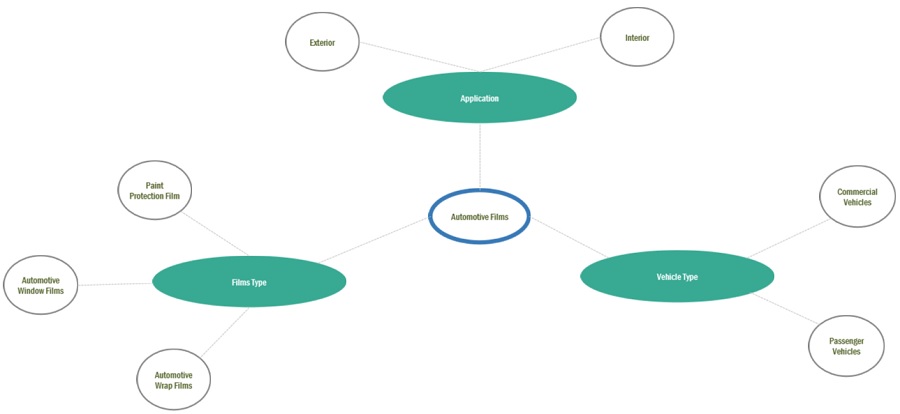

Automotive Films Market by Films Type (Automotive Wrap Films, Automotive Window Films, Paint Protection Films), Application (Interior, Exterior), Vehicle Type (Passenger Vehicles, Commercial Vehicles), and Region - Global Forecast to 2028

Updated on : June 27, 2024

Automotive Films Market

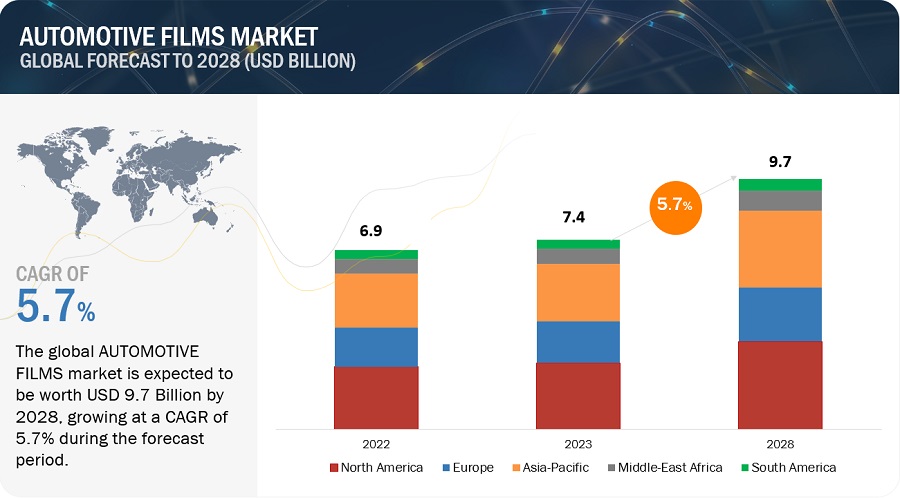

The automotive films market is projected to reach USD 9.7 billion by 2028, at a CAGR of 5.7% from USD 7.4 billion in 2023. The increasing need for heat reduction and UV protection, particularly from the automobile industry is the key factor driving the market for automotive films. The R&D in the automobile technologies of Asia-Pacific region, is growing the concerns for safety and security in the region further influencing the market. The rising awareness among consumers and vehicles owners about advantages of automotive films including UV protection, heat and glare reduction, and enhanced privacy is contributing to the expansion of market. These drivers collectively, fuel the growth of automotive films market making it a dynamic and evolving sector with upcoming opportunities for innovation and expansion.

Attractive Opportunities in the Automotive Films Market

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Films Market Dynamics

Driver: Technological advancements in automotive films market

Automotive films make driving experience comfortable by blocking the UV rays and reducing the amount of heat from entering vehicles. They enhance the security and privacy of the passengers and drivers. The innovations and developments in new technologies such as nano ceramic films is fueling the production of effective and durable automotive films. This is transforming the market by offering features such as enhancing the visibility of driver, reduction in heat and glare, increasing privacy and add up to the appearance of vehicles. Additionally, they prevent the damage caused by heat to the interiors of vehicles. The manufacturers continue to innovate and produce films to meet the changing demands of modern vehicles, further driving the market for automotive films.

