Agrochemicals Market Mergers & Acquisitions Deal Type (Acquisitions, Agreements, Divestitures, Mergers), Segment (Crop Protection Chemicals, Herbicides, Fungicides, Insecticides), By Crop Type, By Function, and Region - Global Trends & Outlook (2018- 2023)

Agrochemicals Market Mergers & Acquisitions Insights

The global agrochemicals market mergers & acquisitions size is poised to grow US$ 6.1 billion between 2018 to 2023. Large-scale agrochemical manufacturers are collaborating with local companies to increase their market share across various regions, which has posed intense competition to the local players. The agrochemicals market is broadly classified into two categories crop-protection chemicals and others including plant-growth regulators. The global crop protection market is fairly consolidated with the top four companies accounting for over 70% of the market. Syngenta, Bayer, Corteva, and BASF are the market leaders in the global crop protection market. A huge and high-value number of mergers & acquisitions characterizes the global market. Many large-scale agrochemical manufacturers have collaborated in the existing markets

Agrochemicals Mergers and Acquisitions Market Dynamics

Drivers: Strong focus on R&D

R&D has become an integral part of the agriculture sector due to the continuously growing demand for food and decreasing arable land that demands innovative products. Stakeholders are working to develop new products that are safe for the environment and human health; currently, products are more effective and less toxic than their predecessors as most problematic ingredients are screened out early in development.

Restraints: Stringent Regulatory Framework

Three major government agencies that regulate crop protection chemicals are Environmental Protection Agency (EPA), Food & Drugs Administration (FDA), and Food Safety and Inspection Service (FSIS). The regulatory bodies have laid down stringent regulations for producing, labeling, and marketing organic products. The above-mentioned government organizations are responsible for registering the pesticides and regulating their toxicity, usage, and residue levels permitted on food; they also produce a list of banned pesticides.

Opportunities: Strategic initiatives and deals in agriculture sectors

Companies in the agrochemicals market have immense opportunities to enter into strategic agreements that would benefit both companies entering the agreement. Even strategic acquisitions can help companies grow and build a strong platform for themselves in the industry. The trend of mergers, acquisitions, and agreements is changing daily. Now, companies with different specializations and expertise collaborate by sharing their expertise and expanding their businesses together.

Challenges: Volatile energy, commodity, and raw materials prices to inflate operating costs

Fluctuations in commodity prices pose a major challenge to agrochemical companies. It can increase costs and decrease agrochemical sales, thereby affecting companies' overall revenue structure. The chemical manufacturing operations of companies use chemical intermediates for raw materials and energy, which are price volatile due to the increasing costs of oil and natural gas. Farmers are receiving substantial governmental support globally, which could mitigate the potential negative impact on fertilizer demand. Similar is the case for raw material prices for agrochemical companies.

By deal type, the agreements segment occupies the second-largest market share during the forecast period

Based on deal type, the agreements segment occupies the second-largest significant share in the agrochemicals mergers and acquisitions market. Agreements are a type of trade deal in which two or more companies come together for a specific trade, commerce, transit, or investment. Agreements helps all the stakeholders to have their standalone market share and at the same time share individual expertise to enhance the growth in the market.

By segment, the fungicides segment is estimated to occupy the second-largest market share in terms of value

By segment, the fungicides segment deal occupied the second-largest market share in the "agrochemicals mergers and acquisitions market. The need for fungicides is increasing due to rising organic farming, which gives rise to need for fungicides products. The major deals in the fungicides segments help the players to invest and innovate products that are being brought to the market.

