Biometrics As a Service in Healthcare Market by Component, Modality (Unimodal, Multimodal), Solution Type (Fingerprint, Iris, Vein Recognition), Application (Patient Identification, Medical Record Security), Region - Global Forecast to 2028

Updated on : September 24, 2024

Biometrics As a Service in Healthcare Market Size, Growth Drivers & Restraints

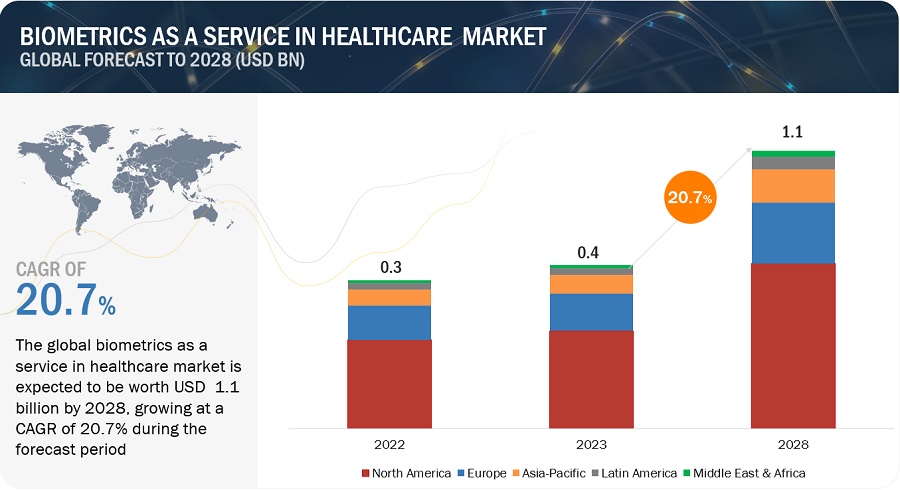

The global biometrics as a service in healthcare market, valued at US$0.3 billion in 2022, stood at US$0.4 billion in 2023 and is projected to advance at a resilient CAGR of 20.7% from 2023 to 2028, culminating in a forecasted valuation of US$1.1 billion by the end of the period. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Significant strides in biometric technologies, including innovations like palm vein scanning, iris recognition, and facial recognition, have ushered in a new era of heightened accuracy and user-friendliness. These advancements, characterized by their precision and ease of implementation, have played an instrumental role in propelling the adoption of biometrics within the healthcare sector. As healthcare organizations increasingly recognize the potential for enhanced security, streamlined workflows, and improved patient experiences that these cutting-edge biometric solutions offer, the market experiences a substantial boost, with providers and stakeholders embracing these technologies as indispensable tools for elevating healthcare standards and operational efficiency. Technical challenges such as the occurrence of false positives or negatives, particularly notable in biometric methods like facial recognition, can exert a considerable influence on the accuracy of patient identification processes, potentially acting as a restraint and hindrance to the growth of the market within healthcare.

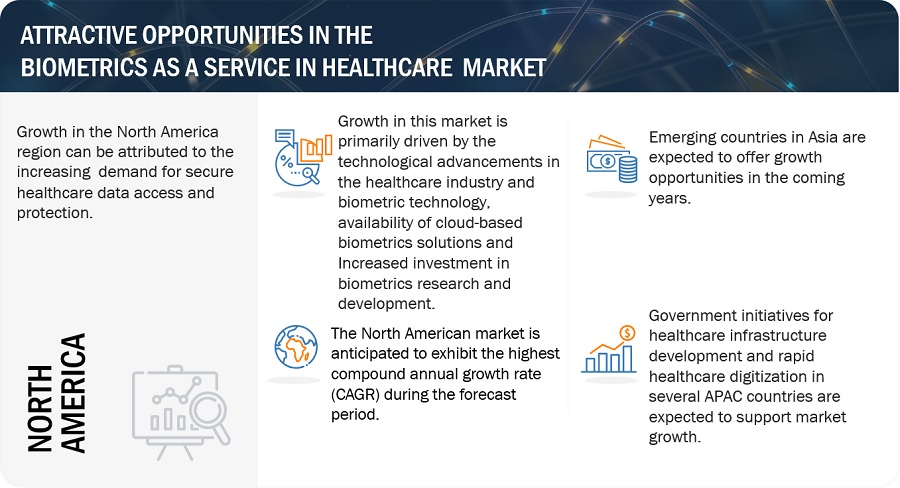

Attractive Opportunities in Biometrics as a Service in Healthcare Market

To know about the assumptions considered for the study, Request for Free Sample Report

Biometrics as a Service in Healthcare Market Dynamics

Driver: Growing focus on Government initiatives supporting the adoption of biometrics in healthcare

Governments across the globe are firmly committed to establishing and operationalizing legally sanctioned, trusted identities for their citizens. As such, they are steadfastly focused on the integration of biometric technologies into governmental operations to authenticate and verify the identities of individuals. Government-led initiatives are playing a pivotal role in advocating for the adoption of biometrics within healthcare systems.

