Next-Generation Memory Market Size, Share & Industry Growth Analysis Report by Technology (Non-Volatile Memory (MRAM (STT-MRAM, SOT-MRAM, Toggle Mode MRAM), FRAM, RERAM/CBRAM, 3D XPoint, NRAM), and Volatile Memory (HBM, and HMC)), Wafer Size (200 mm, and 300 mm) - Global Forecast to 2028

Updated on : October 22, 2024

Next-Generation Memory Market Size & Growth

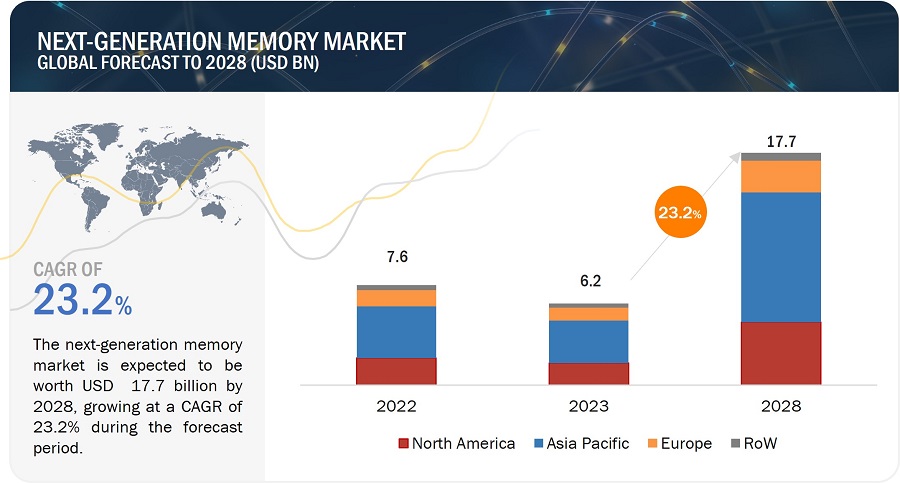

The next-generation memory market size was valued at USD 6.2 billion in 2023 and is estimated to reach USD 17.7 billion by 2028, growing at a CAGR of 23.2% between 2023 to 2028.

The growth of the next-generation memory market is driven by increasing demand for memory devices that provide fast access and consume minimal power, rising adoption of next-generation memory technologies for enterprise storage applications, and suring adoption of next-generation memories in smartphones and smart wearables.

Next-Generation Memory Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Next-Generation Memory Market Trends and Dynamics:

Drivers: Increasing demand for memory devices that provide fast access and consume minimal power

With the increasing amount of data in businesses and the popularity of cloud storage solutions, there is a growing demand for high-capacity, fast storage memory. The performance of advanced products is continually improving, driving much of the semiconductor industry. To meet the requirement for memory devices with high speed, low power consumption, and high scalability, various emerging non-volatile memories such as RRAM, MRAM, FeRAM, and NRAM have been developed. Compared to traditional technologies, these technologies offer higher scalability, density, speed, and endurance. Most emerging memory technologies take between 1 and 10 ns for their output to meet the specified requirements after a command request. The switching time is the time taken by the memory to meet the specified requirements after a command request. The lower the switching time, the faster the read/write data operations of the memory.

Restraint: High manufacturing cost of next-generation memories

The production costs of high-density DRAM and SRAM are comparatively high, and the manufacturing costs of high-bit-density next-generation memories are also high at present. Next-generation memory technologies often involve more complex manufacturing processes than traditional memory technologies. These processes may require specialized equipment, materials, and expertise, leading to higher costs. In the early stages of development and production, next-generation memory technologies may experience lower production yields due to issues like defects, process variations, or materials challenges. Low yields result in a higher cost per functional chip. Some next-generation memory technologies may rely on advanced and expensive materials that contribute to the overall manufacturing costs. Also, the more complex manufacturing processes for next-generation memory technologies may lead to longer manufacturing cycles and slower throughput, increasing manufacturing costs.

Opportunities: Increasing adoption of next-generation memory technologies in embedded systems and IoT devices

The increasing replacement of traditional memories with next-generation memories offers a significant opportunity for next-generation memory market players. Next-generation memory like MRAM and ReRAM offer fast read and write speeds, low power consumption, and non-volatility, making them suitable for use in embedded systems and IoT devices. These memories can enable instant-on capabilities, improve energy efficiency, and enhance data retention in smart devices. These memories have high endurance, allowing them to endure a large number of read and write cycles without degradation. This feature is essential in applications where data is frequently updated, ensuring long-term reliability and longevity of IoT and embedded devices. The low-latency and high-speed access of next-generation memory like MRAM and ReRAM enable in-memory computing, where data can be processed directly in memory without the need for frequent data transfers to the processor. This can enhance the efficiency of certain IoT and embedded applications. The compact size of MRAM and ReRAM memory cells allows for high-density memory storage in a small footprint, making them suitable for space-constrained embedded systems. MRAM and ReRAM's fast write speeds make them ideal for data logging and edge analytics applications, where real-time data processing and storage are crucial. AI and IoT integrated solutions are major users of such technologies. A non-volatile memory that supports fast writes and can be shut down fully but quickly restarted. MRAM is a good fit for IoT and AI use cases since it has better capacity, density, low power requirements, quick writing performance, and extremely low read latency.

