Telehealth & Telemedicine Market by Component (Software & Services (RPM, Real-Time), Hardware (Monitors)), Delivery (On-Premise, Cloud-Based), Application (Teleradiology, Telestroke, TelelCU), End User (Provider, Payer) & Region - Global Forecast to 2028

Market Growth Outlook Summary

The global telehealth & telemedicine market growth forecasted to transform from $120.4 billion in 2023 to $285.7 billion by 2028, driven by a CAGR of 23.2%. Key entities in the global Telehealth & Telemedicine market include major players like Koninklijke Philips, N.V, Medtronic plc, and GE Healthcare. This surge is largely driven by the demand for enhanced healthcare efficiency and accessibility, particularly in areas like teleradiology and teleICU, and is supported by advancements in AI, IoT, and machine learning. North America leading the market due to high internet penetration and substantial healthcare IT investments. However, challenges such as regulatory discrepancies and the need for standardized reimbursement models persist. Opportunities exist in using telehealth for infectious disease management, while innovative technologies like blockchain and AI are poised to improve data security and diagnostic accuracy. As the landscape evolves, addressing hygiene standards, affordability, and awareness will be crucial for sustainable growth, ensuring telehealth becomes a vital component of modern healthcare delivery.

What will your New Revenue Sources be? REQUEST FREE SAMPLE REPORT

Telehealth and Telemedicine Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Increasing Adoption Of Digital Health And Telehealth to drive the market

The healthcare landscape is witnessing a significant shift with the increasing adoption of digital health and telehealth solutions. This trend is primarily driven by technological advancements that have transformed the way healthcare services are delivered. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and data analytics enhances the capabilities of telehealth platforms. AI-powered chatbots provide real-time assistance to patients, while remote monitoring tools and Internet of Things (IoT) devices enable healthcare providers to gather and analyze patient data. This not only facilitates personalized healthcare but also allows for proactive management of health conditions.

Shortage of medical professionals and increasing demand for healthcare services to drive the market.

A critical challenge facing the healthcare industry is the shortage of medical professionals, coupled with a growing demand for healthcare services. Traditional healthcare delivery models struggle to cope with this imbalance, creating a need for innovative solutions. Digital health and telehealth emerge as crucial tools in addressing this challenge. Virtual consultations and remote healthcare services not only bridge the gap caused by the shortage of medical professionals but also enhance overall healthcare accessibility. By leveraging technology, healthcare providers can optimize resources, streamline administrative processes, and ensure that patients receive timely and efficient care. This shift towards digital health solutions aligns with the broader goal of making healthcare more patient-centric and accessible.

Restraint: Variations in Regulations Across Regions

The challenge of variations in regulations across regions in the telehealth sector is intricately linked to the diverse nature of healthcare policies and reimbursement models worldwide. Each country, and sometimes even different regions within a country, may formulate and implement distinct policies concerning the reimbursement of telehealth services. This lack of uniformity results in a complex operational environment for telehealth service providers, as they must navigate through disparate reimbursement mechanisms, each with its own set of rules and procedures. The complexity arises from the fact that telehealth providers often operate across borders or in regions with different regulatory frameworks. Consequently, understanding and complying with the nuanced reimbursement policies of each jurisdiction become a significant financial challenge. This scenario necessitates concerted efforts and collaboration among various stakeholders, including healthcare providers, policymakers, and payers.

To address this restraint, the telehealth industry requires a collective and collaborative approach to establish standardized reimbursement models. These models should be designed collaboratively with input from all stakeholders and should aim to incentivize the widespread adoption of telehealth services. By fostering collaboration among healthcare stakeholders, policymakers, and payers, the industry can work towards creating a more uniform and predictable reimbursement landscape. The development of standardized reimbursement models is crucial not only for the sustainable growth of telehealth providers but also for fostering greater trust and confidence among healthcare professionals, patients, and investors. Establishing a cohesive and standardized approach to reimbursement will contribute to the long-term viability and success of telehealth as an integral component of modern healthcare delivery. This collaborative effort is essential to overcome the challenges posed by regulatory variations and ensure the continued expansion and acceptance of telehealth services on a global scale.

