AI Data Center Market Size, Share & Trends, 2025 To 2030

AI Data Center Market by Offering (Compute Server (GPU-Based, FPGA-Based, ASIC-based), Storage, Cooling, Power, DCIM), Data Center Type (Hyperscale, Colocation), Application (GenAI, Machine Learning, NLP, Computer Vision) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

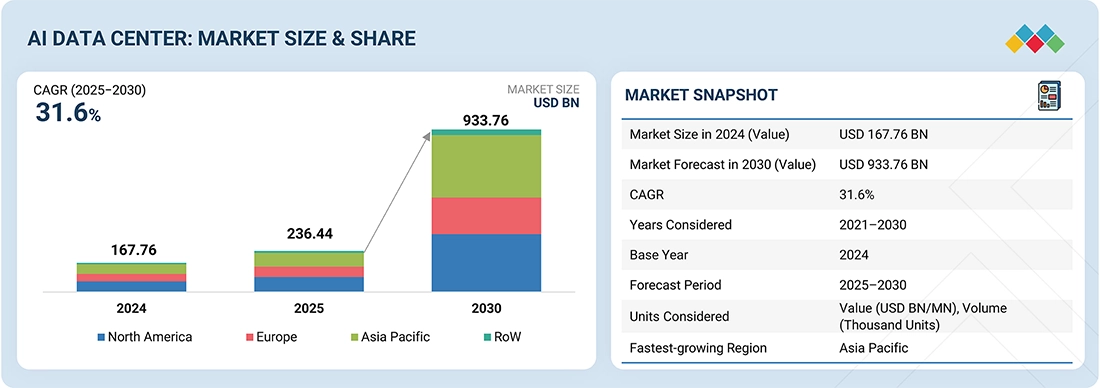

The global AI data center market is anticipated to grow from USD 236.44 billion in 2025 to USD 933.76 billion by 2030, at a CAGR of 31.6%. The market is driven by surging demand for AI workloads, hyperscaler investments, rapid adoption of cloud computing, and the need for energy-efficient, high-performance infrastructure.

KEY TAKEAWAYS

- The North American AI Data Center market accounted for 36.7% revenue share in 2024.

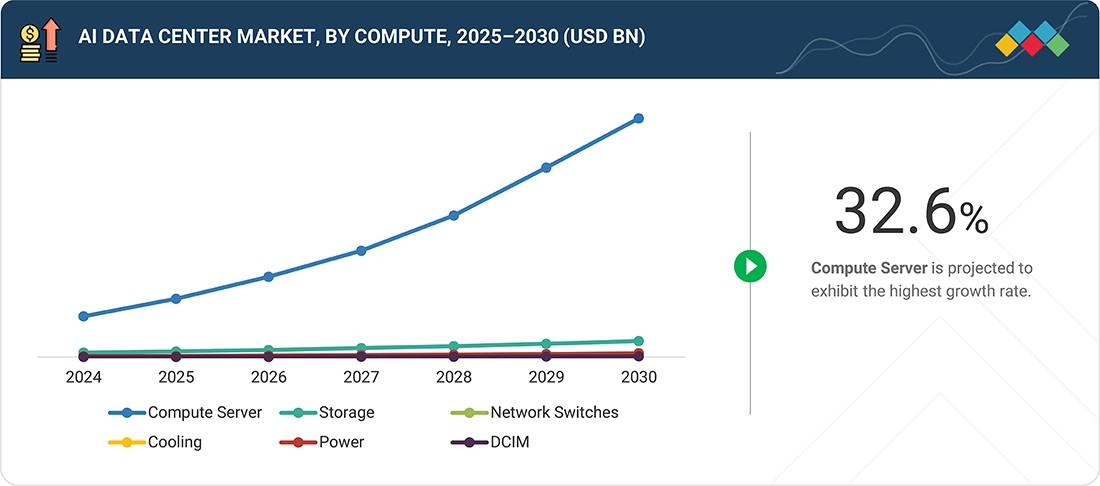

- By Offering, compute server is expected to grow at the fastest rate from 2025 to 2030.

