United Kingdom: A2P SMS Market Analysis & Forecast (2010 – 2016)

Mobile network operators are focusing on Application-to-Person (A2P) SMS to increase their average revenue per user/subscriber (ARPU). Application-to-person (A2P) SMS is a part of mobile value added services (VAS). It enhances the average revenue per user by providing mobile content to subscribers which generates stimulation and acts as a gateway to reach mobile subscribers in minimum time. This report analyzes the market for Application-to-Person (A2P) SMS in United Kingdom.

The report analyses the market for Application-to-Person (A2P) in terms of volume and percentage split of standard and premium SMS.

We have used a combination of primary and secondary research to arrive at market estimates, market trends, and market shares; and have adopted a bottoms-up model to derive the volume (messages/year) of United Kingdom premium messaging market and further validated numbers with key market participants including CIO’s, CTO’s, global heads of strategy.

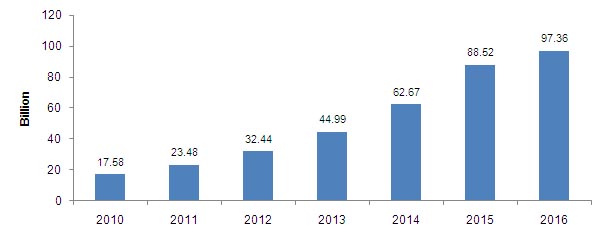

The United Kingdom Application-to-Person (A2P) SMS market is estimated to grow from 23.48 billion in 2011 to 97.36 billion in 2016, registering a CAGR of 32.90% during 2011-2016. With increasing mobile marketing initiatives by mobile marketers and enterprises, the application-to-person (A2P) segment has emerged as a key market for the mobile network operators, sms aggregators, and content providers. Growth in the mobile subscriber base and overall sms traffic is driving the UK application-to-person (A2P) market; benefiting a pool of stakeholders such as mobile content developers, software developers, premium messaging integrators and aggregators.

Amongst the SMS volumes by type, Person-to-Person (P2P) SMS is expected to grow from 140.97 billion in 2011 to 389.66 billion by 2016, registering a CAGR of 22.55% during 2011-2016. The overall sms is estimated to grow from 164.45 billion in 2011 to 487.02 billion in 2016, registering a CAGR of 24.25% during 2011-2016. Standard Application-to-Person (A2P) SMS accounted for the largest share; i.e. 85.72% of the overall Application-to-Person (A2P) SMS market generating 20.13 million in 2011 and is expected to reach 77.90 million by 2016 with a CAGR of 31.08% for the same period.

The stakeholders of the report include mobile network operators, software developers, mobile content developers, mobile marketers, telecommunication regulatory authorities and bodies and key premium messaging integrators or aggregators.

MarketsandMarkets has defined the market from the service provider side. Market players provide Application-to-Person SMS, alternatively called Mobile Terminated (MT) messaging services. MarketsandMarkets has further broken-down the Application-to-Person SMS market based on percentage contribution of Application-to-Person (A2P) mobile messaging towards industry verticals such as BFSI, publishing & media, entertainment, retail, travel & hospitality, and others which include call centers & outsourcing and shipping & logistics.

The report encapsulates the mobile messaging market of United Kingdom to analyze trends and forecast revenues in the submarkets such as application-to-person (A2P) or Mobile Terminated (MT).

Scope of the report

The report provides an extensive analysis of United Kingdom A2P SMS Market that includes pricing, current market trends, industry drivers, and challenges for better understanding of the market structure. The A2P SMS market is segmented on the basis of type which includes standard and premium. The report analyses the market for Application-to-Person (A2P) in terms of volume and percentage split of standard and premium SMS.

Market segmentation

This research report categorizes the UK mobile messaging market into the following sub segments:

On the basis of origin of messages:

Messages such as Application-to-Person (A2P) or Mobile Terminated and Person-to-Person (P2P) are covered in the report. The Application-to-Person (A2P) SMS is further segmented into Standard Application-to-Person and Premium Application-to-Person. The Application-to-Person SMS market has further been broken down into industry verticals such as BFSI, publishing & media, entertainment, retail, travel & hospitality, and others that include call centers & outsourcing and shipping & logistics.

On the basis of geography:

United Kingdom

The report provides extensive analysis of the A2P SMS market that includes pricing, current market trends, industry drivers, and challenges for better understanding of the market structure. The A2P SMS market is segmented on the basis of types that include standard and premium.

