Cellulose Ether & Derivatives Market by Product Type (Methyl Cellulose & Derivatives, Carboxymethyl Cellulose, HEC, HPC, EC), Application (Construction, Pharmaceutical, Personal Care, Food & Beverage), Region - Forecast to 2028

Updated on : August 22, 2024

Cellulose Ether Market

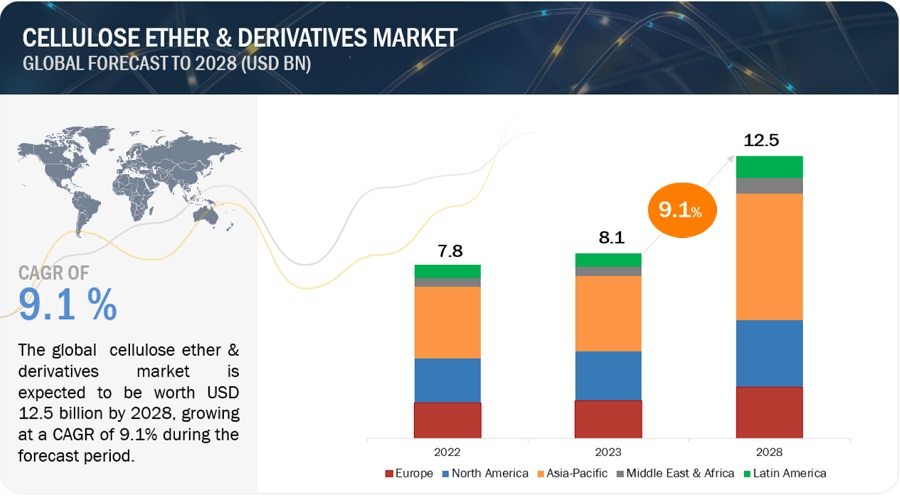

The global cellulose ether market was valued at USD 8.1 billion in 2023 and is projected to reach USD 12.5 billion by 2028, growing at 9.1% cagr from 2023 to 2028. Over the world, the cellulose ether & derivatives market is expanding significantly, and during the forecast period, a similar trend is anticipated.

The growth of the market is driven by the increasing demand for cellulose ether & derivatives in a variety of applications, such as food, pharmaceuticals, personal care, and industrial products.

The construction industry is a major consumer of cellulose ether & derivatives. They are extensively used in cement and mortar formulations to enhance workability, water retention, adhesion, and durability. The increasing demand for infrastructure development and energy-efficient buildings drives the consumption of cellulose ether & derivatives in this sector. The pharmaceutical and personal care industries are significant markets for cellulose ether & derivatives. They serve as essential ingredients in pharmaceutical formulations, providing functionalities such as binding, controlled release, thickening, and stabilizing. In personal care products, cellulose ethers enhance texture, viscosity, and moisturizing properties.

Attractive Opportunities in Cellulose Ether & Derivatives Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Cellulose Ether & Derivatives Market Dynamics

Driver: High demand from the growing construction industry

The construction industry is a major driver of the cellulose ether & derivatives market. The demand for these compounds is driven by the need for improved construction materials, such as cement, mortar, and adhesives, which require enhanced workability, water retention, and durability. The increasing construction activities, infrastructure development, and focus on sustainable building practices contribute to the growth of the market.

Restraint: Burning and explosion risk

Many industrially processed powdery materials are combustible and can, under certain conditions, if dispersed, cause dust explosions. Cellulose ethers are fine organic dust that is combustible and potentially explosive in a favorable environment. They can catch fire at the time of processing and/or handling. In order to avoid any such conditions, there are rules and regulations that the companies have to follow. There are certain guidelines for the safe handling, processing, transport, and packaging of cellulose ether derivatives.

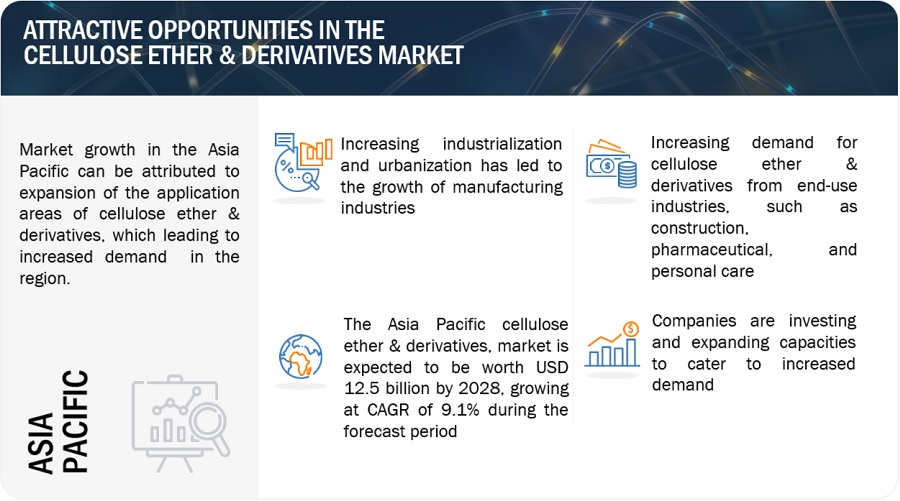

Opportunity: Increasing demand from emerging markets

Asia Pacific economies such as China and India are growing rapidly. South Asian countries such as Thailand and Malaysia also have growth potential along with the globalization of the economy. The primary driver behind their growth is the ever-growing population. With developing economies, per capita income has also increased in these countries. With a growing population, end-use industries such as pharmaceutical and personal care, construction, food & beverages, and personal care are growing. These industries have shown very healthy growth in the past five years, and this scenario is expected to remain the same in the future too. Growth of the pharmaceutical and personal care sector has resulted in increased demand for cellulose ether & derivatives.

