Zero Liquid Discharge Systems Market by System (Conventional, Hybrid), Process (Pretreatment, Filtration, Evaporation & Crystallization), End-Use Industry (Energy & Power, Chemicals & Petrochemicals, Food & Beverages), and Region - Global Forecast to 2027

Updated on : June 17, 2024

Zero Liquid Discharge Systems Market

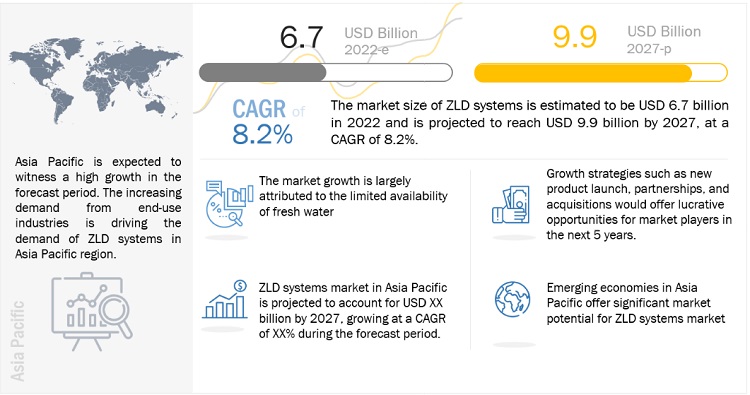

The global zero liquid discharge systems market was valued at USD 6.7 billion in 2022 and is projected to reach USD 9.9 billion by 2027, growing at 8.2% cagr from 2022 to 2027. The overall increase in demand for zero liquid discharge (ZLD) systems in emerging regions such as Asia Pacific and Middle East & Africa is driving the ZLD systems market. Rising demand from end-use industries including energy & power, food & beverage, Pharmaceuticals, and chemicals & petrochemicals is driving the global ZLD systems market.

Global ZLD Systems Market Trends

Note: e-estimated, p-projected

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

ZLD Systems Market Dynamics

Driver: High efficiency of ZLD systems

ZLD systems are wastewater management systems that ensure zero industrial wastewater discharge into the environment. Advanced treatment methods and technologies are used to treat industrial brine wastewater, which is essentially reduced to dry solids. An advanced and well-designed ZLD system recovers around 95% of liquid waste for reuse and can retrieve valuable byproducts such as salts and brines, reducing operational costs. Conventional wastewater treatment systems often result in brine waste and loss of valuable materials. The effluent cannot be brought to acceptable discharge standards using conventional or other chemical treatment methods. The water recovery efficiency of all these methods is less than ZLD systems. These factors make ZLD systems an effective and economically viable solution for wastewater treatment.

Restrain: High installation & operational cost of ZLD systems

The industrial plants that produce effluents install ZLD systems per their requirements through engineering, procurement, & construction (EPC) and turnkey companies. ZLD systems comprise various membranes and components procured from various equipment manufacturers. These systems carry out various processes, such as pretreatment (biological or chemical), filtration, evaporation, and crystallization of wastewater concentrates. Therefore, the procurement of raw materials used for designing & engineering ZLD systems, and their installation is capital-intensive. Other factors, such as the level of system automation needed, shipping costs, environmental regulatory fees, and taxes, are also important to consider while pricing ZLD systems.

Opportunity: Increasing concerns over disposal of brine concentrate into oceans

The disposal of brine concentrates generated from various processes, such as desalination, into oceans has become a major environmental issue. The desalination plants discharge dense brine into the ocean, which may cause harmful effects on the marine environment. Brine concentrates are produced from the reverse osmosis (RO) process to remove salts from water. The concentrates resulting from the reverse osmosis (RO) process contain chemical additives. When reverse osmosis technology is used to treat wastewater and groundwater, the contaminates and other components present in the water make the brine concentrates produced by the process more toxic, which can be bad for marine life and impact the weather cycles.

Challenge: Lack of awareness regarding disposal of wastewater concentrates

The use of ZLD systems is still a new concept in various regions, such as the Middle East & Africa, Asia Pacific, and South America, due to the use of various traditional methods such as pond evaporation, solar drying, and thermal evaporation, among others for the treatment of wastewater sludge. The lack of awareness among the masses regarding various environmental regulations related to wastewater management might hamper the growth of the ZLD systems market. For instance, Nigeria is an oil-rich country, and it is observed that there are no regulations for flue-gas desulfurization (FGD) and cooling tower blowdown in the country. However, this scenario is expected to change with increasing industrial growth in these regions in the coming years.

Conventional segment accounted for the largest share amongst systems in the ZLD systems market

Among systems, the conventional ZLD systems segment to lead the ZLD systems market in 2021. As, conventional ZLD systems are standard systems widely used by various end-use industries due to their specific designs, which involve pre-defined stages such as pretreatment, filtration, evaporation, and crystallization. These systems are compatible with small as well as medium operating plants that do not have customized requirements.

