Additive Manufacturing Market , By Application (Medical Devices, Automotives, & Aerospace) and Technology (3D Printing, Laser Sintering, Stereolithography, Fused Deposition Modeling, Electron Beam Melting, & Tissue Engineering) - Forecast (2012 - 2017)

Additive manufacturing is an automatic process used to create rapid prototypes and functional end-use parts. It takes virtual designs from Computer Aided Design (CAD) software, and transforms them into thin, virtual, horizontal layer-wise cross-sections, until the model is complete. The AM is a potentially growing market in every manufacturing sector with a global additive manufacturing market of $1,843.2 million in 2012 and is expected to grow at a CAGR of 13.5% to reach $3,471.9 million by 2017.

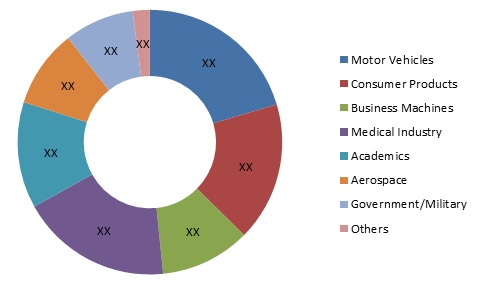

The global devices market has been segmented into different areas such as, automotives, consumer products, business machines, medical, academic, aerospace, government/military and others. Automotives or motor vehicles account for the largest share in this market, primarily due to the easy applications of 3D printing in the production of end-products (engines, spare parts, other interior, and exterior parts) as compared to other segments such as consumer products and business machines, which have limited usage in manufacturing of end-products. Rising healthcare expenditure in emerging economies provide growth opportunities for the AM technologies, as new healthcare facilities have come up in these areas.

New and improved technologies, financial support from governments, large application area, rapid product development at a low cost, and ease of development of custom products are the major drivers that are slated to propel additive manufacturing market. However, a few pivotal factors restraining the growth of this market are regulatory hurdles in different countries, material characterization during development, and process control and understanding.

In this report, we are mainly focusing on medical applications of AM. Within the medical industry, additive manufacturing is used in making end-products such as surgical equipments, prosthetics & implants, and scaffolds. The additive manufacturing market is growing due to the rising incidence of surgeries, coupled with increasing awareness and advances in technology. Surgical equipments account for the largest share in this market due to their wide applicability.

Europe dominates the AM for medical devices market in 2012, followed by North America. However, adoption of novel technologies in the medical field is gaining momentum at a fast pace in emerging nations due to growing educational and awareness efforts of industry players among physicians and patients. Moreover, increasing healthcare expenditure, growing income levels, low cost of manufacturing, rapid product development, growing surgical procedures in lieu with medical tourism, and lesser competition than mature countries, have amplified interest of market players in emerging markets.

The key players in this market are 3D Systems Corporation (U.S.), 3T RPD (U.K.), Arcam AB (Sweden), Biomedical Modeling, Inc. (U.S.), Envisiontec GmbH (Germany), EOS GmbH Electro Optical Systems (Germany), Fcubic AB (Sweden), GPI Prototype and Manufacturing Services, Inc. (U.S.), Greatbatch, Inc. (U.S.), Layerwise NV (Belgium), Limacorporate SPA (Italy), Materialise NV (Belgium), Medical Modeling, Inc. (U.S.), and others.

Scope of the Report

This research report categorizes the global additive manufacturing market into the following:

Global 3D Printing Market, by industry

- Automotives

- Consumer products

- Business machines

- Medical

- Academic

- Aerospace

- Government/military

- Others

Global Additive Manufacturing Market for medical devices, by materials

- Homogeneous materials

- Polymers

- Metals

- Natural materials

- Ceramics

- Heterogeneous materials

- Polymeric matrix

- Metallic matrix

- Ceramic matrix

- Multiple materials

Global 3D Printing for medical devices market

- By Products

- Surgical equipment

- Surgical guides

- surgical instruments

- Prosthetics & implants

- Orthopedic implants

- Dental implants

- Cranio-maxillofacial implants

- Tissue engineering

- Porous tissue engineering scaffolds

- Surgical equipment

- By Technology

- Electron Beam Melting (EBM)

