Calcium Formate Market by Grade, Application ( Feed Additives, Tile & Stone Additives, Concrete Setting, Leather Tanning, Drilling Fluids, Textile Additives, Flue gas desulfurization), End-use Industry, and Region - Global Forecast to 2025

Updated on : June 18, 2024

Calcium Formate Market

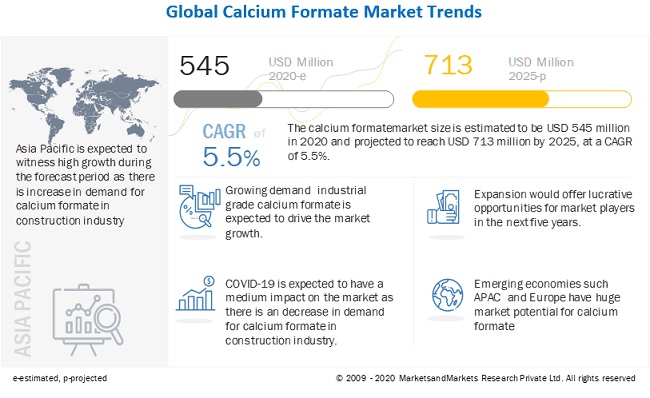

Calcium Formate Market was valued at USD 545 million in 2020 and is projected to reach USD 713 million by 2025, growing at 5.5% cagr from 2020 to 2025. The driving factors for the market is its growing demand from construction industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the calcium formate Market

The global calcium formate market includes major Tier I and II suppliers like as Lanxess (Germany), Perstorp (Sweden), Chongqing Chuandong Chemical (Group) Co. Ltd. (China), Geo Specialty Chemical Inc.(Ohio), and Zibo Ruibao Chemical Co. Ltd. (China), American Elements (US), Henan Botai Chemical Building Material Co. Ltd. (China), Shandong Baoyuan Chemical Co. Ltd. (China), Jiangxi Kosin Organic Chemical Co. Ltd (China) and Sidley Chemical Co. Ltd (China). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, South America, and Middle East & Africa. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for calcium formate is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

Calcium Formate Market Dynamics

Driver: Growing demand of calcium formate in the construction industry

Calcium formate is used as cement additive and concrete accelerator, tile adhesives and cement-based mortars. The growth in the consumption of cement from the construction industry effectively boosts the demand for calcium formate market.

Calcium fromate is used as a cement additive in the construction industry for quick setting and increasing hardness of cement products. Cement is also used in the production of various products such as bricks and blocks, slabs and sheets, adhesives and concrete. In addition, calcium formate is also used as an inhibitor, PH regulator, corrosion protector to substrates of buildings and infrastructure, and for cementation of oil drilling. It is mostly used in the production of concrete in China which is one of the most dominant countries in the production and consumption of cement. Thus, the growing demand of cement in the construction industry is driving the market for calcium formate

Restraint: Availability of substitutes

Several substitutes are available for calcium formate such as thiocynaets, chlorides, carbonates, thiosulfates, silicates, bromides, flourides, nitrates, alkali hydroxides and aluminates in cement and concrete industrial applications. These substitutes are particularly used in the construction industry, thus hampering the market growth for calcium formate

Opportunity: Increasing use of calcium formate as feed additives

The demand for calcium formate as feed additives is projected to witness a remarkable rise in the coming years, as governments of variouss countries implement regulations on health enhancers used in animal feed. The use of nutrition rich feed benefits the digestive health of the animals. This has influenced the adoption of additives and preservatives to achieve healthy growth of livestock. Moreover, increasing consumption rate of meat and poultry products has boosted the demand for livestock, which creates opportunities for the calcium formate producers.

Challenges: Volatility of raw material prices

Formic acid and calcium carbonate are the major raw materials that are used in manufacturing calcium formate. The volatility in the prices of these raw materials pose a key challenge for the calcium formate market. Also, high energy consumption and low process efficiency results in increased production cost. Therefore, the calcium formate manufacturers tend to look for effective alternatives to cut down the production cost and improve profit margins.

To know about the assumptions considered for the study, download the pdf brochure

“The calcium formate market is projected to register a CAGR of 5.5% during the forecast period, in terms of value.”

The global calcium formate market is estimated to be USD 545.8 million in 2020 and is projected to reach USD 713.3 million by 2025, at a CAGR of 5.5% from 2020 to 2025. The market is witnessing moderate growth, owing to increasing application, technological advancements, and growing demand for these resins in the Asia Pacific and Europe. Calcium Formate is largely used in the construction industry. The increasing use of industrial grade calcium formate and the rising construction activities is driving the calcium formate market.

Construction industry segment is expected to lead the calcium formate market during the forecast period.”

