Data Center Solutions Market

Data Center Solutions Market by Infrastructure (IT (Server, Storage, Network), Power (Generator, UPS, Switchgear, PDU, Switchboard), Cooling (CRAC & CRAH, Chiller, Heat Exchanger, CDU)), Rack (Enclosed, Open Frame), Software (DCIM, BMS) - Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

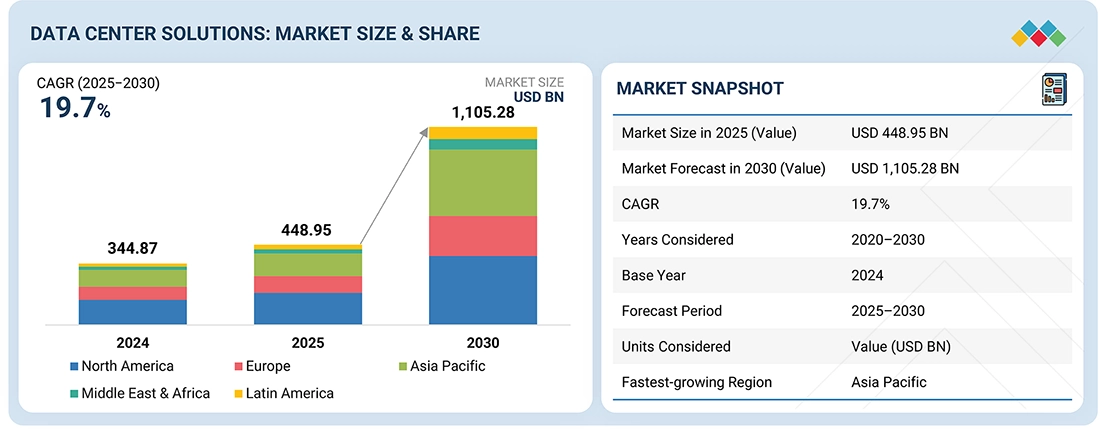

The data center solutions market is valued at USD 448.95 billion in 2024 and projected to reach USD 1,105.28 billion by 2030, registering a CAGR of 19.7% (2025–2030). Growth is driven by hyperscaler and colocation expansions, increasing enterprise demand for hybrid and multi-cloud environments, and rising adoption of advanced power, cooling, and monitoring solutions. Other drivers include AI/ML-enabled DCIM for predictive management, deployment of modular and liquid cooling infrastructures, and strong focus on ESG compliance and carbon-neutral operations. North America and Asia Pacific dominate as the largest and fastest-growing regions, supported by sustainability initiatives and digital transformation programs.

KEY TAKEAWAYS

- Asia Pacific is the fastest-growing region with 23.8% CAGR, driven by hyperscale cloud expansion, AI-led compute demand, and strong digital infrastructure investments across China, India, Japan, and Southeast Asia. Government-backed data localization requirements and rapid edge deployments further accelerate adoption of advanced data center solutions.