- Laser Beam Melting (LBM)

- Direct Metal Laser Sintering (DMLS)

- Selective Laser Melting (SLM)

- Selective Laser Sintering (SLS)

- Laser Cusing

- Photopolymerization

- Digital Light Processing

- Stereolithography

- Two-Photon Polymerization

- Droplet Deposition (DD) or Extrusion based technologies

- Low-temperature Deposition Manufacturing (LDM)

- Multiphase Jet Solidification (MJS)

- Fused Deposition Modeling (FDM)

- Three Dimensional Printing (3DP) or Adhesion Bonding

- By Application

- Orthopaedic

- Dental

- Cranio-Maxillofacial

- Bio-Engineering

- By Geography

- North America

- Europe

- Asia

- RoW (Middle East, Africa, Russia, and Latin America)

Application of material used in 3D printing for medical products, by materials

- Homogeneous materials

- Polymers

- Metals

- Natural materials

- Ceramics

- Heterogeneous materials

- Polymeric matrix

- Metallic matrix

- Ceramic matrix

- Multiple materials

According to the American Society for Testing and Materials (ASTM), additive manufacturing is the process of joining materials to make objects from 3D model data, usually layer upon layer. Various synonyms generally used for AM are additive fabrication, additive processes, additive techniques, additive layer manufacturing, layer manufacturing, and freeform fabrication. The AM market can be applied in various industries such as motor vehicles, consumer products, business machines, medical, academic, aerospace, government/military, and others (architecture, paleontology, and forensic pathology). In this report, we are mainly focusing on the medical applications of AM.

Additive manufacturing for medical devices market is studied by dividing the overall market on the basis of industry, materials, products, technology and application. Traditionally additive manufacturing in the medical field was considered as a technique for the production of prototypes or model. However, with the development of more biocompatible materials and advanced technologies, the market has started showing a preference for additive manufacturing of 3D products. The biggest advantage of additive manufacturing technologies over traditional manufacturing technologies is that they allow rapid production of parts at low costs. It is possible to achieve better accuracy and complexity in products through additive manufacturing as compared to traditional manufacturing methods. The market is also showing preference towards new applications of additive manufacturing such as in tissue engineering and organ printing for the continuum of advantages offered by them over traditional techniques. The principal advantages of these procedures over traditional manufacturing is short product development time, better patient recovery, development of patient or surgeon specific products, low manufacturing costs, and better accuracy.

Technological innovations in 3d printing have been witnessed over the past few years. Newer surgical products manufactured from AM, with better safety and efficacy attributes, contribute to the widespread adoption of the additive manufacturing in medical by physicians and patients worldwide.

The penetration rate of additive manufacturing for the medical devices market is faltering in emerging markets. However, established companies and new entrants in the additive manufacturing for medical devices market should consider these GDP growth rates, ease of product approval, increasing procedural volumes, and low penetration rates compared to mature markets, as the driving opportunistic factors that will plant the seed for future possible success for such companies.

Europe accounts for the largest market share of the global additive manufacturing for medical devices market in 2012, followed by North America. In the future, it is estimated that the share of the European region will decrease, attributable to lowering device prices, regulatory pressures, and increasing focus of players towards emerging markets in the Asian and Latin American regions.

Global Additive Manufacturing (3D Printing) Market Share, By Industry, 2012 (%)

Source: MarketsandMarkets Analysis

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 MARKET SHARE

1.5.3 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.4 KEY DATA POINTS FROM PRIMARY SOURCES