Opportunity: High utility in combating infectious diseases and use of technologies such as blockchain and AI

The opportunity in the telehealth and telemedicine market lies in its high utility in combating infectious diseases, especially in the context of global health crises. The ongoing advancements in technologies, such as blockchain and artificial intelligence (AI), present a significant avenue for enhancing the capabilities of telehealth solutions.In the realm of infectious diseases, telehealth plays a crucial role in providing timely and efficient healthcare services. The ability to remotely diagnose, monitor, and treat individuals can be instrumental in managing the spread of infectious diseases, ensuring timely interventions, and reducing the burden on traditional healthcare systems. Telehealth platforms facilitate remote consultations, real-time monitoring of patients' health parameters, and the delivery of essential healthcare services without the need for physical presence, thereby minimizing the risk of transmission.

The integration of cutting-edge technologies like blockchain and AI further amplifies the potential of telehealth. Blockchain, with its decentralized and secure nature, enhances data integrity and privacy, addressing critical concerns in healthcare information exchange. This is particularly valuable in telehealth applications where sensitive patient data is transmitted and stored.Artificial intelligence contributes to telehealth by enabling more accurate diagnostics, personalized treatment plans, and predictive analytics. AI algorithms can analyze vast amounts of healthcare data, assisting healthcare professionals in making informed decisions and improving patient outcomes. Additionally, AI-driven chatbots and virtual assistants enhance the patient experience by providing timely information, appointment scheduling, and continuous support.

As the world faces ongoing and emerging infectious threats, the combination of telehealth solutions with advanced technologies creates a compelling opportunity to revolutionize healthcare delivery. Leveraging the high utility of telehealth in infectious disease management, coupled with the transformative capabilities of blockchain and AI, holds the potential to reshape the healthcare landscape, making it more resilient, responsive, and accessible. This convergence presents an optimistic outlook for the telehealth industry, positioning it as a key player in global health preparedness and response efforts.

Challenge: Issues related to hygiene and cleanliness, behavioral barriers, healthcare affordability, and lack of awareness.

The landscape of telehealth and telemedicine presents a myriad of challenges that necessitate strategic solutions for sustainable growth. One significant obstacle is the challenge of ensuring hygiene and cleanliness standards in virtual healthcare interactions, particularly when traditional physical examinations are not possible. This hurdle demands the development of standardized protocols and the integration of remote monitoring devices to maintain cleanliness without compromising the accuracy of assessments. Additionally, behavioral barriers to the widespread adoption of telehealth services must be addressed through extensive education and awareness campaigns, emphasizing the efficacy, convenience, and safety of virtual care. Healthcare affordability stands as a critical challenge, requiring strategic pricing models, government subsidies, and collaboration with insurance providers to make telehealth financially accessible. Lastly, the lack of awareness, particularly in underserved communities, necessitates robust public awareness campaigns, community outreach programs, and collaborations with local healthcare providers. By holistically addressing these challenges, the telehealth industry can pave the way for a more inclusive, efficient, and widely adopted healthcare paradigm.

Ecosystem/ Market Map

The telehealth and telemedicine market ecosystem comprises entities responsible for the end-to-end workflow of telehealth services. The major stakeholders present in this market include telecommunications companies, CT tools and electronics manufacturers, platforms, service and medical device providers, pharmaceutical companies, healthcare providers, payers, patients/customers, pharmacies and health retailers, senior living/post-acute/hospice centers, startups, and governments and regulatory bodies. The demand continues to grow and expand, especially after the outbreak of the COVID-19 pandemic. Solution and service providers continue to enhance and mature their offerings to add value.

Telehealth and Telemedicine Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

Software and services segment accounted for a substantial share of the telehealth & telemedicine industry, by Component in 2022.

The software segment of the telehealth & telemedicine market is poised to experience a favorable CAGR in the forecast period, propelled by the increasing demand for cost-effective and easily accessible healthcare services, streamlined workflow management, and enhanced quality care. The surge in healthcare expenses, coupled with the escalating requirement for real-time and accurate population health monitoring, is fostering the uptake of software solutions. Additionally, healthcare institutions in developed countries are transitioning to value-based care models to enhance patient outcomes. The segment's growth is further accelerated by various global initiatives undertaken by key industry players.