To know about the assumptions considered for the study, download the pdf brochure

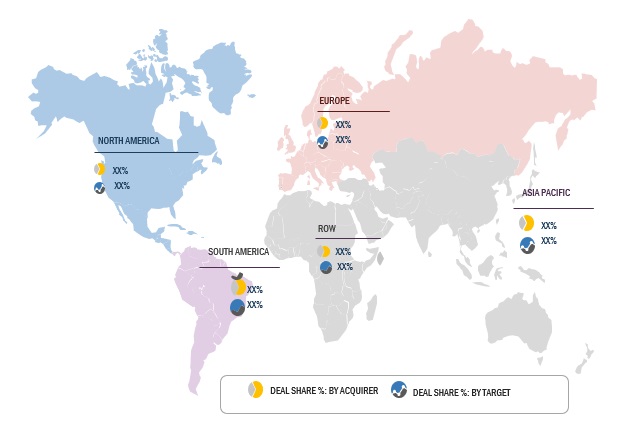

Asia Pacific deals share by the target is high due to the availability of large arable land and high dependency on agriculture. Major crops like rice, soybean, and wheat are majorly produced in the Asia Pacific region with the presence of agricultural economies like China, India, and Japan. The post-harvest damage and surging crop cultivation are the major factors increasing the demand for agrochemicals. Overall, these trends fueling the demand for strategic deals among players operating in the agrochemical market in the region. Key players in the market include BASF SE (Germany), Syngenta AG (Switzerland), Bayer CropSciences (Germany), and Corteva Agrisceinces (US).

Scope of the Report:

This research report categorizes the agrochemicals mergers & acquisitions market based on deal type, segments, and region

By Deal Type

- Acquisitions

- Agreements

- Divestitures

- Merger

- Other

By Segment

- Crop Protection Chemicals

- Herbicides

- Fungicides

- Insecticides

- Others

By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In June 2022, K+S signed an agreement with Cinis Fertilizer for the synthetic production of SOP. K+S intended to supply Cinis Fertilizer with its entire MOP requirements. In return, K+S Aktiengesellschaft could purchase up to 600,000 tons of SOP per year from Cinis Fertilizer.

- In July 2021, Syngenta Crop Protection announced the signing of a contract to acquire Dipagro, a distributor of agricultural inputs in the Brazilian state of Mato Grosso. This move would increase farmers’ access to Syngenta’s technologies and services in a region experiencing rapid agricultural growth.

- In May 2021, ADAMA acquired a 51% stake in Huifeng’s newly established wholly-owned subsidiary, ADAMA Huifeng (Jiangsu) Co., Ltd, which incorporated Huifeng’s key crop protection synthesis and formulation facilities.

Frequently Asked Questions (FAQ):

Which are the major agrochemicals mergers and acquisitions market deal types considered in this study, and which segments are projected to have promising growth rates in the future?

All the major agrochemical deal types such as acquisitions, agreements, mergers, partnerships, etc., are considered in the scope of the study. Acquisitions currently account for a dominant share in the agrochemical mergers and acquisitions market, and the segment is projected to experience a significant growth rate in the next five years.

I wanted to understand the region-wise deal type What all information would be included in the same?

Yes, customization for the region-wise market for various segments can be provided on various aspects, including type, market scope, top companies etc. Exclusive insights on below region can be provided:

- North America

- Europe

- Asia Pacific

- RoW

What are some drivers fueling the growth of the agrochemicals mergers and agrochemicals market?

Global agrochemicals mergers and acquisitions market is characterized by the following drivers:

Drivers: Increasing need for food security due to climatic changes and decrease in arable land

Food security is a big problem in developing countries, where the poverty rate is high, and people cannot afford good and nutritious food. Similar is the case in highly populated countries such as China and India. Thus, the production of nutritious and high-yield crops is necessary. Agrochemical products help reduce crop damage resulting in higher crop yield, which is then used to satisfy the increasing food demand of the population.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of the research methodology can be provided over a scheduled call; it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market, including:

- Bottom-up approach

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 BIG FOUR AGROCHEMICALS CORPORATIONS

- 5.3 SEGMENT SHARE ANALYSIS: HERBICIDES SEGMENT TO HOLD LARGEST MARKET SHARE

- 5.4 CROP SHARE ANALYSIS: CEREALS AND GRAINS SEGMENT TO DOMINATE MARKET

-

5.5 MARKET DYNAMICSDRIVERS- Strong focus on R&D- Robust growth in emerging markets due to advancements in farming technologies- Increasing need for food security due to climatic changes and decrease in arable land- Growth of horticulture and floricultureRESTRAINTS- Infringement of intellectual property rights- Stringent regulatory framework- Environmental concerns regarding excessive use of agrochemicals- High liabilities on major agrochemicals companiesOPPORTUNITIES- Strategic initiatives and deals in agriculture sector- Introduction of modern technology to help address problems faced in agrochemicals marketCHALLENGES- Volatile energy, commodity, and raw material prices to inflate operating costs