Challenge: Higher design costs due to lack of standardized manufacturing processes

The next-generation memory market includes advanced non-volatile memory technologies such as 3D XPoint, MRAM, FRAM, and ReRAM. Most of these memories are in the stage of development or early commercialization and are expected to be produced in bulk in the next few years. Thus, unless these non-volatile memories are produced using standard manufacturing processes, the cost of designing them would be much higher compared to that of existing memories. On the other hand, the cost of competing memories such as DRAM, SRAM, and Flash is declining year-on-year. This poses a challenge for the growth of the market to some extent. Hence, to overcome this, standardized processes and advanced system designs are required to streamline production and reduce cost.

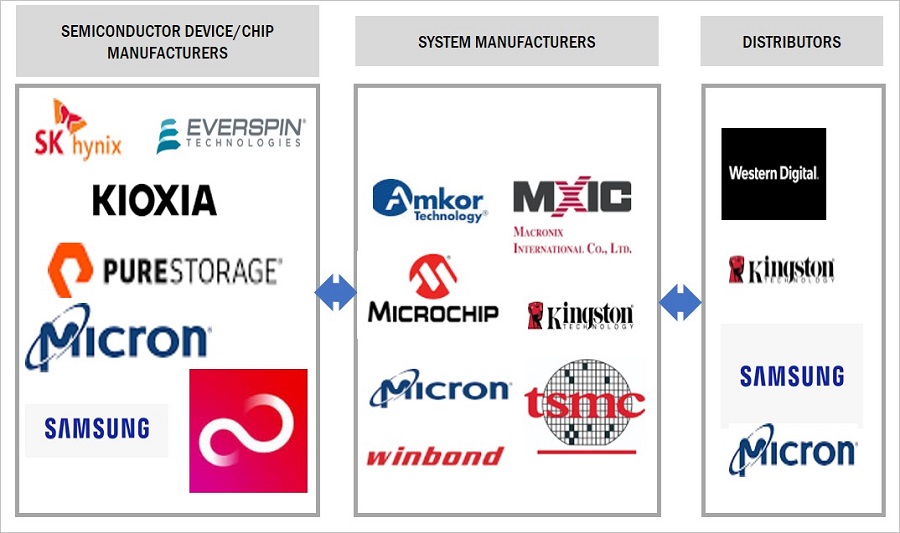

Next-Generation Memory Market Ecosystem

Next-Generation Memory Market Segmentation

Non-volatile memory segment to hold larger market share during the forecast period.

The non-volatile memory segment held a larger share of the market in 2022 and is expected to retain its dominant position throughout the forecast period. This can be attributed to the rising demand for faster, more effective, and cost-efficient memory solutions. Emerging memory technologies also overcome the limitations of traditional non-volatile memory devices pertaining to scalability, endurance, and other parameters. A huge amount of data is generated globally daily, creating the need for more effective storage solutions with large storage capacity. Non-volatile memory, such as ReRAM and STT-MRAM PCM, offers speed and performance comparable to volatile memory technologies such as DRAM and SRAM, along with higher storage densities. Additionally, the increasing demand for wearable electronics, high-performance computing, and replacement of Flash memory storage is also fueling the demand for emerging non-volatile memory technologies.

Volatile Memory Technologies Drive Next-Generation Memory Market Growth During Forecast Period

The market is experiencing rapid growth, fueled by the increasing demand for advanced memory technologies that offer faster access, lower power consumption, and higher storage capacities. Volatile memory technologies such as Hybrid Memory Cube (HMC) and High-bandwidth Memory (HBM) are driving this growth, as they provide high-speed data access and processing capabilities essential for applications such as artificial intelligence, machine learning, and edge computing. With the volatile memory segment expected to witness significant growth during the forecast period, driven by the increasing demand for high-performance memory solutions and the growing adoption of these applications, it is crucial for memory manufacturers to invest in research and development to improve the performance and efficiency of volatile memory technologies.

Enterprise storage segment account for the largest share of the next-generation memory market for during the forecast period

In 2022, the enterprise storage segment held the largest share of the next-generation memory market. The increasing need for data storage in data centers is creating demand for NGM technologies. In recent years, cloud storage has grown with the increasing use of cloud platforms containing some public as well as private data. To store such huge amounts of data, emerging memory technologies are mostly used. Data centers are considering the implementation of emerging memory technologies to keep pace with constant data growth and user productivity. Emerging memory technologies help improve performance and reduce the total cost of ownership (TCO).

300 mm wafer size segment to exhibit highest growth in terms of next-generation memory market during the forecast period

The 300 mm wafer size segment is expected to account for the highest growth of the market. Currently, the market share of 300 mm wafer size is greater than that of the 200 mm wafer size. This is because 300 mm wafers can hold twice as many dies per wafer as 200 mm wafers, resulting in a 2-4% lower IC cost per cm per year. Key players such as Micron Technology, Inc, SAMSUNG, and SK Hynix, Inc. are currently designing most of the memory technologies on 300 mm wafers.