Providers segment accounted for a considerable share in the telehealth & telemedicine industry, by end user in 2022

The provider segment of the telehealth & telemedicine market dominated with the largest revenue share of 32.9% in 2022, primarily attributed to the growing acceptance of telehealth, teleconsultation, and telemedicine within the healthcare professional community, aiming to alleviate the strain on healthcare facilities. Additionally, the heightened convenience provided by these solutions enables healthcare providers to access patient health records swiftly, facilitate real-time quality reporting, enhance data management, make informed decisions, and embrace eHealth solutions, thereby fostering an increased adoption of these services among healthcare providers.

Web bases delivery mode accounted for the largest share in telehealth & telemedicine industry by Delivery mode in 2022

The web-based delivery mode segment of the telehealth & telemedicine market secured the largest share, constituting XX% of the total revenue in 2022. Factors contributing to its dominance include the rise of virtual care and web-based telehealth applications, fostering direct patient access to healthcare services. Increased internet penetration and smartphone industry innovations further propel the growth of web-based delivery, with its cost-effectiveness and user-friendly interface enhancing adoption rates.

On the other hand, the cloud-based delivery segment is poised for the fastest growth, driven by escalating adoption among healthcare providers and patients, alongside the introduction of technologically advanced solutions. The appeal lies in seamless data storage, easy accessibility, high bandwidth, and enhanced security, especially amid growing concerns over data breaches in web-based and on-premise telehealth platforms. Cloud-based applications address critical needs like patient monitoring and teleconsultation in rural and remote areas, emphasizing the demand for immediate medical assistance.

North America dominated the telehealth & telemedicine industry in 2022

In 2022, North America asserted its dominance in the telehealth & telemedicine market, securing 40.8% of the total revenue. The region's robust growth is attributed to substantial healthcare IT expenditures, coupled with a high penetration of internet and smartphone users. Future prospects are promising, fueled by the increasing burden of chronic conditions and a heightened awareness of digital health and virtual care platforms among both healthcare providers and patients. The region's favorable conditions, including the presence of key industry players and the emergence of startups, are poised to further drive the adoption of telehealth platforms.

Prominent players in the telehealth and telemedicine market include GE Healthcare (US), Oracle (US), Siemens Healthcare GmbH (Germany), Cisco Systems (US), Asahi Kasei Corporation (Japan), Iron Bow Technologies (US), American Well (US), AMC Health (US), TeleSpecialists (US), Doctor On Demand by Included Health, Inc. (US), MDLIVE (US), GlobalMedia Group, LLC (US), Medweb (US), VSee (US), Imedi Plus (China), ACL Digital (US), iCliniq (US).

Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$120.4 billion |

|

Projected Revenue by 2028 |

$285.7 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 23.2% |

|

Market Driver |

Increasing Adoption Of Digital Health And Telehealth to drive the market |

|

Market Opportunity |

High utility in combating infectious diseases and use of technologies such as blockchain and AI |

Report Segmentation

By Component

-

Software and Service by Type

- Remote Patient Monitoring

- Real Time Interaction

- Store and Forward

-

Software and Service by Offering

- One-Time Purchase

- Subscription Based

- Pay-Per Use

-

Hardware

- Monitors

-

Medical Peripheral Devices

- Blood Pressure Monitors

- Blood Glucose Meter

- Weight Scales

- Pulse Oximeters

- Peak Flow Meters

- Ecg Monitors

- Other Medical Peripheral Devices

By Mode of Delivery

- Cloud based

- On Premise

By Application

- Telecare

- Activity Monitoring

- Remote Medication Management

- Teleconsultation

- Tele ICU

- Telepsychiatry

- Teledermatology

- other applications

By End User

-

Providers

- Hospitals & Clinics

- Long Term Care Centers & Assisted Living Centers

-

Payers

- Public

- Private

- Patients and consumers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- Italy

- Spain

- France

- RoE

-

Asia Pacific

- Japan

- China

- India

- Australia

- RoAPAC

- Latin America

- Middle East and Africa

Recent Developments

- In 2021, Medtronic forged a partnership with Statis Lab Inc., aiming to introduce a patient monitoring system in India.

- Koninklijke Philips unveiled new products, such as Patch, Maternal Pod, and Avalon CL Fetalin 2020 for remote patient monitoring across New Zealand, Europe, Singapore, the United States, and Australia.