- 6.1 INTRODUCTION

- 6.2 PRICING TRENDS

- 6.3 PRIORITY FACTORS OF MERGERS & ACQUISITIONS IN AGROCHEMICALS MARKET, BY REGION

-

6.4 OPERATIONAL CHALLENGES IN AGROCHEMICALS MARKETHIGH RESEARCH & DEVELOPMENT COSTSREGION-WISE GROWTH STAGES OF AGROCHEMICALS MARKETLACK OF AWARENESS REGARDING ADVANCED TECHNICAL EXPERTISE AMONG FARMERSINCREASE IN AGRICULTURAL PRODUCTIONGROWING DEMAND FOR INTEGRATED PEST MANAGEMENT & ORGANIC FARMING

- 8.1 SPECIFIC CHANGES IN VALUE CHAIN

-

8.2 INTEGRATION CHALLENGESACCESS TO RAW MATERIALSTARGET LARGE-SCALE PLAYERS FOR EASY CUSTOMER ACCESSCUSTOMIZATION OF PRODUCT PORTFOLIOGROWTH IN COMPANIES’ MARKET SHARE GLOBALLYCONCLUSION

- 9.1 GLOBAL AGROCHEMICALS MARKET DEALS: VALUE ANALYSIS

-

9.2 CASE STUDIESSUMITOMO CHEMICAL COMPANY AND NUFARM LTD.: ACQUISITIONACQUISITION OF UPL LTD. AND ARYSTA LIFESCIENCES INC.

- 11.1 FUTURE LANDSCAPE OF AGROCHEMICALS MARKET

- 11.2 HERBICIDES SEGMENT: MERGERS & ACQUISITIONS OUTLOOK

- 11.3 FUNGICIDES SEGMENT: MERGERS & ACQUISITIONS OUTLOOK

- 11.4 INSECTICIDES SEGMENT: MERGERS & ACQUISITIONS OUTLOOK

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 FUNGICIDES MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.4 HERBICIDE SAFENER MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.5 AGROCHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

13.6 CROP PROTECTION CHEMICALS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019–2021

- TABLE 3 AGROCHEMICALS MERGERS & ACQUISITIONS MARKET CONSOLIDATION, 2019–2022

- TABLE 4 MERGERS, ACQUISITIONS, ALLIANCES, AGREEMENTS, AND DIVESTITURES BY AGROCHEMICAL COMPANIES, 2018–2022

- TABLE 5 LIST OF AGROCHEMICAL COMPANY MERGERS, ACQUISITIONS, ALLIANCES, AGREEMENTS, AND DIVESTITURES, JANUARY 2019 TO JANUARY 2023

- TABLE 6 ADJACENT MARKETS TO AGROCHEMICALS MARKET MERGERS & ACQUISITIONS

- TABLE 7 FUNGICIDES MARKET, BY TYPE, 2017–2021 (USD MILLION)

- TABLE 8 FUNGICIDES MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 9 HERBICIDE SAFENER MARKET, BY HERBICIDE SELECTIVITY, 2016–2021 (USD MILLION)

- TABLE 10 HERBICIDES SAFENER MARKET, BY HERBICIDE SELECTIVITY, 2022–2027 (USD MILLION)

- TABLE 11 GLOBAL AGROCHEMICALS MARKET, BY PESTICIDE TYPE, 2018–2025 (USD MILLION)

- TABLE 12 CROP PROTECTION CHEMICALS MARKET, BY ORIGIN, 2016–2019 (USD MILLION)

- TABLE 13 CROP PROTECTION CHEMICALS MARKET, BY ORIGIN, 2020–2025 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 AGROCHEMICALS MERGERS & ACQUISITIONS MARKET: RESEARCH DESIGN

