MRI Systems Market: Growth, Size, Share, and Trends

MRI Systems Market by Architecture (Open, Closed), Field Strength (High Field MRI Systems & Low Field MRI Systems), Design (Portable MRI Systems, Fixed/Stationary MRI Systems), End User (Hospitals, Diagnostic Clinic), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

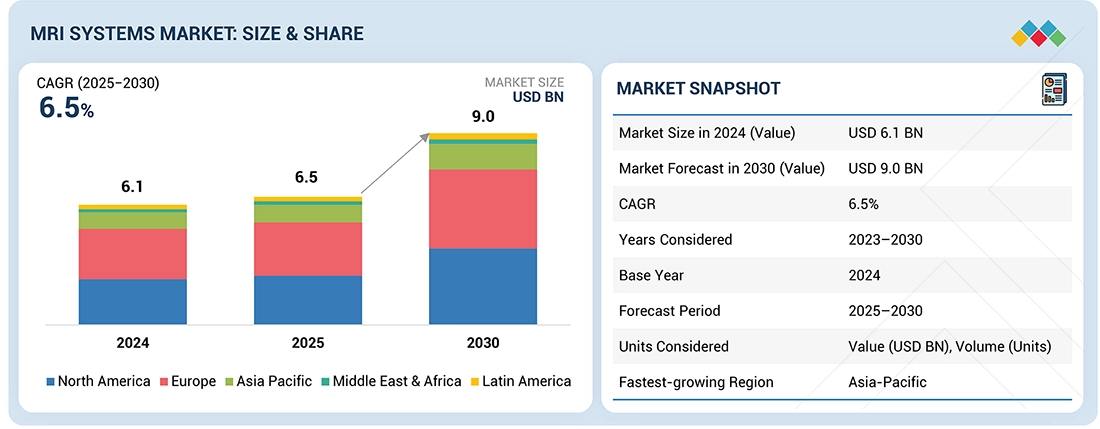

The global MRI systems market is projected to reach USD 9.0 billion by 2030 from USD 6.5 billion in 2025, at a CAGR of 6.5% from 2025 to 2030. The market for MRI systems is driven by a confluence of technological innovation, rising chronic disease prevalence, and heightened demand for non-invasive diagnostic imaging. MRI continues to evolve from a conventional radiology tool into a precision diagnostic platform supporting advanced clinical applications such as functional brain imaging, cardiac assessment, and oncology staging. Vendors are focusing on hybrid imaging modalities, workflow automation, AI-assisted reconstruction, and portable MRI systems to address both developed and emerging market requirements. The market’s steady growth trajectory reflects increasing procedural volumes, installation of high-field systems, and the emergence of MRI as an indispensable modality in personalized medicine and translational research.

KEY TAKEAWAYS

-

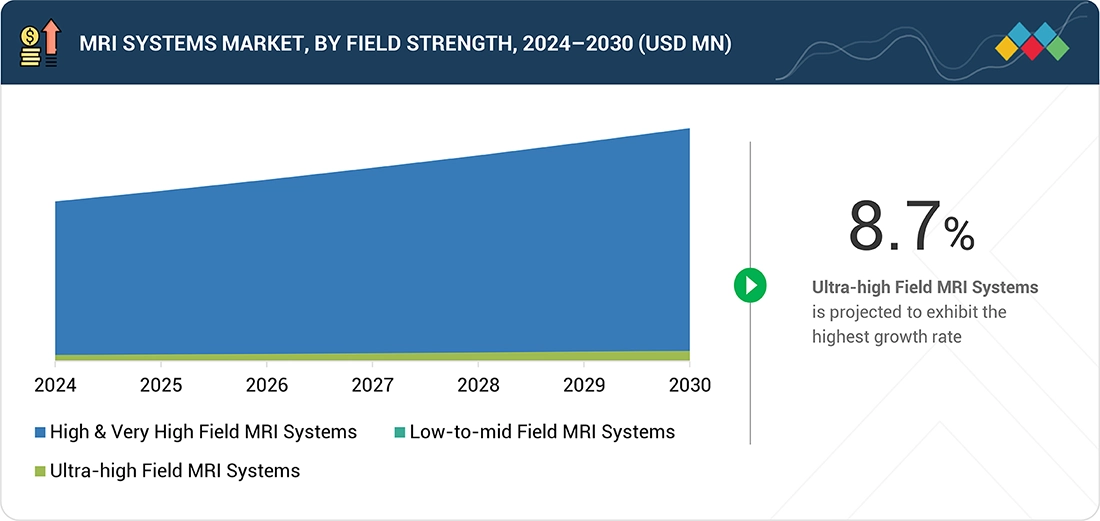

BY FIELD STRENGTH

- By Field Strength, the market is categorized into low-to-mid-field systems, high & very high field systems, and ultra-high-field MRI systems