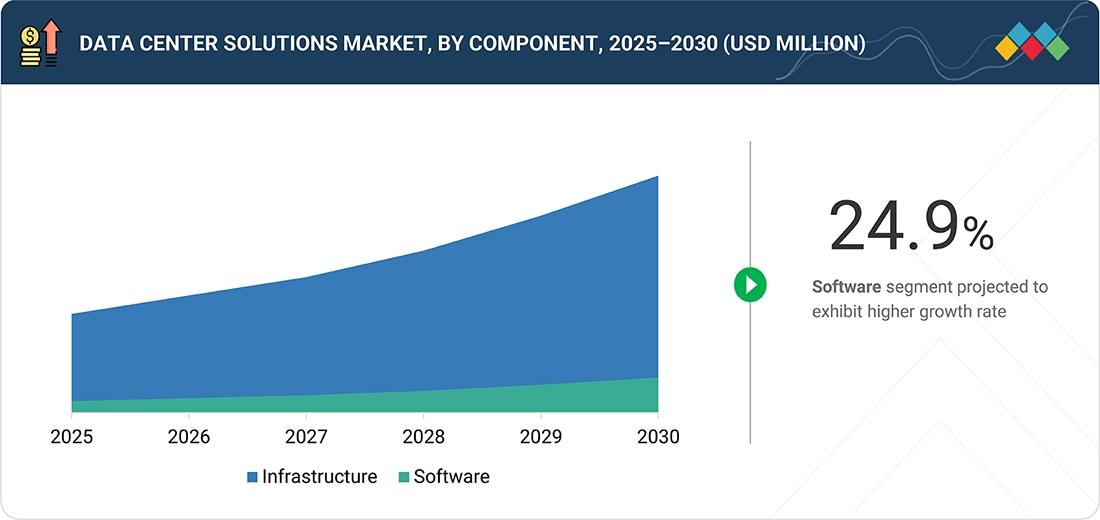

- Software is the fastest-growing component with a 24.9% CAGR, driven by rapid adoption of DCIM, virtualization, AIOps, and compliance tools. Demand grows as operators prioritize automation, intelligent orchestration, and real-time infrastructure visibility to reduce downtime and optimize operational efficiency.

- Data Center IT Infrastructure leads growth with a 20.5% CAGR, fueled by rising cloud workloads, high-density compute, AI/ML clusters, and hyperscaler capacity expansion. Its rapid scaling needs, performance requirements, and modernization of compute systems make it the fastest-expanding infrastructure segment.

- Compliance and security software are experiencing increased demand as organizations focus on regulatory compliance, data sovereignty, and zero-trust architectures in multi-tenant and hybrid cloud settings. The growing use of DCIM, facility management, and virtualization software is driven by AI/ML-powered monitoring, predictive maintenance, and automation to boost efficiency and minimize downtime.

- HPC and AI workloads are driving investments in high-performance cooling, low-latency networking, and scalable infrastructure to support compute-intensive training and inference applications. General-purpose IT workloads continue to require reliable, cost-efficient solutions, with enterprises adopting hybrid models balancing on-prem, cloud, and colocation to optimize resources and performance.

- Tier 3 data centers dominate deployments, offering balanced reliability and cost efficiency to support enterprise, BFSI, and colocation workloads requiring high availability and redundancy. Tier 4 facilities are expanding, driven by hyperscaler demand for fault tolerance, fully redundant systems, and uninterrupted uptime supporting AI, HPC, and mission-critical workloads.

- Large data centers are witnessing significant investments as hyperscalers scale to meet AI, HPC, and cloud workloads, demanding high-density racks, liquid cooling, and grid independence. Mid-sized facilities remain critical for enterprises and regional colocation providers, focusing on modular upgrades, automation, and sustainability initiatives to improve efficiency and cost competitiveness.

- Hyperscale data centers are fueling growth, emphasizing high-capacity infrastructure, renewable integration, and modular solutions to manage exponential data growth and AI-driven applications. Colocation data centers are expanding rapidly, driven by enterprise outsourcing, interconnection demand, and rising compliance requirements, creating opportunities for solution vendors in power, cooling, and monitoring.

- BFSI, IT & telecom, and cloud-intensive verticals are leading adoption, requiring secure, compliant, and resilient infrastructure with low-latency connectivity and high uptime guarantees. The healthcare, retail, and manufacturing sectors are accelerating investments, leveraging advanced data center solutions for digital transformation, predictive analytics, and regulatory-compliant operations at scale.