Regional Analysis - Next-Generation Memory Market

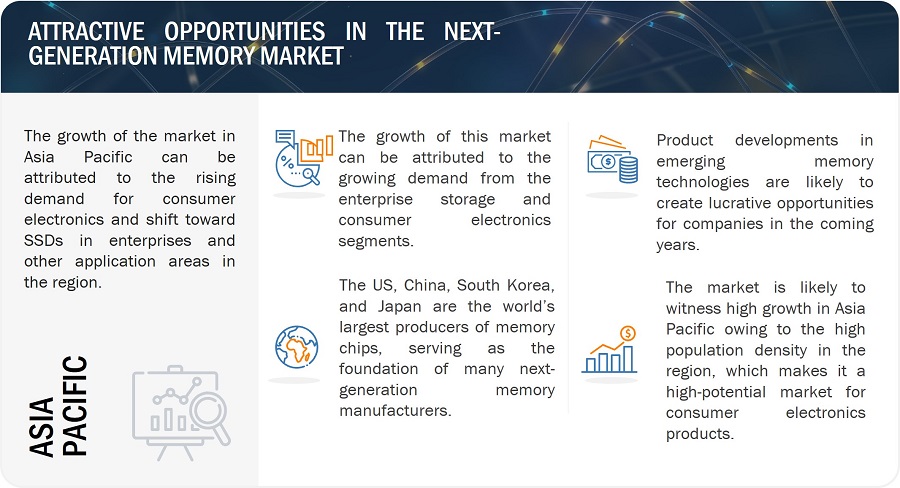

Next-generation memory industry in Asia Pacific estimated to grow at the fastest rate during the forecast period

The market, in Asia Pacific is expected to grow at high CAGR during the forecast period. The market growth is propelled by burgeoning consumer demand, dynamic technological landscape, and robust manufacturing ecosystem. With the presence of major economies such as China, Japan, South Korea, and India which are rapidly advancing their semiconductor capabilities the region is poised to leverage its extensive expertise and resources to lead the development and adoption of next-generation memory solutions.

Next-Generation Memory Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Next-Generation Memory Market Key Players

Major vendors in the next-generation memory companies include

- SAMSUNG (South Korea),

- KIOXIA Holdings Corporation (Japan),

- Micron Technology, Inc. (US),

- Fujitsu (Japan),

- SK Hynix Inc (South Korea),

- Honeywell International, Inc. (US),

- Winbond (Taiwan),

- Microchip Technology Inc. (US),

- Nanya Technology (Taiwan),

- Everspin Technologies (US).

- Macronix International Co., Ltd. (Macronix),

- Kingston Technology (US),

- Infineon Technologies AG (Germany),

- ROHM CO., LTD. (Japan),

- Nantero, Inc. (US),

- Crossbar Inc. (US),

- Viking Technology (US),

- Avalanche Technology (US) are among a few emerging companies in the next-generation memory market.

Next-Generation Memory Market Report Scope

|

Report Metric |

Details |

|

Estimated Value |

USD 6.2 billion in 2023 |

|

Expected Value |

USD 17.7 billion by 2028 |

|

Growth Rate |

CAGR of 23.2% |

|

Market size available for years |

2019—2028 |

|

Base year |

2022 |

|

Forecast period |

2023—2028 |

|

Segments covered |

Technology, Wafer Size, Application and Region |

|

Geographic regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major players include SAMSUNG (South Korea), KIOXIA Holdings Corporation (Japan), Micron Technology, Inc. (US), Fujitsu (Japan), SK Hynix Inc (South Korea), Honeywell International, Inc. (US), Winbond (Taiwan), Microchip Technology Inc. (US), Nanya Technology (Taiwan), Everspin Technologies (US) and Others- total 25 players have been covered. |

Next-Generation Memory Market Highlights

This research report categorizes the next-generation memory market based on technology, wafer size, application, and region.

|

Segment |

Subsegment |

|

By Technology: |

|

|

By Wafer Size: |

|

|

By Application: |

|

|

By Region: |

|

Recent Developments in Next-Generation Memory Industry

- In April 2023, SK Hynix Inc. (South Korea) became the industry’s first to develop a 12-layer HBM31 product with a 24 gigabyte (GB)2 memory capacity, currently the largest in the industry. The company succeeded in developing the 24 GB package product that increased the memory capacity by 50% from the previous product, following the mass production of the world’s first HBM3 in June 2022

- In May 2022, Everspin Technologies Inc. (US) announced the launch of the STT-MRAM EMxxLX xSPI Family with densities ranging from 8 Mbit up to 64 Mbit.

- In March 2022, Fujitsu Semiconductor Memory Solution Limited (Japan) announced the launch of a 12Mbit ReRAM (Resistive Random Access Memory), MB85AS12MT, which is the largest density in Fujitsu’s ReRAM product family. The MB85AS12MT is a non-volatile memory with 12Mbit memory density and operates at a wide range of power supply voltage from 1.6V to 3.6V.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the next-generation memory market size during 2023-2028?

The global next-generation memory market is expected to record the CAGR of 23.2% from 2023-2028.

Which regions are expected to pose significant demand for next-generation memory market share from 2023-2028?

North America, and Asia Pacific is expected to pose significant demand from 2023 to 2028. Major economies such as US, Canada, China, Japan, and South Korea are expected to have a high potential for the future growth of the market.

What are the major market opportunities in the next-generation memory market share?

Increasing adoption of next-generation memory technologies in embedded systems and IoT devices, and rising adoption of high-bandwidth memory (HBM) in data centers for memory-intensive applications are projected to create lucrative opportunities for the players operating in the next-generation memory market during the forecast period.

Which are the significant players operating in next-generation memory market?

Key players operating in the next-generation memory market are SAMSUNG (South Korea), SK Hynix Inc (South Korea), Micron Technology, Inc. (US), KIOXIA Holdings Corporation (Japan), and Fujitsu (Japan).

What are the major applications of the next-generation memory market?

