Combat System Integration Market by Application (Land-based, Naval, Airborne), Platform (Large Ships, Medium Ships, Small Ships, Submarines, Fighter Aircraft, Combat Helicopters, Armored Vehicles/Artillery), Region - Global Forecast to 2022

[172 Pages Report] The combat system integration market is projected to grow from USD 4.26 Billion in 2016 to USD 25.46 Billion by 2022, at a CAGR of 34.7% during the forecast period, 2016 to 2022. This report on the combat system integration market, forecasts the market and its dynamics over the next six years. It also identifies the market application gaps, recent developments in the market, and high growth potential countries. The market has been segmented on the basis of platform into large combat ships, medium combat ships, small combat ships, submarines, fighter aircraft, combat helicopters, and armored vehicles/artillery. On the basis of application, the market has been classified into naval, airborne, and land-based.

The combat system integration market is projected to grow from USD 4.26 Billion in 2016 to USD 25.46 Billion by 2022, at a CAGR of 34.7% during the forecast period, 2016 to 2022. Factors such as increasing focus on the naval sector in emerging economies, commissioning of new warships, and continuous upgradation of existing combat platforms and interconnected warfare systems are expected to drive the growth of the market during the forecast period.

On the basis of platform, the combat system integration market has been segmented into large combat ships, medium combat ships, small combat ships, submarines, fighter aircraft, combat helicopters, and armored vehicles/artillery. Increasing demand for integration of combat systems can be attributed to several factors, which include upgradation of existing naval platforms, need for interconnected warfare systems, and requirement for command & control over large scale combat platforms, among others. These factors are expected to fuel the growth of the market during the forecast period.

Use of combat system integration in the defense sector has increased considerably over the past few years. In addition, there is increase in the number of new combat systems that are manufactured, worldwide. These combat systems as well as support systems need to be integrated with each other on combat platforms. Among applications, the naval segment is projected to lead the combat system integration market during the forecast period. This segment is expected to witness the highest growth during the forecast period.

The large combat ships platform segment of the combat system integration market has been segmented into destroyers, frigates, cruisers, and amphibious ships. Among platforms, the submarines segment of the combat system integration market is expected to grow at the highest CAGR during the forecast period. This can be attributed to the growing demand for procurement of new underwater systems as well as increased focus of emerging economies on upgradation of their submarine platforms. Australia is currently developing a major fleet of submarines, for which, it has selected DCNS Group. However, Lockheed Martin Corporation will be the combat system integrator and service provider for these submarines in coordination with DCNS Group.

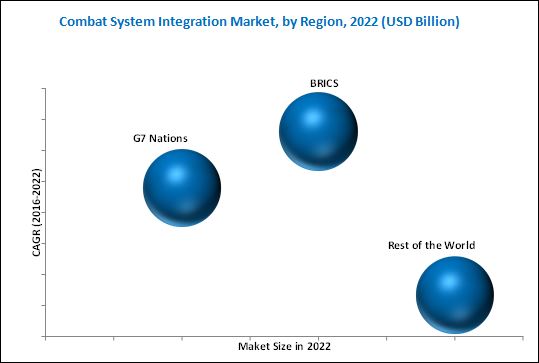

The BRICS combat system integration market is projected to grow at the highest rate during the forecast period. The key drivers for the growth of the BRICS combat system integration market include continuously increasing defense budgets of China and India. China is developing huge force of blue water navy, while India is also increasing its submarine and surface warship capabilities.

Declining defense budgets of developed economies, such as the U.S., Canada, the U.K., and Germany as well as stringent rules regarding technology sharing are the factors expected to restrain the growth of the combat system integration market during the forecast period.

