Water Cut Monitors Market by Sector (Upstream, Midstream, Downstream) Location (Onshore, Offshore) Application (Well Testing, Separation Vessel, LACT, Tank Farm & Pipeline, MPFM Applications, Refinery), Region - Global Forecast to 2024

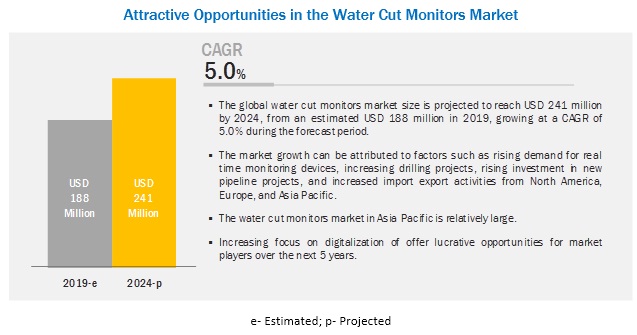

[126 Pages Report] The global water cut monitors market size is projected to reach USD 241 million by 2024, from an estimated USD 188 million in 2019, growing at a CAGR of 5.0% during the forecast period. Rising demand for real-time monitoring devices, increasing investment in the development of additional refinery capacity, and increasing import-export activities are factors driving the water cut monitors market.

By sector, the offshore segment is expected to grow at the fastest rate during the forecast period.

The offshore sector segment is expected to grow at a high CAGR during the forecast period. The increasing demand for crude oil has led to an increase in offshore exploration & drilling operations because which emergence of new oil fields in the offshore sector is expected to drive the water cut monitors market. For instance, in June 2017, ONGC discovered an oil field with approximately 20 million tons of hydrocarbon reserves in Mumbai High offshore fields. Thus, rising shale oil and deep-water exploration activities are expected to drive the growth of the offshore water cut monitors market during the forecast period.

By application, the separation vessel segment is expected to make the most significant contribution to the water cut monitors during the forecast period.

The separation vessel segment led the water cut monitors market, by application. Separation vessels are pressure vessels installed to separate the produced crude into gas, oil, and water. Operators are making their priority to maintain the quality of oil obtained after separation while conforming to specification and standards; this drives the demand for water cut monitors at these separation vessels. Increasing dependence on unconventional resources has further boosted the demand for separation vessels as the crude obtained from it contains impurities and heavy water content, thereby making it necessary to measure the water content in the oil after the separation

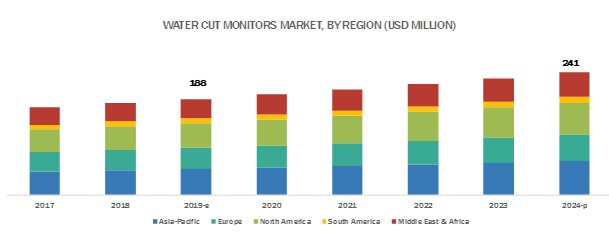

Asia Pacific is expected to be the largest market during the forecast period.

North America, Europe, South America, Asia Pacific, and the Middle East & Africa are the major regions considered for the study of the water cut monitors. The Asia Pacific market is the largest, by size, and is estimated to grow at the highest rate during the forecast period. Rising import activities, especially in Southeast Asian countries such as South Korea, and Japan, coupled with increasing investment in enhancing refineries are key factors expected to drive growth of the Asia Pacific water cut monitors market to a significant extent during the forecast period.

Key Market Players

The major players in the global water cut monitors are Weatherford (Switzerland), Emerson (US), Phase Dynamics (US), and Ametek Inc. (US).

Want to explore hidden markets that can drive new revenue in Water Cut Monitors Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Water Cut Monitors Market?

|

Report Metric |

Details |

|

Market Size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Sector, Location, Application, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, South America, and Middle East & Africa |

|

Companies covered |

Weatherford (Switzerland), Emerson Electric (US), Schlumberger (US), TechnipFMC (UK), Ametek Inc. (US), EESIFLO (Singapore), Phase Dynamics (US), ZelenTech (Singapore), Kam Controls (US), M-Flow Technologies (UK), Delta C Technologies (Canada), Sentech AS (Norway), Agar Corporation (US), LEMIS Process (US), Haimo Technologies (China), and Aquasant (Switzerland) |

This research report categorizes the water cut monitors market-based on sector, location, application, and region.