- By Data Center Type, the colocation data center is expected to register the highest CAGR of 37.2%

- By Deployment, the hybrid segment is projected to grow at the fastest rate from 2025 to 2030.

- By Application, the generative AI segment is expected to dominate the market.

- By End User, enterprises segment is projected to grow at the fastest rate from 2025 to 2030.

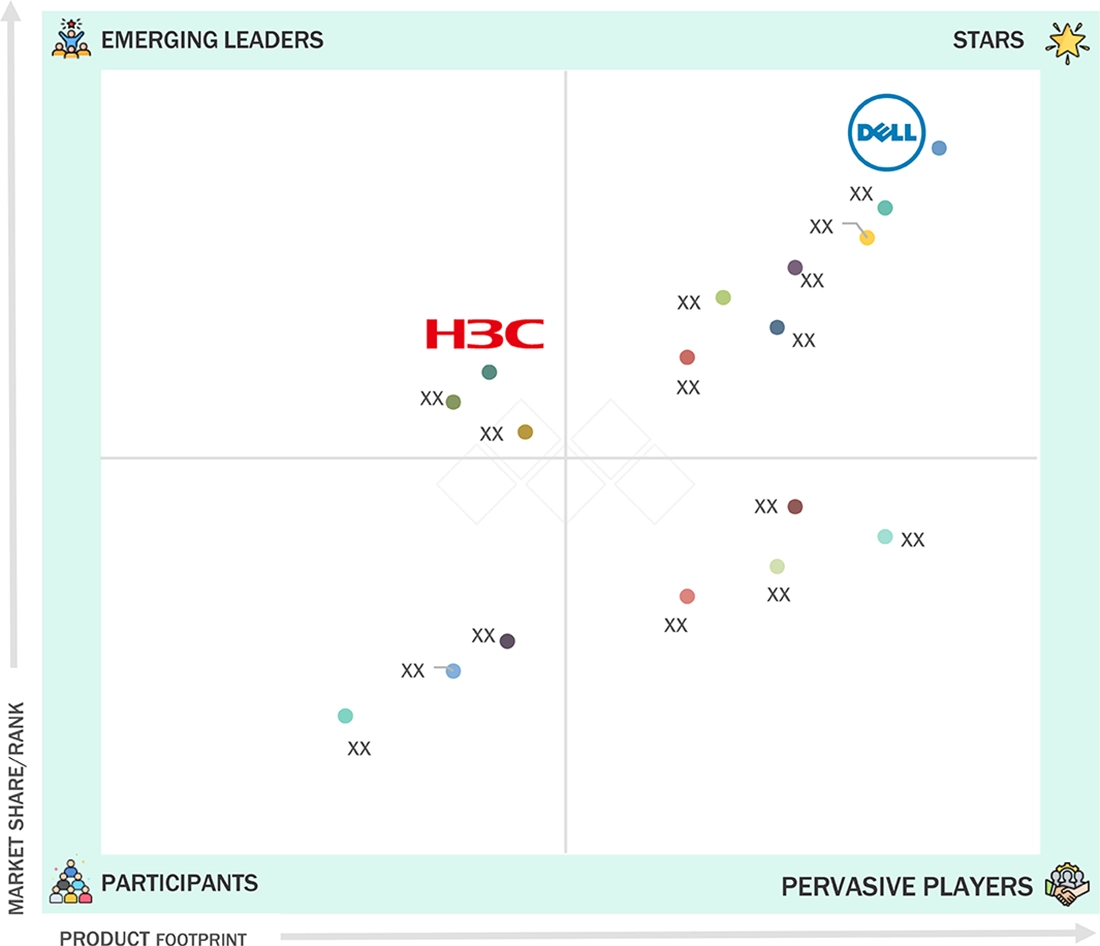

- Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (US), Huawei Technologies Co., Ltd (China), were identified as some of the star players in the AI data center market (global), given their strong market share and product footprint.

