Topical Drug Delivery Market by Type (Semi-solids (Creams, Gels, Lotions), Solids (Suppositories), Liquids (Solutions), Transdermal Products), Route (Dermal, Ophthalmic), Facility of Use (Homecare setting, Hospitals, Burn Centres) & Region - Global Forecast to 2027

Market Growth Outlook Summary

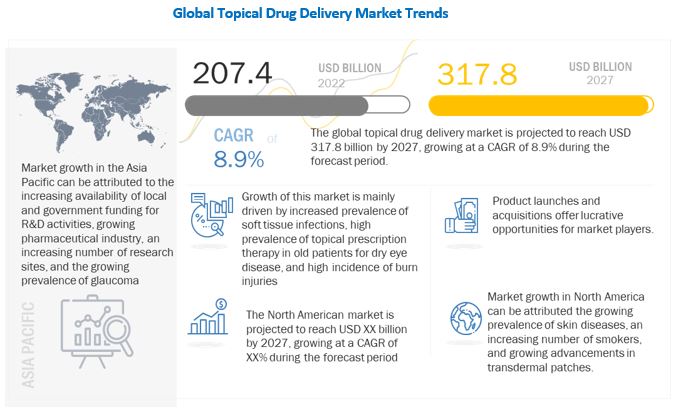

The global topical drug delivery market in terms of revenue was estimated to be worth $207.4 billion in 2022 and is poised to reach $317.8 billion by 2027, growing at a CAGR of 8.9% from 2022 to 2027. The comprehensive research encompasses an exhaustive examination of industry trends, meticulous pricing analysis, patent scrutiny, insights derived from conferences and webinars, identification of key stakeholders, and a nuanced understanding of market purchasing dynamics.

Growth in this market is majorly driven by the high incidence for burn injuries, increasing number of smokers around the world, growing prevalence of diabetes, and advancements in transdermal drug delivery systems.

Topical Drug Delivery Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Topical Drug Delivery Market Dynamics

Driver: High Incidence of burn injuries

The treatment of burn injuries is one of the major application areas of topical drugs. Topical antimicrobial agents such as Fenistil (GSK), Sulfamylon cream (Mylan), Bactroban (GSK), and Silvadene (Pfizer) are considered the first line of treatment for burn injuries in patients.

According to the Lancet Public Health, in 2021, burns were one of the major causes of disability, with more than 8 million disability-adjusted life-years (DALYs). The high incidence of burn injuries in major regional segments across the globe has resulted in sustained demand for topical drugs for effective burn treatment and management. Many topical antimicrobial agents are used to cure burns. An antimicrobial agent such as silver sulfadiazine cream is used to treat wound infections in second and third-degree burns patients. However, patients with severe burns or burns over a large area are treated in a hospital. There are many other antibiotic ointments for burns, such as over-the-counter options for an uncomplicated burn.

Restraint: Continuous irritation on skin and allergies caused by topical drugs

Many topical formulations are available over the counter and include antibacterial & antifungal preparations, anti-inflammatory & pain-relief preparations, and cleansing & moisturizing agents. Topical corticosteroids are used in many inflammatory rashes. However, in some cases, topical corticosteroid sensitivity produces allergic reactions. Usually, this is seen as a failure to cure dermatitis or to worsen existing dermatitis treated with corticosteroids. Very rarely, corticosteroid allergy may appear as an eczematous rash in a completely different area of the body from the original dermatitis. Some topical antibiotics may also cause contact allergies, such as bacitracin, which is used to prevent minor skin injuries such as cuts, scrapes, and burns. Benzocaine and salicylate are some of the active ingredients in topical formulations which causes allergies. These allergies caused by such drugs can be diagnosed by a patch test that can detect contact allergens. Allergy to topical medications is more common in older patients, but some patients with pre-existing skin conditions are at a higher risk of developing allergic reactions to topical medications. These allergies caused by the topical drugs are one of the limitations of the usage of such medicines. In most cases, patients adopt another type of drug delivery system or go for other forms of medicine.

Opportunity: Rising demand for self-administration and home care

Self-administration of drugs within home care settings is expected to provide significant growth opportunities for players operating in the market. This is mainly due to the rising geriatric population and closing regular OPDs for a few months during COVID-19. Elderly individuals form a large consumer base for topical drugs in-home care. This factor also increases the need for inhalation, topical, and transdermal drug products designed to cater to the needs of caregivers and patients. Transdermal drug delivery enhances the ease of administration of drugs as it uses a transdermal patch that can be easily self-administered. It provides suitable and painless self-administration for patients. This approach helps reduce healthcare costs by reducing the duration of hospital stays. Also, in the case of transdermal patches, caregivers can easily determine if a patch is placed securely. This acts as one of the main opportunities to increase the demand for transdermal patches, boosting the growth of topical drug deliveries.

