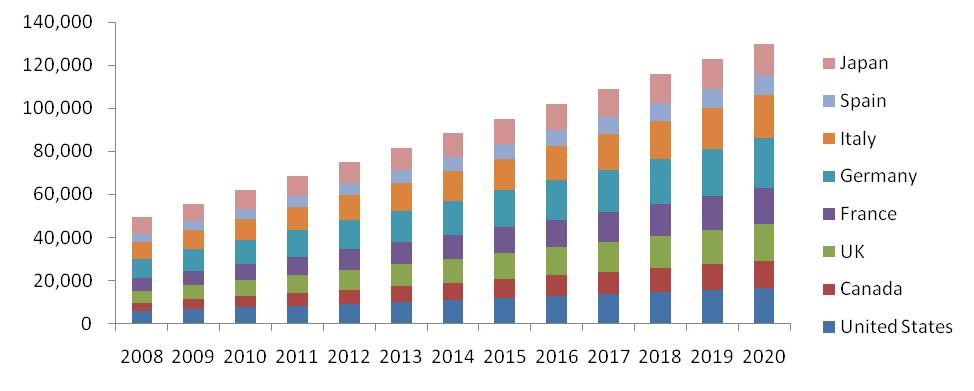

Acute Myeloid Leukemia Therapeutics Market in G8 Countries (2010 - 2020)

Acute Myeloid Leukemia Therapeutics Market in G8 Countries (2010 - 2020)

Acute myeloid leukemia is the second frequent type (after acute lymphocytic leukemia) of leukemia diagnosed in infants. About 15% of children from birth to 19 years of age diagnosed with leukemia have acute myeloid leukemia. The risk of acute myeloid leukemia is closely associated with age. About 90% of acute myeloid leukemia is diagnosed in middle age. Incidence rate of acute myeloid leukemia is high in men and women over 50 years. The acute myeloid leukemia market is segmented into two types; namely childhood acute myeloid leukemia and adulthood acute myeloid leukemia. The market was dominated by AVD regimen in 2010. However, in 2020, the market is expected to be dominated by AVD regimen, Cyatarabine, and Quizartinib drug.

This report studies the market from 2010 to 2020 covering seven major regimens and single drugs (off-patent and pipeline) for acute myeloid leukemia treatment. At present, there are four regimens in the market; namely DC regimen used for induction purpose, DC regimen for elderly patients, VCD, and AVD regimen. Plus, there is a drugs named Cytarabine in the market. Growing population of acute myeloid leukemia is an impetus for the growth of the market. This market is expected to grow at a CAGR of 28.4% from 2015 to 2020. North America was the major contributor to this market; accounting for 68.62% of the total sales of acute myeloid leukemia drugs in 2010; whereas AVD regimen was the major regimen accounting for 54.08% of the total sales of acute myeloid leukemia drugs in 2010. Cytarabine drug is also highly effective in the treatment of acute myeloid leukemia that captured the highly market share of AML market in 2010. Acute myeloid leukemia is still an area with high unmet need for early diagnosis and limited treatment options in this area.

The report studies four existing regimens and single drugs for acute myeloid leukemia market. Currently, there are four major drugs in pipeline for acute myeloid leukemia; which are expecting a market launch by 2012-2014. Quizartinib is currently in phase II pivotal clinical trial for the relapsed/refractory AML patient; which will be launched in the market in 2012 by Ambit Biosciences Inc. Quizartinib has received Orphan Drug designation grant from U.S. FDA and European Union. Besides, the drug has obtained fast track designation in the United States in 2010 for the treatment of FLT3-ITD positive patients with relapsed/refractory AML. The drug is expected to be priced at $25,448 for patients who take them annually.

Players are implementing various growth strategies in the market to gain a competitive edge. New product launches, product pipelines, agreements and collaborations, clinical trials, and acquisitions were some of the major strategies adopted by the players from January 2008 to September 2011.

Clinical trials form a major growth strategy in the acute myeloid leukemia therapeutics market; accounting for 39% share between January 2008 and September 2011, followed by collaborations and agreements strategy with a 25% share, and approvals with a 18% share.

Cephalon Inc, Celgene Corporation, Eisai Co. Ltd, and Sunesis Pharmaceuticals rule the present market for acute myeloid leukemia drugs; whereas Ambit Bioscience is expected to capture major share of the market by 2020.

Scope of the report

This myeloid leukemia therapeutics market research report evaluates the therapeutics market of acute myeloid leukemia in G8 countries with respect to the current and pipeline drugs and regimens. It analyzes geography; forecasting revenue, and trends in each of the following submarkets:

- Chemotherapy regimens

- DC regimen

- AVD Regimen

- VCD regimen

- Chemotherapy drugs

- Cytarabine

- Pipeline drugs

- Vidaza

- Dacogen

- Midostaurin

- Quizartinib

- Vosaroxin

The geographies covered under the report are

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- Italy

- France

- Spain

- Japan

Each section provides market data, market drivers, trends and opportunities, key players, and competitive outlook. This report also provides market tables for covering the sub-segments and micro-markets. Additionally, it makes ways for company profiles that cover all the sub-segments. The report has been made by keeping past trends, current happenings, and future forecasts in consideration.