Biometric technologies offer a heightened level of security, precision, and efficiency in the critical domains of patient identification, data safeguarding, and overall healthcare processes. According to a report published by Mint in April 2023, the National Health Authority is currently in the process of enhancing the Ayushman Bharat Health Account (ABHA) application. This enhancement will empower individuals to utilize a facial authentication service linked to their Aadhar number to establish their identity within the Ayushman Bharat Health Account (ABHA) application.

This application functions as a digital health ecosystem platform, facilitating the seamless digital exchange and accessibility of health records for users. In essence, governments worldwide are increasingly acknowledging the advantages of integrating biometric solutions into healthcare data security and patient identification. This recognition has driven the incorporation of biometric solutions into diverse healthcare systems and services. Consequently, these initiatives are expected to generate significant demand for biometric solutions in the forthcoming years.

Restrain: High costs associated with biometric systems

Providers of biometric systems must adhere to stringent requirements when catering to specialized healthcare applications. The production of advanced biometric systems necessitates substantial capital investment across various stages, encompassing research and development (R&D), manufacturing, installation, maintenance, and shipping of both software and hardware components. Notably, high-performance biometric systems comprise components such as fingerprint readers, electronic locking systems, scanners, sensors, and cameras, each incurring significant installation and maintenance expenses. Moreover, the incorporation of more sophisticated biometric technologies demands the utilization of modernized raw materials and subcomponents, adding further to the overall costs.

End-users, on their part, are burdened with the expenses associated with shipping, installation, and proactive maintenance. Consequently, the substantial capital outlay required poses a hindrance to the growth of the market. Nonetheless, in the future landscape, services like cloud computing and Software-as-a-Service (SaaS) are poised to attract small and medium-sized enterprises (SMEs). This shift is expected to reduce the cost barriers associated with implementing biometric systems within their organizational setups.

Opportunity: Increasing demand for advanced biometric solutions designed for authentication and identification applications

Biometric solutions have experienced substantial technological advancements in recent times, driven by innovations in sensing technologies and the ubiquitous presence of computing devices like computers and mobile phones. These developments offer fresh opportunities for capturing both physiological and behavioral human traits, with the subsequent analysis of this data enabling robust biometric authentication. Biometric systems, empowered by machine learning and artificial intelligence, present new avenues for effectively identifying unusual behavior and providing supplementary authentication layers when necessary.

Traditionally, fingerprint recognition has held sway as the predominant biometric technology. However, there has been a noteworthy shift towards facial and iris recognition technologies among end users. Iris recognition technology, in particular, is gaining significant traction in healthcare applications. The healthcare sector has grappled with the persistent challenge of precise patient identification, and biometric iris recognition technologies are increasingly being harnessed for various purposes, such as accessing patient records and details within the healthcare industry.

The emergence of innovative technologies and cost-effective multi-layered authentication systems is expected to foster greater adoption of iris recognition within global healthcare systems. Precise patient identification remains a paramount concern in healthcare management applications, encompassing tasks like personal identification, attendance tracking, individual matching to medical records, and the implementation of efficient authentication and authorization mechanisms across diverse healthcare domains. These domains include patient registration monitoring, treatment pathways, checkup scheduling, recurring treatments, and support for national or private health insurance cards, as well as ambulatory treatment documentation.

Challenge: Complexities in implementing recognition technologies within existing healthcare systems

The integration of recognition technologies into existing healthcare systems in the realm of healthcare biometrics presents a multifaceted challenge for several compelling reasons. Firstly, the transition from conventional identification methods, such as plastic ID cards and barcoded wristbands, to newer solutions built upon one of three biometric technologies (facial, fingerprint, or iris recognition) necessitates substantial investments by healthcare organizations. These investments encompass both technological upgrades and infrastructural enhancements required to facilitate the seamless integration of biometric solutions.

Secondly, the implementation of biometric-based patient identification on a large scale entails overcoming a myriad of barriers. These barriers encompass cost considerations for healthcare systems, sustainability concerns, consumer and healthcare system acceptance, limitations in the array of biometric options currently available in the market, workflow intricacies within individual healthcare systems, as well as the complexities inherent in aligning workflows across interconnected healthcare systems. Additionally, privacy concerns loom prominently, adding to the challenges faced in the adoption and integration of biometric solutions.

For instance, as reported in a June 2023 article by BiometricUpdate.com, the Japanese government's My Number digital ID initiative has struggled to assuage concerns about the mishandling of personal data, especially in relation to disability certificates. This apprehension has sparked objections, particularly in light of the impending substitution of health insurance cards with My Number IDs. Japanese medical practitioners have even initiated legal actions, contesting the mandatory replacement of health insurance cards due to concerns related to financial burdens and implementation costs.

