Biophotonics Market by Application(See-through Imaging, Inside Imaging, Spectromolecular, Surface Imaging, Microscopy, Light Therapy, Biosensors), Technology(In-vivo, In-vitro), End-use(Diagnostics, Therapeutic, Tests), & Geography - Global Forecast to 2020

The overall market for biophotonics in 2014 was valued at USD 26.26 Billion, which is estimated to reach USD 50.18 Billion by 2020, at a CAGR of 11.5% during the forecast period. This market growth can be attributed to emergence of nanotechnology, significant technological advancements over the last few years and their adoption in the medical sector, increase in the demand for home-based POC devices, aging population, and growing lifestyle diseases. The report categorizes the global biophotonics market on the basis of application, technology, end use, and geography as well as forecasts the market size and analyzes trends in the said market. This report is focused on giving a bird’s eye-view of the market with regards to the qualitative analysis at each and every aspect of the classification done. The report provides a forecast of the growth of the biophotonics market between 2015 and 2020.

The global biophotonics market is expected to reach USD 50.18 Billion by 2020 from USD 26.26 Billion in 2014, at a CAGR of 11.5% from 2015 to 2020. This market is primarily driven by the emergence of nanotechnology, significant technological advancements, increasing demand for home-based POC devices, aging population, and growing lifestyle diseases. Biophotonics technologies enable better imaging of tissues and other biological entities, thereby enhancing the drug discovery process and biomedical research.

The largest market segment for biophotonics market, by application is see-through imaging, however the fastest growing segment is surface imaging. There have been significant developments in the field of see-through imaging techniques in recent years, especially in drug discovery and medical diagnostics. Over the years, see-through imaging has emerged as an effective tool for in-vitro and in-vivo imaging, and become an integral part of biomedical research. However, a fundamental factor in the growth of the surface imaging market is endoscopy, which has witnessed exponential growth in recent years owing to an increased patient acceptance for minimally invasive procedures for treatment as well as diagnosis.

The market for in-vivo technology has the largest market share in 2014. There is a growing demand for in-vivo monitoring and diagnostics because of its ability to detect diseases and infections as well as find the real-time efficiency of a drug and the effectiveness of a specific treatment or response to a particular medical procedure. The market for other (non-medical) sectors is expected grow at a highest CAGR during the forecast period. As biophotonics is an emerging technology there are a lot of other areas where it is yet to be adapted such as biometrics, and biosensing; therefore, it is expected that this market will grow at a high CAGR during the forecast period.

In 2014, the Americas accounted for the largest share of the global biophotonics market. In Americas, factors such as rising incidences of chronic disorders, growing demand for non-invasive and nonionizing diagnostic modalities, and introduction of new and advanced technologies in the field of diagnostics and imaging are fueling the biophotonics market growth.

However, slow rate of commercialization is hindering the growth of this market. Considering the vast application areas, it has become very challenging for players to commercialize the biophotonics technology. Moreover, the biophotonics market is going through a slow rate of commercialization, which is primarily due to price sensitivity, low acceptance from end users, and concerns related to quality, authenticity, and reliability of products. Becton, Dickinson and Company (U.S.) is one of the key companies in this market because of its financial power, brand value, and technical expertise; it is a well-known medical technology company that serves healthcare institutions, life sciences researchers, clinical laboratories, industry and the general public. Another major company is Hamamatsu Photonics K.K. (Japan) because of its expertise in optical sensors, photodiodes, photo ICs, image sensors, and other opto-semiconductor elements. Hamamatsu has a dedicated research laboratory in Tsukuba (Japan) where research primarily related with biophotonics in the field of life sciences is conducted.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Market Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rapid Growth in the Elderly Population

2.2.3 Supply-Side Analysis

2.2.3.1 Poor Customer Perception

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Biophotonics Market Overview