The construction industry will continue to lead the calcium formate market, , accounting for a share of 29.7% of the overall market, in 2019 terms of value. Increasing construction and infrastructural activities is expected to boost the rising demand for cement and concrete in the near future. The use of calcium formate as an accelerator in the concrete setting application decreses the setting time and increases the strength, thus boosting the global calcium formate market

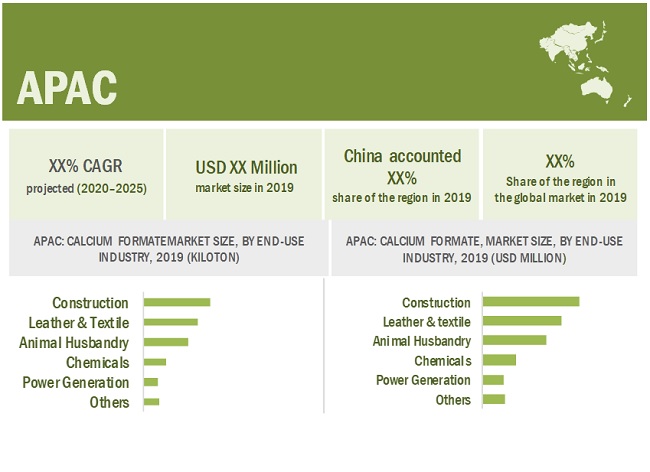

“Asia Pacific is the largest market for calcium formate.”

Asia Pacific accounted for the largest share of the calcium formate market in 2020. Factors such as the rapidly increasing consumption of calcium formate in the construction, chemicals, leather & textile and animal husbsndry industries in countries such as India, Japan, China, and South Korea have led to an increased demand for calcium formate in the Asia Pacific region.

Calcium Formate Market Players

Calcium Formate is a diversified and competitive market with a large number of global players, regional and local players. Lanxess (Germany), Perstorp (Sweden), Chongqing Chuandong Chemical (Group) Co. Ltd. (China), Geo Specialty Chemical Inc.(Ohio), and Zibo Ruibao Chemical Co. Ltd. (China), are some of the key players in the market.

Calcium Formate Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 545 million |

|

Revenue Forecast in 2025 |

USD 713 million |

|

CAGR |

5.5% |

|

Market Size Available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) and Volume (Kiloton) |

|

Segments covered |

By Grade, By Application, By End-Use Industry & By Region |

Calcium Formate Market by Grade

- Industrial Grade

- Feed Grade

Calcium Formate Market by Application

- Feed Additives

- Tile & Stone Additives

- Concrete Setting

- Leather Tanning

- Drilling Fluids

- Textile Additives

- Flue Gas Desulfurization

- Others

Calcium Formate Market by End-Use Industry

- Construction

- Leather & Textile

- Animal Husbandry

- Chemicals

- Power Generation

- Others

Calcium Formate Market by Region

- North America

- Asia Pacific

- Europe

- South America

- Middle East and Africa

Recent Developments

- In February 2020, LANXESS completed the acquisition of Itibanyl Produtos Especiais Ltda. (IPEL). With the acquisition, LANXESS is strengthening its position as one of the world’s leading manufacturers of antimicrobial active ingredients and formulations.

- In November 2019, PMC Group acquires of Lanxess’ Organotin Specialties Business Assets. The Business included Lanxess’ global organotin catalyst, organotin specialties and intermediates product lines.

- In November 2019, Perstorp, invested in the construction of a new Pentaerythritol (Penta) production facility in Gujarat, India. The Gujarat plant will produce Penta, including the renewable grades of Voxtar, providing up to a 60% reduced carbon footprint. Commercial production is planned to start in Q1 2022.

- In July 2019, ProPhorce™ Valerins is the latest innovation by Perstorp in the field of animal nutrition. It consists of glycerol esters of valeric acid. Research have shown that this product significantly improves broiler performance even when compared to industry standards such as butyric acid

- In January 2019, Perstorp reshaped the organization with the three new Business Areas; Specialty Polyols & Solutions, Advanced Chemicals and Animal Nutrition. The main objective for the re-organization is to better address customer demands for supply reliability and focused innovation.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- U.K.

- Italy

- Spain

- Russia

- France

- Rest of Europe

What is the COVID-19 impact on the calcium formate market?

Industry experts believe that COVID-19 would have a impact on calcium formate market as there is an decrease in demand for calcium formate in various industries such as construction, leather & textile and power generation. Furthermore, they also believe that the market will rebound in Q4 in 2020.

What are some of the uses of calcium formate?