Notably, one significant hurdle in deploying iris recognition technology lies in its integration with existing systems to enhance security, surveillance, and access control. The ever-evolving nature of iris biometrics technology, including advancements in high-definition camera technology, algorithms, and analytics solutions, has amplified the complexity of integrating this technology with other biometric devices. Despite these challenges, the seamless amalgamation of iris recognition technology with other biometric modalities holds the potential to unlock numerous applications and significantly contribute to precise patient identification. The integration of multiple biometric modalities also stands to bolster accuracy and security within the domain of healthcare biometrics.

In light of these considerations, healthcare organizations must meticulously evaluate both the advantages and obstacles associated with integrating biometric solutions into their existing systems, devising comprehensive strategies to navigate these challenges effectively.

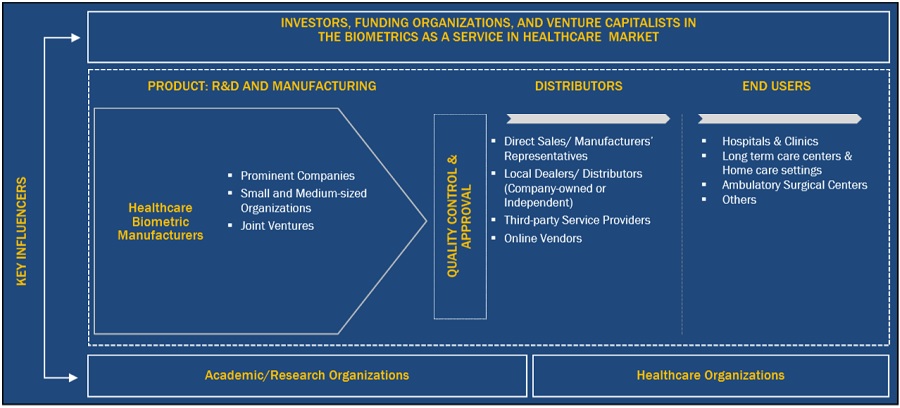

Biometrics as a Service in the Healthcare Industry Ecosystem

The aspects present in this market are included in the ecosystem market map of the overall healthcare biometrics/biometrics as a service in the healthcare market, and each element is defined with a list of the organizations involved. Products and services are included. The manufacturers of various products include the organizations involved in the entire process of research, product development, optimization, and launch. Vendors provide the services to end users either directly or through a collaboration with a third party.

In-house research facilities, contract research organizations, and contract development and manufacturing companies are all part of research and product development and are essential for outsourcing product development services.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

The global biometrics as a service in the healthcare industry is segmented by component, modality, solution type, application, end-user, and region.

Software segment accounted for the largest share of the biometrics as a service in the healthcare industry and is expected to grow at the highest rate during the forecast period.

The software segment plays a pivotal role in bolstering the healthcare biometrics and biometrics-as-a-service (BaaS) market. With the increasing emphasis on patient data security and accurate identity verification in healthcare, software solutions have become the linchpin of this sector. These software offerings encompass a range of applications, including biometric authentication systems, data encryption, and identity management platforms, enabling healthcare providers to safeguard patient information while ensuring seamless and efficient access for authorized personnel. Furthermore, software-based BaaS solutions are poised to drive cost-efficiency and scalability in healthcare operations, facilitating rapid adoption and integration across the industry. As the healthcare landscape continues to prioritize data protection and accessibility, the software component of biometrics solutions is set to be a catalyst for transformative change in the healthcare sector, fostering trust and compliance among healthcare stakeholders.

The multimodal modality segment accounted for the largest share of the biometrics as a service in the healthcare industry and is expected to grow at the highest rate during the forecast period.

The multimodal segment is emerging as a key driver in propelling the growth of the healthcare biometrics and biometrics-as-a-service (BaaS) market. Multimodal biometrics, which integrates multiple biometric authentication methods such as fingerprint, facial recognition, iris scanning, and voice recognition, offers healthcare organizations a robust and versatile solution for identity verification and access control. This approach enhances security and minimizes the risk of unauthorized access to sensitive patient data and medical facilities, ultimately enhancing patient trust and regulatory compliance. Moreover, multimodal biometrics can improve the overall patient experience by streamlining authentication processes, reducing the need for multiple credentials, and ensuring accurate patient identification at various touchpoints within the healthcare ecosystem. As healthcare providers seek comprehensive, efficient, and secure biometric solutions, the multimodal segment is positioned to play a pivotal role in shaping the future of biometrics adoption in the healthcare industry.

Fingerprint solution segment accounted for the largest share of the global biometrics as a service in healthcare industry.

The fingerprint segment is exerting a significant influence on the growth trajectory of the healthcare biometrics and biometrics-as-a-service (BaaS) market. Fingerprint biometrics offer a highly reliable and easily deployable solution for patient identification and access control within healthcare settings. With an increasing emphasis on data security, patient privacy, and compliance with regulatory standards like HIPAA, healthcare organizations are turning to fingerprint recognition as a fundamental layer of their security infrastructure. Fingerprint-based BaaS solutions not only enhance the accuracy of patient identification but also streamline workflows by providing healthcare professionals with quick and secure access to electronic health records and medical facilities. Furthermore, the scalability and cost-effectiveness of fingerprint biometrics make them an attractive option for healthcare providers looking to bolster security without significant capital investment. As the healthcare industry continues its digital transformation, the fingerprint segment is poised to play a pivotal role in ensuring data integrity and patient safety.