Consumer electronics, enterprise storage, automotive and transportation, telecommunications, industrial, automotive, military and aerospace, agriculture, retail, and healthcare are the major applications of the next-generation memory market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for memory devices that provide fast access and consume minimal power- Surging adoption of next-generation memory technologies for enterprise storage applications- Rising integration of next-generation memories in smartphones and smart wearables- Growing adoption of next-generation memory solutions in automotive sector to handle evolving data and computational needsRESTRAINTS- High manufacturing cost of next-generation memories- Compatibility and interoperability issues associated with next-generation memoriesOPPORTUNITIES- Increasing adoption of next-generation memory technologies in embedded systems and IoT devices- Rising adoption of high-bandwidth memory (HBM) in data centers for memory-intensive applicationsCHALLENGES- Scalability issues associated with high-density non-volatile memories- Higher design costs due to lack of standardized manufacturing processes- Achieving high-speed write performance and energy efficiency

-

5.3 VALUE CHAIN ANALYSISVALUE CHAIN ANALYSIS OF NEXT-GENERATION MEMORIESVALUE CHAIN ANALYSIS OF MAGNETO-RESISTIVE RANDOM-ACCESS MEMORY (MRAM)

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF NEXT-GENERATION MEMORY SOLUTIONS OFFERED BY KEY PLAYERS, BY NON-VOLATILE MEMORY TECHNOLOGYAVERAGE SELLING PRICE OF NEXT-GENERATION MEMORY SOLUTIONS OFFERED BY KEY PLAYERS, BY VOLATILE MEMORY TECHNOLOGY

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Conductive-bridge RAM (CBRAM)- Oxide-based ReRAM (OxRAM)- Atomic-switch ReRAM- HfO2-based ReRAMADJACENT TECHNOLOGIES- Perpendicular magnetic anisotropy (PMA)- ML- and AI-based memory management- 3D stacking and packaging techniques

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

-

5.10 CASE STUDY ANALYSISEVERSPIN TECHNOLOGIES HELPED BMW OPTIMIZE MOTORSPORT SUPERBIKE WITH MRAM MEMORYIBM SWITCHED TO MRAM WRITE CACHES FOR NEW FLASHSYSTEM STORAGE, ELIMINATING BULKY SUPERCAPSEVERSPIN AND QUICKLOGIC PARTNERED TO PROVIDE MRAM FOR HIGH-RELIABILITY FPGA TO SUPPORT DEPARTMENT OF DEFENSE (DOD) SYSTEMS

-

5.11 TRADE ANALYSISIMPORT SCENARIO- Import scenario for electronic integrated circuits such as memoriesEXPORT SCENARIO- Export scenario for electronic integrated circuits such as memories

- 5.12 TARIFF ANALYSIS

-

5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.15 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS- US regulations- EU regulationsSTANDARDS- CEN- ISO/IEC JTC 1- European Telecommunications Standards Institute (ETSI)- Institute of Electrical and Electronics Engineers Standards Association (IEEE)

- 6.1 INTRODUCTION

-

6.2 NON-VOLATILE MEMORYMAGNETO-RESISTIVE RANDOM-ACCESS MEMORY (MRAM)- Spin-transfer torque magnetic random-access memory (STT-MRAM)- Spin-orbit torque magnetic random-access memory (SOT-MRAM)- Toggle mode MRAMFERROELECTRIC RAM (FRAM)- Growing preference for FRAM over Flash memory to drive segmentRESISTIVE RANDOM-ACCESS MEMORY (RERAM)/CONDUCTIVE-BRIDGING RAM (CBRAM)- Ability of ReRAM/CBRAM to achieve high-density data storage while maintaining exceptional speed and low energy consumption to drive market3D XPOINT- Breakthrough combination of fast access speeds and high endurance to boost demand for 3D XPointNANO RAM (NRAM)- Exceptional data retention capabilities of NRAM at high temperatures to drive marketOTHERS

-

6.3 VOLATILE MEMORYHYBRID MEMORY CUBE (HMC)- Growing adoption of HMC for high-performance computing applications to drive marketHIGH-BANDWIDTH MEMORY (HBM)- Increasing adoption of HBM in network devices and high-performance graphics accelerators to drive market

- 7.1 INTRODUCTION

-

7.2 CONSUMER ELECTRONICSFOCUS ON IMPROVING MEMORY CAPACITY OF CONSUMER ELECTRONICS DEVICES TO DRIVE MARKET- Use case: Wearable electronic devices- Use case: Others (Washing machines and dishwashers)

-

7.3 ENTERPRISE STORAGEADOPTION OF NEXT-GEN MEMORY IN ENTERPRISE STORAGE TO IMPROVE PERFORMANCE AND REDUCE LATENCY TO DRIVE MARKET

-

7.4 AUTOMOTIVE & TRANSPORTATIONINCREASING DEMAND FOR ADVANCED AUTOMOTIVE FEATURES TO FUEL ADOPTION OF NEXT-GENERATION MEMORIES- Use case: Smart airbags

-

7.5 MILITARY & AEROSPACENEED FOR HIGH ACCURACY AND RELIABILITY IN MILITARY AND AEROSPACE OPERATIONS TO DRIVE DEMAND FOR NEXT-GEN MEMORIES

-

7.6 INDUSTRIALNEED FOR FASTER PERFORMANCES OF INDUSTRIAL EQUIPMENT TO BOOST DEMAND FOR NEXT-GENERATION MEMORIES- Use case: Human–machine interface (HMI)- Use case: Programmable logic controllers (PLCs)