Challenge: Growing competition and Stringent regulations

The cellulose ether & derivatives market is in a growing competition phase, with numerous players operating in the market. This makes it challenging for new entrants to establish a foothold in the market. The cellulose ether & derivatives market is subject to various regulations and standards regarding product quality, safety, and environmental impact. Compliance with these regulations can be a challenge for manufacturers, especially small and medium-sized enterprises.

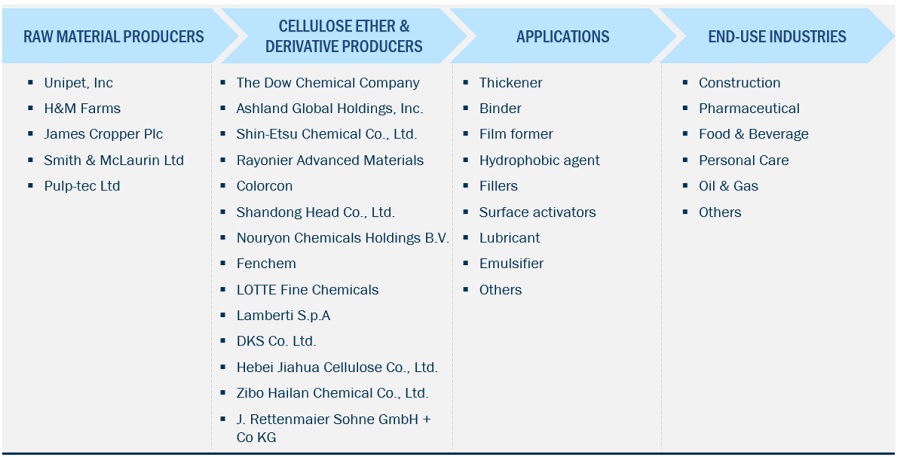

Cellulose Ether & Derivatives Market Ecosystem

Industrial application of carboxymethyl cellulose to dominate the cellulose ether & derivatives market.

The cellulose ether & derivatives market is segmented on the basis of applications which include product type, by applications such as food & beverage, construction, pharmaceutical, personal care, paints & coatings, industrial, and others. Carboxymethyl cellulose (CMC) finds wide-ranging industrial applications within the cellulose ether and derivatives market. Carboxymethyl cellulose is used in the textile industry as a sizing agent and thickener in the production of yarns and fabrics. It improves the weaving process by providing better strength, lubrication, and adhesion properties to the fibers. Carboxymethyl cellulose also contributes to better dye absorption and color fastness. These factors will contribute to market growth.

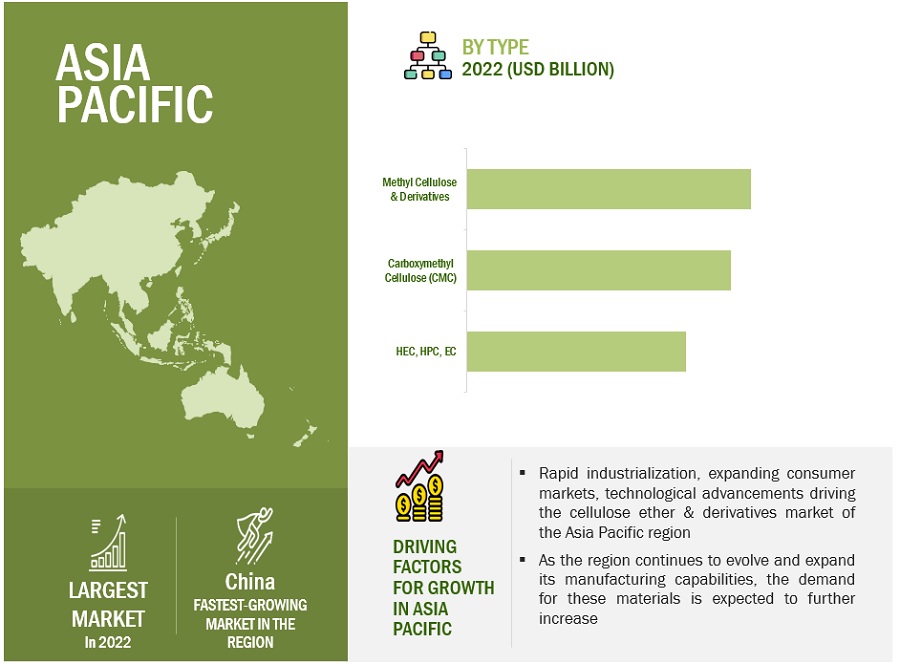

Based on type, the methylcellulose & derivatives segment is anticipated to register the highest CAGR.

The methylcellulose & derivatives product type segment dominated the cellulose ether & derivatives market, accounting for the largest share of the overall cellulose ether & derivatives market. The versatile properties of methylcellulose and its derivatives make them valuable additives in the cellulose ether and derivatives market. Their applications span across industries, including construction, coatings, pharmaceuticals, food, and personal care, providing functionalities such as rheology modification, water retention, film formation, controlled release, adhesion, and stabilization. Due to these factors, the methylcellulose & derivatives type of cellulose ether & derivatives is expected to witness the highest CAGR between 2023 and 2028.

Asia Pacific to hold the largest market share during the forecast period.

Cellulose ether & derivatives are extensively used in the Asia Pacific across industries such as construction, pharmaceutical, food & beverages, consumer goods, and others. The high growth can be majorly attributed to high economic development and significant investments across industries. The market is expected to continue growing due to factors such as rapid urbanization, infrastructure development, increasing industrialization, and a growing population. Asia Pacific is the largest end-use market and is expected to continue to be the largest in the near future. Global manufacturers are shifting their production facilities to the Asia Pacific region. The advantages of shifting production to the Asian region are the low cost of production and the ability to better serve the local emerging markets.