Based on the sector:

- Upstream

- Midstream

- Downstream

Based on the location:

- Onshore

- Offshore

Based on the application:

- Well Testing

- Separation Vessels

- Lease Automatic Custody Transfer (LACT)

- Tank Farm and Pipelines

- MPFM Application

- Refinery

- Others (fiscal quality measurement, well monitoring, pump protection, crude sampling)

Based on the region:

- Asia Pacific

- Europe

- North America

- South America

- Middle East & Africa

Key Questions Addressed by the Report

- The report identifies and addresses the key segments of the water cut monitors, which will help water cut monitor and flow, meter manufacturers and service providers, review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights regarding the drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make more pivotal strategic decisions.

- The report addresses the market share analysis of key players in the Water cut monitors, and with the help of this, companies can enhance their revenues in the respective markets.

- The report provides insights about emerging geographies for water cut, and hence, the entire market ecosystem can gain a competitive advantage.

Frequently Asked Questions (FAQ):

Which of the water cut monitors market by application will dominate by 2024?

The separation vessel segment, by application will dominate the water cut monitors market by 2024. Increasing adoption of water cut monitors to measure water cut and final oil-phase quality so that they meet the salable pipeline specification is a major factor boosting its adoption for separation vessel application.

Which of the sectors segments will have the maximum opportunity to grow during the forecast period?

The downstream segment, by sector will have the maximum opportunity to grow during the forecast period. The rise in refining capacities due to increasing demand for refined products is expected to drive the downstream water cut monitors market.

Which will be the leading region with the largest market share by 2024?

The Asia Pacific region is expected to be the leading region by 2024, as the region witnesses rising E&P investments by international and national companies such as Chevron, Shell, Pertamina, Petronas, and CNOOC coupled with new reserve discovery in the Gulf of Thailand, Great Australian Bight, Turkmenistan, and the South China Sea.

How are the companies implementing organic and inorganic strategies to gain increased market share?

The companies are emphasizing on contracts & agreements and new product launch to increase their share in the water cut monitors market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Water Cut Monitors Market, By Application: Inclusions vs. Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakup of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Water Cut Monitors Market During the Forecast Period

4.2 Water Cut Monitors Market, By Region

4.3 Asia Pacific Water Cut Monitors Market, By Sector & Country

4.4 Water Cut Monitors Market, By Location

4.5 Water Cut Monitors Market, By Application

4.6 Water Cut Monitors Market, By Sector

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Need for Real-Time Measuring Devices in North America and Europe

5.2.1.2 Advantages of Water Cut Monitors Over Conventional Measurement Techniques

5.2.2 Restraints

5.2.2.1 Fluctuating Crude Oil Prices

5.2.3 Opportunities

5.2.3.1 Digitalization of Oilfields

5.2.3.2 Lack of Players Providing Water Cut Monitors for Subsea Applications

5.2.4 Challenges

5.2.4.1 High Initial Cost of Water Cut Monitors

6 Water Cut Monitors Market, By Sector (Page No. - 38)

6.1 Introduction

6.1.1 Upstream

6.1.1.1 The Demand for Water Cut Monitors in the Upstream Sector is Driven By the Rise in Digitalization and Increasing Exploration & Production Activities 40

6.1.2 Midstream

6.1.2.1 Rising Import and Export Activities Globally are Expected to Drive the Midstream Market

6.1.3 Downstream

6.1.3.1 Rising Refining Capacities Due to Increasing Demand for Refined Products are Expected to Drive the Downstream Market

7 Water Cut Monitors Market, By Location (Page No. - 43)

7.1 Introduction

7.1.1 Onshore

7.1.1.1 Demand for Water Cut Monitors is Primarily Driven By Onshore Horizontal and Vertical Well Drilling Activities

7.1.2 Offshore

7.1.2.1 Extensive Shale Gas and Tight Oil Exploration Combined With Digitalization are Expected to Drive the Market

8 Water Cut Monitors Market, By Application (Page No. - 47)

8.1 Introduction

8.2 Separation Vessel

8.2.1 Rising Demand for Precise Monitoring Devices is Driving the Separation Vessel Market

8.3 LACT

8.3.1 Rising Crude Oil & Gas Import Activities in the Asia Pacific Region to Drive the LACT Market During the Forecast Period