- Submer (Germany), Iceotope (UK) and LiquidStack Holding B.V. (Netherlands) among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The AI data center market is expanding rapidly as rising AI workloads and data-intensive applications drive demand for high-performance infrastructure and advanced analytics. This growth is further supported by government spending and regulatory policies that encourage the development of AI-optimized facilities. Along with this, the rise of AI-as-a-Service (AIaaS) is widening adoption across enterprises, including smaller businesses.

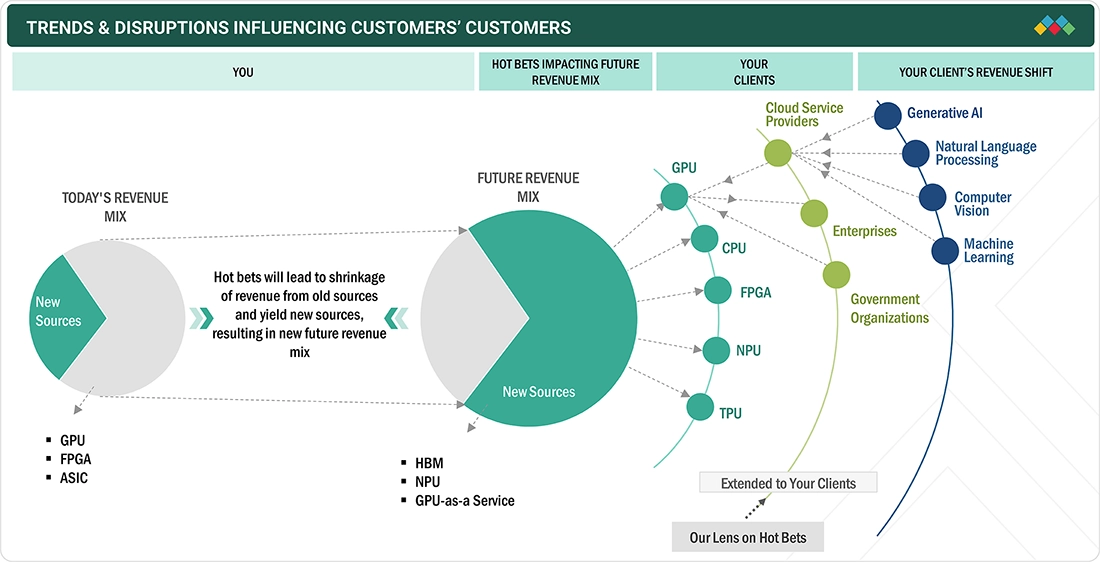

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Several trends and disruptions are reshaping the AI data center landscape and directly impacting customer business models, revenue streams, and technology adoption strategies. The current revenue mix primarily comprises traditional components, including GPUs, FPGAs, and ASICs. As AI continues to permeate various sectors, there is a growing demand for HBM, NPU, and GPU-as-a-service, which are better suited for handling the intensive computational requirements of AI workloads. The changing revenue mix is directly linked to customer needs, particularly in AI-driven domains such as generative AI, natural language processing, computer vision, and machine learning.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for AI workloads

-

Data explosion and big data analytics

Level

-

High implementation costs

-

Data privacy and cyber security concerns

Level

-

Increasing demand for hyperscale data center

-

Rising adoption of green AI data centers

Level

-

Supply chain disruptions

-

Energy consumption and environmental concerns

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for AI workloads

The increasing need for AI workloads is one of the most significant drivers propelling the AI data center market. As AI technologies increasingly penetrate business operations, the need for a secure computing infrastructure capable of delivering high-performance training and inference operations is gaining traction. AI computations, ranging from natural language processing and computer vision to autonomous systems, demand high amounts of computational power, large memory bandwidth, and low latency. Thus, businesses are investing quickly in AI-optimized data centers equipped with GPUs, TPUs, and accelerators.

