Thermal Imaging Market Size, Share & Industry Growth Analysis Report by Product Type (Modules, Cameras, Scopes), Type (Handheld and Standstill), Technology(Cooled, Uncooled), Application, Wavelength(SWIR, MWIR, LWIR), Vertical, and Region - Global Growth Driver and Industry Forecast to 2026

Updated on : October 22, 2024

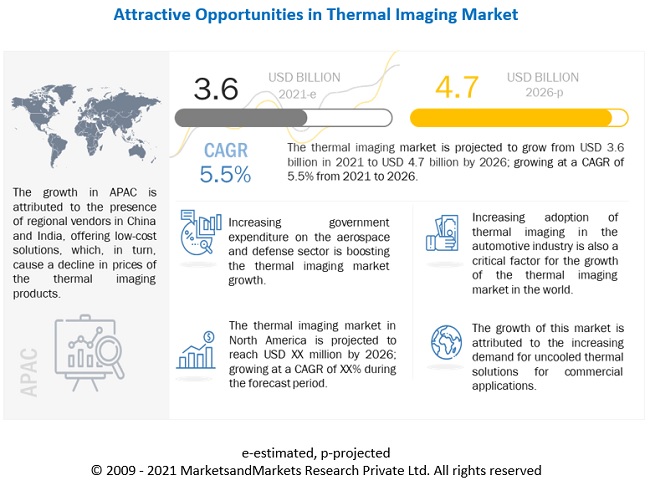

The global thermal imaging market size in terms of revenue was estimated to be worth USD 3.6 billion in 2021 and is poised to reach USD 4.7 billion by 2026, growing at a CAGR of 5.5% from 2021 to 2026. The new research study consists of an industry trend analysis of the market.

The key factors driving the growth of the global market include Increasing government expenditure on the aerospace & defense sector boosting the growth of the thermal imaging market size. Increasing adoption of thermal imaging in the automotive industry, growing R&D investments by companies, governments, and capital firms for developing innovative thermal imaging solutions, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Thermal cameras segment to account for the largest thermal imaging market share during the forecast period

On the basis of product types, the thermal imaging market report has been segmented into three categories—thermal cameras, thermal scopes, and thermal modules. The thermal cameras segment held the largest share of the market in 2020 and is expected to continue this growth during the forecast period. Several reasons, such as an electronic image of high-quality precision produced in less time and the availability in different types (handheld, mounted, and standalone) and various micro-and nano-sizes, contribute to this dominance.

Security and surveillance segment to account for the largest share of thermal imaging market during the forecast period

Based on applications, the thermal imaging market analysis has been segmented into security and surveillance, monitoring and inspection, and detection and measurement. The security and surveillance segment held the largest share of the market during the forecast period. Rapid urbanization increases the demand for advanced thermal imaging solutions for security and surveillance applications. The rising conflicts and terrorist activities among countries also increase the demand for well-equipped systems to monitor the country's borders from the illegal intrusion of enemies and protect the country from them.

North America to account for the largest share of thermal imaging market during the forecast period

Among all regions, North America accounted for the largest share of the thermal imaging market and is expected to continue this growth during the forecast period. The region is home to the major producers of thermal imaging components, such as thermal cameras, scopes, and modules. The US is the major contributor to this region and accounts for ~89% of the total market share in North America. The growth of the thermal imaging market statistics in this region is attributed to the presence of numerous manufacturers and distributors, the low cost of thermal imaging components, and the increasing government expenditure in the aerospace & defense sector.

To know about the assumptions considered for the study, download the pdf brochure

Top Thermal Imaging Companies - Key Market Players

Major operating thermal imaging companies are FLIR Systems (US), Fluke Corporation (US), Leonardo (Italy), L3HARRIS TECHNOLOGIES (US), United Technologies (US), Axis Communications (Sweden), BAE Systems (UK), Opgal (Israel), Testo (Germany), Xenics (Belgium), Thermoteknix Systems (UK), and so on.

Want to explore hidden markets that can drive new revenue in Thermal Imaging Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Thermal Imaging Market?

|

Report Attributes |

Details |

|

Market Size Value in 2023 |

USD 4.2 Billion |

| Revenue Forecast in 2026 | USD 4.7 Billion |

| Growth Rate | 5.5% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Thermal Imaging Companies in North America |

|

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Thermal Cameras Segment |

| Highest CAGR Segment | Monitoring and Inspection Segment |

| Largest Application Market Share | Security and Surveillance Application |

In this research report, the thermal imaging market size has been segmented on the basis of Type, Product Type, Technology, Wavelength, Vertical, Application, and geography.