1.5.5 ASSUMPTIONS

2 EXECUTIVE SUMMARY

3 ADDITIVE MANUFACTURING (3D PRINTING) MARKET OVERVIEW

3.1 INTRODUCTION

3.2 MARKET SEGMENTATION

3.2.1 GLOBAL MARKET, BY INDUSTRY TYPE

3.2.2 GLOBAL MARKET, BY MATERIALS

3.2.3 GLOBAL ADDITIVE MANUFACTURING SYSTEMS MARKET, BY VALUE & VOLUME ANALYSIS

3.2.4 GLOBAL AM FOR MEDICAL DEVICES MARKET SEGMENTATION

3.2.4.1 By Products

3.2.4.2 By Technology

3.2.4.3 By Application

3.3 MARKET DYNAMICS

3.3.1 DRIVERS

3.3.1.1 New & improved technologies

3.3.1.2 Financial support from Governments

3.3.1.3 Large application area

3.3.1.4 Rapid product development at a low cost

3.3.1.5 Ease of development of custom products

3.3.2 RESTRAINTS

3.3.2.1 Regulatory hurdles in different countries

3.3.2.2 Material development & characterization

3.3.2.3 Process control & understanding

3.3.3 OPPORTUNITIES & THREATS

3.3.3.1 Rising of global AM market

3.3.3.2 Participation of small companies

3.3.3.3 Positive growth by mergers & acquisitions

3.3.3.4 Emerging research & development

3.3.4 TRENDS

3.4 UPCOMING TECHNOLOGIES

3.5 MARKET SHARE ANALYSIS

3.5.1 BY MATERIALS

3.5.2 BY TECHNOLOGY

3.5.3 BY APPLICATION

3.5.4 BY GEOGRAPHY

3.5.5 AM FOR MEDICAL DEVICES MARKET, BY PLAYERS

3.5.6 ADDITIVE MANUFACTURING END PRODUCTS MARKET IN MEDICAL SEGMENT, BY PLAYERS

4 GLOBAL ADDITIVE MANUFACTURING (3D PRINTING) MARKET, BY INDUSTRY TYPE

4.1 INTRODUCTION

4.2 MOTOR VEHICLES

4.3 CONSUMER PRODUCTS

4.4 BUSINESS MACHINES

4.5 MEDICAL INDUSTRY

4.6 ACADEMICS

4.7 AEROSPACE

4.8 GOVERNMENT/MILITARY

4.9 OTHERS (ARCHITECTURE, PALEONTOLOGY & FORENSIC PATHOLOGY)

5 GLOBAL ADDITIVE MANUFACTURING MARKET FOR MEDICAL DEVICES, BY MATERIALS

5.1 INTRODUCTION

5.2 HOMOGENEOUS MATERIALS

5.2.1 POLYMERS

5.2.2 METALS

5.2.3 CERAMICS

5.2.4 NATURAL MATERIALS

5.3 HETEROGENEOUS MATERIALS

5.3.1 POLYMERIC MATRIX

5.3.2 METALLIC MATRIX

5.3.3 MULTIPLE MATERIALS

5.4 APPLICATION OF MATERIAL USED IN ADDITIVE MANUFACTURING FOR MEDICAL PRODUCTS

6 GLOBAL ADDITIVE MANUFACTURING (3D PRINTING) MARKET (VALUE & VOLUME ANALYSIS)

6.1 INTRODUCTION

6.1.1 3D PRINTERS

6.1.2 3D BIO-PRINTERS

7 GLOBAL ADDITIVE MANUFACTURING (3D PRINTING) MARKET, BY PRODUCTS

7.1 INTRODUCTION

7.2 SURGICAL EQUIPMENT

7.2.1 SURGICAL GUIDES

7.2.1.1 Dental guides

7.2.1.2 Cranio-Maxillofacial (CMF) guides

7.2.1.3 Orthopedic guides

7.2.2 SURGICAL INSTRUMENTS

7.2.2.1 Retractors

7.2.2.2 Scalpels

7.2.2.3 Surgical fasteners

7.2.3 PROSTHETICS & IMPLANTS

7.2.3.1 Standard implants

7.2.3.1.1 Standard orthopedic implants