- In 2020, BioTelemetry completed the acquisition of various healthcare services and products from Envolve, encompassing a coaching platform and remote patient monitoring. The strategic move concentrated on addressing healthcare needs in hypertension, mental health, diabetes, and chronic heart failure.

Frequently Asked Questions (FAQ):

What are the key drivers of growth in the telehealth and telemedicine market?

The telehealth and telemedicine market is primarily driven by the increasing demand for efficient healthcare services, advancements in technology such as AI and IoT, and a growing emphasis on accessibility, particularly following the COVID-19 pandemic. Additionally, the rising prevalence of chronic diseases and the shortage of healthcare professionals are pushing the adoption of telehealth solutions across various regions.

What challenges does the telehealth market face?

The telehealth market faces several challenges, including regulatory variations across different regions that complicate operations and reimbursement processes. Additionally, issues related to healthcare affordability and the need for standardized protocols can hinder widespread adoption. Addressing these challenges is crucial for ensuring the sustainable growth of telehealth services in the evolving healthcare landscape.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing geriatric population and increasing need to expand healthcare access- Rising prevalence of chronic conditions and cost-benefits of telehealth & telemedicine services- Shortage of skilled healthcare professionals- Advancements in telecommunication technologies- Increased government support and favorable reimbursement policiesRESTRAINTS- Regulatory variations across regions- Increase in fraud in telehealth practices- Violation of medical ethicsOPPORTUNITIES- Increased utility of telemedicine against infectious diseases and epidemics- Use of blockchain technology in healthcare industry- Increased use of artificial intelligence and big data analytics- Growing demand for virtual careCHALLENGES- Inability to maintain hygiene and cleanliness standards- Behavioral barriers, healthcare affordability, and lack of awareness

-

5.3 INDUSTRY TRENDSOVERVIEW OF USE CASES

-

5.4 TECHNOLOGY ANALYSISMACHINE LEARNINGARTIFICIAL INTELLIGENCEINTERNET OF THINGSBLOCKCHAIN TECHNOLOGYCLOUD COMPUTINGDATA ANALYTICSEXTENDED REALITY

-

5.5 CASE STUDY ANALYSISCASE STUDY 1CASE STUDY 2

-

5.6 ECOSYSTEM MARKET MAP

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.9 PATENT ANALYSISPATENT PUBLICATION TRENDSINSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSISLIST OF MAJOR PATENTS

-

5.10 TARIFF & REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY ANALYSIS

-

5.11 TRADE ANALYSISTRADE ANALYSIS FOR TELEHEALTH & TELEMEDICINE DEVICES

-

5.12 PRICING ANALYSISCOSTS INVOLVED IN TELEMEDICINE DEVICESAVERAGE SELLING PRICE FOR TELEHEALTH & TELEMEDICINE DEVICES, BY KEY PLAYERINDICATIVE PRICING ANALYSIS OF TELEHEALTH & TELEMEDICINE DEVICES, BY REGIONPRICING MODELS

-

5.13 REIMBURSEMENT ANALYSISTYPES OF VIRTUAL SERVICES TO MEDICARE BENEFICIARIES

- 5.14 INVESTMENT LANDSCAPE

- 5.15 KEY CONFERENCES & EVENTS

-

5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.17 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERSBUYING CRITERIA

- 5.18 UNMET NEEDS

- 6.1 INTRODUCTION

-

6.2 SOFTWARE & SERVICESSOFTWARE & SERVICES, BY TYPE- Remote patient monitoring- Real-time interaction- Store and forwardSOFTWARE & SERVICES, BY REVENUE MODEL- One-time purchase- Subscription-based- Pay-per-use

-

6.3 HARDWAREMONITORS- Increase in remote monitoring and rising adoption of telemedicine devices to drive segmentMEDICAL PERIPHERAL DEVICES- Blood pressure monitors- Blood glucose meters- Weight scales- Pulse oximeters- Peak flow meters- ECG monitors- Other medical peripheral devices

- 7.1 INTRODUCTION

-

7.2 CLOUD-BASED DELIVERYCLOUD-BASED DELIVERY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

-

7.3 ON-PREMISE DELIVERYENHANCED CONTROL OF SOFTWARE AND EASY REUSE OF EXISTING INFRASTRUCTURE TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 TELECONSULTATIONINCREASED NEED FOR AT-HOME FACILITIES AND SHORTAGE OF MEDICAL STAFF TO DRIVE MARKET

