Acrylic Acid Market by Derivative (Methyl, Ethyl, Butyl, 2-EH, SAP, Water Treatment), Acrylic Ester/Polymer Application (Surface coating, Adhesive & Sealant, Plastic additive, Textile, Detergent Diaper & Training Pad), & Region - Global Forecast to 2028

Updated on : November 11, 2025

Acrylic Acid Market

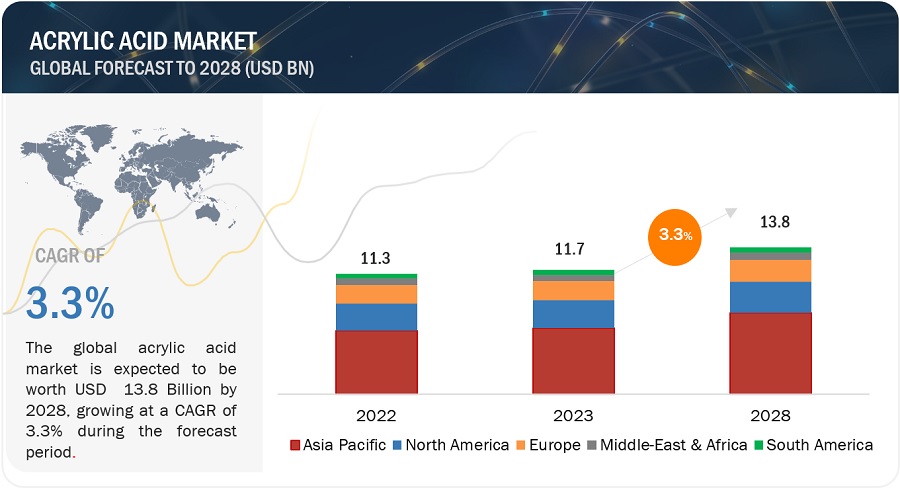

The global acrylic acid market was valued at USD 11.3 billion in 2023 and is projected to reach USD 13.8 billion by 2028, growing at 3.3% cagr from 2023 to 2028. Acrylic acid is a colorless, corrosive liquid that readily forms polymers. It is used to make plastics, paints, synthetic rubbers, and textiles. Acrylic acid derivatives such as acrylic esters, acrylic polymers, and other derivatives are used in various industries. They are key ingredients for a number of polymer formulations. Owing to the versatile properties of acrylic esters and polymers, they have a high demand in many end-use applications, such as surface coatings, sealants & adhesive, plastic additives, detergents, textiles, diapers & training pants, adult incontinence, and water treatment.

Acrylic Acid Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Acrylic Acid Market

Acrylic Acid Market Dynamics

Driver: Rise in demand from paints & coatings sector

The growing demand for paints and coatings is playing a pivotal role in driving the acrylic acid market. Acrylic acid, a key component in the production of acrylate esters, has extensive application in the paints & coatings industry. Acrylate esters derived from acrylic acid serve as essential ingredients in a wide range of coatings, including architectural coatings, OEM finishes for automotive and other products, as well as special-purpose coatings.

Restraint: Acute toxicity and air exposure limits

Being a volatile organic compound, acrylic acid has the tendency to form photo-chemical smog. NIOSH (National Institute for Occupational Safety and Health) and the ACGIH (American Conference of Governmental Industrial Hygienists Inc.) have also added a skin notation to their recommended workplace air exposure limits for acrylic acid.

Opportunities: Increasing demand in emerging economies

The economy of Asia Pacific countries such as China and India are growing rapidly. South Asian countries such as Indonesia, Taiwan, and South Korea are also witnessing fast growth. The primary driver behind their growth is the increasing population. With the increase in disposable income, the consumer buying pattern has changed, which has also been influenced by globalization. The end-use industries have shown steady growth in the past few years, and this scenario is expected to remain the same during the forecast period. These countries are welcoming foreign investments and global manufacturers to set up manufacturing facilities.

Challenges: Fluctuations in raw material prices, high transportation cost, and reactivity hazards

The acrylic acid market is currently navigating through a complex landscape characterized by multiple challenges. These include escalating costs of raw materials, transportation, and energy and geopolitical uncertainties. The aftermath of the COVID-19 pandemic, marked by intermittent lockdowns in certain regions, further adds to the complexities.

