Vector Control Market by Vector Type (Insects and Rodents), End-use Sector (Commercial & Industrial and Residential), Method of Control (Chemical, Physical & Mechanical, and Biological), and Region Global Forecast to 2023

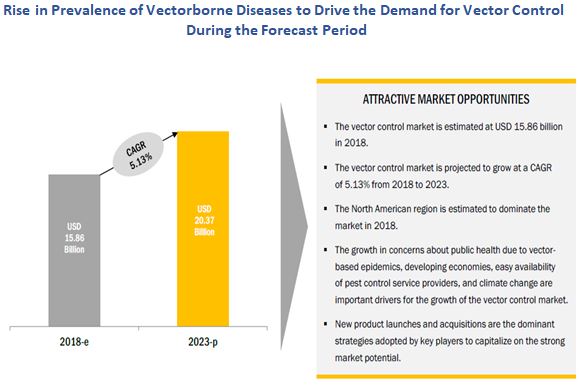

The vector control market was valued at USD 15.12 Billion in 2017 and is projected to reach 20.37 Billion by 2023, at a CAGR of 5.13% during the forecast period. Factors such as the rising prevalence of vector-based diseases worldwide, promotions by the individual country government as a part of their disease/vector eradication programs, and the efficiency of a chemical-based vector control products have been the primary drivers responsible for the growth of the vector control market.

The Increasing population has paved the way to an increase in pressure for the limited resources, which has resulted in overexploitation eventually causing a threat to the environment by chemical poisoning and degradation associated with chemical-based products, thus alternative control methods are under the research phase. Furthermore, regulations on the use of chemical insecticides have become stringent in North American and European countries, owing to the environmental concerns rising from their usage. This has led to opportunities for the growth of biological insect pest control methods. However, there is still significant demand for synthetic insecticides among public health authorities, and pest control service providers as their biological counterparts are environment-friendly but less effective and require repeated usage for optimum results.

Additionally, the market in Asia-Pacific region is expected to diversify from the high-value low-volume commercial sector to the low-value high-volume residential sector due to the increase in the living standards of urban people in countries such as India, China, Brazil, and South Africa. These trends are expected to propel the vector control market during the forecast period.

For more details on this research, Request Free Sample Report

The years considered for the study are as follows:

- Base year 2017

- Estimated year 2018

- Projected year 2023

- Forecast period 2018 to 2023

The objectives of the report

- Determining and projecting the size of the vector control market with respect to vector type, end-use sector, method of control, and regional markets over the period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing markets across regions

- Identifying drivers and restraints impacting the global market for vector control

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to determine the value of vector control market for regions such as North America, Europe, Asia Pacific, and RoW

- The key players have been identified through secondary sources such as the Pest Management Association (PMA), the US Department of Agriculture (USDA), World Health Organization (WHO), the United States Environmental Protection Agency (EPA), and Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA), while their market share in respective regions has been determined through both primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the vector control market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the vector control market include manufacturers such as Bayer AG (Germany), Syngenta AG (Switzerland), BASF SE (Germany), Bell Laboratories, Inc. (US), and FMC Corporation (US); R&D institutes; service providing companies such Rentokil Initial plc (UK), Ecolab (US), The Terminix International Company LP (US), Rollins, Inc. (US), Anticimex Group (Sweden), Arrow Exterminators, Inc. (US), Massey Services Inc. (US), Ensystex (US); and government bodies, regulatory associations, and world recognized agencies such as the World Health Organization (WHO), US Presidents Malaria Initiatives (PMI), United States Environmental Protection Agency (US EPA), and The Federal Insecticide, Fungicide, and Rodenticide Act (FIFRA).

Target Audience

The stakeholders for the report are as follows:

- Vector control product manufacturers, suppliers, and formulators

- Professional pest control service providers

- Pesticide traders, distributors, importers, exporters, and suppliers

- Public health contractors

- Agricultural warehouse owners and animal & dairy co-operative societies

- Commercial research & development (R&D) organizations and financial institutions

- Pest control associations and industry bodies

- Government health authorities and regulatory bodies such as World Health Organization (WHO), Environmental Protection Agency (EPA), and Pest Management Regulatory Agency (PMRA)

Scope of the Vector Control Market Report:

This research report categorizes the vector control market broadly based on vector type, method of control method, end-use sector, and region.