Calcium fornate are largely used in additives applications by the construction, animal husbandry and leather & textile end-use industries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 CALCIUM FORMATE MARKET SEGMENTATION

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 2 CALCIUM FORMATE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE ANALYSIS

FIGURE 3 MARKET NUMBER ESTIMATION

2.2.2 MARKET NUMBER ESTIMATION

2.2.3 FORECAST

2.3 DATA TRIANGULATION

FIGURE 4 CALCIUM FORMATE MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 5 CONSTRUCTION INDUSTRY LED THE CALCIUM FORMATE MARKET IN 2019

FIGURE 6 INDUSTRIAL GRADE DOMINATED THE CALCIUM FORMATE MARKET IN 2019

FIGURE 7 CONCRETE WITNESSED HIGHEST GROWTH IN 2019

FIGURE 8 APAC TO BE THE FASTEST-GROWING CALCIUM FORMATE MARKET

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN CALCIUM FORMATE MARKET

FIGURE 9 GROWING CONSTRUCTION INDUSTRY TO DRIVE THE MARKET

4.2 CALCIUM FORMATE MARKET, BY MAJOR COUNTRIES

FIGURE 10 CHINA TO BE THE FASTEST-GROWING MARKET

4.3 GLOBAL CALCIUM FORMATE MARKET, BY END-USE INDUSTRY AND REGION, 2019

FIGURE 11 CONSTRUCTION INDUSTRY AND APAC ACCOUNTED FOR LARGEST SHARES

5 MARKET OVERVIEW (Page No. - 44)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CALCIUM FORMATE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand in the construction industry

5.2.1.2 Multi-utility nature of calcium formate

TABLE 1 APPLICATIONS OF CALCIUM FORMATE

5.2.2 RESTRAINTS

5.2.2.1 Availability of substitutes

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand in feed additives application

5.2.3.2 Growing demand among automakers

5.2.4 CHALLENGES

5.2.4.1 Volatile raw material prices

6 INDUSTRY TRENDS (Page No. - 47)

6.1 PORTER¡¯S FIVE FORCES ANALYSIS

FIGURE 13 CALCIUM FORMATE MARKET: PORTER¡¯S FIVE FORCES ANALYSIS

6.1.1 THREAT OF NEW ENTRANTS

6.1.2 THREAT OF SUBSTITUTES

6.1.3 BARGAINING POWER OF SUPPLIERS

6.1.4 BARGAINING POWER OF BUYERS

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

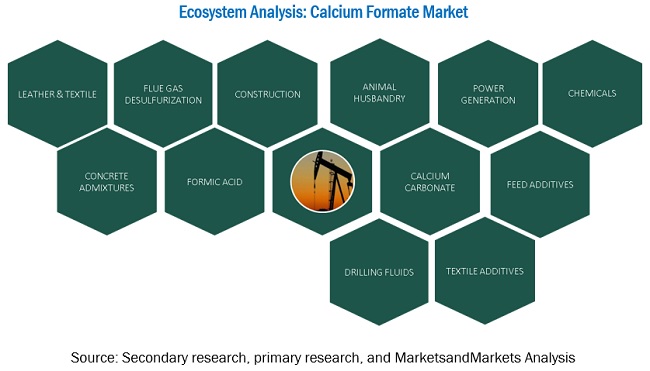

6.2 ECOSYSTEM ANALYSIS

FIGURE 14 ECOSYSTEM ANALYSIS: CALCIUM FORMATE MARKET

6.3 IMPACT OF COVID-19 ON SUPPLY CHAIN

6.4 MACROECONOMIC INDICATORS

6.4.1 INTRODUCTION

6.4.2 TRENDS AND FORECAST OF GDP

TABLE 2 TRENDS AND FORECAST OF GDP, 2016-2023 (USD MILLION)

6.4.3 TRENDS OF PRODUCTION & DRILLING

TABLE 3 OIL PRODUCTION (THOUSAND BARRELS DAILY)

TABLE 4 OIL & GAS WELLS DRILLED, BY REGION, 2019-2020

6.4.4 TRENDS AND FORECAST IN CONSTRUCTION INDUSTRY

TABLE 5 CONSTRUCTION INDUSTRY: GDP CONTRIBUTION, BY COUNTRY, 2014¨C2019 (USD BILLION)

7 CALCIUM FORMATE MARKET, BY GRADE (Page No. - 54)

7.1 INTRODUCTION

FIGURE 15 INDUSTRIAL GRADE SEGMENT TO DOMINATE THE MARKET

TABLE 6 CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (USD MILLION)

TABLE 7 CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (KILOTON)

7.2 INDUSTRIAL GRADE

7.2.1 WIDE RANGE OF APPLICATIONS SERVED BY INDUSTRIAL-GRADE CALCIUM FORMATE IN CONSTRUCTION INDUSTRY DRIVING THE MARKET

FIGURE 16 APAC TO BE THE LARGEST MARKET IN INDUSTRIAL GRADE SEGMENT

TABLE 8 INDUSTRIAL-GRADE CALCIUM FORMATE MARKET SIZE, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 9 INDUSTRIAL-GRADE CALCIUM FORMATE MARKET SIZE, BY REGION, 2018¡ª2025 (KILOTON)

