Autonomous Mobile Robots (AMR) Market Size, Share and Trends, 2025 To 2030

Autonomous Mobile Robots (AMR) Market by Navigation Technology (Laser/LiDAR, Vision Guidance, SLAM, RFID Tags, Magnetic & Inertial Sensors), Batteries, Sensors, Actuators, Payload Capacity (<100 kg, 100–500 kg and >500 kg) – Global Forecast to 2030

OVERVIEW

-market-img-overview.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global Autonomous Mobile Robots (AMR) market is projected to grow from USD 2.01 billion in 2024 to USD 4.56 billion by 2030, registering a CAGR of 15.1%. Growth is fueled by the rapid expansion of e-commerce and 3PL services, increasing automation in manufacturing, and the push for efficient intralogistics. Advancements in AI-driven navigation, fleet orchestration, and human-robot collaboration are enabling large-scale deployments across warehouses and production facilities. Government incentives for smart manufacturing and digital transformation are further strengthening adoption in key industries such as automotive, electronics, and healthcare.

KEY TAKEAWAYS

-

BY REGIONThe Asia Pacific market is projected to grow at the fastest rate of 17.0% in the Autonomous Mobile Robots (AMR) market, driven by the rapid expansion of e-commerce and 3PL logistics, rising automation in manufacturing, and increasing investments in smart factory infrastructure across China, Japan, South Korea, and India.

-

BY OFFERINGSoftware and services are expected to grow at the highest CAGR of 16.7%, driven by rising demand for fleet management platforms, AI-enabled navigation, deployment, and managed services to ensure seamless integration with warehouse and factory operations.

-

BY PAYLOAD CAPACITY>500 kg segment is projected to grow at the highest CAGR of 17.3%, driven by rising demand for heavy-duty material handling in automotive plants, large warehouses, and industrial manufacturing.

-

BY NAVIGATION TECHNOLOGYVision Guidance is projected to grow with the highest CAGR of 16.9%, supported by advancements in AI, computer vision, and deep learning that enable AMRs to operate safely in dynamic environments with high precision.

-

BY INDUSTRYE-commerce is projected to grow at the highest CAGR of 18.8%, driven by the surge in online retail, demand for faster fulfillment, and growing adoption of automated warehousing solutions.

-

COMPETITIVE LANDSCAPEMajor players including ABB, KUKA AG, Geekplus Technology, OMRON Corporation, and Mobile Industrial Robots (MiR) are expanding their regional presence through AMR portfolio diversification, AI-driven navigation advancements, and strategic partnerships with warehouse operators, manufacturers, and system integrators. These initiatives enable them to capture rising demand for autonomous mobile robots across e-commerce, logistics, automotive, healthcare, and other key industries, strengthening their role in driving large-scale automation and smart factory transformation.

The Autonomous Mobile Robots (AMR) market is projected to expand significantly over the next decade, driven by the rapid growth of e-commerce and logistics, increasing automation in manufacturing, and rising demand for flexible intralogistics solutions. Advancements in AI-based navigation, fleet orchestration software, and human-robot collaboration are enhancing scalability, safety, and operational efficiency, positioning AMRs as a critical enabler for smart factories, agile supply chains, and Industry 4.0 adoption worldwide.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on customers' business in the Autonomous Mobile Robots (AMR) market stems from the rising need for flexible, automated intralogistics and labor cost optimization. E-commerce, logistics, automotive, healthcare, and electronics sectors are increasingly deploying AMRs, with warehouse automation, line feeding, and collaborative material handling emerging as primary focus areas. Shifts toward AI-enabled navigation, fleet orchestration, and multi-fleet interoperability are directly influencing productivity, safety, and scalability for end users. These transformations, in turn, accelerate the demand for advanced AMR hardware, software, and services, shaping the market’s long-term growth trajectory.

-market-img-disruption.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid advances in robotics and artificial intelligence technologies

-

Growing emphasis on warehouse automation

Level

-

High initial implementation costs

-

Increasing risks of cyberattacks

Level

-

Mounting demand for efficient last-mile delivery services

-

Increasing availability of customizable hardware and programmable software

Level

-

Data integration complexities and compatibility issues

-

Lack of standardization of autonomous mobile robots

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid advances in robotics and artificial intelligence technologies

The integration of AI, computer vision, and machine learning is enhancing AMR navigation, fleet orchestration, and human-robot collaboration, enabling wider adoption across warehouses and manufacturing sites.

Restraint: High initial implementation costs

Significant capital investment is required for AMR deployment, including fleet setup, integration with WMS/ERP systems, and facility redesign, which limits adoption among small and mid-sized enterprises.

