Construction Equipment Market Size, Share & Analysis

Construction Equipment Market by Equipment Type (Excavator, Loader, Dozer, Dump Truck, Compactor, Crane), Propulsion, Power Output, Engine Capacity, Application, Electric Construction Equipment, Battery Chemistry, & Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global construction equipment market size was valued at USD 148.02 billion in 2024 and is expected to reach USD 186.62 billion by 2030, at a CAGR of 3.9%, during the forecast period 2024-2030. Asia continues to be the dominant market for construction equipment. Growth in the market is now driven by technological advancements like connected machinery and telematics, enabling OEMs to generate new revenue through data services that enhance uptime, predictive maintenance, and fuel efficiency. Supply chain contraints raise component costs and limit OEM production. These factors, along with training needs for connected and autonomous machines, create bottlenecks in growth of construction equipment market.

KEY TAKEAWAYS

-

BY EQUIPMENT TYPERigid dump trucks are projected to record the highest CAGR within the construction equipment market, primarily driven by large-scale infrastructure development and mining activities across China, India, and Indonesia. Crawler Excavators are expected to hold largest market share during the forecast period. The surge in government-backed projects such as highway expansion, urban redevelopment, and quarry operations is boosting demand for high-capacity hauling equipment. Additionally, rising investments in metal and mineral extraction projects and the replacement of aging fleets with high-performance, fuel-efficient models further reinforce growth prospects for rigid dump trucks in the forecast period.

-

BY EQUIPMENT CATEGORYThe earthmoving segment is the fastest and largest growing in the construction equipment market, owing to high demand pull from China and India due to massive infrastructure investments. Rapid urbanization and projects like China's Belt and Road Initiative and India's $1.4 trillion National Infrastructure Pipeline boost needs for excavators and loaders in site preparation and earthmoving tasks. OEMs rapidly adopt hydraulic-electric integration, advanced telematics, and grade-control systems in excavators, loaders, and dozers, gaining fuel efficiency and precision. These technologies enable scalable hybrid and electric variants across multiple weight classes faster than cranes or concrete machinery.

-

BY AFTER-TREATMENT DEVICEExhaust Gas Recirculation (EGR) systems are witnessing the fastest growth within the construction equipment market, driven by stringent Stage V and Bharat Stage IV emission mandates. In China and India, rapid expansion of road and urban infrastructure projects, coupled with high production of diesel-based excavators and loaders, is boosting EGR adoption. Additionally, OEMs are integrating cooled and electronically controlled EGR systems to meet NOx reduction targets while maintaining engine efficiency across heavy-duty segments.

-

BY APPLICATIONThe infrastructure segment is the fastest growing in the construction equipment market, mainly due to high demand from China, India, and Southeast Asian countries. These regions are investing heavily in mega infrastructure projects such as highways, metros, airports, and smart cities. Government stimulus and national programs like China’s Belt and Road Initiative and India’s National Infrastructure Pipeline are driving a surge in equipment orders for earthmoving, concrete, and lifting machinery. Rapid urbanization and the push for modernization further amplify the need for advanced equipment across large-scale job sites.

-

BY ENGINE CAPACITYThe <5L engine capacity segment is the largest and fastest growing in the construction equipment market, mainly due to high demand pull from China, India, and Southeast Asia. These countries are focusing on compact construction machinery for urban infrastructure, smart city, and residential projects that require fuel-efficient, low-emission engines. Growing investments in small to medium construction, rising regulatory pressure for emission compliance, and preference for agile machines in tight city spaces are boosting adoption. Manufacturers are responding with advanced, efficient diesel and hybrid engines to fit this segment.

-

BY POWER OUTPUTBy power output, Equipment below 100 hp remains the largest market segment because it powers compact, versatile machines suited for urban construction, rental fleets, and last-mile earthmoving, these applications demand high maneuverability and lower operating costs. In contrast, the 201–400 hp range is the fastest-growing as OEMs electrify and automate mid-to-heavy-duty platforms, these power class is ideal for integrating advanced hydraulics, telematics, and hybrid powertrains, delivering high productivity with improved fuel and emissions performance in large-scale infrastructure and mining projects.