7.3 FEED GRADE

7.3.1 GROWING DEMAND FOR FEED IN ANIMAL HUSBANDRY INDUSTRY BOOSTING THE MARKET

FIGURE 17 APAC TO BE THE LARGEST MARKET IN FEED GRADE SEGMENT

TABLE 10 FEED-GRADE CALCIUM FORMATE MARKET SIZE, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 11 FEED-GRADE CALCIUM FORMATE MARKET SIZE, BY REGION, 2018¡ª2025 (KILOTON)

8 CALCIUM FORMATE MARKET, BY APPLICATION (Page No. - 59)

8.1 INTRODUCTION

FIGURE 18 FEED ADDITIVES TO BE THE LARGEST APPLICATION OF CALCIUM FORMATE

TABLE 12 CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¡ª2025 (USD MILLION)

TABLE 13 CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¡ª2025 (KILOTON)

8.2 FEED ADDITIVES

8.2.1 GROWING DEMAND FOR CALCIUM FORMATE IN ANIMAL FEEDSTOCK

FIGURE 19 APAC TO BE THE LARGEST MARKET FOR FEED ADDITIVES APPLICATION

TABLE 14 CALCIUM FORMATE MARKET SIZE IN FEED ADDITIVES, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 15 CALCIUM FORMATE MARKET SIZE IN FEED ADDITIVES, BY REGION, 2018¡ª2025 (KILOTON)

8.3 TILE & STONE ADDITIVES

8.3.1 GROWTH OF CONSTRUCTION INDUSTRY INCREASING THE DEMAND FOR TILE & STONE ADDITIVES 63

FIGURE 20 APAC TO BE THE FASTEST-GROWING MARKET FOR TILE & STONE ADDITIVES APPLICATION

TABLE 16 CALCIUM FORMATE MARKET SIZE IN TILE & STONE ADDITIVES, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 17 CALCIUM FORMATE MARKET SIZE IN TILE & STONE ADDITIVES, BY REGION, 2018¡ª2025 (KILOTON)

8.4 CONCRETE SETTING

8.4.1 EFFICIENCY OF CALCIUM FORMATE TO ACCELERATE THE SETTING TIME OF CONCRETE 64

FIGURE 21 APAC TO BE THE LARGEST MARKET FOR CONCRETE SETTING APPLICATION

TABLE 18 CALCIUM FORMATE MARKET SIZE IN CONCRETE SETTING, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 19 CALCIUM FORMATE MARKET SIZE IN CONCRETE SETTING, BY REGION, 2018¡ª2025 (KILOTON)

8.5 LEATHER TANNING

8.5.1 GROWING DEMAND FOR LEATHER TANNING IN TEXTILE INDUSTRY

FIGURE 22 APAC TO BE THE FASTEST-GROWING MARKET FOR LEATHER TANNING APPLICATION

TABLE 20 CALCIUM FORMATE MARKET SIZE IN LEATHER TANNING, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 21 CALCIUM FORMATE MARKET SIZE IN LEATHER TANNING, BY REGION, 2018¡ª2025 (KILOTON)

8.6 DRILLING FLUIDS

8.6.1 INCREASING DRILLING PENETRATION RATE OFFERED BY THE USE OF CALCIUM FORMATE TO HELP IN MARKET GROWTH

FIGURE 23 APAC TO BE THE LARGEST MARKET FOR DRILLING FLUIDS APPLICATION

TABLE 22 CALCIUM FORMATE MARKET SIZE IN DRILLING FLUIDS, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 23 CALCIUM FORMATE MARKET SIZE IN DRILLING FLUIDS, BY REGION, 2018¡ª2025 (KILOTON)

8.7 TEXTILE ADDITIVES

8.7.1 EMERGING TEXTILE INDUSTRY IN APAC BOOSTING THE MARKET IN TEXTILE ADDITIVES APPLICATION

FIGURE 24 APAC TO BE THE LARGEST MARKET FOR TEXTILE ADDITIVES APPLICATION

TABLE 24 CALCIUM FORMATE MARKET SIZE IN TEXTILE ADDITIVES, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 25 CALCIUM FORMATE MARKET SIZE IN TEXTILE ADDITIVES, BY REGION, 2018¡ª2025 (KILOTON)

8.8 FLUE GAS DESULFURIZATION

8.8.1 REQUIREMENT FOR SO2-FREE FLUE TO SPUR MARKET GROWTH

FIGURE 25 APAC TO BE THE FASTEST-GROWING MARKET FOR FLUE GAS DESULFURIZATION APPLICATION

TABLE 26 CALCIUM FORMATE MARKET SIZE IN FLUE GAS DESULFURIZATION, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 27 CALCIUM FORMATE MARKET SIZE IN FLUE GAS DESULFURIZATION, BY REGION, 2018¡ª2025 (KILOTON)