- High & very high field MRI systems accounted for a larger share in the market, attributed to their growing installed base and wider application portfolio along with technical advantages such as ease of operation.

-

BY ARCITECTURE

- By architecture, the market includes closed MRI systems and open MRI systems

- The closed MRI systems accounted for a larger share in the market due to their superior image quality and the breadth of diagnostic applications.

-

BY DESIGN

- Key designs of MRI systems include portable and fixed/stationary MRI systems

- The fixed/stationary MRI systems acquired a larger share due to the ability of full-body scanning, enhanced workflow efficiency, and lower lifecycle cost along with dominant installed base

-

BY APPLICATION

- Key application segments inludes brain & neurological, spine & musculoskeletal, pelvic & abdominal, vascular, breast, cardiac, pediatric, and other applications

- The brain and neurological applications acquired a major share due to the greater demand for brain & functional imaging procedures coupled with increase in the prevalence of neurological conditions such as stroke, dementia, Parkinson's disease.

-

BY END USER

- The MRI systems market is divided by end users into hospitals, diagnostic imaging centers, and other end users

- Hospitals, as an end-user segment, acquired the largest share due to the increasing use of advanced MRI systems in hospitals for patient screening and image guided procedures, rising demand for preventive screening programs, and shift towards organ specific imaging.

-

BY REGIONThe enteral feeding devices market covers Europe, North America, Asia Pacific, South America and Middle East and Africa. North America is the largest market for enteral feeding devices.

-

COMPETITIVE LANDSCAPEThe key market players utilize both organic and inorganic strategies to strengthen their position in the market. The key players in the MRI systems market are Siemens Healthineers (Germany), GE Healthcare (US), Koninklijke Philips N.V. (Netherlands). These players have formed strategic partnerships and expanded capacity by establishing new manufacturing facilities to meet growing demand. Such activities will help them to maintain a dominant position in the market.

The MRI ecosystem is undergoing a rapid digital transformation. Key trends include the integration of AI-based reconstruction algorithms for faster image acquisition and higher throughput, migration toward low-helium or helium-free magnet designs to reduce operational costs, and the proliferation of 3T and 7T high-field systems for research and neuroimaging. Simultaneously, demand for portable and point-of-care MRI scanners is increasing in critical care and orthopedic settings. Multi-parametric MRI (mpMRI) and quantitative MRI are emerging as decision-support tools in oncology and neurology. Moreover, vendors are emphasizing sustainability through energy-efficient cryogen systems and modular architecture for easier upgrades.

