Wireless Fire Detection Systems Market by Product, System Type (Fully Wireless, Hybrid), Installation Type (New, Retrofit), Vertical (Commercial, Residential, Manufacturing), and Geography - Global Forecast to 2020

[136 Pages Report] The wireless fire detection systems market is expected to be worth USD 303.8 Million by 2020, at a CAGR of 7.7% between 2016 and 2020. The base year considered for the study is 2015, and the forecast period is between 2016 and 2020.

Objectives of the Study:

- To define, describe, and forecast the global wireless fire detection systems market segmented on the basis of product, system type, installation type, vertical, and geography

- To forecast the size, in terms of value and volume, for several segments with respect to four major regions (including their respective countries): North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To strategically analyze the micromarkets with respect to the individual growth trends, future prospects, and contribution to the total market

- To analyze the competitive environment prevailing in the market through Porter’s five forces analytical framework

- To study the market dynamics that currently drive and restrain the growth of the market, the opportunities and challenges, along with trends of the market

- To analyze the opportunities in this market for various stakeholders by identifying high-growth segments of the market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders

- To analyze various strategic developments such as joint ventures, mergers and acquisitions, new product launches and developments, and R&D in this market

Research Methodology:

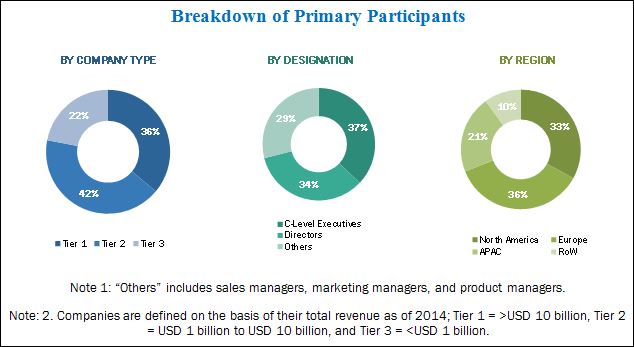

The research methodology used to estimate and forecast the wireless fire detection systems market begins with obtaining data on key vendor revenues through secondary research. Some of the secondary sources used in this research include information from various journals and databases such as IEEE journals, Factiva, Hoover’s, and OneSource. The vendor offerings have also been taken into consideration to determine the market segmentation. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with the key officials from the industry, such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the figure below.

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights into the ecosystem of this market. The major players in this market are EMS Security Group Ltd (UK), Electro Detectors Ltd (UK), Sterling Safety Systems (UK), Honeywell International Inc. (US), Siemens AG (Germany), Tyco International PLC (Ireland), HOCHIKI Corporation (Japan), Halma Plc (UK), Robert Bosch GmbH (Germany), EuroFyre Ltd (UK), and Detectomat GmbH (Germany), among others.

Key Target Audience:

- Wireless fire detection system technology platform developers

- Fire detection system component manufacturers

- Fire detection system original equipment manufacturers (OEMs)

- Distributors and traders

- Research organizations

- Fire protection organizations, forums, alliances, and associations

Scope of the Report:

The research report segments this market into the following submarkets:

By Product:

- Sensors/Detectors

- Smoke Detectors

- Photoelectric

- Ionization

- Dual Sensor

- Heat Detectors

- Gas Detectors

- Multisensor Detectors

- Smoke Detectors

- Call Points

- Fire Alarm Panels and Devices

- Input/Output Modules

- Others

By System Type:

- Fully Wireless Systems

- Hybrid Systems

By Installation Type:

- New Installation

- Retrofit Installation

By Vertical:

- Residential

- Commercial

- Academia and Institutional

- Retail

- Healthcare

- Hospitality and Historical Buildings

- BFSI

- Government

- Manufacturing

- Other Verticals

By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Wireless fire detection systems can be integrated within a hardwired addressable system through radio loop modules. This amalgamation of wired with wireless technologies adds to the efficiency and enhances the reliability of the overall system. Hybrid wireless fire detection solutions are suitable for both new buildings and retrofitting environments. These systems are easy to install being wireless, and installation time is also very less when compared to the traditionally wired systems, which reduces the labor cost as well. The most significant benefit of the wireless technology lies in eliminating the need for wiring different devices, which makes up to almost 50–60% of the initial cost of installation to the end users.