Lockheed Martin Corporation (U.S.), Leonardo-Finmeccanica (Italy), Raytheon Company (U.S.), BAE Systems PLC. (U.K.), QinetiQ Group PLC (U.K.), Saab AB (Sweden), and Thales Group (France), among others are the leading players in the combat system integration market. The strategy of contracts was among the major growth strategies adopted by top players to strengthen their position in the combat system integrations market as well as to enhance their product offerings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency & Pricing

1.5 Distribution Channel Participants

1.6 Limitations

1.7 Market Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

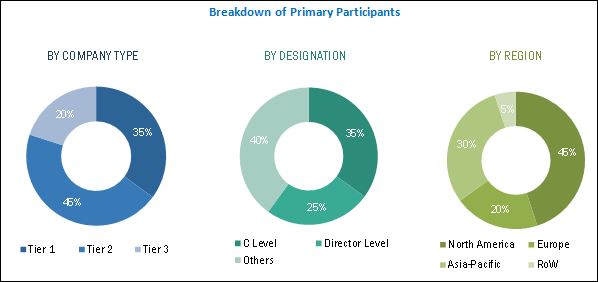

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increase in Military Spending of Emerging Countries

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Combat System Integration Market, 2016-2022

4.2 Market, By Application

4.3 Market, By Platform

4.4 Market in Small Combat Ships, By Subsegment

4.5 Market in Medium Combat Ships, By Subsegment

4.6 Market, By Region

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Combat System Integration Market, By Application

5.2.2 Market, By Platform

5.2.3 Market, By Region

5.2.4 Component of Combat System Integration

5.2.5 Type of Combat System Integration

5.2.6 Architecture of Combat System Integration

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Development of Advanced Combat Systems for Improved Situational Awareness

5.3.1.2 Growing Need for Networking Unmanned Systems

5.3.1.3 Military Modernization and Replenishment Programs

5.3.2 Restraints

5.3.2.1 Declining Defense Budget of Advanced Economies

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Combat System Integration in Emerging Economies