Based on Vector Type, the vector control market has been segmented as follows:

- Insects

- Rodents

- Others (ticks and snails)

Based on Method of Control, the vector control market has been segmented as follows:

- Chemical

- Pyrethroids

- Fipronil

- Organophosphates

- Larvicides

- Others (Carbamates, neonicotinoids, benzoyl urea, acaricides, and pyrroles)

- Physical & mechanical

- Traps and baits

- Ultraviolet devices

- Others (Ultrasonic vibrations, mesh screens, and row covers)

- Biological

- Microbials

- Botanicals

- Predatory agents

- Others (Radiation and environmental control services)

Based on End-use Sector, the vector control market has been segmented as follows:

- Commercial & industrial

- Residential

Based on Region, the vector control market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific vector control market

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The vector control market is projected to grow at a CAGR of 5.13% from 2018 to 2023, to reach a projected value of USD 20.37 Billion by 2023. The increasing awareness about public health has led to the adoption of vector/pest control services on a regular basis in the residential, commercial, and industrial sectors.

On the basis of vector type, the insect control segment accounted for a major share in the market for 2017, due to the rising cases of epidemics caused by vectors such as mosquitoes, cockroaches, bedbugs, flies, and ants across the globe. Promotions by individual country governments and renowned global organizations such as the WHO for the disease/vector eradication programs have also driven the growth of the insect control segment.

On the basis of method of control, the biological segment is projected to grow at the highest growth rate during the forecast period. This can be attributed to the growing concerns on the environmental impact of chemical compounds and the rising number of cases of insecticide resistance among pests. Additionally, biologicals are gaining preference as they are perceived to be safer than their chemical-based counterparts.

On the basis of end-use sector, the commercial & industrial segment accounted for a larger market share in 2017, due to the increased demand from sectors such as food & beverage manufacturing, food services, hospitality, government organizations, and pharmaceuticals. The demand can be attributed to the need for complying with the local authorities for workplace hygiene and maintenance as a part of the stringent regulations laid by governments.

The North American region dominated the vector control method market in 2017 wherein the US and Canada were the major markets owing to the high demand for vector control services in the residential sector, which, in turn, is expected to grow rapidly in the next five years. In the commercial & industrial sector, stringent implementation of regulations is being carried out to ensure the maintenance of the overall standards for safe and hygienic environment.

For more details on this research, Request Free Sample Report

The major restraining factor that affects the vector control industry is the lack of funds in developing countries. Moreover, the environmental hazards associated with chemical-based vector control products also act as a restraining factor in this industry. Alternative methods such as biological-based control methods are increasingly gaining prominence due to their perceived risk-free nature to the environment.

The key manufacturers in the vector control market are Bayer AG (Germany), Syngenta AG (Switzerland), BASF SE (Germany), Bell Laboratories, Inc. (US), and FMC Corporation (US). The key service providers in the industry are Rentokil Initial plc (UK), Ecolab (US), The Terminix International Company LP (US), Rollins, Inc. (US), Anticimex Group (Sweden), Arrow Exterminators, Inc. (US), Massey Services Inc. (US), and Ensystex (US).

Frequently Asked Questions (FAQ):

What is the leading method of control in the vector control market?

The chemical segment was the highest revenue contributor to the market, with USD 8,590.4 million in 2017, and is estimated to reach USD 11,374.3 million by 2023, with a CAGR of 4.8%. The physical & mechanical segment is estimated to reach USD 6,051.8 million by 2023, at a significant CAGR of 5.5% during the forecast period.

What is the estimated industry size of vector control?

The global vector control market was valued at USD 400.6 million in 2017, and is projected to reach USD 590.2 million by 2023, registering a CAGR of 6.8% from 2018 to 2023.