Thermal Imaging Market, by Type

- Thermal Cameras

- Thermal Scopes

- Thermal Modules

Market, by Product Type

- Fixed Thermal Cameras

- Handheld Thermal Cameras

Market, by Technology

- Cooled

- Uncooled

Market, by Wavelength

- SWIR

- MWIR

- LWIR

Market, by Vertical

- Industrial

- Commercial

- Residential

- Aerospace & Defence

- Automotive

- Healthcare & Life Sciences

- Oil & Gas

- Food & Beverages

Market, by Application

- Security & Surveillance

- Monitoring & Inspection

- Detection & Measurement

Geographic Analysis

- North America

- Europe

- APAC

- RoW

COVID-19 Impact on the Global Thermal Imaging Market Trends

The outbreak and spread of COVID-19 have led to a slowdown in global economic growth. It has adversely affected several industries, including the thermal imaging industry. Thermal imaging companies are planning and working on keeping their businesses operational. Manufacturing and distributing products are the key challenges faced by companies. Several countries worldwide have imposed or prolonged lockdowns to contain the spread of the pandemic, which has resulted in disruptions in the supply chain of the thermal imaging market analysis.

Market Dynamics of Thermal Imaging Market Report

Driver: Increasing adoption of thermal imaging in the automotive industry

Currently, high-tech autonomous vehicles, driverless vehicles, or Advanced Driver-Assistance Systems (ADAS) are gaining momentum in the automotive industry. In these vehicles, drivers are replaced by multiple sensors, including Light Detection and Ranging (LIDAR) sensor, Radio Detection and Ranging (RADAR), proximity sensor, and thermal cameras to aid automatic driving, navigation, and enhanced situational awareness. Thermal imaging cameras are integrated into driverless vehicles to improve night vision and detect pedestrians or animals in cluttered environments, misty, and foggy conditions, and automatically stop the vehicle to avoid any casualty.

In the automotive industry, thermal imaging cameras enable drivers to see in extreme lighting and weather conditions to avoid accidents and ensure safety. Automotive manufacturing companies and thermal imaging solution providers are collaborating to deliver unique and advance thermal solutions for use in the automotive application. For instance, ADASKY, the Israeli startup, collaborated with Magneti Marelli, an Italian developer and manufacturer of high-tech components for the automotive industry, to develop a Viper thermal sensing camera, which is integrated into autonomous vehicle’s headlights. The thermal imaging technology is also used for non-destructive testing of automotive parts, such as tires and brakes, and micro-components to ensure vehicle safety and save time and money. For instance, InfraTec GmbH (Germany) offers ImageIR 10300, ImageIR 9400 hp, and VarioCAM HD inspect 900 thermal imaging cameras specially designed for automotive applications.

Restraint: Export restriction imposed on thermal imaging products

Export restrictions are imposed on thermal imaging cameras, thermal cameras, and thermal sensors by the US state government under International Traffic in Arms Regulations (ITAR) and Export Administration Regulations (EAR) laws. ITAR laws are governed by the US Department of State, while EAR laws are controlled by the US Department of Commerce. These restrictions are imposed on devices based on sensor size and pixel pitch. For instance, uncooled microbolometer-based thermal imaging cameras of less than or equal to 9 Hz can be purchased without restriction, whereas thermal cameras with pixel pitch smaller than 17 um, are subjected to restrictions. The ITAR requires commodity jurisdiction approval for the sale of restricted thermal cameras in the US. Thermal camera manufacturers are restricted to exchange their products with buyers in the US or overseas without export authorization and are liable to face penalties in case of non-compliance with the regulation. Commodity jurisdiction approval is required by not only manufacturers but also distributors to sell these products, which adds complications and costs involved in the sale and purchase of these devices. Hence, restricting the US manufacturers from selling their products in countries other than the US hampers sales growth. Few thermal camera manufacturers, such as FLIR Systems, Inc. (US), United Technologies (US), Princeton Thermal Technologies (US), and Xenics (Belgium) offer some of their thermal imaging solutions with no ITAR restrictions by receiving commodity jurisdiction approval for the product sale in the US. However, several manufacturers and distributors have to follow the regulatory process to get approval, which limits the growth of the thermal imaging market share.

Opportunity: Increase in the adoption of thermography for infancy stage diagnosis in healthcare applications

Clinical Thermography (CT) or thermal imaging is a non-invasive screening and diagnostic technique, which is combined with mammography or other scanning or diagnostic tool. Clinical thermography uses thermal cameras for infancy stage diagnose of cancer, infections, injuries, or vascular disease. It is one of the best preventive health assessment techniques, in which thermal cameras produce images based on the amount of heat dissipated by the human body. The images display heat patterns, thermal imbalances, and inflammation produced by blood circulation problems in the human body. This thermal imaging is also used in mass fever screening, neurological disorders, and breast cancer screening. Breast cancer is one of the common cancers diagnosed in women universally. Medical thermal imaging used to diagnose breast cancer is gaining momentum as it is a non-invasive and low-cost technique. Currently, researchers and companies are conducting research studies to improve and introduce advanced thermal imaging techniques. For instance, NIRAMAI Health Analytix, a Bangalore, India-based deep-tech start-up, developed Thermalytix, a computer-aided diagnostic engine, and Software with Machine Intelligence for Life Enhancement (SMILE), a cancer screening tool, which deploys a high-resolution thermal sensing device and a cloud-hosted analytics solution for analyzing the thermal images. The solution is useful in the early diagnosis of breast cancer. Thermal imaging is also used to observe the effect of drugs on the human body. For instance, a study was carried out by the Hebrew University of Jerusalem to observe the effect of the drug, called RZL-012, injected for melting away fat to cure obesity. Various groups and associations, including the American Academy of Thermology, the European Association of Thermology, the German Society of Thermography and Regulation Medicine (DGTR), the United Kingdom Thermography Association, and the Northern Norwegian Centre for Medical Thermography, promote the proper application of thermal imaging in the practice of sports medicine. Hence, the increasing opportunities for thermal imaging in healthcare applications are expected to drive the thermal imaging market outlook in the future.