7.2.3.1.2 Standard dental implants

7.2.3.1.3 Standard cranio-maxillofacial implants

7.2.3.2 Custom implants

7.2.3.2.1 Custom orthopedic implants

7.2.3.2.2 Custom dental implants

7.2.3.2.3 Custom cranio-maxillofacial implants

7.2.4 TISSUE ENGINEERING

7.2.4.1 Porous scaffolds

7.2.4.1.1 Bone & cartilage scaffolds

7.2.4.1.2 Ligament & tendon scaffolds

8 GLOBAL ADDITIVE MANUFACTURING (3D PRINTING) MARKET, BY TECHNOLOGY

8.1 INTRODUCTION

8.2 ELECTRON BEAM MELTING (EBM)

8.3 LASER BEAM MELTING

8.3.1 DIRECT METAL LASER SINTERING (DMLS)

8.3.2 SELECTIVE LASER MELTING (SLM)

8.3.3 SELECTIVE LASER SINTERING (SLS)

8.3.4 LASER CUSING

8.4 PHOTOPOLYMERIZATION

8.4.1 DIGITAL LIGHT PROCESSING (DLP)

8.4.2 STEREOLITHOGRAPHY (SLA)

8.4.3 TWO-PHOTON POLYMERIZATION (2PP)

8.5 DROPLET DEPOSITION (DD) OR EXTRUSION-BASED TECHNOLOGIES

8.5.1 LOW-TEMPERATURE DEPOSITION MANUFACTURING (LDM)

8.5.2 MULTIPHASE JET SOLIDIFICATION (MJS)

8.5.3 FUSED DEPOSITION MODELING (FDM)

8.5.4 THREE DIMENSIONAL PRINTING (3DP) OR ADHESION BONDING

9 GLOBAL ADDITIVE MANUFACTURING (3D PRINTING) MARKET, BY APPLICATION

9.1 INTRODUCTION

9.2 ORTHOPEDIC

9.2.1 STANDARD ORTHOPEDIC IMPLANTS

9.2.2 CUSTOM ORTHOPEDIC IMPLANTS

9.3 DENTAL

9.3.1 STANDARD DENTAL IMPLANTS

9.3.2 CUSTOM DENTAL IMPLANTS

9.4 CRANIO-MAXILLOFACIAL

9.4.1 STANDARD CRANIO-MAXILLOFACIAL IMPLANTS

9.4.2 CUSTOM CRANIO-MAXILLOFACIAL IMPLANTS

9.5 BIO-ENGINEERING

9.5.1 BONE & CARTILAGE POROUS SCAFFOLDS

9.5.2 LIGAMENT & TENDON POROUS SCAFFOLDS

10 GEOGRAPHIC ANALYSIS

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.3 EUROPE

10.4 ASIA

10.5 ROW

11 COMPETITIVE LANDSCAPE

11.1 INTRODUCTION

11.2 MERGERS & ACQUISITIONS

11.3 NEW PRODUCT LAUNCHS

11.4 APPROVALS

11.5 EXPANSIONS

11.6 INSTALLATIONS

12 COMPANY PROFILES (OVERVIEW, FINANCIALS, PRODUCTS & SERVICES, STRATEGY, & DEVELOPMENTS)*

12.1 3D SYSTEMS CORPORATION

12.2 3T RPD, LTD.

12.3 ARCAM AB

12.4 BIOMEDICAL MODELING, INC.

12.5 ENVISIONTEC GMBH

12.6 EOS GMBH ELECTRO OPTICAL SYSTEMS

12.7 FCUBIC AB

12.8 GPI PROTOTYPE& MANUFACTURING SERVICES, INC.

12.9 GREATBATCH, INC.

12.10 LAYERWISE NV

12.11 LIMACORPORATE S.P.A.

12.12 MATERIALISE NV

12.13 MEDICAL MODELING, INC.

12.14 MORRIS TECHNOLOGIES, INC.

12.15 OBJET, LTD.

12.16 RENISHAW, PLC

12.17 SIRONA DENTAL SYSTEMS

12.18 SLM SOLUTIONS GMBH

12.19 STRATASYS, INC.

12.20 SURGIVAL-GRUPO COSΝAS

12.21 XILLOC MEDICAL B.V.

*DETAILS ON FINANCIALS, PRODUCT & SERVICES, STRATEGY, & DEVELOPMENTS MIGHT NOT BE CAPTURED IN CASE OF UNLISTED COMPANIES.