4.2 Biophotonics Market, By End-Use and Geography

4.3 Geographic Snapshot of the Biophotonics Market

4.4 Biophotonics Market, By Technology (2015 – 2020)

4.5 See-Through Imaging Biophotonics Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Biophotonics Market, By Application

5.2.2 Biophotonics Market, Technology

5.2.3 Biophotonics Market, By End Use

5.2.4 Biophotonics Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Emergence of Nanotechnology

5.3.1.2 Significant Technological Advancements Over the Last Few Years

5.3.1.3 Increase in the Demand for Home-Based Poc Devices

5.3.1.4 Aging Population and Growing Lifestyle Diseases

5.3.2 Restraints

5.3.2.1 Slow Rate of Commercialization

5.3.2.2 High Cost Involved in Research and Development

5.3.2.3 Reluctance Toward the Adoption of New Treatment Practices

5.3.3 Opportunities

5.3.3.1 Emerging Markets in the Developing Countries

5.3.3.2 The Use of Biophotonics in Non-Medical Sectors

5.3.4 Challenges

5.3.4.1 Government Regulations and Long Certification & Approval Cycles

5.3.4.2 Pricing Pressure in the Point-Of-Care Market

6 Industry Insights (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Industry Trends

6.4 Porter’s Five Forces Analysis

6.4.1 Bargaining Power of Suppliers

6.4.2 Bargaining Power of Buyers

6.4.3 Threat of New Entrants

6.4.4 Threat of Substitutes

6.4.5 Degree of Competition

6.5 Pest Analysis

6.5.1 Political Factors

6.5.2 Economic Factors

6.5.3 Social Factors

6.5.4 Technological Factors

7 Biophotonics Market, By Application (Page No. - 54)

7.1 Introduction

7.2 See-Through Imaging

7.3 Inside Imaging (Endoscopy)

7.4 Spectromolecular

7.5 Surface Imaging

7.6 Microscopy

7.7 Light Therapy

7.8 Biosensors

7.9 Others

8 Biophotonics Market, By Technology (Page No. - 63)

8.1 Introduction

8.2 In-Vivo

8.3 In-Vitro

9 Biophotonics Market, By End Use (Page No. - 67)

9.1 Introduction

9.2 Medical Diagnostics

9.3 Medical Therapeutics

9.4 Test Components

9.5 Other (Non-Medical)

10 Regional Analysis (Page No. - 72)

10.1 Introduction

10.2 Americas

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.2.4 Others

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Others

10.4 APAC

10.4.1 Japan

10.4.2 China

10.4.3 India

10.4.4 Others

10.5 RoW

10.5.1 Middle East

10.5.2 Africa

11 Competitive Landscape (Page No. - 114)

11.1 Overview

11.2 Top 5 Players in Biophotonics Market- Market Ranking

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Agreements, Collaborations, Contracts, & Partnerships

11.3.3 Expansions and Patents

11.3.4 Acquisitions

12 Company Profiles (Page No. - 120)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 Affymetrix, Inc.

12.3 Andor Technology Ltd

12.4 Becton, Dickinson and Company

12.5 Carl Zeiss AG

12.6 FEI Company

12.7 Hamamatsu Photonics K.K.

12.8 Lumenis Ltd.

12.9 Olympus Corporation

12.10 Perkinelmer, Inc.

12.11 Zecotek Photonics Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 150)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Report

List of Tables (80 Tables)

Table 1 Emergence of Nanotechnology and Technological Advancements are the Key Market Drivers

Table 2 Slow Rate of Commercialisation and High Cost of R&D are Major Restraining Factors

Table 3 Use of Biophotonics in Non-Medical Applications is A Key Opportunity for the Companies

Table 4 Government Regulations, Long Certification & Approval Cycles are the Major Challenges for the Market Players

Table 5 Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 6 See-Through Imaging Biophotonics Market, By Region, 2013 - 2020 (USD Billion)

Table 7 Inside Imaging Biophotonics Market, By Region, 2013 - 2020 (USD Billion)