Challenge: Thermal cameras do not work through glass and water

Thermal cameras detect heat energy dissipated by the human body, animal, or any structure. The camera produces heat patterns and an image based on them, which helps investigate defects, threats, or other possibilities. Thermal imaging cameras do not work through glass and water because glass allows visible light to pass through it, but it acts as a mirror for thermal wavelengths. If a thermal camera is held in front of the glass, it will produce an image of the person holding the thermal camera. The image produced will be a blur and will lack significant detail and contrast.

Similarly, water acts as a barrier for thermal wavelength. Water has a higher heat capacity than air, requiring four times the energy to raise or lower the temperature of an equivalent volume by one degree. This means the objects lose or gain their heat energy faster in comparison to water over shorter distances. Hence, it becomes difficult for the thermal imager to differentiate objects underwater.

Recent Developments

- In May 2021, FLIR Systems won a contract to deliver its FLIR Black Hornet ®3 Personal Reconnaissance Systems (PRS). It is an advanced nano-unmanned aerial vehicle used for surveillance.

- In December 2019, the company launched Fluke TiS20+, a thermal imaging camera, to capture smaller temperature differences and detect issues in various applications where precise monitoring is essential.

- In May 2021, the company announced a strategic partnership with Maire Tecnimont (Italy) to support industrial evolution by designing next-generation greenfield and brownfield plants in the transformation of natural resources and green chemistry sectors.

Frequently Asked Questions (FAQ):

What is the current size of the global thermal imaging market?

The thermal imaging market was valued at USD 3.4 billion in 2020 and is expected to reach USD 4.7 billion by 2026, growing at a CAGR of 5.5% during the forecast period.

Who are the winners in the global thermal imaging market?

Some of the key companies operating in the global thermal imaging market are FLIR Systems (US), Fluke Corporation (US), Leonardo (Italy), L3HARRIS TECHNOLOGIES (US), United Technologies (US), Axis Communications (Sweden), BAE Systems (UK), Opgal (Israel), Testo (Germany), Xenics (Belgium), Thermoteknix Systems (UK), and so on.

What are the major drivers for the thermal imaging market?

The key factors driving the growth of the global thermal imaging market include Increasing government expenditure on the aerospace & defense sector boosting the growth of the thermal imaging market, Increasing adoption of thermal imaging in the automotive industry, growing R&D investments by companies, governments, and capital firms for developing innovative thermal imaging solutions, and others.

What are the impact of COVID-19 on the global thermal imaging market?

The outbreak and spread of COVID-19 have led to a slowdown in global economic growth. It has adversely affected several industries, including the thermal imaging industry. Companies are planning and working on keeping their businesses operational. Manufacturing and distributing products are the key challenges faced by companies. Several countries worldwide have imposed or prolonged lockdowns to contain the spread of the pandemic, which has resulted in disruptions in the supply chain of the thermal imaging market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 THERMAL IMAGING MARKET

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 THERMAL IMAGING MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

FIGURE 3 THERMAL IMAGING MARKET: RESEARCH APPROACH

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary sources

2.1.2.2 Breakdown of primary profiles

2.1.2.3 Primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALE OF THE THERMAL IMAGING MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing the market size by bottom-up analysis (demand side)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing the market share by top-down analysis (supply side)

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 ANALYSIS OF RISK FACTORS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 8 UNCOOLED TECHNOLOGY TO DOMINATE THE THERMAL IMAGING MARKET DURING THE FORECAST PERIOD

FIGURE 9 SHORT-WAVE INFRARED WAVELENGTH TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 10 THERMAL CAMERAS SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

FIGURE 11 DETECTION AND MEASUREMENT APPLICATION TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 12 HEALTHCARE & LIFE SCIENCES VERTICAL TO WITNESS THE HIGHEST CAGR DURING 2021–2026

FIGURE 13 NORTH AMERICA TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN THE THERMAL IMAGING MARKET

FIGURE 14 RISING DEMAND FOR ADVANCED THERMAL IMAGING COMPONENTS IN THE AEROSPACE & DEFENSE SECTOR TO SPUR THE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 MARKET, BY PRODUCT TYPE

FIGURE 15 THERMAL CAMERAS SEGMENT TO RECORD THE HIGHEST CAGR IN THE OVERALL MARKET DURING THE FORECAST PERIOD

4.3 MARKET, BY APPLICATION

FIGURE 16 SECURITY AND SURVEILLANCE SEGMENT TO RECORD THE LARGEST SHARE IN THE OVERALL MARKET DURING THE FORECAST PERIOD

4.4 MARKET, BY TYPE

FIGURE 17 UNCOOLED SEGMENT EXPECTED TO ACCOUNT FOR A LARGER SHARE BY 2026

4.5 MARKET, BY COUNTRY

FIGURE 18 CHINA TO WITNESS THE HIGHEST GROWTH IN THE OVERALL MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW & INDUSTRY TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 MARKET DYNAMICS: THERMAL IMAGING MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing government expenditure in the aerospace & defense sector boosting the market growth