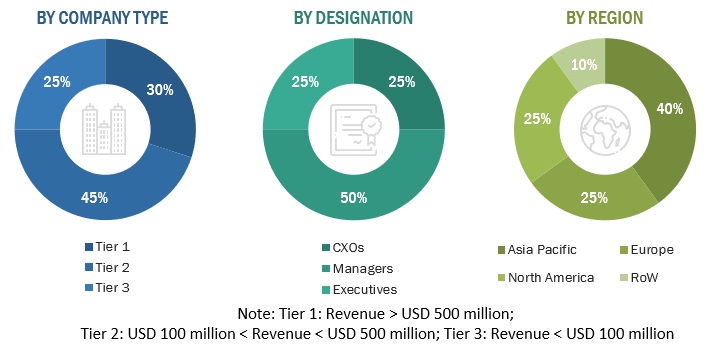

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET ANALYSIS: RESEARCH APPROACH

- FIGURE 5 AGROCHEMICAL MERGERS & ACQUISITIONS MARKET DEAL SIZE ESTIMATION: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 RESEARCH ASSUMPTIONS CONSIDERED

- FIGURE 8 LIMITATIONS AND RISK ASSESSMENT

- FIGURE 9 AGROCHEMICALS MARKET FUTURISTIC LANDSCAPE (2018–2023)

- FIGURE 10 AGROCHEMICALS MARKET: POTENTIAL REGIONS FOR MERGERS & ACQUISITIONS, 2018–2023

- FIGURE 11 SHARE OF MAJOR PLAYERS IN AGROCHEMICALS MARKET

- FIGURE 12 COST OF LAUNCHING AGROCHEMICAL PRODUCTS, 2014 VS. 2019

- FIGURE 13 VALUE OF DEALS UNDERTAKEN BY KEY PLAYERS, 2018–2023 (USD MILLION)

- FIGURE 14 AGROCHEMICALS MARKET, COMPANY REVENUE SHARE, 2021

- FIGURE 15 AGROCHEMICALS MARKET SHARE ANALYSIS, BY SEGMENT, 2020 (USD MILLION)

- FIGURE 16 AGROCHEMICALS MARKET SHARE ANALYSIS, BY CROP, 2020 (USD MILLION)

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AGROCHEMICALS MARKET

- FIGURE 18 AGROCHEMICALS PRICE TREND IN CHINA, 2017–2020 (USD/TON)

- FIGURE 19 MERGERS & ACQUISITIONS PRIORITY IN AGROCHEMICALS, BY REGION

- FIGURE 20 OPERATIONAL CHALLENGES FACED BY AGROCHEMICALS VENDORS

- FIGURE 21 PUBLIC SECTOR INVESTMENT IN AGRICULTURAL RESEARCH & DEVELOPMENT, 1970–2020

- FIGURE 22 AGROCHEMICALS MARKET REGION-WISE GROWTH

- FIGURE 23 PRIVATE SECTOR EXPENDITURE IN AGRICULTURAL AND FOOD RESEARCH, 1970–2019 (USD MILLION)

- FIGURE 24 AGROCHEMICALS MARKET VALUE CHAIN

- FIGURE 25 AGROCHEMICALS PRODUCT VALUE CHAIN

- FIGURE 26 GLOBAL AGROCHEMICALS MARKET DEAL VALUE ANALYSIS: TOP SEVEN DEALS (2018 – 2023)

- FIGURE 27 GLOBAL AGROCHEMICALS MARKET GROWTH (2018 – 2022)

- FIGURE 28 GLOBAL AGROCHEMICALS MARKET SHARE, BY COMPANY 2018 VS. 2021

- FIGURE 29 AGROCHEMICALS MARKET M&A ACTIVITY BY DEAL TYPE (2018 – 2022)

- FIGURE 30 GLOBAL DEAL SHARE BY SEGMENTS (2019 – 2023)

- FIGURE 31 DEALS IN GLOBAL AGROCHEMICALS MARKET BY REGION, ACQUIRER, AND TARGET (2019 – 2023)

- FIGURE 32 DEALS IN GLOBAL AGROCHEMICALS MARKET, BY REGION ACQUIRER, AND TARGET (2018 – 2023)

- FIGURE 33 SUMITOMO CHEMICAL COMPANY AND NUFARM LTD.: ACQUISITION

- FIGURE 34 IMPACT OF ACQUISITION OF SUMITOMO CHEMICAL COMPANY AND NUFARM LTD., INFLUENCE ON STOCK PRICES

- FIGURE 35 ACQUISITION OF UPL LTD. AND ARYSTA LIFESCIENCES INC.