To know about the assumptions considered for the study, download the pdf brochure

Cellulose Ether & Derivatives Market Players

The cellulose ether & derivatives market is dominated by a few globally established players such as The Dow Chemical Company (US), Ashland Global Holdings, Inc. (US), Rayonier Advanced Materials (US), Shin-Etsu Chemical Co., Ltd. (Japan), LOTTE Fine Chemicals (South Korea), DKS Co. Ltd. (Japan), Nouryon Chemical Holdings B.V. (The Netherlands), J.M. Huber Corporation (US), Shandong Head Co., Ltd. (China), Colorcon (US), FENCHEM (China), Lamberti S.p.A. (US), J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany), Hebei JiaHua Cellulose Co., Ltd. (China), among others, are the key manufacturers that secured major contracts in the last few years. The major focus was given to the contracts and new product development due to the changing requirements across the world.

These companies are pursuing a variety of inorganic and organic strategies in order to gain a foothold in the cellulose ether & derivatives market. The research includes a detailed competitive analysis of these key players in the cellulose ether & derivatives market, including company profiles, recent developments, and key market strategies.

Cellulose Ether & Derivatives Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD billion/million), Volume (Kiloton) |

|

Segments Covered |

By Product Type, By Application, Region |

|

Geographies covered |

Europe, North America, Asia Pacific, Latin America, the Middle East, and Africa |

|

Companies covered |

The Dow Chemical Company (US), Ashland Global Holdings, Inc. (US), Rayonier Advanced Materials (US), Shin-Etsu Chemical Co., Ltd. (Japan), LOTTE Fine Chemicals (South Korea), DKS Co. Ltd. (Japan), Nouryon Chemical Holdings B.V. (The Netherlands), J.M. Huber Corporation (US), Shandong Head Co., Ltd. (China), Colorcon (US), FENCHEM (China), Lamberti S.p.A. (US), J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany), Hebei JiaHua Cellulose Co., Ltd. (China), and Zibo Hailan Chemical Co., Ltd. (China). |

The study categorizes the Cellulose ether & derivatives market based on product type, application, and region.

By Product Type:

- Methyl Cellulose & Derivatives

- Carboxymethyl Cellulose

- HEC, HPC, EC

By Application Type:

- Methyl Cellulose & Derivatives, By Application

- Carboxymethyl Cellulose, By Application

- HEC, By Application

- HPC, By Application

- EC, By Application

By Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In May 2021, Rayonier Advanced Materials announced a strategic investment in Anomera Inc., which produces the highest quality Cellulose Nanocrystals under the brand names, ChromAllur, DextraCel, and ChromaPu. Anomera represents a new cellulosic technology platform for future growth. This investment is expected to offer a new platform to expand its business to new areas.

- In January 2020, Nouryon accelerated growth by signing an agreement to acquire the carboxymethyl cellulose (CMC) business of J.M. Huber Corporation. This transaction will significantly broaden Nouryon’s portfolio of products in CMC, a bio-based, sustainable, water-soluble polymer used as a film former, thickener, binder, and stabilizer.

- In November 2017, Rayonier Advanced Materials announced the acquisition of Tembec Inc., combining two complementary high-purity cellulose businesses and diversifying its product offerings with integrated forest products, paper, paperboard, and newsprint businesses. This acquisition is expected to help the company diversify its product offering in high-purity cellulose and enable it to expand into new adjacent businesses.

Frequently Asked Questions (FAQ):

Which are the major companies in the cellulose ether & derivatives market? What are their major strategies to strengthen their market presence?

Some of the key players in the cellulose ether & derivatives market are The Dow Chemical Company (US), Ashland Global Holdings, Inc. (US), Rayonier Advanced Materials (US), Shin-Etsu Chemical Co., Ltd. (Japan), LOTTE Fine Chemicals (South Korea), DKS Co. Ltd. (Japan), Nouryon Chemical Holdings B.V. (The Netherlands), J.M. Huber Corporation (US), Shandong Head Co., Ltd. (China), Colorcon (US), FENCHEM (China), Lamberti S.p.A. (US), J. RETTENMAIER & SÖHNE GmbH + Co KG (Germany), Hebei JiaHua Cellulose Co., Ltd. (China), among others, are the key manufacturers that secured contracts, deals in the last few years. Contracts and deals were the key strategies adopted by these companies to strengthen their position in the cellulose ether & derivatives market.

What are the drivers and opportunities for the cellulose ether & derivatives market?

The need for cellulose ether & derivatives has increased significantly around the world, particularly in Asia Pacific and North America, followed by Europe, where the major cellulose ether & derivatives manufacturers are present. Rising R&D efforts and growing technological advancement in manufacturing are anticipated to accelerate market expansion globally.

Which region is expected to hold the highest market share?

Asia Pacific dominated the market share in 2022, showcasing strong demand for cellulose ether & derivatives from this region. Well-established and prominent manufacturers in this region include Shin-Etsu Chemical Co., Ltd. (Japan), LOTTE Fine Chemicals (South Korea), DKS Co. Ltd. (Japan), and Shandong Head Co., Ltd. (China).

What is the total CAGR expected to be recorded for the cellulose ether & derivatives market during 2023-2028?

The CAGR is expected to record a CAGR of 9.1% from 2023-2028.