FIGURE 20 MILITARY EXPENSES OF DIFFERENT COUNTRIES IN 2020

5.2.1.2 Increasing adoption of thermal imaging in the automotive industry

5.2.1.3 Growing R&D investments by companies, governments, and capital firms for developing innovative thermal imaging solutions

FIGURE 21 MARKET DRIVERS AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 Export restriction imposed on thermal imaging products

FIGURE 22 MARKET RESTRAINTS AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increase in the adoption of thermography for infancy stage diagnosis in healthcare applications

5.2.3.2 Thermal imaging diagnoses defects in building structures

FIGURE 23 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Thermal cameras do not work through glass and water

5.2.4.2 Thermal imaging does not work for see-through wall applications

FIGURE 24 MARKET CHALLENGES AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 25 VALUE CHAIN OF THE THERMAL IMAGING MARKET

5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

FIGURE 26 ARTIFICIAL INTELLIGENCE TO PRESENT NEW GROWTH OPPORTUNITIES FOR THERMAL IMAGING COMPANIES

5.5 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 THERMAL IMAGING: PORTER’S FIVE FORCES ANALYSIS, 2020

TABLE 2 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS, (2021–2026)

5.6 CASE STUDY ANALYSIS

5.6.1 USE CASE 1: FLIR SYSTEMS

5.6.2 USE CASE 2: FLIR SYSTEMS

5.7 TECHNOLOGY ANALYSIS

5.7.1 IR IMAGING AS A RAPID TOOL TO ANALYZE ORGANIC COMPOSTS

5.7.2 VIBRATIONAL SPECTROSCOPIC TECHNIQUES FOR TEA QUALITY AND SAFETY ANALYSES

5.8 PATENT ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 28 TOP TEN COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS IN THE LAST TEN YEARS

TABLE 5 TOP TEN PATENT OWNERS IN THE LAST TEN YEARS

5.9 THERMAL IMAGING MARKET ECOSYSTEM ANALYSIS

TABLE 6 MARKET: SUPPLY CHAIN/ECOSYSTEM

5.10 PRICING ANALYSIS

5.10.1 THERMAL IMAGING CAMERAS

TABLE 7 PRICE RANGE OF THERMAL IMAGING CAMERAS

5.11 TRADE ANALYSIS

FIGURE 29 TOP FIVE COUNTRIES WITH THE HIGHEST IMPORTS IN THE LAST FIVE YEARS

TABLE 8 IMPORT FOR TOP FIVE COUNTRIES RELATED TO INSTRUMENTS AND APPARATUS, PHYSICAL OR CHEMICAL ANALYSIS, 2016−2020 (USD BILLION)

FIGURE 30 TOP FIVE COUNTRIES WITH THE HIGHEST EXPORTS IN THE LAST FIVE YEARS

TABLE 9 EXPORT BY TOP FIVE COUNTRIES RELATED TO INSTRUMENTS AND APPARATUS, PHYSICAL OR CHEMICAL ANALYSIS, 2016−2020, (USD MILLION)

5.11.1 TARIFF ANALYSIS

TABLE 10 TARIFF FOR INSTRUMENTS AND APPARATUS RELATED TO PHYSICAL OR CHEMICAL ANALYSIS EXPORTED BY UNITED STATES, 2020

TABLE 11 TARIFF FOR INSTRUMENTS AND APPARATUS RELATED TO PHYSICAL OR CHEMICAL ANALYSIS EXPORTED BY GERMANY, 2020

TABLE 12 TARIFF FOR INSTRUMENTS AND APPARATUS RELATED TO PHYSICAL OR CHEMICAL ANALYSIS EXPORTED BY SINGAPORE, 2020

5.12 REGULATORY STANDARDS

5.12.1 INTERNATIONAL TRAFFIC IN ARMS REGULATIONS (ITAR)

5.12.2 NATIONAL ELECTRONIC DISTRIBUTORS ASSOCIATION (NEDA)

5.12.3 INSTITUTE FOR PRINTED CIRCUITS (IPC)

5.12.4 WORKING-PARTY ON INSTRUMENT BEHAVIOR M-2784 (WIB M-2784) – PROCESS CONTROL DOMAIN: SECURITY REQUIREMENTS FOR VENDORS

6 THERMAL IMAGING MARKET, BY PRODUCT TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 31 THERMAL CAMERAS SEGMENT OF THE THERMAL IMAGING MARKET TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

TABLE 13 MARKET, BY PRODUCT TYPE, 2017–2020 (USD MILLION)

TABLE 14 MARKET, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 15 MARKET, BY PRODUCT TYPE, 2017–2020 (THOUSAND UNITS)

TABLE 16 MARKET, BY PRODUCT TYPE, 2021–2026 (THOUSAND UNITS)