-

BY PROPULSIONThe CNG/LNG/RNG segment is the fastest growing propulsion type in the construction equipment market, driven mainly by demand from the Middle East region due to abundant natural gas reserves and expanding infrastructure projects. Governments here are promoting cleaner fuel usage through subsidies and sustainability targets. Whereas, the diesel segment remains the largest growing type globally, supported by strong demand from countries like China and India owing to established diesel fleets, large-scale infrastructure, and industrial development requiring high-power equipment. Diesel engines also benefit from extensive fuel availability and service networks in these regions.

-

By application (Rental)The infrastructure segment is the fastest growing in the construction equipment rental market, driven by high demand pull from India, China, and the U.S. These countries are investing in large-scale projects like India's National Infrastructure Pipeline, China's Belt and Road Initiative, and U.S. Bipartisan Infrastructure Law, requiring flexible access to heavy machinery for roads, bridges, and urban development. Rental services offer cost savings on ownership and maintenance, enabling contractors to scale fleets for short-term needs without capital strain. Government funding and urbanization further accelerate rentals for earthmovers and cranes in these high-volume sites.

-

electric & hybrid construction equipment market, by equipment typeElectric dump trucks hold the largest market share during the forecast period in the electric & hybrid construction equipment market, by equipment type, owing to high demand pull from China, the U.S., and India due to massive mining and infrastructure projects. These countries are leading in EV adoption through government incentives like China's dual-credit policy, U.S. IRA tax credits, and India's FAME scheme, pushing zero-emission fleets for cost savings on fuel and maintenance. Electric dump trucks excel in hauling heavy loads with regenerative braking for energy recovery and lower operating costs up to 40% versus diesel, suiting long-haul sites. Rapid battery advancements and charging infrastructure expansions further enable their scalability in urban and remote operations.

-

electric construction equipment market, by battery chemistry,The lithium iron phosphate (LFP) segment is projected to be the fastest and largest growing in the construction equipment market during the forecast period, owing to high demand pull from China, India, and the U.S. These countries are driving adoption through massive infrastructure and mining electrification, supported by China's dual-credit policy, U.S. IRA tax credits up to $7,500 per vehicle, and India's FAME-II subsidies for electric fleets. LFP batteries offer superior safety with no thermal runaway risks, up to 5,000 cycles for 10+ year lifespan, and 30% lower costs versus NMC types, suiting heavy-duty excavators and loaders in harsh environments. Rapid scaling of domestic production in China and incentives for LFP-based EVs further boost scalability for zero-emission construction goals.

-

AUTONOMOUS CONSTRUCTION EQUIPMENT MARKET, BY REGIONThe Americas is the fastest and largest growing region in the autonomous construction equipment market during the forecast period, owing to high demand pull from the U.S. and Canada due to acute labor shortages and massive infrastructure modernization. The U.S. Bipartisan Infrastructure Law allocates over USD 1.2 trillion for roads, bridges, and EV charging networks, while Canada's $150 billion investment in national infrastructure drives adoption of semi-autonomous dozers and excavators to boost productivity by up to 30%. These countries benefit from advanced R&D by OEMs like Caterpillar and Volvo, focusing on AI, LiDAR, and GPS for safety in hazardous sites amid a projected 2.2 million worker gap by 2026. Regulatory incentives and mining sector pilots further accelerate deployment for precision earthmoving.