-

7.7 TELECOMMUNICATIONSADVENT OF 5G TO GENERATE DEMAND FOR NEXT-GENERATION MEMORY TECHNOLOGIES- Use case: Cybersecurity and networking- Use case: Network security

-

7.8 ENERGY & POWERNEED TO IMPROVE DATA PROCESSING SPEED AND EFFICIENCY IN O&G OPERATIONS TO FUEL DEMAND FOR EMERGING MEMORY TECHNOLOGIES- Use case: Smart grids- Use case: Smart metering

-

7.9 HEALTHCAREMRAM AND FRAM TECHNOLOGIES TO GAIN POPULARITY IN HEALTHCARE DUE TO THEIR ENERGY-EFFICIENT AND NON-VOLATILE NATURE- Use case: Pacemakers- Use case: Medical imaging

-

7.10 AGRICULTUREADOPTION OF EMERGING MEMORY TECHNOLOGIES IN AGRICULTURE FOR CROP MANAGEMENT AND SOIL ANALYSIS TO DRIVE MARKET- Use case: Field/Crop management- Use case: Soil analysis/monitoring

-

7.11 RETAILEMERGENCE OF E-COMMERCE TO DRIVE DEMAND FOR NEXT-GENERATION MEMORIES- Use case: Inventory management- Use case: Interactive kiosks and digital signage

-

8.1 INTRODUCTION200 MM- 200 mm wafers widely used in electronic products300 MM- Majority of next-generation memory chips manufactured using 300 mm wafers

- 8.2 NON-VOLATILE MEMORY MARKET, BY WAFER SIZE

- 8.3 VOLATILE MEMORY MARKET, BY WAFER SIZE

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Presence of numerous data centers to support market growthCANADA- Demand from telecommunications industry to drive marketMEXICO- Focus on improving semiconductor production capability to boost market growth

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Demand from automotive industry to accelerate market growthUK- Increasing number of data centers to drive marketFRANCE- High demand from enterprise storage segment to foster market growthREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Government support for R&D of next-generation memory technologies to favor market growthJAPAN- Presence of memory and digital device manufacturers to augment market growthSOUTH KOREA- Established consumer electronics industry to foster market growthINDIA- Focus on domestic production of semiconductors to augment market growthREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLD (ROW)REST OF THE WORLD: RECESSION IMPACTSOUTH AMERICA- Proliferation of data centers to create demand for next-generation memoriesMIDDLE EAST & AFRICA- Increasing investments to develop regional healthcare infrastructure to boost demand for next-generation memories

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS, 2022

-

10.5 EVALUATION MATRIX FOR KEY COMPANIES, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 EVALUATION MATRIX FOR SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

10.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

11.1 KEY PLAYERSSAMSUNG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKIOXIA HOLDINGS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICRON TECHNOLOGY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSK HYNIX INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJITSU- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHONEYWELL INTERNATIONAL INC.- Business overview- Products/Solutions/Services offeredMICROCHIP TECHNOLOGY INC.- Business overview- Products/Solutions/Services offered- Recent developmentsWINBOND- Business overview- Products/Solutions/Services offered- Recent developmentsNANYA TECHNOLOGY- Business overview- Products/Solutions/Services offeredEVERSPIN TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSMACRONIX INTERNATIONAL CO., LTD.KINGSTON TECHNOLOGYINFINEON TECHNOLOGIES AGROHM CO., LTD.RENESAS ELECTRONICS CORPORATIONNANTERO, INC.CROSSBAR, INC.VIKING TECHNOLOGYNVMDURANCEAVALANCHE TECHNOLOGYSKYHIGH MEMORY LIMITEDATP ELECTRONICS, INC.RAMBUS4DS MEMORYINTEL CORPORATION

- 12.1 DISCUSSION GUIDE

- 12.2 CUSTOMIZATION OPTIONS

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 2 RISK ASSESSMENT: NEXT-GENERATION MEMORY MARKET

- TABLE 3 MARKET: ROLE OF KEY PLAYERS IN ECOSYSTEM

- TABLE 4 PRICE OF NON-VOLATILE MEMORY DEVICES, BY COMPANY

- TABLE 5 PRICE OF VOLATILE MEMORY DEVICES, BY COMPANY

- TABLE 6 AVERAGE SELLING PRICE OF NEXT-GENERATION MEMORY SOLUTIONS OFFERED BY KEY PLAYERS, BY TECHNOLOGY

- TABLE 7 NEXT GENERATION MEMORY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 9 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 10 IMPORT DATA FOR HS CODE 854232, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 854232, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 12 TARIFFS FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY US, 2023

- TABLE 13 TARIFFS FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY CHINA, 2023

- TABLE 14 TARIFFS FOR ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS EXPORTED BY GERMANY, 2023