6.2 THERMAL CAMERAS

6.2.1 INCREASE IN THE ADOPTION OF THERMAL CAMERAS IN APPLICATIONS SPURRING MARKET GROWTH

6.3 THERMAL SCOPES

6.3.1 HIGH ADOPTION OF THERMAL SCOPES IN THE AEROSPACE & DEFENSE VERTICAL ACCELERATING MARKET GROWTH

6.4 THERMAL MODULES

6.4.1 INCREASING DEMAND FOR THERMAL MODULES TO BOOST THE GROWTH OF THE MARKET

7 THERMAL IMAGING MARKET, BY TYPE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 32 HANDHELD SEGMENT EXPECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 17 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 18 MARKET, BY TYPE, 2021–2026 (USD MILLION)

7.2 FIXED THERMAL CAMERAS

7.3 HANDHELD THERMAL CAMERAS

8 THERMAL IMAGING MARKET, BY TECHNOLOGY (Page No. - 78)

8.1 INTRODUCTION

TABLE 19 MARKET, BY TECHNOLOGY, 2017–2020 (USD MILLION)

FIGURE 33 UNCOOLED SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 20 MARKET, BY TECHNOLOGY, 2021–2026 (USD MILLION)

8.2 COOLED

8.2.1 USAGE OF HIGHLY SENSITIVE COOLED THERMAL CAMERAS TO MONITOR MINUTE TEMPERATURE DIFFERENCE (<20 MK)

TABLE 21 COOLED MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 22 COOLED MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

8.3 UNCOOLED

8.3.1 UNCOOLED THERMAL CAMERAS SUITABLE FOR LOW-COST AND HIGH-VOLUME APPLICATIONS

TABLE 23 UNCOOLED MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 24 UNCOOLED MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

9 THERMAL IMAGING MARKET, BY WAVELENGTH (Page No. - 83)

9.1 INTRODUCTION

FIGURE 34 SWIR SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

TABLE 25 MARKET, BY WAVELENGTH, 2017–2020 (USD MILLION)

TABLE 26 MARKET, BY WAVELENGTH, 2021–2026 (USD MILLION)

9.2 SHORT-WAVE INFRARED (SWIR)

9.2.1 CAPABILITY OF SWIR THERMAL IMAGING PRODUCTS TO PRODUCE DETAILED IMAGES WITH HIGH-RESOLUTION

9.3 MID-WAVE INFRARED (MWIR)

9.3.1 MWIR THERMAL IMAGING PRODUCTS USED TO PROVIDE HIGH CONTRAST THERMAL IMAGES

9.4 LONG-WAVE INFRARED (LWIR)

9.4.1 LWIR THERMAL IMAGING PRODUCTS USED TO MONITOR HUMAN ACTIVITIES AND VEHICLES

10 THERMAL IMAGING MARKET, BY VERTICAL (Page No. - 87)

10.1 INTRODUCTION

FIGURE 35 HEALTHCARE & LIFE SCIENCES SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 27 MARKET, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 28 MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

10.2 INDUSTRIAL

10.2.1 RISE IN DEPLOYMENT OF THERMAL CAMERAS IN THE INDUSTRIAL SEGMENT TO SAFEGUARD INDUSTRIAL ASSETS AND HUMAN LIVES

TABLE 29 INDUSTRIAL MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 30 INDUSTRIAL MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3 COMMERCIAL

10.3.1 GROWING DEMAND FOR THERMAL CAMERAS IN THE COMMERCIAL SEGMENT TO SUPPORT THE GROWTH OF THE MARKET

TABLE 31 COMMERCIAL MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 32 COMMERCIAL MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4 RESIDENTIAL

10.4.1 INCREASING ADOPTION OF THERMAL CAMERAS FOR BUILDING SAFETY AND INCREASING EFFICIENCY

TABLE 33 RESIDENTIAL MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 36 MONITORING AND INSPECTION SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 34 RESIDENTIAL MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.5 AEROSPACE & DEFENSE

10.5.1 RISING ADOPTION OF ADVANCED THERMAL IMAGING SOLUTIONS ACROSS THE AEROSPACE & DEFENSE INDUSTRY TO FUEL THE MARKET GROWTH

TABLE 35 AEROSPACE & DEFENSE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 36 AEROSPACE & DEFENSE MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.6 AUTOMOTIVE

10.6.1 EVOLUTION OF ADVANCED THERMAL IMAGING SOLUTIONS FOR AUTOMOTIVE TO SPUR THE MARKET

TABLE 37 AUTOMOTIVE MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 38 AUTOMOTIVE MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.7 HEALTHCARE & LIFE SCIENCES

10.7.1 SIMPLE, NON-INVASIVE, AND LESS EXPENSIVE THERMAL IMAGING TECHNIQUE TO INCREASE THE DEMAND FOR THERMAL CAMERAS IN THE HEALTHCARE & LIFE SCIENCES VERTICAL

TABLE 39 HEALTHCARE & LIFE SCIENCES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

FIGURE 37 DETECTION AND MEASUREMENT SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 40 HEALTHCARE & LIFE SCIENCES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.8 OIL & GAS

10.8.1 INCREASING IMPORTANCE OF PREDICTIVE MAINTENANCE TO FUEL THE MARKET

TABLE 41 OIL & GAS MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 42 OIL & GAS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.9 FOOD & BEVERAGES