-

CONSTRUCTION EQUIPMENT MARKET, BY REGIONAsia as the largest growing market by value in the construction equipment market. The growth in this region is due to high demand pull from China, India, and Indonesia. These countries are fueling expansion through massive infrastructure investments like China's Belt and Road Initiative with over USD 1 trillion in projects, India's USD 1.4 trillion National Infrastructure Pipeline, and Indonesia's USD 475 billion infrastructure plan for ports and highways. Rapid urbanization at 2-3% annual rates, population growth exceeding 1.4 billion in China and India, and government stimulus for smart cities and industrial corridors drive demand for earthmovers and cranes. Local OEM manufacturing and EV incentives further lower costs and accelerate adoption in these high-growth economies.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Caterpillar (US), Komatsu Ltd. (Japan), Deere & Company (US), Hitachi Construction Machinery Co., Ltd. (Japan), Xuzhou Construction Machinery Group (China), SANY Group (China), and AB Volvo (Sweden) have entered into a number of agreements and partnerships to cater to the growing demand for construcution equipment market across innovative applications.

The construction equipment market is growing steadily as governments and developers push new infrastructure and urban projects, while contractors increasingly use rentals for cost flexibility and rely on telematics to monitor uptime, safety, and maintenance. Electrification and hybrid machines are gaining momentum due to tighter emission goals and city rules, with OEMs and rental firms partnering with technology providers to roll out compact electric models, better batteries, and connected systems that reshape how fleets are managed.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The infographic illustrates the strategic shift for Construction Equipment Market participants, focusing on future revenue growth and client alignment. The industry is undergoing a transition from its current revenue mix (80% conventional construction equipment) to a reversed future mix (80% from Rental Services, Alternative fuel equipment, autonomous construction equipment). This shift is necessary to meet client imperatives, such as maximizing asset utilization/uptime and pursuing ESG-compliant projects. By fulfilling these imperatives, OEMs and Technology Providers drive client outcomes such as optimized fleet performance, safer navigation, and Sustainable Energy Access.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growth in infrastructural development projects

-

Increasing demand for sustainable construction solutions

Level

-

Stringent international trade policies and mandates

Level

-

Ongoing developments in lithium battery chemistry

-

Advancements in autonomous construction equipment

Level

-

Battery-related issues in electric equipment

-

Susceptibility to cyber attacks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growth in infrastructural development projects

The growth of the construction equipment market is mainly driven by increasing urbanization, population growth, technological advancements, the need to modernize existing infrastructure, and increased focus on developing sustainable green projects. The market has grown in tandem with the sales of new equipment due to an increasing number of construction projects and planned new investments in the construction industry. In the US, growth in infrastructural developments is mainly due to strategic inward investment, rising manufacturing activities, and mega infrastructure projects supported by the US Inflation Reduction Act.

Restraint: Stringent international trade policies and mandates

The sales of construction equipment in Europe have been directly impacted due to Russia-Ukraine ongoing dispute. In March 2022, the EU imposed anti-subsidy duties on the imports of stainless-steel cold-rolled flat products used as raw materials in construction equipment originating in Indonesia and India. With Indonesia at the forefront, the EU is countering the highly trade-distorting export restrictions on key raw materials linked to Chinese financing. Thus, the global international trade policies and socio-political differences among countries may lead to the restriction of the growth of the construction equipment market.

Opportunity: Ongoing developments in lithium battery chemistry

Stringent pollution laws are fueling the demand for construction equipment in electric and hybrid vehicles. As the use of zero-emission technologies increases, the off-highway equipment sector is always seeking to create better solutions for optimized and efficient electric equipment. Electric construction equipment has several advantages over conventional construction equipment, including less noise, fewer moving parts, and lower pollutants. It is also small and lightweight because it does not require the engine setup, resulting in significantly fewer parts and assemblies being replaced.

Challenge: Battery-related issues in electric equipment

Battery issues are a real hurdle for electric construction machines: they cost more upfront, packs lose value, runtime often does not cover a full shift, and long charging slows work. Remote jobsites usually lack strong power, while heat, dust, and vibration shorten battery life and add safety risk, and mixed fleets with different plugs make planning hard. The practical fixes are service-inclusive leases to cut capex, modular or swappable packs and hybrids to extend shifts, mobile/fast chargers or temporary microgrids for on-site power, rugged batteries with active cooling and telematics for health monitoring, and standard plugs plus shift-based charging plans to keep machines working.