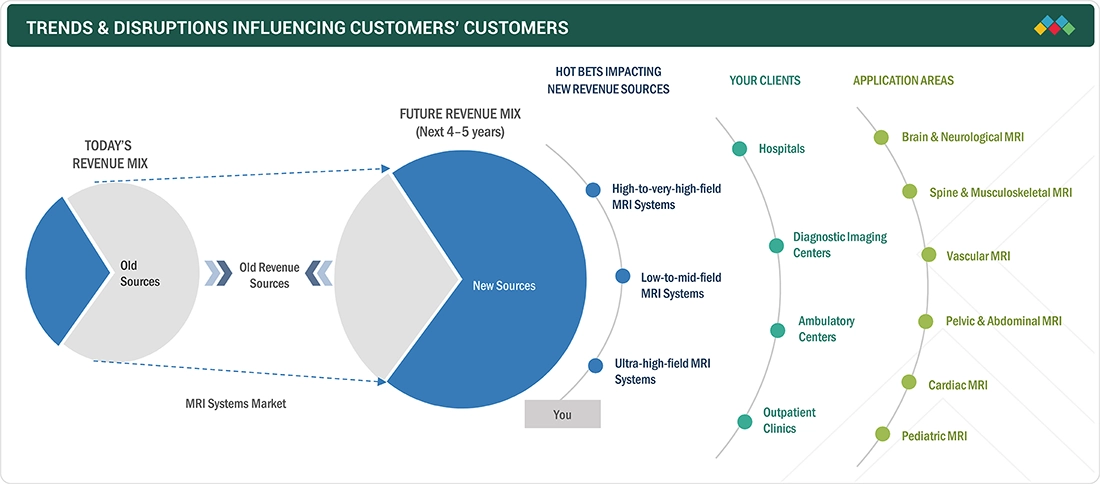

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Healthcare providers—MRI end users—are transitioning from volume-based to value-based imaging models. Their key imperatives include reducing scan turnaround times, improving patient comfort, and enhancing diagnostic confidence through AI-enabled workflows. Radiology networks and hospitals are expanding their imaging fleet mix toward high-field and open MRI units, balancing cost efficiency and clinical sophistication. These shifts are being driven by payer pressure, the need for data interoperability, and the growing use of imaging biomarkers in clinical decision-making. For OEMs, the future revenue mix will be dominated by software-driven services, subscription-based maintenance, and digital platforms rather than standalone hardware sales.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Public-private partnerships to scale the diagnostic imaging landscape

Level

-

Complex operations and maintenance of MRI systems

Level

-

Helium-free MRI systems as offering to shift market toward sustainability

Level

-

Limited capital budgets

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Public-private partnerships to scale the diagnostic imaging landscape

Public-private partnerships (PPPs) are emerging as crucial factors in reshaping the MRI systems market by leveraging technological advancements, patient accessibility, and clinical impact. Recent global initiatives suggest that MRI’s upcoming phase will be driven not solely by technological advancement but by strategic collaborations with public health systems, which will help to create a growth-focused ecosystem. In 2023, Siemens Healthineers (Germany) partnered with SAMEER (Society for Applied Microwave Electronics Engineering and Research India) to develop low-cost MRI technology tailored to local needs. This initiative emphasizes energy efficiency and affordability, targeting deployment in underserved regions. As India looks to expand its digital health footprint, such collaborations set a precedent for co-developing MRI platforms in emerging economies, potentially expanding the addressable market for mid- and low-field MRI systems. Meanwhile, in Europe, the USD 6.8 million COMBINE-CT project—backed by the Innovative Health Initiative and led by Philips—demonstrates a new class of imaging-focused PPPs. Though focused on coronary CT, the initiative’s push for non-invasive diagnostics, AI-driven workflows, and cross-border clinical validation is a relevant blueprint for MRI’s evolution into a data-centric, decision-support tool. All such partnerships and collaborations between the public and private sectors aim to provide the accessibility of MRI to tier 2 and rural markets, as MRI imaging still faces a constraint of affordability. This will make the landscape for MRI systems more patient or consumer-centric while easing out the accessibility concerns that will help to grow the market for MRI systems around the globe

Restraint: Complex operations and maintenance of MRI systems

An MRI system is installed in a dedicated room, acquiring space in a facility. Many systems require liquid helium, posing supply chain and safety challenges. Helium-free systems are emerging slowly as key players are progressively moving towards launching new systems. But the end user healthcare infrastructure is still not adequately developed & equipped to support the working of such advanced systems. Another restraining factor for end-use consumers for MRI is power and cooling. MRI machines generate a significant amount of heat during operation. The powerful magnets require precise temperature control to function correctly. The system can overheat without adequate cooling, leading to decreased performance, increased downtime, and potentially costly repairs. The MRI units demand a stable high-voltage power supply and adequate cooling infrastructure. If the pre-requisite conditions are not provided, the MRI systems cannot perform/operate on the specifications they are designed for. Such conditions produce a downtime risk. Service interruptions can be costly. Regular servicing and the need for OEM-certified engineers make maintenance expensive

Opportunity: Helium-free MRI systems as offering to shift market toward sustainability

