The study involves four major activities that estimate the size of the DC torque tool market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the DC torque tool market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

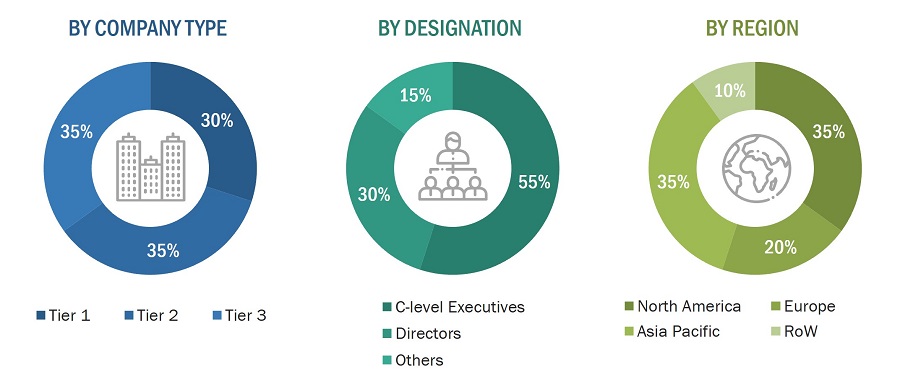

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from DC torque tool providers, (such as Atlas Copco AB, Apex Tool Group, LLC, ESTIC CORPORATION) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

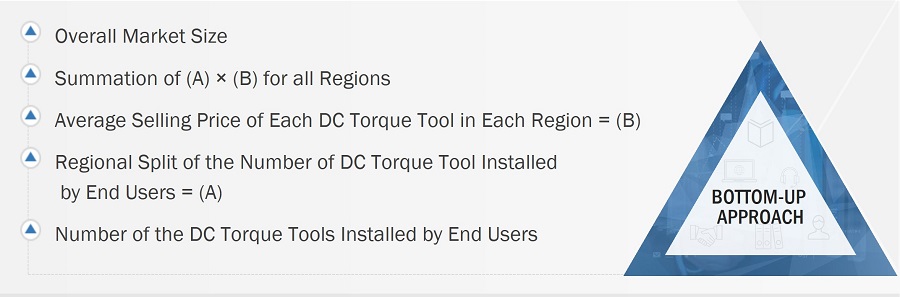

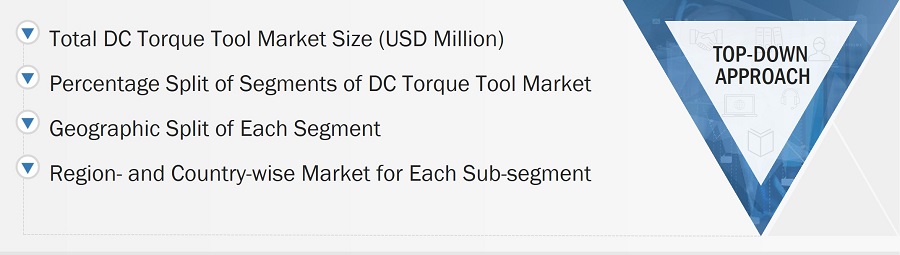

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the DC torque tool market and other dependent submarkets listed in this report.

-

The key players in the industry and markets were identified through extensive secondary research.

-

Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology Bottom-up Approach

Market Size Estimation Methodology Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

DC torque tool, also known as an electric fastening system, is used to apply precise and specific torque to fasteners, such as nuts, bolts, and screws, that mechanically join two or more objects together. These tools operate either on continuous power supply or battery-operated supply. They are used where the tightening of fasteners is challenging. These systems create a non-permanent joint, which can be removed without any damage. These tools are widely used in industries where precision and reliability are critical. They are commonly utilized in automotive, aerospace, electronics, and manufacturing industries, where consistent torque application is vital to ensure the functionality and safety of the devices.

Key Stakeholders

-

Power tool manufacturers

-

Brushed DC motor and brushless DC (BLDC) motor suppliers

-

Li-ion battery suppliers

-

Torque sensors/torque transducer suppliers

-

Wireless charging market players

-

Analysts and strategic business planners

-

End-user industries

-

Governments, financial institutions, and investment communities

-

Electronic component original equipment manufacturers (OEMs)

-

Raw material suppliers

-

Research organizations

-

Technology investors and venture capitalists

-

Technology-standard organizations, forums, alliances, and associations

The main objectives of this study are as follows:

-

To define, describe, segment, and forecast the global DC torque tool market, by tool type, power source, control system, and industry, in terms of value

-

To define and forecast the DC torque tool market, by handheld tool, in terms of volume

-

To forecast the market size for various segments with regard to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries, in terms of value

-

To provide detailed information regarding major factors influencing the growth of the DC torque tool market (drivers, restraints, opportunities, and challenges)

-

To analyze the value chain of the electric fastening systems ecosystem

-

To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem analysis, pricing analysis, Porter’s five forces analysis, case study analysis, and regulatory standards pertaining to the DC torque tool market

-

To strategically analyze the micromarkets1 with respect to the individual growth trends, prospects, and contribution to the overall DC torque tool market

-

To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global DC Torque tools market

-

To strategically profile key players and comprehensively analyze their ranking and core competencies2, along with detailing the competitive landscape for market leaders

-

To analyze competitive developments, such as expansions, mergers & acquisitions, product launches and developments, and research & development activities, in the global DC torque tool market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

-

Analysis for additional countries (up to five)

Company Information:

-

Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in DC Torque Tool Market