Challenge: Topical formulation for drugs with limited plasma concentration

Topical drug delivery refers to the application of medication to the surface of the skin or within the layers of skin or mucous membrane. Skin acts as a barrier and prevents the penetration of many APIs, even though it is an ideal site to achieve both local and systemic effects via the delivery of drug substances. However, drugs that have a larger particle size are not easily absorbed through the skin. To facilitate skin absorption, the molecular weight of a compound should be under 500 Dalton when developing drug substances for use in topical dermatological therapies. These high molecular weight drugs are poorly lipid-soluble and cannot achieve the desired therapeutic effect and action. Percutaneous absorption decreases with high molecular weight. This decreased therapeutic effect of topical medicines limits the adoption of topical drug delivery.

<43 style="font-size: 16px;"> The semi-solid formulation segment accounted for the largest share of the topical drug delivery market, by product.

Based on products, the the market is segmented into semi-solid formulations, liquid formulations, solid formulations, and transdermal products. The semi-solid formulations segment accounted for the largest share in the market. The large share of this segment is attributed to suitability to APIs with low density, more stable in atmospheric conditions than liquid and solid forms, and rise in personalized medicine as they have a unique composition and increased absorptive properties. These dosage forms are non-dehydrating and make no modifications to skin functioning.

The dermal drug delivery segment accounted for the largest share of the topical drug delivery market, by route of administration.

Based on the route of administration, the market is segmented into dermal, ophthalmic, rectal, vaginal, and nasal drug delivery. The large share of the dermal drug delivery market segment can largely be attributed to pain free self-administration for patients, advantageous for drugs with shorter half-lives or narrow therapeutic indices, and elimination of frequent administration of drugs and plasma level peaks and valleys associated with oral dosing and injections to maintain a constant drug concentration.

The home care settings segment accounted for the largest share of the topical drug delivery market, by facility of use.

Based on the facility of use, the market is segmented into home care settings, hospitals & clinics, burn centers, and other facilities. The large share of home care settings segment can be attributed to advantages for long-term therapy, better convenience in comparison with inpatient care, and improvement in medical adherence and treatment outcomes. The increasing geriatric population across the globe and the growing need for self- administration of drugs are some other important factors influencing the growth of the home care settings segment.

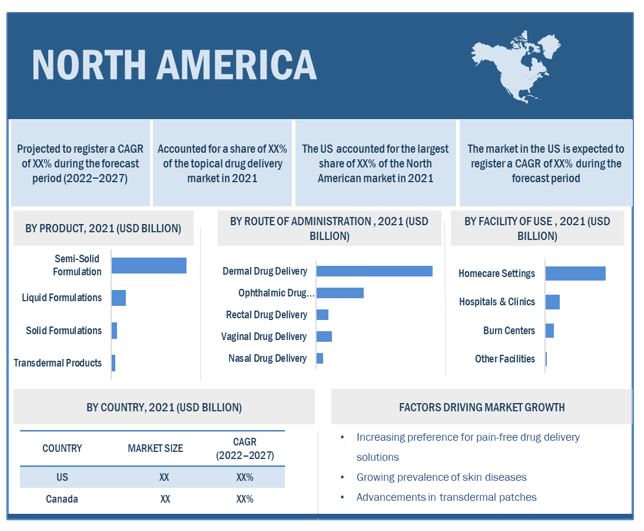

North America accounted for the largest share of the topical drug delivery market.

North America accounted for the largest share the global market, followed by Europe, Asia Pacific, Latin America, and the Middle East & Africa. The large share of North America can be attributed to the rising prevalence of target health conditions, the increasing preference for pain-free drug delivery solutions, the growing prevalence of skin diseases, an increasing number of smokers around the world, rising advancements in transdermal patches, and the high demand for drugs that can be self-administered.

North America: Topical Drug Delivery Market Snapshot

To know about the assumptions considered for the study, download the pdf brochure

Major players in the topical drug delivery market are Glenmark Pharmaceuticals Ltd. (India), Galderma (Switzerland), Johnson & Johnson Private Limited (US), GlaxoSmithKline Plc. (UK), Bausch Health Companies Inc. (Canada), Hisamitsu Pharmaceuticals Inc. (Japan), Cipla (India), Bayer AG (Germany), Viatris Inc. (Mylan N.V.) (US), 3M (US), Merck & Co.Inc.. (Germany), Crescita Therpeautics Inc. (Canada), Novartis International AG (Switzerland), Boehringer Ingelheim International GmBH (Germany), Pfizer Inc. (US), Teva Pharmaceuticals Industries Ltd. (Israel), Bristol Myers Squibb (US), Lead Chemical Co., Ltd. (Japan), Purdue Pharma L.P. (US), Lavipharm (Greece), AbbVie Inc. (US), CMP Pharma, Inc. (Germany), Encore Dermatology, Inc. (US), Prosolus Inc. (US), and Rusan Pharma Ltd. (India).