How is the cellulose ether & derivatives market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Sustainable product offering several advantages- Growing applications in end-use industries- Increasing use of carboxymethyl cellulose in mining industryRESTRAINTS- Emission of hazardous air pollutants during production- Risk of burning and explosionsOPPORTUNITIES- Increasing demand from growing pharmaceutical industry- Rapid growth in construction activities- Booming personal care industry- Growth in end-use industries in emerging economiesCHALLENGES- Emergence of substitutes in various applications- Water retention due to external factors

-

5.3 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

-

5.6 ECOSYSTEM: CELLULOSE ETHER & DERIVATIVES MARKET

-

5.7 VALUE CHAIN ANALYSISRAW MATERIAL SELECTIONMANUFACTURINGDISTRIBUTION & APPLICATION

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE OF PRODUCT TYPES OFFERED BY KEY PLAYERSAVERAGE SELLING PRICE ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 TARIFFS AND REGULATIONS

-

5.11 KEY MARKETS FOR IMPORTS/EXPORTSEXPORT SCENARIO FOR CELLULOSE ETHER & DERIVATIVESIMPORT SCENARIO FOR CELLULOSE ETHER & DERIVATIVES

- 5.12 CASE STUDY ANALYSIS

- 5.13 TRENDS IMPACTING CUSTOMER BUSINESS

-

5.14 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTS' ANALYSISPATENTS: DOW GLOBAL TECHNOLOGIES LLCPATENTS: SHIN-ETSU CHEMICAL CO., LTD.PATENTS: SE TYLOSE GMBH & CO. KGTOP PATENT OWNERS (US) IN LAST 10 YEARS

- 6.1 INTRODUCTION

-

6.2 METHYL CELLULOSE & DERIVATIVESWIDE USAGE IN FOOD AND PHARMACEUTICAL INDUSTRIES TO DRIVE MARKETMETHYL CELLULOSE & DERIVATIVES MARKET, BY REGIONMETHYL CELLULOSE (MC)HYDROXYPROPYL METHYL CELLULOSE (HPMC)HYDROXYETHYL METHYL CELLULOSE (HEMC)METHYL CELLULOSE & DERIVATIVES MARKET, BY PRODUCT DERIVATIVES

-

6.3 CARBOXYMETHYL CELLULOSEGROWING APPLICATIONS ACROSS INDUSTRIES TO BOOST MARKETCARBOXYMETHYL CELLULOSE MARKET, BY REGION

-

6.4 HYDROXYETHYL CELLULOSE (HEC), HYDROXYPROPYL CELLULOSE (HPC), AND ETHYL CELLULOSE (EC)RISING DEMAND FROM PHARMACEUTICAL INDUSTRY TO FUEL MARKETHYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY REGIONHYDROXYETHYL CELLULOSE (HEC)HYDROXYPROPYL CELLULOSE (HPC)ETHYL CELLULOSE (EC)HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY PRODUCT DERIVATIVES

- 7.1 INTRODUCTION

-

7.2 METHYL CELLULOSE & DERIVATIVES MARKET, BY APPLICATIONCONSTRUCTION APPLICATION TO DRIVE DEMAND

-

7.3 CARBOXYMETHYL CELLULOSE MARKET, BY APPLICATIONINDUSTRIAL APPLICATION TO FUEL DEMAND

-

7.4 HYDROXYETHYL CELLULOSE (HEC) MARKET, BY APPLICATIONPAINTS & COATINGS APPLICATION TO BOOST DEMAND

-

7.5 HYDROXYPROPYL CELLULOSE MARKET (HPC), BY APPLICATIONPHARMACEUTICAL APPLICATION TO PROPEL MARKET GROWTH

-

7.6 ETHYL CELLULOSE (EC) MARKET, BY APPLICATIONELECTRICAL APPLICATION TO DRIVE MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPENORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRYNORTH AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRYNORTH AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRYNORTH AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY- US- Canada

-

8.3 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPEEUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRYEUROPE: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRYEUROPE: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRYEUROPE: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY- Germany- Russia- UK- France- Turkey- Rest of Europe

-

8.4 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPEASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRYASIA PACIFIC: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRYASIA PACIFIC: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRYASIA PACIFIC: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY- China- Japan- India- Indonesia- Rest of Asia Pacific

-

8.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPEMIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRYMIDDLE EAST & AFRICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRYMIDDLE EAST & AFRICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRYMIDDLE EAST & AFRICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY- UAE- Saudi Arabia- South Africa- Rest of Middle East & Africa

-

8.6 LATIN AMERICAIMPACT OF RECESSION ON LATIN AMERICALATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPELATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRYLATIN AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRYLATIN AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRYLATIN AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY- Brazil- Mexico- Rest of Latin America

- 9.1 INTRODUCTION

- 9.2 MARKET SHARE ANALYSIS

- 9.3 MARKET RANKING

- 9.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

9.5 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 9.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

9.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.8 MARKET EVALUATION FRAMEWORK

-

10.1 KEY COMPANIESTHE DOW CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Developments- MnM viewSHIN-ETSU CHEMICAL CO., LTD.- Business overview- Products/Solutions/Services offered- Deals- MnM viewLOTTE FINE CHEMICALS- Business overview- Products/Solutions/Services offered- MnM viewASHLAND GLOBAL HOLDINGS, INC.- Business overview- Products/Solutions/Services offered- Product developments- Other developments- MnM viewRAYONIER ADVANCED MATERIALS- Business overview- Products/Solutions/Services offered- Deals- MnM viewDKS CO. LTD.- Business overview- Products/Solutions/Services offered- MnM viewNOURYON CHEMICALS HOLDING B.V.- Business overview- Products offered- Product developments- Deals- MnM viewJ.M. HUBER CORPORATION- Business overview- Products offered- Deals- MnM viewSHANDONG HEAD CO., LTD.- Business overview- Products offered- MnM viewCOLORCON- Business overview- Products offered- MnM viewLAMBERTI S.P.A.- Business overview- Products offered- MnM viewJ. RETTENMAIER & SOHNE GMBH + CO KG- Business overview- Products offered- MnM viewFENCHEM- Business overview- Products offered- MnM viewHEBEI JIAHUA CELLULOSE CO., LTD.- Business overview- Products offered- MnM viewZIBO HAILAN CHEMICAL CO., LTD.- Business overview- Products offered- MnM view