Acrylic Acid Market Ecosystem

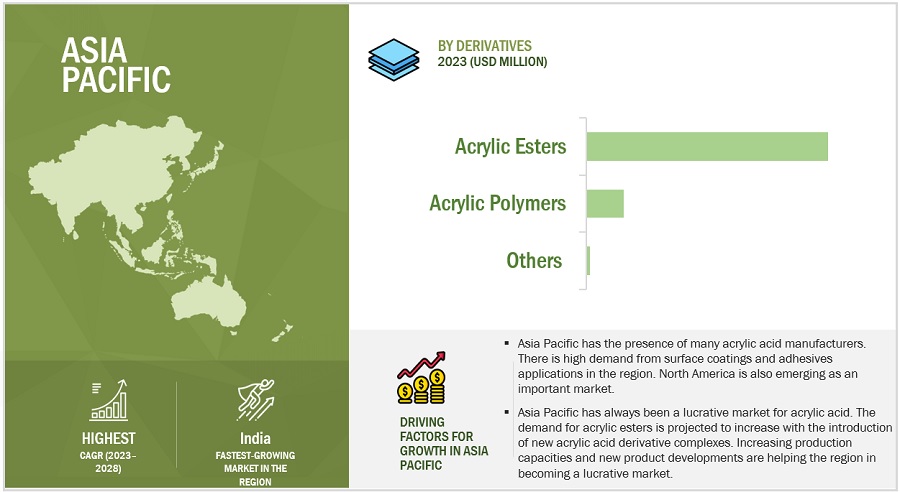

By Derivative, acrylic esters accounted for the largest market share.

The acrylic ester derivative has emerged as the dominant player, capturing the highest market share in the acrylic acid market. This is primarily due to their versatile applications and wide-ranging utility across various industries. Acrylic esters or acrylates are clear and volatile liquids. They are moderately soluble in water and completely soluble in alcohols, ethers, and other organic solvents. Acrylates have a double bond and functional carboxyl group. Acrylic acid and its derivative acrylic esters are multi-use monomers, which have the capabilities to provide a wide range of multi-purpose polymers.

By Acrylic Esters Applications, the surface coatings segment accounts for the highest share in the acrylic acid market during the forecast period.

The surface coatings segment is the largest application of acrylic acid esters due to their versatile properties that contribute to enhanced paint and coating formulations. Acrylic acid esters exhibit excellent adhesion, durability, and weather resistance, making them a preferred choice for various surface coatings in automotive, construction, and consumer goods industries. The ability of acrylic acid esters to impart gloss, color retention, and corrosion protection, coupled with their compatibility with a wide range of other chemicals, drives their adoption in surface coatings, solidifying their prominence in the acrylic acid market's application landscape.

By Acrylic Polymer Application, the diapers & training pants segment to have the largest market share in 2022 in the acrylic acid market.

The dominance of the diapers & training pants segment as the primary application for acrylic acid polymers is attributed to their exceptional absorbent properties that ensure effective moisture management and leakage prevention in personal care products. Acrylic acid polymers are primarily used to make superabsorbent polymers (SAPs) as they possess the unique ability to absorb and retain fluids many times their weight, making them integral components of diapers and training pants. Factors such as comfort, hygiene, and convenience to infants and toddlers are responsible for the high demand of acrylic acid polymers in the diapers & training pants sector.

Asia Pacific is projected to account for the highest CAGR in the Acrylic acid market during the forecast period.

Asia Pacific has the largest demand for both baby and adult diapers. Emerging markets like India, Taiwan, Malaysia, and Indonesia are projected to be the hotspots, in terms of demand for personal care products where superabsorbent polymers (SAP) is a crucial component. The increasing applications of superabsorbent polymer (SAP) in personal care products, agriculture, and cosmetics, and the use of water-based paints and coatings due to environmental standards concerning VOC reduction are projected to drive the market in the region. Rapid growth and innovation in the industry, along with industry consolidations between acrylic acid manufacturers, are projected to offer a bright future for the industry in this region.