Scope of the Topical Drug Delivery Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$207.4 billion |

|

Projected Revenue Size by 2027 |

$317.8 billion |

|

Industry Growth Rate |

Poised to grow at a CAGR of 8.9% |

|

Market Driver |

High Incidence of burn injuries |

|

Market Opportunity |

Rising demand for self-administration and home care |

The study categories the topical drug delivery Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Semi-Solid Formulations

- Creams

- Ointments

- Lotions

- Gel

- Pastes

-

Liquid Formulations

- Suspensions

- Solutions

-

Solid Formulations

- Powders

- Suppositories

-

Transdermal Products

- Transdermal Patches

- Transdermal Semi-Solids

By Route of Administration

- Dermal Drug Delivery

- Ophthalmic Drug Delivery

- Rectal Drug Delivery

- Vaginal Drug Delivery

- Nasal Drug Delivery

By Facility of Use

- Home Care Settings

- Hospitals & Clinics

- Burn Centers

- Other Facilities

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments

- In 2022, Galderma and Taro Pharmaceutical Industries Ltd. signed a definitive agreement for Taro to acquire Alchemee, which is formerly The Proactiv Company, from Galderma. This agreement between Galderma and Taro includes Alchemee’s business and assets around the world, including the Proactiv brand. This agreement will add Proactiv to Taro’s broad portfolio of prescription and over-the-counter dermatology products.

- In 2021, GlaxoSmithKline plans to build a new global campus and innovation center in Weybridge. This campus will house the global headquarters for the new Consumer Healthcare business, including an innovation center (made up of R&D laboratories and the Consumer Healthcare Shopper Science lab) and the company’s global support function teams based in the UK.

- In 2020, Teva Pharmaceuticals Industries Ltd. expanded in Japan, it was a new strategy for its local commercial operations as it will focus on commercializing complex generics, specialty assets, and other pipeline opportunities.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the topical drug delivery market?

The topical drug delivery market boasts a total revenue value of $317.8 billion by 2027.

What is the estimated growth rate (CAGR) of the topical drug delivery market?

The global market for topical drug delivery has an estimated compound annual growth rate (CAGR) of 8.9% and a revenue size in the region of $207.4 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS & EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 TOPICAL DRUG DELIVERY MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED

1.3 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE PARTICIPANTS

2.2 MARKET SIZE ESTIMATION

FIGURE 6 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

FIGURE 7 MARKET - REVENUE SHARE ANALYSIS ILLUSTRATION: JOHNSON & JOHNSON

FIGURE 8 PHARMACEUTICAL SALES APPROACH

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 CAGR PROJECTIONS

FIGURE 11 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN GLOBAL MARKET (2022–2027): IMPACT ON MARKET GROWTH & CAGR

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 12 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 STUDY ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.6.2 SCOPE-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 54)

FIGURE 13 TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2022 VS. 2027 (USD BILLION)

FIGURE 14 GLOBAL MARKET, BY ROUTE OF ADMINISTRATION, 2022 VS. 2027 (USD BILLION)

FIGURE 15 GLOBAL MARKET, BY FACILITY OF USE, 2022 VS. 2027 (USD BILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 58)

4.1 GLOBAL MARKET OVERVIEW

FIGURE 17 HIGH PREVALENCE OF SKIN DISEASES AND HIGH INCIDENCE OF BURN INJURIES TO DRIVE MARKET GROWTH

4.2 LATIN AMERICA: MARKET, BY PRODUCT AND COUNTRY (2021)

FIGURE 18 SEMI-SOLID FORMULATIONS TO DOMINATE LATIN AMERICA MARKET IN 2021

4.3 GLBOAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 INDIA TO REGISTER HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

4.4 GLOBAL MARKET, BY REGION (2020–2027)

FIGURE 20 NORTH AMERICA TO DOMINATE MARKET IN 2027

4.5 GLOBAL MARKET: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 21 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 62)

5.1 INTRODUCTION

5.2 PRICING ANALYSIS

TABLE 3 TOPICAL DRUG DELIVERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High prevalence of skin diseases

5.2.1.2 Increase in self-medication as a popular practice in dermatology

5.2.1.3 High prevalence of topical prescription therapy for dry eye diseases

5.2.1.4 Switching from conventional needle injections to transdermal patches

5.2.1.5 High incidence of burn injuries

5.2.1.6 Growing prevalence of diabetes

5.2.2 RESTRAINTS

5.2.2.1 Continuous irritation of skin and allergies caused by topical drugs

5.2.2.2 Preference for alternative modes of drug delivery

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for self-administration and home care

5.2.3.2 Delivery of biologics through transdermal route

5.2.3.3 Topical vehicles used in cosmetic industry

5.2.4 CHALLENGES

5.2.4.1 Topical formulations for drugs with limited plasma concentration

5.2.4.2 Increasing number of drug failures and product recalls

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 NEW ADVANCEMENT IN TRANSDERMAL DRUG DELIVERY SYSTEM

5.3.2 ADOPTION OF TELEDERMATOLOGY

5.4 PATENT ANALYSIS

TABLE 4 GLOBAL MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.5 MARKET DYNAMICS