The wireless fire detection systems market is expected to be worth USD 303.8 Million by 2020, growing at a CAGR of 7.7% between 2016 and 2020. The growth of the market is propelled by the increasing demand of these systems in retrofit installations due to the cost effectiveness and the ease involved in installing these systems. In addition, the improvement in the existing government regulations and mandates regarding fire protection systems are the major factors driving the market.

The scope of this report covers the wireless fire detection systems market based on product, system type, installation type, vertical, and geography. The sensors/detectors segment is leading the market based on product, and the market for the same is expected to register the highest CAGR during the forecast period. The hybrid systems held the largest size in the market based on system type in 2015, and the market for hybrid systems is expected to grow at a higher CAGR between 2016 and 2020. The major factor driving the growth of the market for hybrid systems is the connectivity and cost-effectiveness of these systems. This system reduces the labor cost involved in the installation as well. The market for retrofit installations dominated the market based on installation type in 2015, and the market for the said segment is expected to grow at a higher CAGR during the forecast period.

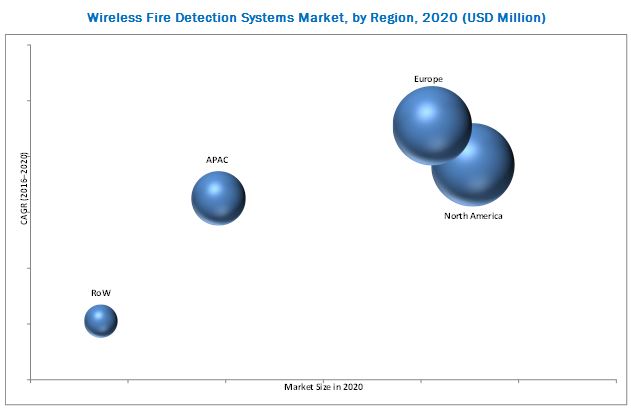

North America held the largest share of the wireless fire detection systems market in 2015, while the market in Europe is expected to grow at the highest CAGR during the forecast period. This market in the US is a matured one. The fire safety regulations in this region are highly mandated, and most of the building structures are fixed with wireless (hybrid) fire detection systems.

The major factor restraining the growth of this market is the lack of acceptance in the market due to high maintenance cost and low-reliability perception. EMS Security Group Ltd (UK), Electro Detectors Ltd (UK), Sterling Safety Systems (UK), Honeywell International Inc. (US), Siemens AG (Germany), Tyco International PLC (Ireland), HOCHIKI Corporation (Japan), Halma Plc (UK), Robert Bosch GmbH (Germany), EuroFyre Ltd (UK), and Detectomat GmbH (Germany), among others, are the major players operating in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

2 Research Methodology

3 Market Overview

3.1 Market Drivers

3.2 Market Restraints

3.3 Market Opportunities

3.4 Challenges

4 Industry Trends

4.1 Value Chain Analysis

4.2 Porters Five Force Analysis

4.2.1 Threat From New Entrants

4.2.2 Threat From Substitutes

4.2.3 Bargaining Power of Suppliers

4.2.4 Bargaining Power of Buyers

4.2.5 Intensity of Competitive Rivalry

5 Wireless Fire Detection Systems Market, By Product

5.1 Sensors/Detectors

5.1.1 Smoke Detectors

5.1.1.1 Photoelectric

5.1.1.2 Ionization

5.1.1.3 Dual Sensor

5.1.2 Heat Detectors

5.1.3 Gas Detectors

5.1.4 Multi Sensor Detectors

5.2 Call Points

5.3 Fire Alarm Panels and Devices

5.4 Input/Output Modules

5.5 Others

6 Wireless Fire Detection Systems Market, By System Type

6.1 Fully Wireless Systems

6.2 Hybrid Systems

7 Wireless Fire Detection Systems Market, By Installation Type

7.1 New Installation

7.2 Retrofit Installation

8 By Vertical

8.1 Residential

8.2 Commercial

8.2.1 Academia & Institutional

8.2.2 Retail

8.2.3 Healthcare

8.2.4 Hospitality & Historical Buildings

8.2.5 BFSI

8.3 Government

8.4 Manufacturing

8.5 Other Verticals

9 By Geography

9.1 North America

9.2 Europe

9.3 APAC

9.4 RoW

10 Competitive Landscape

11 Regulation Analysis of Wireless Fire Detection Systems Market

12 Company Profiles

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.1 EMS Wireless Fire & Security Ltd