To know about the assumptions considered for the study, download the pdf brochure

Acrylic Acid Market Players

The Acrylic acid market comprises key manufacturers such as BASF SE (Germany), Arkema (France), Nippon Shokubai Co., Ltd. (Japan), LG Chem (South Korea), the Dow Chemical Company (US), and others. Expansions, mergers & acquisitions, new product launches and deals were some of the major strategies adopted by these key players to enhance their positions in the acrylic acid market. A major focus was given to the expansions and deals.

Acrylic Acid Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 11.3 billion |

|

Revenue Forecast in 2028 |

USD 13.8 billion |

|

CAGR |

3.3% |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion) and Volume (Kilo tons) |

|

Segments |

Acrylic acid Market-By Derivative, By Application (acrylic esters), By Application (acrylic polymers and other derivatives), and Region |

|

Regions |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies |

The major players are BASF SE (Germany), Arkema (France), Nippon Shokubai Co., Ltd. (Japan), LG Chem (South Korea), and The Dow Chemical Company (Midland, Michigan) and others covered in the acrylic acid market. |

This research report categorizes the global acrylic acid market on the basis of derivative, Application (acrylic esters), Application (acrylic polymers), and Region.

Acrylic Acid Market by Derivative

-

Acrylic Esters

- Methyl Acrylate

- Ethyl Acrylate

- Butyl Acrylate

- 2-Ethylhexyl Acrylate

- Other Acrylic Esters

-

Acrylic Polymers

- Water Treatment Polymers

- Super Absorbent Polymer

- Acrylic Elastomers

-

Others

- Ammonium Polyacrylate

- Polycyanoacrylates

Acrylic Esters Market by Application

- Surface Coatings

- Adhesives & Sealants

- Plastic Additives

- Detergents

- Textiles

- Others

Acrylic Polymers & Other Derivatives Market by Application

- Diapers & Training Pants

- Adult Incontinence & Other Personal Care Products

- Water Treatment (Dispersants, Anti-scalants, and Thickeners)

- Others

Acrylic Acid Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In July 2022, LG Chem and GS Caltex initiated the creation of a white bio ecosystem by commencing the construction of a 3HP pilot plant for eco-friendly bio raw materials.

- In July 2022, Arkema announced its intention to acquire Polimeros Especiales, a prominent producer of emulsion resins based in Mexico. This strategic acquisition was done to enhance Arkema's presence in the fast-growing market for solvent-free waterborne acrylic resins. By incorporating Polimeros Especiales' expertise and capabilities, Arkema aimed to bolster its position in the market and meet the increasing demand for sustainable and eco-friendly resin solutions in Mexico.

- In November 2022, Arkema and Nippon Shokubai American Industries, Inc. (NAII), in collaboration with its joint venture American Acryl L.P. located in Bayport, Texas, took significant steps towards advancing the decarbonization of energy sources. They solidified their commitment by entering into a long-term power purchase agreement with EDF Energy Services, LLC (EDF), ensuring that 100% of their anticipated annual energy consumption is supplied by wind power. This move reflects their dedication to sustainable practices and reducing their environmental impact in the production of acrylic monomers.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the acrylic acid market?

The Acrylic acid market is expected to witness significant growth in the future due to a rise in demand from the paints and coatings sector, increasing demand of superabsorbent polymers and increasing application in chemical synthesis.

What is the major challenge in the acrylic acid market?

The major challenge in the acrylic acid market is the improper waste disposal of end products.

What are the restraining factors in the acrylic acid market?

The major restraining factor faced by the acrylic acid market is the environmental concerns and health hazards.

What is the key opportunity in the acrylic acid market?

The increasing demand in emerging economies is a major opportunity in the acrylic acid market.

What are the applications where acrylic acid materials are used?

Acrylic acid materials are majorly used in paint and coating industry, textile industry, diapers and training pads among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rise in demand from paints & coatings sector- Increasing demand for superabsorbent polymers- Expanding application in chemical synthesis- Shift from solvent-based coatings to acrylic emulsionsRESTRAINTS- Environmental concerns and health hazardsOPPORTUNITIES- Commercial production of bio-based acrylic acid- Increasing demand in emerging economiesCHALLENGES- Improper waste disposal of end products- Strong competition among market players- Fluctuations in raw material prices, high transportation costs, and reactivity hazards

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRYTRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TARIFF AND REGULATORY LANDSCAPE