-

8.3 TELEICUINCREASING NUMBER OF PATIENTS IN EMERGENCY DEPARTMENTS AND STAFF SHORTAGE IN RURAL AREAS TO DRIVE MARKET

-

8.4 TELEPSYCHIATRYSHORTAGE OF MENTAL HEALTH PRACTITIONERS AND FAVORABLE REIMBURSEMENT SCENARIO TO DRIVE MARKET

-

8.5 TELERADIOLOGYTELERADIOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

-

8.6 TELESTROKERISING INCIDENCE OF STROKE AND INCREASING GERIATRIC POPULATION TO DRIVE MARKET

-

8.7 TELEDERMATOLOGYRISING PREVALENCE OF SKIN DISEASES AND GROWING USE OF HD CAMERAS FOR SKIN DIAGNOSIS TO DRIVE MARKET

- 8.8 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 PROVIDERSHOSPITALS & CLINICS- Growing incidence of chronic diseases and rising demand for high-quality care to drive segmentLONG-TERM CARE CENTERS AND ASSISTED LIVING FACILITIES- Increasing geriatric population and rising need for prolonged treatment for chronic diseases to drive segment

-

9.3 PAYERSPUBLIC PAYERS- Increasing investments by public payers to drive segmentPRIVATE PAYERS- Expansion of telehealth services to mental health and substance usage to drive segment

-

9.4 PATIENTSRISING PREVALENCE OF CHRONIC DISEASES AND EMERGENCE OF ADVANCED WEARABLE MONITORS TO DRIVE MARKET

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- US to dominate North American market during forecast periodCANADA- Increasing geriatric population and rising government healthcare expenditure to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Rapid digitization of healthcare systems and repealed ban on remote treatment to drive marketFRANCE- Favorable reimbursement and investment scenario for remote healthcare services to drive marketUK- Need to manage growing government healthcare expenditure and shortage of medical staff to drive marketITALY- Established telehealth and telespecialty practices and increased geriatric population to drive marketSPAIN- Rising incidence of chronic diseases and well-organized healthcare system to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Opportunities for advanced internet-based telehealth platforms to drive marketJAPAN- Rise in geriatric population and well-established health insurance system to drive marketINDIA- Favorable government policies and high density of rural population to drive marketAUSTRALIA- Favorable government initiatives and healthcare policies to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACTBRAZIL- Growing focus on reducing government healthcare expenditure to drive marketMEXICO- Increasing demand and adoption of healthcare IT solutions to drive marketREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTGCC COUNTRIES- Rising focus on expanding and improving present health infrastructure to drive marketREST OF MIDDLE EAST & AFRICA

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOS AND TRENDSKEY PRODUCT LAUNCHESKEY DEALSOTHER KEY DEVELOPMENTS

-

12.1 KEY PLAYERSKONINKLIJKE PHILIPS N.V.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMEDTRONIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGE HEALTHCARE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSIEMENS HEALTHINEERS AG- Business overview- Products/Services/Solutions offered- Recent developmentsCISCO SYSTEMS, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsORACLE- Business overview- Products/Services/Solutions offered- Recent developmentsASAHI KASEI CORPORATION- Business overview- Products/Services/Solutions offered- Recent developmentsIRON BOW TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developmentsAMERICAN WELL- Business overview- Products/Services/Solutions offered- Recent developmentsTELADOC HEALTH, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsAMC HEALTH- Business overview- Products/Services/Solutions offered- Recent developmentsTELESPECIALISTS- Business overview- Products/Services/Solutions offered- Recent developmentsDOCTOR ON DEMAND, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsEVERNORTH HEALTH, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsGLOBAL MEDIA GROUP LLC- Business overview- Products/Services/Solutions offered- Recent developmentsMEDVIVO GROUP LTD.- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSMEDWEBVSEEIMEDI PLUSZIPNOSISACL DIGITALICLINIQBOSTON SCIENTIFIC CARDIAC DIAGNOSTICS INC.RESIDEO LIFE CARE SOLUTIONS

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 MARKET DYNAMICS: IMPACT ANALYSIS

- TABLE 2 INCREASE IN POPULATION, 2022, 2030, AND 2050, BY MEDIUM SCENARIO (MILLION)