5.6 INDUSTRY TRENDS

TABLE 5 REGULATORY SCENARIO, BY COUNTRY

5.7 KEY CONFERENCES & EVENTS IN 2022-2023

FIGURE 22 GLOBAL MARKET: VALUE CHAIN ANALYSIS

5.8 IMPACT OF COVID-19

FIGURE 23 PHARMACEUTICAL DRUG DELIVERY MARKET ECOSYSTEM

5.9 REGULATORY ANALYSIS

5.10 VALUE CHAIN ANALYSIS

TABLE 6 REGIONAL PRICING ANALYSIS OF TOPICAL DRUGS, 2021 (USD)

5.11 ECOSYSTEM MAPPING

TABLE 7 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 PATENT PUBLICATION TRENDS FOR TOPICAL DRUG DELIVERY

FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2011– APRIL 2022)

5.12.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 25 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR TOPICAL DRUG DELIVERY PATENTS (JANUARY 2011–APRIL 2022)

FIGURE 26 TOP APPLICANT COUNTRIES/REGIONS FOR TOPICAL DRUG DELIVERY (JANUARY 2011–APRIL 2022)

TABLE 8 LIST OF PATENTS/PATENT APPLICATIONS IN GLOBAL MARKET, 2021–2022

6 TOPICAL DRUG DELIVERY MARKET, BY PRODUCT (Page No. - 84)

6.1 INTRODUCTION

TABLE 9 GLOBAL MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

6.2 SEMI-SOLID FORMULATIONS

TABLE 10 KEY TOPICAL DRUG DELIVERY SEMI-SOLID FORMULATIONS AVAILABLE

TABLE 11 GLOBAL MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 12 GLOBAL MARKET FOR SEMI-SOLID FORMULATIONS, BY COUNTRY, 2020–2027 (USD BILLION)

6.2.1 OINTMENTS

6.2.1.1 Ointments to be widely used in analgesic indications

TABLE 13 GLOBAL MARKET FOR OINTMENTS, BY COUNTRY, 2020–2027 (USD BILLION)

6.2.2 CREAMS

6.2.2.1 Creams to be most widely used formulation due to better absorption

TABLE 14 GLOBAL MARKET FOR CREAMS, BY COUNTRY, 2020–2027 (USD BILLION)

6.2.3 LOTIONS

6.2.3.1 Easy administration of lotions to drive demand

TABLE 15 GLOBAL MARKET FOR LOTIONS, BY COUNTRY, 2020–2027 (USD BILLION)

6.2.4 GELS

6.2.4.1 Faster drug release and greater patient acceptability to drive gels market

TABLE 16 GLOBAL MARKET FOR GELS, BY COUNTRY, 2020–2027 (USD BILLION)

6.2.5 PASTES

6.2.5.1 Topical pastes to treat and prevent skin irritation

TABLE 17 GLOBAL MARKET FOR PASTES, BY COUNTRY, 2020–2027 (USD BILLION)

6.3 LIQUID FORMULATIONS

TABLE 18 GLOBAL MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 19 GLOBAL MARKET FOR LIQUID FORMULATIONS, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 20 KEY LIQUID FORMULATIONS AVAILABLE

6.3.1 SUSPENSIONS

6.3.1.1 Higher rate of bioavailability and controlled onset of action to support market growth

TABLE 21 GLOBAL MARKET FOR SUSPENSIONS, BY COUNTRY, 2020–2027 (USD BILLION)

6.3.2 SOLUTIONS

6.3.2.1 Topical solutions with soluble chemicals to dissolve in various solvents

TABLE 22 GLOBAL MARKET FOR SOLUTIONS, BY COUNTRY, 2020–2027 (USD BILLION)

6.4 SOLID FORMULATIONS

TABLE 23 GLOBAL MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 24 GLOBAL MARKET FOR SOLID FORMULATIONS, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 25 KEY SOLID FORMULATIONS AVAILABLE

6.4.1 POWDERS

6.4.1.1 Inexpensive manufacturing and effectiveness against antifungal infections to propel powders market

TABLE 26 GLOBAL MARKET FOR POWDERS, BY COUNTRY, 2020–2027 (USD BILLION)

6.4.2 SUPPOSITORIES

6.4.2.1 Suppositories require suitable base to ensure drug compatibility and stability

TABLE 27 GLOBAL MARKET FOR SUPPOSITORIES , BY COUNTRY, 2020–2027 (USD BILLION)

6.5 TRANSDERMAL PRODUCTS

TABLE 28 GLOBAL MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 29 GLOBAL MARKET FOR TRANSDERMAL PRODUCTS, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 30 KEY TRANSDERMAL PRODUCTS AVAILABLE

6.5.1 TRANSDERMAL PATCHES

6.5.1.1 Transdermal patches to offer increased drug permeability across skin

TABLE 31 GLOBAL MARKET FOR TRANSDERMAL PATCHES, BY COUNTRY, 2020–2027 (USD BILLION)