- 5.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 TECHNOLOGY ANALYSISNEW CATALYST TECHNOLOGY TURNS CORN INTO ACRYLIC ACIDNEW TECHNOLOGIES - ACRYLIC RESINS

-

5.9 ACRYLIC ACID MARKET ECOSYSTEM

- 5.10 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.11 TRADE ANALYSIS (IMPORT AND EXPORT)IMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPE

- 5.13 CASE STUDY ANALYSIS

-

5.14 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY ACRYLIC ACID DERIVATIVE

-

5.15 MACROECONOMIC OVERVIEWINTRODUCTIONTRENDS AND FORECAST OF GDP

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.1 INTRODUCTIONACRYLIC ESTERS- Methyl acrylate- Ethyl acrylate- Butyl acrylate- 2-Ethylhexyl acrylate- Other acrylic estersACRYLIC POLYMERS- Acrylic elastomers- Superabsorbent polymers- Water treatment polymersOTHER DERIVATIVES- Ammonium polyacrylate- Polycyanoacrylate

- 7.1 INTRODUCTION

-

7.2 ACRYLIC ESTERS MARKET, BY APPLICATIONSURFACE COATINGSADHESIVES & SEALANTSPLASTIC ADDITIVESDETERGENTSTEXTILESOTHER APPLICATIONS

-

7.3 ACRYLIC POLYMERS AND OTHER DERIVATIVES MARKET, BY APPLICATIONDIAPERS & TRAINING PANTSADULT INCONTINENCE & OTHER PERSONAL CARE PRODUCTSWATER TREATMENT (DISPERSANTS, ANTI-SCALANTS, AND THICKENERS)OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICRECESSION IMPACTCHINA- Surface coatings application to be largest consumer of acrylic estersJAPAN- Increasing demand for adult diaper and incontinence products to drive marketINDIA- India to register highest CAGR in acrylic acid market during forecast periodSOUTH KOREA- Increasing demand from diaper and textile sectors to support market growthREST OF ASIA PACIFIC

-

8.3 NORTH AMERICARECESSION IMPACTUS- Expanding residential sector to fuel market growthCANADA- Government initiatives in construction sector to support acrylic acid market growthMEXICO- Acrylic esters to account for major share of overall market during forecast period

-

8.4 EUROPERECESSION IMPACTGERMANY- Presence of highly developed chemical industry to support market growthFRANCE- Growing investment in plastic industry to drive demandNETHERLANDS- Strategic location in European chemical industry to support marketBELGIUM- Increasing exports to support market growthREST OF EUROPE

-

8.5 MIDDLE EAST & AFRICARECESSION IMPACTSOUTH AFRICA- Increasing demand for surface coatings to boost market growthSAUDI ARABIA- Acrylic esters segment to dominate overall market during forecast periodEGYPT- Increasing exports of chemicals to boost market for acrylic acidREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Brazil to be dominant market for acrylic acid in South AmericaARGENTINA- Unfavorable economic conditions likely to cause sluggish market growthREST OF SOUTH AMERICA

- 9.1 OVERVIEW

- 9.2 MARKET SHARE ANALYSIS

- 9.3 REVENUE ANALYSIS OF TOP PLAYERS

-

9.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE PLAYERS

- 9.5 COMPANY FOOTPRINT

-

9.6 SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 9.7 COMPETITIVE BENCHMARKING

-

9.8 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARKEMA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNIPPON SHOKUBAI CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLG CHEM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDOW CHEMICAL COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI CHEMICAL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSASOL LTD.- Business overview- Products/Solutions/Services offered- MnM viewEVONIK INDUSTRIES AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products/Solutions/Services offered- MnM viewSUMITOMO CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

10.2 ADDITIONAL PLAYERSSATELLITE CHEMICAL CO., LTD.SYNTHOMER PLCSHANGHAI HUAYI ACRYLIC ACID CO., LTD.SIBUR HOLDING PJSCWANHUA CHEMICAL GROUP CO., LTD.TOAGOSEI CO., LTD.SINOCHEM GROUP CO., LTD.LUBRIZOL CORPORATIONPOLYSCIENCES, INC.JURONG GROUPMOMENTIVE PERFORMANCE MATERIALSSOLVAYRÖHM GMBHKAMSONS CHEMICALS PVT. LTD.GELLNER INDUSTRIAL LLC