Table 8 Spectromolecular Biophotonics Market, By Region, 2013 - 2020 (USD Billion)

Table 9 Surface Imaging Biophotonics Market, By Region, 2013 - 2020 (USD Million)

Table 10 Microscopy Biophotonics Market, By Region, 2013 - 2020 (USD Million)

Table 11 Light Therapy Biophotonics Market, By Region, 2013 - 2020 (USD Million)

Table 12 Biosensors Biophotonics Market, By Region, 2013 - 2020 (USD Million)

Table 13 Other Applications Biophotonics Market, By Region, 2013 - 2020 (USD Million)

Table 14 Biophotonics Market, By Technology, 2013 - 2020 (USD Billion)

Table 15 In-Vivo Biophotonics Market, By End Use, 2013 - 2020 (USD Billion)

Table 16 In-Vitro Biophotonics Market, By End Use, 2013 - 2020 (USD Billion)

Table 17 Biophotonics Market, By End Use, 2013 - 2020 (USD Billion)

Table 18 Medical Diagnostics Biophotonics Market, By Technology, 2013 - 2020 (USD Billion)

Table 19 Medical Therapeutics Biophotonics Market, By Technology, 2013 - 2020 (USD Billion)

Table 20 Tests & Components Biophotonics Market, By Technology, 2013 - 2020 (USD Billion)

Table 21 Biophotonics Market, By Region, 2013 - 2020 (USD Billion)

Table 22 The Americas Biophotonics Market, By Country, 2013 - 2020 (USD Billion)

Table 23 The Americas: Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 24 The Americas: Biophotonics Market for See-Through Imaging, By Country, 2013 - 2020 (USD Billion)

Table 25 The Americas: Biophotonics Market for Inside Imaging, By Country, 2013 - 2020 (USD Billion)

Table 26 The Americas: Biophotonics Market for Spectromolecular, By Country, 2013 - 2020 (USD Million)

Table 27 The Americas: Biophotonics Market for Surface Imaging, By Country, 2013 - 2020 (USD Million)

Table 28 The Americas: Biophotonics Market for Microscopy, By Country, 2013 - 2020 (USD Million)

Table 29 The Americas: Biophotonics Market for Light Therapy, By Country, 2013 - 2020 (USD Million)

Table 30 The Americas: Biophotonics Market for Biosensors, By Country, 2013 - 2020 (USD Million)

Table 31 The Americas: Biophotonics Market for Other Sectors, By Country, 2013 - 2020 (USD Million)

Table 32 U.S.: Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 33 Canada: Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 34 Mexico: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 35 Others Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 36 Europe: Biophotonics Market, By Country, 2013 - 2020 (USD Billion)

Table 37 Europe: Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 38 Europe: Biophotonics Market for See-Through Imaging, By Country, 2013 - 2020 (USD Million)

Table 39 Europe: Biophotonics Market for Inside Imaging, By Country, 2013 - 2020 (USD Million)

Table 40 Europe: Biophotonics Market for Spectromolecular, By Country, 2013 - 2020 (USD Million)

Table 41 Europe: Biophotonics Market for Surface Imaging, By Country, 2013 - 2020 (USD Million)

Table 42 Europe: Biophotonics Market for Microscopy, By Country, 2013 - 2020 (USD Million)

Table 43 Europe: Biophotonics Market for Light Therapy, By Country, 2013 - 2020 (USD Million)

Table 44 Europe: Biophotonics Market for Biosensors, By Country, 2013 - 2020 (USD Million)

Table 45 Europe: Biophotonics Market for Other Sectors, By Country, 2013 - 2020 (USD Million)

Table 46 U.K.: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 47 Germany: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 48 France: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 49 Others Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 50 APAC: Biophotonics Market, By Country, 2013 - 2020 (USD Billion)

Table 51 APAC: Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 52 APAC: Biophotonics Market for See-Through Imaging, By Country, 2013 - 2020 (USD Million)