5.3.3.2 Huge R&D Investments for Technological Advancements in Defense Operations

5.3.4 Challenges

5.3.4.1 Complexity and High Operational Cost

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Major Companies

6.2.2 Applications

6.2.3 Future Outlook

6.3 Technology Trends

6.3.1 Integration of Unmanned Systems

6.3.2 Open Architecture Integration

6.3.3 Inter-Services Integration

6.3.4 Tactical Data Links

6.4 Innovation & Patent Registrations

7 Combat System Integration Market, By Application (Page No. - 58)

7.1 Introduction

7.2 Naval

7.2.1 Surface

7.2.2 Underwater

7.3 Airborne

7.4 Land-Based

8 Combat System Integration Market, By Platform (Page No. - 62)

8.1 Introduction

8.2 Large Combat Ships

8.3 Medium Combat Ships

8.3.1 Frigates

8.3.2 Destroyers

8.3.3 Cruisers

8.3.4 Amphibious Ships

8.4 Small Combat Ships

8.4.1 Corvette

8.4.2 Fast Attack Craft

8.4.3 Offshore Patrol Vessel (OPV)

8.5 Submarines

8.5.1 Conventional Submarines

8.5.2 Nuclear Submarines

8.6 Fighter Aircraft

8.7 Helicopters

8.8 Armored Vehicles/Artillery

9 Combat System Integration Market, By Region (Page No. - 72)

9.1 Introduction

9.2 G7 Nations

9.2.1 By Application

9.2.2 By Platform

9.2.2.1 By Small Combat Ships

9.2.2.2 By Medium Combat Ships

9.2.3 By Country

9.2.3.1 U.S.

9.2.3.1.1 By Application

9.2.3.1.2 By Platform

9.2.3.1.2.1 By Small Combat Ships

9.2.3.1.2.2 By Medium Combat Ships

9.2.3.2 France

9.2.3.2.1 By Application

9.2.3.2.2 By Platform

9.2.3.2.2.1 By Small Combat Ships

9.2.3.2.2.2 By Medium Combat Ships

9.2.3.3 U.K.

9.2.3.3.1 By Application

9.2.3.3.2 By Platform

9.2.3.3.2.1 By Small Combat Ships

9.2.3.3.2.2 By Medium Combat Ships

9.2.3.4 Italy

9.2.3.4.1 By Application

9.2.3.4.2 By Platform

9.2.3.4.2.1 By Small Combat Ships

9.2.3.4.2.2 By Medium Combat Ships

9.2.3.5 Germany

9.2.3.5.1 By Application

9.2.3.5.2 By Platform

9.2.3.5.2.1 By Small Combat Ships

9.2.3.5.2.2 By Medium Combat Ships

9.2.3.6 Japan

9.2.3.6.1 By Application

9.2.3.6.2 By Platform

9.2.3.6.2.1 By Small Combat Ships

9.2.3.6.2.2 By Medium Combat Ships

9.2.3.7 Canada

9.2.3.7.1 By Application

9.2.3.7.2 By Platform

9.2.3.7.2.1 By Small Combat Ships

9.2.3.7.2.2 By Medium Combat Ships

9.3 BRICS

9.3.1 By Application

9.3.2 By Platform

9.3.2.1 By Small Combat Ships

9.3.2.2 By Medium Combat Ships

9.3.3 By Country

9.3.3.1 China

9.3.3.1.1 By Application

9.3.3.1.2 By Platform

9.3.3.1.2.1 By Small Combat Ships

9.3.3.1.2.2 By Medium Combat Ships

9.3.3.2 India

9.3.3.2.1 By Application

9.3.3.2.2 By Platform

9.3.3.2.2.1 By Small Combat Ships

9.3.3.2.2.2 By Medium Combat Ships

9.3.3.3 Russia

9.3.3.3.1 By Application

9.3.3.3.2 By Platform

9.3.3.3.2.1 By Small Combat Ships

9.3.3.3.2.2 By Medium Combat Ships

9.3.3.4 Brazil

9.3.3.4.1 By Application

9.3.3.4.2 By Platform

9.3.3.4.2.1 By Small Combat Ships

9.3.3.4.2.2 By Medium Combat Ships

9.3.3.5 South Africa

9.3.3.5.1 By Application

9.3.3.5.2 By Platform

9.3.3.5.2.1 By Small Combat Ships

9.3.3.5.2.2 By Medium Combat Ships

9.4 Rest of the World (RoW)

9.4.1 By Application

9.4.2 By Platform

9.4.2.1 By Small Combat Ships

9.4.2.2 By Medium Combat Ships

9.4.3 By Country

9.4.3.1 Australia

9.4.3.1.1 By Application

9.4.3.1.2 By Platform

9.4.3.1.2.1 By Small Combat Ships

9.4.3.1.2.2 By Medium Combat Ships

9.4.3.2 Saudi Arabia

9.4.3.2.1 By Application

9.4.3.2.2 By Platform

9.4.3.2.2.1 By Small Combat Ships

9.4.3.2.2.2 By Medium Combat Ships

9.4.3.3 Israel

9.4.3.3.1 By Application

9.4.3.3.2 By Platform

9.4.3.3.2.1 By Small Combat Ships

9.4.3.3.2.2 By Medium Combat Ships

10 Competitive Landscape (Page No. - 119)

10.1 Introduction

10.2 Brand Analysis

10.3 Product Mapping

10.4 Combat System Integration Products, By Companies

10.5 Rank Analysis

10.6 Revenue and Contract-Based Market Share Analysis of Top Companies

10.6.1 Contracts

10.6.2 Others (Devaluation & Testing)

10.6.3 Acquisitions

11 Company Profiles (Page No. - 132)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Lockheed Martin Corporation

11.3 Raytheon Company

11.4 BAE Systems, PLC.

11.5 Saab AB

11.6 Thales Group

11.7 Leonardo-Finmeccanica

11.8 Qinetiq Group PLC.

11.9 Elbit Systems Ltd.

11.10 DCS Corporation

11.11 ICI Services Corporation

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

12 Appendix (Page No. - 165)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customization

12.5 Related Reports

12.6 Author Details

List of Tables (93 Tables)