Medical record and data center security application segment accounted for the largest share and is expected to grow at the highest rate during the forecast period of the global biometrics as a service in the healthcare industry.

The medical record and data center security segment are emerging as vital catalysts for the growth of the healthcare biometrics and biometrics-as-a-service (BaaS) market. In an era characterized by the digitization of patient records and the increasing volume of sensitive healthcare data, ensuring robust security within medical record repositories and data centers has become paramount. Biometric solutions, including fingerprint recognition, iris scanning, and facial recognition, are being integrated into data center access points and electronic health record systems to fortify the protection of patient information. This integration not only safeguards patient privacy and meets stringent regulatory requirements but also enhances operational efficiency by providing authorized personnel with swift and secure access to critical data. As healthcare organizations continue to grapple with the challenges of data breaches and identity theft, the medical record and data center security segment within the healthcare biometrics market is poised to experience significant growth, underlining its indispensable role in fortifying the healthcare industry's digital infrastructure.

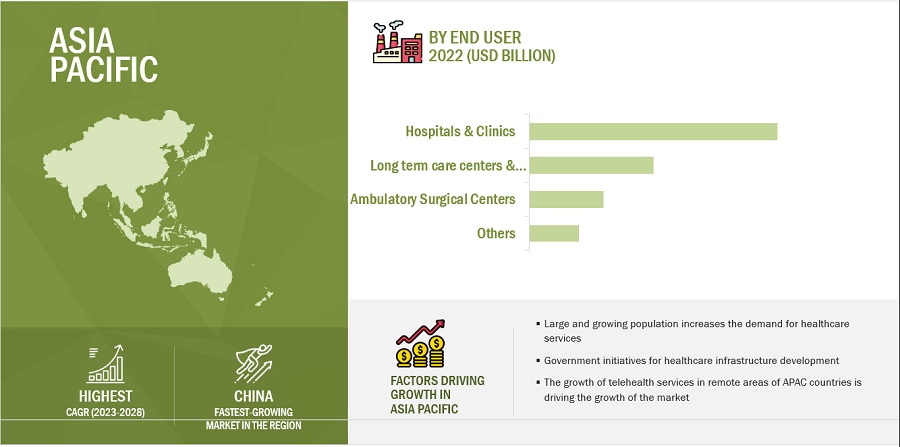

Hospitals and clinics end user segment held the largest market share growing at the highest CAGR during the forecast period of the biometrics as a service in the healthcare industry.

With the healthcare industry's increasing reliance on digital technologies and the imperative of safeguarding patient data, biometric solutions have become instrumental in enhancing security and efficiency within healthcare facilities. Hospitals and clinics are deploying biometrics to streamline patient check-in processes, ensuring accurate patient identification while reducing administrative bottlenecks. Additionally, biometrics are being utilized to restrict unauthorized access to critical areas, such as operating rooms and medication dispensaries, improving patient safety and compliance with stringent regulatory standards. The hospitals and clinics segment is thus poised to continue its significant role in the adoption of biometrics, shaping a future where healthcare delivery is not only more secure but also more seamless and patient-centric.

The rapid population growth in the Asia Pacific region has resulted in a surge in the demand for healthcare services.

In 2022, the Asia Pacific region is anticipated to exhibit the highest compound annual growth rate (CAGR) during the forecast period. The Asia-Pacific region is emerging as a dynamic force propelling the growth of the healthcare biometrics and biometrics-as-a-service (BaaS) market. With a burgeoning population, rising healthcare expenditures, and increasing digitalization of healthcare systems, the region presents a fertile ground for the adoption of biometric technologies. Governments and healthcare organizations in countries such as China, India, Japan, and South Korea are actively investing in biometric solutions to address critical healthcare challenges, including patient identification, fraud prevention, and data security. Furthermore, the proliferation of smartphones and internet connectivity in the region is driving the demand for BaaS solutions, allowing healthcare providers to leverage cloud-based biometric authentication services efficiently. As Asia-Pacific continues to prioritize healthcare infrastructure development and data protection, the region is poised to be a significant contributor to the global healthcare biometrics market's expansion, fostering innovation and resilience in the healthcare sector.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players operating in the biometrics as a service in the healthcare market are NEC Corporation (Japan), Fujitsu Limited (Japan), Imprivata, Inc. (US), Suprema Inc. (South Korea), BIO-key International, Inc. (US), Thales (US), ASSA ABLOY (HID Global Corporation) (US), Cognitec Systems GmbH (Germany), Hitachi, Ltd. (Japan), Idex Biometrics ASA (Europe), Spectra Technovision(India) Pvt. Ltd. (India), Aware, Inc. (US), Aratek (US), Advent International, L.P. (US), NICE Ltd. (Israel), Voice Biometrics Group (US), Imageware (US).