What is the leading vector type of vector control market?

The insects segment was the highest revenue contributor to the market, with USD 9,215.6 million in 2017, and is estimated to reach USD 12,399.9 million by 2023, with a CAGR of 5.1%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

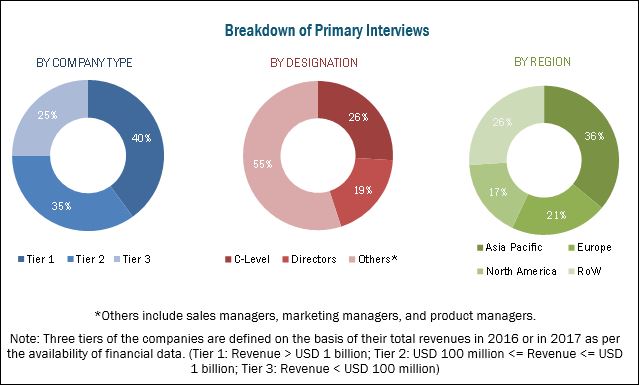

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Vector Control Market

4.2 Market For Vector Control, By Type & Region, 2017

4.3 North America: Vector Control Market

4.4 Market For Vector Control, By Application & Region

4.5 Vector Control Market Share: Key Countries

5 Market Overview (Page No. - 38)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Rising Prevalence of Vectorborne Diseases Worldwide