Table 1 Market Segmentation: By Platform

Table 2 Component of Combat System Integration

Table 3 Type of Combat System Integration

Table 4 Architecture of Combat System Integration

Table 5 Uav Market Size, By Class 2014-2022 (USD Million)

Table 6 Factors Affecting the Declining Defense Expenditure of Advanced Economies

Table 7 Budget Allocated for R&D Activities in the Defense Sector By the U.S. Government (USD Million)

Table 8 Important Innovation & Patent Registrations, 2010-2015

Table 9 Combat System Integration Market Size, By Application, 2015–2022 (USD Million)

Table 10 Market Size, By Platform, 2014–2022 (USD Million)

Table 11 Market for Medium Combat Ships, By Subsegment, 2014–2022 (USD Million)

Table 12 Market for Small Combat Ships, By Subsegment, 2014–2022 (USD Million)

Table 13 Market Size, By Region, 2014-2022 (USD Million)

Table 14 G7 Nations: Market Size, By Application, 2014-2022 (USD Million)

Table 15 G7 Nations: Market Size, By Platform, 2014-2022 (USD Million)

Table 16 G7 Nations: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 17 G7 Nations: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 18 G7 Nations: Combat System Integration Market Size, By Country, 2014-2022 (USD Million)

Table 19 U.S.: Market Size, By Application, 2014-2022 (USD Million)

Table 20 U.S.: Market Size, By Platform, 2014-2022 (USD Million)

Table 21 U.S.: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 22 U.S.: Combat System Integration Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 23 France: Combat System Integration Market Size, By Application, 2014-2022 (USD Million)

Table 24 France: Market Size, By Platform, 2014-2022 (USD Million)

Table 25 France: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 26 France: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 27 U.K.: Market Size, By Application, 2014-2022 (USD Million)

Table 28 U.K.: Market Size, By Platform, 2014-2022 (USD Million)

Table 29 U.K.: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 30 U.K.: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 31 Italy: Combat System Integration Market Size, By Application, 2014-2022 (USD Million)

Table 32 Italy: Market Size, By Platform, 2014-2022 (USD Million)

Table 33 Italy: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 34 Italy: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 35 Germany: Market Size, By Application, 2014-2022 (USD Million)

Table 36 Germany: Market Size, By Platform, 2014-2022 (USD Million)

Table 37 Germany: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 38 Germany: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 39 Japan: Market Size, By Application, 2014-2022 (USD Million)

Table 40 Japan: Market Size, By Platform, 2014-2022 (USD Million)

Table 41 Japan: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 42 Japan: Combat System Integration Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 43 Canada: Market Size, By Application, 2014-2022 (USD Million)

Table 44 Canada: Market Size, By Platform, 2014-2022 (USD Million)

Table 45 Canada: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 46 Canada: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 47 BRICS: Market Size, By Application, 2014-2022 (USD Million)

Table 48 BRICS: Market Size, By Platform, 2014-2022 (USD Million)

Table 49 BRICS: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 50 BRICS: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 51 BRICS: Combat System Integration Market Size, By Country, 2014-2022 (USD Million)

Table 52 China: Market Size, By Application, 2014-2022 (USD Million)

Table 53 China: Market Size, By Platform, 2014-2022 (USD Million)

Table 54 China: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 55 China: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 56 India: Market Size, By Application, 2014-2022 (USD Million)

Table 57 India: Market Size, By Platform, 2014-2022 (USD Million)

Table 58 India: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 59 India: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 60 Russia: Combat System Integration Market Size, By Application, 2014-2022 (USD Million)

Table 61 Russia: Market Size, By Platform, 2014-2022 (USD Million)

Table 62 Russia: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 63 Russia: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 64 Brazil: Market Size, By Application, 2014-2022 (USD Million)

Table 65 Brazil: Market Size, By Platform, 2014-2022 (USD Million)