Restraint: High installation cost of premium automotive films

The cost of installing premium automotive films requires high costs making it a restraint to market growth. The installation of these films requires expertise and precision along with the highly functional equipment. The prices tend to vary with the size of the vehicles. The customers in a price sensitive market find it expensive to purchase and install these materials. Moreover, in the regions with less feasible economic conditions to support luxury, these high installation costs for premium products limits the growth of the market. Furthermore, the reluctance of customers to invest in premium market slows down the overall adoption rate for these automotive films which hampers the market growth.

Opportunity: Growing demand for customized films

The customers in automotive sector are continuously seeking personalization of their vehicles to express their unique styles which is fueling the market for automotive films for different colors, patterns and finishes. Going beyond aesthetic, the customization also improves the performance of vehicles by reducing glare and heat, enhancing privacy and increasing visibility. Moreover, the rise in adoption of automotive films as an effective alternative for traditional repainting allows owners to enhance the appearance of their vehicles without making any permanent changes. Additionally, the trend towards this personalization is creating new opportunities for manufacturers to generate revenue enabling them to provide premium customized solutions at high price.

Challenge: Government regulations on automotive films

The strict regulations posed by government hamper the design and functionality of automotive films by imposing constraints such as tint darkness, reflectivity and the material used. The regulations specific to regions necessitates the manufacturers and installers to comply with these standards. In addition to discouraging innovation and increasing operating expenses, non-compliance with these regulations can result into fines, legal problems and necessity of increased product pricing. The regulations varying with regions further make it difficult to make strategies for expansion at international market as products are required to be customized depending on the local needs.

Automotive Films Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

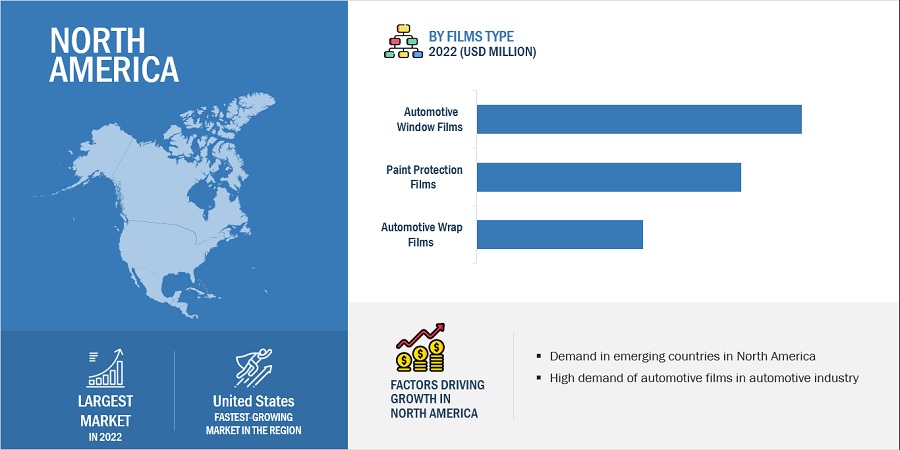

"Automotive window films captures the largest share by films type in automotive films market, in terms of value."

Automotive window films capture the largest share by films type in automotive films market due to its wide variety of uses and advantages. These films are commonly used on vehicle windows to protect the passengers and drivers from UV rays and heat along with reduction in glare and enhanced privacy. In addition to improving the passenger comfort, they also prevent the damage caused by heat to the interiors of car. Automotive window films also increase the safety by protecting the passengers and driver from the shattered flying glass during an accident thereby reducing the risk of injury. Moreover, the encouragement of UV protection and energy efficiency by the regulatory bodies further increase he adoption of these films, making them the preferrable choice for customers. Collectively, these factors contribute to making automotive window films the largest segment by films type.

" Based on application, exterior captures the largest share in automotive films market in 2022, in terms of value."