5.1.1.2 Promotions/Recommendations of Vector Control Methods By Renowned Organizations and Governments

5.1.1.3 High Efficiency, Ease of Application, and Availability of Chemical-Based Vector Control Products

5.1.2 Restraints

5.1.2.1 Lack of Funds in Developing Countries

5.1.2.2 Lengthy Approval Procedure and Absence of Uniform Guidelines for Testing

5.1.2.3 Environmental Hazards of Chemical-Based Vector Control Products

5.1.3 Opportunities

5.1.3.1 Increasing Adoption of Physical Control Methods for Vectors

5.1.3.2 Technological Advancements in Vector Control Products

5.1.4 Challenges

5.1.4.1 Need for Effective Biological Methods for Vector Control

5.1.4.2 Development of Insecticide Resistance Reduces the Effectiveness of Chemical-Based Vector Control Products

6 Industry Trends (Page No. - 48)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Key Trends

6.4 Regulatory Analysis

6.4.1 Introduction

6.4.2 North America

6.4.2.1 US

6.4.2.2 Canada

6.4.3 Europe

6.4.3.1 UK

6.4.4 Asia Pacific

6.4.4.1 Australia

6.4.4.2 India

6.4.5 RoW

6.4.5.1 Argentina

7 Vector Control Market, By Vector Type (Page No. - 53)

7.1 Introduction7.2 Insects

7.3 Rodents

7.4 Others

8 Vector Control Market, By Method of Control (Page No. - 59)

8.1 Introduction8.2 Chemical Methods

8.2.1 Pyrethroids

8.2.1.1 Permethrin

8.2.1.2 Deltamethrin

8.2.1.3 Cypermethrin

8.2.1.4 Lambda-Cyhalothrin

8.2.2 Fipronil

8.2.3 Organophosphates

8.2.3.1 Malathion

8.2.3.2 Temephos

8.2.3.3 Chlorpyrifos

8.2.4 Larvicides

8.2.4.1 Pyriproxyfen

8.2.5 Other Chemical Methods

8.3 Physical & Mechanical Control Methods

8.4 Biological Control Methods

8.4.1 Microbials

8.4.2 Predators

8.4.3 Botanicals

8.5 Other Control Methods

9 Vector Control Market, By End-Use Sector (Page No. - 72)

9.1 Introduction9.2 Commercial & Industrial

9.3 Residential

10 Vector Control Market, By Region (Page No. - 77)

10.1 Introduction10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 Spain

10.3.4 UK

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.2 Australia

10.4.3 China

10.4.4 India

10.4.5 Rest of Asia Pacific

10.5 Rest of the World (RoW)

10.5.1 Brazil

10.5.2 South Africa

10.5.3 Argentina

10.5.4 Others in RoW

11 Competitive Landscape (Page No. - 109)

11.1 Overview

11.2 Company Rankings

11.3 Competitive Scenario

11.3.1 New Product Launches, Product Developments, and Product Approvals

11.3.2 Collaborations

11.3.3 Expansions

11.3.4 Acquisitions and Mergers

12 Company Profiles (Page No. - 114)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

12.1 BASF SE

12.2 Bayer AG

12.3 Syngenta AG

12.4 Rentokil Initial PLC.

12.5 FMC Corporation

12.6 Ecolab

12.7 Rollins Inc.

12.8 The Terminix International Company Lp

12.9 Bell Laboratories Inc.

12.10 Arrow Exterminators, Inc

12.11 Massey Services Inc.

12.12 Anticimex Group

12.13 Ensystex

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 146)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (71 Tables)

Table 1 US Dollars Exchange Rate, 20142017

Table 2 US: Registration Fee for Insecticides

Table 3 Size of Market For Vector Control, By Vector Type, 20162023 (USD Million)

Table 4 Insect Control Market Size, By Region, 20162023 (USD Million)

Table 5 Rodent Control Market Size, By Region, 20162023 (USD Million)

Table 6 Other Vector Control Market Size, By Region, 20162023 (USD Million)

Table 7 Size of Market For Vector Control, By Method of Control, 20162023 (USD Million)

Table 8 Chemical Vector Control Methods Market Size, By Subtype, 20162023 (USD Million)

Table 9 Chemical Vector Control Methods Market Size, By Region, 20162023 (USD Million)

Table 10 Physical & Mechanical Vector Control Methods Market Size, By Subtype, 20162023 (USD Million)

Table 11 Physical & Mechanical Vector Control Methods Market Size, By Region, 20162023 (USD Million)

Table 12 Biological Control Vector Methods Market Size, By Subtype, 20162023 (USD Million)

Table 13 Biological Control Vector Methods Market Size, By Region, 20162023 (USD Million)

Table 14 Other Vector Control Methods Market Size, By Region, 20162023 (USD Million)

Table 15 Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 16 Vector Control Market Size in Commercial & Industrial Sector, By Region, 20162023 (USD Million)

Table 17 Vector Control Market Size in Residential Sector, By Region, 20162023 (USD Million)

Table 18 Size of Market For Vector Control, By Region, 20162023 (USD Million)

Table 19 North America: Vector Control Market Size, By Country, 20162023 (USD Million)

Table 20 North America: Size of Market For Vector Control, By Vector Type, 20162023 (USD Million)

Table 21 North America: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 22 North America: Size of Market For Vector Control, By Method of Control, 20162023 (USD Million)

Table 23 US: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 24 US: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 25 Canada: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 26 Canada: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 27 Mexico: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 28 Mexico: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 29 Europe: Vector Control Market Size, By Country, 20162023 (USD Million)

Table 30 Europe: Size of Market For Vector Control, By Vector Type, 20162023 (USD Million)

Table 31 Europe: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 32 Germany: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 33 Germany: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 34 France: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 35 France: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 36 Spain: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 37 Spain: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 38 UK: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 39 UK: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 40 Rest of Europe: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 41 Rest of Europe: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 42 Asia Pacific: Vector Control Market Size, By Country, 20162023 (USD Million)

Table 43 Asia Pacific: Size of Market For Vector Control, By Vector Type, 20162023 (USD Million)

Table 44 Asia Pacific: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 45 Japan: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 46 Japan: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 47 Australia: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 48 Australia: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 49 China: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 50 China: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 51 India: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 52 India: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 53 Rest of Asia Pacific: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 54 Rest of Asia Pacific: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 55 RoW: Vector Control Market Size, By Country, 20162023 (USD Million)

Table 56 RoW: Size of Market For Vector Control, By Vector Type, 20162023 (USD Million)