- TABLE 15 NUMBER OF PATENTS REGISTERED FROM 2013 TO 2022

- TABLE 16 PATENTS RELATED TO NEXT-GENERATION MEMORY MARKET

- TABLE 17 NEXT GENERATION MEMORY MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 23 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 24 NON-VOLATILE MEMORY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 25 NON-VOLATILE MEMORY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 26 MRAM: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 27 MRAM: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 FRAM: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 29 FRAM: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 30 RERAM/CBRAM: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 31 RERAM/CBRAM: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 3D XPOINT: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 3D XPOINT: NEXT GENERATION MEMORY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 NANO RAM: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 35 NANO RAM: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 OTHERS: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 OTHERS: NEXT GENERATION MEMORY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 VOLATILE MEMORY: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 39 VOLATILE MEMORY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 40 HMC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 HMC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 HBM: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 43 HBM: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 NEXT-GENERATION MEMORY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 NEXT GENERATION MEMORY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 NEXT-GENERATION NON-VOLATILE MEMORY MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 47 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 49 NEXT-GENERATION VOLATILE MEMORY MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 50 CONSUMER ELECTRONICS: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 51 CONSUMER ELECTRONICS: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 56 ENTERPRISE STORAGE: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 57 ENTERPRISE STORAGE: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 58 ENTERPRISE STORAGE: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 59 ENTERPRISE STORAGE: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 60 ENTERPRISE STORAGE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 61 ENTERPRISE STORAGE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 62 AUTOMOTIVE & TRANSPORTATION: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 63 AUTOMOTIVE & TRANSPORTATION: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 64 AUTOMOTIVE & TRANSPORTATION: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 65 AUTOMOTIVE & TRANSPORTATION: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 66 AUTOMOTIVE & TRANSPORTATION: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 67 AUTOMOTIVE & TRANSPORTATION: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 68 MILITARY & AEROSPACE: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 69 MILITARY & AEROSPACE: NEXT-GENERATION MEMORY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 70 MILITARY & AEROSPACE: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 71 MILITARY & AEROSPACE: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 72 MILITARY & AEROSPACE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 73 MILITARY & AEROSPACE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 74 INDUSTRIAL: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 75 INDUSTRIAL: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 76 INDUSTRIAL: NEXT GENERATION MEMORY MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 77 INDUSTRIAL: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 78 INDUSTRIAL: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 79 INDUSTRIAL: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 80 TELECOMMUNICATIONS: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 81 TELECOMMUNICATIONS: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 82 TELECOMMUNICATIONS: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 83 TELECOMMUNICATIONS: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 84 TELECOMMUNICATIONS: NEXT GENERATION MEMORY MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 85 TELECOMMUNICATIONS: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 86 ENERGY & POWER: NEXT-GENERATION MEMORY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 87 ENERGY & POWER: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 88 ENERGY & POWER: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 89 ENERGY & POWER: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 90 ENERGY & POWER: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 91 ENERGY & POWER: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 92 HEALTHCARE: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 93 HEALTHCARE: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 94 HEALTHCARE: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 95 HEALTHCARE: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 96 HEALTHCARE: MARKET BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 97 HEALTHCARE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 98 AGRICULTURE: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 99 AGRICULTURE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 100 AGRICULTURE: MARKET, BY NONVOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 101 AGRICULTURE: MARKET, BY NONVOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 102 AGRICULTURE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 103 AGRICULTURE: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 104 RETAIL: MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 105 RETAIL: NEXT GENERATION MEMORY MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 106 RETAIL: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 107 RETAIL: MARKET, BY NON-VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 108 RETAIL: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 109 RETAIL: MARKET, BY VOLATILE MEMORY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 110 NEXT-GENERATION MEMORY MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 111 NEXT GENERATION MEMORY MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 112 MRAM: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 113 MRAM: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 114 FRAM: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 115 FRAM: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 116 RERAM/CBRAM: NEXT GENERATION MEMORY MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 117 RERAM/CBRAM: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 118 3D XPOINT: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 119 3D XPOINT: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 120 NANO RAM: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 121 NANO RAM: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 122 OTHERS: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 123 OTHERS: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 124 HMC: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 125 HMC: NEXT GENERATION MEMORY MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 126 HBM: MARKET, BY WAFER SIZE, 2019–2022 (USD MILLION)

- TABLE 127 HBM: MARKET, BY WAFER SIZE, 2023–2028 (USD MILLION)

- TABLE 128 NEXT-GENERATION MEMORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 129 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 130 MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 131 MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 132 MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 133 NEXT GENERATION MEMORY MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 135 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 137 NORTH AMERICA: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: NEXT GENERATION MEMORY MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 NORTH AMERICA: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 140 EUROPE: NEXT-GENERATION MEMORY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 141 EUROPE: NEXT GENERATION MEMORY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 142 EUROPE: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 143 EUROPE: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 144 EUROPE: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 EUROPE: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: NEXT GENERATION MEMORY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 REST OF THE WORLD: NEXT GENERATION MEMORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 153 REST OF THE WORLD: NEXT-GENERATION MEMORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 154 REST OF THE WORLD: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 155 REST OF THE WORLD: MARKET FOR NON-VOLATILE MEMORY TECHNOLOGY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 156 REST OF THE WORLD: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY REGION, 2019–2022 (USD MILLION)

- TABLE 157 REST OF THE WORLD: MARKET FOR VOLATILE MEMORY TECHNOLOGY, BY REGION, 2023–2028 (USD MILLION)

- TABLE 158 OVERVIEW OF KEY GROWTH STRATEGIES ADOPTED BY MAJOR COMPANIES

- TABLE 159 MARKET: DEGREE OF COMPETITION

- TABLE 160 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 161 NEXT GENERATION MEMORY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 162 MARKET: COMPANY FOOTPRINT

- TABLE 163 MARKET: TECHNOLOGY FOOTPRINT

- TABLE 164 MARKET: APPLICATION FOOTPRINT

- TABLE 165 MARKET: REGION FOOTPRINT

- TABLE 166 MARKET: PRODUCT LAUNCHES, JANUARY 2019–JUNE 2023

- TABLE 167 MARKET: DEALS, JULY 2019–MARCH 2023

- TABLE 168 NEXT-GENERATION MEMORY MARKET: OTHERS, DECEMBER 2020–JULY 2023

- TABLE 169 SAMSUNG: COMPANY OVERVIEW

- TABLE 170 SAMSUNG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 SAMSUNG: PRODUCT LAUNCHES