The protective properties, durability and aesthetic benefits of automotive films makes exteriors application the largest market in terms of application. These films prevent the exteriors of vehicles from the damage caused by dust, stains, scratches, stone chips, debris and other forms of damage. The vulnerable parts of the vehicles such as front bumpers, hoods, mirrors, fenders, door edges, door handle cavities, and rock panels are covered with these films providing precise coverage to the vehicles. In addition to protecting against damage, these films also provide customization to enhance the appearance of the vehicles. They are also used for advertising purposes by applying on the exterior parts of the vehicles. The advertisements can be customized with unique designs, vibrant colors and graphics, thus, making them visually appealing.

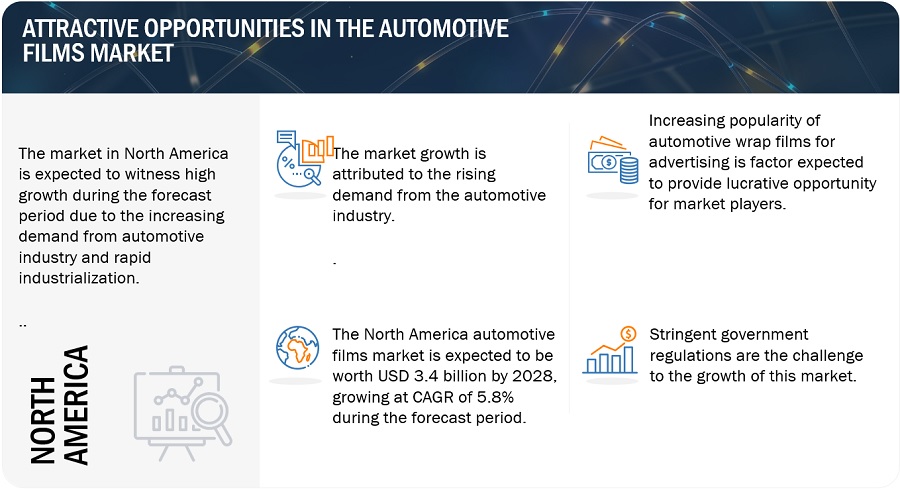

“North America was the largest market for automotive films in 2022, in terms of value."

North America accounted the largest automotive films market. The demand for automotive films in the region is expected to witness steady growth, driven by the well- established automotive sector. Technological advancements in the manufacturing sector are driving the market in this region. The automotive industry in North America is projected to grow due to increasing domestic demand and the plans for production plant expansions by major automotive manufacturers in Mexico. The market in the region is diversified and is strongly focused on the development of new products and advanced technology to cater to the needs of the automotive industry.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are 3M (US), Saint-Gobain (France), Eastman Chemical Company (US), Avery Dennison (US), LINTEC Corporation (Japan), Ergis S.A. (Poland), Toray industries, Inc. (Japan), Johnson Window Films (US), Hexis S.A. (France), XPEL, Inc. (US), and Nexfil Co., Ltd. (South Korea). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow.

Automotive Films Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 7.4 billion |

|

Revenue Forecast in 2028 |

USD 9.7 billion |

|

CAGR |

5.7% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Square foot; Value (USD Million) |

|

Segments |

Films Type, Application, Vehicle Type, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

3M (US), Saint-Gobain (France), Eastman Chemical Company (US), Avery Dennison (US), LINTEC Corporation (Japan), Ergis S.A. (Poland), Toray industries, Inc. (Japan), Johnson Window Films (US), Hexis S.A. (France), and Nexfil Co., Ltd. (South Korea), and XPEL, Inc. (US). |

This report categorizes the global automotive films market based on films type, application, vehicle type, and region.

Automotive Films Market based on the Films Type:

- Automotive window films

- Automotive wrap films

- Paint protection films

Automotive Films Market based on the Application:

- Interior

- Exterior

Automotive Films Market based on the Vehicle Type:

- Passenger vehicles

- Commercial vehicles

Automotive Films Market based on the Region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In June 2023, Toray Industries, Inc. developed a high heat-insulating solar control film PICASUS for advanced mobility applications. The film helped the company’s innovative nano-multilayer technology to deliver a transparency that is comparable to that of glass. It also offers world-class thermal insulation from the sun’s infrared rays.

