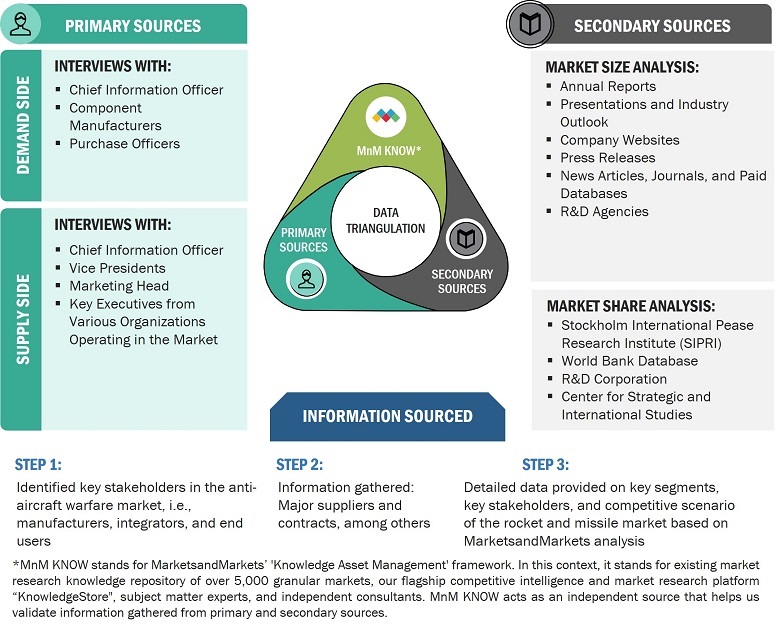

The research study conducted on anti-aircraft warfare market involved extensive use of secondary sources, including directories, databases of articles, journals on anti-aircraft defense systems in military, company newsletters, and information portals such as Hoover’s, Bloomberg, and Factiva to identify and collect information useful for this extensive, technical, market-oriented study of the anti-aircraft warfare market. Primary sources include industry experts from the core and related industries, alliances, organizations, Original Equipment Manufacturers (OEMs), vendors, suppliers, and technology developers. These sources relate to all segments of the value chain of anti-aircraft warfare market.

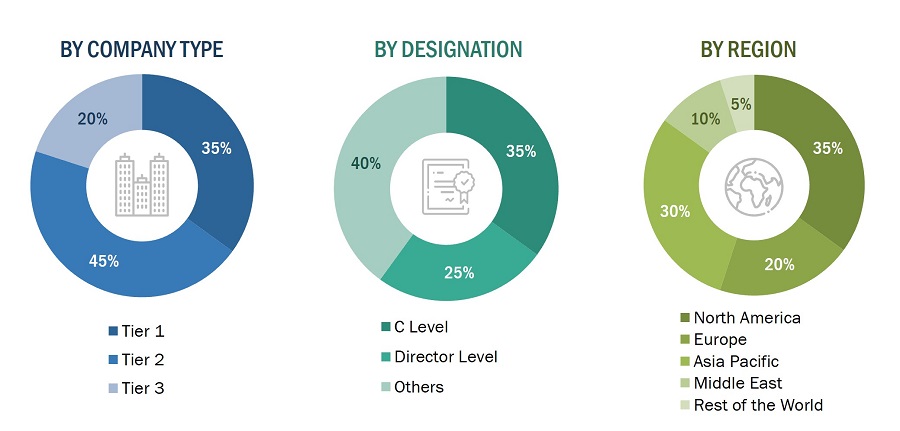

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and assess future market prospects.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as World Defense expenditure database; department of defense websites, corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from anti-aircraft system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, threat type, range, domain, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using anti-aircraft systems were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of anti-aircraft systems and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