Construction Equipment Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Autonomous haul trucks deployed in large-scale mining operations for material transport. | Integrates GPS-guided navigation and LiDAR for route optimization, achieves up to 15% fuel efficiency improvement, reduces human error in haul cycles, and maintains continuous 24/7 operation with remote fleet control. |

|

Smart Construction platform integrating drones and IoT for real-time site management. | Uses GNSS and LiDAR survey data to generate 3D terrain models, enabling ±25 mm grading accuracy, automated progress mapping, and synchronized machine control through cloud analytics. |

|

Electric compact excavators used in urban and indoor construction projects. | Powered by lithium-ion battery packs with up to 8 hours runtime per charge, achieves 90% reduction in CO2 emissions, reduces hydraulic system losses through electric actuation, and lowers noise below 65 dB(A) for indoor compliance. |

|

Tower cranes with telematics and remote monitoring for high-rise projects. | Equipped with CAN-bus sensors and remote telemetry modules for real-time load torque monitoring, predictive maintenance via data analytics, and 15–20% uptime gain through preemptive fault detection. |

|

AI-based predictive maintenance solutions for heavy-duty machinery in industrial plants. | Utilizes onboard diagnostics (OBD) and machine learning algorithms to analyze vibration, temperature, and pressure data; enables 40% reduction in unscheduled maintenance, enhances component life prediction, and supports remote fault alerts via cloud-based dashboards. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The construction equipment market ecosystem consists of raw material suppliers (ArcelorMittal, SSAB), component manufacturers (Cummins, Bosch Rexroth), OEMs (Caterpillar, Komatsu, Volvo CE), and end users (construction contractors, rental companies, infrastructure developers). Steel, hydraulics, and electronic components are integrated into machines such as excavators, loaders, and cranes. End users drive demand through infrastructure expansion, urbanization, and sustainability targets, while OEMs focus on performance, automation, and energy efficiency. Collaboration across the value chain supports technological advancement, reduced emissions, and competitive market growth.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

BY EQUIPMENT TYPE

Crawler excavators hold the largest market share in the construction equipment market, owing to high demand pull from China, India, and Indonesia. These countries are experiencing massive infrastructure investments, including China's Belt and Road Initiative with over $1 trillion in projects, India's $1.4 trillion National Infrastructure Pipeline, and Indonesia's $475 billion plan for highways and urban development, requiring stable machines for digging, grading, and foundation work on challenging terrains. Their 40-50% segment dominance stems from superior traction in soft or uneven soils, 20-30% higher productivity in mining and earthmoving, and integration of hybrid powertrains for emission compliance under Stage V standards. Government subsidies for localized manufacturing and fleet upgrades further drive adoption in these high-volume markets.

BY EQUIPMENT CATEGORY

The earthmoving equipment segment is the fastest growing in the construction equipment market, driven by high demand pull from India, China, and Australia. These countries are investing heavily in infrastructure development such as roadways, airports, and urban projects, fueling demand for excavators, loaders, and dump trucks. Rapid urbanization, government stimulus for affordable housing, and industrial expansion are key growth drivers. Advanced technologies like automation and telematics in earthmoving equipment further boost operational efficiency, accelerating market growth.

BY AFTER-TREATMENT DEVICE

Asia is the largest market by aftermarket device in the construction equipment market, owing to high demand pull from China, India, and Indonesia. These countries are experiencing booming infrastructure and mining activities, with China's Belt and Road Initiative, India's USD 1.4 trillion National Infrastructure Pipeline, and Indonesia's USD 475 billion development plan requiring extensive maintenance, repair, and replacement services to minimize downtime on large fleets. Rapid urbanization and equipment aging in high-usage sites drive aftermarket needs for parts like hydraulics and engines, supported by local OEM networks and telematics for predictive maintenance. Government incentives for fleet upgrades and sustainability further boost aftermarket adoption in these economies.