- In February 2023, Eastman Chemical Company acquired Ai-Red Technology (Dalian) Co., Ltd., a manufacturer and supplier of paint protection and window film for auto and architectural markets in the Asia Pacific region. The acquisition helped Eastman Chemical Company to increase its presence in China and enhance its earning strength.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the automotive films market?

The growth of this market can be attributed to rising demand in the developing countries undergoing industrialization and increasing awareness towards safety and security.

Which are the key sectors driving the automotive films market?

The sector driving the demand for automotive films is the automotive industry.

Who are the major manufacturers?

Major manufacturers include 3M, Saint-Gobain, Eastman Chemical Company, Avery Dennison, LINTEC Corporation, Ergis S.A., Toray industries, Inc., Johnson Window Films, Hexis S.A., XPEL, Inc., and Nexfil Co., Ltd., among others.

What is the biggest restraint for automotive films?

The biggest restraint can be the installation complexity of automotive films.

How is COVID-19 affecting the overall automotive films market?

The COVID-19 pandemic had caused a decrease in demand for automotive films technology, resulting in decreased sales and revenue for market participants.

What will be the growth prospects of the automotive films market?

Rapid urbanization & industrialization, expanding application, technological advancement and increasing market trends. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for heat reduction and UV protection in automotive sector- Technological advancements in automotive films- Enhanced safety and security- Growing automotive sector in Asia PacificRESTRAINTS- Installation complexity of automotive films- High installation cost of premium automotive filmsOPPORTUNITIES- Increasing demand for automotive wrap films for advertising- Growing demand for customized filmsCHALLENGES- Government regulations on automotive films

-

5.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.5 PATENT ANALYSISINTRODUCTIONDOCUMENT TYPESPUBLICATION TRENDS IN LAST 10 YEARSINSIGHTSJURISDICTION ANALYSISTOP APPLICANTS

-

5.6 ECOSYSTEM

-

5.7 TECHNOLOGY ANALYSISNEW TECHNOLOGIES: AUTOMOTIVE FILMS

-

5.8 TARIFF AND REGULATORY LANDSCAPEREGULATIONSNORTH AMERICAASIA PACIFICEUROPEMIDDLE EAST & AFRICA

-

5.9 TRADE ANALYSISIMPORT TRADE ANALYSISEXPORT TRADE ANALYSIS

-

5.10 MACROECONOMIC INDICATORSTRENDS IN AUTOMOTIVE INDUSTRY

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.13 KEY FACTORS AFFECTING BUYING DECISIONSQUALITYSERVICE

-

5.14 CASE STUDY ANALYSIS3M’S GRAPHIC FILMS FOR FLEET ADVERTISING PROGRAM IN AUTOMOTIVE INDUSTRYHEXIS S.A. PROVIDES SELF-ADHESIVE FILM SOLUTIONS FOR AUTOMOTIVE INDUSTRY

-

5.15 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE BASED ON FILM TYPEAVERAGE SELLING PRICE TREND, BY KEY PLAYERS

- 6.1 INTRODUCTION

-

6.2 AUTOMOTIVE WRAP FILMSADVERTISEMENT APPLICATION IN COMMERCIAL VEHICLES TO DRIVE MARKET

-

6.3 AUTOMOTIVE WINDOW FILMSPROTECTION FROM UV RAYS AND PASSENGER PRIVACY TO DRIVE DEMANDDYED FILMSMETALIZED FILMSHYBRID FILMSCERAMIC FILMS

-

6.4 PAINT PROTECTION FILMSEXTERNAL PROTECTION TO VULNERABLE VEHICLE AREAS TO DRIVE DEMAND

- 7.1 INTRODUCTION

- 7.2 PASSENGER VEHICLES

- 7.3 COMMERCIAL VEHICLES

- 8.1 INTRODUCTION

-

8.2 INTERIORAUTOMOTIVE DIALSCONTROL PANELSOTHERS

-

8.3 EXTERIORDOORSHOODSROOF PANELSOTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Strong automotive industry to drive marketJAPAN- Large automotive industry to drive marketINDIA- Government initiatives and strong outlook to drive marketSOUTH KOREA- Heavy investments in automotive industry to drive marketAUSTRALIA- Strong emphasis on trade partnerships with other countries to drive marketINDONESIA- Rising foreign investments to drive marketREST OF ASIA PACIFIC