Restraint: Data privacy and cyber security concerns

The AI data center market faces restraints due to growing concerns about data privacy and cybersecurity. Centralized infrastructures are prime targets for ransomware and DDoS attacks, while AI models are vulnerable to adversarial threats and data poisoning. Strict regulations, such as GDPR and CCPA, add compliance burdens, requiring costly security investments. The misuse of sensitive data, as seen in halted AI healthcare deployments, highlights operational and reputational risks that often delay or limit the enterprise adoption of AI-enabled data centers.

Opportunity: Increasing demand for hyperscale data center

The AI data center market is witnessing strong opportunities, driven by the rising demand for hyperscale data centers to handle massive computational loads, vast data volumes, and intensive AI workloads. These centers deliver scalability, redundancy, and energy efficiency, essential for generative AI, deep learning, and real-time analytics. Initiatives like Meta’s AI-focused data centers and Microsoft’s renewable energy-backed projects highlight how hyperscale infrastructure is becoming the backbone of large-scale AI deployments, driving significant future growth.

Challenge: Energy consumption and environmental concerns

The AI data center industry faces significant challenges, including high energy consumption and environmental concerns. Large AI model training demands continuous, power-intensive processing, which drives up emissions and strains cooling infrastructure. With governments enforcing carbon reduction, sustainability becomes critical; however, limited access to renewable resources and high electricity costs hinder growth. Companies like Google and Microsoft are adopting carbon-conscious strategies; however, the rising complexity of AI workloads continues to outpace energy-saving innovations, making sustainability a key barrier to long-term scalability.

AI Data Center Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Dell Technologies and NVIDIA build large-scale AI-ready data centers with Dell PowerEdge servers, PowerScale storage, and VMware integration. | The collaboration enabled enterprises to accelerate AI deployment with scalable infrastructure, high-performance GPU clusters, and simplified management, providing a blueprint for next-generation AI data centers. |

|

AI-driven hybrid cloud infrastructure with HPE GreenLake for AI and HPC workloads | HPE’s GreenLake delivers flexible, cloud-based AI capacity with integrated data pipelines, reducing time-to-value for enterprises. Customers benefit from on-demand scalability and simplified deployment of AI workloads. |

|

Huawei launches AI data center solutions supporting smart city digital transformation. | Huawei’s modular AI data center architecture improves energy efficiency, enhances computing density, and supports real-time applications such as traffic management and city-wide monitoring. |

|

Lenovo Neptune announces liquid-cooled data centers designed for AI workloads. | Neptune technology improves cooling efficiency and computational density, enabling sustainable AI training and reducing operational costs for enterprises scaling AI infrastructure. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

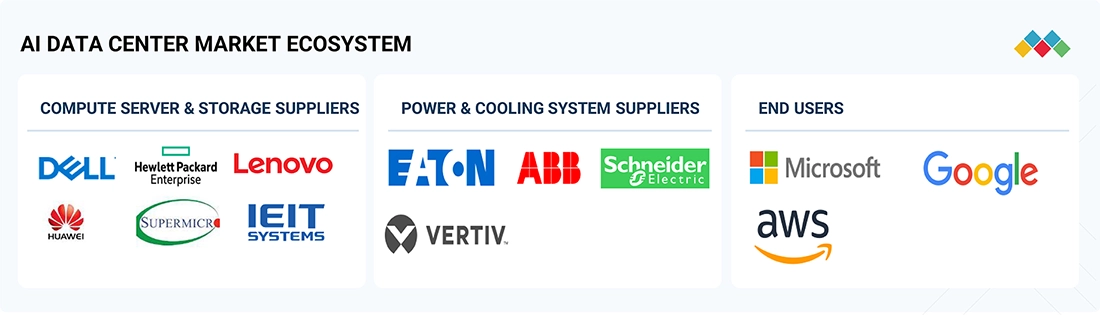

MARKET ECOSYSTEM

Companies in the market offer AI data center solutions suitable for various end users, such as cloud service providers, enterprises, and government organizations. Prominent AI data center providers include Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (US), Huawei Technologies Co., Ltd (China), IBM (US), Super Micro Computer, Inc. (US), IEIT SYSTEMS CO., LTD. (China), among others.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