Scope of the Biometrics As a Service in Healthcare Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.4 billion |

|

Projected Revenue by 2028 |

$1.1 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 20.7% |

|

Market Driver |

Growing focus on Government initiatives supporting the adoption of biometrics in healthcare |

|

Market Opportunity |

Increasing demand for advanced biometric solutions designed for authentication and identification applications |

This study categorizes the global Biometrics As a Service in Healthcare Market to forecast revenue and analyze trends in each of the following submarkets:

By Component

- Software

- Services

By Modality

- Unimodal

- Multimodal

By Solution Type

- Fingerprint scanning

- Facial Recognition

- Iris Recognition

- Voice Recognition

- Palm & Vein Recognition

- Others (DNA, signature, and keystroke)

By Application

- Patient Identification & Tracking

- Medical Record Security & Data Center Security

- Care Provider Authentication

- RPM

- Pharmacy Dispensing

- Others (Insurance Frauds & Narcotic Security)

By End User

- Hospitals & Clinics

- Long term care centers and home care settings

- Ambulatory Surgical Centers

- Others (diagnostic centers, physicians and physician organizations, and private healthcare service providers)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

- Latin America

- Middle East and Africa

Recent Developments of Biometrics As A Service In The Healthcare Industry:

- In June 2023, NEC Corporation (Japan) announced the launch of its new biometric authentication solution, NEC Biometric Engine. The solution is designed to help healthcare organizations improve patient safety and security by providing a more secure and convenient way to identify patients.

- In May 2023, Fujitsu (Japan) announced the expansion of its biometrics portfolio with the launch of its new palm vein authentication solution. The solution is designed to be used in a variety of healthcare applications, such as patient identification, access control, and payment.

- In 2022, NEC Corporation (Japan) launched a multimodal biometric authentication solution, facilitating rapid and highly accurate authentication, achieved by requiring individuals to simply direct their face towards the authentication device, while maintaining a remarkably low false acceptance rate of less than one in 10 billion.

- In 2022, Imprivata (US) acquired OGiTiX Software AG (Germany), a leading provider of agile identity and access management (IAM) solutions for the DACH region. This development strengthened Imprivata’s presence in the DACH market.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global biometrics as a service in the healthcare market?

The global biometrics as a service in the healthcare market boasts a total revenue value of $1.1 billion by 2028.

What is the estimated growth rate (CAGR) of the global biometrics as a service in the healthcare market?

The global biometrics as a service in the healthcare market has an estimated compound annual growth rate (CAGR) of 20.7% and a revenue size in the region of $0.4 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing need for patient identification and authentication- Rising incidences of medical identity theft and data breaches- Government initiatives supporting biometrics adoption in healthcareRESTRAINTS- High costs associated with biometric systems- Concerns over hygiene and risk of transmitting infectious diseasesOPPORTUNITIES- Increasing demand for advanced biometric solutions designed for authentication and identification- Growing focus on biometrics as a service solutionsCHALLENGES- Failure to detect authorized and unauthorized users- Complexities in implementing recognition technologies within existing healthcare systems

-

5.3 INDUSTRY TRENDSMULTIMODAL BIOMETRICSBIOMETRIC MOBILE APP SECURITY

-

5.4 TECHNOLOGY ANALYSISCLOUD-BASED BIOMETRIC SYSTEMFINGER-VEIN RECOGNITION3D FACE RECOGNITION

-

5.5 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA- USEUROPE

-

5.6 CASE STUDY ANALYSISUSE CASE: ACCESS CONTROL AT BATES COUNTY MEMORIAL HOSPITAL IN EMPLOYEES’ HANDS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.9 VALUE CHAIN ANALYSIS

-

5.10 ECOSYSTEM MAPPING

- 5.11 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.12 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR BIOMETRICS AS A SERVICE IN HEALTHCAREJURISDICTION AND TOP APPLICANT ANALYSIS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 6.1 INTRODUCTION