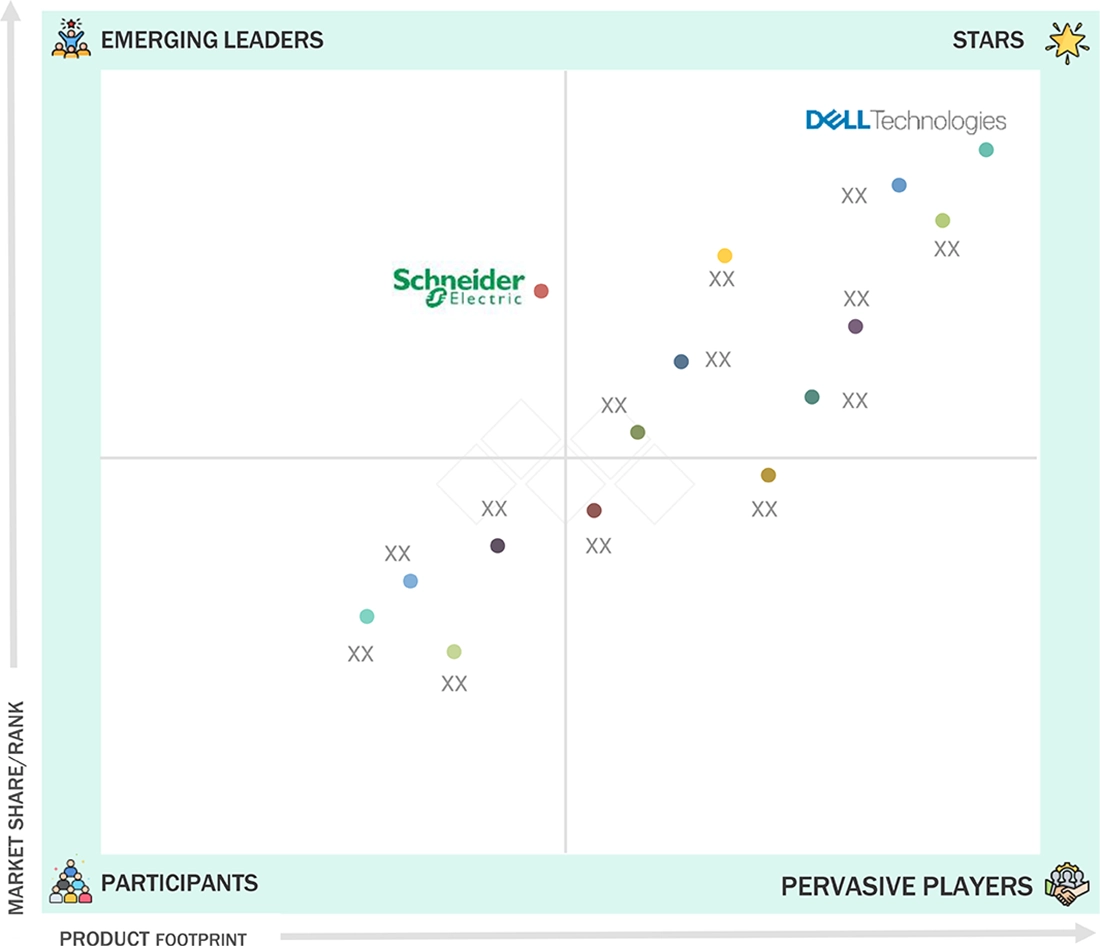

- Key players such as Dell Technologies, Broadcom, and HPE lead the data center solutions market with broad product portfolios, strong global customer bases, and deep capabilities across compute, storage, and networking that position them at the forefront of large enterprise deployments.

- Among startups and SMEs, Chatsworth Products, Riello UPS, and Sunbird Software stand out for focused innovation in racks and enclosures, critical power protection, and DCIM/monitoring software, helping operators improve energy efficiency, capacity utilization, and visibility in modern data center environments.

The data center solutions market is growing quickly as enterprises, hyperscalers, and colocation providers expand their infrastructure to meet increasing demand from AI, cloud, and HPC workloads. Companies are prioritizing integrated power, cooling, IT, and monitoring systems to minimize downtime, boost efficiency, and support high-density setups. Sustainability goals are driving more adoption of liquid cooling, modular designs, and renewable energy sources to enhance energy efficiency and achieve ESG targets. These solutions offer reliability, scalability, and compliance, helping organizations reduce costs, improve resilience, and stay competitive in a rapidly digitalizing economy.