-

10.2 OTHER COMPANIESTAIAN RUITAI CELLULOSE CO., LTD.RELIANCE CELLULOSE PRODUCTS LIMITEDSICHUAN NITROCELL CORPORATIONHENAN BOTAI CHEMICAL BUILDING MATERIAL CO., LTD.AMTEX CORP SA DE CVCHANGSHU WEALTHY SCIENCE AND TECHNOLOGY CO., LTD.JIANGSU SHANGYONG NEW MATERIAL CO., LTD.CELOTECH CHEMICAL CO., LTD.SIDLEY CHEMICAL CO., LTD.ZHEJIANG KEHONG CHEMICAL CO., LTD.HUZHOU MIZUDA HOPE BIOSCIENCE CO., LTD.HEBEI HAOSHUO CHEMICAL CO., LTD.HEBEI SHENGXING TECHNOLOGY CO., LTD.SHANDONG LIAOCHENG E HUA PHARMACEUTICAL CO., LTD.YIXING LUTRON NEW MATERIAL TECH CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 PROPERTIES AND BENEFITS OF CELLULOSE ETHER

- TABLE 2 CELLULOSE ETHER & DERIVATIVES: BURNING AND EXPLOSION PARAMETERS

- TABLE 3 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019-2030)

- TABLE 4 CELLULOSE ETHER & DERIVATIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 CELLULOSE ETHER & DERIVATIVES MARKET: SUPPLY CHAIN

- TABLE 6 AVERAGE SELLING PRICE OF PRODUCT TYPES OFFERED BY KEY PLAYERS (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE OF CELLULOSE ETHER & DERIVATIVES, BY REGION

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 10 CURRENT STANDARD CODES FOR CELLULOSE ETHER & DERIVATIVES

- TABLE 11 CELLULOSE ETHER & DERIVATIVES MARKET: GLOBAL PATENTS

- TABLE 12 CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 13 CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 14 CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 15 CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 16 METHYL CELLULOSE & DERIVATIVES MARKET, BY REGION, 2018–2022 (KILOTONS)

- TABLE 17 METHYL CELLULOSE & DERIVATIVES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 METHYL CELLULOSE & DERIVATIVES MARKET, BY REGION, 2023–2028 (KILOTONS)

- TABLE 19 METHYL CELLULOSE & DERIVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 METHYL CELLULOSE & DERIVATIVES MARKET, BY PRODUCT DERIVATIVES, 2018–2022 (KILOTONS)

- TABLE 21 METHYL CELLULOSE & DERIVATIVES MARKET, BY PRODUCT DERIVATIVES, 2018–2022 (USD MILLION)

- TABLE 22 METHYL CELLULOSE & DERIVATIVES MARKET, BY PRODUCT DERIVATIVES, 2023–2028 (KILOTONS)

- TABLE 23 METHYL CELLULOSE & DERIVATIVES MARKET, BY PRODUCT DERIVATIVES, 2023–2028 (USD MILLION)

- TABLE 24 CARBOXYMETHYL CELLULOSE MARKET, BY REGION, 2018–2022 (KILOTONS)

- TABLE 25 CARBOXYMETHYL CELLULOSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 CARBOXYMETHYL CELLULOSE MARKET, BY REGION, 2023–2028 (KILOTONS)

- TABLE 27 CARBOXYMETHYL CELLULOSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY REGION, 2018–2022 (KILOTONS)

- TABLE 29 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY REGION, 2023–2028 (KILOTONS)

- TABLE 31 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY PRODUCT DERIVATIVES, 2018–2022 (KILOTONS)

- TABLE 33 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY PRODUCT DERIVATIVES, 2018–2022 (USD MILLION)

- TABLE 34 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY PRODUCT DERIVATIVES, 2023–2028 (KILOTONS)

- TABLE 35 HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY PRODUCT DERIVATIVES, 2023–2028 (USD MILLION)

- TABLE 36 METHYL CELLULOSE & DERIVATIVES: APPLICATIONS AND FUNCTIONS

- TABLE 37 METHYL CELLULOSE & DERIVATIVES MARKET, BY APPLICATION, 2018–2022 (KILOTONS)

- TABLE 38 METHYL CELLULOSE & DERIVATIVES MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 39 METHYL CELLULOSE & DERIVATIVES MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- TABLE 40 METHYL CELLULOSE & DERIVATIVES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 41 CARBOXYMETHYL CELLULOSE: APPLICATIONS AND FUNCTIONS

- TABLE 42 CARBOXYMETHYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (KILOTONS)

- TABLE 43 CARBOXYMETHYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 44 CARBOXYMETHYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- TABLE 45 CARBOXYMETHYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 HYDROXYETHYL CELLULOSE: APPLICATIONS AND FUNCTIONS

- TABLE 47 HYDROXYETHYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (KILOTONS)

- TABLE 48 HYDROXYETHYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 49 HYDROXYETHYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- TABLE 50 HYDROXYETHYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 HYDROXYPROPYL CELLULOSE: APPLICATIONS AND FUNCTIONS

- TABLE 52 HYDROXYPROPYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (KILOTONS)

- TABLE 53 HYDROXYPROPYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 54 HYDROXYPROPYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- TABLE 55 HYDROXYPROPYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 ETHYL CELLULOSE: APPLICATIONS AND FUNCTIONS

- TABLE 57 ETHYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (KILOTONS)

- TABLE 58 ETHYL CELLULOSE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 59 ETHYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (KILOTONS)