The MRI systems market is shifting in terms of design and features, with helium-free and helium-light MRI technologies emerging as a significant growth driver. This development is largely influenced by increasing operational costs, helium supply instability, and the healthcare sector’s growing focus on sustainability. Conventional MRI systems typically require over 1,000 liters of helium to cool superconducting magnets. However, global helium shortages—such as the Helium Shortage 4.0 reported by Gasworld—have led to price increases of up to 250%, disrupting imaging operations and increasing maintenance costs. Such challenges are particularly pressing for mid-sized hospitals and outpatient facilities with constrained budgets. In response, manufacturers like Koninklijke Philips N.V. (Netherlands), Siemens Healthineers (Germany), and Shanghai United Imaging Healthcare Co., Ltd. (China) have launched MRI systems that require significantly less helium or are completely sealed. Philips’ BlueSeal technology, for example, uses less than 7 liters of helium in a zero-boil-off, sealed magnet configuration, eliminating the need for helium refills and reducing service complexity. Over 1,000 such systems had been installed globally by 2023. These innovations reduce the total cost of ownership and support environmental goals in terms of sustainability set by institutions like the NHS and U.S. HHS. Moreover, helium-free systems typically have a smaller footprint and simplified infrastructure requirements, allowing deployment in previously unsuitable locations such as ambulatory surgical centers and mobile units.

Challenge: Limited capital budgets

Limited capital budgets across healthcare providers like hospitals and diagnostic imaging centers, particularly in tier 2 or 3 cities or community hospitals and outpatient centers, have led to the extended use of MRI systems beyond their recommended operational warranty. The American College of Radiology suggests upgrading MRI equipment every 7 to 10 years; real-world usage frequently extends to 12–15 years due to fiscal limitations. A 2023 GE Healthcare report indicates that nearly 60% of mid-sized U.S. radiology departments have delayed MRI upgrades post-pandemic, prioritizing financial recovery over capital expenditure. As a result, aging MRI systems with lower signal-to-noise ratios and slower scan speeds remain in operation, potentially compromising image quality and diagnostic accuracy, particularly in complex neurological or oncological cases. Furthermore, legacy systems often lack compatibility with modern imaging advancements, such as AI-based reconstruction, compressed sensing, and advanced coil technologies. OEMs like Siemens and Philips have underscored that such limitations may reduce the clinical value of imaging, increase false negatives, and limit throughput

magnetic resonance imaging market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Remote MRI scanning support (syngo Virtual Cockpit) at multiple hospital sites (InHealth / GenesisCare) | Enables expert radiographers to support scans remotely, reducing the need for travel, improving scheduling flexibility, and reducing bottlenecks in oversight. |

|

Maçka EMAR Diagnostic Center (Istanbul): upgrade to SIGNA Works with AIR Recon DL + Multi-Purpose Coils | Reduced scan times (average drop from 45 to 28 min), better image quality, fewer repeats, improved throughput. |

|

St. Joseph’s Hospital (Phoenix, Arizona): MRI in Neuro ED with fast protocols | MRI used in the Emergency Department to enable richer diagnosis (soft tissues, spinal cord) vs CT; scan times reduced to ~10 min in some protocols. |

|

Entry into U.S. market; first U.S. installation of uMR 570 1.5T MRI | Market expansion; demonstrating baseline clinical viability; building service infrastructure in U.S. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The MRI ecosystem is a multi-layered network comprising magnet and gradient subsystem manufacturers, system integrators, software developers, service providers, and end-user institutions. Magnet OEMs and cryogen suppliers form the core of the hardware value chain, while image reconstruction software vendors, AI developers, and cloud-based service providers increasingly occupy value-added layers. Collaborations among OEMs, imaging centers, and academic institutions are accelerating translational innovation and cross-modality integration.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MRI Systems Market, By Field Strength

High-field MRI (1.5T and 3T) dominates the market as hospitals and imaging centers prioritize image quality and shorter scan times. The 3T segment, in particular, benefits from applications in functional MRI, neuroimaging, and oncology. Meanwhile, ultra-high-field (7T) systems are expanding in research institutions, while low-field MRI is emerging as a niche portable alternative for developing economies.