10.9.1 GROWING NEED FOR PRECISE TEMPERATURE MONITORING OF FOOD PROCESSING TO MAKE THERMAL IMAGING QUALITY CONTROL METHOD PREFERRED BY SEVERAL MANUFACTURERS

TABLE 43 FOOD & BEVERAGES MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 44 FOOD & BEVERAGES MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11 THERMAL IMAGING MARKET, BY APPLICATION (Page No. - 99)

11.1 INTRODUCTION

FIGURE 38 DETECTION & MEASUREMENT SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

TABLE 45 MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 46 MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

11.2 SECURITY AND SURVEILLANCE

11.2.1 INCREASING ADOPTION OF SECURITY AND SURVEILLANCE SYSTEMS IN THE AEROSPACE & DEFENSE SECTOR TO BOOST MARKET GROWTH

TABLE 47 SECURITY AND SURVEILLANCE: MARKET SIZE, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 48 SECURITY AND SURVEILLANCE: MARKET SIZE, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

TABLE 49 SECURITY AND SURVEILLANCE: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 50 SECURITY AND SURVEILLANCE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 51 SECURITY AND SURVEILLANCE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 52 SECURITY AND SURVEILLANCE: MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2.2 PERIMETER SECURITY

11.2.2.1 Rising deployment of thermal cameras in perimeter security

TABLE 53 PERIMETER SECURITY: SECURITY AND SURVEILLANCE MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

FIGURE 39 INDUSTRIAL VERTICAL EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

TABLE 54 PERIMETER SECURITY: SECURITY AND SURVEILLANCE MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 55 PERIMETER SECURITY: SECURITY AND SURVEILLANCE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 PERIMETER SECURITY: SECURITY AND SURVEILLANCE MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2.3 UNMANNED AERIAL VEHICLE

11.2.3.1 Advancement in technology will increase the requirement for advanced thermal UAVs to ensure complete protection

TABLE 57 UAV: SECURITY AND SURVEILLANCE MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 58 UAV: SECURITY AND SURVEILLANCE MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 59 UAV: SECURITY AND SURVEILLANCE MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 UAV: SECURITY AND SURVEILLANCE MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2.4 TRACKING

11.2.4.1 Panoramic thermal imaging system enables tracking in wide area spurring market growth

TABLE 61 TRACKING: SECURITY AND SURVEILLANCE MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 62 TRACKING: SECURITY AND SURVEILLANCE MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 63 TRACKING: SECURITY AND SURVEILLANCE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 TRACKING: SECURITY AND SURVEILLANCE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 MONITORING AND INSPECTION

11.3.1 REQUIREMENT OF MONITORING AND INSPECTION TO ASSESS THE QUALITY OF MANUFACTURED DEVICES DRIVING THE ADOPTION OF THERMAL IMAGING PRODUCTS

TABLE 65 MONITORING AND INSPECTION: MARKET SIZE, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

TABLE 66 MONITORING AND INSPECTION: MARKET SIZE, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

TABLE 67 MONITORING AND INSPECTION: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 68 MONITORING AND INSPECTION: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 69 MONITORING AND INSPECTION: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 MONITORING AND INSPECTION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3.2 MACHINE CONDITION MONITORING

11.3.2.1 Increasing awareness about the safety of machines used for the deployment of thermal cameras propelling the market growth

TABLE 71 MACHINE CONDITION MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

FIGURE 40 INDUSTRIAL VERTICAL EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

TABLE 72 MACHINE CONDITION MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 73 MACHINE CONDITION MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 MACHINE CONDITION MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3.3 STRUCTURAL HEALTH MONITORING

11.3.3.1 Rising adoption of thermal cameras to safeguard building structures

TABLE 75 STRUCTURAL HEALTH MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 76 STRUCTURAL HEALTH MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 77 STRUCTURAL HEALTH MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 STRUCTURAL HEALTH MONITORING: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3.4 QUALITY ASSESSMENT

11.3.4.1 Human safety increases the demand for the thermal imaging technology

TABLE 79 QUALITY ASSESSMENT: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 80 QUALITY ASSESSMENT: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 81 QUALITY ASSESSMENT: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 QUALITY ASSESSMENT: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3.5 HVAC SYSTEM INSPECTION

11.3.5.1 Rise in the awareness of HVAC systems increasing the deployment of thermal imagers driving the market growth

TABLE 83 HVAC SYSTEM INSPECTION: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 84 HVAC SYSTEM INSPECTION: MONITORING AND INSPECTION MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 85 HVAC SYSTEM INSPECTION: MONITORING AND INSPECTION MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 86 HVAC SYSTEM INSPECTION: MONITORING AND INSPECTION MARKET, BY REGION, 2021–2026 (USD MILLION)

11.4 DETECTION AND MEASUREMENT

11.4.1 INCREASING ADOPTION OF THERMAL IMAGING DEVICES TO DETECT, MEASURE, AND ENSURE VEHICLE & DRIVER SAFETY AS WELL AS EFFICIENCY

TABLE 87 DETECTION AND MEASUREMENT: MARKET SIZE, BY APPLICATION TYPE, 2017–2020 (USD MILLION)

