This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the ablation technology market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global ablation technology market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, research universities, academic institutions, and government institutions, among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

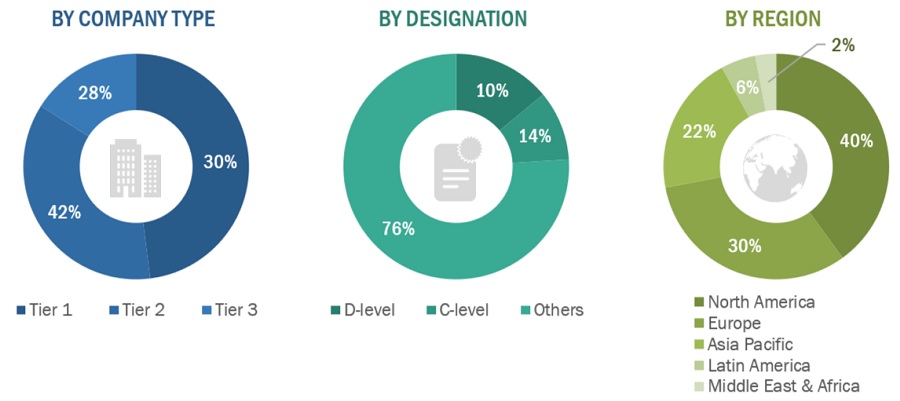

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ablation technology market.These methods were also used extensively to estimate the size of various subsegments in the market . The research methodology used to estimate the market size includes the following:

Data Triangulation:

After arriving at the overall size of the global ablation technology market through the above-mentioned methodology, this market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and sub-segments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both the demand- and supply-side participants.

Report Objectives:

-

To define, describe, and forecast the ablation technology market based on type, product, application, end user, and region

-

To provide detailed information regarding the major factors influencing the growth of the global ablation technology market (such as drivers, restraints, challenges, opportunities, and regulatory landscape, among others)

-

To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the global ablation technology market

-

To analyze the opportunities in the global ablation technology market for stakeholders and provide details of the competitive landscape for market leaders

-

To profile key global players and comprehensively analyze their market shares and core competencies

-

To provide a five-year forecast for various market segments in terms of revenue with respect to five main regions, namely, North America (includes the US and Canada), Europe (includes Germany, the UK, France, Italy, and Spain), Asia Pacific (includes Japan, China, India, Australia, and South Korea), Latin America (includes Brazil and Mexico), and the Middle East & Africa

-

To track and analyze competitive developments such as product launches; expansions, and mergers and acquisitions; and research and development activities in the ablation technology market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the global ablation technology market report:

Product analysis

-

Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company information

-

Detailed analysis and profiling of additional market players (up to five)

Geographic analysis

-

Further breakdown of the Rest of Europe ablation technology market into Belgium, Austria, Denmark, Greece, Poland, and Russia, among other countries

-

Further breakdown of the Rest of Asia Pacific ablation technology market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

-

Further breakdown of the Rest of Latin America ablation technology market into Argentina and Colombia, among other countries

Top players operating in Ablation systems Market

-

Abbott Laboratories

-

AngioDynamics Inc.

-

AtriCure Inc.

-

Biosense Webster Inc. (Johnson & Johnson)

-

Boston Scientific Corporation

-

CONMED Corporation

-

Medtronic plc

-

Olympus Corporation

-

Smith & Nephew plc

-

Varian Medical Systems Inc.

Niche growth drivers for Ablation systems Market

Growing demand for minimally invasive procedures: Ablation procedures are minimally invasive and have the potential to reduce recovery time and hospital stays. As a result, there is growing demand for ablation procedures, which is expected to drive the growth of the ablation systems market.

Increasing prevalence of chronic diseases: Ablation systems are used to treat various chronic diseases such as atrial fibrillation, cancer, and chronic pain. As the prevalence of these diseases continues to rise, the demand for ablation systems is also expected to increase.

Technological advancements in ablation systems: Advancements in ablation systems, such as the development of new ablation catheters, are expected to drive the growth of the ablation systems market. New technologies have the potential to improve the efficacy of ablation procedures and make them more accessible to patients.