Table 53 APAC: Biophotonics Market for Inside Imaging, By Country, 2013 - 2020 (USD Million)

Table 54 APAC: Biophotonics Market for Spectromolecular, By Country, 2013 - 2020 (USD Million)

Table 55 APAC: Biophotonics Market for Surface Imaging, By Country, 2013 - 2020 (USD Million)

Table 56 APAC: Biophotonics Market for Microscopy, By Country, 2013 - 2020 (USD Million)

Table 57 APAC: Biophotonics Market for Light Therapy, By Country, 2013 - 2020 (USD Million)

Table 58 APAC: Biophotonics Market for Biosensors, By Country, 2013 - 2020 (USD Million)

Table 59 APAC: Biophotonics Market for Other Sectors, By Country, 2013 - 2020 (USD Million)

Table 60 Japan: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 61 China: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 62 India: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 63 Others Biophotonics Market, By Application, 2013 - 2020 (USD Billion)

Table 64 RoW: Biophotonics Market, By Country, 2013 - 2020 (USD Billion)

Table 65 RoW Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 66 RoW: Biophotonics Market for See-Through Imaging, By Country, 2013 - 2020 (USD Million)

Table 67 RoW: Biophotonics Market for Inside Imaging, By Country, 2013 - 2020 (USD Million)

Table 68 RoW: Biophotonics Market for Spectromolecular, By Country, 2013 - 2020 (USD Million)

Table 69 RoW: Biophotonics Market for Surface Imaging, By Country, 2013 - 2020 (USD Million)

Table 70 RoW: Biophotonics Market for Microscopy, By Country, 2013 - 2020 (USD Million)

Table 71 RoW: Biophotonics Market for Light Therapy, By Country, 2013 - 2020 (USD Million)

Table 72 RoW: Biophotonics Market for Biosensors, By Country, 2013 - 2020 (USD Million)

Table 73 RoW: Biophotonics Market for Other Sectors, By Country, 2013 - 2020 (USD Million)

Table 74 The Middle East: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 75 Africa: Biophotonics Market, By Application, 2013 - 2020 (USD Million)

Table 76 Biophotonics Market: Key Players, 2014

Table 77 New Product Launches

Table 78 Agreements, Collaborations, Contracts, & Partnerships

Table 79 Expansions and Patents

Table 80 Acquisitions

List of Figures (50 Figures)

Figure 1 Biophotonics Market: Research Design

Figure 2 Countrywise Percentage of Aging Population (2004 vs 2014)

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Biophotonics Market Snapshot: Application in See-Through Imaging are Expected to Lead the Market

Figure 7 Other End Uses Such as Biometrics and Biosensing Expected to Witness the Highest Growth Rate

Figure 8 Global Biophotonics Market, By Technology, 2014

Figure 9 Global Biophotonics Market, By Region, 2014

Figure 10 Biophotonics Market to Showcase Lucrative Growth Opportunities in Non-Medical Sectors

Figure 11 Medical Diagnostics Segment to Hold the Largest Market Share in 2015

Figure 12 Countries in APAC Expected to Witness High Growth Rate During the Forecast Period

Figure 13 Other (Non-Medical) Sectors to Witness Highest Growth Rate During the Forecast Period

Figure 14 Americas Expected to Be the Leading Market for See-Through Imaging Till 2020

Figure 15 Biophotonics Market Segmentation

Figure 16 Market, By Application

Figure 17 Market, By Technology

Figure 18 Biophotonics Market: By End Use

Figure 19 Biophotonics Market: By Geography

Figure 20 Emergence of Nanotechnology and Technological Advancements are the Key Market Drivers

Figure 21 Nanotechnology-Based Medical Devices Market, By Application

Figure 22 Percentage of World Population, By Country, 2014

Figure 23 Value Chain Analysis: Major Value is Added During R&D and Manufacturing Stages