- TABLE 172 SAMSUNG: DEALS

- TABLE 173 KIOXIA HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 174 KIOXIA HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 KIOXIA HOLDINGS CORPORATION: PRODUCT LAUNCHES

- TABLE 176 KIOXIA HOLDINGS CORPORATION: DEALS

- TABLE 177 KIOXIA HOLDINGS CORPORATION: OTHERS

- TABLE 178 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 179 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 MICRON TECHNOLOGY, INC.: PRODUCT LAUNCHES

- TABLE 181 MICRON TECHNOLOGY, INC.: OTHERS

- TABLE 182 SK HYNIX INC.: COMPANY OVERVIEW

- TABLE 183 SK HYNIX INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 SK HYNIX INC.: PRODUCT LAUNCHES

- TABLE 185 SK HYNIX INC.: DEALS

- TABLE 186 FUJITSU: COMPANY OVERVIEW

- TABLE 187 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 FUJITSU: PRODUCT LAUNCHES

- TABLE 189 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 190 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 192 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 194 MICROCHIP TECHNOLOGY INC.: OTHERS

- TABLE 195 WINBOND: COMPANY OVERVIEW

- TABLE 196 WINBOND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 WINBOND: PRODUCT LAUNCHES

- TABLE 198 WINBOND: DEALS

- TABLE 199 NANYA TECHNOLOGY: COMPANY OVERVIEW

- TABLE 200 NANYA TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 EVERSPIN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 202 EVERSPIN TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 EVERSPIN TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 204 EVERSPIN TECHNOLOGIES: DEALS

- TABLE 205 EVERSPIN TECHNOLOGIES: OTHERS

- FIGURE 1 NEXT-GENERATION MEMORY MARKET: SEGMENTATION

- FIGURE 2 GDP GROWTH PROJECTION TILL 2023 FOR MAJOR ECONOMIES

- FIGURE 3 NEXT GENERATION MEMORY MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH FLOW

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 VOLATILE MEMORY SEGMENT TO REGISTER HIGHER CAGR IN MARKET DURING FORECAST PERIOD

- FIGURE 10 ENTERPRISE STORAGE SEGMENT TO ACCOUNT FOR LARGEST SIZE OF NEXT GENERATION MEMORY MARKET BY 2028

- FIGURE 11 300 MM SEGMENT TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 12 ASIA PACIFIC HELD LARGEST SHARE OF MARKET IN 2022

- FIGURE 13 HIGH ADOPTION OF NEXT-GENERATION MEMORY DEVICES IN ENTERPRISE STORAGE AND CONSUMER ELECTRONICS APPLICATIONS TO DRIVE MARKET

- FIGURE 14 NON-VOLATILE MEMORY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 300 MM WAFER SIZE AND ENTERPRISE STORAGE APPLICATION TO HOLD LARGEST MARKET SHARES IN 2023

- FIGURE 16 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2023

- FIGURE 17 MARKET IN CHINA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 18 NEXT GENERATION MEMORY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL VEHICLE PRODUCTION, 2017–2022 (MILLION UNITS)

- FIGURE 20 ANALYSIS OF IMPACT OF DRIVERS ON GLOBAL NEXT-GENERATION MEMORY MARKET

- FIGURE 21 ANALYSIS OF IMPACT OF RESTRAINTS ON GLOBAL NEXT GENERATION MEMORY MARKET

- FIGURE 22 ANALYSIS OF IMPACT OF OPPORTUNITIES ON GLOBAL MARKET

- FIGURE 23 ANALYSIS OF IMPACT OF CHALLENGES ON GLOBAL MARKET

- FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: MAGNETO-RESISTIVE RANDOM-ACCESS MEMORY (MRAM) MARKET

- FIGURE 26 NEXT GENERATION MEMORY MARKET: ECOSYSTEM

- FIGURE 27 AVERAGE SELLING PRICE OF NEXT-GENERATION MEMORY SOLUTIONS OFFERED BY KEY PLAYERS, BY NON-VOLATILE MEMORY TECHNOLOGY

- FIGURE 28 AVERAGE SELLING PRICE OF NEXT-GENERATION MEMORY SOLUTIONS OFFERED BY KEY PLAYERS, BY VOLATILE MEMORY TECHNOLOGY

- FIGURE 29 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR VENDORS IN MARKET

- FIGURE 30 NEXT-GENERATION MEMORY MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 KEY BUYING CRITERIA, BY APPLICATION

- FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS BETWEEN 2013 AND 2022

- FIGURE 34 NUMBER OF PATENTS PUBLISHED BETWEEN 2013 AND 2023

- FIGURE 35 NON-VOLATILE MEMORY SEGMENT TO HOLD LARGER SHARE OF MARKET BY 2028

- FIGURE 36 MRAM SEGMENT TO RECORD HIGHEST CAGR IN NEXT GENERATION MEMORY MARKET FROM 2023 TO 2028

- FIGURE 37 TOGGLE MRAM CELL STRUCTURE

- FIGURE 38 BASIC FERROELECTRIC MEMORY CELL

- FIGURE 39 BASIC STRUCTURE OF RERAM

- FIGURE 40 HBM SEGMENT TO EXHIBIT HIGHER CAGR IN VOLATILE MARKET FROM 2023 TO 2028

- FIGURE 41 ENTERPRISE STORAGE SEGMENT TO HOLD LARGEST SHARE OF NEXT GENERATION MEMORY MARKET BY 2028

- FIGURE 42 MAKING OF SILICON WAFER

- FIGURE 43 300 MM SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 46 US TO DOMINATE NORTH AMERICAN NEXT-GENERATION NON-VOLATILE MEMORY MARKET DURING FORECAST PERIOD