-

9.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Large automotive sector to drive marketUK- Strong government support to drive marketFRANCE- Established automotive sector to drive market growthITALY- Strong economic growth to drive marketSPAIN- Increased investments and economic growth to drive marketREST OF EUROPE

-

9.4 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Presence of major manufacturers to increase demandCANADA- Harsh weather conditions to drive marketMEXICO- Developing manufacturing hub to drive demand

-

9.5 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing automotive sector to drive marketARGENTINA- Rising automotive investment to drive marketREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Government support to drive marketUAE- Strong growth and government investments to boost marketSOUTH AFRICA- Government initiatives to significantly drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS

- 10.4 RANKING OF KEY PLAYERS

- 10.5 MARKET EVALUATION MATRIX

- 10.6 MARKET SHARE ANALYSIS

-

10.7 COMPANY EVALUATION MATRIX (TIER 1)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.8 STARTUPS AND SMES EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 10.9 COMPETITIVE BENCHMARKING

-

10.10 COMPETITIVE SITUATION AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTDEALSOTHERS

-

11.1 KEY PLAYERS3M- Business overview- Products offered- Recent developments- MnM viewSAINT-GOBAIN- Business overview- Products offered- Recent developments- MnM viewEASTMAN CHEMICAL COMPANY- Business overview- Products offered- Recent developments- MnM viewAVERY DENNISON- Business overview- Products offered- Recent developments- MnM viewLINTEC CORPORATION- Business overview- Products offered- Recent developments- MnM viewERGIS S.A.- Business overview- Products offered- Recent developments- MnM viewHEXIS S.A.- Business overview- Products offered- Recent developments- MnM viewJOHNSON WINDOW FILMS- Business overview- Products offered- MnM viewNEXFIL CO., LTD.- Business overview- Products offered- MnM viewTORAY INDUSTRIES, INC.- Business overview- Products offered- Recent developments- MnM viewXPEL, INC.- Business overview- Products offered- Recent developments- MnM view

-

11.2 OTHER PLAYERSADS WINDOW FILMS LTD.ALL PRO WINDOW FILMS, INC.ARLON GRAPHICS LLCFILMTACK PTE. LTD.FOLIATEC BÖHM GMBH & CO. VERTRIEBS-KGGARWARE POLYESTER LTD.GEOSHIELDKAY PREMIUM MARKING FILMSMAXPRO WINDOW FILMSPRESTIGE FILM TECHNOLOGIESPROFILMRENOLIT GROUPSSA EUROPE GES.M.B.H.ZEO FILMS

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 AUTOMOTIVE FILMS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ASIA PACIFIC, VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021–2022 (UNIT)

- TABLE 3 MAJOR COUNTRIES WITH TINT LAW REGULATIONS

- TABLE 4 AUTOMOTIVE FILMS MARKET: VALUE CHAIN OF STAKEHOLDERS

- TABLE 5 AUTOMOTIVE FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 7 TINT LAWS IN CANADA

- TABLE 8 COUNTRY-WISE IMPORT TRADE DATA FOR AUTOMOTIVE FILMS (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORT TRADE DATA FOR AUTOMOTIVE FILMS (USD THOUSAND)

- TABLE 10 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021–2022 (UNIT)

- TABLE 11 AUTOMOTIVE FILMS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 12 AVERAGE SELLING PRICE BASED ON APPLICATION (USD/SQUARE FOOT)

- TABLE 13 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 14 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 15 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (USD MILLION)

- TABLE 16 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (USD MILLION)

