Air Management System Market by System (Thermal Management, Engine Bleed Air, Oxygen System, Fuel Tank Inerting, Cabin Pressure Control, ICE Protection), Platform (Fixed Wing, Rotary Wing), Component, and Region - Global Forecast to 2022

The air management system market is estimated to grow from USD 4.68 Billion in 2017 to USD 6.26 Billion by 2022, at a CAGR of 5.97% from 2017 to 2022. The objective of this study is to analyze the market from 2017 to 2022 and define, describe, and forecast the market based on system, component, platform, and region. The base year considered for the study is 2016 and the forecast is from 2017 to 2022.

The air management system market is projected to grow from an estimated USD 4.68 Billion in 2017 to USD 6.26 Billion by 2022, at a CAGR of 5.97% from 2017 to 2022. Technological advancements resulting in performance efficiency of the system, the increased requirement of efficient thermal management due to rising heat loads from growing use of electric system architecture in aircraft, and the need for safer operations in freezing weather conditions are key factors expected to drive the market. The market has been segmented based on system, component, platform, and region.

Based on system, the air management system market has been segmented into thermal management system, engine bleed air system, oxygen system, fuel tank inerting system, cabin pressure control system, and ice protection system. The thermal management system segment is estimated to lead the market in 2016. The rising adoption of more electric aircraft technology has led to the replacement of various pneumatic and hydraulic systems by electric systems, which has resulted in increased heat loads. A thermal management system is extremely important for safe and efficient operations of an aircraft, as it manages heat loads and prevents the overheating of systems and components that may lead to mishaps.

Based on component, the air management system market has been segmented into onboard oxygen generation system, sensors, valves, air cycle machines, heat exchangers, air separator modules, control and monitoring electronic units, air mixers, and condenser and evaporator, among others. The onboard oxygen generation system segment is estimated to lead the market in 2017. An onboard oxygen generation system is an important system in an aircraft, as it facilitates the flow of fresh air in an aircraft cabin. The main function of the onboard oxygen generation system is to provide pressurizedairto the cabin and convert engine bleed air to oxygen-rich air suitable for human intake. The system works with the help of other components, such as engine bleed air system, shutoff valve, heat exchangers, oxygen concentrator, plenum, and regulators.

Based on platform, the market has been segmented into fixed wing and rotary wing. The fixed wing segment is projected to witness a higher growth during the forecast period. Rotary wing aircraft fly at a comparatively lower altitude than fixed wing aircraft. Therefore, the cabin of rotary wing aircraft is not required to be pressurized and the aircraft require smaller air management systems as compared to fixed wing aircraft.

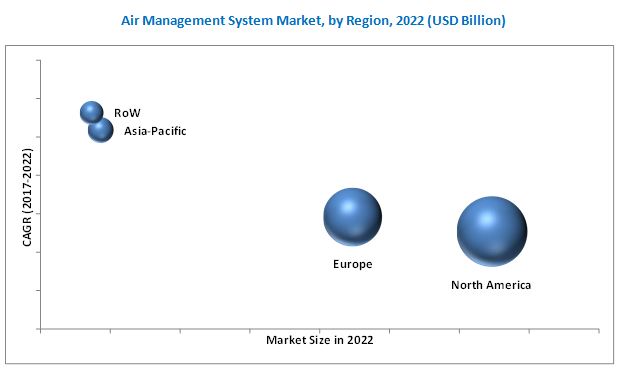

Regions, including North America, Europe, Asia-Pacific, and rest of the world have been considered in the geographical analysis of the air management system market. North America is estimated to lead the market in 2017, as the major regions in the global aviation industry, with the presence of major aircraft manufacturers, such as Boeing (U.S.), Bombardier (Canada), Lockheed Martin (U.S.), Bell Helicopter (U.S.), and Sikorsky Aircraft (U.S.) in the region.

Backlogs of aircraft deliveries can restrain the growth of the air management system market. Major manufacturers of aircraft have a large number of orders for new aircraft, due to the increased air passenger traffic across regions in recent years. However, the limited manufacturing capacity of these companies has led to a large backlog of aircraft deliveries, which can result in order cancellation.

