Software-as-a-Service (SaaS) Market in Asia-Pacific (APAC)

Application and Trends in SaaS Market in APAC Region

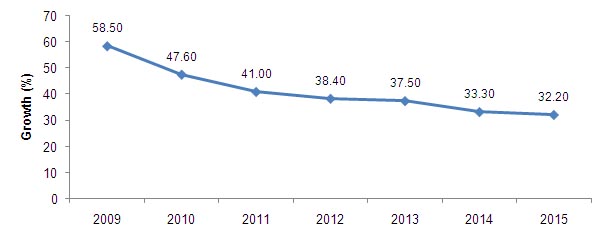

The APAC Software as a Service (SaaS) market is expected to grow from $390 million in 2008 to $4321 million in 2015, at a CAGR of 41.0% from 2008 to 2015. The demand for software as a service (SaaS) continues to grow rapidly among enterprises in Asia Pacific region.

The region comprises few of the fastest growing economies of the world including India and China where the IT industry is registering phenomenal growth outpacing the global average. However, with the recent economic downturn, enterprises in Asia-Pacific were exploring possibilities of trimming down their IT budgets. This created the opportunity for SaaS in the Asia-Pacific.

The key applications of SaaS model are Customer Relationship Management (CRM), Web Collaboration, ERP (Enterprise Resource Planning), Supply Chain Management (SCM), On- Demand HR Solution, to some extent Product Life-cycle Management (PLM), and Document Management (DM).

The mid-sized enterprises had the highest adoption of SaaS in the APAC region in 2008. In 2008, the revenue coming from mid-sized enterprises was $276.9 million, which contributed to 71.0% of the total market in that year. The high number of medium-sized organizations and the low cost to implement SaaS is the main reason for adoption in mid-sized companies.

Australia, New Zealand, and Singapore have reached maturity in terms of SaaS. In 2008, the three countries together had contributed more than one-third of the APAC market. Therefore, large global SaaS vendors continue to focus on these markets. The Independent Software Vendors (ISV) and other service providers are mainly focusing on the overseas clients, mainly from the U.S. and some countries in Europe. The phenomenal growth is also evident in the increase in the number of large customers won by vendors, emergence of strong local players, and the proliferation of different SaaS applications.

Markets Covered

The study includes vendors and independent software vendors, distributors, and users in the APAC region and identifies crucial trends that determine the growth of the market. The report analyzes the APAC SaaS markets and identifies crucial parameters governing the growth of the market:

TRENDS IN APAC SAAS MARKET:

- Pricing

- Technology

- Applications

- Verticals

- Horizontals

- Market size and forecast

KEY SAAS APPLICATION DYNAMICS IN APAC

- CRM

- COLLABORATION

- ERP/SCM/PLM

- ON-DEMAND HR SOLUTIONS

DEMAND ANALYSIS

- GEOGRAPHY

- APPLICATIONS

- HORIZONTALS

- VERTICALS

COMPETITIVE LANDSCAPE FOR 35 VENDORS IN THE REGION

The report analyzes the recent developments and strategies of the vendors in the SaaS market of APAC region. In addition to market sizes and forecasts, the report also provides a detailed analysis of the market trends and factors influencing market growth by offering in-depth analyses of the SaaS applications markets APAC. The report highlights the burning issues in the region and draws competitive landscape of the SaaS applications market, providing an in-depth comparative analysis of the key players.

Stakeholders

The targeted audience for this report includes:

- Independent software vendors

- Distributors of applications

- End users of applications

- Small and medium enterprises who would like to lessen their operational costs

- Software application developers

- Vendors who supply internet connection

- Internet users

- Enterprises and businesses that require business-specific applications based on demand

The global SaaS market is relatively mature than the Asia-Pacific segment and the level of awareness is high in the western countries due to which, revenue generation from the west is higher. The global economic slowdown has created an opportunity for the growth of SaaS and the organizations in the west have been careful in terms of investment. Enterprises experiencing credit crunch and small & medium companies are opting for the SaaS model as a cost effective alternative and they can also avail facility of installment-based payments.

The APAC Software as a Service (SaaS) market is expected to grow from $390 million in 2008 to $4321 million in 2015, at an estimated CAGR of 41.0% from 2008 to 2015.

Australia, New Zealand, and Singapore have reached maturity in terms of SaaS. In 2008, the three countries together had contributed more than one-third of the APAC market. Therefore, large global SaaS vendors continue to focus on these markets. The Independent Software Vendors (ISV) and other service providers are mainly focusing on the overseas clients, mainly from the U.S. and some countries in Europe. The phenomenal growth is also evident in the increase in the number of large customers won by vendors, emergence of strong local players, and the proliferation of different SaaS applications.