FIGURE 41 BODY TEMPERATURE SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR FROM 2021 TO 2026

TABLE 88 DETECTION AND MEASUREMENT: MARKET SIZE, BY APPLICATION TYPE, 2021–2026 (USD MILLION)

TABLE 89 DETECTION AND MEASUREMENT: MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 90 DETECTION AND MEASUREMENT: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 91 DETECTION AND MEASUREMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 92 DETECTION AND MEASUREMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4.2 GAS DETECTION

11.4.2.1 Strict regulations imposed on the oil & gas industry increasing the adoption of thermal imaging cameras

TABLE 93 GAS DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 94 GAS DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 95 GAS DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 96 GAS DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4.3 FIRE/FLARE DETECTION

11.4.3.1 Deployment of thermal cameras to reduce human, material, and property losses to boost market

TABLE 97 FIRE/FLARE DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 98 FIRE/FLARE DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 99 FIRE/FLARE DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 100 FIRE/FLARE DETECTION: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4.4 BODY TEMPERATURE MEASUREMENT

11.4.4.1 Increasing use of thermal cameras propelling the market growth

TABLE 101 BODY TEMPERATURE MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

FIGURE 42 HEALTHCARE & LIFE SCIENCES VERTICAL EXPECTED TO GROW AT A HIGHER CAGR FROM 2021 TO 2026

TABLE 102 BODY TEMPERATURE MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 103 BODY TEMPERATURE MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 104 BODY TEMPERATURE MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4.5 LEVEL MEASUREMENT

11.4.5.1 Use of thermal imaging cameras by technicians to maintain appropriate container or tank levels to boost the market growth

TABLE 105 LEVEL MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 106 LEVEL MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 107 LEVEL MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 108 LEVEL MEASUREMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.4.6 PROTOTYPE ASSESSMENT

11.4.6.1 Adoption of thermal imagers for prototype assessment increasing their demand

TABLE 109 PROTOTYPE ASSESSMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2017–2020 (USD MILLION)

TABLE 110 PROTOTYPE ASSESSMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 111 PROTOTYPE ASSESSMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 112 PROTOTYPE ASSESSMENT: DETECTION AND MEASUREMENT MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 GEOGRAPHIC ANALYSIS (Page No. - 129)

12.1 INTRODUCTION

TABLE 113 THERMAL IMAGING MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 114 MARKET, BY REGION, 2021–2026 (USD MILLION)

FIGURE 43 MARKET SNAPSHOT

12.2 NORTH AMERICA

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

TABLE 115 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 NORTH AMERICA MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Presence of thermal imaging manufacturing companies to boost the market growth in the US

12.2.2 CANADA

12.2.2.1 Investment in R&D of thermal imaging by the government

12.2.3 MEXICO

12.2.3.1 Wide distribution network

12.3 EUROPE

FIGURE 45 EUROPE: MARKET SNAPSHOT

TABLE 119 MARKET IN EUROPE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 120 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.1 UK

12.3.1.1 Increasing use of thermal cameras for monitoring and inspecting building structures in the residential and commercial sector

12.3.2 GERMANY

12.3.2.1 Market for thermal imaging expected to witness significant growth

12.3.3 FRANCE

12.3.3.1 Presence of automobile manufacturers spurring the market growth

12.3.4 REST OF EUROPE

12.4 APAC

FIGURE 46 APAC: MARKET SNAPSHOT

TABLE 123 APAC: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 124 APAC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 125 APAC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 126 APAC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Mass production of thermal imaging products

12.4.2 JAPAN

12.4.2.1 Increase in the use of thermal cameras in the healthcare industry and structural health monitoring applications

12.4.3 INDIA

12.4.3.1 Collaborations, government initiatives, and foreign direct investments spurring the market growth

12.4.4 REST OF APAC

12.5 ROW

TABLE 127 ROW: MARKET, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 128 ROW: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 129 ROW: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 130 ROW: MARKET, BY REGION, 2021–2026 (USD MILLION)

12.5.1 MIDDLE EAST & AFRICA

12.5.1.1 Ongoing investments in the oil & gas and aerospace & defense industries supporting the market growth

12.5.2 SOUTH AMERICA

12.5.2.1 Increasing demand for monitoring and inspection in the healthcare and life sciences, industrial, and aerospace & defense sectors

13 COMPETITIVE LANDSCAPE (Page No. - 144)

13.1 INTRODUCTION

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

13.3 REVENUE ANALYSIS

FIGURE 47 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN THE MARKET

13.4 MARKET SHARE ANALYSIS, 2020

FIGURE 48 MARKET: MARKET SHARE ANALYSIS (2020)

TABLE 131 MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 49 THERMAL IMAGING MARKET COMPANY EVALUATION QUADRANT, 2020