Products offered by various companies operating in the air management system market have been listed in the report. The recent developments section of the report includes information on strategies adopted by various companies between 2012 and 2016. Major players in the market include Liebherr Group (Switzerland), United Technologies Corporation (U.S.), and Honeywell International Inc. (U.S.), among others. These companies have an excellent geographic reach and distribution channels.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Study Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Indicators

2.2.2.1 Growth of Air Traffic in Emerging Economies

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Air Management System Market

4.2 Air Management System Market, By Component

4.3 Market, By System

4.4 Market, By Platform

4.5 Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Component

5.2.2 By System

5.2.3 By Platform

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Technological Advancements Resulting in Performance Efficiency of Air Management Systems

5.3.1.2 Increased Requirement of Efficient Thermal Management Due to Rising Heat Loads From Growing Use of Electric System Architecture

5.3.1.3 Need for Safer Operations in Freezing Weather Conditions

5.3.2 Restraints

5.3.2.1 Backlogs in Aircraft Deliveries

5.3.3 Opportunities

5.3.3.1 Rising Demand for Business Jets in Emerging Economies

5.3.3.2 Upgrades of Old Systems in the Aging Aircraft

5.3.4 Challenges

5.3.4.1 Inefficiency of an Air Conditioning System in Switching Between Heating and Cooling Functions

5.3.4.2 Difficulty in Installation

5.3.4.3 Stringent Regulations Pertaining to Aircraft Safety

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 New Trends and Technologies