With the advent of internet and telecommunication, SaaS in the APAC region is expected to gain momentum.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 SUMMARY

1.2 OPERATING DEFINITION

1.3 ADVANTAGES

1.4 APPLICATIONS

1.5 OVERVIEW OF GLOBAL SAAS MARKET

2 SAAS MARKET IN APAC REGION

2.1 OVERVIEW OF SAAS IN APAC

2.2 OPPORTUNITIES

3 TRENDS IN APAC SAAS MARKET

3.1 PRICING

3.2 TECHNOLOGY

3.3 APPLICATIONS

3.3.1 HR

3.3.2 IT, EDUCATION & MANUFACTURING

3.4 ENTERPRISE SIZE

3.5 MARKET SIZE AND FORECAST

4 KEY SAAS APPLICATION DYNAMICS IN APAC

4.1 INTRODUCTION

4.2 CRM

4.3 COLLABORATION

4.4 ERP/SCM/PLM

4.5 ON-DEMAND HR SOLUTIONS

5 DEMAND ANALYSIS OF APAC SAAS MARKET

6 COMPETITIVE LANDSCAPE

6.1 SAAS VENDORS IN APAC

7 COMPANY PROFILES

7.1 ACCENTURE INC.

7.1.1 Overview

7.1.2 Primary Business

7.1.3 Strategy

7.1.4 Developments

7.2 AKAMAI TECHNOLOGIES INC.

7.2.1 Overview

7.2.2 Primary Business

7.2.3 Strategy

7.2.4 Developments

7.3 APPTIX ASA

7.3.1 Overview

7.3.2 Primary Business

7.3.3 Strategy

7.3.4 Developments

7.4 ARIBA, INC.

7.4.1 Overview

7.4.2 Primary Business

7.4.3 Strategy

7.4.4 Developments

7.5 CA TECHNOLOGIES

7.5.1 Overview

7.5.2 Primary Business

7.5.3 Strategy

7.5.4 Developments

7.6 CDC CORP

7.6.1 Overview

7.6.2 Primary Business

7.6.3 Strategy

7.6.4 Developments

7.7 CISCO SYSTEMS, INC.

7.7.1 Overview

7.7.2 Primary Business

7.7.3 Strategy

7.7.4 Developments

7.8 CITRIX SYSTEMS, INC.

7.8.1 Overview

7.8.2 Primary Business

7.8.3 Strategy

7.8.4 Developments

7.9 EMC CORP

7.9.1 Overview

7.9.2 Primary Business

7.9.3 Strategy

7.9.4 Developments

7.10 ESKER INC.

7.10.1 Overview

7.10.2 Primary Business

7.10.3 Strategy

7.10.4 Developments

7.11 ETELOS, INC.

7.11.1 Overview

7.11.2 Primary Business

7.11.3 Strategy

7.11.4 Developments

7.12 GOGRID

7.12.1 Overview

7.12.2 Primary Business

7.12.3 Strategy

7.12.4 Developments

7.13 HCL TECHNOLOGIES

7.13.1 Overview

7.13.2 Primary Business

7.13.3 Strategy

7.13.4 Developments

7.14 INTERNATIONAL BUSINESS MACHINES CORP

7.14.1 Overview

7.14.2 Primary Business

7.14.3 Strategy

7.14.4 Developments

7.15 INFOSYS TECHNOLOGIES LTD

7.15.1 Overview

7.15.2 Primary Business

7.15.3 Strategy

7.15.4 Developments

7.16 JOYENT, INC.

7.16.1 Overview

7.16.2 Primary Business

7.16.3 Strategy

7.16.4 Developments

7.17 MICROSOFT CORP

7.17.1 Overview

7.17.2 Primary Business

7.17.3 Strategy

7.17.4 Developments

7.18 NETSUITE INC

7.18.1 Overview

7.18.2 Primary Business

7.18.3 Strategy

7.18.4 Developments

7.19 NOVELL, INC.

7.19.1 Overview

7.19.2 Primary Business

7.19.3 Strategy

7.19.4 Developments

7.20 ORACLE CORP

7.20.1 Overview

7.20.2 Primary Business

7.20.3 Strategy

7.20.4 Developments

7.21 PATNI COMPUTER SYSTEMS LTD

7.21.1 Overview

7.21.2 Primary Business

7.21.3 Strategy

7.21.4 Developments

7.22 PROGRESS SOFTWARE

7.22.1 Overview

7.22.2 Primary Business

7.22.3 Strategy

7.22.4 Developments

7.23 RAMCO SYSTEMS LTD

7.23.1 Overview

7.23.2 Primary Business

7.23.3 Strategy

7.23.4 Developments

7.24 RIGHTNOW TECHNOLOGIES INC.