Table 57 RoW: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 58 Brazil: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 59 Brazil: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 60 South Africa: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 61 South Africa: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 62 Argentina: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 63 Argentina: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 64 Others in RoW: Vector Control Market Size, By Vector Type, 20162023 (USD Million)

Table 65 Others in RoW: Size of Market For Vector Control, By End-Use Sector, 20162023 (USD Million)

Table 66 Vector Control Products: Company Rankings, 2017

Table 67 Vector Control Services: Company Rankings, 2017

Table 68 New Product Launches, Product Developments, and Product Approvals 20122018

Table 69 Collaborations, 20122018

Table 70 Expansions, 20122018

Table 71 Acquisitions and Mergers, 20122018

List of Figures (52 Figures)

Figure 1 Vector Control Market Segmentation

Figure 2 Geographic Scope

Figure 3 Research Design: Vector Control Market

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Vector Control Market, By End-Use Sector, 2018 vs 2023

Figure 9 Market For Vector Control, By Method of Control, 2018 vs 2023

Figure 10 Market For Vector Control, By Vector Type, 2018 vs 2023

Figure 11 Market For Vector Control: Regional Snapshot

Figure 12 Rise in Prevalence of Vectorborne Diseases to Drive the Demand for Vector Control During the Forecast Period

Figure 13 North America is Projected to Dominate the Market For Vector Control Through 2023

Figure 14 North America: Vector Control Market Share, By Vector Type & Country, 2017

Figure 15 Commercial Segment Dominated the Market in 2017

Figure 16 US and Canada: Important Markets for Vector Control, 2017

Figure 17 Pest Control Market Dynamics: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Mosquitoes: Leading Disease-Causing Vector

Figure 19 Value Chain Analysis: Major Value is Added During the Product Development Phase

Figure 20 Size of Market For Vector Control, By Vector Type, 2018 vs 2023 (USD Million)

Figure 21 Insect Control Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 22 Rodent Control Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 23 Other Vector Control Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 24 Size of Market For Vector Control, By Method of Control, 2018 vs 2023 (USD Million)

Figure 25 Chemical Vector Control Methods Market Size, By Subtype, 2018 vs 2023 (USD Million)

Figure 26 Chemical Vector Control Methods Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 27 Physical & Mechanical Vector Control Methods Market Size, By Subtype, 2018 vs 2023 (USD Million)

Figure 28 Physical & Mechanical Vector Control Methods Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 29 Biological Control Vector Methods Market Size, By Subtype, 2018 vs 2023 (USD Million)

Figure 30 Biological Control Vector Methods Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 31 Other Vector Control Methods Market Size, By Region, 2018 vs 2023 (USD Million)

Figure 32 Size of Market For Vector Control Size, By End-Use Sector, 2018 vs 2023 (USD Million)

Figure 33 Vector Control Market Size in Commercial & Industrial Sector, By Region, 2017 vs 2023 (USD Million)

Figure 34 Vector Control Market Size in Residential Sector, By Region, 2018 vs 2023 (USD Million)

Figure 35 Snapshot of Market For Vector Control, 2016

Figure 36 North America: Snapshot of Market For Vector Control

Figure 37 Europe: Snapshot of Market For Vector Control

Figure 38 Asia Pacific: Snapshot of Market For Vector Control, 2016

Figure 39 Key Developments of the Leading Players in the Vector Control Market During 20132018

Figure 40 BASF: Company Snapshot

Figure 41 BASF: SWOT Analysis

Figure 42 Bayer: Company Snapshot

Figure 43 Bayer: SWOT Analysis

Figure 44 Syngenta: Company Snapshot

Figure 45 Syngenta: SWOT Analysis

Figure 46 Rentokil: Company Snapshot

Figure 47 Rentokil: SWOT Analysis

Figure 48 FMC: Company Snapshot

Figure 49 FMC: SWOT Analysis

Figure 50 Ecolab: Company Snapshot

Figure 51 Rollins: Company Snapshot

Figure 52 The Terminix International Company L P: Company Snapshot

Growth opportunities and latent adjacency in Vector Control Market