8.4 Mpfm Applications

8.4.1 The Rise in Subsea E&P Activates is Expected to Drive the Demand for Mpfm Water Cut Monitors During the Forecast Period

8.5 Tank Farm & Pipeline

8.5.1 Upcoming Pipeline Projects are Driving the Market

8.6 Well Testing

8.6.1 Increasing Number of Well Drilling Activities are Driving the Market

8.7 Refinery

8.7.1 Increasing Refinery Capacity and Increasing Number of Refineries are Driving the Water Cut Monitors Market

8.8 Others

9 Water Cut Monitors Market, By Region (Page No. - 56)

9.1 Introduction

9.2 Asia Pacific

9.2.1 By Application

9.2.2 By Sector

9.2.3 By Location

9.2.4 By Country

9.2.4.1 China

9.2.4.1.1 Increasing Crude Oil Refining Capacity is Likely to Drive the Chinese Water Cut Monitors Market

9.2.4.2 Japan

9.2.4.2.1 Increasing Import Activities Via Marine Vessels are Likely to Drive the Market

9.2.4.3 South Korea

9.2.4.3.1 Rising Adoption of Advanced Instruments at Refineries is Expected to Support Demand for Water Cut Monitors in South Korea

9.2.4.4 India

9.2.4.4.1 Rising Investments in Midstream Pipeline Projects are Expected to Drive the Indian Market

9.2.4.5 Rest of Asia Pacific

9.3 North America

9.3.1 By Application

9.3.2 By Sector

9.3.3 By Location

9.3.4 By Country

9.3.4.1 US

9.3.4.1.1 Rising Drilling Activities and Increasing Trade Movement in the US are A Driving Force for the Market

9.3.4.2 Canada

9.3.4.2.1 Rising Drilling of Oil Sands is Expected to Boost the Demand for Water Cut Monitors Operations

9.3.4.3 Mexico

9.3.4.3.1 New Offshore Activities are Expected to Boost the Demand for Water Cut Monitors Operations

9.4 Europe

9.4.1 By Application

9.4.2 By Sector

9.4.3 By Location

9.4.4 By Country

9.4.4.1 Germany

9.4.4.1.1 Rising Export of Oil is Offering Opportunities for the Market in Germany

9.4.4.2 Russia

9.4.4.2.1 Rising E&P Activities in Russia’s Far East Region is Expected to Drive the Market in Russia

9.4.4.3 UK

9.4.4.3.1 Redevelopments in Brownfields are Expected to Drive the UK Market

9.4.4.4 Italy

9.4.4.4.1 Rise in Demand for Petroleum Products is Expected to Support the Growth of the Market in Italy

9.4.4.5 France

9.4.4.5.1 Rise in Import Activities for Supplementing the Demand for Petroleum Products is Expected to Support the Growth of French Water Cut Monitors Market

9.4.4.6 Rest of Europe

9.5 Middle East & Africa

9.5.1 By Applications

9.5.2 By Sector

9.5.3 By Location

9.5.4 By Country

9.5.4.1 Saudi Arabia

9.5.4.1.1 Enhanced Crude Production From Onshore Fields and the Surge in Export are Expected to Drive the Market

9.5.4.2 UAE

9.5.4.2.1 Demand for Water Cut Monitors Services is Likely to Grow With Rising Drilling Activities in the UAE

9.5.4.3 Egypt

9.5.4.3.1 New Discoveries in Egypt to Pave Demand for Water Cut Monitors

9.5.4.4 Nigeria

9.5.4.4.1 Rising Exploration Activities and Developments in Mature Oil & Gas Fields are Expected to Support the Market During the Forecast Period

9.5.4.5 South Africa

9.5.4.5.1 Rising Investments in Pipeline Projects to Offer Lucrative Growth Opportunities for the Market in South Africa

9.5.4.6 Rest of Middle East & Africa

9.6 South America

9.6.1 By Application

9.6.2 By Sector

9.6.3 By Location

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.1.1 Offshore Developments are Expected to Drive the Brazilian Market