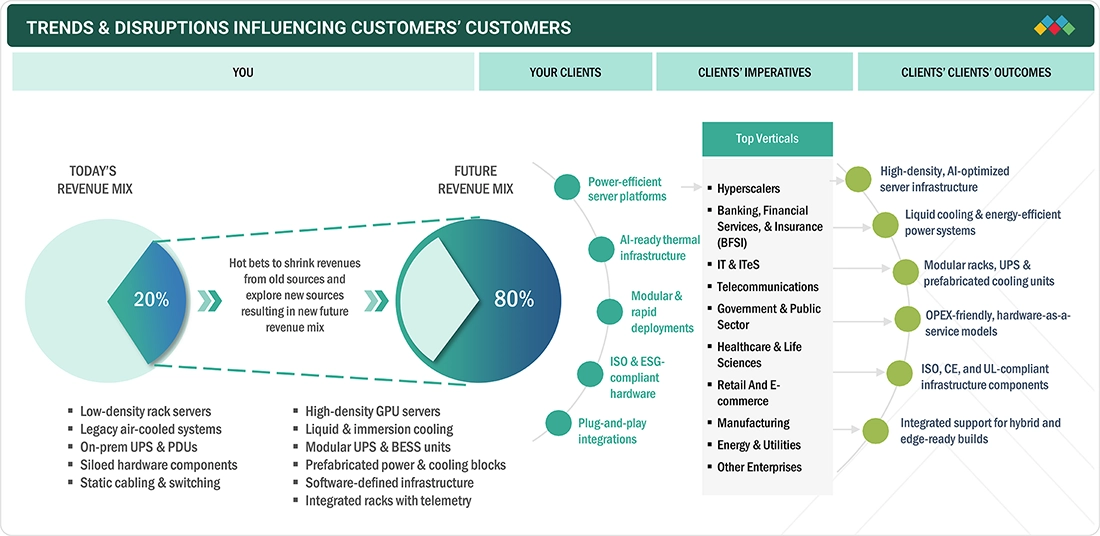

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The data center solutions market is experiencing a significant shift in revenue, transitioning from traditional infrastructure to integrated, scalable, and sustainable models. Hyperscalers, colocation providers, and enterprises are increasingly demanding modular constructions, liquid cooling solutions, and AI-driven Data Center Infrastructure Management (DCIM). Critical priorities include cost optimization, regulatory adherence, and Environmental, Social, and Governance (ESG) objectives, which facilitate outcomes such as dependable uptime, carbon-neutral operations, seamless hybrid IT integration, and transparent supply chains, thereby ensuring resilience and sustained competitiveness.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

AI/HPC compute boom to drive high-density infrastructure upgrades

-

Hyperscale CAPEX super-cycle to accelerate infrastructure spend

Level

-

Extended lead times for critical electrical & mechanical equipment to disrupt build timelines and capex planning

-

Land use and permitting bottlenecks to affect equipment lead times

Level

-

Retrofitting legacy data centers to meet AI-driven density demands

-

Rise of liquid cooling in AI-driven data center infrastructure to meet next-gen density requirements

Level

-

Skilled labor shortage to threaten project delivery timelines and long-term operational efficiency

-

Grid capacity & power scarcity to limit facility deployment

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Hyperscale Capex Super-Cycle to Accelerate Infrastructure Spend

Global hyperscaler build-outs are driving unprecedented investment, with 10 GW of new capacity expected in 2025. Microsoft, Meta, Amazon, and Google have announced multibillion-dollar AI and data center expansion plans, totaling over USD 500 billion in long-term commitments. These mega-projects demand tens of thousands of high-density racks, advanced power systems, and liquid cooling. Capital expenditure by hyperscalers now serves as the primary growth catalyst, reshaping procurement across power, cooling, networking, and orchestration solutions.

Restraint: Extended lead times for critical electrical & mechanical equipment to disrupt build timelines and capex planning

The data center solutions market faces challenges due to long lead times for electrical and mechanical equipment, with transformers above 500 MVA now taking 3–4 years to deliver. Delays of 18–24 months impact switchgear, UPS, and cooling systems, especially liquid cooling units essential for AI workloads. These supply chain bottlenecks disrupt commissioning, raise costs, and lower utilization, forcing operators to modify build schedules and CAPEX planning, which affects overall project efficiency and timelines.

Opportunity: Retrofitting Legacy Data Centers to Meet AI-driven Density Demands

AI and HPC workloads are increasing rack power from 8 kW in 2023 to an estimated 30 kW by 2027, making legacy facilities outdated. Retrofitting provides a cost-effective alternative, costing USD 4–8 million per megawatt compared to USD 12–15 million for new constructions. Vendors like Schneider Electric and Vertiv are developing high-density retrofit solutions that support GPU clusters, liquid cooling, and 132 kW cabinets, while reducing cooling energy consumption by 20%.

Challenge: Skilled Labor Shortage to Threaten Project Delivery Timelines

The data center solutions market is facing a rising shortage of skilled workers, with Infrastructure Masons projecting 300,000 roles will be unfilled by 2025. Uptime Institute reports that 58% of operators have difficulty finding qualified staff, while 70% of the workforce is over 45, which raises retirement concerns. Gaps in skills for controllers, medium-voltage installation, and liquid cooling can delay projects by 6–12 months, emphasizing the importance of apprenticeships, training programs, and workforce development efforts.

data center solutions market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