Acute myeloid leukemia is also known as acute myelogenous leukemia. Acute myeloid leukemia is a cancer of the myeloid line of blood cells and also termed as acute myeloblastic leukemia, acute granulocytic leukemia, or acute non-lymphocytic leukemia. In acute myeloid leukemia, there is a rapid production of abnormal white blood cells that get collected in the bone marrow and disturb the production of normal blood cells. Acute myeloid leukemia is the most common acute leukemia affecting adults, and its incidence increases with age. In addition, acute myeloid leukemia accounts for approximately 1.2% of cancer deaths in the United States. There are two types of acute myeloid leukemia; namely childhood acute myeloid leukemia and adult acute myeloid leukemia.

The symptoms of AML are caused by replacement of normal bone marrow with leukemia cells, which causes a drop in red blood cells, platelets, and normal white blood cells. These symptoms include fatigue, shortness of breath, easy bruising and bleeding, and increased risk of infection. Several risk factors and chromosomal abnormalities have been identified, but the specific cause is not clear. As an acute leukemia, AML progresses rapidly and is typically fatal within weeks or months if left untreated.

Acute myeloid leukemia is the second frequent type (After acute lymphocytic leukemia) of leukemia diagnosed in infants. About one-sixth of children from birth to 19 years of age diagnosed with leukemia have acute myeloid leukemia. Children under 2 years of age have a lower chance of remission and cure than the older children. Prevalence of acute myeloid leukemia is very high in men and women between the ages of 75 and 84. Doctor can decide the kind of treatment is suitable and help to diagnose the patient. The patients who are in the earlier stage can have better long-term survival.

Acute myeloid Leukemia diagnosed population, 2008 - 2020, (Thousands)

Source: MarketsandMarkets analysis

According to WHO, acute myeloid leukemia is expected to be more prominent in the developed world due to genetic and environmental factor, and radiation exposure is the primary cause of all the types of acute myeloid leukemia. Global incidence of acute myeloid leukemia was 49,539 in 2008 with the developing countries. Total 62,226 new cases were recorded in 2010 with 95,211 and 129,837 as the predicted new cases for 2015 and 2020.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.3 ASSUMPTIONS MADE FOR THIS REPORT