- 11.1 INTRODUCTION

- 11.2 LIMITATIONS

-

11.3 BIO-ACRYLIC ACID MARKETMARKET DEFINITIONMARKET OVERVIEW

- 11.4 BIO-ACRYLIC ACID MARKET, BY TYPE

- 11.5 BIO-ACRYLIC ACID MARKET, BY APPLICATION

- 11.6 BIO-ACRYLIC ACID MARKET, BY REGION

- 12.1 DISCUSSION GUIDE

- 12.2 CUSTOMIZATION OPTIONS

- 12.3 RELATED REPORTS

- 12.4 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.5 AUTHOR DETAILS

- TABLE 1 ACRYLIC ACID MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 PORTER’S FIVE FORCES ANALYSIS: ACRYLIC ACID MARKET

- TABLE 3 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 AMERICAN INDUSTRIAL HYGIENE ASSOCIATION EMERGENCY RESPONSE PLANNING GUIDELINES (ERPG) 2010: ACRYLIC ACID DOSE-EFFECT RELATIONSHIP

- TABLE 5 ACRYLIC ACID MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 6 IMPORT SCENARIO FOR HS CODE 291611, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 7 EXPORT SCENARIO FOR HS CODE: 291611, BY COUNTRY, 2017–2021 (USD THOUSAND)

- TABLE 8 AVERAGE SELLING PRICE, BY ACRYLIC ACID DERIVATIVE TYPE (USD/KG)

- TABLE 9 WORLD GDP GROWTH, 2021–2028 (USD TRILLION)

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ACRYLIC ACID AND ITS DERIVATIVES

- TABLE 11 KEY BUYING CRITERIA IN ACRYLIC ACID MARKET

- TABLE 12 ACRYLIC ACID MARKET, BY DERIVATIVE, 2017–2020 (USD MILLION)

- TABLE 13 ACRYLIC ACID MARKET, BY DERIVATIVE, 2017–2020 (KILOTON)

- TABLE 14 ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 15 ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 16 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 17 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY TYPE, 2021–2028 (KILOTON)

- TABLE 18 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS, BY TYPE, 2021–2028 (KILOTON)

- TABLE 20 ACRYLIC ACID MARKET IN OTHER DERIVATIVES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 21 ACRYLIC ACID MARKET IN OTHER DERIVATIVES, BY TYPE, 2021–2028 (KILOTON)

- TABLE 22 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 23 ACRYLIC ACID MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 24 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 25 ACRYLIC ACID MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 26 ACRYLIC ACIDS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 27 ACRYLIC ACID MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 28 ASIA PACIFIC: ACRYLIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 30 ASIA PACIFIC: MARKET, BY DERIVATIVE, 2017–2020 (USD MILLION)

- TABLE 31 ASIA PACIFIC: MARKET, BY DERIVATIVE, 2017–2020 (KILOTON)

- TABLE 32 ASIA PACIFIC: MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 38 CHINA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 39 CHINA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 40 CHINA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 41 CHINA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 42 CHINA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 43 CHINA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 44 JAPAN: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 45 JAPAN: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 46 JAPAN: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 47 JAPAN: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 48 JAPAN: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 49 JAPAN: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 50 INDIA: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 51 INDIA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 52 INDIA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 53 INDIA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 54 INDIA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 55 INDIA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 56 SOUTH KOREA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 57 SOUTH KOREA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 58 SOUTH KOREA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 59 SOUTH KOREA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 60 SOUTH KOREA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 61 SOUTH KOREA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 62 REST OF ASIA PACIFIC: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 64 REST OF ASIA PACIFIC: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 65 REST OF ASIA PACIFIC: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 66 REST OF ASIA PACIFIC: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 68 NORTH AMERICA: ACRYLIC ACIDS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 70 NORTH AMERICA: MARKET, BY DERIVATIVE, 2017–2020 (USD MILLION)

- TABLE 71 NORTH AMERICA: MARKET, BY DERIVATIVE, 2017–2020 (KILOTON)