6.2.1 Integrated Air Management System

6.2.2 Digitization of Thermal Management Techniques

6.2.3 Use of Turbomachine Assembly for Air Cooling

6.3 Patent Listings, 2011-2016

7 Air Management System Market, By Component (Page No. - 51)

7.1 Introduction

7.2 On-Board Oxygen Generation System

7.3 Sensors

7.4 Valves

7.5 Air Cycle Machines

7.6 Heat Exchangers

7.7 Air Separator Modules

7.8 Control and Monitoring Electronic Units

7.9 Air Mixers

7.10 Condenser and Evaporator

8 Air Management System Market, By System (Page No. - 55)

8.1 Introduction

8.2 Thermal Management System

8.2.1 Air Conditioning System

8.2.2 Fluid & Hydraulic Cooling System

8.2.3 Supplement Cooling System

8.3 Engine Bleed Air System

8.4 Oxygen System

8.4.1 Pressure Demand System

8.4.2 Continuous Flow System

8.4.3 Portable Oxygen System

8.5 Fuel Tank Inerting System

8.6 Cabin Pressure Control System

8.7 Ice Protection System

8.7.1 De-Icing System

8.7.2 Anti-Icing System

9 Air Management System Market, By Platform (Page No. - 63)

9.1 Introduction

9.2 Fixed Wing

9.2.1 Commercial Fixed Wing, By Aircraft Type

9.2.2 Military Fixed Wing

9.3 Rotary Wing

9.3.1 Commercial Rotary Wing

9.3.2 Military Rotary Wing

10 Regional Analysis (Page No. - 67)

10.1 Introduction

10.2 North America

10.2.1 By System

10.2.2 By Platform

10.2.2.1 Fixed Wing Platform, By Application

10.2.2.1.1 Commercial Fixed Wing, By Aircraft Type

10.2.2.2 Rotary Wing Platform

10.2.3 By Country

10.2.3.1 U.S.

10.2.3.1.1 By System

10.2.3.1.2 By Platform

10.2.3.2 Canada

10.2.3.2.1 By System

10.2.3.2.2 By Platform

10.3 Europe

10.3.1 By System

10.3.2 By Platform

10.3.2.1 Fixed Wing Platform, By Application

10.3.2.1.1 Commercial Fixed Wing, By Aircraft Type

10.3.2.2 Rotary Wing Platform

10.3.3 By Country

10.3.3.1 France

10.3.3.1.1 By System

10.3.3.1.2 By Platform

10.3.3.2 Germany

10.3.3.2.1 By System

10.3.3.2.2 By Platform

10.3.3.3 U.K.

10.3.3.3.1 By System

10.3.3.3.2 By Platform

10.3.3.4 Italy

10.3.3.4.1 By System

10.3.3.4.2 By Platform

10.3.3.5 Rest of Europe

10.3.3.5.1 By System

10.3.3.5.2 By Platform

10.4 Asia-Pacific

10.4.1 By System

10.4.2 By Platform

10.4.2.1 Fixed Wing Platform, By Application

10.4.2.1.1 Commercial Fixed Wing, By Aircraft Type

10.4.2.2 Rotary Wing Platform

10.4.3 By Country

10.4.3.1 Russia

10.4.3.1.1 By System

10.4.3.1.2 By Platform

10.4.3.2 China

10.4.3.2.1 By System

10.4.3.2.2 By Platform

10.4.3.3 India

10.4.3.3.1 By System

10.4.3.3.2 By Platform

10.4.3.4 Japan

10.4.3.4.1 By System

10.4.3.4.2 By Platform

10.4.3.5 Rest of APAC

10.4.3.5.1 By System

10.4.3.5.2 By Platform

10.5 Rest of the World

10.5.1 By System

10.5.2 By Platform

10.5.2.1 Fixed Wing Platform, By Application

10.5.2.1.1 Commercial Fixed Wing, By Aircraft Type

10.5.2.2 Rotary Wing Platform

11 Competitive Landscape (Page No. - 99)

11.1 Vendor Dive Overview

11.1.1 Visionary Leaders

11.1.2 Innovators

11.1.3 Dynamic Differentiators

11.1.4 Emerging Companies

11.2 Competitive Leadership Mapping

11.3 Competitive Benchmarking

11.3.1 Product Portfolio Analysis of Air Management Systems Market (24 Players)

11.3.2 Business Strategies Adopted By Players in Market (24 Players)

11.4 Market Ranking Analysis

12 Company Profiles (Page No. - 105)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Liebherr Group

12.2 United Technologies Corporation

12.3 Honeywell International, Inc.

12.4 Zodiac Aerospace

12.5 Meggitt, PLC

12.6 Rockwell Collins, Inc.

12.7 Diehl Stiftung & Co. Kg

12.8 Shimadzu Corporation

12.9 Dukes Aerospace Inc

12.10 Aeronamic Aircraft Subsystems

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 135)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (69 Tables)

Table 1 Segment Definition

Table 2 Segment Definition

Table 3 Segment Definition

Table 4 Business Jets Market Size, By Region, 2014-2020 (USD Million)

Table 5 Innovation & Patent Registrations, 2011-2016

Table 6 Air Management Systems Market Size, By Component, 2015-2022 (USD Million)

Table 7 Market Size, By System, 2015-2022 (USD Million)

Table 8 Thermal Management System Market Size, By Region, 2015-2022 (USD Million)

Table 9 Thermal Management System Market Size, By Subsystem, 2015-2022 (USD Million)

Table 10 Engine Bleed Air System Market Size, By Region, 2015-2022 (USD Million)

Table 11 Oxygen System Market Size, By Region, 2015-2022 (USD Million)

Table 12 Oxygen System Market Size, By Subsystem, 2015-2022 (USD Million)

Table 13 Fuel Tank Inerting System Market Size, By Region, 2015-2022 (USD Million)

Table 14 Cabin Pressure Control System Market Size, By Region, 2015-2022 (USD Million)

Table 15 Ice Protection System Market Size, By Region, 2015-2022 (USD Million)

Table 16 Ice Protection System Market Size, By Subsystem, 2015-2022 (USD Million)

Table 17 Air Management Systems Market Size, By Platform, 2015-2022 (USD Million)

Table 18 Fixed Wing Platform Market Size, By Application, 2015-2022 (USD Million)

Table 19 Commercial Market Size, By Aircraft Type, 2015-2022 (USD Million)

Table 20 Rotary Wing Platform Market Size, By Application, 2015-2022 (USD Million)

Table 21 Air Management Systems Market Size, By Region, 2015-2022 (USD Million)

Table 22 North America: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 23 North America: Market Size, By Platform, 2015-2022 (USD Million)

Table 24 North America: Fixed Wing Segment, By Application, 2015-2022 (USD Million)

Table 25 North America: Commercial Fixed Wing Segment, By Aircraft Type, 2015-2022 (USD Million)

Table 26 North America: Rotary Wing Segment, By Application, 2015-2022 (USD Million)

Table 27 North America: Air Management Systems Market Size, By Country, 2015-2022 (USD Million)

Table 28 U.S.: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 29 U.S.: Market Size, By Platform, 2015-2022 (USD Million)

Table 30 Canada: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 31 Canada: Market Size, By Platform, 2015-2022 (USD Million)

Table 32 Europe: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 33 Europe: Market Size, By Platform, 2015-2022 (USD Million)

Table 34 Europe: Fixed Wing Segment, By Application, 2015-2022 (USD Million)