6.5.2 TRANSDERMAL SEMI-SOLIDS

6.5.2.1 Transdermal semi-solids to offer fast drying on application site

TABLE 32 GLOBAL MARKET FOR TRANSDERMAL SEMI-SOLIDS, BY COUNTRY, 2020–2027 (USD BILLION)

7 TOPICAL DRUG DELIVERY MARKET, BY ROUTE OF ADMINISTRATION (Page No. - 107)

7.1 INTRODUCTION

TABLE 33 MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

7.2 DERMAL DRUG DELIVERY

7.2.1 NANO-SIZED DRUG CARRIER SYSTEMS TO BE STUDIED TO OVERCOME DRUG PENETRATION LIMITATION

TABLE 34 DERMAL DRUG DELIVERY MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

7.3 OPHTHALMIC DRUG DELIVERY

7.3.1 MICROEMULSION-BASED FORMULATIONS LEAD TO BETTER OCULAR DRUG ADSORPTION

TABLE 35 OPHTHALMIC DRUG DELIVERY MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

7.4 VAGINAL DRUG DELIVERY

7.4.1 RICH AND COMPLEX NETWORK OF CAPILLARIES OF UPPER VAGINA TO CREATE SYSTEMIC DRUG DELIVERY SYSTEM

TABLE 36 VAGINAL DRUG DELIVERY MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

7.5 RECTAL DRUG DELIVERY

7.5.1 RECTAL ADMINISTRATION TO ENABLE BOTH LOCAL AND SYSTEMIC THERAPY OF DRUGS

TABLE 37 RECTAL DRUG DELIVERY MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

7.6 NASAL DRUG DELIVERY

7.6.1 NASAL DELIVERY ROUTE OFFERS QUICK ONSET OF DRUG ACTION AND CONVENIENCE AS COMPARED TO PARENTERAL ROUTE

TABLE 38 NASAL DRUG DELIVERY MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

8 TOPICAL DRUG DELIVERY MARKET, BY FACILITY OF USE (Page No. - 118)

8.1 INTRODUCTION

TABLE 39 GLOBAL MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

8.2 HOMECARE SETTINGS

8.2.1 HOMECARE TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 40 GLOBAL MARKET FOR HOMECARE SETTINGS, BY COUNTRY, 2020–2027 (USD BILLION)

8.3 HOSPITALS & CLINICS

8.3.1 TOPICAL ANAESTHETICS TO BE ADOPTED FOR VARIOUS MEDICAL AND SURGICAL SUB-SPECIALTIES

TABLE 41 GLOBAL MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2020–2027 (USD BILLION)

8.4 BURN CENTERS

8.4.1 TOPICAL ANTIMICROBIAL FORMULATIONS FOR BURN-RELATED INJURIES TO DRIVE MARKET GROWTH

TABLE 42 GLOBAL MARKET FOR BURN CENTERS, BY COUNTRY, 2020–2027 (USD BILLION)

8.5 OTHER FACILITIES

TABLE 43 GLOBAL MARKET FOR OTHER FACILITIES, BY COUNTRY, 2020–2027 (USD BILLION)

9 TOPICAL DRUG DELIVERY MARKET, BY REGION (Page No. - 126)

9.1 INTRODUCTION

FIGURE 27 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

TABLE 44 GLOBAL MARKET, BY REGION, 2020–2027 (USD BILLION)

9.2 NORTH AMERICA

FIGURE 28 NORTH AMERICA: TOPICAL DRUG DELIVERY MARKET SNAPSHOT

TABLE 45 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 46 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 47 NORTH AMERICA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 48 NORTH AMERICA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 49 NORTH AMERICA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 50 NORTH AMERICA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 51 NORTH AMERICA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 52 NORTH AMERICA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.2.1 US

9.2.1.1 Rising prevalence of skin diseases alongside approval and launch of innovative topical formulations to propel market growth

TABLE 53 US: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 54 US: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 55 US: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 56 US: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 57 US: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 58 US: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 59 US: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.2.2 CANADA

9.2.2.1 Rising prevalence of hypertension and funding for topical drugs research to drive market growth

TABLE 60 CANADA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 61 CANADA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 62 CANADA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 63 CANADA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 64 CANADA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 65 CANADA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 66 CANADA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3 EUROPE

TABLE 67 RECENT DEVELOPMENTS IN EUROPEAN MARKET, 2019–2022

TABLE 68 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 69 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 70 EUROPE: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 71 EUROPE: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 72 EUROPE: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 73 EUROPE: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 74 EUROPE: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 75 EUROPE: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.1 GERMANY

9.3.1.1 Growing focus of pharmaceutical companies on topical products development and increasing target diseases to drive market growth

TABLE 76 DEVELOPMENTS AND PRODUCT LAUNCHES IN TOPICAL DRUG DELIVERY IN GERMANY, 2019–2022

TABLE 77 GERMANY: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 78 GERMANY: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 79 GERMANY: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 80 GERMANY: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 81 GERMANY: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 82 GERMANY: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 83 GERMANY: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.2 UK