LIST OF TABLES

TABLE 1 GLOBAL ADDITIVE MANUFACTURING DEVICES MARKET REVENUE, BY INDUSTRY TYPE, 2010 2017 ($MILLION)

TABLE 2 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 3 GLOBAL ADDITIVE MANUFACTURING DEVICES MARKET REVENUE, BY INDUSTRY TYPE, 2010 2017 ($MILLION)

TABLE 4 GLOBAL MARKET REVENUE, BY MATERIALS, 2010 2017 ($MILLION)

TABLE 5 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY MATERIALS, 2010 2017 ($MILLION)

TABLE 6 GLOBAL ADDITIVE MANUFACTURING HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 7 ADDITIVE MANUFACTURING HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 8 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES POLYMER MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 9 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES METAL MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 10 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CERAMIC MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 11 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES NATURAL MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 12 GLOBAL ADDITIVE MANUFACTURING HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 13 ADDITIVE MANUFACTURING HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 14 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES POLYMERIC MATRIX MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 15 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES METALLIC MATRIX MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 16 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CERAMIC MATRIX MATERIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 17 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MULTIPLE MATERIALS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 18 CLASSIFICATION OF BIO-MATERIALS USED FOR ADDITIVE MANUFACTURING OF MEDICAL DEVICES

TABLE 19 ADDITIVE MANUFACTURING 3D PRINTERS/SYSTEMS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 20 ADDITIVE MANUFACTURING 3D PRINTERS/SYSTEMS MARKET VOLUME, BY GEOGRAPHY, 2010 2017 (NO. OF UNITS)

TABLE 21 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 22 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL EQUIPMENT MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 23 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL EQUIPMENT MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 24 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL GUIDES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 25 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL GUIDES MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 26 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES DENTAL GUIDES MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 27 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CRANIO-MAXILLOFACIAL GUIDES MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 28 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES ORTHOPEDIC GUIDES MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 29 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL INSTRUMENTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 30 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL INSTRUMENTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 31 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES, RETRACTORS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 32 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SCALPELS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 33 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES SURGICAL FASTENERS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 34 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES PROSTHETICS & IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 35 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES PROSTHETICS & IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 36 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES, STANDARD IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 37 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES STANDARD IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 38 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES STANDARD ORTHOPEDIC IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 39 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES STANDARD DENTAL IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 40 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES STANDARD CRANIO-MAXILLOFACIAL IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 41 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CUSTOM IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 42 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CUSTOM IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 43 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CUSTOM ORTHOPEDIC IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 44 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CUSTOM DENTAL IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 45 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES CUSTOM CRANIO-MAXILLOFACIAL IMPLANTS MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 46 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES TISSUE ENGINEERING MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 47 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY TECHNOLOGY, 2010 2017 ($MILLION)

TABLE 48 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES LASER BEAM MELTING MARKET REVENUE, BY TECHNOLOGY, 2010 2017 ($MILLION)

TABLE 49 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES PHOTOPOLYMERIZATION MARKET REVENUE, BY TECHNOLOGY, 2010 2017 ($MILLION)

TABLE 50 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES DROPLET DEPOSITION/EXTRUSION BASED MARKET REVENUE, BY TECHNOLOGY, 2010 2017 ($MILLION)

TABLE 51 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY APPLICATION, 2010 2017 ($MILLION)

TABLE 52 ADDITIVE MANUFACTURING (3D PRINTING) MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 53 ADDITIVE MANUFACTURING (3D PRINTING) ORTHOPEDIC MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 54 GLOBAL ADDITIVE MANUFACTURING (3D PRINTING) DENTAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 55 ADDITIVE MANUFACTURING (3D PRINTING) CRANIO-MAXILLOFACIAL MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 56 ADDITIVE MANUFACTURING (3D PRINTING) BIO-ENGINEERING MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 57 ADDITIVE MANUFACTURING (3D PRINTING) MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 58 ADDITIVE MANUFACTURING (3D PRINTING) MARKET REVENUE, BY GEOGRAPHY, 2010 2017 ($MILLION)

TABLE 59 NORTH AMERICA: ADDITIVE MANUFACTURING (3D PRINTING) MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 60 NORTH AMERICA: AM (3D PRINTING) SURGICAL EQUIPMENT MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 61 NORTH AMERICA: AM (3D PRINTING) PROSTHETICS & IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 62 NORTH AMERICA: AM (3D PRINTING) MARKET REVENUE, BY APPLICATION, 2010 2017 ($MILLION)