Table 35 Europe: Commercial Fixed Wing Segment, By Aircraft Type, 2015-2022 (USD Million)

Table 36 Europe: Rotary Wing Segment, By Application, 2015-2022 (USD Million)

Table 37 Europe: Air Management Systems Market Size, By Country, 2015-2022 (USD Million)

Table 38 France: Market Size, By System, 2015-2022 (USD Million)

Table 39 France: Market Size, By Platform, 2015-2022 (USD Million)

Table 40 Germany: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 41 Germany: Market Size, By Platform, 2015-2022 (USD Million)

Table 42 U.K.: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 43 U.K.: Market Size, By Platform, 2015-2022 (USD Million)

Table 44 Italy: Market Size, By System, 2015-2022 (USD Million)

Table 45 Italy: Market Size, By Platform, 2015-2022 (USD Million)

Table 46 Rest of Europe: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 47 Rest of Europe: Market Size, By Platform, 2015-2022 (USD Million)

Table 48 Asia-Pacific: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 49 Asia-Pacific: Market Size, By Platform, 2015-2022 (USD Million)

Table 50 Asia-Pacific: Fixed Wing Segment, By Application, 2015-2022 (USD Million)

Table 51 Asia-Pacific: Commercial Fixed Wing Segment, By Aircraft Type, 2015-2022 (USD Million)

Table 52 Asia-Pacific: Rotary Wing Segment, By Application, 2015-2022 (USD Million)

Table 53 Asia-Pacific: Air Management Systems Market Size, By Country, 2015-2022 (USD Million)

Table 54 Russia: Market Size, By System, 2015-2022 (USD Million)

Table 55 Russia: Market Size, By Platform, 2015-2022 (USD Million)

Table 56 China: Market Size, By System, 2015-2022 (USD Million)

Table 57 China: Market Size, By Platform, 2015-2022 (USD Million)

Table 58 India: Market Size, By System, 2015-2022 (USD Million)

Table 59 India: Market Size, By Platform, 2015-2022 (USD Million)

Table 60 Japan: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 61 Japan: Market Size, By Platform, 2015-2022 (USD Million)

Table 62 Rest of APAC: Air Management Systems Market Size, By System, 2015-2022 (USD Million)

Table 63 Rest of APAC: Market Size, By Platform, 2015-2022 (USD Million)

Table 64 Rest of the World: Market Size, By System, 2015-2022 (USD Million)

Table 65 Rest of the World: Market Size, By Platform, 2015-2022 (USD Million)

Table 66 Rest of the World: Fixed Wing Segment, By Application, 2015-2022 (USD Million)

Table 67 Rest of the World: Commercial Fixed Wing Segment, By Aircraft Type, 2015-2022 (USD Million)

Table 68 Rest of the World: Rotary Wing Segment, By Application, 2015-2022 (USD Million)

Table 69 Air Management Systems Market: Ranking of Key Players

List of Figures (45 Figures)

Figure 1 Air Management Systems Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Research Process Flow

Figure 4 Air Management Systems Market: Research Design

Figure 5 Breakdown of Primary Interviews

Figure 6 Region-Wise Increase in Air-Traffic (2014-2016)

Figure 7 Market Size Estimation Methodology: Bottom-Up Approach

Figure 8 Market Size Estimation Methodology: Top-Down Approach

Figure 9 Data Triangulation

Figure 10 Assumptions of the Research Study

Figure 11 Air Management Systems Market, By System, 2017 & 2022 (USD Billion)

Figure 12 The Fixed Wing Segment Accounted for the Largest Share of the Market in 2017

Figure 13 The Narrow Body Aircraft Subsegment is Projected to Be the Largest Subsegment of the Fixed Wing in Commercial Application Segment During the Forecast Period

Figure 14 The On-Board Oxygen Generation System Segment is Projected to Be the Largest Segment of the Air Management Systems Market During the Forecast Period

Figure 15 North America is Estimated to Be the Largest Market for Air Management System During the Forecast Period

Figure 16 Contracts and Agreements Accounted for A Major Share of the Overall Developments By Key Players in the Market From July 2010 to October 2016

Figure 17 Emerging Demand for Digitization of Thermal Management System is the Latest Trend in the Market

Figure 18 The Sensors Segment is Projected to Witness the Highest Growth During the Forecast Period

Figure 19 Thermal Management System is Expected to Be the Largest Segment of the Market During the Forecast Period