9.3.2.1 Increasing developments by top players and demand for pain-free treatment to drive market growth

TABLE 84 UK: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 85 UK: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 86 UK: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 87 UK: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 88 UK: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 UK: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 90 UK: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.3 FRANCE

9.3.3.1 Rising prevalence of diabetes and increasing geriatric population to support market growth

TABLE 91 FRANCE: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 92 FRANCE: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 93 FRANCE: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 94 FRANCE: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 95 FRANCE: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 96 FRANCE: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 97 FRANCE: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.4 ITALY

9.3.4.1 Rising number of smokers to propel transdermal patches demand

TABLE 98 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 99 ITALY: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 100 ITALY: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 101 ITALY: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 102 ITALY: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 103 ITALY: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 104 ITALY: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.5 SPAIN

9.3.5.1 Growing diabetic patients to drive market growth

TABLE 105 SPAIN: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 106 SPAIN: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 107 SPAIN: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 108 SPAIN: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 109 SPAIN: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 110 SPAIN: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 111 SPAIN: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.6 SWITZERLAND

9.3.6.1 Rising geriatric population and emerging players focusing on topical drugs development to drive market growth

TABLE 112 SWITZERLAND: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 113 SWITZERLAND: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 114 SWITZERLAND: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 115 SWITZERLAND: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 116 SWITZERLAND: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 117 SWITZERLAND: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 118 SWITZERLAND: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.3.7 REST OF EUROPE

TABLE 119 REST OF EUROPE: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 120 REST OF EUROPE: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 121 REST OF EUROPE: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 122 REST OF EUROPE: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 123 REST OF EUROPE: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 124 REST OF EUROPE: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 125 REST OF EUROPE: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.4 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 126 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 128 ASIA PACIFIC: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 129 ASIA PACIFIC: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 130 ASIA PACIFIC: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 131 ASIA PACIFIC: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 132 ASIA PACIFIC: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 133 ASIA PACIFIC: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.4.1 CHINA

9.4.1.1 Prevalence of diabetes and increase in pharmaceutical R&D investments to drive market growth

TABLE 134 CHINA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 135 CHINA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 136 CHINA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 137 CHINA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 138 CHINA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 139 CHINA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 140 CHINA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.4.2 JAPAN

9.4.2.1 Increasing number of product approvals and growing focus of local players on topical formulations R&D to support market growth

TABLE 141 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 142 JAPAN: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 143 JAPAN: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 144 JAPAN: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 145 JAPAN: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 146 JAPAN: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 147 JAPAN: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.4.3 INDIA

9.4.3.1 Rising awareness among healthcare providers and patients alongside increasing focus on noninvasive methods of drug delivery to drive market growth

TABLE 148 INDIA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 149 INDIA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 150 INDIA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 151 INDIA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 152 INDIA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 153 INDIA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 154 INDIA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.4.4 AUSTRALIA

9.4.4.1 Increasing number of smokers to drive market growth

TABLE 155 AUSTRALIA: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 156 AUSTRALIA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 157 AUSTRALIA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 158 AUSTRALIA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 159 AUSTRALIA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 160 AUSTRALIA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 161 AUSTRALIA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 162 REST OF ASIA PACIFIC: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 163 REST OF ASIA PACIFIC: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 164 REST OF ASIA PACIFIC: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 165 REST OF ASIA PACIFIC: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 166 REST OF ASIA PACIFIC: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 167 REST OF ASIA PACIFIC: DELIVERY MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 168 REST OF ASIA PACIFIC: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.5 LATIN AMERICA

TABLE 169 LATIN AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD BILLION)

TABLE 170 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 171 LATIN AMERICA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 172 LATIN AMERICA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 173 LATIN AMERICA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 174 LATIN AMERICA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 175 LATIN AMERICA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 176 LATIN AMERICA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.5.1 BRAZIL

9.5.1.1 High prevalence of diabetes to propel market growth

TABLE 177 BRAZIL: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 178 BRAZIL: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 179 BRAZIL: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 180 BRAZIL: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 181 BRAZIL: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 182 BRAZIL: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 183 BRAZIL: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.5.2 MEXICO

9.5.2.1 Increasing prevalence of glaucoma to drive market growth

TABLE 184 MEXICO: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 185 MEXICO: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 186 MEXICO: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 187 MEXICO: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 188 MEXICO: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 189 MEXICO: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 190 MEXICO: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.5.3 REST OF LATIN AMERICA

TABLE 191 REST OF LATIN AMERICA: TOPICAL DRUG DELIVERY MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 192 REST OF LATIN AMERICA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 193 REST OF LATIN AMERICA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 194 REST OF LATIN AMERICA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 195 REST OF LATIN AMERICA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 196 REST OF LATIN AMERICA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 197 REST OF LATIN AMERICA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 GROWING PREVALENCE OF BURN INJURIES AND INCREASING EXPENDITURE ON HEALTHCARE TO DRIVE MARKET GROWTH

TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2020–2027 (USD BILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET FOR SEMI-SOLID FORMULATIONS, BY TYPE, BY TYPE, 2020–2027 (USD BILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET FOR LIQUID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 201 MIDDLE EAST & AFRICA: MARKET FOR SOLID FORMULATIONS, BY TYPE, 2020–2027 (USD BILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET FOR TRANSDERMAL PRODUCTS, BY TYPE, 2020–2027 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY ROUTE OF ADMINISTRATION, 2020–2027 (USD BILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY FACILITY OF USE, 2020–2027 (USD BILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 204)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS

10.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 30 REVENUE ANALYSIS OF TOP PLAYERS IN TOPICAL DRUG DELIVERY MARKET

10.4 MARKET SHARE ANALYSIS

FIGURE 31 GLOBAL MARKET SHARE, BY KEY PLAYER, 2021

TABLE 205 GLOBAL MARKET: DEGREE OF COMPETITION

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 32 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

10.6 COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS

10.6.1 PROGRESSIVE COMPANIES

10.6.2 DYNAMIC COMPANIES

10.6.3 STARTING BLOCKS

10.6.4 RESPONSIVE COMPANIES

FIGURE 33 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING FOR OTHER PLAYERS (2021)

10.7 COMPANY FOOTPRINT

TABLE 206 COMPANY FOOTPRINT: TOPICAL DRUG DELIVERY MARKET

10.7.1 PRODUCT FOOTPRINT OF MAJOR PLAYERS

TABLE 207 PRODUCT FOOTPRINT: MARKET (2021)

10.7.2 ROUTE OF ADMINISTRATION FOOTPRINT OF MARKET

TABLE 208 ROUTE OF ADMINISTRATION FOOTPRINT: MARKET (2021)

10.7.3 FACILITY OF USE IN MARKET

TABLE 209 FACILITY OF USE FOOTPRINT: MARKET (2021)

10.7.4 GEOGRAPHIC FOOTPRINT OF MAJOR PLAYERS IN MARKET

TABLE 210 GEOGRAPHIC FOOTPRINT: MARKET (2021)

10.8 COMPETITIVE SCENARIO

10.8.1 PRODUCT LAUNCHES

TABLE 211 PRODUCT LAUNCHES, JANUARY 2019–APRIL 2022

10.8.2 DEALS

TABLE 212 DEALS, JANUARY 2019–APRIL 2022

10.8.3 OTHER DEVELOPMENTS

TABLE 213 OTHER DEVELOPMENTS, JANUARY 2019–APRIL 2022

11 COMPANY PROFILES (Page No. - 222)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.2 OTHER PLAYERS

11.1.1 GLENMARK PHARMACEUTICALS LTD.

TABLE 214 GLENMARK PHARMACEUTICALS LTD.: BUSINESS OVERVIEW

FIGURE 34 GLENMARK PHARMACEUTICALS LTD.: COMPANY SNAPSHOT (2021)

11.1.2 GALDERMA

TABLE 215 GALDERMA: BUSINESS OVERVIEW

11.1.3 JOHNSON & JOHNSON PRIVATE LIMITED

TABLE 216 JOHNSON & JOHNSON PRIVATE LIMITED: BUSINESS OVERVIEW

FIGURE 35 JOHNSON & JOHNSON PRIVATE LIMITED: COMPANY SNAPSHOT (2021)

11.1.4 GLAXOSMITHKLINE PLC.

TABLE 217 GLAXOSMITHKLINE PLC: BUSINESS OVERVIEW

FIGURE 36 GLAXOSMITHKLINE, PLC.: COMPANY SNAPSHOT (2021)

11.1.5 BAUSCH HEALTH COMPANIES INC.

TABLE 218 BAUSCH HEALTH COMPANIES INC.: BUSINESS OVERVIEW

FIGURE 37 BAUSCH HEALTH COMPANIES INC.: COMPANY SNAPSHOT (2021)

11.1.6 HISAMITSU PHARMACEUTICAL CO., INC.

TABLE 219 HISAMITSU PHARMACEUTICAL CO., INC.: BUSINESS OVERVIEW

FIGURE 38 HISAMITSU PHARMACEUTICAL CO., INC.: COMPANY SNAPSHOT (2021)

11.1.7 CIPLA

TABLE 220 CIPLA: BUSINESS OVERVIEW

FIGURE 39 CIPLA: COMPANY SNAPSHOT (2021)

11.1.8 BAYER AG

TABLE 221 BAYER AG: BUSINESS OVERVIEW

FIGURE 40 BAYER AG: COMPANY SNAPSHOT (2021)

11.1.9 VIATRIS INC. (MYLAN N.V.)

TABLE 222 VIATRIS INC.: BUSINESS OVERVIEW

FIGURE 41 VIATRIS INC.: COMPANY SNAPSHOT (2021)

11.1.10 3M

TABLE 223 3M: BUSINESS OVERVIEW

FIGURE 42 3M: COMPANY SNAPSHOT (2021)