Table 66 Brazil: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 67 Brazil: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 68 South Africa: Market Size, By Application, 2014-2022 (USD Million)

Table 69 South Africa: Market Size, By Platform, 2014-2022 (USD Million)

Table 70 South Africa: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 71 South Africa: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 72 RoW: Market Size, By Application, 2014-2022 (USD Million)

Table 73 RoW: Market Size, By Platform, 2014-2022 (USD Million)

Table 74 RoW: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 75 RoW: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 76 RoW: Combat System Integration Market Size, By Country, 2014-2022 (USD Million)

Table 77 Australia: Market Size, By Application, 2014-2022 (USD Million)

Table 78 Australia: Market Size, By Platform, 2014-2022 (USD Million)

Table 79 Australia: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 80 Australia: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 81 Saudi Arabia: Market Size, By Application, 2014-2022 (USD Million)

Table 82 Saudi Arabia: Market Size, By Platform, 2014-2022 (USD Million)

Table 83 Saudi Arabia: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 84 Saudi Arabia: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 85 Israel: Market Size, By Application, 2014-2022 (USD Million)

Table 86 Israel: Market Size, By Platform, 2014-2022 (USD Million)

Table 87 Israel: Market for Small Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 88 Israel: Market for Medium Combat Ships, By Subsegment, 2014-2022 (USD Million)

Table 89 Brand Analysis of Top Players in the Market

Table 90 Product Mapping of Top Players in the Market

Table 91 Contracts, May 2013–June 2016

Table 92 Others (Devaluation & Testing), November 2015-July 2016

Table 93 Acquisitions, 2014

List of Figures (60 Figures)

Figure 1 Markets Covered: Combat System Integration Market

Figure 2 Market: Study Years

Figure 3 Research Flow

Figure 4 Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 6 Increasing Defense Budget of Emerging Countries, 2005 & 2015 (USD Billion & % )

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Assumptions of the Research Study

Figure 11 The Large Combat Ships Segment is Expected to Lead the Combat System Integration Market During the Forecast Period

Figure 12 BRICS Countries are Projected to Account for the Largest Market Size By 2022

Figure 13 The Market in BRICS Countries is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Among BRICS Countries, China is Expected to Lead the Combat System Integration Market From 2016 to 2022

Figure 15 Among G7 Nations, the U.S. is Projected to Lead the Market During the Forecast Period

Figure 16 Major Players Adopted Contracts to Ensure Growth in the Market From January 2014 to December 2016

Figure 17 Huge Investments Made By BRICS Countries to Develop Combat Systems for Different Platforms Drive the Combat System Integration Market

Figure 18 The Naval Segment of the Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 19 The Large Combat Ships Segment Led the Market in 2016

Figure 20 The Corvette Subsegment Led the Small Combat Ships Segment in 2016

Figure 21 The Destroyers Subsegment Led the Medium Combat Ships Segment in 2016

Figure 22 BRICS Countries Accounted for the Largest Share of the Market in 2016

Figure 23 The Market in BRICS Countries is Expected to Be the Fastest-Growing Market

Figure 24 Market Segmentation: By Application

Figure 25 Market Segmentation: By Platform

Figure 26 Market Segmentation: By Region

Figure 27 Component of Combat System Integration (Qualitative)

Figure 28 Type of Combat System Integration (Qualitative)

Figure 29 Architecture of Combat System Integration

Figure 30 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 31 Defense Spending of Advanced Economies, 2011-2015 (USD Million)

Figure 32 Defense Spending of Emerging Economies, 2011-2015 (%)

Figure 33 Supply Chain Analysis: Market

Figure 34 Naval Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 35 Market, By Platform, 2016 & 2022 (USD Million)

Figure 36 Market, By Region

Figure 37 The U.S. Accounted for the Largest Share of the G7 Nations Combat System Integration Market in 2016