9.6.4.2 Argentina

9.6.4.2.1 Drilling of Unconventional Oil Reserves is Expected to Drive the Market

9.6.4.3 Colombia

9.6.4.3.1 Government Initiatives in the Development of Pipelines are Expected to Drive the Market in Colombia

9.6.4.4 Rest of South America

10 Competitive Landscape (Page No. - 90)

10.1 Overview

10.2 Ranking of Players and Industry Concentration, 2018

10.3 Competitive Scenario

10.3.1 Mergers & Acquisitions

10.3.2 Contracts & Agreements

10.3.3 New Product Launches

10.3.4 Partnerships/Collaborations/Joint Ventures/Mergers & Acquisitions

10.4 Competitive Leadership Mapping

10.4.1 Visionary Leaders

10.4.2 Innovators

10.4.3 Dynamic

10.4.4 Emerging

11 Company Profile (Page No. - 97)

11.1 Weatherford

11.1.1 Business Overview

11.1.2 Product Offerings

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Emerson

11.2.1 Business Overview

11.2.2 Product Offerings

11.2.3 SWOT Analysis

11.2.4 MnM View

11.3 Schlumberger

11.3.1 Business Overview

11.3.2 Product Offerings

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 TechnipFMC

11.4.1 Business Overview

11.4.2 Product Offerings

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 Ametek Inc.

11.5.1 Business Overview

11.5.2 Product Offerings

11.5.3 Recent Developments

11.5.4 SWOT Analysis

11.5.5 MnM View

11.6 EESIFLO

11.6.1 Business Overview

11.6.2 Product Offerings

11.6.3 Recent Developments

11.7 Phase Dynamics

11.7.1 Business Overview

11.7.2 Product Offerings

11.8 Zelentech

11.8.1 Business Overview

11.8.2 Product Offerings

11.8.3 Recent Developments

11.9 Kam Controls

11.9.1 Business Overview

11.9.2 Product Offerings

11.9.3 Recent Developments

11.10 M-Flow Technologies

11.10.1 Business Overview

11.10.2 Product Offerings

11.10.3 Recent Developments

11.11 Delta C Technologies

11.11.1 Business Overview

11.11.2 Product Offerings

11.12 Sentech AS

11.12.1 Business Overview

11.12.2 Product Offerings

11.13 Agar Corporation

11.13.1 Business Overview

11.13.2 Product Offerings

11.14 LEMIS Process

11.14.1 Business Overview

11.14.2 Product Offerings

11.15 Haimo Technologies

11.15.1 Business Overview

11.15.2 Product Offerings

11.16 Aquasant

11.16.1 Business Overview

11.16.2 Product Offerings

12 Appendix (Page No. - 119)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (64 Tables)

Table 1 Water Cut Monitors Market Snapshot

Table 2 Upstream Segment is Expected to Dominate the Market, By Sector, During the Forecast Period

Table 3 Water Cut Monitors Market Size, By Sector, 2017–2024 (USD Million)

Table 4 Upstream: Market Size, By Region, 2017–2024 (USD Million)

Table 5 Midstream: Market Size, By Region, 2017–2024 (USD Million)

Table 6 Downstream: Market Size, By Region, 2017–2024 (USD Million)

Table 7 Offshore Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Table 8 Water Cut Monitors Market Size, By Location, 2017–2024 (USD Million)

Table 9 Onshore: Market Size, By Region, 2017–2024 (USD Million)

Table 10 Offshore: Market Size, By Region, 2017–2024 (USD Million)

Table 11 Water Cut Monitors Market Size, By Application, 2017–2024 (USD Million)

Table 12 Separation Vessel: Market Size, By Region, 2017–2024 (USD Thousand)

Table 13 LACT: Market Size, By Region, 2017–2024 (USD Thousand)

Table 14 Mpfm Applications: Market Size, By Region, 2017–2024 (USD Thousand)

Table 15 Tank Farm & Pipeline: Market Size, By Region, 2017–2024 (USD Thousand)

Table 16 Well Testing: Market Size, By Region, 2017–2024 (USD Thousand)

Table 17 Refinery: Market Size, By Region, 2017–2024 (USD Thousand)

Table 18 Others: Market Size, By Region, 2017–2024 (USD Thousand)

Table 19 Water Cut Monitors Market Size, By Region, 2017–2024 (USD Million)

Table 20 Asia Pacific: Market Size, By Application, 2017–2024 (USD Thousand)

Table 21 Asia Pacific: Market Size, By Sector, 2017–2024 (USD Thousand)