The report analyses the market for Application-to-Person (A2P) in terms of volume and percentage split of standard and premium SMS in United Kingdom.

United Kingdom: A2P SMS Market Analysis & Forecast (2010 – 2016)

The mobile subscriber base in the United Kingdom is increasing gradually. It is expected to grow from 83.70 million in 2010 to 95.43 million in 2015, registering a CAGR of 2.66% from 2010 to 2015. The volume of the Application-to-Person (A2P) SMS market is expected to grow from 17.58 billion in 2010 to 97.36 billion in 2016, registering a CAGR of 33.02% from 2010 to 2016.

The increasing popularity of mobile marketing as a medium to reach the masses is driving the volume of A2P SMS. The revenue from application-to-person sms will surpass that of person-to-person sms as the strategic focus for enterprises within the mobile messaging ecosystem will shift from communication between persons and individuals to sending and receiving service enabling messages. It refers to the messages sent by mobile network operators to their subscribers. The stakeholders in this market can gain competitive advantages by entering into agreements and collaborations and bundling their service offerings to gain more traction.

Favorable telecommunication regulatory policies by Ofcom and reduction of messaging tariffs have led to a remarkable increase in the mobile subscriber base. The growing subscriber base has affected the industry revenue positively. The general penchant is that when average revenue per user (ARPU) reduces, voice gets commoditized. The challenge is to retain mobile subscribers by developing alternative revenue streams using mobile marketing campaigns and create a sense of service differentiation in the high-churn messaging market.

The growth of the mobile industry has also led to the development of an exclusive new business ecosystem supporting industries such as content design and development and SMS aggregators.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 TAXONOMY