- TABLE 60 ETHYL CELLULOSE MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 CELLULOSE ETHER & DERIVATIVES MARKET, BY REGION, 2018–2022 (KILOTONS)

- TABLE 62 CELLULOSE ETHER & DERIVATIVES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 CELLULOSE ETHER & DERIVATIVES MARKET, BY REGION, 2023–2028 (KILOTONS)

- TABLE 64 CELLULOSE ETHER & DERIVATIVES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 66 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 68 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 70 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 72 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 74 NORTH AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 76 NORTH AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 78 NORTH AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 80 NORTH AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 82 NORTH AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 84 NORTH AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 US: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 86 US: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 87 US: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 88 US: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 90 CANADA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 91 CANADA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 92 CANADA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 94 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 96 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 97 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 98 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 100 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 EUROPE: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 102 EUROPE: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 104 EUROPE: METHYL CELLULOSE & DERIVATIVES MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 106 EUROPE: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 107 EUROPE: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 108 EUROPE: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 EUROPE: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 110 EUROPE: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 111 EUROPE: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 112 EUROPE: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 GERMANY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 114 GERMANY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 115 GERMANY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 116 GERMANY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 117 RUSSIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 118 RUSSIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 119 RUSSIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 120 RUSSIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 121 UK: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 122 UK: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 123 UK: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 124 UK: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 125 FRANCE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 126 FRANCE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 127 FRANCE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 128 FRANCE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 129 TURKEY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 130 TURKEY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 131 TURKEY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 132 TURKEY: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 133 REST OF EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 134 REST OF EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 135 REST OF EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 136 REST OF EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 138 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 140 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 142 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 144 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 146 ASIA PACIFIC: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 148 ASIA PACIFIC: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 150 ASIA PACIFIC: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 152 ASIA PACIFIC: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 154 ASIA PACIFIC: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 156 ASIA PACIFIC: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 157 CHINA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 158 CHINA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 159 CHINA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 160 CHINA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 161 JAPAN: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 162 JAPAN: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 163 JAPAN: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 164 JAPAN: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 165 ANNUAL OIL & GAS INDUSTRY PRODUCTS SALES, BY REGION

- TABLE 166 INDIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 167 INDIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 168 INDIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 169 INDIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 170 INDONESIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 171 INDONESIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 172 INDONESIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 173 INDONESIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 175 REST OF ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 177 REST OF ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 179 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 181 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 183 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 185 MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 187 MIDDLE EAST & AFRICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 189 MIDDLE EAST & AFRICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 191 MIDDLE EAST & AFRICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 193 MIDDLE EAST & AFRICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 195 MIDDLE EAST & AFRICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 197 MIDDLE EAST & AFRICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 198 UAE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 199 UAE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 200 UAE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 201 UAE: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 202 SAUDI ARABIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 203 SAUDI ARABIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 204 SAUDI ARABIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 205 SAUDI ARABIA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 206 SOUTH AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 207 SOUTH AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 208 SOUTH AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 209 SOUTH AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 215 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET SZE, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 216 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 217 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 219 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 221 LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 223 LATIN AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 225 LATIN AMERICA: METHYL CELLULOSE & DERIVATIVES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 227 LATIN AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 228 LATIN AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 229 LATIN AMERICA: CARBOXYMETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 230 LATIN AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (KILOTONS)

- TABLE 231 LATIN AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 232 LATIN AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (KILOTONS)

- TABLE 233 LATIN AMERICA: HYDROXYETHYL CELLULOSE, HYDROXYPROPYL CELLULOSE, AND ETHYL CELLULOSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 234 BRAZIL: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 235 BRAZIL: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 236 BRAZIL: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 237 BRAZIL: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 238 MEXICO: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 239 MEXICO: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 240 MEXICO: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 241 MEXICO: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (KILOTONS)

- TABLE 243 REST OF LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2018–2022 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (KILOTONS)

- TABLE 245 REST OF LATIN AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET, BY PRODUCT TYPE, 2023–2028 (USD MILLION)

- TABLE 246 DEGREE OF COMPETITION: CELLULOSE ETHER & DERIVATIVES MARKET

- TABLE 247 COMPANY PRODUCT FOOTPRINT

- TABLE 248 COMPANY APPLICATION FOOTPRINT

- TABLE 249 COMPANY TYPE FOOTPRINT

- TABLE 250 COMPANY REGION FOOTPRINT

- TABLE 251 CELLULOSE ETHER & DERIVATIVES MARKET: KEY STARTUPS/SMES

- TABLE 252 CELLULOSE ETHER & DERIVATIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 253 CELLULOSE ETHER & DERIVATIVES MARKET: PRODUCT LAUNCHES/DEVELOPMENT, 2018-2023

- TABLE 254 CELLULOSE ETHER & DERIVATIVES MARKET: DEALS, 2018-2023

- TABLE 255 CELLULOSE ETHER & DERIVATIVES MARKET: OTHER DEVELOPMENTS, 2018-2023

- TABLE 256 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 257 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 258 LOTTE FINE CHEMICALS: COMPANY OVERVIEW

- TABLE 259 ASHLAND GLOBAL HOLDINGS, INC.: COMPANY OVERVIEW

- TABLE 260 RAYONIER ADVANCED MATERIALS: COMPANY OVERVIEW

- TABLE 261 DKS CO. LTD.: COMPANY OVERVIEW

- TABLE 262 NOURYON CHEMICALS HOLDING B.V.: BUSINESS OVERVIEW

- TABLE 263 J.M. HUBER CORPORATION: BUSINESS OVERVIEW

- TABLE 264 SHANDONG HEAD CO., LTD.: BUSINESS OVERVIEW

- TABLE 265 COLORCON: BUSINESS OVERVIEW

- TABLE 266 LAMBERTI S.P.A.: BUSINESS OVERVIEW

- TABLE 267 J. RETTENMAIER & SOHNE GMBH + CO KG: BUSINESS OVERVIEW

- TABLE 268 FENCHEM: BUSINESS OVERVIEW

- TABLE 269 HEBEI JIAHUA CELLULOSE CO., LTD.: BUSINESS OVERVIEW

- TABLE 270 ZIBO HAILAN CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- TABLE 271 TAIAN RUITAI CELLULOSE CO., LTD.: COMPANY OVERVIEW