University of Winchester used Eaton’s Intelligent Power Management (IPM) software with VMware vCenter, 50× SPX 3kVA UPS, 2× 9SX 5000i UPS, and a 93PM UPS system. Eaton’s ABM battery technology enabled proactive diagnostics across campus IT infrastructure. | Enhanced IT uptime with predictive monitoring, reduced battery failures, improved reliability, and future-proof infrastructure. Over 1,500 interventions in a year ensured seamless academic operations. |

|

Oxigen DC implemented Vertiv’s AFC chillers, Powerbar iMPB, Geist rPDUs, CRV row-based cooling units, and Critical Insight to design scalable colocation facilities powered by 100% renewable energy. | Supported 20 kW/rack AI & HPC workloads, Tier III compliance, energy-efficient operations, and phased capacity expansion. Delivered sustainable growth with flexible, modular power and cooling. |

|

Deutsche Bahn AG installed Stulz’s 8× Tel-Air3 AC units, 6× TXD cooling units (4.6–12.6 kW capacity), and free/mixed-mode cooling with Ethernet-based BMS for battery train charging substations. | Delivered 100% cooling redundancy, energy-efficient mixed-mode operation, seamless BMS integration, and reliable climate control. Ensured 24/7 resilience for sustainable battery-electric rail infrastructure. |

|

ED Netze GmbH adopted Schneider Electric’s 17 SF6-free GIS MV cubicles with native sensors, enabling digital monitoring and preventive maintenance at a 110/20 kV substation. | Eliminated 2,166 tons of CO2 emissions, enhanced grid reliability, supported DER integration, and ensured long-term sustainable and regulatory-compliant power distribution. |

|

Scott Data Center installed Caterpillar’s 4× Cat 3516 diesel generator sets, paralleling switchgear, and storm-resistant enclosures, with end-to-end servicing by NMC Power Systems. | Achieved 99.999% uptime, N+1 redundancy, seamless utility transition, and disaster-resilient backup. Enabled mission-critical workloads for Fortune 500 clients with long-term operational reliability. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center solutions ecosystem integrates electrical equipment, mechanical equipment, IT equipment, and software providers to enable end-to-end infrastructure efficiency. Electrical players focus on resilient power systems, mechanical vendors enhance cooling and enclosure efficiency, IT providers drive compute and networking performance, while software firms deliver DCIM, monitoring, and automation. Together, they create a holistic ecosystem addressing uptime, scalability, energy efficiency, and sustainability across hyperscale, colocation, and enterprise data centers.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Solution Market, By Component

Infrastructure will dominate the market, driven by rising demand for reliable power, advanced cooling, and scalable IT systems. With AI, HPC, and IoT workloads expanding, enterprises and hyperscalers are investing heavily in UPS, generators, racks, and liquid cooling technologies. Modular and prefabricated systems further accelerate deployments, making infrastructure the backbone of modern data center transformation.

Data Center Solution Market, By Software

Analytics & AIOps software will capture the largest share, as operators adopt predictive maintenance, anomaly detection, and automated workload management to reduce downtime and optimize resources. Growing integration with DCIM, energy monitoring, and cybersecurity tools enhances efficiency. AI-driven insights into PUE, WUE, and CUE will make AIOps central to sustainability and operational resilience in future data centers.

Data Center Solution Market, By Workload Type

General Purpose IT will remain the largest workload type, fueled by enterprise digital transformation, cloud adoption, and SaaS expansion. Demand for scalable computing, storage, and networking solutions supports varied workloads across industries. While AI and HPC workloads grow rapidly, general-purpose IT continues to anchor most deployments, requiring versatile infrastructure with a balance of cost-efficiency, security, and flexibility.

Data Center Solution Market, By Data Center Size

Large data centers will dominate market share due to hyperscaler and colocation providers expanding multi-megawatt campuses globally. These facilities support diverse workloads with advanced modular infrastructure, high-density racks, and redundant power systems. Their ability to integrate hybrid IT, AI-driven monitoring, and sustainable cooling solutions positions them as critical hubs for cloud services, enterprise hosting, and digital ecosystems.

Data Center Solution Market, By Tier Type

Tier 3 data centers will hold the largest share, offering an optimal balance of uptime, redundancy, and cost-efficiency. Widely preferred by enterprises and colocation operators, Tier 3 ensures concurrent maintainability while keeping costs lower than Tier 4. Demand for N+1 redundancy, resilient cooling, and regulatory compliance will sustain Tier 3 adoption, particularly across high-growth enterprise and BFSI sectors.

Data Center Solution Market, By Data Center Type

Hyperscale data centers will lead growth, supported by massive investments from Microsoft, AWS, Google, and Meta in AI and cloud workloads. These facilities deploy modular power systems, liquid cooling, and AI-driven orchestration to manage thousands of servers efficiently. Rising demand for AI, HPC, and IoT processing at scale cements hyperscale as the backbone of global digital infrastructure.