AI Data Center Market, By Offering

The compute server segment includes GPU-based servers, FPGA-based servers, and ASIC-based servers. Each of these servers plays a distinct role in AI server infrastructure, offering unique benefits in terms of performance, flexibility, and power efficiency. The growing integration of AI across healthcare, automotive, and finance industries is fueling the demand for specialized processors, making this segmentation critical to understanding the market dynamics.

AI Data Center Market, By Data Center Type

Hyperscale data centers are poised to hold the largest market share due to their ability to efficiently handle massive computing workloads, scale resources rapidly, and support high-demand applications like AI, big data analytics, and cloud services. Major tech giants, including Amazon, Google, Meta, IBM, and Microsoft, rely on these facilities for critical operations, often deploying hundreds of megawatts of sustainable energy. Their modular, automated designs offer cost-effective and energy-efficient performance, driving rapid adoption and market dominance in the face of rising data traffic and the expansion of 5G.

AI Data Center Market, By Deployment

The cloud-based deployment segment is poised to dominate the AI data center market due to its unparalleled scalability, cost-efficiency, and accessibility, which are critical for supporting the rapid expansion of AI workloads. Cloud-based AI infrastructure eliminates the need for massive upfront capital investments in hardware, allowing businesses of all sizes to leverage high-performance computing resources, such as GPUs and TPUs, on a pay-as-you-go basis. This flexibility is particularly advantageous for AI applications, which often require bursts of computational power for training large models or processing vast datasets.

AI Data Center Market, By Application

Generative AI refers to a class of AI models that create new content, such as text, images, music, code, and even entire simulations, based on patterns learned from vast datasets. This technology encompasses generative adversarial networks (GANs), large language models (LLMs) such as GPT, and diffusion models, which can generate content indistinguishable from human creations. Generative AI has gained significant traction due to its ability to automate complex tasks like content creation, code generation, product design, and even drug discovery, offering powerful solutions across various industries. As these models become more sophisticated and capable of handling broader applications, their adoption is expected to accelerate.

AI Data Center Market, By End User

The enterprise segment is projected to grow rapidly in the AI data center market, driven by increasing adoption of AI-enabled digital transformation. Enterprises across manufacturing, finance, and retail are investing heavily in AI-powered predictive analytics, automation, and customer insight tools, all of which demand robust and scalable AI infrastructure. To support these capabilities, companies are expanding their AI operations using private and hybrid cloud models, ensuring strong data security while leveraging the flexibility and innovation of cloud technologies.

REGION

Asia Pacific to be fastest-growing region in global AI Data Center market during forecast period

The Asia Pacific is set to grow at the highest CAGR in the AI data center market, driven by widespread adoption of AI across the automotive, healthcare, finance, and e-commerce sectors. Key countries, including China, Japan, South Korea, and India, are investing heavily in AI infrastructure, hyperscale data centers, and the development of AI chips. Initiatives such as China’s AI Development Plan (2030) are also boosting supercomputing capabilities. Rapid urbanization, digital transformation, 5G, edge AI, AI-powered IoT, and supportive government policies further accelerate data center expansion, making the region the fastest-growing globally.

