The study involved major activities in estimating the current market size for the smart agriculture market. Exhaustive secondary research was done to collect information on the smart agriculture industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the smart agriculture market.

Secondary Research

The market for the companies offering smart agriculture solutions and services is arrived at by secondary data available through paid and unpaid sources, analysing the offering portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives

Primary Research

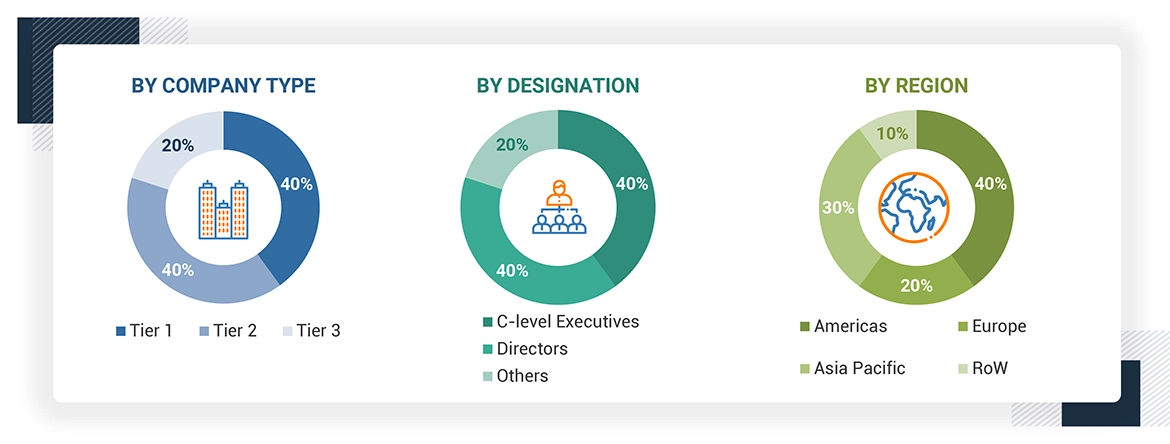

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users and related executives from multiple key companies and organizations operating in the smart agriculture market ecosystem.

After market engineering that includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation, extensive primary research has been conducted to verify and validate critical market numbers.

Primary research has also been conducted to identify segmentation types, industry trends, key players, and analyze the competitive landscape and key factors affecting the market dynamics, such as drivers, restraints, opportunities, industry trends, and key growth strategies. In the market engineering process, both the top-down and bottom-up approaches have been extensively used along with data triangulation methods to estimate and forecast the size of the smart agriculture market, including the overall market segments and subsegments as listed in the report. Extensive qualitative and quantitative analysis has been done on the complete market engineering process to include important information and insights throughout the report.

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the smart agriculture market. The key players in the market have been identified through secondary research, and their market shares in respective regions have been determined through primary and secondary research. This entire research methodology includes the study of key insights by top players, as well as interviews with experts (such as CXOs, vice presidents, directors, and marketing executives) for quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All parameters that affect markets covered in this research study were accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been competitive and supplemented with detailed inputs and analysis from the MarketsandMarkets data repository and presented in this report.

Smart Agriculture Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall smart agriculture market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

Smart agriculture leverages advanced technologies such as the Internet of Things (IOT), sensors, location tracking systems, robotics, and artificial intelligence (Al) to enable agricultural processes and reduce the manual labour and other resources. This approach aims on improving both the quality and quantity of crop yields while minimizing operational expenses. Moreover, data gathered from these advanced devices delivers valuable insights, that supports farmers to make informed and efficient decisions towards farm management.

Key Stakeholders

-

Agriculture Equipment Component Suppliers

-

Electronics Component and Device Manufacturers

-

Original Equipment Manufacturers (OEMs)

-

Product Manufacturers

-

Agriculture Component and Device Suppliers and Distributors

-

Software, Service, and Technology Providers

-

Standardization and Testing Firms

-

Government Bodies such as Regulatory Authorities and Policymakers

-

Research Institutes and Organizations

-

Market Research and Consulting Firms

-

Agri-food Buyers

Report Objectives

-

To define, analyze and forecast the smart agriculture market size, by agriculture type, offering, farm size, and application in terms of value

-

To define, analyze and forecast the market size, by application, in terms of volume

-

To forecast the market size for various segments with respect to four main regions, namely, Americas, Europe, Asia Pacific, and Rest of the World (RoW)

-

To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the smart agriculture market

-

To study the complete value chain and related industry segments for the market

-

To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

-

To analyze the value chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; investment and funding; impact of Gen AI/AI; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; regulations related to the smart agriculture market; and investment and funding scenario.

-

To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market.

-

To strategically profile the key players and comprehensively analyze their market position in terms of ranking, core competencies, company valuation and financial metrics and product/brand comparison; along with detailing the competitive landscape for the market leaders.

-

To analyze competitive developments such as product launches, brand launches, product developments, collaborations, joint ventures, partnerships, agreements, contracts, acquisitions, expansions and research and development (R&D) activities carried out by players in the smart agriculture market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

-

Detailed analysis and profiling of additional market players (up to 5)

-

Detailed analysis of additional countries (up to 5)

-

Detailed analysis of smart agriculture solutions and services

User

Sep, 2019

Dairy farm automation and livestock monitoring management have picked up its growth in recent years. Application such as early detection of diseases and feeding management is of focus area for ranchers and farm owners. Have you covered these applications for livestock industry in your reserach survey?.

User

Sep, 2019

"Adoption of technologies such as GPS, IoT, remote sensing and AI has witnessed substantial adoption in recent years. I am looking for application areas like Yield monitoring, crop scouting, harvesting management, and crop health analytics.".

User

Sep, 2019

I would like to procure data with breakdown for Asian countries for the smart agricultural report..

User

Nov, 2019

I'm working now on the smart farming in the hay and straw market, if you have something in this topic ill might be interested .

User

Mar, 2019

Have you include aquaculturetechnology in your scope or it is just limited to precision agriculture industry ?.