- TABLE 272 RELIANCE CELLULOSE PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 273 SICHUAN NITROCELL CORPORATION: COMPANY OVERVIEW

- TABLE 274 HENAN BOTAI CHEMICAL BUILDING MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 275 AMTEX CORP SA DE CV: COMPANY OVERVIEW

- TABLE 276 CHANGSHU WEALTHY SCIENCE AND TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 277 JIANGSU SHANGYONG NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 278 CELOTECH CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 279 SIDLEY CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 280 ZHEJIANG KEHONG CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 281 HUZHOU MIZUDA HOPE BIOSCIENCE CO., LTD.: COMPANY OVERVIEW

- TABLE 282 HEBEI HAOSHUO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 283 HEBEI SHENGXING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 284 SHANDONG LIAOCHENG E HUA PHARMACEUTICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 285 YIXING LUTRON NEW MATERIAL TECH CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 CELLULOSE ETHER & DERIVATIVES MARKET SEGMENTATION

- FIGURE 2 CELLULOSE ETHER & DERIVATIVES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 CELLULOSE ETHER & DERIVATIVES MARKET: DATA TRIANGULATION

- FIGURE 6 METHYL CELLULOSE & DERIVATIVES SEGMENT LED CELLULOSE ETHER & DERIVATIVES MARKET IN 2022

- FIGURE 7 CONSTRUCTION APPLICATION DOMINATED METHYL CELLULOSE & DERIVATIVES MARKET IN 2022

- FIGURE 8 ASIA PACIFIC LED CELLULOSE ETHER & DERIVATIVES MARKET IN 2022

- FIGURE 9 MARKET TO EXPERIENCE SIGNIFICANT GROWTH BETWEEN 2023 AND 2028

- FIGURE 10 CARBOXYMETHYL CELLULOSE SEGMENT AND ASIA PACIFIC DOMINATED MARKET IN 2022

- FIGURE 11 CONSTRUCTION SEGMENT DOMINATED METHYL CELLULOSE & DERIVATIVES APPLICATION

- FIGURE 12 CHINA TO SHOW FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 FACTORS GOVERNING CELLULOSE ETHER & DERIVATIVES MARKET

- FIGURE 14 CELLULOSE ETHER & DERIVATIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 15 CELLULOSE ETHER & DERIVATIVES MARKET: ECOSYSTEM

- FIGURE 16 CELLULOSE ETHER & DERIVATIVES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 17 AVERAGE SELLING PRICE OF PRODUCT TYPES OFFERED BY KEY PLAYERS (USD/KG)

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 20 EXPORT OF CELLULOSE ETHER (EXCLUDING CARBOXYMETHYL CELLULOSE AND ITS SALTS), BY KEY COUNTRY, 2016-2020 (USD MILLION)

- FIGURE 21 EXPORT OF CARBOXYMETHYL CELLULOSE AND ITS SALTS, BY KEY COUNTRY, 2016-2020 (USD MILLION)

- FIGURE 22 IMPORT OF CELLULOSE ETHER (EXCLUDING CARBOXYMETHYL CELLULOSE AND ITS SALTS), BY KEY COUNTRY, 2016-2020 (USD MILLION)

- FIGURE 23 IMPORT OF CARBOXYMETHYL CELLULOSE AND ITS SALTS, BY KEY COUNTRY, 2016-2020 (USD MILLION)

- FIGURE 24 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 25 GLOBAL PATENT PUBLICATION TREND, 2012–2022

- FIGURE 26 CELLULOSE ETHER & DERIVATIVES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 27 GLOBAL JURISDICTION ANALYSIS, 2012–2022

- FIGURE 28 DOW GLOBAL TECHNOLOGIES LLC REGISTERED HIGHEST NUMBER OF PATENTS IN 2022

- FIGURE 29 METHYL CELLULOSE & DERIVATIVES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO DOMINATE METHYL CELLULOSE & DERIVATIVES MARKET DURING FORECAST PERIOD

- FIGURE 31 HYDROXYPROPYL METHYL CELLULOSE SEGMENT TO DOMINATE METHYL CELLULOSE & DERIVATIVES MARKET

- FIGURE 32 ASIA PACIFIC TO LEAD CARBOXYMETHYL CELLULOSE SEGMENT

- FIGURE 33 CELLULOSE ETHER & DERIVATIVES MARKET, BY APPLICATION

- FIGURE 34 CONSTRUCTION APPLICATION TO LEAD METHYL CELLULOSE & DERIVATIVES SEGMENT

- FIGURE 35 INDUSTRIAL APPLICATION TO RECORD HIGHEST CAGR IN CARBOXYMETHYL CELLULOSE MARKET

- FIGURE 36 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: CELLULOSE ETHER & DERIVATIVES MARKET SNAPSHOT

- FIGURE 38 EUROPE: CELLULOSE ETHER & DERIVATIVES MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: CELLULOSE ETHER & DERIVATIVES MARKET SNAPSHOT

- FIGURE 40 SHARE OF TOP COMPANIES IN CELLULOSE ETHER & DERIVATIVES MARKET

- FIGURE 41 RANKING OF TOP FIVE PLAYERS IN CELLULOSE ETHER & DERIVATIVES MARKET

- FIGURE 42 CELLULOSE ETHER & DERIVATIVES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 43 CELLULOSE ETHER & DERIVATIVES MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- FIGURE 44 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 45 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 LOTTE FINE CHEMICALS: COMPANY SNAPSHOT