- FIGURE 47 US TO DOMINATE NORTH AMERICAN NEXT-GENERATION VOLATILE MEMORY MARKET DURING FORECAST PERIOD

- FIGURE 48 EUROPE: NEXT GENERATION MEMORY MARKET SNAPSHOT

- FIGURE 49 GERMANY TO DOMINATE EUROPEAN NEXT-GENERATION NON-VOLATILE MEMORY MARKET DURING FORECAST PERIOD

- FIGURE 50 GERMANY TO DOMINATE EUROPEAN NEXT-GENERATION VOLATILE MEMORY MARKET DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC: NEXT-GENERATION MEMORY MARKET SNAPSHOT

- FIGURE 52 CHINA TO DOMINATE ASIA PACIFIC NEXT-GENERATION NON-VOLATILE MEMORY MARKET DURING FORECAST PERIOD

- FIGURE 53 CHINA TO DOMINATE ASIA PACIFIC NEXT-GENERATION VOLATILE MEMORY MARKET DURING FORECAST PERIOD

- FIGURE 54 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN MARKET

- FIGURE 55 MARKET SHARE ANALYSIS, 2022

- FIGURE 56 NEXT-GENERATION MEMORY MARKET (GLOBAL): EVALUATION MATRIX FOR KEY COMPANIES, 2022

- FIGURE 57 NEXT GENERATION MEMORY MARKET (GLOBAL): EVALUATION MATRIX FOR SMES, 2022

- FIGURE 58 SAMSUNG: COMPANY SNAPSHOT

- FIGURE 59 KIOXIA HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 60 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- FIGURE 61 SK HYNIX INC.: COMPANY SNAPSHOT

- FIGURE 62 FUJITSU: COMPANY SNAPSHOT

- FIGURE 63 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 64 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 65 WINBOND: COMPANY SNAPSHOT

- FIGURE 66 NANYA TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 67 EVERSPIN TECHNOLOGIES: COMPANY SNAPSHOT

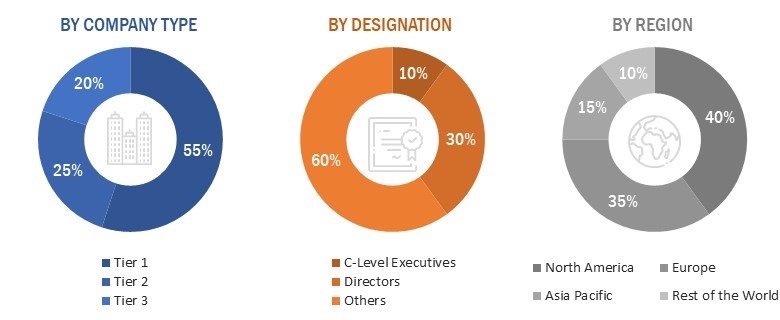

The study involved four major activities in estimating the size for next-generation memory market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, and articles by recognized authors were referred to. Secondary research was done to obtain key information about the market’s supply chain, the market's value chain, the pool of key market players, and market segmentation according to industry trends, region, and developments from both market and technology perspectives.

Primary Research

Extensive primary research has been conducted after understanding and analyzing the next-generation memory market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of primary interviews have been conducted with the demand side and 75% with the supply side. These primary data have been collected through telephonic interviews, questionnaires, and emails.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to perform the market size estimation and forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information/insights throughout the report.

The key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top players as well as extensive interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) on the next-generation memory market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Next-Generation Memory Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the next-generation memory market from the revenues of key players and their share in the market.

Next-Generation Memory Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. For the calculation of specific market segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The bottom-up approach has also been implemented for the data obtained from the secondary research to validate the market size of various segments. The market share of each company has been estimated to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of the data through primaries, the overall parent market size and each individual market size have been determined and confirmed in this study.

Data Triangulation

After arriving at the overall market size through the process explained above, the overall market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Definition

Next-generation memory technologies refer to the emerging memory solutions that have been introduced in the market or are currently under development and are expected to penetrate the market in the coming years. These technologies offer advanced features such as high power efficiency, faster switching time, high scalability, low power consumption, high endurance, operation and speed trade-off, low operating voltages, and high density.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- OEM technology solution providers

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Forums, alliances, and associations

- Technology investors

- Research institutes and organizations

- Analysts and strategic business planners

- Market research and consulting firms

Report Objectives

- To define, describe, segment, and forecast the size of the global next-generation memory (NGM) market, by technology, wafer size, and application, in terms of value

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the next-generation memory market

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, pricing analysis, Porter’s Five Forces analysis, and regulations pertaining to the market

- To provide a detailed overview of the value chain of the next-generation memory ecosystem

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities for stakeholders by identifying the high-growth segments of the market

- To strategically profile key players, comprehensively analyze their market positions in terms of ranking and core competencies2

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the next-generation memory market

- To study the impact of the recession on the next-generation memory (NGM) market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Growth opportunities and latent adjacency in Next-Generation Memory Market