- TABLE 72 NORTH AMERICA: MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 74 NORTH AMERICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 76 NORTH AMERICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 78 US: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 79 US: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 80 US: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 81 US: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 82 US: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 83 US: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 84 CANADA: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 85 CANADA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 86 CANADA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 87 CANADA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 88 CANADA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 90 MEXICO: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 91 MEXICO: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 92 MEXICO: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 MEXICO: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 94 MEXICO: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 95 MEXICO: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 96 EUROPE: ACRYLIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 98 EUROPE: MARKET, BY DERIVATIVE, 2017–2020 (USD MILLION)

- TABLE 99 EUROPE: MARKET, BY DERIVATIVE, 2017–2020 (KILOTON)

- TABLE 100 EUROPE: MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 101 EUROPE: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 102 EUROPE: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 104 EUROPE: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 106 GERMANY: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 107 GERMANY: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 108 GERMANY: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 109 GERMANY: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 110 GERMANY: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 111 GERMANY: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 112 FRANCE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 113 FRANCE: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 114 FRANCE: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 115 FRANCE: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 116 FRANCE: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 117 FRANCE: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 118 NETHERLANDS: ACRYLIC ACIDS MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 119 NETHERLANDS: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 120 NETHERLANDS: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 121 NETHERLANDS: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 122 NETHERLANDS: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 123 NETHERLANDS: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 124 BELGIUM: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 125 BELGIUM: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 126 BELGIUM: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 BELGIUM: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 128 BELGIUM: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 129 BELGIUM: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 130 REST OF EUROPE: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 131 REST OF EUROPE: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 132 REST OF EUROPE: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 133 REST OF EUROPE: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 134 REST OF EUROPE: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 135 REST OF EUROPE: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 136 MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY DERIVATIVE, 2017–2020 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY DERIVATIVE, 2017–2020 (KILOTON)

- TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 142 MIDDLE EAST & AFRICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 144 MIDDLE EAST & AFRICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 146 SOUTH AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 147 SOUTH AFRICA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 148 SOUTH AFRICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 149 SOUTH AFRICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 150 SOUTH AFRICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 151 SOUTH AFRICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 152 SAUDI ARABIA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 153 SAUDI ARABIA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 154 SAUDI ARABIA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 155 SAUDI ARABIA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 156 SAUDI ARABIA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 157 SAUDI ARABIA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 158 EGYPT: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 159 EGYPT: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 160 EGYPT: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 161 EGYPT: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 162 EGYPT: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 163 EGYPT: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 168 REST OF MIDDLE EAST & AFRICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 169 REST OF MIDDLE EAST & AFRICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 170 SOUTH AMERICA: ACRYLIC ACID MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 171 SOUTH AMERICA: MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 172 SOUTH AMERICA: MARKET, BY DERIVATIVE, 2017–2020 (USD MILLION)

- TABLE 173 SOUTH AMERICA: MARKET, BY DERIVATIVE, 2017–2020 (KILOTON)

- TABLE 174 SOUTH AMERICA: MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 175 SOUTH AMERICA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 176 SOUTH AMERICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 177 SOUTH AMERICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 178 SOUTH AMERICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 180 BRAZIL: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 181 BRAZIL: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 182 BRAZIL: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 183 BRAZIL: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 184 BRAZIL: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 185 BRAZIL: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 186 ARGENTINA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 187 ARGENTINA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 188 ARGENTINA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 189 ARGENTINA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 190 ARGENTINA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 191 ARGENTINA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 192 REST OF SOUTH AMERICA: ACRYLIC ACID MARKET, BY DERIVATIVE, 2021–2028 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: MARKET, BY DERIVATIVE, 2021–2028 (KILOTON)

- TABLE 194 REST OF SOUTH AMERICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 195 REST OF SOUTH AMERICA: MARKET IN ACRYLIC ESTERS, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 196 REST OF SOUTH AMERICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 197 REST OF SOUTH AMERICA: MARKET IN ACRYLIC POLYMERS AND OTHER DERIVATIVES, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 198 COMPANIES ADOPTED EXPANSIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- TABLE 199 ACRYLIC ACID MARKET: COMPANY FOOTPRINT