Data Center Solution Market, By Enterprise Data Centers

BFSI will emerge as the largest vertical, driven by digital banking, fintech innovation, and real-time transaction workloads requiring high reliability and security. Regulatory compliance, ESG mandates, and the rise of AI-based fraud detection amplify demand for resilient infrastructure. BFSI firms increasingly rely on hybrid cloud and colocation facilities, ensuring seamless operations, data protection, and sustainable growth in financial services.

REGION

North America is expected to hold the largest market share in the data center power market during the forecast period.

Asia Pacific is the fastest-growing data center solutions market, driven by rapid hyperscale expansion, cloud adoption, and AI-led workloads across India, China, Japan, Singapore, and Australia. The region added 1.6 GW of new capacity in 2024, bringing operational IT load to 12.2 GW. Key developments include NEXTDC’s USD 480 million capital raise in Australia, Digital Edge’s SEL2 facility in South Korea, and Equinix’s acquisitions in the Philippines and Malaysia. Japan and China lead in high-density infrastructure and liquid cooling, while Southeast Asia sees rising modular builds. Strong government support and localization requirements position APAC as a global digital hub.

data center solutions market: COMPANY EVALUATION MATRIX

The competitive landscape of the data center solutions market positions Dell Technologies as a Star, demonstrating strong market dominance and a comprehensive product footprint across IT infrastructure and integrated solutions. Schneider Electric stands out among Emerging Leaders, driven by its innovation in power management and cooling systems. Other vendors occupy the Pervasive Players and Participants quadrants, indicating focused portfolios with selective market reach.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 448.95 BN |

| Revenue Forecast in 2030 | USD 1,105.28 BN |

| Growth Rate | CAGR of 19.7% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Component: Infrastructure (IT Infrastructure – Servers, Storage, Network; Power Infrastructure – Power Generation [Generators, Gas Turbines], Power Backup [UPS, BESS], Power Distribution [Switchboards, Busways, PDUs], Switchgear [High, Medium, Low Voltage], Cabling Infrastructure, Racks & Enclosures [Open Frame, Enclosed], Cooling Infrastructure [Air Cooling – CRAH & CRAC, Air-Cooled Chillers, Cooling Towers; Liquid Cooling – Heat Exchangers [RDHx], Water-Cooled Chillers, CDU]); Software (DCIM, Building/Facility Management, Virtualization & Orchestration, Compliance & Security, Analytics & AIOps) |

| Regional Scope | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

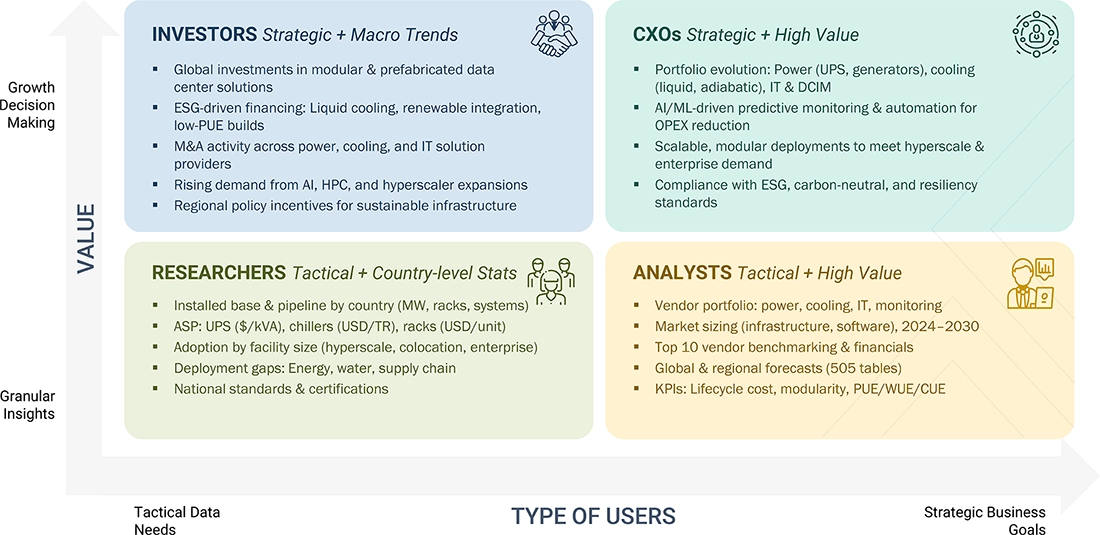

WHAT IS IN IT FOR YOU: data center solutions market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Hyperscaler (North America) | Regional market sizing and component-level forecast for power and cooling infrastructure | Identified growth hotspots and investment priorities by quantifying market potential across UPS, switchgear, and cooling segments for hyperscale deployments |