8.9 OTHERS

FIGURE 26 APAC TO BE THE LARGEST MARKET FOR OTHER APPLICATIONS

TABLE 28 CALCIUM FORMATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 29 CALCIUM FORMATE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018¡ª2025 (KILOTON)

9 CALCIUM FORMATE MARKET, BY END-USE INDUSTRY (Page No. - 73)

9.1 INTRODUCTION

FIGURE 27 CONSTRUCTION TO BE THE LARGEST END-USE INDUSTRY OF CALCIUM FORMATE

TABLE 30 CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¡ª2025 (USD MILLION)

TABLE 31 CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¡ª2025 (KILOTON)

9.2 CONSTRUCTION

9.2.1 RISING INFRASTRUCTURE ACTIVITIES TO DRIVE THE DEMAND FOR CALCIUM FORMATE IN THIS INDUSTRY

9.2.2 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY

FIGURE 28 APAC TO BE THE LARGEST MARKET IN CONSTRUCTION SEGMENT

TABLE 32 CALCIUM FORMATE MARKET SIZE IN CONSTRUCTION, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 33 CALCIUM FORMATE MARKET SIZE IN CONSTRUCTION, BY REGION, 2018¡ª2025 (KILOTON)

9.3 LEATHER & TEXTILE

9.3.1 VARIOUS APPLICATIONS OF CALCIUM FORMATE IN TEXTILE INDUSTRY TO BOOST THE MARKET

9.3.2 IMPACT OF COVID-19 ON LEATHER & TEXTILE INDUSTRY

FIGURE 29 APAC TO BE THE LARGEST MARKET IN LEATHER & TEXTILE SEGMENT

TABLE 34 CALCIUM FORMATE MARKET SIZE IN LEATHER & TEXTILE, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 35 CALCIUM FORMATE MARKET SIZE IN LEATHER & TEXTILE, BY REGION, 2018¡ª2025 (KILOTON)

9.4 ANIMAL HUSBANDRY

9.4.1 GROWING DEMAND FOR CALCIUM FORMATE IN THE ANIMAL NUTRITION SEGMENT TO PROPEL THE MARKET

9.4.2 IMPACT OF COVID-19 ON ANIMAL HUSBANDRY INDUSTRY

FIGURE 30 APAC TO BE THE FASTEST-GROWING MARKET IN ANIMAL HUSBANDRY SEGMENT

TABLE 36 CALCIUM FORMATE MARKET SIZE IN ANIMAL HUSBANDRY, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 37 CALCIUM FORMATE MARKET SIZE IN ANIMAL HUSBANDRY, BY REGION, 2018¡ª2025 (KILOTON)

9.5 CHEMICAL

9.5.1 VARIOUS USES OF CALCIUM FORMATE TO INCREASES ITS DEMAND IN CHEMICAL INDUSTRY

9.5.2 IMPACT OF COVID-19 ON CHEMICAL INDUSTRY

FIGURE 31 APAC TO BE THE LARGEST MARKET IN CHEMICAL SEGMENT

TABLE 38 CALCIUM FORMATE MARKET SIZE IN CHEMICAL, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 39 CALCIUM FORMATE MARKET SIZE IN CHEMICAL, BY REGION, 2018¡ª2025 (KILOTON)

9.6 POWER GENERATION

9.6.1 USE OF CALCIUM FORMATE TO HELP IN THE SHIFT FROM COAL TO HEAVY FUEL OIL

9.6.2 IMPACT OF COVID-19 ON POWER GENERATION INDUSTRY

FIGURE 32 APAC TO BE THE LARGEST MARKET IN POWER GENERATION SEGMENT

TABLE 40 CALCIUM FORMATE MARKET SIZE IN POWER GENERATION, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 41 CALCIUM FORMATE MARKET SIZE IN POWER GENERATION, BY REGION, 2018¡ª2025 (KILOTON)

9.7 OTHERS

FIGURE 33 APAC TO BE THE LARGEST MARKET IN OTHER END-USE INDUSTRIES SEGMENT

TABLE 42 CALCIUM FORMATE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018¡ª2025 (USD MILLION)

TABLE 43 CALCIUM FORMATE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018¡ª2025 (KILOTON)

10 CALCIUM FORMATE MARKET, BY REGION (Page No. - 85)

10.1 INTRODUCTION

FIGURE 34 CHINA TO RECORD THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 44 CALCIUM FORMATE MARKET SIZE, BY REGION, 2018¨C2025 (USD MILLION)

TABLE 45 CALCIUM FORMATE MARKET SIZE, BY REGION, 2018¨C2025 (KILOTON)

10.2 APAC

10.2.1 IMPACT OF COVID-19 ON CALCIUM FORMATE MARKET IN APAC

FIGURE 35 APAC: CALCIUM FORMATE MARKET SNAPSHOT

TABLE 46 APAC: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (USD MILLION)