TABLE 63 NORTH AMERICA: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY MATERIALS, 2010 2012 ($MILLION)

TABLE 64 NORTH AMERICA: AM HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 65 NORTH AMERICA: AM HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 66 EUROPE: AM (3D PRINTING) MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 67 EUROPE: AM (3D PRINTING) SURGICAL EQUIPMENT MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 68 EUROPE: AM (3D PRINTING) PROSTHETICS & IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 69 EUROPE: ADDITIVE MANUFACTURING MEDICAL DEVICES MARKET REVENUE, BY APPLICATION, 2010 2017 ($MILLION)

TABLE 70 EUROPE: AM (3D PRINTING) MARKET REVENUE, BY MATERIALS, 2010 2012 ($MILLION)

TABLE 71 EUROPE: AM HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 72 EUROPE: AM HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 73 ASIA: AM (3D PRINTING) MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 74 ASIA: AM (3D PRINTING) SURGICAL EQUIPMENT MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 75 ASIA: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES PROSTHETICS & IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 76 ASIA: AM (3D PRINTING) MARKET REVENUE, BY APPLICATION, 2010 2017 ($MILLION)

TABLE 77 ASIA: AM (3D PRINTING) MARKET REVENUE, BY MATERIALS, 2010 2012 ($MILLION)

TABLE 78 ASIA: AM HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 79 ASIA: AM HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 80 ROW: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 81 ROW: AM (3D PRINTING) SURGICAL EQUIPMENT MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 82 ROW: AM (3D PRINTING) PROSTHETICS & IMPLANTS MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 83 ROW: AM (3D PRINTING) MARKET REVENUE, BY APPLICATION, 2010 2017 ($MILLION)

TABLE 84 ROW: AM (3D PRINTING) MARKET REVENUE, MATERIALS, 2010 2012 ($MILLION)

TABLE 85 ROW: HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 86 ROW: HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2010 2017 ($MILLION)

TABLE 87 MERGERS & ACQUISITIONS, 2009 2012

TABLE 88 AGREEMENTS, PARTNERSHIPS, COLLABORATIONS, & JOINT VENTURES, 2009 2012

TABLE 89 NEW PRODUCT LAUNCHS, 2009 2012

TABLE 90 APPROVALS, 2009 2012

TABLE 91 EXPANSIONS, 2009 2012

TABLE 92 INSTALLATIONS, 2009 2012

TABLE 93 OTHER DEVELOPMENTS, 2009 2012

TABLE 94 3D SYSTEMS CORPORATION: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 95 3D SYSTEMS CORPORATION: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 96 3D SYSTEMS CORPORATION: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 97 ARCAM AB: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 98 ARCAM AB: TOTAL REVENUE, BY SEGMENTS, 2010 2011 ($MILLION)

TABLE 99 GREATBATCH, INC.: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 100 GREATBATCH, INC.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 101 GREATBATCH, INC.: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 102 MATERIALISE NV: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 103 OBJET LTD.: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 104 OBJET LTD.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 105 RENISHAW, PLC: TOTAL REVENUE AND R&D EXPENDITURE, 2010 2012 ($MILLION)

TABLE 106 RENISHAW, PLC: TOTAL REVENUE, BY SEGMENTS, 2010 2012 ($MILLION)

TABLE 107 RENISHAW, PLC: TOTAL REVENUE, BY GEOGRAPHY, 2010 2012 ($MILLION)

TABLE 108 SIRONA DENTAL SYSTEMS, INC.: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 109 SIRONA DENTAL SYSTEMS, INC.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 110 SIRONA DENTAL SYSTEMS, INC.: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 111 STRATASYS, INC.: TOTAL REVENUE AND R&D EXPENDITURE, 2009 2011 ($MILLION)

TABLE 112 STRATASYS, INC.: TOTAL REVENUE, BY SEGMENTS, 2009 2011 ($MILLION)

TABLE 113 STRATASYS, INC.: TOTAL REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

LIST OF FIGURES

FIGURE 1 GLOBAL ADDITIVE MANUFACTURING DEVICES MARKET REVENUE, BY INDUSTRY TYPE, 2012

FIGURE 2 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2012 ($MILLION)