1.6 FORECAST ASSUMPTIONS

1.7 RESEARCH METHODOLOGY

2 SUMMARY

3 MARKET OVERVIEW

3.1 UK: COMMUNICATION & TECHNOLOGY OVERVIEW

3.2 MESSAGING VALUE CHAIN ANALYSIS

3.3 SMS MESSAGING MARKET SIZE

3.4 UK MOBILE SUBSCRIPTION & MOBILE VAS MARKET

3.5 SMS MESSAGING IN MOBILE 2.0

3.6 MARKET DYNAMICS

3.6.1 DRIVERS

3.6.1.1 Increase in mobile subscriber base

3.6.1.2 Emergence of mobile messaging applications

3.6.1.3 Increase in SMS traffic

3.6.1.4 SMS interoperability

3.6.2 RESTRAINTS

3.6.2.1 Mobile instant messaging

3.6.2.2 Mobile spam

3.6.3 OPPORTUNITIES

3.6.3.1 Mobile marketing

3.6.3.2 Hybrid technology

3.6.4 IMPACT ANALYSIS OF DROS

3.6.5 OPPORTUNITY ANALYSIS

3.6.6 MARKET SHARE ANALYSIS

3.7 UK: REASONS FOR ENTERPRISES TO USE MESSAGING SERVICES

3.7.1 OVERVIEW

3.7.2 BENEFITS OF SMS TO ENTERPRISES

3.7.2.1 A2P SMS benefits

3.7.3 UK: REASONS FOR USE OF MESSAGING SERVICES SUCH AS TEXT & SMS

3.7.3.1 Increasing brand awareness by connecting directly with consumers

3.7.3.2 Mobile message marketing

3.7.3.3 Customer acquisition, retention & engagement (CARE)

3.7.4 APPLICATION AREAS WHERE MOBILE MESSAGING IS GROWING

3.7.4.1 B2B messaging

3.7.4.2 B2B campaigns & list processing

3.7.4.3 B2B applications

3.8 FUTURE MESSAGING TECHNOLOGIES THAT ENTERPRISES WANT OR WILL ADOPT

3.8.1 ENTERPRISE INSTANT MESSAGING

3.8.2 APPLICATION-TO-PERSON SOFTWARE TOOLS

3.8.3 MOBILE DEVICE MANAGEMENT

3.8.4 ENTERPRISE GRADE SMS DEPLOYMENT

3.9 UK: OPPORTUNITIES FOR ENTERPRISES USING MOBILE MESSAGING SERVICES

3.9.1 ENTERPRISE VAS

3.9.1.1 VAS using mobile messaging service

3.9.2 MOBILE MARKETING

3.9.2.1 Trend analysis

3.9.2.1.1 SMS the preferred format

3.9.2.1.2 Integration of end-to-end services

3.9.2.1.3 Mobile network operators would enter full service market

3.9.2.1.4 Pricing

3.9.3 MOBILE BANKING

3.9.4 MOBILE COMMERCE

3.9.5 AFFINITY PROGRAMS

3.9.6 REMOTE MONITORING

3.10 UK: ENTERPRISES’ KEY CRITERIA FOR SELECTING MESSAGING VENDORS

3.10.1 CONNECTIVITY

3.10.2 COST OR PRICING

3.10.3 RELIABILITY

3.10.4 SECURITY

3.10.5 USER FRIENDLINESS

3.10.6 SPEED

3.10.7 SCALABILITY

LIST OF TABLES

TABLE 1 SMS VOLUMES, BY TYPES, 2010 - 2016 (BILLION)

TABLE 2 PERCENTAGE SPLIT OF A2P SMS, BY TYPES, 2010 - 2016

TABLE 3 UK: A2P SMS VOLUMES, 2010 – 2016 (BILLION)

TABLE 4 UK: A2P SMS SPLIT, BY VERTICALS, 2010 - 2016 (%)

TABLE 5 PERCENTAGE SPLIT OF MOBILE SUBSCRIPTIONS, BY TYPES, 2004 - 2009

TABLE 6 MOBILE SUBSCRIPTIONS, 2004 - 2009 (MILLION)

TABLE 7 MOBILE CONTENT SERVICES MARKET, BY REVENUE, 2010 ($BILLION)

TABLE 8 DIFFERENTIATION BETWEEN MOBILE SMS & MOBILE INSTANT MESSAGING

TABLE 9 UK: INITIATIVES, BY MOBILE NETWORK OPERATORS

TABLE 10 MOBILE NETWORK OPERATORS ANALYSIS, 2010

TABLE 11 MOBILE NETWORK OPERATORS VALUE ADDED SERVICES, BY APPLICATIONS, 2010

TABLE 12 MOBILE CAMPAIGN FORMATS, BY TYPES & BRANDS

LIST OF FIGURES

FIGURE 1 MESSAGING VALUE CHAIN ANALYSIS (I)

FIGURE 2 MESSAGING VALUE CHAIN ANALYSIS (II)

FIGURE 3 UK: SMS TRAFFIC GROWTH, 2010 – 2016 (BILLION)

FIGURE 4 UK: A2P MESSAGING TRAFFIC GROWTH, 2010 – 2016 (BILLION)

FIGURE 5 UK: A2P SMS SPLIT, BY VERTICALS, 2010 VS 2016 (%)

FIGURE 6 UK: MOBILE SUBSCRIPTION GROWTH, 2004 – 2009 (MILLION)

FIGURE 7 MOBILE CONTENT SERVICES MARKET, BY APPLICATIONS, 2010 (%)

FIGURE 8 UK: MOBILE ADVERTISEMENT MARKET, BY SPENDING, 2009 – 2016 (MILLION)

FIGURE 9 UK: MOBILE SUBSCRIBERS, 2010 – 2015 (MILLION)

FIGURE 10 UK: SMS SENT, 2005 – 2009 (BILLION)

FIGURE 11 SMS INTEROPERABILITY DRIVES MOBILE MESSAGING

FIGURE 12 MEASUREMENT OF MOBILE MARKETING STRATEGY, BY COST PER LEAD ($) & RESPONSE RATE (%)

FIGURE 13 OPPORTUNITY ANALYSIS MATRIX

FIGURE 14 MOBILE NETWORK OPERATORS MARKET SHARE (%), BY MOBILE SUBSCRIBERS (2010)

FIGURE 15 TOP UK MOBILE SITES, BY TOTAL MINUTES SPENT, 2010 (MILLION)

FIGURE 16 SMS & MMS IN INDUSTRY VERTICALS, BY SERVICES OFFERED

FIGURE 17 UK: MARKET POSITION OF MOBILE PAYMENT

FIGURE 18 IMPACT OF PARAMETERS ON MESSAGING VENDOR CRITERIA

Growth opportunities and latent adjacency in United Kingdom: A2P SMS Market

Interested in understanding the opportunities and threats of the market

interested in competitive landscape