TABLE 47 APAC: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (KILOTON)

TABLE 48 APAC: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (USD MILLION)

TABLE 49 APAC: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (KILOTON)

TABLE 50 APAC: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 51 APAC: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 52 APAC: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 53 APAC: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.2 CHINA

10.2.2.1 Increasing infrastructural activities and high growth of leather & textile sector to boost the market

TABLE 54 CHINA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 55 CHINA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 56 CHINA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 57 CHINA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.3 INDIA

10.2.3.1 Growing construction industry and rising trend of industrialization in animal husbandry sector driving the market

TABLE 58 INDIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 59 INDIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 60 INDIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 61 INDIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.4 JAPAN

10.2.4.1 Stabilization in feed prices to drive the adoption of feed additives

TABLE 62 JAPAN: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 63 JAPAN: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 64 JAPAN: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 65 JAPAN: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.5 SOUTH KOREA

10.2.5.1 Increasing government investments for infrastructural activities boosting the market

TABLE 66 SOUTH KOREA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 67 SOUTH KOREA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 68 SOUTH KOREA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 69 SOUTH KOREA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.6 MALAYSIA

10.2.6.1 Strong spending in construction and drilling activities to propel the market

TABLE 70 MALAYSIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 71 MALAYSIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 72 MALAYSIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 73 MALAYSIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.7 AUSTRALIA

10.2.7.1 Strong spending in construction activities due to increased demand for residential buildings to drive the market

TABLE 74 AUSTRALIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 75 AUSTRALIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 76 AUSTRALIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 77 AUSTRALIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.2.8 REST OF APAC

TABLE 78 REST OF APAC: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 79 REST OF APAC: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 80 REST OF APAC: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 81 REST OF APAC: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3 EUROPE

10.3.1 IMPACT OF COVID-19 ON CALCIUM FORMATE MARKET IN EUROPE

FIGURE 36 EUROPE: CALCIUM FORMATE MARKET SNAPSHOT

TABLE 82 EUROPE: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (USD MILLION)

TABLE 83 EUROPE: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (KILOTON)

TABLE 84 EUROPE: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (USD MILLION)

TABLE 85 EUROPE: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (KILOTON)

TABLE 86 EUROPE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 87 EUROPE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 88 EUROPE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 89 EUROPE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.2 GERMANY

10.3.2.1 Growing automotive industry, a surge in residential construction, and investment in infrastructural developments driving the demand for calcium formate

TABLE 90 GERMANY: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 91 GERMANY: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 92 GERMANY: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 93 GERMANY: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.3 FRANCE

10.3.3.1 Increasing demand from construction and textile industries fueling the market

TABLE 94 FRANCE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 95 FRANCE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 96 FRANCE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 97 FRANCE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.4 UK

10.3.4.1 Presence of a large number of automotive companies and development of renewable energy and construction industries to drive the market

TABLE 98 UK: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 99 UK: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 100 UK: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 101 UK: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.5 ITALY

10.3.5.1 Construction industry is the major driver for the market

TABLE 102 ITALY: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 103 ITALY: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 104 ITALY: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 105 ITALY: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.6 SPAIN

10.3.6.1 Rise in the production of automobiles increasing the demand for calcium formate in the transportation end-use industry

TABLE 106 SPAIN: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 107 SPAIN: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 108 SPAIN: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 109 SPAIN: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.7 RUSSIA

10.3.7.1 Developments in public infrastructure sector and growing automobile industry driving the market

TABLE 110 RUSSIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 111 RUSSIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 112 RUSSIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 113 RUSSIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.3.8 REST OF EUROPE

TABLE 114 REST OF EUROPE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 115 REST OF EUROPE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 116 REST OF EUROPE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 117 REST OF EUROPE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.4 NORTH AMERICA

10.4.1 IMPACT OF COVID-19 ON CALCIUM FORMATE MARKET IN NORTH AMERICA

FIGURE 37 NORTH AMERICA: CALCIUM FORMATE MARKET SNAPSHOT

TABLE 118 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (USD MILLION)

TABLE 119 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (KILOTON)

TABLE 120 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (USD MILLION)

TABLE 121 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (KILOTON)

TABLE 122 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 123 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 124 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 125 NORTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.4.2 US

10.4.2.1 Demand to get hampered with growing market maturity

TABLE 126 US: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 127 US: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 128 US: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 129 US: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.4.3 CANADA

10.4.3.1 Government¡¯s efforts to augment residential and public infrastructure significantly contributing to market growth

TABLE 130 CANADA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 131 CANADA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 132 CANADA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 133 CANADA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.4.4 MEXICO

10.4.4.1 Growth of industrial sector and building & construction industry to drive the demand for calcium formate in the country