BY APPLICATION

The crawler excavators segment is the largest growing application in the construction equipment market, driven by high demand pull from China, India, and Southeast Asia. These countries are witnessing rapid urbanization, infrastructure expansion, and mining activities that require highly stable and efficient excavators capable of operating on uneven and soft terrains. Advanced technologies like hydraulic-electronic integration, telematics, and automation enhance fuel efficiency and operational precision, making crawler excavators ideal for large-scale infrastructure projects, urban developments, and mining sectors in these regions. Additionally, government initiatives supporting smart city developments and sustainable construction further propel demand.

BY ENGINE CAPACITY

The >10L engine capacity segment is the fastest growing in the construction equipment market, owing to high demand pull from China, India, and Australia. These countries are prioritizing large-scale mining, heavy excavation, and mega-infrastructure projects like China's Belt and Road Initiative, India's National Infrastructure Pipeline, and Australia's resource boom, requiring high-torque engines for equipment such as large excavators, dump trucks, and bulldozers to handle extreme loads and long operations. The segment benefits from a projected CAGR of 8.5%, driven by increasing energy resource extraction and urban megaprojects that demand durable, high-power performance over smaller engines. Advances in emission-compliant technologies, like Cummins' 15L X15 diesel engine, further enable adoption by reducing operational costs and meeting global standards.

BY POWER OUTPUT

The <100 HP segment holds the largest market share in the construction equipment market, owing to high demand pull from China, India, and Southeast Asian countries. These nations are fueling growth through rapid urbanization and small to medium-scale projects like residential developments, urban renewal, and agricultural infrastructure under initiatives such as India's PMAY housing scheme and China's rural revitalization program, where compact mini-excavators, skid-steer loaders, and backhoes offer maneuverability in tight spaces. The segment's dominance stems from its 45% share in compact equipment, driven by 30% lower acquisition costs, fuel efficiency up to 20% better than higher HP classes, and suitability for emission-regulated urban sites. Rising adoption of electric variants in this range further accelerates penetration amid government subsidies for green machinery.

REGION

Asia is the largest-growing region in global construction equipment market during forecast period

The Asia construction equipment market is the largest globally by value during the forecast period, driven by large-scale infrastructure development, rapid urbanization, and government-backed projects. Countries like China and India dominate in this market, supported by initiatives such as China's Belt and Road, fueling demand for earthmoving and concrete equipment. OEMs and suppliers in the region are focusing on advanced manufacturing with improved fuel efficiency, rental fleets, digital equipment management, and R&D in electric goals. Rising adoption of hybrid powertrains to advance sustainability further accelerates market growth across the region.

Construction Equipment Market: COMPANY EVALUATION MATRIX

In the construction equipment market matrix, Caterpillar Inc. (Star) leads with a strong global presence and broad product portfolio, supported by advanced telematics, autonomous systems, and energy-efficient machinery widely used across mining, infrastructure, and urban projects. Liebherr (Emerging Leader) is gaining traction through its high-precision engineering, electric and hybrid machinery development, and focus on customized solutions for heavy-duty applications. While Caterpillar dominates through scale, digital integration, and aftersales network strength, Liebherr shows strong potential to advance toward the leaders’ quadrant as demand for sustainable and intelligent construction equipment continues to expand.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 148.02 Billion |

| Market Forecast in 2030 (Value) | USD 186.62 Billion |

| Growth Rate | CAGR of 3.9% from 2024-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Equipment Type, Equipment Category, Power Output, Propulsion, Engine Capacity, Application, Rental Application, Electric Equipment Type, Battery Chemistry, Compact Equipment Shipment By OEM, Aftertreatment Device, Region. |

| Regions Covered | North America, Asia, Europe, Middle East and Rest of the World |

WHAT IS IN IT FOR YOU: Construction Equipment Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Global CE OEM |

|

|

| Regional Rental Major |

|

|

| Component Tier-1 (Engines/Hydraulics) |

|

|

| Digital Tech Provider (Machine Control/Telematics) |

|

|

| Dealer Group (Multi-OEM) |

|

|

RECENT DEVELOPMENTS

- December 2024 : Sany India lined up an investment of Rs USD 117 million to enhance its manufacturing capacity in its Pune plant. The company enhanced its annual production capacity to 12,000 machines (2024) units from around 6,000 machines (2023). The company also doubled its shed area through this expansion.