-

6.2 SOFTWARESOFTWARE TO HOLD LARGEST MARKET SHARE

-

6.3 SERVICESCONTINUED DEMAND FOR SERVICES TO ENSURE MARKET GROWTH

- 7.1 INTRODUCTION

-

7.2 MULTIMODALHIGHER ACCURACY AND BETTER PERFORMANCE TO DRIVE MARKET

-

7.3 UNIMODALEASE OF IMPLEMENTATION TO SUPPORT ADOPTION

- 8.1 INTRODUCTION

-

8.2 FINGERPRINT SCANNINGFINGERPRINT SCANNING TO HOLD LARGEST MARKET SHARE TILL 2028

-

8.3 FACIAL RECOGNITIONEASE OF USE, CONVENIENCE, AND PERFORMANCE IN DIFFERENT ENVIRONMENTS TO DRIVE DEMAND

-

8.4 IRIS RECOGNITIONINCREASED ACCURACY OF IRIS RECOGNITION TO DRIVE THE MARKET

-

8.5 VOICE RECOGNITIONIMPLEMENTATION OF SPEECH RECOGNITION IN MEDICAL DEVICES TO DRIVE MARKET

-

8.6 PALM & VEIN RECOGNITIONDIFFICULTY IN DUPLICATING VEIN PATTERNS TO BOOST DEMAND

- 8.7 OTHER SOLUTIONS

- 9.1 INTRODUCTION

-

9.2 MEDICAL RECORD & DATA CENTER SECURITYMEDICAL RECORD & DATA CENTER SECURITY TO HOLD LARGEST MARKET SHARE TILL 2028

-

9.3 PATIENT IDENTIFICATION & TRACKINGNEED FOR ENHANCED DATA SECURITY AND PRIVACY TO DRIVE ADOPTION

-

9.4 CARE PROVIDER AUTHENTICATIONENHANCED PATIENT SAFETY TO DRIVE THE MARKET

-

9.5 RPMIMPROVED PATIENT OUTCOMES AND QUALITY OF CARE TO DRIVE DEMAND FOR RPM

-

9.6 PHARMACY DISPENSINGNEED TO IMPROVE MEDICATION SAFETY TO BOOST MARKET GROWTH

- 9.7 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 HOSPITALS & CLINICSHOSPITALS & CLINICS TO FORM LARGEST END-USER SEGMENT

-

10.3 LONG-TERM CARE CENTERS & HOME CARE SETTINGSSUPPORT TO ENHANCE PATIENT CARE OUTCOMES TO ENSURE DEMAND FOR BIOMETRICS

-

10.4 AMBULATORY SURGICAL CENTERSRISING DEMAND FOR OUTPATIENT CARE TO FAVOR MARKET GROWTH

- 10.5 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- US to dominate North American marketCANADA- Technological advancements, increasing adoption of EHRs to boost market growth

-

11.3 EUROPEGERMANY- Germany to dominate market in EuropeUK- Technological developments to support market growthFRANCE- Rising population, decreased mortality ratio, and growing adoption of digital healthcare to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICCHINA- China to hold largest market shareJAPAN- High geriatric population to favor healthcare technology adoptionINDIA- Growing adoption of digital healthcare to drive marketREST OF ASIA PACIFIC

-

11.5 LATIN AMERICAEXTENSIVE USE OF INTERNET AND MOBILE-BASED APPLICATIONS TO SUPPORT ADOPTION OF BAAS IN HEALTHCARE

-

11.6 MIDDLE EAST & AFRICADEVELOPMENTS IN IT INFRASTRUCTURE TO SUPPORT ADOPTION

- 12.1 OVERVIEW

- 12.2 MARKET RANKING ANALYSIS

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

-

12.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.5 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

- 12.6 COMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOPRODUCT/SERVICE LAUNCHES & APPROVALSDEALS

-

13.1 KEY PLAYERSTHALES- Business overview- Products & services offered- MnM viewIMPRIVATA, INC. (THOMA BRAVO)- Business overview- Products offered- Recent developments- MnM viewNEC CORPORATION- Business overview- Products offered- Recent developments- MnM viewFUJITSU- Business overview- Products offered- Recent developments- MnM viewBIO-KEY INTERNATIONAL, INC.- Business overview- Products offered- Recent developments- MnM viewARATEK- Business overview- Products offered- Recent developmentsIDEX BIOMETRICS ASA- Business overview- Products & services offeredASSA ABLOY (HID GLOBAL CORPORATION)- Business overview- Products offeredHITACHI, LTD.- Business overview- Products offered- Recent developmentsIDEMIA (ADVENT INTERNATIONAL, L.P.)- Business overview- Products offered- Recent developmentsCOGNITEC SYSTEMS GMBH- Business overview- Products offered- Recent developmentsAWARE, INC.- Business overview- Products offered- Recent developmentsSUPREMA INC.- Business overview- Products offeredNICE LTD.- Business overview- Products offered- Recent developmentsSPECTRA TECHNOVISION (INDIA) PVT. LTD.- Business overview- Products offeredVOICE BIOMETRICS GROUP- Business overview- Products offeredIMAGEWARE (TECH5)- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSLEIDOSRELX GROUP PLC (LEXISNEXIS RISK SOLUTIONS)FACETEC, INC.DAON, INC.PRINCETON IDENTITYINTEGRATED BIOMETRICSREDROCK BIOMETRICSRIGHTPATIENT

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: ASSUMPTIONS

- TABLE 2 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: RISK ASSESSMENT

- TABLE 3 LARGEST HEALTHCARE DATA BREACHES IN AMERICA (JANUARY 2020–JULY 2023)

- TABLE 4 ADVANCEMENTS IN BIOMETRIC SYSTEMS

- TABLE 5 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: PRICING BY SOLUTION TYPE