Evaporation & crystallization segment to lead the process in the overall ZLD systems market

Evaporation & crystallization is the most dominated and popular process for the ZLD systems. This process is widely used in multiple end use industries such as power, chemicals, textile, pharmaceuticals, and electronics. Evaporators & crystallizers are an important part of zero-liquid discharge systems as they ensure zero to minimal liquid discharge. This factor is driving the growth of the evaporation & crystallization process in ZLD systems market

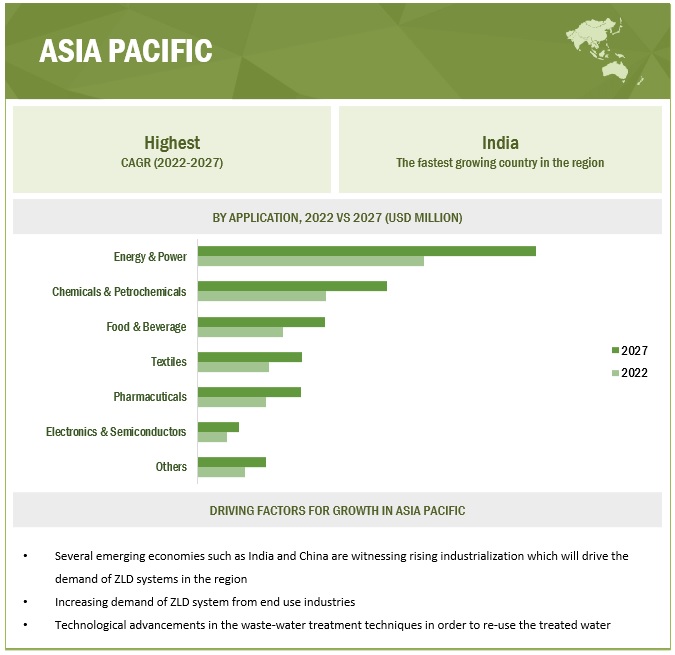

Energy & Power segment holds the largest market of all the end-use industries in the ZLD systems market

Energy & Power segment holds the largest market share in the end-use industry of ZLD systems market. The dominant market position is attributed to the exponential growth in demand for ZLD systems in the energy & power application. The size of installations in energy & power is large in comparison to other sectors with flow rates higher than 10 cubic meters. The thermal power industry, which utilizes coal energy, is one of the key sectors expected to drive the market in this end-use industry. Countries such as China have released mandates for installing ZLD plants in the energy sector. CTX and Coal to Liquid (CTL) are some key processes that demand ZLD systems, and coal plants are largely situated in non-coastal regions, which inhibits the easy disposal of brine concentrates. These factors are expected to drive the ZLD systems market in the energy & power sector, during the forecast period.

Asia Pacific is estimated to grow at the fastest growth rate in the global ZLD systems market

The Asia Pacific region accounted for the largest market share in 2021 and is also expected to grow at the highest CAGR, during the forecast period. This growth is attributed to the increasing demand for ZLD systems because of stringent regulations regarding the treatment of wastewater, rapid industrialization, and the growing population. In addition, the increasing awareness about water treatment and industrial wastewater re-use is expected to increase the demand for ZLD systems in the region.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Zero Liquid Discharge Systems Market Players

The key players in the ZLD systems market Aquatech International (US), Veolia (France), GEA Group AG (Germany), Alfa Laval AB(Sweden), Praj Industries (India), Andritz AG(Austria), H20 GmbH (Germany), Aquarion AG (Switzerland), Condorchem Envitech (Spain), Safbon Water Technology (US), Ion Exchange India Ltd (India), Toshiba Infrastructure Systems and Solutions Corporation (Japan), and Petro Sep (Canada). These players have established a strong foothold in the market by adopting strategies, such as new product launches, strategic partnerships, investment & expansions, and acquisitions between 2019 and 2022.

Read More: Zero Liquid Discharge Systems Companies

Zero Liquid Discharge Systems Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/USD Billion) and Volume (Units) |

|

Segments |

System, Process, Technology, End-use Industry and Region |

|

Regions |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies |

Aquatech International (US), Veolia (France), GEA Group AG (Germany), Alfa Laval AB(Sweden), Praj Industries (India), Andritz AG(Austria), H20 GmbH (Germany), Aquarion AG (Switzerland), Condorchem Envitech (Spain), Safbon Water Technology (US), Ion Exchange India Ltd (India), Toshiba Infrastructure Systems and Solutions Corporation (Japan), and Petro Sep (Canada) Total 26 players were covered. |

This research report categorizes the ZLD systems market based on System, Process, Technology, End-use Industry and Region.

By System:

- Hybrid

- Conventional

By Process:

- Pre-treatment

- Filtration

- Evaporation/Crystallization

By Technology:

- Reverse Osmosis

- Ultrafiltration

- Evaporation/Crystallization

By End-use Industry:

- Energy & Power

- Chemicals & Petrochemicals

- Food & Beverage

- Textile

- Pharmaceuticals

- Electronics & Semiconductors

- Others

By Region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

- The ZLD systems market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In September 2022, Veolia Water Technologies announced a partnership with Orange Business Services. This partnership helps strengthen Veolia Water Technologies’ business data collection infrastructure and hubgrade digital solutions platform. The hubgrade digital platform allows its customers to remotely view, anticipate, and optimize water treatment plants and equipment.