- FIGURE 47 ASHLAND GLOBAL HOLDINGS, INC.: COMPANY SNAPSHOT

- FIGURE 48 RAYONIER ADVANCED MATERIALS: COMPANY SNAPSHOT

- FIGURE 49 DKS CO. LTD.: COMPANY SNAPSHOT

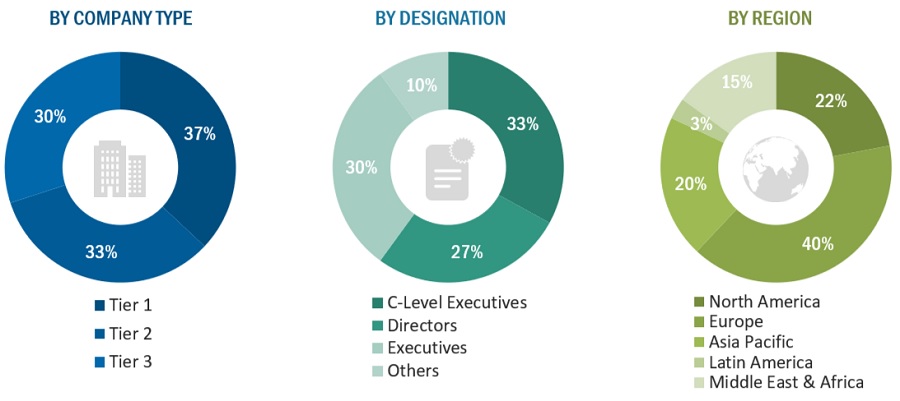

The study involves two major activities in estimating the current market size for the cellulose ether & derivatives market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering cellulose ether & derivatives and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the cellulose ether & derivatives market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the cellulose ether & derivatives market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from cellulose ether & derivatives industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the cellulose ether & derivatives industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of cellulose ether & derivatives and future outlook of their business which will affect the overall market.

The Breakup of Primary Research

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

Dow Chemical Company |

Product Development Head |

|

Shandong Head Co., Ltd. |

Director |

|

DKS Co. Ltd. |

Consultant |

|

Rayonier Advanced Materials |

Sales Head |

Market Size Estimation

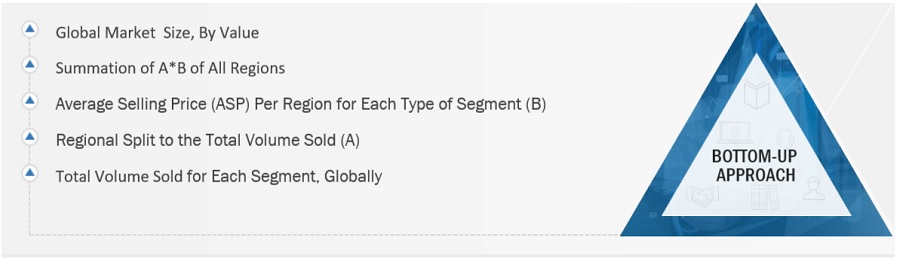

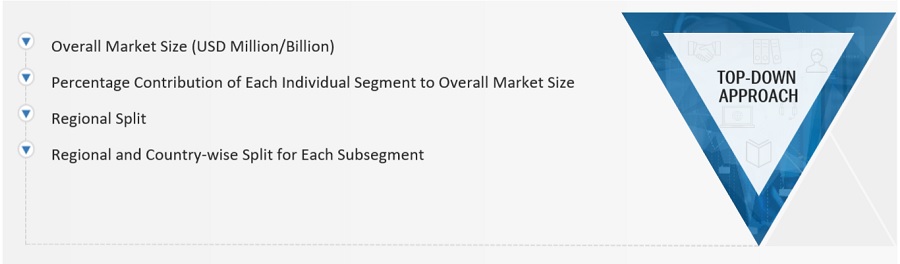

The research methodology used to estimate the size of the cellulose ether & derivatives market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in cellulose ether & derivatives in different product type applications of the cellulose ether & derivatives at a regional level. Such procurements provide information on the demand aspects of the cellulose ether & derivatives industry for each application. For each application, all possible segments of the cellulose ether & derivatives market were integrated and mapped.

Cellulose Ether & Derivatives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Cellulose Ether & Derivatives Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Cellulose ether & derivatives are defined as polymers, which are produced by the chemical modification of cellulose. It consists of methylcellulose & derivatives, carboxymethyl cellulose, hydroxyethyl cellulose, hydroxypropyl cellulose, and ethyl cellulose. They perform a variety of functions, such as thickening, binding, water retention, emulsifying, and acting as a protective colloid in industries, including pharmaceutical, construction, food & beverage, oil & gas, and paints & coatings.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the global cellulose ether & derivatives based on product type, application type, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region

- Europe, Asia Pacific, Latin America, Middle East & Africa, along with major countries in each region restraints, opportunities, and challenges) influencing the growth of the market

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the cellulose ether & derivatives market

- To analyze technological advancements and product launches in the market

- To strategically analyze micro markets with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with a market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the cellulose ether & derivatives market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cellulose Ether & Derivatives Market

General information on cellulose ether and its derivatives and specific focus on cosmetics and personal care

Report on cellulose ethers concentrating on Asian market

Detailed information on the MCAA (monochloroacetic acid) market

Information on the Cellulose Ethers Market

cellulose ether market

Market data for Cellulose ether CMC market.

Import data of Cellulose Ether(HECELLOSE) SBHV for Bangladesh

General information on cellulose ether and its derivatives