Figure 24 Industry Trends

Figure 25 Porter’s Five Forces Analysis: Biophotonics Market

Figure 26 Biophotonics Market, By Application

Figure 27 Biophotonics Market, By Technology

Figure 28 Biophotonics Market, By End Use

Figure 29 Geographical Snapshot: APAC Was the Fastest-Growing Market for Biophotonics, 2014

Figure 30 The Americas: Market Snapshot

Figure 31 European Market Snapshot

Figure 32 APAC Market Snapshot

Figure 33 RoW Market Snapshot

Figure 34 Companies Adopted New Product Launches as the Key Growth Strategy Over the Last Four Years (2012-2015)

Figure 35 Battle for Market Share: New Product Launches has Been the Key Strategy

Figure 36 Geographic Revenue Mix of Major Players

Figure 37 Affymetrix, Inc. : Company Snapshot

Figure 38 Affymetrix, Inc. : SWOT Analysis

Figure 39 Becton, Dickinson and Company : Company Snapshot

Figure 40 Becton, Dickinson and Company : SWOT Analysis

Figure 41 Carl Zeiss AG : Company Snapshot

Figure 42 Carl Zeiss AG : SWOT Analysis

Figure 43 FEI Company: Company Snapshot

Figure 44 Hamamatsu Photonics K.K. : Company Snapshot

Figure 45 Hamamatsu Photonics K.K. : SWOT Analysis

Figure 46 Lumenis Ltd. : Company Snapshot

Figure 47 Olympus Corporation : Company Snapshot

Figure 48 Olympus Corporation : SWOT Analysis

Figure 49 Perkinelmer, Inc. : Company Snapshot

Figure 50 Zecotek Photonics Inc. : Company Snapshot

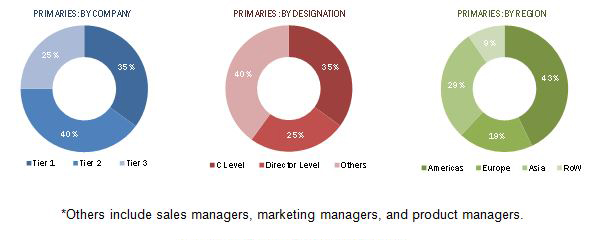

This research study involves extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial aspects of biophotonics market. In addition to secondary sources, the market data was collected by primary research as well by conducting extensive interviews with key people such as CEOs, VPs, Directors and executives. After arriving at the overall market size the total market has been split into several segments and sub-segments. The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

This report takes a close look at the biophotonics market, providing a holistic outlook on market dynamics, industry trends, and supply & demand. The study aims at providing granular information regarding estimates and forecasts for the biophotonics market segments. This report is based on an extensive research study of the biophotonics market and aims at identifying the entire market and all its sub-segments through extensively detailed classifications. The demand for biophotonics is expected to grow significantly and gain importance among players across various domains. The Americas is projected to be the fastest-growing market during the forecast period.

The information provided in this report includes profiles of leading companies in the biophotonics ecosystem, key developments, core strategies deployed by various players, mergers and acquisitions, new product developments, collaborations, and joint ventures of key manufacturers along with their financials. A competitive landscape of the current market has been analyzed on the basis of a company’s recent developments, R&D activities, and product portfolio among other factors.

The target audience of the report include existing players in biophotonics market, start-up companies, venture capitalists, private equity groups, investment houses, equity research firms and other stakeholders. This study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

The report also discusses the future of the global market with roadmaps, upcoming technologies, and applications with respect to biophotonics market. Key players in this industry include, Affymetrix, Inc. (U.S.), Andor Technology Ltd. (U.K.), Becton, Dickinson and Company (U.S.), Carl Zeiss AG (Germany), FEI Company (U.S.), Hamamatsu Photonics K.K. (Japan), Lumenis Ltd. (Israel), Olympus Corporation (Japan), PerkinElmer, Inc. (U.S.), and Zecotek Photonics Inc. (Canada).

Growth opportunities and latent adjacency in Biophotonics Market