- In June 2021, Aquatech International announced a joint venture with Upwell Water, a leading technology-enabled water asset company. This joint venture provides AQUIOS, a new platform enabling Aquatech to provide customers with all-in-one water treatment and service, integrating Aquatech’s best-in-class technology and operations with no upfront cost.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the ZLD systems market?

The growth of the ZLD systems market can be attributed to the increasing demand of ZLD systems in the end use industries for waste-water treatment.

Energy & power is the largest end-use of ZLD systems. ZLD systems are also used in end-use industries such as chemicals & petrochemicals, food & beverage, textile, pharmaceuticals, and electronics & semiconductors.

Energy & power is the largest end-use of ZLD systems. ZLD systems are also used in end-use industries such as chemicals & petrochemicals, food & beverage, textile, pharmaceuticals, and electronics & semiconductors.

Who are the major manufacturers of the ZLD systems?

Major manufacturers of ZLD systems include Aquatech International (US), Veolia (France), GEA Group AG (Germany), Alfa Laval AB(Sweden), and Praj Industries (India).

What are the restraints for ZLD systems?

The biggest restraint for this market can be the high installation & operational cost and availability of effective substitutes.

What will be the growth prospects of the ZLD systems market?

Increasing concerns over disposal of brine concentrates into ocean is expected to provide the growth opportunities to ZLD systems manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size for ZLD systems market. The exhaustive secondary research was conducted to collect information on the market, peer market, and child market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, extensive use of secondary sources, directories, and databases, such as World Bank, Statista, Organization for Economic Cooperation and Development (OECD), Bloomberg, International Monetary Fund (IMF), Trademap, Zauba, Environmental Protection Agency (EPA), European Environment Agency, and other government & private websites, associations related to the ZLD systems industry. The study also involves analyzing regulations and regional government websites to identify and collect information useful for this technical, market-oriented, and commercial ZLD systems market study.

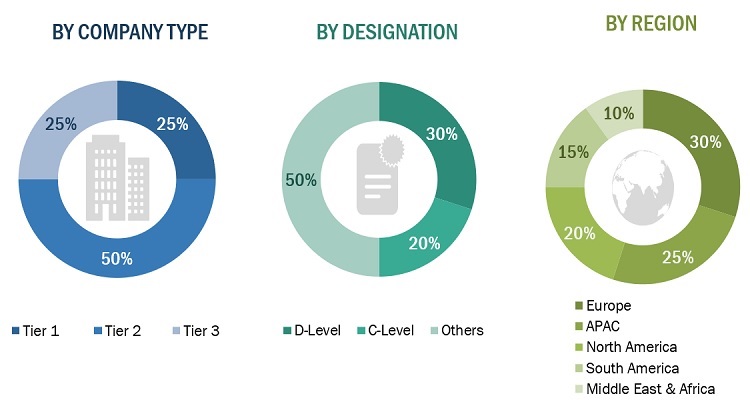

Primary Research

The ZLD systems market comprises several stakeholders such as raw material suppliers, distributors, manufacturers, end-users, and regulatory organizations in the supply chain. Primary sources include experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives of major market players, and industry consultants, have been conducted to obtain and verify critical qualitative and quantitative information and assess growth prospects.

Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the ZLD systems market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players, system, process, technology, and applications in various end-use industries and markets were identified through extensive secondary research.

- The industry’s value chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size - using the market size estimation process explained above - the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of ZLD systems and their applications.

Objectives of the Study:

- To analyze and forecast the ZLD systems market size, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To define, describe, and forecast the market by system, process, technology, and end-use industry

- To forecast the size of the market with respect to five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with the key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments such as new product launch, merger & acquisition, agreement & collaboration, and investment & expansion in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- Notes: 1. Micro markets are defineAAd as sub segments of the ZLD systems market included in the report.

- 2. Core competencies of the companies are covered in terms of their key developments and strategies adopted to sustain their position in the market.

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the ZLD systems market

Company Information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Zero Liquid Discharge Systems Market

Looking for report on ZLD- Zero Liquid Discharge Systems Market

Specific information on waste water treatment market globally, Europe and Romania

Want zero liquid discharge companies profile

Market information for Zero Liquid discharge systems in battery manufacturing

Market price and production cost of Glyceric and Tartronic acids using glycerol. Cost analysis on zero liquid discharge for glycerol recovery from biodiesel.

General Information on the production price ,market cost and other insights on Glyceric acid, tartronic acid, glycolic acid and oxalic acid. Information to analyze the cost to achieve zero liquid discharge if glycerol from biodiesel industry is to be treated and purified to produce these products.

Method and Technical information on Recycling of water

Zero liquid discharge with application in power station

Looking for strategic partner with solution on Zero liquid discharge.

Looking for potential and opportunities for organic chemicals

Global Food Waste Management Market

Interest on irrigation and aquaculture engineering solutions (systems design, installation and maintanance services).

Market develoment on ZLD for brine with high content of Ca Sulphate.

Report on Zero liquid discharge systems