Table 22 Asia Pacific: Market Size, By Location, 2017–2024 (USD Thousand)

Table 23 Asia Pacific: Market Size, By Country, 2017–2024 (USD Thousand)

Table 24 China: Water Cut Monitors Market Size, By Location, 2017–2024 (USD Thousand)

Table 25 Japan: Market Size, By Application, 2017–2024 (USD Thousand)

Table 26 South Korea: Market Size, By Location, 2017–2024 (USD Thousand)

Table 27 India: Water Cut Monitors Market Size, By Location, 2017–2024 (USD Thousand)

Table 28 Rest of Asia Pacific: Market Size, By Application, 2017–2024 (USD Thousand)

Table 29 North America: Market Size, By Application, 2017–2024 (USD Thousand)

Table 30 North America: Market Size, By Sector, 2017–2024 (USD Thousand)

Table 31 North America: Market Size, By Location, 2017–2024 (USD Thousand)

Table 32 North America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 33 US: Market Size, By Location, 2017–2024 (USD Thousand)

Table 34 Canada: Market Size, By Application, 2017–2024 (USD Thousand)

Table 35 Mexico: Market Size, By Location, 2017–2024 (USD Thousand)

Table 36 Europe: Market Size, By Application, 2017–2024 (USD Thousand)

Table 37 Europe: Market Size, By Sector, 2017–2024 (USD Thousand)

Table 38 Europe: Market Size, By Location, 2017–2024 (USD Thousand)

Table 39 Europe: Market Size, By Country, 2017–2024 (USD Thousand)

Table 40 Germany: Market Size, By Location, 2017–2024 (USD Thousand)

Table 41 Russia: Market Size, By Location, 2017–2024 (USD Thousand)

Table 42 UK: Market Size, By Location, 2017–2024 (USD Thousand)

Table 43 Italy: Market Size, By Location, 2017–2024 (USD Thousand)

Table 44 France: Market Size, By Location, 2017–2024 (USD Thousand)

Table 45 Rest of Europe: Market Size, By Location, 2017–2024 (USD Thousand)

Table 46 Middle East & Africa: Market Size, By Application, 2017–2024 (USD Thousand)

Table 47 Middle East: Market Size, By Sector, 2017–2024 (USD Thousand)

Table 48 Middle East & Africa: Market Size, By Location, 2017–2024 (USD Thousand)

Table 49 Middle East & Africa: Market Size, By Country, 2017–2024 (USD Thousand)

Table 50 Saudi Arabia: Market Size, By Location, 2017–2024 (USD Thousand)

Table 51 UAE: Market Size, By Location, 2017–2024 (USD Thousand)

Table 52 Egypt: Market Size, By Location, 2017–2024 (USD Thousand)

Table 53 Nigeria: Market Size, By Location, 2017–2024 (USD Thousand)

Table 54 South Africa: Market Size, By Location, 2017–2024 (USD Thousand)

Table 55 Rest of Middle East: Market Size, By Location, 2017–2024 (USD Thousand)

Table 56 South America: Market Size, By Application, 2017–2024 (USD Thousand)

Table 57 South America: Market Size, By Sector, 2017–2024 (USD Thousand)

Table 58 South America: Market Size, By Location, 2017–2024 (USD Thousand)

Table 59 South America: Market Size, By Country, 2017–2024 (USD Thousand)

Table 60 Brazil: Water Cut Monitors Market Size, By Location, 2017–2024 (USD Thousand)

Table 61 Argentina: Market Size, By Location, 2017–2024 (USD Thousand)

Table 62 Colombia: Market Size, By Application, 2017–2024 (USD Thousand)

Table 63 Rest of South America: Market Size, By Location, 2017–2024 (USD Thousand)

Table 64 Developments of Key Players in the Market, January 2015–November 2019

List of Figures (44 Figures)

Figure 1 Water Cut Monitors Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation Methodology

Figure 5 Asia Pacific Dominated the Market in 2019

Figure 6 Upstream Segment of the Water Cut Monitors Market, By Sector, is Expected to Hold the Largest Share During the Forecast Period

Figure 7 Onshore Segment of the Market, By Location, is Expected to Lead During the Forecast Period

Figure 8 LACT Segment is Expected to Grow at the Second Highest CAGR During the Forecast Period