| Global Colocation Provider (Europe) | Competitive landscape and vendor share analysis across IT and facility software solutions | Enabled strategic positioning by benchmarking top DCIM, virtualization, and BMS software providers with detailed market share and capability insights |

| Leading BFSI Data Center (Asia Pacific) | End-user demand mapping and adoption analysis by component type | Enhanced strategic decision-making by mapping adoption trends across servers, storage, and compliance software, highlighting regional growth opportunities |

RECENT DEVELOPMENTS

- July 2025 : HPE completed the acquisition of Juniper Networks, forming HPE Networking. The unified HPE–Aruba–Juniper portfolio delivers an AI-native, secure LAN-to-WAN stack powered by Mist AIOps and integrated with HPE GreenLake, enhancing user experiences and high-performance data center fabrics.

- June 2025 : DDC Solutions partnered with Quantum Technology Systems to deliver S-Series cooling cabinets (15 kW–600 kW+) with bundled white-space infrastructure and integration services, enabling hyperscalers, enterprises, and colocation providers to deploy AI/HPC-ready cooling at scale.

- June 2025 : Deutsche Telekom and NVIDIA launched the world’s first industrial AI cloud in Germany, featuring 10,000 GPUs with DGX B200 systems and RTX PRO Servers. Deutsche Telekom will manage infrastructure and security to drive AI adoption across European manufacturing and industrial sectors.

- May 2025 : Dell Technologies and NVIDIA introduced PowerEdge XE9780 servers with Blackwell Ultra GPUs, Spectrum-X Ethernet switches, and BlueField-3 DPUs. Supporting up to 256 GPUs, the air- and liquid-cooled systems enable 4× faster AI model training for enterprise workloads.

- March 2025 : NVIDIA acquired Gretel, a synthetic data startup specializing in privacy-preserving datasets. The acquisition enhances NVIDIA’s AI training capabilities by improving synthetic data generation for large-language models and enterprise AI applications.

Table of Contents

Methodology

This research study on the data center solutions market involved extensive secondary sources, directories, IEEE Communication-Efficient: Algorithms and Systems, International Journal of Innovation and Technology Management, and paid databases. Primary sources were mainly industry experts from the core and related industries, preferred data center solution providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

Secondary Research

In the secondary research process, various sources were referred to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors’ websites. Additionally, the data center solutions spending of various countries was extracted from the respective sources.

Primary Research

In the primary research process, various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), and directors specializing in business development, marketing, and data center solution providers. It also included key executives from data center solution vendors, system integrators (SIs), professional service providers, industry associations, and other key opinion leaders.

Note: Tier 1 companies’ revenues are more than USD 10 billion; tier 2 companies’ revenues range between USD 1 and

10 billion; and tier 3 companies’ revenues range between USD 500 million and USD 1 billion.

Other designations include sales managers, marketing managers, and product managers.

Source: Industry Experts

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the data center solutions market. The first approach involved estimating the market size by companies’ revenue generated through the sale of data center solutions.

Market Size Estimation Methodology- Top-down approach

The top-down approach prepared an exhaustive list of all the vendors offering products in the data center solutions market. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor’s offerings were evaluated based on platform, degree of customization, type, application, end user, and region. The markets were triangulated through primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

Market Size Estimation Methodology-Bottom-up approach

In the bottom-up approach, the adoption rate of data center solutions among different verticals in key countries, concerning their regions contributing the most to the market share, was identified. For cross-validation, the adoption of data center solutions by enterprises, along with various use cases across different regions, was identified and analyzed. The use cases identified in different areas were given weight for the market size calculation.

Based on the market numbers, the regional split was determined by primary and secondary sources. The procedure included an analysis of the data center solutions market’s regional penetration. Based on secondary research, the regional spending on Information and Communications Technology (ICT), socioeconomic analysis of each country, strategic vendor analysis of major data center solution providers, and organic and inorganic business development activities of regional and global players were estimated.