Figure 20 The Fixed Wing Segment is Expected to Be the Larger Segment of the Market in 2017

Figure 21 North America is Estimated to Account for the Largest Share of the Market in 2017

Figure 22 Air Management Systems Market, By Component

Figure 23 Market, By System

Figure 24 Market, By Platform

Figure 25 Drivers, Restraints, Opportunities, and Challenges of the Market

Figure 26 Order Backlogs of Aircraft Manufacturers (Airbus & Boeing)

Figure 27 Airbus and Boeing Aircraft Fleet Forecast Comparison, By Region, 2035

Figure 28 Advanced Technologies Used in Market

Figure 29 The On-Board Oxygen Generation System Segment is Expected to Witness the Highest Growth During the Forecast Period

Figure 30 The Thermal Management System Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 31 The Rotary Wing Segment is Expected to Grow at A Higher CAGR During the Forecast Period

Figure 32 North America is Estimated to Account for the Largest Share of the Market in 2017

Figure 33 North America Air Management Systems Market Snapshot

Figure 34 Europe Market Snapshot

Figure 35 Asia-Pacific Air Management Systems Market Snapshot

Figure 36 Air Management Systems Market (Global) Competitive Leadership Mapping, 2017

Figure 37 Market Ranking Analysis of Key Player

Figure 38 Liebherr Group: Company Snapshot

Figure 39 United Technologies Corporation: Company Snapshot

Figure 40 Honeywell International Inc.: Company Snapshot

Figure 41 Zodiac Aerospace: Company Snapshot

Figure 42 Meggitt PLC: Company Snapshot

Figure 43 Rockwell Collins, Inc.: Company Snapshot

Figure 44 Diehl Stiftung & Co. Kg: Company Snapshot

Figure 45 Shimadzu Corporation: Company Snapshot

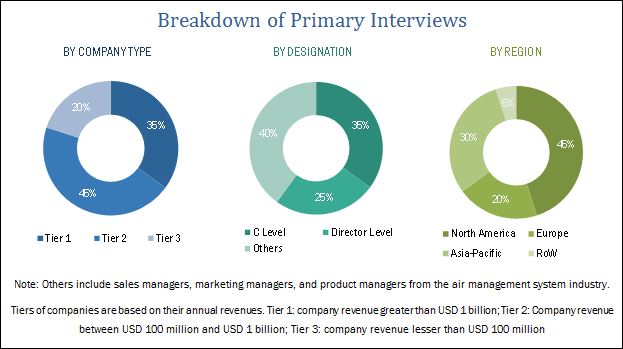

The research methodology used to estimate and forecast the air management system market begins with capturing the data of the revenues from air management systems through secondary sources, such as International Civil Aviation Organization (ICAO), International Air Transport Association (IATA), Federal Aviation Administration (FAA), European Aviation Safety Agency (EASA), and paid databases. The air management system offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall air management system market size from the revenue of key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key individuals, such as (CEOs), VPs, and directors. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The air management system market ecosystem comprises airline component providers, such as Liebherr Group (Switzerland), United Technologies Corporation (U.S.), Honeywell International Inc (U.S.), Meggitt Plc (U.K.), Zodiac Aerospace (France), among others, and component manufacturers such as Rockwell Collins Inc. (U.S.), Diehl Stiftung & Co. KG (Germany), Shimadzu Corporation (Japan), Dukes Aerospace, Inc. (U.S.), and Aeronamic Aircraft Subsystems (Netherlands), among others.

Target Audience for this Report:

- Aircraft Manufacturers

- Environmental System Manufacturers

- Original Equipment Manufacturers (OEMs)

- Research Institutes and Organizations

- Military Service Providers

- Regulatory Bodies

- Sub-component Manufacturers

-

Technology Support Providers

“Study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing the efforts and investments”.

Scope of the Report

This research report categorizes the air management system market into the following segments:

-

By System

- Thermal Management System

- Engine Bleed Air System

- Oxygen System

- Fuel Tank Inerting System

- Cabin Pressure Control System

- Ice Protection System

-

By Component

- Onboard Oxygen Generation System

- Sensors

- Valves

- Air Cycle Machines

- Heat Exchangers

- Air Separator Modules

- Control and Monitoring Electronic units

- Air Mixers

- Condenser and Evaporator

- Others

-

By Platform

- Fixed Wing

- Rotary Wing

-

By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per specific needs of a company. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the rest of the world air management system market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Air Management System Market