Figure 38 BRICS Combat System Integration Market Snapshot

Figure 39 RoW Combat System Integration Market Snapshot

Figure 40 Companies Adopted Contracts as the Key Growth Strategy From January 2014 to June 2016

Figure 41 Product for Combat System Integration of Major Companies

Figure 42 Revenue and Product-Based Rank Analysis of Top Players in the Market

Figure 43 Revenue and Product-Based Market Share Analysis for the Market

Figure 44 Contracts and Acquisitions Were the Key Growth Strategies Adopted By Key the Players From 2014 to 2016

Figure 45 Benchmarking of Top Players, 2015

Figure 46 Financials of Major Players in the Combat System Integration Market

Figure 47 Lockheed Martin Corporation: Company Snapshot

Figure 48 Lockheed Martin Corporation: SWOT Analysis

Figure 49 Raytheon Company: Company Snapshot

Figure 50 Raytheon Company: SWOT Analysis

Figure 51 BAE Systems, PLC.: Company Snapshot

Figure 52 BAE Systems, PLC.: SWOT Analysis

Figure 53 Saab AB: Company Snapshot

Figure 54 Saab AB: SWOT Analysis

Figure 55 Thales Group: Company Snapshot

Figure 56 Thales Group: SWOT Analysis

Figure 57 Leonardo-Finmeccanica: Company Snapshot

Figure 58 Qinetiq Group PLC.: Company Snapshot

Figure 59 Elbit Systems Ltd.: Company Snapshot

Figure 60 Market Segmentation

The market size estimations for various segments and subsegments of the combat system integration market have been done through extensive secondary research, which includes government sources, such as the U.S. Department of Defense (DoD), the U.S. Air Force website, company websites, corporate filings that include annual reports, investor presentations, and financial statements, and press releases from trade, business, and professional associations, among others. This has been followed by corroboration with primaries and market triangulation with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the combat system integration market comprises Original Equipment Manufacturers (OEMs), integrators, and end users. The key end users of the market are defense forces. The technology providers for the market include Raytheon Company (U.S.), Saab AB (Sweden), Thales Group (France), and Lockheed Martin Corporation (U.S.), among others, while as the companies, such as Lockheed Martin Corporation (U.S.), Leonardo-Finmeccanica (Italy), Raytheon Company (U.S.), BAE Systems PLC. (U.K.), and QinetiQ Group PLC (U.K.), among others are the providers of combat system integration.

“Study answers several questions for stakeholders, primarily, which segments to focus on over the next five years for prioritizing efforts and investments.”

Target Audience

- Original Equipment Manufacturers (OEMs)

- Component Suppliers

- Militaries

- Integration Service Providers

Scope of the Report

This research report categorizes the combat system integration market into the following segments and subsegments:

-

Combat System Integration Market, By Platform

-

Large Combat Ships

- Aircraft Carriers

-

Medium Combat Ships

- Destroyers

- Frigates

- Cruisers

- Amphibious Ships

-

Small Combat Ships

- Corvette

- Offshore Patrol Vessel (OPV)

- Fast Attack Boats

-

Submarines

- Nuclear

- Conventional

- Fighter Aircraft

- Combat Helicopters

- Armored Vehicles/ Artillery

-

Large Combat Ships

-

Combat System Integration Market, By Application

-

Naval

- Surface

- Underwater

- Airborne

- Land-based

-

Naval

-

Combat System Integration Market, By Region

-

G7 Nations

- U.S.

- U.K.

- France

- Germany

- Italy

- Canada

- Japan

-

BRICS

- Brazil

- Russia

- India

- China

- South Africa

-

Rest of the World

- Australia

- Israel

- Saudi Arabia

-

G7 Nations

Customizations available for the report

With the given market data, MarketsandMarkets offers customizations as per specific needs of the companies. The following customization options are available for the report:

-

Country-level Analysis

- Comprehensive market projections for countries categorized under G7 Nations, BRICS, and rest of the world

- Country level analysis for open architecture and closed architecture

-

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Combat System Integration Market