- TABLE 7 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS IN 2023–2024

- TABLE 8 LIST OF PATENTS/PATENT APPLICATIONS IN THE BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, 2021–2023

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 10 KEY BUYING CRITERIA FOR BIOMETRICS-AS-A-SERVICE COMPONENTS

- TABLE 11 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 12 BIOMETRICS SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 13 BIOMETRICS SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 14 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 15 MULTIMODAL BIOMETRICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 UNIMODAL BIOMETRICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 18 FINGERPRINT SCANNING FOR HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 FACIAL RECOGNITION FOR HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 IRIS RECOGNITION FOR HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 VOICE RECOGNITION FOR HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 PALM & VEIN RECOGNITION FOR HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 OTHER BIOMETRICS SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 25 BIOMETRICS AS A SERVICE IN MEDICAL RECORD & DATA CENTER SECURITY MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 BIOMETRICS AS A SERVICE IN PATIENT IDENTIFICATION & TRACKING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 BIOMETRICS AS A SERVICE IN CARE PROVIDER AUTHENTICATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 BIOMETRICS AS A SERVICE IN RPM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 BIOMETRICS AS A SERVICE IN PHARMACY DISPENSING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 BIOMETRICS AS A SERVICE IN OTHER HEALTHCARE APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 32 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET FOR LONG-TERM CARE CENTERS & HOME CARE SETTINGS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 43 US: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 44 US: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 45 US: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 46 US: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 US: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 48 CANADA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 49 CANADA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 50 CANADA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 51 CANADA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 52 CANADA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 53 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 55 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 56 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 57 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 59 GERMANY: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 60 GERMANY: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 61 GERMANY: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 62 GERMANY: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 63 GERMANY: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 64 UK: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 65 UK: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 66 UK: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 67 UK: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 68 UK: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 69 FRANCE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 70 FRANCE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 71 FRANCE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 72 FRANCE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 73 FRANCE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 74 REST OF EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 75 REST OF EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 77 REST OF EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 85 CHINA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 86 CHINA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 87 CHINA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 88 CHINA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 CHINA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 90 JAPAN: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 91 JAPAN: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 92 JAPAN: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 93 JAPAN: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 94 JAPAN: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 INDIA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 96 INDIA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 97 INDIA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 98 INDIA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 99 INDIA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 REST OF ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 101 REST OF ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 LATIN AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 106 LATIN AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 107 LATIN AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 108 LATIN AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 109 LATIN AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2021–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2021–2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 115 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: COMPANY FOOTPRINT ANALYSIS

- TABLE 116 COMPANY COMPONENT FOOTPRINT (17 COMPANIES)

- TABLE 117 COMPANY SOLUTION TYPE FOOTPRINT (17 COMPANIES)

- TABLE 118 COMPANY REGIONAL FOOTPRINT (17 COMPANIES)

- TABLE 119 PRODUCT/SERVICE LAUNCHES & APPROVALS, JANUARY 2020– JUNE 2023

- TABLE 120 DEALS, JANUARY 2020– MAY 2023

- TABLE 121 THALES: COMPANY OVERVIEW

- TABLE 122 IMPRIVATA, INC.: COMPANY OVERVIEW

- TABLE 123 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 124 FUJITSU: COMPANY OVERVIEW

- TABLE 125 BIO-KEY INTERNATIONAL, INC.: COMPANY OVERVIEW

- TABLE 126 ARATEK: COMPANY OVERVIEW

- TABLE 127 IDEX BIOMETRICS ASA: COMPANY OVERVIEW

- TABLE 128 ASSA ABLOY: COMPANY OVERVIEW

- TABLE 129 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 130 IDEMIA: COMPANY OVERVIEW

- TABLE 131 COGNITEC SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 132 AWARE, INC.: COMPANY OVERVIEW

- TABLE 133 SUPREMA, INC.: COMPANY OVERVIEW

- TABLE 134 NICE LTD.: COMPANY OVERVIEW

- TABLE 135 SPECTRA TECHNOVISION (INDIA) PVT. LTD.: COMPANY OVERVIEW

- TABLE 136 VOICE BIOMETRICS GROUP: COMPANY OVERVIEW

- TABLE 137 IMAGEWARE: COMPANY OVERVIEW

- FIGURE 1 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

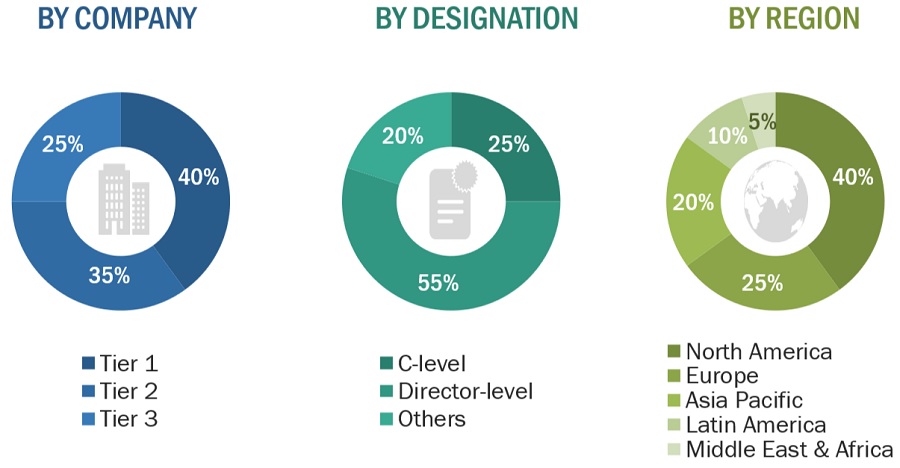

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY MODALITY, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY SOLUTION TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 15 TECHNOLOGICAL ADVANCEMENT TO DRIVE MARKET GROWTH