2 EXECUTIVE SUMMARY

2.1 OVERVIEW

3 MARKET OVERVIEW

3.1 DEFINING LEUKEMIA

3.1.1 BASED ON DEVELOPMENT/PROGRESSION RATE & TYPE OF BONE MARROW CELLS AFFECTED

3.2 ACUTE MYELOID LEUKEMIA (AML)

3.2.1 STAGES/PHASES OF ACUTE MYELOID LEUKEMIA

3.2.1.1 Childhood AML

3.2.1.2 Adult AML

3.2.2 DIAGNOSIS

3.2.2.1 Biopsy & bone marrow aspiration

3.2.2.2 Complete blood count (CBC) & differential

3.2.2.3 Philadelphia chromosomes presence

3.2.2.4 Spinal tap (lumbar puncture) & cerebrospinal fluid (CSF) analysis

3.2.2.5 Immunophenotyping or phenotyping by flow cytometry

3.2.2.6 Polymerase chain reaction (PCR)

3.2.3 LEUKEMIA PREVALENCE

3.2.4 INCIDENCE & MORTALITY

3.2.5 MARKET STRUCTURE

3.2.5.1 Key therapies

3.2.5.1.1 Chemotherapy

3.2.5.1.2 Stem cell/bone marrow transplant

3.2.5.1.3 Radiation therapy

4 ACUTE MYELOID LEUKEMIA MARKET DYNAMICS

4.1 MARKET OVERVIEW

4.2 BURNING ISSUES

4.3 WINNING IMPERATIVE

4.3.1 STRATEGY OF MARKET EXPANSION BY UTILIZING MULTIPLE THERAPEUTIC APPROACHES

4.4 MARKET DYNAMICS

4.4.1 DRIVERS

4.4.1.1 Innovative therapies to drive the market for leukemia

4.4.1.2 Oncology is the largest therapeutic market with high unmet needs

4.4.1.3 Off-label prescribing drives market growth

4.4.2 RESTRAINTS

4.4.2.1 Adverse effects of treatment

4.4.2.2 Low production capability for efficient drugs

4.4.3 OPPORTUNITIES

4.4.3.1 Limited players in the market

4.4.3.2 Growing older male population

4.4.3.3 Leukemias underserved patient populations offer potential for market growth

5 ACUTE MYELOID LEUKEMIA PRODUCT MARKET

5.1 MARKET OVERVIEW

5.1.1 DAUNORUBICIN + CYTARABINE (FOR INDUCTION)

5.1.2 CYTARABINE (FOR RELAPSE)

5.1.3 DAUNORUBICIN + CYTARABINE (FOR ELDERLY)

5.1.4 VCD REGIMEN (APL)

5.1.5 AVD REGIMEN (APL)

6 ACUTE MYELOID LEUKEMIA DRUG PIPELINE (PHASE III)

6.1 PIPELINE DRUGS

6.1.1 VIDAZA

6.1.2 DACOGEN

6.1.3 MIDOSTAURIN

6.1.4 VOSAROXIN

6.1.5 QUIZARTINIB

7 GEOGRAPHICAL ANALYSIS

7.1 U.S.

7.2 CANADA

7.3 U.K.

7.4 GERMANY

7.5 FRANCE

7.6 ITALY

7.7 SPAIN

7.8 JAPAN

8 COMPETITIVE LANDSCAPE

8.1 OVERVIEW

9 COMPANY PROFILES

9.1 AMBIT BIOSCIENCES CORPORATION

9.1.1 OVERVIEW

9.1.2 FINANCIALS

9.1.3 PRODUCTS & SERVICES

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 CELGENE CORPORATION

9.2.1 OVERVIEW

9.2.2 FINANCIALS

9.2.3 PRODUCTS & SERVICES

9.2.4 STRATEGY

9.2.5 DEVELOPMENTS

9.3 CEPHALON INC

9.3.1 OVERVIEW

9.3.2 FINANCIALS

9.3.3 PRODUCTS & SERVICES

9.3.4 STRATEGY

9.3.5 DEVELOPMENTS

9.4 CLAVIS PHARMA ASA

9.4.1 OVERVIEW

9.4.2 FINANCIALS

9.4.3 PRODUCTS & SERVICES

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 EISAI CO. LTD

9.5.1 OVERVIEW

9.5.2 FINANCIALS

9.5.3 PRODUCTS & SERVICES

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 GENZYME CORPORATION

9.6.1 OVERVIEW

9.6.2 FINANCIALS

9.6.3 PRODUCTS & SERVICES

9.6.4 STRATEGY

9.6.5 DEVELOPMENTS

9.7 SUNESIS PHARMACEUTICALS INC

9.7.1 OVERVIEW

9.7.2 FINANCIALS

9.7.3 PRODUCTS & SERVICES

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 YEARLY COST OF DRUGS IN NORTH AMERICA & JAPAN, 2011 ($)

TABLE 2 YEARLY COST OF DRUGS IN EUROPEAN COUNTRIES, 2011 ($)

TABLE 3 DOSAGE PATTERN OF DRUGS

TABLE 4 ACUTE MYELOID LEUKEMIA DRUGS MARKET REVENUE, BY DRUGS/REGIMENS, 2008 2020 ($MILLION)

TABLE 5 ACUTE MYELOID LEUKEMIA THERAPEUTICS MARKET REVENUE, BY DRUGS/REGIMENS, 2008 2020 ($MILLION)

TABLE 6 AGED MALE POPULATION GROWTH, 2010 2025 (THOUSAND)

TABLE 7 ACUTE MYELOID LEUKEMIA MARKET REVENUE, BY DRUGS/REGIMENS, 2008 2020 ($MILLION)

TABLE 8 ACUTE MYELOID LEUKEMIA (DC REGIMEN) MARKET REVENUE, BY COUNTRY, 2008 2020 ($MILLION)

TABLE 9 ACUTE MYELOID LEUKEMIA (CYTARABINE) MARKET REVENUE, BY COUNTRY, 2008 2020 ($MILLION)

TABLE 10 ACUTE MYELOID LEUKEMIA (DC REGIMEN FOR ELEDERLY) MARKET REVENUE, BY COUNTRY, 2008 2020 ($MILLION)

TABLE 11 ACUTE MYELOID LEUKEMIA (VCD REGIMEN) MARKET REVENUE, BY COUNTRY, 2008 2020 ($MILLION)

TABLE 12 ACUTE MYELOID LEUKEMIA (AVD REGIMEN) MARKET REVENUE, BY COUNTRY, 2008 2020 ($MILLION)

TABLE 13 ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS (VIDAZA) MARKET REVENUE, BY COUNTRY, 2015 2020 ($MILLION)

TABLE 14 ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS (DACOGEN) MARKET REVENUE, BY COUNTRY, 2015 2020 ($MILLION)

TABLE 15 ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS (MIDOSTAURIN) MARKET REVENUE, BY COUNTRY, 2015 2020 ($MILLION)

TABLE 16 ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS (VOSAROXIN) MARKET REVENUE, BY COUNTRY, 2015 2020 ($MILLION)