Rising geriatric population: The aging population is at a higher risk of developing chronic diseases that require ablation procedures. As the geriatric population continues to grow, the demand for ablation systems is expected to increase.

Increasing investments in healthcare infrastructure: Governments and private organizations are investing in healthcare infrastructure, including the development of new hospitals and clinics. This is expected to increase the availability of ablation systems and drive the growth of the market.

Rising demand for cosmetic procedures: Ablation systems are also used in cosmetic procedures such as laser hair removal and skin rejuvenation. As the demand for cosmetic procedures continues to rise, the demand for ablation systems is also expected to increase.

Future Ablation systems Market trends

Increased use of robotic-assisted ablation: Robotic-assisted ablation allows for greater precision and control during procedures, which may improve patient outcomes. As a result, the use of robotic-assisted ablation is expected to increase in the future.

Expansion into emerging markets: As healthcare infrastructure improves in emerging markets, there is expected to be increased demand for ablation systems. As a result, companies may expand their operations into these markets to take advantage of the growing demand.

Development of new ablation techniques: There is ongoing research into new ablation techniques that may be more effective and have fewer side effects than current techniques. As these new techniques are developed and approved, they may drive the growth of the ablation systems market.

Growing demand for image-guided ablation: Image-guided ablation allows for greater accuracy during procedures, which may improve patient outcomes. As a result, there is expected to be increased demand for image-guided ablation in the future.

Adoption of disposable ablation devices: Disposable ablation devices are more convenient and may reduce the risk of infection during procedures. As a result, there is expected to be increased adoption of disposable ablation devices in the future.

Increasing focus on outpatient procedures: Ablation procedures can be performed on an outpatient basis, which may reduce healthcare costs and improve patient satisfaction. As a result, there is expected to be an increasing focus on performing ablation procedures in outpatient settings.

Future hypothetic growth opportunity for Ablation systems Market

One potential future growth opportunity for the Ablation Systems Market is the development of new indications for ablation therapy. Ablation therapy is currently used to treat a variety of conditions, including cancer, atrial fibrillation, and chronic pain. However, there may be new indications for ablation therapy that have not yet been explored.

For example, there is ongoing research into the use of ablation therapy to treat psychiatric disorders such as depression and obsessive-compulsive disorder. If these new indications are proven effective and approved by regulatory agencies, it could drive significant growth in the ablation systems market.

Another potential growth opportunity is the development of new ablation technologies that are more effective and have fewer side effects than current technologies. As research in this area continues, new ablation technologies may be developed that can treat a wider range of conditions and improve patient outcomes.

Finally, the continued expansion of healthcare infrastructure in emerging markets could also drive growth in the ablation systems market. As access to healthcare improves in these markets, there is likely to be increased demand for ablation therapy, which could create new growth opportunities for companies operating in the market.

Niche threats/restraints for Ablation systems Market in enterprise

High cost: Ablation systems can be expensive, and this may limit their adoption in certain markets. Hospitals and healthcare providers may be hesitant to invest in expensive equipment, especially if they are unsure about the long-term return on investment.

Competition from alternative therapies: Ablation therapy competes with other therapies, including surgery and radiation therapy. The availability of alternative therapies may limit the adoption of ablation systems, particularly in cases where these alternative therapies are proven effective.

Regulatory hurdles: The regulatory environment for ablation systems is complex and constantly evolving. Companies operating in the market may face challenges obtaining regulatory approval for new products or expanding into new markets.

Limited reimbursement: The availability of reimbursement for ablation therapy varies by region and may limit the adoption of these systems. In some markets, reimbursement for ablation therapy may be limited, which could impact the willingness of hospitals and healthcare providers to invest in these systems.

Limited clinical evidence: Despite the growing use of ablation therapy, there is still limited clinical evidence supporting its effectiveness for certain conditions. The lack of robust clinical evidence may limit the adoption of these systems, particularly in cases where other therapies have established clinical evidence.

Jane

May, 2022

Looking information on ablation technology market growth to invest.

Johnson

May, 2022

Detailed US geo analysis of Ablation Technology Market - Forecast 2022 to 2030. .