AI Data Center Market: COMPANY EVALUATION MATRIX

In the AI data center market matrix, Dell Inc. (Star) leads with a strong market share and a comprehensive product portfolio, offering servers, storage solutions, and AI-optimized infrastructure to support cloud computing, enterprise AI workloads, and high-performance applications. H3C Technologies Co., Ltd. (Emerging Leader) is gaining traction with AI-focused data center solutions, driving innovations in AI computing, cloud infrastructure, and enterprise digital transformation.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2025 (Value) | USD 236.44 Billion |

| Market Forecast in 2030 (Value) | USD 933.76 Billion |

| Growth Rate | CAGR of 31.6% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion/Million), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

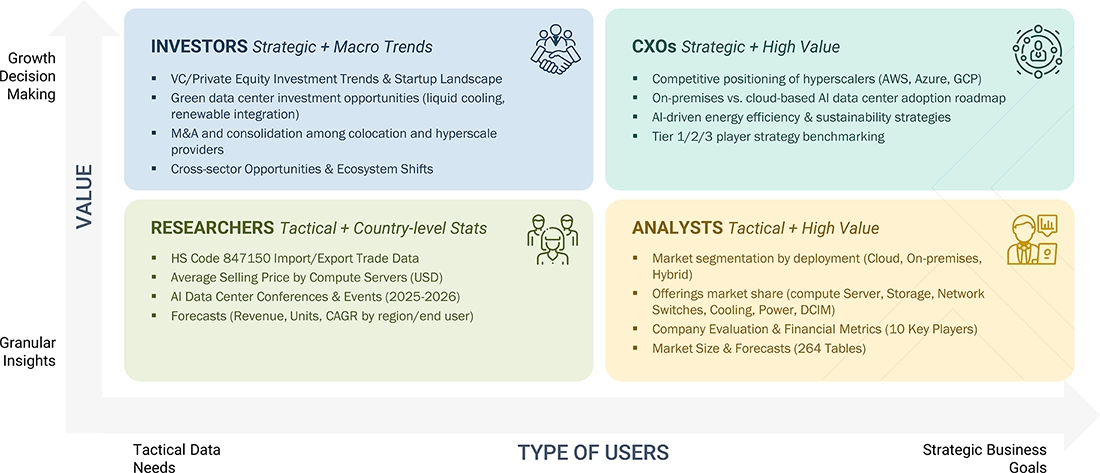

WHAT IS IN IT FOR YOU: AI Data Center Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Hyperscale Cloud Provider | Competitive benchmarking of AI-optimized data center architectures (GPU clusters, ASIC-based accelerators, liquid cooling, high-bandwidth interconnects) with cost-performance and energy efficiency assessments |

|

| Colocation Data Center Operator | Regional demand analysis for AI-ready colocation services, power density requirements, and regulatory compliance benchmarking | Regional demand analysis for AI-ready colocation services, power density requirements, and regulatory compliance benchmarking |

| Enterprise IT & Cloud Vendor | Workload optimization strategies for AI training vs inference workloads, edge–core–cloud integration models, and hybrid deployment roadmaps |

|

| AI Hardware Manufacturer | Supply-demand mapping for AI accelerators in data centers, procurement trends, and deployment forecasts |

|

RECENT DEVELOPMENTS

- September 2024 : Dell Inc. and Red Hat collaborated to make Red Hat Enterprise Linux AI (RHEL AI) the preferred platform for AI workloads on Dell PowerEdge servers. This partnership streamlines AI deployment by continuously testing and validating hardware, including NVIDIA GPUs, for seamless development and deployment of AI models, enabling enterprises to accelerate their AI/ML strategies across business applications.

- September 2024 : The HPE ProLiant DL145 Gen11 server, part of the Gen11 edge server portfolio, delivers high performance for a diverse range of edge workloads. It supports applications such as inventory management, point-of-sale systems, and AI/ML workloads. The server is optimized for edge-specific solutions, with a growing ecosystem of ISV partners offering tailored solutions for retail, manufacturing, and more.

- April 2024 : Lenovo introduced three new high-performance AI servers: ThinkSystem SR680a V3, SR685a V3, and SR780a V3. These systems support eight GPUs, offering massive computational power for AI and high-performance computing (HPC) workloads. The servers feature Intel and AMD processors, air or hybrid cooling, and support for NVIDIA and AMD GPUs, enhancing performance for demanding AI, graphical, and simulation tasks.