Opportunity: Mounting demand for efficient last-mile delivery services

Rising urbanization and consumer expectations for faster deliveries are creating opportunities for AMRs in autonomous last-mile logistics, especially in e-commerce and retail.

Challenge: Data integration complexities and compatibility issues

Integrating AMRs with diverse warehouse management systems, conveyors, and ASRS remains a challenge, requiring advanced orchestration platforms to ensure seamless operations.

Autonomous Mobile Robots (AMR) Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

-market-abb.svg) |

ABB’s Flexley series includes tuggers, movers, and stacker AMRs designed for intralogistics, pallet handling, and production line supply. Integrated with ABB’s robotics and AMR Studio software, they use AI-driven Visual SLAM for fleet management and navigation across industries. | Offers flexible, scalable automation covering diverse payloads and workflows. Enhances ROI by reducing reliance on fixed systems, ensures safety compliance, and strengthens ABB’s position as a full-stack automation provider. |

-market-kuka.svg) |

Flexible AMR fleets for factory automation, enabling collaboration with cobots and automated production lines | Enhanced manufacturing agility, reduced downtime, and increased efficiency in dynamic production environments |

-market-geek.svg) |

AI-driven AMRs for e-commerce fulfillment, goods-to-person picking, and warehouse automation | Accelerated order processing, optimized storage utilization, and scalable fulfillment operations for omnichannel retail |

-market-omron.svg) |

Mobile robots integrated with IoT and AI for lean manufacturing and smart factory operations | Reduced labor dependency, enhanced safety, and higher productivity in complex industrial workflows |

-market-mir.svg) |

Collaborative AMRs for logistics, material transport, and cross-industry automation in warehouses, hospitals, and manufacturing plants | Increased operational flexibility, improved worker safety, and faster ROI through scalable mobile automation |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The Autonomous Mobile Robots (AMR) market ecosystem spans raw material and component suppliers, software and service providers, AMR manufacturers, and end users, working together to enable large-scale automation across industries. Component suppliers provide essential technologies such as sensors, batteries, processors, and navigation systems, forming the hardware backbone of AMRs. Software and service providers deliver fleet management platforms, AI-enabled navigation tools, and integration services that enhance robot intelligence, interoperability, and scalability. AMR manufacturers design and deploy mobile robots for diverse applications ranging from warehouse logistics to production line automation. End users, including e-commerce, manufacturing, healthcare, and logistics enterprises, drive adoption by leveraging AMRs to improve intralogistics efficiency, reduce labor dependency, and support Industry 4.0 transformation. This interconnected ecosystem collectively fuels innovation, operational efficiency, and widespread adoption of AMRs across global industries.

-market-img-ecosystem.webp)

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

-market-img-segment.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Autonomous Mobile Robots (AMR) Market, By Payload Capacity

The 100–500 kg payload capacity segment is expected to hold the largest share of the Autonomous Mobile Robots (AMR) market during the forecast period, supported by its versatility across a wide range of industries. AMRs in this category, including cart-pulling robots, mid-range pallet movers, and shelf-to-person systems, are widely adopted in warehouses, e-commerce fulfillment centers, and manufacturing facilities. Their ability to balance payload flexibility with high maneuverability makes them suitable for mixed-use operations, enabling efficient transport of goods while optimizing space utilization. As enterprises accelerate warehouse automation and smart factory adoption, the 100–500 kg segment will continue to dominate AMR deployments, serving as the backbone of scalable and cost-efficient intralogistics solutions.

Autonomous Mobile Robots (AMR) Market, By Navigation Technology

The Laser/LiDAR navigation technology segment is expected to hold the largest share of the Autonomous Mobile Robots (AMR) market during the forecast period, owing to its reliability and precision in dynamic industrial environments. LiDAR-based AMRs create accurate 2D and 3D maps, enabling safe navigation, obstacle detection, and route optimization without requiring major infrastructure changes. Their robustness in handling complex warehouse layouts and manufacturing facilities makes them the preferred choice for large-scale deployments. As industries expand automation in e-commerce, automotive, and logistics, Laser/LiDAR technology will continue to dominate AMR adoption, serving as the foundation for efficient, scalable, and safe intralogistics operations.

Autonomous Mobile Robots (AMR) Market, By Industry

The logistics segment is expected to hold a significant share of the Autonomous Mobile Robots (AMR) market during the forecast period, supported by growing adoption in distribution centers, cross-docking hubs, and large warehouses. AMRs in logistics are widely used for pallet transport, goods-to-person workflows, and automated material transfer, helping operators manage high-volume operations with greater accuracy and efficiency. Their ability to reduce manual intervention, optimize turnaround times, and improve scalability positions AMRs as a vital component of modern logistics networks. As global trade and supply chain complexity increase, the logistics sector will remain a major contributor to AMR adoption.