11.1.11 MERCK & CO., INC.

TABLE 224 MERCK & CO., INC.: BUSINESS OVERVIEW

FIGURE 43 MERCK & CO., INC.: COMPANY SNAPSHOT (2021)

11.1.12 CRESCITA THERAPEUTICS INC.

TABLE 225 CRESCITA THERAPEUTICS INC.: BUSINESS OVERVIEW

FIGURE 44 CRESCITA THERAPEUTICS INC.: COMPANY SNAPSHOT (2021)

11.1.13 NOVARTIS INTERNATIONAL AG

TABLE 226 NOVARTIS INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 45 NOVARTIS INTERNATIONAL AG: COMPANY SNAPSHOT (2021)

11.1.14 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

TABLE 227 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: BUSINESS OVERVIEW

FIGURE 46 BOEHRINGER INGELHEIM INTERNATIONAL GMBH: COMPANY SNAPSHOT (2021)

11.1.15 PFIZER INC.

TABLE 228 PFIZER INC.: BUSINESS OVERVIEW

FIGURE 47 PFIZER INC.: COMPANY SNAPSHOT (2021)

11.1.16 TEVA PHARMACEUTICAL INDUSTRIES LTD.

TABLE 229 TEVA PHARMACEUTICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 48 TEVA PHARMACEUTICALS: COMPANY SNAPSHOT (2021)

11.1.17 BRISTOL MYERS SQUIBB

TABLE 230 BRISTOL MYERS SQUIBB: BUSINESS OVERVIEW

FIGURE 49 BRISTOL MYERS SQUIBB: COMPANY SNAPSHOT (2021)

11.1.18 LEAD CHEMICAL CO., LTD.

TABLE 231 LEAD CHEMICAL CO., LTD.: BUSINESS OVERVIEW

11.1.19 PURDUE PHARMA L.P.

TABLE 232 PURDUE PHARMA L.P.: BUSINESS OVERVIEW

11.1.20 LAVIPHARM

TABLE 233 LAVIPHARM: BUSINESS OVERVIEW

11.1.21 ABBVIE INC.

TABLE 234 ABBVIE INC.: BUSINESS OVERVIEW

FIGURE 50 ABBVIE INC.: COMPANY SNAPSHOT (2021)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2.1 CMP PHARMA, INC.

11.2.2 ENCORE DERMATOLOGY, INC.

11.2.3 PROSOLUS INC.

11.2.4 RUSAN PHARMA LTD.

12.2 DISCUSSION GUIDE

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 298)

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

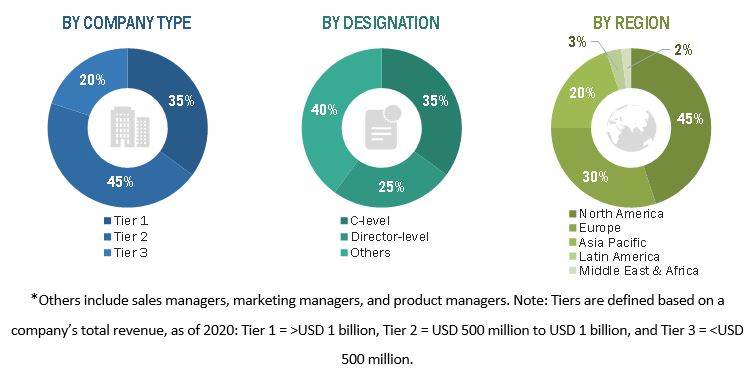

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the topical drug delivery market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side and demand side are detailed below. Industry experts such as CEOs, presidents, vice presidents, directors, marketing directors, marketing managers, and related executives from various key companies and organizations in the topical drug delivery industry were interviewed to obtain and verify both the qualitative and quantitative aspects of this research study. A robust primary research methodology has been adopted to validate the contents of the report and fill in the gaps.

A breakdown of the primary respondents is provided below

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the revenue share analysis, pharmaceutical sales approach, primary interviews, and top-down approach (assessment of Individual shares of each topical drug delivery product, route of administration, and facility of use).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Objectives of the Study

- To define, describe, and forecast the topical drug delivery market based on product, route of administration, facility of use, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market players

- To estimate the market size and growth potential of the market segments with respect to five key regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players operating in the market and comprehensively analyze their revenue shares and core competencies

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, collaborations, divestiture, divestment, spin-off, expansions, joint ventures, and acquisitions in the market

- To benchmark players in the market using the “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategy within the market

- To evaluate and analyze the overall impact of COVID-19 on the topical drug delivery market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe topical drug delivery market into the Netherlands, Belgium, and others.

- Further breakdown of the Middle East & Africa topical drug delivery market into Saudi Arabia, UAE, and others.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Topical Drug Delivery Market

Want more detailed information on how key players are retaining their places in the global Topical Drug Delivery Market. Thank You

Which are the target audience for the global study of Global Topical Drug Delivery Market?

Which geography is expected to hold the largest share of the global Topical Drug Delivery Market?