MRI Systems Market, By Application

MRI applications span across neurology, musculoskeletal, oncology, cardiology, breast imaging, and abdominal imaging, each contributing uniquely to the modality’s diagnostic and clinical relevance. Among these, oncology imaging is projected to be the fastest-growing application segment during 2025–2030, driven by the accelerating adoption of multi-parametric and whole-body MRI for cancer detection, staging, and treatment response monitoring. The shift toward radiomics-based and AI-assisted tumor characterization is reinforcing MRI’s position as a preferred imaging modality for precision oncology.

MRI Systems Market, By End User

Hospitals remain the largest end-user segment, accounting for over half of MRI installations worldwide, driven by high patient throughput and broad diagnostic capabilities. Diagnostic imaging centers represent a fast-growing segment due to outsourcing of radiology services and the expansion of teleradiology networks. Research institutions are key adopters of 7T and functional MRI for neuroscientific and translational research.

MRI Systems Market, By region

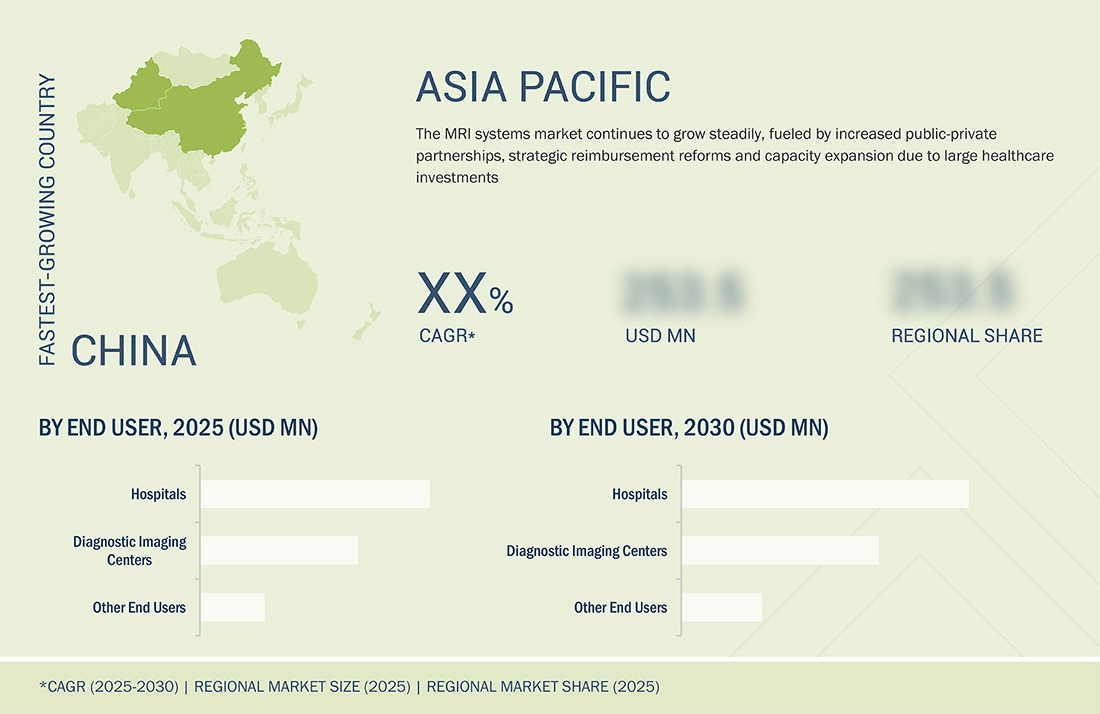

North America leads the global MRI systems market, supported by strong healthcare infrastructure, high diagnostic imaging volumes, early adoption of advanced MRI systems, and robust reimbursement mechanisms. The region is also at the forefront of AI integration, cloud-based imaging analytics, and hybrid MRI modalities. Europe follows, with sustained investment in public health imaging programs and digital radiology infrastructure. Asia-Pacific is projected to witness the fastest growth due to expanding healthcare access in China, India, and Southeast Asia.