FIGURE 3 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET, BY GEOGRAPHY, 2012

FIGURE 4 GLOBAL MARKET SEGMENTATION

FIGURE 5 GLOBAL ADDITIVE MANUFACTURING MATERIALS MARKET SEGMENTATION

FIGURE 6 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SEGMENTATION

FIGURE 7 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET, BY PRODUCTS

FIGURE 8 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET, BY TECHNOLOGY

FIGURE 9 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET, BY APPLICATION

FIGURE 10 MARKET DYNAMICS

FIGURE 11 GLOBAL MARKET SHARE, BY MATERIALS, 2012 VS 2017

FIGURE 12 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, BY TECHNOLOGY, 2012 VS 2017

FIGURE 13 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, BY APPLICATION, 2012 VS 2017

FIGURE 14 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, BY GEOGRAPHY, 2012 VS 2017

FIGURE 15 ADDITIVE MANUFACTURING DEVICES MARKET FOR MEDICAL DEVICES MARKET, BY PLAYERS, 2012

FIGURE 16 MARKET IN MEDICAL SEGMENT, BY PLAYERS, 2012

FIGURE 17 ADDITIVE MANUFACTURING PROCESS

FIGURE 18 GLOBAL DEVICES MARKET, BY INDUSTRY TYPE, 2012 VS 2017

FIGURE 19 GLOBAL MARKET REVENUE, BY MATERIALS, 2012 & 2017 ($MILLION)

FIGURE 20 MATERIALS USED FOR ADDITIVE MANUFACTURING

FIGURE 21 GLOBAL HOMOGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2012 & 2017 ($MILLION)

FIGURE 22 HIERARCHY OF HOMOGENEOUS MATERIALS SYSTEMS FOR ADDITIVE MANUFACTURING

FIGURE 23 GLOBAL HETEROGENEOUS MATERIAL FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2012 & 2017 ($MILLION)

FIGURE 24 A HIERARCHY OF HETEROGENEOUS MATERIALS SYSTEMS FOR ADDITIVE MANUFACTURING

FIGURE 25 3D PRINTER MARKET ANALYSIS, BY VOLUME, 2010 2017

FIGURE 26 GLOBAL ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY PRODUCTS, 2012 & 2017 ($MILLION)

FIGURE 27 GLOBAL SURGICAL EQUIPMENT MARKET REVENUE, BY PRODUCTS, 2012 & 2017 ($MILLION)

FIGURE 28 CLASSIFICATION OF SURGICAL GUIDES

FIGURE 29 GLOBAL PROSTHETICS & IMPLANT MARKET, BY PRODUCTS, 2012 & 2017 ($MILLION)

FIGURE 30 TISSUE ENGINEERING SCAFFOLD

FIGURE 31 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES, BY TECHNOLOGY

FIGURE 32 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES, BY TECHNOLOGY, 2012 & 2017

FIGURE 33 TYPES OF LASER BEAM MELTING FOR ADDITIVE MANUFACTURING

FIGURE 34 GLOBAL LASER BEAM MELTING MARKET REVENUE, BY TECHNOLOGY, 2012 & 2017 ($MILLION)

FIGURE 35 TYPES OF PHOTOPOLYMERIZATION TECHNOLOGIES FOR ADDITIVE MANUFACTURING

FIGURE 36 TYPES OF DROPLET DEPOSITION (DD) OR EXTRUSION BASED TECHNOLOGIES FOR ADDITIVE MANUFACTURING

FIGURE 37 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET, BY APPLICATION, 2012 & 2017

FIGURE 38 ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET REVENUE, BY GEOGRAPHY, 2012 ($MILLION)

FIGURE 39 NORTH AMERICA: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, 2012 & 2017

FIGURE 40 EUROPE: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, 2012 & 2017

FIGURE 41 ASIA: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, 2012 & 2017

FIGURE 42 ROW: ADDITIVE MANUFACTURING FOR MEDICAL DEVICES MARKET SHARE, 2012 & 2017

FIGURE 43 KEY GROWTH STRATEGIES, 2009 2012

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Additive Manufacturing Market