REGION

Asia Pacific to be fastest-growing region in global Autonomous Mobile Robots (AMR) Market during forecast period

Asia Pacific is projected to grow at the highest CAGR in the Autonomous Mobile Robots (AMR) market during the forecast period, supported by the rapid expansion of logistics networks, large-scale automation in manufacturing, and increasing adoption of AI-enabled robotics across key sectors. Governments in China, Japan, South Korea, and India are actively promoting Industry 4.0, smart factories, and 5G-enabled infrastructure, creating favorable conditions for AMR deployment. The region’s strong manufacturing ecosystems, coupled with rising investments in warehouse automation and intralogistics, further strengthen its position. With expanding automotive, electronics, and healthcare industries, Asia Pacific is emerging as the global hub for AMR innovation and large-scale adoption.

-market-img-region.webp)

Autonomous Mobile Robots (AMR) Market: COMPANY EVALUATION MATRIX

In the Autonomous Mobile Robots (AMR) market matrix, ABB (Star) leads with a strong global presence and a comprehensive AMR portfolio spanning tuggers, movers, and autonomous forklifts, integrated with ABB’s industrial robots, PLCs, and AMR Studio fleet management software. Its ability to deliver scalable, AI-driven, and safety-compliant intralogistics solutions across industries such as automotive, electronics, and logistics has established ABB as a dominant player in the market. Locus Robotics (Emerging Leader), specializing in collaborative AMRs for warehouse and fulfillment operations, is rapidly expanding its footprint through strong adoption in 3PL and retail sectors. With its Robots-as-a-Service (RaaS) model and focus on scalable fleet orchestration, Locus is demonstrating strong growth momentum, positioning itself to move toward the leaders’ quadrant within the evolving AMR market.

-market-img-evaluation.webp)

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 2.01 Billion |

| Market Forecast in 2030 (Value) | USD 4.56 Billion |

| Growth Rate | CAGR of 15.1% from 2025-2030 |

| Years Considered | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe & RoW |

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| E-commerce & Fulfillment Operator |

|

|

| Logistics & 3PL Provider |

|

|

| Automotive OEM |

|

|

RECENT DEVELOPMENTS

- October 2024 : Mobile Industrial Robots launched MIR Fleet Enterprise, a new software platform designed for managing autonomous mobile robots. This platform enhances scalability, security, and operational efficiency, optimizing internal logistics and material handling processes.

- March 2024 : ABB launched the Flexley Tug T702, an autonomous mobile robot equipped with AI-based Visual SLAM technology for enhanced navigation and operational efficiency. Integrated with AMR Studio software, the system enables streamlined route configuration, reducing setup time by 20%. Designed for dynamic environments, the AMR T702 provides scalable intralogistics solutions, offering real-time monitoring and intelligent order management capabilities.

- February 2024 : OMRON Corporation launched the MD Series of Autonomous Mobile Robots (AMRs), designed to handle medium payloads ranging from 650kg to 900kg. These AMRs feature a top speed of 2.2 m/sec and offer up to 10 hours of operation with ultra-fast charging. Equipped with 360° safety sensing, the MD Series integrates seamlessly with production systems and is managed through Omron's Fleet Manager software for optimized fleet control.

- January 2024 : ABB acquired Sevensense Robotics AG, a Swiss start-up specializing in AI-driven 3D vision navigation for autonomous mobile robots (AMRs). This acquisition strengthens ABB's AMR portfolio with advanced Visual SLAM technology, enhancing autonomy, speed, and flexibility in dynamic environments. The move positions ABB as a leader in next-generation robotics, further expanding its capabilities in industries such as automotive and logistics.

- March 2023 : Mobile Industrial Robots launched its cloud-based software, offering robot fleet owners precise and actionable insights that drive performance improvements. The software enables enhanced fleet management and optimization, contributing to greater efficiency and productivity in automated operations.