- TABLE 200 ACRYLIC ACID MARKET: LIST OF KEY PLAYERS

- TABLE 201 DEALS, 2018–2023

- TABLE 202 PRODUCT LAUNCHES, 2018–2023

- TABLE 203 OTHER DEVELOPMENTS, 2018–2023

- TABLE 204 BASF SE: COMPANY OVERVIEW

- TABLE 205 BASF SE: DEALS

- TABLE 206 BASF SE: OTHERS

- TABLE 207 ARKEMA: COMPANY OVERVIEW

- TABLE 208 ARKEMA: PRODUCT LAUNCHES

- TABLE 209 ARKEMA: DEALS

- TABLE 210 ARKEMA: OTHERS

- TABLE 211 NIPPON SHOKUBAI CO., LTD.: COMPANY OVERVIEW

- TABLE 212 NIPPON SHOKUBAI CO., LTD.: OTHERS

- TABLE 213 LG CHEM: COMPANY OVERVIEW

- TABLE 214 LG CHEM: DEALS

- TABLE 215 LG CHEM: OTHERS

- TABLE 216 DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 217 DOW CHEMICAL COMPANY: OTHERS

- TABLE 218 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 219 MITSUBISHI CHEMICAL CORPORATION: DEALS

- TABLE 220 MITSUBISHI CHEMICAL CORPORATION: OTHERS

- TABLE 221 SASOL LTD.: COMPANY OVERVIEW

- TABLE 222 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 223 EVONIK INDUSTRIES AG: DEALS

- TABLE 224 EVONIK INDUSTRIES AG: PRODUCT LAUNCHES

- TABLE 225 EVONIK INDUSTRIES AG: OTHERS

- TABLE 226 MERCK KGAA: COMPANY OVERVIEW

- TABLE 227 SUMITOMO CORPORATION: COMPANY OVERVIEW

- TABLE 228 SUMITOMO CORPORATION: OTHERS

- TABLE 229 SATELLITE CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 230 SYNTHOMER PLC: COMPANY OVERVIEW

- TABLE 231 SHANGHAI HUAYI ACRYLIC ACID CO., LTD.: COMPANY OVERVIEW

- TABLE 232 SIBUR HOLDING PJSC: COMPANY OVERVIEW

- TABLE 233 WANHUA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 234 TOAGOSEI CO., LTD.: COMPANY OVERVIEW

- TABLE 235 SINOCHEM GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 236 LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 237 POLYSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 238 JURONG GROUP: COMPANY OVERVIEW

- TABLE 239 MOMENTIVE PERFORMANCE MATERIALS?: COMPANY OVERVIEW

- TABLE 240 SOLVAY: COMPANY OVERVIEW

- TABLE 241 RÖHM GMBH: COMPANY OVERVIEW

- TABLE 242 KAMSONS CHEMICALS PVT. LTD. COMPANY OVERVIEW

- TABLE 243 GELLNER INDUSTRIAL LLC: COMPANY OVERVIEW

- TABLE 244 BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (USD MILLION)

- TABLE 245 BIO-ACRYLIC ACID MARKET, BY TYPE, 2021–2027 (TON)

- TABLE 246 BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 247 BIO-ACRYLIC ACID MARKET, BY APPLICATION, 2021–2027 (TON)

- TABLE 248 BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (TON)

- TABLE 249 BIO-ACRYLIC ACID MARKET, BY REGION, 2021–2027 (USD MILLION)

- FIGURE 1 ACRYLIC ACID MARKET SEGMENTATION

- FIGURE 2 ACRYLIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 ACRYLIC ACID MARKET: DATA TRIANGULATION

- FIGURE 6 ACRYLIC ESTERS TO LEAD OVERALL ACRYLIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 7 DIAPERS & TRAINING PANTS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 8 SURFACE COATINGS APPLICATION TO DOMINATE ACRYLIC ESTERS MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 11 CHINA DOMINATES ACRYLIC ACID MARKET IN ASIA PACIFIC

- FIGURE 12 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 13 ACRYLIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 WASTE DISPOSABLE DIAPER MANAGEMENT (1970–2018)

- FIGURE 15 ACRYLIC ACID MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 SUPPLY CHAIN OF ACRYLIC ACID MARKET

- FIGURE 17 ACRYLIC ACID MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 REVENUE SHIFT AND NEW REVENUE POCKETS FOR ACRYLIC ACID MANUFACTURERS