- FIGURE 36 IMPACT OF ACQUISITION OF UPL LTD., AND ARYSTA LIFESCIENCE INC., INFLUENCE ON STOCK PRICES

- FIGURE 37 NEED FOR MERGERS & ACQUISITIONS IN AGROCHEMICALS MARKET

- FIGURE 38 PORTFOLIO GAP ANALYSIS OF KEY COMPANIES IN OVERALL AGROCHEMICALS MARKET, 2022

- FIGURE 39 PORTFOLIO GAP ANALYSIS OF KEY COMPANIES IN INSECTICIDES SEGMENT, 2022

- FIGURE 40 PORTFOLIO GAP ANALYSIS OF KEY COMPANIES IN HERBICIDES SEGMENT, 2022

- FIGURE 41 PORTFOLIO GAP ANALYSIS OF KEY COMPANIES IN FUNGICIDES SEGMENT, 2022

- FIGURE 42 HERBICIDES TO COME OFF-PATENT, 2018–2030

- FIGURE 43 FUNGICIDES TO COME OFF-PATENT, 2018–2030

- FIGURE 44 INSECTICIDES TO COME OFF-PATENT, 2018–2030

- FIGURE 45 AGROCHEMICALS PATENT TO EXPIRE DURING 2018 - 2030

- FIGURE 46 AGROCHEMICALS COMPANY-WISE PATENT TO EXPIRE BETWEEN 2018 – 2030

- FIGURE 47 MAJOR CROPS TO BE TARGETED FOR AGROCHEMICAL DEVELOPMENT

The study involved exhaustive secondary research to collect information on the agrochemicals market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both demand-side and supply-side approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as the Food and Agriculture Organization (FAO), Food and Drug Administration (FDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), Food Safety and Standards Authority of India (FSSAI), Food Standards Agency, Agency for Healthcare Research and Quality (AHRQ), were referred to identify and collect information for this study. These secondary sources included annual reports, web releases, investor presentations of companies, news articles, journals, and paid databases.

Primary Research

The agrochemicals market comprises several stakeholders, such as pesticides, fertilizer manufacturers, formulators, & blenders, pesticides, fertilizers traders, suppliers, distributors, importers, exporters, end users, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Given below is the breakdown of the primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Agrochemicals Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total deal size of the agrochemicals mergers & acquisitions market. These methods were also used extensively to estimate the size of various subsegments in the agrochemicals market. The research methodology used to estimate the deal size includes the following:

- The deal values of the key players in the industry and markets have been identified through extensive secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- Research included the study of the reports, reviews, and newsletters of top market players along with extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—the top-down approach, the bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points match, the data is assumed to be correct.

Report Objectives

- To define, segment, and project the global market size for the taste modulators market based on application, type, and regions over a historical period ranging from 2019 to 2021 and a forecast period ranging from 2022 to 2027

- To provide detailed information about the key factors influencing the growth of the agrochemicals market mergers & acquisitions (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to five regions (along with their respective key countries): North America, Europe, Asia Pacific, South America, and the Rest of the World

- To strategically profile the key players and comprehensively analyze their core competencies

- To analyze competitive developments, such as expansions, mergers & acquisitions, and new product launches in the taste modulators market

Target Audience:

- Raw material suppliers

- Pesticides & fertilizer manufacturers

- Regulatory bodies

- Government agencies and NGOs

- Pesticide and fertilizer traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to manufacturers

- Agricultural cooperative societies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agrochemicals Market