- TABLE 17 INSTALLATION MATRIX FOR PAINT PROTECTION FILMS

- TABLE 18 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 19 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 20 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 21 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 22 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 23 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 24 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 25 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 AUTOMOTIVE FILMS MARKET, BY REGION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 27 AUTOMOTIVE FILMS MARKET, BY REGION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 28 AUTOMOTIVE FILMS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 AUTOMOTIVE FILMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE FEET)

- TABLE 31 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE FEET)

- TABLE 32 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 35 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 36 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 39 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 40 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 43 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 44 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 46 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 47 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 48 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 49 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 50 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 51 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 52 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 53 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 54 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 55 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 56 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 57 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 58 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 59 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 60 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 61 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 62 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 63 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 64 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 65 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 66 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 67 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 68 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 69 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 71 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 72 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 74 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE FEET)

- TABLE 75 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE FEET)

- TABLE 76 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 77 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 79 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 80 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (USD MILLION)

- TABLE 81 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 83 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 84 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 87 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 88 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 90 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 91 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 92 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 93 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 94 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 95 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 96 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 97 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 98 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 99 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 100 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 101 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 102 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 103 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 104 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 105 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 106 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 107 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 108 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 109 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 111 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 112 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE FEET)

- TABLE 115 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE FEET)

- TABLE 116 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 119 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 120 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 123 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 124 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 127 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 128 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 130 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 131 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 132 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 133 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 134 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 135 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 136 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 137 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 138 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 139 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 140 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 141 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE FEET)

- TABLE 143 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE FEET)

- TABLE 144 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 147 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 148 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 151 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 152 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 155 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 156 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 158 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 159 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 160 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 161 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 162 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 163 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 164 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 165 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 167 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 168 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (MILLION SQUARE FEET)

- TABLE 171 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (MILLION SQUARE FEET)

- TABLE 172 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 175 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2023 (MILLION SQUARE FEET)

- TABLE 176 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (MILLION SQUARE FEET)

- TABLE 179 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (MILLION SQUARE FEET)

- TABLE 180 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 183 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 184 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 186 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 187 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 188 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 189 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 190 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 191 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 192 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 193 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 195 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 196 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 197 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 198 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (MILLION SQUARE FEET)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (MILLION SQUARE FEET)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019–2022 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023–2028 (USD MILLION)

- TABLE 202 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2022

- TABLE 203 REVENUE ANALYSIS OF KEY COMPANIES (2020 – 2022)

- TABLE 204 MARKET EVALUATION MATRIX

- TABLE 205 AUTOMOTIVE FILMS MARKET: DEGREE OF COMPETITION

- TABLE 206 DETAILED LIST OF COMPANIES

- TABLE 207 AUTOMOTIVE FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 208 AUTOMOTIVE FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY VEHICLE TYPE

- TABLE 209 AUTOMOTIVE FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 210 AUTOMOTIVE FILMS: PRODUCT LAUNCHES/DEVELOPMENT, 2018- 2022

- TABLE 211 AUTOMOTIVE FILMS: DEALS, 2018–2022

- TABLE 212 AUTOMOTIVE FILMS: OTHERS, 2018–2022

- TABLE 213 3M: COMPANY OVERVIEW

- TABLE 214 3M: PRODUCT OFFERINGS

- TABLE 215 3M: DEALS

- TABLE 216 3M: OTHER DEVELOPMENTS

- TABLE 217 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 218 SAINT-GOBAIN: PRODUCT OFFERINGS

- TABLE 219 SAINT GOBAIN: DEALS

- TABLE 220 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 221 EASTMAN CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 222 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 223 EASTMAN CHEMICAL COMPANY: OTHER DEVELOPMENTS