- FIGURE 19 ACRYLIC ACID MARKET: ECOSYSTEM MAPPING

- FIGURE 20 ACRYLIC ACID MARKET: KEY STAKEHOLDERS

- FIGURE 21 GRANTED PATENTS ACCOUNTED FOR 8% OF ALL PATENTS IN LAST FIVE YEARS

- FIGURE 22 PATENT PUBLICATION TRENDS (2018–2022)

- FIGURE 23 JURISDICTION ANALYSIS

- FIGURE 24 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 25 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA IN ACRYLIC ACID MARKET

- FIGURE 28 ACRYLIC ESTERS ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 29 OVERVIEW OF APPLICATIONS OF ACRYLIC ACID

- FIGURE 30 SURFACE COATINGS TO BE LARGEST APPLICATION OF ACRYLIC ESTERS BETWEEN 2023 AND 2028

- FIGURE 31 DIAPERS & TRAINING PANTS TO DOMINATE MARKET FOR ACRYLIC POLYMERS

- FIGURE 32 INDIA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: ACRYLIC ACID MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: ACRYLIC ACID MARKET SNAPSHOT

- FIGURE 36 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 37 FIVE-YEAR REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 38 COMPANY EVALUATION MATRIX: ACRYLIC ACID MARKET, 2022

- FIGURE 39 SME EVALUATION MATRIX: ACRYLIC ACID MARKET, 2022

- FIGURE 40 BASF SE: COMPANY SNAPSHOT

- FIGURE 41 ARKEMA: COMPANY SNAPSHOT

- FIGURE 42 NIPPON SHOKUBAI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 43 LG CHEM: COMPANY SNAPSHOT

- FIGURE 44 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 45 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 SASOL LTD.: COMPANY SNAPSHOT

- FIGURE 47 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 48 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 49 SUMITOMO CORPORATION: COMPANY SNAPSHOT

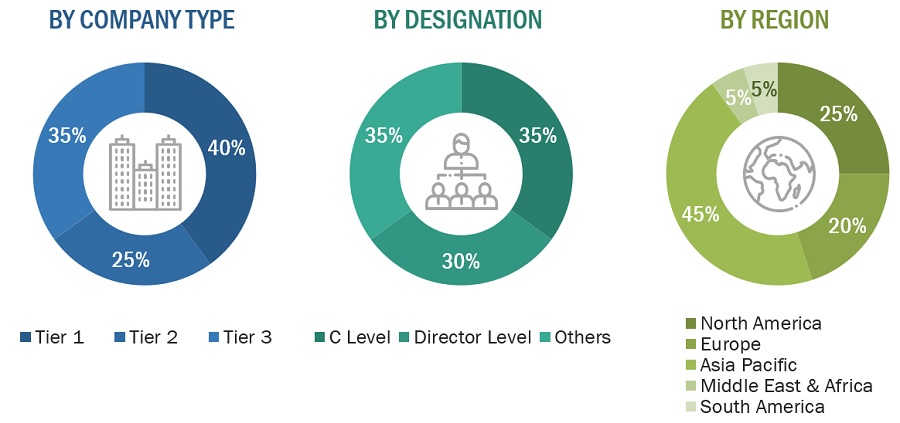

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the acrylic acid market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The acrylic acid market is comprised of several stakeholders in the supply chain, which includes suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the acrylic acid market. Primary sources from the supply side include associations and institutions involved in the acrylic acid industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global acrylic acid market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

The acrylic acid market refers to the industry that produces and supplies acrylic acid and its derivatives. Acrylic acid is an organic substance well-known for its adaptability and wide-ranging industrial uses. It is a clear liquid with a distinctive acrid odor that is a crucial precursor in the creation of many different polymers, including superabsorbent polymers used in diapers, adhesives, coatings, textiles, and more. Due to its reactivity and capacity for polymerization, acrylic acid is a key component in the production of a variety of products vital to daily life and different industries.

Key Stakeholders

- Raw material suppliers

- Acrylic acid products manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, describe, and forecast the global acrylic acid market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on the derivative, and by application.

- To forecast the market size, in terms of value and volume, with respect to five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the Asia Pacific Acrylic acid market

- Further breakdown of the Rest of Europe's Acrylic acid market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Acrylic Acid Market