUCT LAUNCHES

10.2.2 DEALS

TABLE 162 DEALS

10.2.3 OTHER DEVELOPMENTS

TABLE 163 OTHER DEVELOPMENTS

10.3 COMPANY EVALUATION MATRIX

10.3.1 STARS

10.3.2 EMERGING LEADERS

10.3.3 PERVASIVE PLAYERS

10.3.4 PARTICIPANTS

FIGURE 21 DISPOSABLE MEDICAL DEVICE SENSORS INDUSTRY: VENDOR DIVE MATRIX, 2020

10.4 COMPETITIVE LEADERSHIP MAPPING (SMES/START-UPS)

10.4.1 PROGRESSIVE COMPANIES

10.4.2 STARTING BLOCKS

10.4.3 RESPONSIVE COMPANIES

10.4.4 DYNAMIC COMPANIES

FIGURE 22 DISPOSABLE MEDICAL DEVICE SENSORS INDUSTRY: VENDOR DIVE MATRIX FOR SMES & START-UPS, 2020

11 COMPANY PROFILES (Page No. - 153)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1 ABBOTT LABORATORIES

FIGURE 23 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2020)

11.2 F. HOFFMANN-LA ROCHE LTD.

FIGURE 24 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2020)

11.3 MEDTRONIC PLC

FIGURE 25 MEDTRONIC PLC: COMPANY SNAPSHOT (2020)

11.4 PLATINUM EQUITY ADVISORS, LLC

11.5 TEXAS INSTRUMENTS

FIGURE 26 TEXAS INSTRUMENTS: COMPANY SNAPSHOT (2020)

11.6 TE CONNECTIVITY

FIGURE 27 TE CONNECTIVITY: COMPANY SNAPSHOT (2020)

11.7 HONEYWELL INTERNATIONAL, INC.

FIGURE 28 HONEYWELL INTERNATIONAL, INC.: COMPANY SNAPSHOT (2020)

11.8 NXP SEMICONDUCTORS N.V.

FIGURE 29 NXP SEMICONDUCTORS N.V.: COMPANY SNAPSHOT (2020)

11.9 STMICROELECTRONICS N.V.

FIGURE 30 STMICROELECTRONICS N.V.: COMPANY SNAPSHOT (2020)

11.10 ANALOG DEVICES, INC.

FIGURE 31 ANALOG DEVICES, INC.: COMPANY SNAPSHOT (2020)

11.11 SMITHS MEDICAL (SMITHS GROUP PLC)

FIGURE 32 SMITHS GROUP PLC: COMPANY SNAPSHOT (2020)

11.12 KONINKLIJKE PHILIPS N.V.

FIGURE 33 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2020)

11.13 GENERAL ELECTRIC

FIGURE 34 GENERAL ELECTRIC: COMPANY SNAPSHOT (2020)

11.14 WILL SEMICONDUCTOR CO., LTD.

11.15 LIFESIGNALS

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

11.16 SENSIRION AG

11.17 AMPHENOL CORPORATION

11.18 NUOVA GMBH

11.19 ENDRESS+HAUSER GROUP SERVICES AG

11.20 STARBOARD MEDICAL, INC.

11.21 SHENZHEN MED-LINK ELECTRONICS TECH CO., LTD.

11.22 MEDICAL SENSORS INDIA PVT. LTD.

11.23 GENTAG, INC.

11.24 VITALCONNECT

11.25 CONMED CORPORATION

12 APPENDIX (Page No. - 197)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the disposable medical device sensors market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to identify and collect information for this study.

Primary Research

Extensive primary research was conducted after acquiring knowledge about the global market scenario through secondary research. Primary interviews were conducted from both the demand (Physicians, Surgeons, Nurses, and Other Medical Staff, Long-term Care Patients, and Original Equipment Manufacturers) and supply sides (disposable medical device sensors manufacturers and distributors).

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Disposable Medical Device Sensors Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the disposable medical device sensors market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the disposable medical device sensors industry.

Report Objectives

- To define, describe, and forecast the global disposable medical device sensors market on the basis of product, type, application, and region.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the disposable medical device sensors market with respect to four main regions (along with countries), namely, North America, Europe, Asia Pacific, and the Rest of the World

- To strategically profile the key players in the global disposable medical device sensors market and comprehensively analyze their core competencies and market shares.

- To track and analyze competitive developments such as partnerships, mergers & acquisitions; new product launch of the leading players in the global disposable medical device sensors market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the disposable medical device sensors market into specific countries/regions in the Rest of the World, Rest of APAC, and Rest of Europe.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Disposable Medical Device Sensors Market