Figure 9 Contracts & Agreements is the Major Strategy Adopted By Players of the Market

Figure 10 Rising Demand for Real-Time Monitoring Devices and Increasing Drilling Activities are Driving the Market, 2019–2024

Figure 11 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Upstream Segment and China Dominated the Asia Pacific Market in 2018

Figure 13 Onshore Segment Dominated the Market in 2018

Figure 14 Separation Vessel Segment is Expected to Dominate the Market, By Application, During the Forecast Period

Figure 15 Upstream Segment Dominated the Global Market, By Sector, in 2018

Figure 16 Water Cut Monitors Market: Drivers, Restraints, Opportunities, & Challenges

Figure 17 West Texas Intermediate (Wti) Crude Oil Price, January 2013–October 2019

Figure 18 Newly Drilled Wells, 2018

Figure 19 Separation Vessel Application Segment is Expected to Lead the Market From 2019 to 2024

Figure 20 Asia Pacific Dominated the Separation Vessel Application Segment in 2018

Figure 21 Asia Pacific is Expected to Witness the Highest CAGR in the LACT Application Segment in 2018

Figure 22 Saudi Arabia is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific is Expected to Dominate the Market During the Forecast Period

Figure 24 Regional Snapshot: Asia Pacific Led the Water Cut Monitors Market in 2018

Figure 25 Regional Snapshot: North America Led the Water Cut Monitors Market in 2018

Figure 26 Key Developments in the Water Cut Monitors Market, January 2015–October 2019

Figure 27 Ranking of Key Players & Industry Concentration, 2018

Figure 28 Global Water Cut Monitors Market Competitive Leadership Mapping, 2018

Figure 29 Weatherford: Company Snapshot

Figure 30 Emerson: Company Snapshot

Figure 31 Schlumberger: Company Snapshot

Figure 32 TechnipFMC: Company Snapshot

Figure 33 Ametek Inc: Company Snapshot

Figure 34 EESIFLO: Company Snapshot

Figure 35 Phase Dynamics: Company Snapshot

Figure 36 Zelentech: Company Snapshot

Figure 37 Kam Controls: Company Snapshot

Figure 38 M-Flow Technologies: Company Snapshot

Figure 39 Delta C Technologies: Company Snapshot

Figure 40 Sentech As: Company Snapshot

Figure 41 Agar Corporation: Company Snapshot

Figure 42 LEMIS Process: Company Snapshot

Figure 43 Haimo Technologies: Company Snapshot

Figure 44 Aquasant: Company Snapshot

This study involved four major activities in estimating the current size of the global water cut monitors market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to determine the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global water cut monitors market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

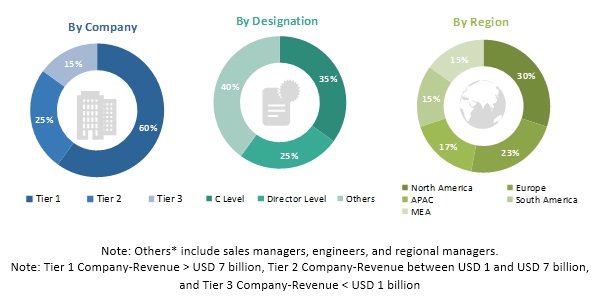

The water cut monitors market comprises several stakeholders, such as water cut monitors manufacturers, public and private operators of oil & gas industries, energy & power sector consulting companies, government & research organizations, national and state regulatory authorities, investment banks, and power & energy associations. The demand-side of this market is characterized by oil & gas operators, refinery operators, and others. The supply-side is characterized by water cut monitors manufacturers, component providers, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global water cut monitors market and its dependent submarkets. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and demand have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares split, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the water cut monitors market.

Report Objectives

- To provide detailed information on the significant factors influencing the growth of the market, such as drivers, restraints, opportunities, and industry-specific challenges

- To define, describe, segment, and forecast the global water cut monitors market based on sector, location, application, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the global market for individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the global market with respect to the main regions (Asia Pacific, Europe, North America, South America, and Middle East & Africa)

- To profile and rank key players and comprehensively analyze their market share

- To analyze competitive developments such as contracts & agreements, expansions & investments, new product launches, mergers & acquisitions, joint ventures, and partnerships & collaborations in the water cut monitors market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Water Cut Monitors Market