Table of Contents

Methodology

The study involved four major activities in estimating the current size of the AI data center market. Exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary research process has referred to various secondary sources to identify and collect necessary information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research was conducted to obtain critical information about the industry's supply chain, the market's value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data was collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the AI data center market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2024 ? Tier 1: >USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods were used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study's overall market size estimation process.

Bottom-Up Approach

- Identifying key countries contributing to the majority market share in the region.

- Identifying and evaluating percentage splits by end user, application, and deployment by each region.

- Evaluation of expenditure on AI data center offerings for each segment.

- Confirmation of all estimations through discussions with key opinion leaders, including corporate executives (CXOs), directors, sales heads, and industry experts from MarketsandMarkets

- Reviewed several paid and unpaid information sources, such as annual reports, press releases, white papers, and databases

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

Top-Down Approach

- Identifying the key players operating in the AI data center ecosystem

- Identifying the product offerings of each player and their contribution toward the AI data center market

- Understanding the company's business units offering AI data center products is considered in the study

- Aggregate companies' revenue and extrapolate to global AI data center market size (USD Million).

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments.

AI Data Center Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the entire market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying various factors and trends from the demand and supply sides in the AI data center market.

Market Definition

An AI data center is a specialized facility designed to support the high-performance computing demands of artificial intelligence (AI) workloads, including model training, inference, and large-scale data processing. These data centers feature high-density compute architectures with GPUs, TPUs, or custom AI accelerators, advanced networking for parallel processing, and innovative cooling solutions such as liquid cooling to manage heat dissipation. Unlike traditional data centers, AI data centers are optimized for massive data throughput, low-latency communication, and energy efficiency. Businesses can access AI infrastructure through hybrid cloud, colocation, or purpose-built AI data centers, enabling scalable AI-driven innovations across various industries.

Key Stakeholders

- Government and financial institutions and investment communities

- Analysts and strategic business planners

- Semiconductor product designers and fabricators

- Application providers

- AI solution providers

- AI platform providers

- Server OEM/ODM

- Business providers

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To define, describe, segment, and forecast the size of the AI data center market, in terms of value, based on offering, data center type, deployment, application, end user, and region

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To define, describe, segment, and forecast the size of the AI data center market, in terms of volume, based on compute server

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter's five forces analysis, investment and funding scenario, and regulations pertaining to the market

- To provide a detailed overview of the value chain analysis of the AI data center ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying high-growth segments of the market

- To strategically profile the key players, comprehensively analyze their market positions in terms of ranking and core competencies2, and provide a competitive market landscape

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the AI data center market

- To understand and analyze the impact of the 2025 US tariff on the AI data center market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Key Questions Addressed by the Report

Which are the major companies in the AI data center market?

Major companies in the AI data center market are Dell Inc. (US), Hewlett Packard Enterprise Development LP (US), Lenovo (US), Huawei Technologies Co., Ltd (China), IBM (US), Super Micro Computer, Inc. (US), IEIT SYSTEMS CO., LTD. (China), among others.

Which end users in the AI data center market are likely to exhibit the highest CAGR during the forecast period?

The cloud service providers and enterprise segments are expected to witness the highest CAGR due to expanding application areas and growing computing demand.

Which offerings in the AI data center market are likely to drive growth over the coming years?

High demand for compute servers and storage, among offerings of the AI data center market, is likely to drive market growth during the forecast period.

What are the drivers and opportunities for the AI data center market?

Rising demand for AI workloads, data explosion, big data analytics, increasing government investments and regulations, and growing demand for AI-as-a-Service (AIaaS) are the major drivers and opportunities of the AI data center market.

What are the restraints and challenges for the players in the AI data center market?

High implementation costs and data privacy and cyber security concerns are the major factors hindering the growth of the data center market. Also, supply chain disruptions, Energy consumption, and environmental concerns are the key challenges the market players face.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the AI Data Center Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in AI Data Center Market