TABLE 134 MEXICO: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 135 MEXICO: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 136 MEXICO: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 137 MEXICO: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.5 SOUTH AMERICA

FIGURE 38 SOUTH AMERICA: CALCIUM FORMATE MARKET SNAPSHOT

10.5.1 IMPACT OF COVID-19 ON CALCIUM FORMATE MARKET IN SOUTH AMERICA

TABLE 138 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (USD MILLION)

TABLE 139 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (KILOTON)

TABLE 140 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (USD MILLION)

TABLE 141 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (KILOTON)

TABLE 142 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 143 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 144 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 145 SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.5.2 BRAZIL

10.5.2.1 Growing GDP to positively impact the growth of industrial sector

TABLE 146 BRAZIL: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 147 BRAZIL: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 148 BRAZIL: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 149 BRAZIL: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.5.3 ARGENTINA

10.5.3.1 Improved economic conditions of the region to fuel the market

TABLE 150 ARGENTINA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 151 ARGENTINA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 152 ARGENTINA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 153 ARGENTINA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.5.4 REST OF SOUTH AMERICA

TABLE 154 REST OF SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 155 REST OF SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 156 REST OF SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 157 REST OF SOUTH AMERICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.6 MIDDLE EAST & AFRICA

10.6.1 IMPACT OF COVID-19 ON CALCIUM FORMATE MARKET IN MIDDLE EAST & AFRICA

FIGURE 39 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SNAPSHOT

TABLE 158 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (USD MILLION)

TABLE 159 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY COUNTRY, 2018¨C2025 (KILOTON)

TABLE 160 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (USD MILLION)

TABLE 161 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY GRADE, 2018¨C2025 (KILOTON)

TABLE 162 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 163 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 164 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.6.2 SAUDI ARABIA

10.6.2.1 Highest demand for calcium formate is generated from the construction industry in the country

TABLE 166 SAUDI ARABIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 167 SAUDI ARABIA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 168 SAUDI ARABIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 169 SAUDI ARABIA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.6.3 UAE

10.6.3.1 Rapid urbanization and favorable government policies to drive the market in the country

TABLE 170 UAE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 171 UAE: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 172 UAE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 173 UAE: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.6.4 SOUTH AFRICA

10.6.4.1 Ongoing government investments and substantial growth in livestock population driving the market

TABLE 174 SOUTH AFRICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 175 SOUTH AFRICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 176 SOUTH AFRICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 177 SOUTH AFRICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

10.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 178 REST OF MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (USD MILLION)

TABLE 179 REST OF MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY APPLICATION, 2018¨C2025 (KILOTON)

TABLE 180 REST OF MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (USD MILLION)

TABLE 181 REST OF MIDDLE EAST & AFRICA: CALCIUM FORMATE MARKET SIZE, BY END-USE INDUSTRY, 2018¨C2025 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 151)

11.1 OVERVIEW

FIGURE 40 COMPANIES PRIMARILY ADOPTED MERGER & ACQUISITION AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

11.2 MARKET RANKING ANALYSIS

FIGURE 41 CALCIUM FORMATE MARKET RANKING, 2019

11.3 COMPETITIVE SCENARIO

11.3.1 MERGER & ACQUISITION

TABLE 182 MERGER & ACQUISITION, 2017¨C2020

11.3.2 NEW PRODUCT DEVELOPMENT

TABLE 183 NEW PRODUCT DEVELOPMENT, 2017¨C2020

11.3.3 EXPANSION

TABLE 184 EXPANSION, 2017¨C2020

12 COMPANY PROFILES (Page No. - 155)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning imperatives, Current Focus and strategies, Threat from Competition, right to win)*