- August 2024 : Komatsu and ABB collaborated on the development of integrated electric solutions to provide net zero-emission technology for heavy industrial machinery. The collaboration is focused on the development of haulage, loading, and auxiliary equipment.

- June 2023 : Xuzhou Construction Machinery Group (XCMG) entered into a long-term strategic cooperation agreement with IBM and a memorandum of strategic cooperation with SAP. This will intensify XCMG’s efforts to promote the "high-end, intelligent, green, service-oriented, and globalization" transformation and upgrading initiatives.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

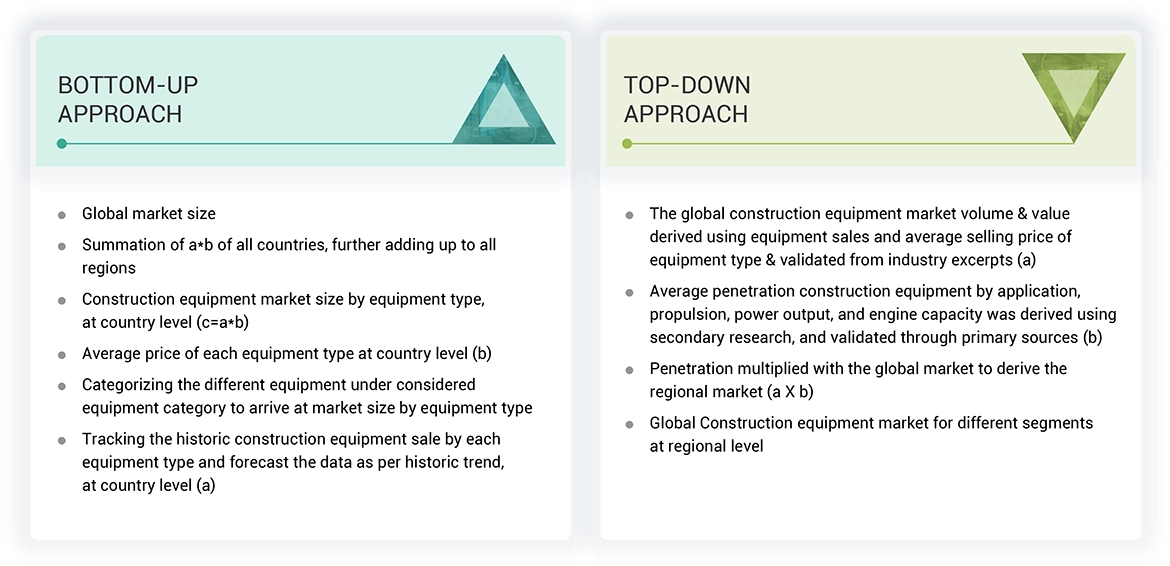

The study encompassed four primary tasks to determine the present and future scope of the construction equipment market. Initially, extensive secondary research was conducted to gather data on the market, its related sectors, and overarching industries. Subsequently, these findings and assumptions were corroborated and validated through primary research involving industry experts across the value chain. The complete market size was estimated by using both top-down and bottom-up methodology. Following this, a market breakdown and data triangulation approach were utilized to determine the size of specific segments and subsegments within the market.

Secondary Research

The secondary sources referred to the company's annual reports/presentations, industry association publications, directories, technical handbooks, World Economic Outlook, technical articles, and databases, which were used to identify and collect information for an extensive study of the construction equipment market. The secondary sources used while estimating the market sizing are the Association of Equipment Manufacturers, the Committee for European Construction Equipment (CECE), corporate filings (such as annual reports, investor presentations, and financial statements), and off-highway associations. Secondary data was collected and analyzed to determine the overall market size, further validated through primary research. The primary sources—experts from related industries, OEMs, rental service players, and component suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations. Historical sales data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