Table of Contents

Methodology

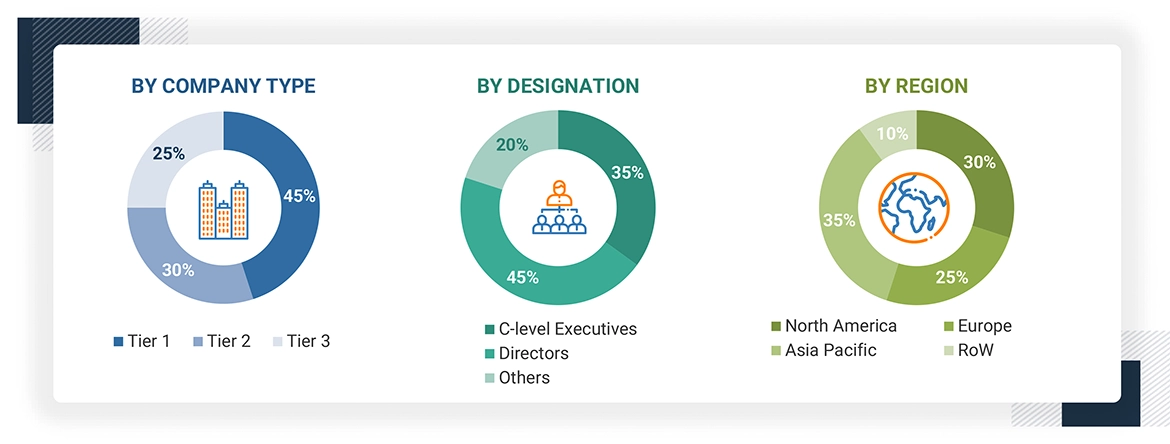

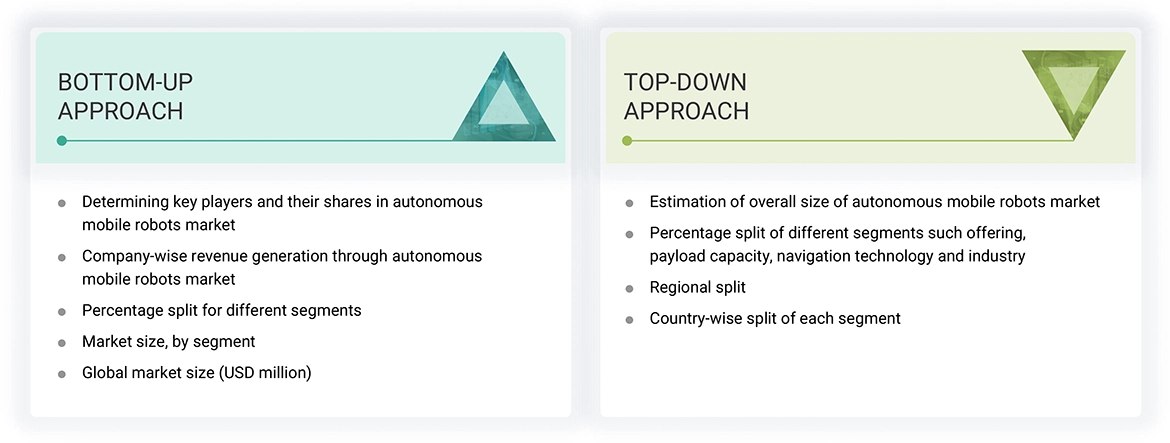

The study involved four major activities in estimating the current size of the autonomous mobile robots market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the autonomous mobile robots market.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the autonomous mobile robots market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: The three tiers of the companies are defined based on their total revenue in 2023: Tier 1 - revenue greater than or equal to USD 1 billion; Tier 2 - revenue between USD 100 million and USD 1 billion; and Tier 3 revenue less than or equal to USD 100 million. Other designations include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the autonomous mobile robots market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Autonomous Mobile Robots (AMR) Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the autonomous mobile robots market from the market size estimation process explained above, the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Market Definition

The autonomous mobile robots market designs, manufactures, and deploys intelligent robots that are capable of navigating dynamic environments without human intervention. These are equipped with advanced sensors, artificial intelligence, and navigation systems to perform material handling, inventory management, and quality control. AMRs are available in different configurations and payload capacities, navigation technologies, and battery life. Due to a rising call for automation, labor shortages and increased efficiency requirement, the market of AMRs is looking towards great rise, propelling innovations and disrupting industries all around the globe.

Key Stakeholders

- Autonomous mobile robots manufacturers

- Sensors, actuators, and other hardware component providers

- AMR Software developers

- AMR suppliers and distributors

- E-commerce and retail companies

- Logistic companies

Report Objectives

- To define, describe and forecast the autonomous mobile robots market, in terms of offering, navigation technology, payload capacity, industry and region.

- To describe and forecast the market, in terms of value, with regard to four main regions: North America, Europe, Asia Pacific, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of autonomous mobile robots market.

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the autonomous mobile robots market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the autonomous mobile robots market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze competitive strategies, such as product launches, expansions, mergers and acquisitions, adopted by key market players in the autonomous mobile robots market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Autonomous Mobile Robots (AMR) Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Autonomous Mobile Robots (AMR) Market