12.1 LANXESS

FIGURE 42 LANXESS: COMPANY SNAPSHOT

FIGURE 43 LANXESS: SWOT ANALYSIS

12.2 PERSTORP

FIGURE 44 PERSTORP: COMPANY SNAPSHOT

FIGURE 45 PERSTORP: SWOT ANALYSIS

12.3 GEO SPECIALTY CHEMICALS, INC.

FIGURE 46 GEO SPECIALTY CHEMICALS, INC.: SWOT ANALYSIS

12.4 ZIBO RUIBAO CHEMICAL CO. LTD

FIGURE 47 ZIBO RUIBAO CHEMICAL CO. LTD: SWOT ANALYSIS

12.5 AMERICAN ELEMENTS

FIGURE 48 AMERICAN ELEMENTS: SWOT ANALYSIS

12.6 CHONGQING CHUANDONG CHEMICAL £¨GROUP£© CO., LTD.

12.7 HENAN BOTAI CHEMICAL BUILDING MATERIALS CO. LTD

12.8 SHANDONG BAOYUAN CHEMICAL CO. LTD

12.9 JIANGXI KOSIN ORGANIC CHEMICAL CO. LTD

12.10 SIDLEY CHEMICAL CO. LTD

12.11 OTHER COMPANIES

12.11.1 SHANDONG XINRUIDA CHEMICAL INDUSTRY CO, LTD

12.11.2 HANGZHOU FOCUS CHEMICAL CO., LTD

12.11.3 ZOUPING FENLIAN CHEMICAL CO., LTD

12.11.4 PUYANG YONGAN CHEMICAL CO., LTD (YACC)

12.11.5 FEICHENG ACID CHEMICALS CO., LTD.

12.11.6 HUBEI HENGXIN CHEMICAL CO. LTD

12.11.7 GELEST, INC.

12.11.8 KRISHNA CHEMICALS

12.11.9 LINYI FANO BIOTECH CO. LTD

12.11.10 ZHANHUA BINBO CHEMICAL CO. LTD

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, Winning imperatives, Current Focus and strategies, Threat from Competition, right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 179)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION

13.4 RELATED REPORT

13.5 AUTHOR DETAILS

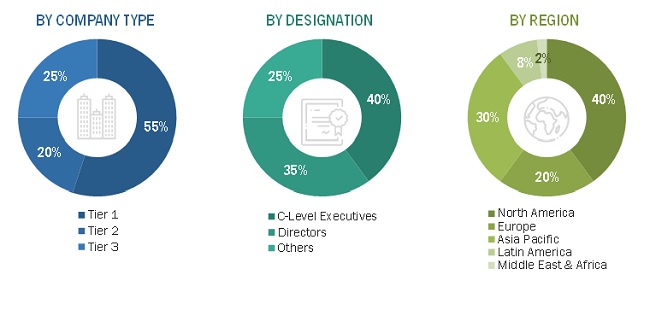

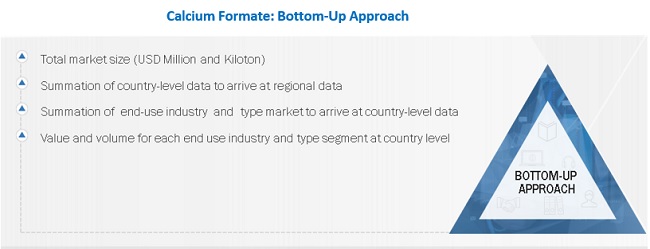

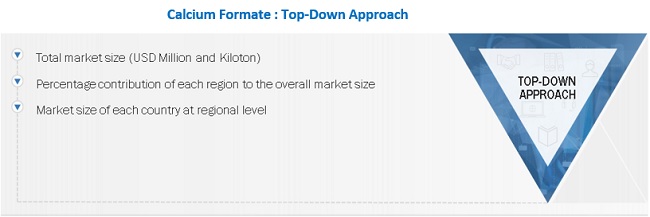

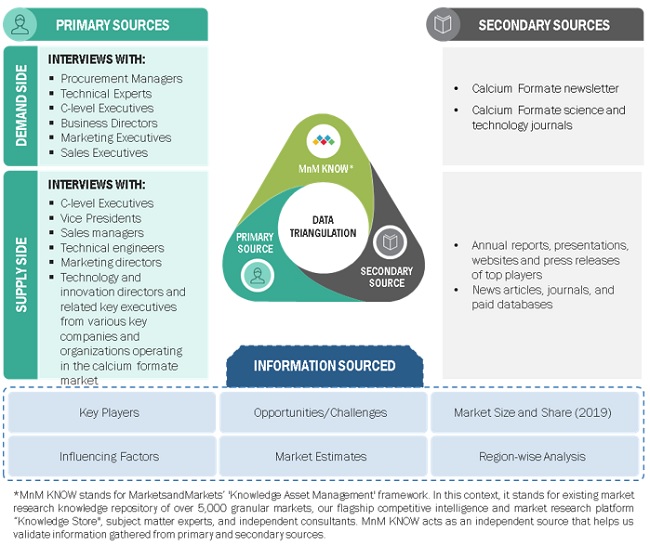

The study involved the estimation of the current size of the calcium formate market. Exhaustive secondary research was conducted to collect information about the market, the peer market, and the parent market, the impact of COVID-19 outbreak in the said market. This was followed by the validation of these findings, assumptions, and sizing with industry experts identified across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

The calcium formate market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the calcium formate market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the calcium formate market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the calcium formate market.

Report Objectives

- To define, describe, and forecast the calcium formate market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on grade, application, and end-use industry

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America (along with the key countries in each region)

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as expansion, mergers & acquisitions, new product developments, and agreement) in the calcium formate market

- To strategically profile the key players and comprehensively analyze their core competencies

Note 1. Micromarkets are defined as subsegments of the Calcium formate market included in the report.

: Core competencies2 of the companies are determined in terms of product offerings and business strategies adopted by them to sustain in the market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Calcium Formate Market