- FIGURE 16 MIDDLE EAST & AFRICA TO REGISTER HIGHEST GROWTH OVER FORECAST PERIOD

- FIGURE 17 NORTH AMERICA TO RETAIN MARKET DOMINANCE THROUGHOUT STUDY PERIOD

- FIGURE 18 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH OVER FORECAST PERIOD

- FIGURE 19 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 US: HEALTHCARE DATA BREACHES OF 500+ RECORDS (JANUARY 2009–JULY 2023)

- FIGURE 21 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: VALUE CHAIN ANALYSIS (2022)

- FIGURE 22 ECOSYSTEM MAPPING: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET

- FIGURE 23 PATENT PUBLICATION TRENDS (JANUARY 2012–JULY 2023)

- FIGURE 24 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR BIOMETRICS AS A SERVICE IN HEALTHCARE PATENTS (JANUARY 2012–JULY 2023)

- FIGURE 25 TOP APPLICANT COUNTRIES/REGIONS FOR BIOMETRICS AS A SERVICE IN HEALTHCARE PATENTS (JANUARY 2012–JULY 2023)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA FOR COMPONENTS

- FIGURE 28 REVENUE SHIFT IN BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET

- FIGURE 29 NORTH AMERICA: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 30 EUROPE: BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 31 OVERVIEW OF STRATEGIES ADOPTED BY MAJOR PLAYERS BETWEEN JANUARY 2020 AND AUGUST 2023

- FIGURE 32 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET RANKING ANALYSIS, BY PLAYER, 2022

- FIGURE 33 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 34 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- FIGURE 35 BIOMETRICS AS A SERVICE IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- FIGURE 36 THALES: COMPANY SNAPSHOT (2022)

- FIGURE 37 NEC CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 38 FUJITSU: COMPANY SNAPSHOT (2022)

- FIGURE 39 BIO-KEY INTERNATIONAL, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 40 IDEX BIOMETRICS ASA: COMPANY SNAPSHOT (2022)

- FIGURE 41 ASSA ABLOY: COMPANY SNAPSHOT (2022)

- FIGURE 42 HITACHI, LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 43 AWARE, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 44 NICE LTD.: COMPANY SNAPSHOT (2022)

- FIGURE 45 IMAGEWARE: COMPANY SNAPSHOT (2021)

This study involved four major activities in estimating the size of biometrics as a service in the healthcare market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the Accreditation Council for Continuing Medical Education (ACCME), Royal College of Physicians and Surgeons of Canada (RCPSC), World Health Organization (WHO), European Accreditation Council for CME (EACCME), Agency for Healthcare Research and Quality (AHRQ), European Union of Medical Specialists (UEMS), Eurostat, The American College of Cardiology (ACC), The American Registry of Radiologic Technologists (ARRT), Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the clinical decision support system market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Tiers are defined based on a company’s total revenue. As of 2022: Tier 1= >USD 2 billion, Tier 2 = USD 50 million to USD 2 billion, and Tier 3= <USD 50 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the biometrics as a service in the healthcare market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global biometrics as a service in the healthcare market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global biometrics as a service in the healthcare market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the provider, payer, and other industries.

Market Definition:

Healthcare biometrics refers to the application of biometric technology, such as fingerprint or facial recognition, in the healthcare sector for patient identification, access control, and data security purposes. Biometrics as a service (BaaS) in healthcare involves the delivery of biometric solutions through cloud-based platforms, allowing healthcare organizations to utilize biometric authentication and identification services on a scalable and subscription-based model without the need for extensive in-house infrastructure.

Key Stakeholders:

- Manufacturers of biometric services and software

- Manufacturers of biometric technologies

- Healthcare institutions (medical data centers)

- Research and clinical laboratories

- Distributors and suppliers of healthcare biometrics

- Health insurance payers

- Academic institutes and universities

- Educational platform providers

- Academic medical institutes

- Venture capitalists

- Government agencies

- Hospitals (public and private)

- Ambulatory surgery centers (ASCs)

- Rehabilitation centers

- Market research and consulting firms

Report Objectives

- To define, describe, and forecast the biometrics as a service in healthcare market on the basis of component, modality, solution type, application, end-user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, Asia Pacific, Latin America and Middle East and Africa.

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, collaborations, and approvals in the global biometrics as a service in healthcare market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe market into Belgium, Russia, Switzerland, and others

Growth opportunities and latent adjacency in Biometrics As a Service in Healthcare Market