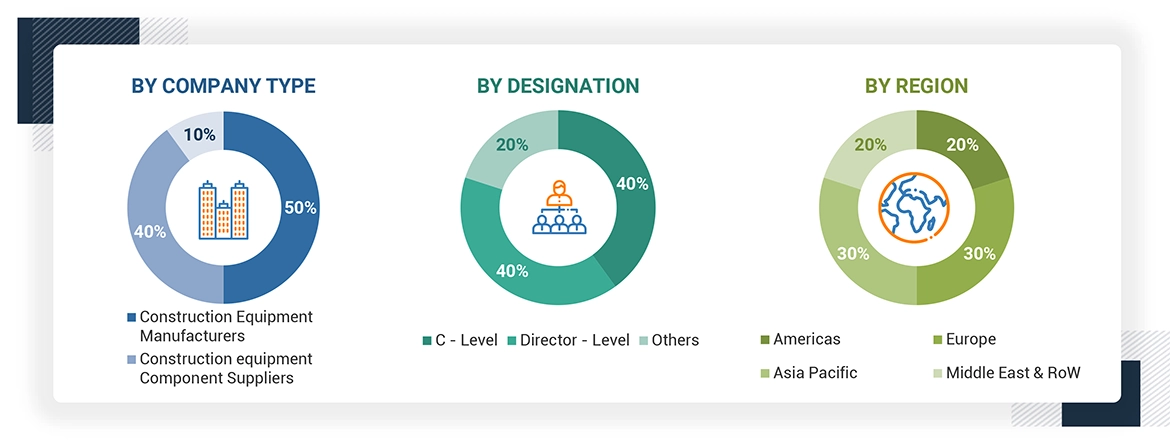

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as construction equipment market sizing estimation and forecast, future technology trends, and upcoming technologies in the market. Data triangulation of all these points was done using the information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points.

Note: Other designations include sales, marketing, and product managers.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the construction equipment market and other dependent submarkets, as mentioned below.

- The bottom-up approach was used to estimate and validate the market size. The market size, by equipment and country, was derived by mapping the historical sales of different equipment at the country level. These data points were largely fetched from the country-level associations, off-highway databases, and OEM data excerpts. The market size, by value, was derived by multiplying the equipment-wise average selling price with the respective equipment volume calculated in units. Each country/region's total volume and value of each country/ region are then summed up to reveal the total volume of the global market for each type. The data was validated through primary interviews with industry experts. The market is further segmented into the equipment categorywhich includes power output, engine capacity, propulsion, and electric construction equipment. The penetration of different segments was derived from secondary research and primary interviews.

- The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Construction Equipment Market : Top-Down and Bottom-Up Approach

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in the report.

Market Definition

CONSTRUCTION EQUIPMENT: Construction equipment refers to a wide range of heavy machinery and tools used in the commercial, residential, and infrastructure sectors. These machines play a crucial role in enhancing the quality, safety, and productivity of construction projects. Common types of construction equipment include excavators, loaders, dozers, graders, scrapers, dump trucks, mixers, compactors, and cranes. Each type of equipment is designed to handle specific tasks, enabling construction teams to complete projects more efficiently and safely.

Stakeholders

- Construction Equipment manufacturers

- Raw Material Suppliers for Construction Equipment component/system manufacturers

- Consulting companies (Road, Building & Infrastructure)

- Tier 1 companies (Aftertreatment device manufacturers & component suppliers)

- Battery, motor, and other electric construction equipment part suppliers

- Equipment service providers

- Off-Vehicle Safety Regulatory Bodies

- Government and research institutions

- Off-highway and heavy equipment associations

- Rental equipment service providers

Report Objectives

-

To define, describe, and forecast the Construction Equipment market in terms of value (USD million) and volume (thousand units) based on the following segments:

- By Equipment Type (Articulated Dump Trucks, Asphalt Finishers, Backhoe Loaders, Crawler Dozers, Crawler Excavators, Crawler Loaders, Mini Excavators, Motor Graders, Motor Scrapers, Rigid Dump Trucks, Road Rollers, Rough Terrain Lift Truck (RTLT) Masted, Rough Terrain Lift Truck (RTLT) Telescopic, Skid-Steer Loaders, Wheeled Excavators, Wheeled Loaders <80 HP, Wheeled Loaders >80 HP, Compactors, and Pick and Carry Cranes)