Data Center Solutions Market : Top-Down and Bottom-Up Approach

Data Triangulation

After determining the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. Data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and determine the exact statistics of each market segment and subsegment. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

The data center solutions market includes technologies, hardware, software, and services that support the design, construction, operation, and optimization of data centers for secure, reliable, and scalable digital infrastructure operations. This market includes systems for IT infrastructure (servers, storage, networking), power and cooling, racks, cabling, and monitoring, supporting workloads from enterprise IT to artificial intelligence and cloud computing. Data center solutions ensure uptime, energy efficiency, compliance, and high-performance processing, allowing organizations to meet growing digital, regulatory, and sustainability demands while underpinning transformation across industries and global cloud and digital platforms.

Stakeholders

- IT service providers

- Support infrastructure equipment providers

- Component providers

- Software providers

- System integrators

- Network service providers

- Consulting service providers

- Professional service providers

- Distributors and resellers

- Cloud providers

- Colocation providers

- Enterprises

- Government and standardization bodies

- Telecom operators

- Healthcare organizations

Report Objectives

- To define, describe, and forecast the data center solutions market based on Component (Infrastructure and Software), Workload Type (HPC & AI and General Purpose IT), Tier Type (Tier 1, Tier 2, Tier 3, Tier 4), Data Center Size (Small, Medium, Large), Data Center Type (Hyperscale, Colocation, Enterprise), and Enterprise Verticals (BFSI, IT & Telecom, Government & Public Sector, Retail & Ecommerce), and Region

- To forecast the market size of five major regional segments: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To strategically analyze the market subsegments concerning individual growth trends, prospects, and contributions to the total market

- To provide detailed information related to the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze macro and micro markets concerning growth trends, prospects, and their contributions to the overall market

- To analyze industry trends, patents and innovations, and pricing data related to the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To analyze the impact of AI/generative AI on the market

- To profile key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments such as mergers & acquisitions, product launches, and partnerships & collaborations in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

- Further breakup of the North American data center solutions market

- Further breakup of the European data center solutions market

- Further breakup of the Asia Pacific data center solutions market

- Further breakup of the Middle East & Africa data center solutions market

- Further breakup of the Latin American data center solutions market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Key Questions Addressed by the Report

What are data center solutions?

According to the Uptime Institute, data center solutions include the systems and infrastructure that store, process, and manage data reliably and securely. The Data Center Alliance defines integrated technologies such as servers, storage, networking, power, cooling, and monitoring tools that support high-performance, scalable, and energy-efficient operations. These solutions are essential for running critical workloads across cloud, AI, and enterprise environments, ensuring uptime, compliance, and seamless connectivity. Data center solutions combine hardware, software, and design best practices to meet evolving digital infrastructure needs across industries.

What are the different types of workloads for the data center solutions?

Data center solutions typically support two main types of workloads: high-performance computing and artificial intelligence, and general-purpose IT. HPC and AI workloads require powerful compute capabilities, low-latency networks, and advanced cooling to handle GPU-intensive tasks such as AI model training, scientific research, and big data analytics. In contrast, general-purpose IT workloads include day-to-day business applications such as databases, enterprise resource planning, virtual desktops, and email systems. These rely on stable, secure, and scalable infrastructure to ensure uninterrupted performance, making them essential for supporting routine enterprise operations across industries.

What are the major factors driving the growth of the data center solutions industry?

The growth of the data center solutions industry is driven by rising demand for artificial intelligence, high-performance computing, and big data processing, which require high-density, scalable infrastructure. Rapid adoption of cloud services, multi-cloud strategies, and enterprise digital transformation also pushes investments in reliable and flexible data center environments. Additionally, regulatory compliance, sustainability goals, and the need for energy-efficient power and cooling systems are prompting modernization across global data center operations.

What challenges are hindering the widespread adoption of data center solutions?

Adopting data center solutions faces several challenges, including extended lead times for critical electrical and mechanical equipment, which disrupt construction and expansion schedules. Land-use restrictions and permitting bottlenecks often delay new site developments. High capital expenditure, complex regulatory compliance, energy supply constraints, and the ongoing need for skilled personnel further limit rapid growth. Sustainability requirements and the demand for advanced power and cooling technologies add complexity and cost.

Who are the key vendors in the data center solutions market?

The key vendors in the global data center solutions market include Dell Technologies (US), Broadcom (US), Nvidia (US), HPE (US), Supermicro Computer Inc. (US), Lenovo (China), Schneider Electric (France), Huawei (China), IBM (US), Cisco (US).

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Solutions Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Solutions Market