12.2 Electro Detectors Ltd

12.3 Sterling Safety Systems

12.4 Ceasefire Industries Pvt. Ltd

12.5 Zeta Alarm Systems

12.6 Detectomat GmbH

12.7 Eurofyre Ltd

12.8 United Technologies

12.9 Honeywell International Inc.

12.10 Siemens AG

12.11 Hochiki Corporation

12.12 Halma PLC

12.13 Robert Bosch GmbH

12.14 Tyco International PLC

12.15 Johnson Controls

12.16 Napco Security Technologies, Inc.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix

List of Tables (14 Tables)

Table 1 Global Wireless Fire Detection Systems Product Market Size, 2014-2020 (USD Million)

Table 2 Wireless Fire Detection Systems Market Size, By Product, 2014-2020 (USD Million)

Table 3 Market Volume, By Product, 2014-2020 (Thousand Units)

Table 4 Sensors/Detectors Market, By Type, 2014-2020 (USD Million)

Table 5 Smoke Detectors Market, By Type, 2014-2020 (USD Million)

Table 6 Wireless Fire Detection Systems Market, By System Type, 2014-2020 (USD Million)

Table 7 Market, By Installation Type, 2014-2020 (USD Million)

Table 8 Market, By Vertical, 2014-2020 (USD Million)

Table 9 Market, By Commercial Vertical, 2014-2020 (USD Million)

Table 10 Market, By Region, 2014-2020 (USD Million)

Table 11 North American By Market, By Country, 2014-2020 (USD Million)

Table 12 European By Market, By Country, 2014-2020 (USD Million)

Table 13 APAC By Market, By Country, 2014-2020 (USD Million)

Table 14 RoW By Market, By Region, 2014-2020 (USD Million)

List of Figures (48 Figures)

Figure 1 Market Segmentation

Figure 2 Stakeholders

Figure 3 Years Considered for the Study

Figure 4 Research Design

Figure 5 Process Flow of Market Size Estimation

Figure 6 Research Methodology

Figure 7 Secondary Research

Figure 8 Primary Research

Figure 9 Analysis and Output

Figure 10 Breakdown of Primaries

Figure 11 Data Triangulation

Figure 12 Key Data Taken From Secondary Sources

Figure 13 Key Data Taken From Primary Sources

Figure 14 Research Assumptions

Figure 15 Market Dynamics

Figure 16 Value Chain Analysis

Figure 17 Porter’s Five Forces Analysis

Figure 18 Overall Porter’s Analysis

Figure 19 Intensity of Competitive Rivalry

Figure 20 Threat of Substitutes

Figure 21 Bargaining Power of Buyers

Figure 22 Bargaining Power of Suppliers

Figure 23 Threat of New Entrants

Figure 24 Attractive Opportunities in Wireless Fire Detection Systems Market By 2020

Figure 25 Global Wireless Fire Detection Systems Product Market Size, 2014–2020 (USD Million)

Figure 26 Sensors/Detectors Market, By Type, 2016 vs 2020 (USD Million)

Figure 27 Smoke Detectors Market, By Type, 2014-2020 (USD Million)

Figure 28 Wireless Fire Detection Systems Market, By System Type, 2016 vs 2020 (USD Million)

Figure 29 Market, By Installation Type, 2014-2020 (USD Million)

Figure 30 Market, By Vertical, 2016 vs 2020 (USD Million)

Figure 31 Market, By Commercial Vertical, 2015 (USD Million)

Figure 32 Market, By Region, 2015 (USD Million)

Figure 33 North American By Market, By Country, 2014-2020 (USD Million)

Figure 34 European By Market, By Country, 2014-2020 (USD Million)

Figure 35 APAC By Market, By Country, 2014-2020 (USD Million)

Figure 36 RoW By Market, By Region, 2014-2020 (USD Million)

Figure 37 Market Ranking Analysis of the By Market in the U.K.

Figure 38 Companies Adopted New Product Developments and Partnerships as the Key Growth Strategies Between 2013 and 2016

Figure 39 New Product Launches Was the Key Strategy Between 2013 and 2016

Figure 40 United Technologies: Company Snapshot

Figure 41 Honeywell International Inc.: Company Snapshot

Figure 42 Siemens AG: Company Snapshot

Figure 43 Hochiki Corporation: Company Snapshot

Figure 44 Halma PLC: Company Snapshot

Figure 45 Robert Bosch GmbH: Company Snapshot

Figure 46 Tyco International PLC: Company Snapshot

Figure 47 Johnson Controls: Company Snapshot

Figure 48 Napco Security Technologies, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Wireless Fire Detection Systems Market