REGION

Asia-Pacific to be the fastest-growing region in the MRI systems market during the forecast period

In the Asia-Pacific MRI systems market, neurology and oncology together dominate overall scan volumes, while oncology imaging represents the fastest-growing application segment through 2030. Rapid cancer burden escalation across China, India, Japan, and South Korea, combined with increasing government-led cancer screening programs, has positioned MRI as a preferred tool for non-invasive tumor detection, staging, and longitudinal therapy assessment. Hospitals and tertiary centers are rapidly upgrading to 3T and hybrid PET/MRI systems to enable quantitative and functional assessment of tumor physiology.

magnetic resonance imaging market: COMPANY EVALUATION MATRIX

The MRI market is moderately consolidated, led by key players such as Siemens Healthineers, GE HealthCare, Philips, Canon Medical Systems, and Fujifilm Healthcare. Competitive differentiation is increasingly driven by image-reconstruction AI, helium-free magnet innovation, and cloud-based service ecosystems. The competitive evaluation matrix positions Siemens and GE in the leadership quadrant for their end-to-end imaging platforms and strong service portfolios, while mid-tier vendors such as United Imaging, Esaote, and Hyperfine are gaining ground through disruptive portable and mid-field MRI innovations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 6.15 million |

| Market Forecast in 2030 (value) | USD 9.00 million |

| Growth Rate | CAGR of 6.5% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Billion), Volume (Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, and Latin America |

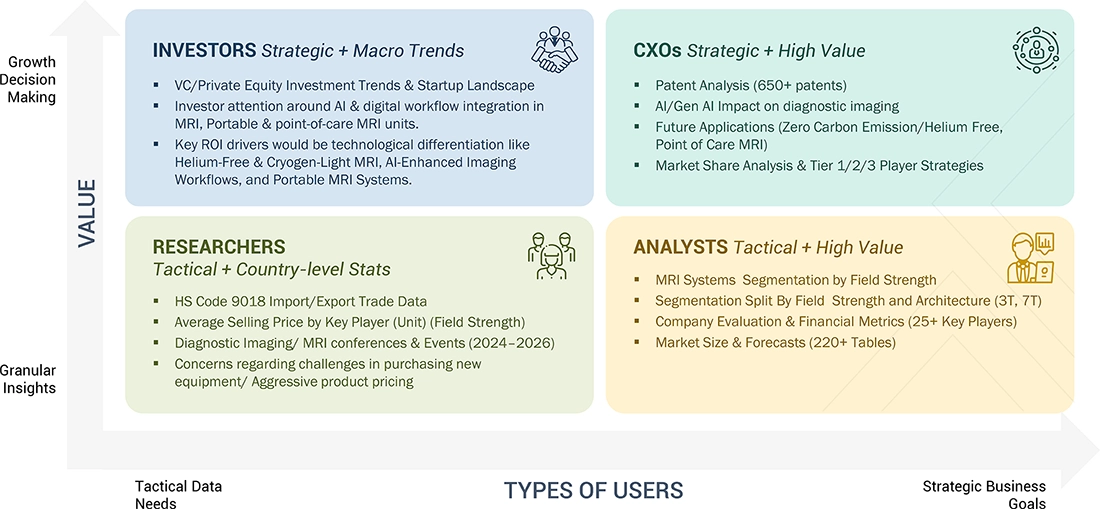

WHAT IS IN IT FOR YOU: magnetic resonance imaging market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Key Maufacturer | Competitive Landscape for major players in the market. |

|

| Global MNC | Customer survey pertaining to maj pain point and purchase workflow |

|

RECENT DEVELOPMENTS

- February 2025 : In February 2025, Koninklijke Philips N.V. (Netherlands), as part of the Dutch National Growth Fund project, partnered with the Government of the Netherlands. This initiative aims to advance radio frequency (RF) technology, enhancing MRI scan speed and accuracy for improved diagnostics.

- January 2025 : In January 2025, Siemens Healthineers (Germany) commenced construction of a new manufacturing facility dedicated to the diagnostic imaging portfolio in China.

- June 2024 : GE Healthcare (US) partnered with the University of Cincinnati, UC Health, and Cincinnati Children’s. The partnership aims to revolutionize MRI technology and clinical outcomes by merging academic research with industry expertise.

Table of Contents

Methodology

This study analyzed various market variables related to small and medium-sized businesses and major corporations to balance primary and secondary research for the MRI systems market. The next phase involved conducting primary research with industry experts along the value chain to validate the findings, assumptions, and market sizing. Several methodologies were employed to estimate the overall market size, including both top-down and bottom-up approaches.