- By Equipment Category (Earthmoving, Material Handling, Heavy Construction Vehicles, Others)

- By Propulsion Type (Diesel, CNG/LNG/RNG)

- By Power Output (<100HP, 101-200HP, 201-400HP, >400 HP)

- By Engine Capacity (<5L, 5-10L,>10L)

- By Application (Commercial, Residential, Infrastructure)

- By Aftertreatment Device (Diesel Oxidation Catalyst, Diesel Particulate Filter, Exhaust Gas Recirculation, Selective Catalyst Reduction)

- Rental, by Application (Commercial, Residential, Infrastructure)

- Electric & hybrid Construction Equipment Market, By Equipment Type (Electric Dump Truck, Electric Dozer, Electric Loader, Electric Excavator, Electric Motor Grader, Electric Load Haul Dump)

- Electric Construction Equipment Market, By Battery Chemistry (Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Others)

- Compact construction Equipment Market, Global Shipment by OEM (Bobcat, Caterpillar, Hitachi Construction Equipment, CNH Industrial, Hyundai Construction Equipment Co., Ltd, JCB, Deere & Company, Komatsu, Kubota Corporation, Liebherr, Liugong Machinery Co., Ltd, Terex Corporation, AB Volvo, Wacker Neuson SE, Yanmar Holdings Co., Ltd, Kobelco)

-

By Region (Asia Pacific, Europe, North America, The Middle East, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players operating in the construction equipment market and evaluate the company evaluation quadrant.

- To strategically analyze key player strategies and company revenue analysis

-

To study the following with respect to the market

- Trends and Disruptions Impacting Customers’ Businesses

- Market Ecosystem

- Supply Chain Analysis

- Patent Analysis

- Regulatory Landscape

- Case Study Analysis

- Key Conferences and Events

- Investment and Funding Scenario

- Pricing Analysis

- To analyze recent developments, including supply contracts, new product launches, expansions, and mergers & acquisitions undertaken by key industry participants in the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

CONSTRUCTION EQUIPMENT MARKET, BY END-USE INDUSTRY

- Construction& Infrastructure

- Mining

- Oil & Gas

- Manufacturing

- Others

Note: This chapter will be further segmented at the country level in terms of volume and value

CONSTRUCTION EQUIPMENT MARKET, BY EMISSION REGULATION

- STAGE II

- STAGE III

- STAGE III a

- STAGE III b

- STAGE IV

- STAGE V

- STAGE VI

- TIER 3

- TIER 4

- TIER 5

Note: This chapter will be further segmented at the country level in terms of volume and value

ELECTRIC CONSTRUCTION EQUIPMENT MARKET, BY COUNTRY

- China

- India

- Japan

- Indonesia

- US

- Canada

- Mexico

- Germany

- UK

- France

- Italy

- Spain

Note: This chapter will be further segmented at the regional level (Asia Pacific, Europe, North America, and the Rest of the World) in terms of volume and value

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Construction Equipment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Construction Equipment Market

Andrew

May, 2022

We would like to know more about how electric construction equipment market and special application products for the further expansion of the European market..

Thomas

Jun, 2022

Who are the top vendors in the Construction Equipment Market? How is the competitive scenario among them?.

Akshit

Jun, 2019

we are looking at setting up a website to sell new and used construction and mining equipment for Africa, there is nothing at the moment .

Atul

Jun, 2019

My company deals with construction equipment, we buy equipment in large number and then sell them to export from Japan to all over the world. .

Nilesh

Jun, 2019

We are trying to evaluate the market size of backhoes, excavators, dozers, skid steers, front end loaders, and articulated dump trucks. This will help prioritize where time and energy are spent. .

Nilesh

Jun, 2019

Looking to identify U.S. market share by brand (Case, Cat, etc...) for various types of construction equipment..