-

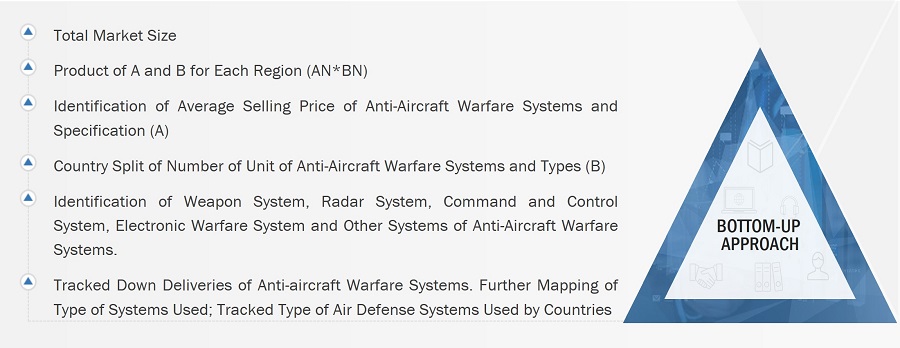

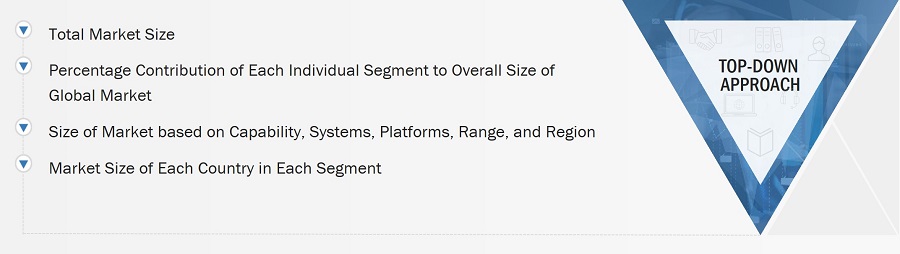

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Anti-aircraft warfare market. These methods were also used extensively to estimate the size of various segments and sub-segments of the market. The research methodology used to estimate the market size included the following:

-

Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews with CEOs, directors, and marketing executives.

-

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

-

This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

-

The research methodology used to estimate the market size also included the following details:

-

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

-

Market growth trends were defined based on approaches such as the product revenues of the significant 10-15 companies from 2019 to 2022, military expenditure, exports/imports of anti-aircraft warfare system parts and equipment by different countries from 2019 to 2022, historic procurement patterns between 2019 to 2022, among others.

Anti-Aircraft Warfare Market Size: Bottom-Up Approach

Anti-Aircraft Warfare Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and the data triangulation procedure implemented in the market engineering process used in this report.

The figure above demonstrates the core data triangulation procedure used in this report for each market, submarket, and subsegment. Percentage splits of various market segments, i.e., capability, segment, platform, range, and region, were used to determine the size of the anti–aircraft warfare market.

Market Definition

Anti-aircraft warfare, alternatively known as AAW or anti-aircraft, refers to the use of systems that are designed to defend against and destroy or deter enemy aircraft. This can include military aircraft, helicopters and UAVs. The primary goal of anti-aircraft warfare is to protect military forces and assets on the ground, sea-surface, and in the air by preventing or minimizing the threat posed by hostile aircraft. This form of warfare encompasses a wide range of technologies and methods, from anti-aircraft guns and surface-to-air missiles to electronic warfare and anti-aircraft artillery fire control systems.

The anti-aircraft warfare market is the global market for the development, production, and sale of anti-aircraft systems. The market is segmented by capability, system, platform, range, and region. The capability segment is further segmented into support, protection, and attack. The system segment is further segmented into weapon systems, radar system, electronic warfare system, command and control systems, and others. The platform segment is further segmented into land, naval and airborne. The range segment is further segmented into short range (<20 KM), medium range (20 – 100 km), and long range (>100 km). The region segment is further segmented into North America, Europe, Asia Pacific, Middle East and Rest of the World.

Key Stakeholders

-

Anti–Aircraft Warfare Systems and Component Providers

-

Technology Support Providers

-

Government Agencies

-

Military Organizations

-

Investors and Financial Community Professionals

-

Research Organizations

Report Objectives

-

To define, describe, and forecast the size of the anti-aircraft warfare market based on capability, system, platform, range, and region from 2023 to 2028

-

To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East and the Rest of the World (RoW), which comprises Africa and Latin America

-

To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the anti-aircraft warfare market across the globe

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the anti–aircraft warfare market

-

To analyze opportunities for stakeholders in the market by identifying key market trends

-

To analyze competitive developments such as contracts, acquisitions and expansions, agreements, joint ventures and partnerships, new product launches, and Research & Development (R&D) activities in the anti–aircraft warfare market

-

To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players

-

To strategically profile key market players and comprehensively analyze their core competencies2

1 Micromarkets are defined as further segments and subsegments of the anti-aircraft warfare market included in the report.

2 Core competencies of the companies have been captured in terms of the key developments and strategies adopted by players to sustain their position in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations per the specific needs of companies. The following customization options are available for the report:

Product Analysis

-

Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

-

Further breakdown of the market segments at country-level

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Anti-aircraft Warfare Market