TABLE 17 ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS (QUIZARTINIB) MARKET REVENUE, BY COUNTRY, 2015 2020 ($MILLION)

TABLE 18 U.S: SEER STATISTICS FOR ACUTE MYELOID LEUKEMIA (ESTIMATED), 2011

TABLE 19 U.S: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 20 U.S: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 21 CANADA: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 22 CANADA: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 23 U.K: INCIDENCE BY GENDER & TYPE OF LEUKEMIA, 2010

TABLE 24 U.K: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 25 U.K: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 26 GERMANY: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 27 GERMANY: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 28 FRANCE: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 29 FRANCE: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 30 ITALY: ACUTE MYELOID LEUKEMIA EXISTING DRUGS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 31 ITALY: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 32 SPAIN: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 33 SPAIN: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 34 JAPAN: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 2020 ($MILLION)

TABLE 35 JAPAN: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 2020 ($MILLION)

TABLE 36 COLLABORATIONS/PARTNERSHIPS/AGREEMENTS/ JOINT VENTURES, 2008 - 2011

TABLE 37 NEW PRODUCTS LAUNCH, 2008 2011

TABLE 38 EXPANSIONS/NEW FACILITY/INVESTMENTS, 2011

TABLE 39 FDA APPROVALS, 2008 2011

TABLE 40 PHASE III CLINICAL TRIALS, 2008 2011

TABLE 41 NDA, BLA & MARKETING APPLICATIONS, 2008 2011

TABLE 42 AMBIT BIOSCIENCES: PRODUCT PORTFOLIO

TABLE 43 CELGENE CORPORATION: TOTAL REVENUE AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 44 CELGENE CORPORATION: PRODUCT PORTFOLIO

TABLE 45 CEPHALON INC: TOTAL REVENUE AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 46 CEPHALON INC: PRODUCT PORTFOLIO

TABLE 47 CLAVIS PHARMA ASA: TOTAL REVENUE AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 48 CLAVIS PHARMA ASA: PRODUCT PORTFOLIO

TABLE 49 EISAI CO. LTD: TOTAL REVENUE AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 50 ISAI CO. LTD: PRODUCT PORTFOLIO

TABLE 51 GENZYME CORPORATION: TOTAL REVENUE AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 52 GENZYME CORPORATION: PRODUCT PORTFOLIO

TABLE 53 SUNESIS PHARMACEUTICALS INC: TOTAL REVENUE AND R&D EXPENSES, 2008 2010 ($MILLION)

TABLE 54 SUNESIS PHARMACEUTICALS INC: PRODUCT PORTFOLIO

LIST OF FIGURES

FIGURE 1 TOTAL ACUTE MYELOID LEUKEMIA MARKET REVENUE, 2008 2020 ($MILLION)

FIGURE 2 ACUTE MYELOID LEUKEMIA MARKET REVENUE, BY DRUGS/REGIMENS, 2008 2020 ($MILLION)

FIGURE 3 LEUKEMIA POPULATION, BY COUNTRY, 2008 2020

FIGURE 4 TYPES OF LEUKEMIA

FIGURE 5 ACUTE MYELOID LEUKEMIA DEVELOPMENT & PROGRESSION RATE, BY AGE

FIGURE 6 DIAGNOSED POPULATION OF ACUTE MYELOID LEUKEMIA, BY COUNTRY, 2008 2020

FIGURE 7 TYPES OF ACUTE MYELOID LEUKEMIA

FIGURE 8 ACUTE MYELOID LEUKEMIA: MARKET SEGMENTATION, BY DRUGS/REGIMENS

FIGURE 9 ACUTE MYELOID LEUKEMIA: EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 10 ACUTE MYELOID LEUKEMIA: PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 11 ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET REVENUE, 2008 - 2020 ($MILLION)

FIGURE 12 ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET REVENUE, 2015 VS 2020 ($MILLION)

FIGURE 13 U.S: EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020 ($MILLION)

FIGURE 14 U.S: PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 15 CANADA: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 16 CANADA: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 17 U.K: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 18 U.K: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 19 GERMANY: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 20 GERMANY: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 21 FRANCE: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 22 FRANCE: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 23 ITALY: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 24 ITALY: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 25 SPAIN: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 26 SPAIN: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 27 JAPAN: ACUTE MYELOID LEUKEMIA EXISTING DRUGS/REGIMENS MARKET SHARE, 2010 VS 2020

FIGURE 28 JAPAN: ACUTE MYELOID LEUKEMIA PIPELINE DRUGS/REGIMENS MARKET SHARE, 2015 VS 2020

FIGURE 29 KEY GROWTH STRATEGIES, JANUARY 2008 SEPTEMBER 2011

Growth opportunities and latent adjacency in Acute Myeloid Leukemia Therapeutics Market