7.24.1 Overview

7.24.2 Primary Business

7.24.3 Strategy

7.24.4 Developments

7.25 SABA SOFTWARE, INC.

7.25.1 Overview

7.25.2 Primary Business

7.25.3 Strategy

7.25.4 Developments

7.26 SALESFORCE.COM INC.

7.26.1 Overview

7.26.2 Primary Business

7.26.3 Strategy

7.26.4 Developments

7.27 SAP AG

7.27.1 Overview

7.27.2 Primary Business

7.27.3 Strategy

7.27.4 Developments

7.28 MAHINDRA SATYAM

7.28.1 Overview

7.28.2 Primary Business

7.28.3 Strategy

7.28.4 Developments

7.29 SAVVIS INC.

7.29.1 Overview

7.29.2 Primary Business

7.29.3 Strategy

7.29.4 Developments

7.3 SONATA SOFTWARE LTD

7.30.1 Overview

7.30.2 Primary Business

7.30.3 Strategy

7.30.4 Developments

7.31 SYMANTEC CORP

7.31.1 Overview

7.31.2 Primary Business

7.31.3 Strategy

7.31.4 Developments

7.32 TALEO CORP

7.32.1 Overview

7.32.2 Primary Business

7.32.3 Strategy

7.32.4 Developments

7.33 TATA CONSULTANCY SERVICES LTD

7.33.1 Overview

7.33.2 Primary Business

7.33.3 Strategy

7.33.4 Developments

7.34 VOCUS, INC.

7.34.1 Overview

7.34.2 Primary Business

7.34.3 Strategy

7.34.4 Developments

7.35 WIPRO LTD

7.35.1 Overview

7.35.2 Primary Business

7.35.3 Strategy

7.35.4 Developments

APPENDIX

U.S. PATENTS

EUROPE PATENTS

JAPAN PATENTS

CONCLUSION

BIBLIOGRAPHY

LIST OF TABLES

1 MARKET DRIVERS & IMPACT

2 MARKET RESTRAINTS & IMPACT

3 INTERNET USAGE IN APAC (2009)

4 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY GEOGRAPHY (2008 – 2015)

5 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY APPLICATIONS (2008 – 2015)

6 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY ENTERPRISE SIZE (2008 – 2015)

7 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY SECTORS (2008 – 2015)

8 MERGERS & ACQUISITIONS/PARTNERSHIPS/AGREEMENTS (2008 – AUGUST 2010)

9 COLLABORATIONS & AGREEMENTS (2008 – AUGUST 2010)

10 NEW PRODUCT DEVELOPMENTS (JANUARY 2008 – MAY 2010)

LIST OF FIGURES

1 APAC SAAS MARKET SIZE & FORECAST (2008 – 2015)

2 APAC SAAS MARKET GROWTH (2009 – 2015)

3 SAAS APPLICATIONS DYNAMICS IN APAC

4 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY GEOGRAPHY (2008-2015)

5 APAC SAAS MARKET GROWTH RATE, BY GEOGRAPHY (2008 – 2015)

6 APAC SAAS MARKET DISTRIBUTION, BY GEOGRAPHY (2008 – 2015)

7 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY APPLICATIONS (2008 – 2015)

8 APAC SAAS MARKET GROWTH RATE, BY APPLICATIONS (2008 – 2015)

9 APAC SAAS MARKET DISTRIBUTION, BY APPLICATIONS (2008 – 2015)

10 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY ENTERPRISE SIZE (2008 – 2015)

11 APAC SAAS MARKET GROWTH RATE, BY ENTERPRISE SIZE (2008 – 2015)

12 APAC SAAS MARKET DISTRIBUTION, BY ENTERPRISE SIZE (2008 – 2015)

13 APAC SAAS MARKET FORECAST OF ABSOLUTE REVENUES, BY SECTORS (2008 – 2015)

14 APAC SAAS MARKET GROWTH RATE, BY APPLICATION SECTORS (2008 – 2015)

15 APAC SAAS MARKET DISTRIBUTION, BY APPLICATION SECTORS (2008 – 2015)

16 THE SAAS ECOSYSTEM IN ASIA PACIFIC

Growth opportunities and latent adjacency in Software-as-a-Service (SaaS) Market

Interested in understanding list of saas/cloud companies in APAC market