13.5.5 MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 132 COMPANY PRODUCT FOOTPRINT

13.5.6 MARKET: PRODUCT TYPE FOOTPRINT

TABLE 133 COMPANY PRODUCT TYPE FOOTPRINT

13.5.7 MARKET: APPLICATION FOOTPRINT

TABLE 134 COMPANY APPLICATION FOOTPRINT

13.5.8 MARKET: REGIONAL FOOTPRINT

TABLE 135 COMPANY REGIONAL FOOTPRINT

13.6 START-UP/SME EVALUATION QUADRANT, 2020

13.6.1 PROGRESSIVE COMPANIES

13.6.2 RESPONSIVE COMPANIES

13.6.3 DYNAMIC COMPANIES

13.6.4 STARTING BLOCKS

FIGURE 50 THERMAL IMAGING MARKET START-UP/SME EVALUATION QUADRANT, 2020

13.7 COMPETITIVE SCENARIO

13.7.1 EXPANSIONS, ACQUISITIONS, PARTNERSHIPS, AND COLLABORATIONS

TABLE 136 MARKET: EXPANSIONS, ACQUISITIONS, PARTNERSHIPS, AND COLLABORATIONS, SEPTEMBER 2019-JUNE 2021

13.7.2 PRODUCT LAUNCHES/DEVELOPMENTS

TABLE 137 MARKET, PRODUCT LAUNCHES, JUNE 2019–JUNE 2021

14 COMPANY PROFILES (Page No. - 165)

(Business Overview, Products/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 INTRODUCTION

14.2 KEY PLAYERS

14.2.1 FLIR SYSTEMS

FIGURE 51 FLIR SYSTEMS: COMPANY SNAPSHOT

14.2.2 FLUKE

FIGURE 52 FORTIVE CORPORATION: COMPANY SNAPSHOT

14.2.3 LEONARDO SPA

FIGURE 53 LEONARDO S.P.A: COMPANY SNAPSHOT

14.2.4 L3HARRIS TECHNOLOGIES

FIGURE 54 L3HARRIS TECHNOLOGIES: COMPANY SNAPSHOT

14.2.5 RAYTHEON TECHNOLOGIES

FIGURE 55 RAYTHEON TECHNOLOGIES: COMPANY SNAPSHOT

14.2.6 XENICS

14.2.7 AXIS COMMUNICATION

FIGURE 56 AXIS COMMUNICATION: COMPANY SNAPSHOT

14.2.8 BAE SYSTEMS

FIGURE 57 BAE SYSTEMS: COMPANY SNAPSHOT

14.2.9 OPGAL

14.2.10 TESTO SE

14.3 OTHER KEY PLAYERS

14.3.1 AMETEK LAND

14.3.2 DIAS INTERNATIONAL

14.3.3 MOVITHERM

14.3.4 ZHEJIANG DALI TECHNOLOGY

14.3.5 HGH INFRARED SYSTEMS

14.3.6 LYNRED

14.3.7 TONBO IMAGING

14.3.8 INFRATEC

14.3.9 COX

14.3.10 CALUMINO®

14.3.11 SEEK THERMAL

14.3.12 TERABEE

14.3.13 C-THERMAL

14.3.14 HIT NANO

14.3.15 EXMAT RESEARCH

14.3.16 CEM INSTRUMENTS

*Details on Business Overview, Products/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 213)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATION

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

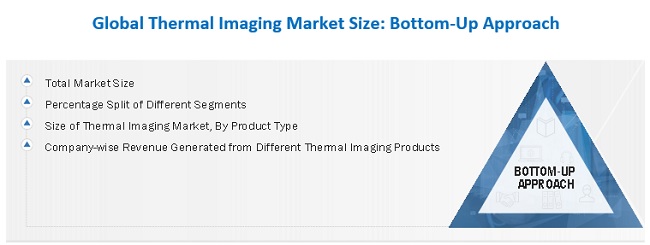

The study involved four major activities in estimating the size of the thermal imaging market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Digital Olfaction Society (DOS), Tokyo Institute of Technology, National Institute of Information and Communications Technology, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

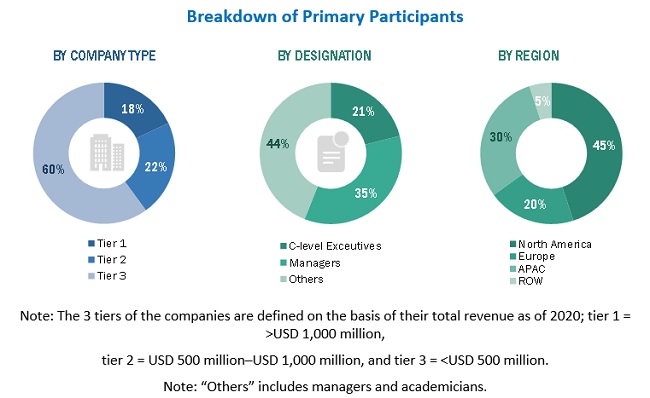

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the thermal imaging market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand and supply-side players across four major regions, namely, North America, Europe, APAC, and Rest of the World (South America, Africa, Middle East). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the thermal imaging market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, segment, and forecast the thermal imaging market in terms of value based on Type, Product Type, Technology, Wavelength, Vertical, and Application.

- To describe and forecast the size of the market for four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide qualitative information about different thermal imaging devices

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed value chain for the thermal imaging market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the thermal imaging market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with the competitive leadership mapping chart

- To analyze the competitive developments such as product launches/developments, contracts/collaborations/agreements/acquisitions in the thermal imaging market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Thermal Imaging Market