This study focuses on key market segments, emerging trends, regulatory frameworks, and competitive environments. It also examines leading market players and their strategies within this sector. In conclusion, the total market size was determined using top-down and bottom-up approaches and data triangulation to arrive at the final figure. Ongoing primary research was conducted throughout the study to validate and test each hypothesis.

Secondary Research

During the study, secondary research utilized a variety of sources, including directories and databases such as Bloomberg Businessweek, D&B Hoovers, and Factiva. Additional materials included white papers, annual reports, SEC filings, and investor presentations. This research approach is aimed at collecting and generating data that offers comprehensive, technical, and market-focused insights into the MRI systems market. The data provides information on key players and market segmentation based on recent industry trends and significant market developments. Additionally, a database of leading industry figures was created through this secondary research.

Primary Research

Primary research involved activities aimed at obtaining both qualitative and quantitative data. Several individuals from the supply and demand sides were interviewed during this phase. On the supply side, participants included key figures such as CEOs, vice presidents, marketing and sales, directors of technology and innovation, and other important leaders. On the demand side, primary sources included academic institutions and research organizations. This real-world primary study was conducted to validate market segmentation, identify prominent market participants, and gain insights into significant industry trends and market dynamics.

A breakdown of the primary respondents is provided below:

*Others include distributors, suppliers, product managers, business development managers, marketing managers, and sales managers.

Note: Companies are categorized into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report comprehensively analyzes the global MRI systems market and reviews major companies and their revenue shares. Key players with significant market shares were identified through secondary research, and their MRI systems business revenues were calculated and subsequently validated through primary research. The secondary research involved analyzing leading market participants' annual and financial reports. In contrast, primary research included in-depth interviews with influential leaders, such as directors, CEOs, and marketing executives. The segmental revenue was calculated based on the revenue mapping of service and product providers to determine the global market value. The process involved the following steps:

- List of key players that operate in the MRI systems market at the regional level

- Formation of product mapping of manufacturers of MRI systems and related product lines at the regional level

- Revenue mapping for listed players from MRI systems and related products & services

- Revenue mapping of major players to cover at least ~90% of the global market share as of 2024

- Revenue mapping extrapolation for players will drive the global market value for the respective segment

- Summation of market value for all segments and subsegments to achieve the actual value of the global MRI systems market

Data Triangulation

After getting the overall market size from the market size estimation process mentioned above, the MRI systems market was split into segments and subsegments. Data triangulation and market segmentation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying and analyzing various factors and trends from both the demand and supply sides. Additionally, top-down and bottom-up approaches verified and validated the MRI systems market.

Market Definition

Magnetic resonance imaging (MRI) is a diagnostic technique designed to visualize/create images of the internal structures of the human body using magnetic and electromagnetic fields, which induce a resonance effect of hydrogen atoms on body parts. The associated software registers and processes the electromagnetic emission created by these atoms to produce images of the body structures. These modalities help healthcare professionals visualize the internal structure and surrounding tissues. MRI systems are primarily used in hospitals and diagnostic imaging centers.

Stakeholders

- Hospitals

- Clinics

- Diagnostic Imaging Centers

- Manufacturers & Suppliers of MRI Systems

- Product Suppliers, Distributors, and Channel Partners

- Research Institutes

- Regulatory Authorities & Industry Associations

- Venture Capitalists & Investment Firms

Report Objectives

- To define, describe, and forecast the size of MRI systems market based on field strength, architecture, design, application, end user, and region

- To provide detailed information regarding the factors influencing the growth potential of the global MRI systems market (drivers, restraints, opportunities, challenges, and trends)

- To analyze micro markets with respect to individual growth trends, prospects, and contributions to the global MRI systems market.

- To analyze key growth opportunities in the global MRI systems market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments concerning five regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Spain, Italy, and the rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and the rest of Asia Pacific), Latin America (Brazil, Mexico, and the rest of Latin America), and the Middle East & Africa (GCC Countries and the rest of the Middle East & Africa).

- To profile the key players in the MRI systems market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the global MRI systems market, such as product launches/approvals, agreements, expansions, collaborations, and acquisitions.

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the MRI Systems Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in MRI Systems Market