- TABLE 224 AVERY DENNISON: COMPANY OVERVIEW

- TABLE 225 AVERY DENNISON: PRODUCT OFFERINGS

- TABLE 226 AVERY DENNISON: PRODUCT LAUNCHES

- TABLE 227 LINTEC CORPORATION: COMPANY OVERVIEW

- TABLE 228 LINTEC CORPORATION: PRODUCT OFFERINGS

- TABLE 229 LINTEC CORPORATION: DEALS

- TABLE 230 ERGIS S.A.: COMPANY OVERVIEW

- TABLE 231 ERGIS S.A.: PRODUCT OFFERINGS

- TABLE 232 ERGIS S.A.: DEALS

- TABLE 233 HEXIS S.A.: COMPANY OVERVIEW

- TABLE 234 HEXIS S.A.: PRODUCT OFFERINGS

- TABLE 235 HEXIS S.A.: OTHER DEVELOPMENTS

- TABLE 236 JOHNSON WINDOW FILMS: COMPANY OVERVIEW

- TABLE 237 JOHNSON WINDOW FILMS: PRODUCT OFFERINGS

- TABLE 238 NEXFIL CO., LTD.: COMPANY OVERVIEW

- TABLE 239 NEXFIL CO., LTD.: PRODUCT OFFERINGS

- TABLE 240 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 241 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 242 TORAY INDUSTRIES, INC.: DEALS

- TABLE 243 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 244 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 245 XPEL, INC.: COMPANY OVERVIEW

- TABLE 246 XPEL, INC.: PRODUCT OFFERINGS

- TABLE 247 XPEL, INC.: DEALS

- TABLE 248 XPEL, INC.: PRODUCT LAUNCHES

- FIGURE 1 AUTOMOTIVE FILMS MARKET SEGMENTATION

- FIGURE 2 AUTOMOTIVE FILMS MARKET: RESEARCH DESIGN

- FIGURE 3 AUTOMOTIVE FILMS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 AUTOMOTIVE FILMS MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: AUTOMOTIVE FILMS MARKET

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 AUTOMOTIVE FILMS MARKET: DATA TRIANGULATION

- FIGURE 8 PAINT PROTECTION FILMS TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 EXTERIOR APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 PASSENGER VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO OFFER ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE FILMS MARKET DURING FORECAST PERIOD

- FIGURE 13 PAINT PROTECTION FILMS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 EXTERIOR APPLICATION TO LEAD MARKET BY 2028

- FIGURE 15 PASSENGER VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMOTIVE FILMS MARKET

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE FILMS MARKET

- FIGURE 18 OVERVIEW OF AUTOMOTIVE FILMS MARKET VALUE CHAIN

- FIGURE 19 AUTOMOTIVE FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 20 PATENTS REGISTERED (2012–2022)

- FIGURE 21 NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 22 TOP JURISDICTIONS

- FIGURE 23 TOP APPLICANTS’ ANALYSIS

- FIGURE 24 AUTOMOTIVE FILMS MARKET ECOSYSTEM

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS IN AUTOMOTIVE FILMS MARKET

- FIGURE 26 SUPPLIER SELECTION CRITERION

- FIGURE 27 AVERAGE SELLING PRICE, BY REGION (USD/SQUARE FOOT)

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY KEY PLAYERS (USD/SQUARE FOOT)

- FIGURE 29 PAINT PROTECTION FILMS TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

- FIGURE 30 PASSENGER VEHICLES TO BE LARGEST VEHICLE TYPE DURING FORECAST PERIOD

- FIGURE 31 EXTERIOR APPLICATION TO GROW FASTER DURING FORECAST PERIOD

- FIGURE 32 MEXICO TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET SNAPSHOT

- FIGURE 34 EUROPE: AUTOMOTIVE FILMS MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 36 RANKING OF TOP 5 PLAYERS IN AUTOMOTIVE FILMS MARKET

- FIGURE 37 AUTOMOTIVE FILMS MARKET SHARE, BY COMPANY (2022)

- FIGURE 38 AUTOMOTIVE FILMS MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2023

- FIGURE 39 AUTOMOTIVE FILMS MARKET: STARTUPS AND SMES EVALUATION MATRIX, 2023

- FIGURE 40 3M: COMPANY SNAPSHOT

- FIGURE 41 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 42 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 43 AVERY DENNISON: COMPANY SNAPSHOT

- FIGURE 44 LINTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 46 XPEL, INC.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the automotive films market. Exhaustive secondary research was done to collect information on the market, the peer market, and the grandparent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, gold standard and silver standard websites, and databases. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The automotive films market comprises several stakeholders in the value chain, which include manufacturers, and end users. Various primary sources from the supply and demand sides of the automotive films market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in the automotive sector. The primary sources from the supply side include manufacturers, associations, and institutions involved in the automotive films industry. Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to films type, application, vehicle type, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of automotive films and outlook of their business, which will affect the overall market.

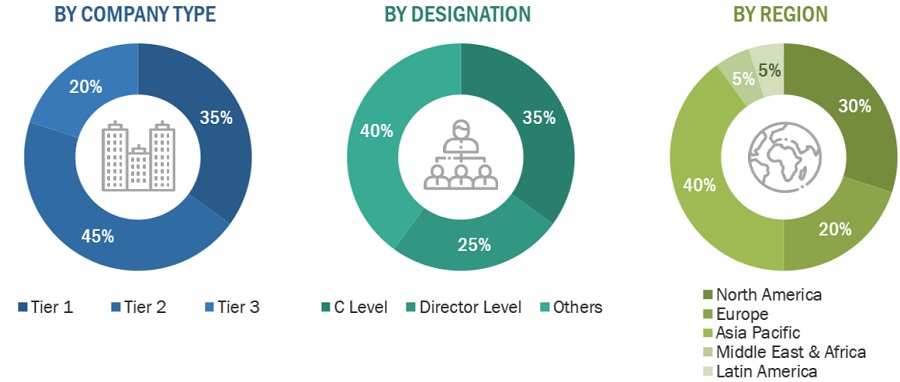

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

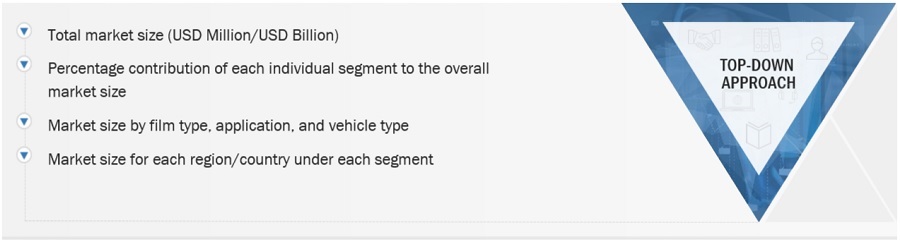

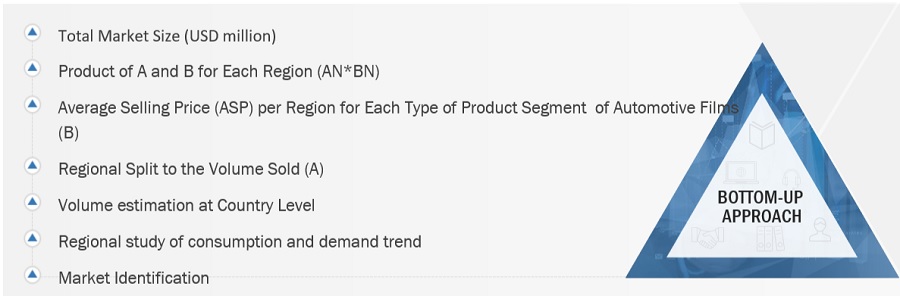

The top-down and bottom-up approaches have been used to estimate and validate the size of the automotive films market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Top - Down Approach-

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom - Up Approach-

Data Triangulation

After arriving at the total market size from the estimation process, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Automotive films are a type of window film applied to the windows of a vehicle. They are made of a polyester coating that is applied to the glass of a vehicle. Automotive films serve various purposes, such as reducing heat and glare, providing privacy, and enhancing the appearance of the vehicle. There are different types of automotive window films available, including dyed films, ceramic films, carbon films, metalized films, and hybrid films. One of their primary functions is solar control, effectively reducing the intrusion of solar heat and harmful UV rays into the vehicle's interior. This not only enhances passenger comfort but also lessens the strain on air conditioning systems, ultimately improving energy efficiency.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

- Manufacturers

- Raw Material Suppliers

Report Objectives

- To define, describe, and forecast the size of the automotive films market in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on films type, application, vehicle type, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and Impact on automotive films market

Growth opportunities and latent adjacency in Automotive Films Market