- TABLE 3 CHRONIC DISEASES AND THEIR COST BURDEN IN US: POTENTIAL FOR SAVINGS

- TABLE 4 US: STATE-WISE REGULATORY REQUIREMENTS FOR TELEHEALTH

- TABLE 5 TRENDS IN TELEHEALTH & TELEMEDICINE MARKET

- TABLE 6 OVERVIEW OF TELEHEALTH USE CASES

- TABLE 7 PORTER’S FIVE FORCES ANALYSIS: TELEHEALTH & TELEMEDICINE MARKET

- TABLE 8 KEY PATENTS IN TELEHEALTH & TELEMEDICINE MARKET

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REGULATORY STANDARDS IN TELEHEALTH & TELEMEDICINE MARKET

- TABLE 13 REGULATORY REQUIREMENTS IN NORTH AMERICA

- TABLE 14 REGULATORY REQUIREMENTS IN EUROPE

- TABLE 15 REGULATORY REQUIREMENTS IN ASIA PACIFIC

- TABLE 16 REGULATORY REQUIREMENTS IN LATIN AMERICA

- TABLE 17 REGULATORY REQUIREMENTS IN MIDDLE EAST & AFRICA

- TABLE 18 MEDICARE TELEMEDICINE SERVICES AND HCPCS/CPT CODES

- TABLE 19 LIST OF KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 21 KEY BUYING CRITERIA FOR TELEHEALTH & TELEMEDICINE MARKET

- TABLE 22 UNMET NEED IN TELEHEALTH & TELEMEDICINE MARKET

- TABLE 23 TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 24 TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 28 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 31 REMOTE PATIENT MONITORING MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 REAL-TIME INTERACTION MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 STORE AND FORWARD MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 35 ONE-TIME PURCHASE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 SUBSCRIPTION-BASED MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 PAY-PER-USE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 43 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 45 MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 47 MEDICAL PERIPHERAL DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 48 BLOOD PRESSURE MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 BLOOD GLUCOSE METERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 50 WEIGHT SCALES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 51 PULSE OXIMETER MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 52 PEAK FLOW METERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 ECG MONITORS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 54 OTHER MEDICAL PERIPHERAL PRODUCTS OFFERED BY KEY PLAYERS

- TABLE 55 OTHER MEDICAL PERIPHERAL DEVICES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 56 TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 57 TELEHEALTH & TELEMEDICINE MARKET FOR CLOUD-BASED DELIVERY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR CLOUD-BASED DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR CLOUD-BASED DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR CLOUD-BASED DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR CLOUD-BASED DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 62 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR CLOUD-BASED DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 TELEHEALTH & TELEMEDICINE MARKET FOR ON-PREMISE DELIVERY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR ON-PREMISE DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR ON-PREMISE DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR ON-PREMISE DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR ON-PREMISE DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR ON-PREMISE DELIVERY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 TELEHEALTH & TELEMEDICINE MARKET FOR TELECONSULTATION, BY REGION, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELECONSULTATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR TELECONSULTATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR TELECONSULTATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELECONSULTATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELECONSULTATION, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 TELEHEALTH & TELEMEDICINE MARKET FOR TELEICU, BY REGION, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEICU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR TELEICU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR TELEICU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEICU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEICU, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 TELEHEALTH & TELEMEDICINE MARKET FOR TELEPSYCHIATRY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEPSYCHIATRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR TELEPSYCHIATRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR TELEPSYCHIATRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEPSYCHIATRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEPSYCHIATRY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 TELEHEALTH & TELEMEDICINE MARKET FOR TELERADIOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELERADIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR TELERADIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR TELERADIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELERADIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELERADIOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 TELEHEALTH & TELEMEDICINE MARKET FOR TELESTROKE, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELESTROKE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR TELESTROKE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR TELESTROKE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELESTROKE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELESTROKE, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 100 TELEHEALTH & TELEMEDICINE MARKET FOR TELEDERMATOLOGY, BY REGION, 2021–2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEDERMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR TELEDERMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR TELEDERMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEDERMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR TELEDERMATOLOGY, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 TELEHEALTH & TELEMEDICINE MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 112 TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 113 TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 116 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 120 HOSPITALS & CLINICS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 121 LONG-TERM CARE CENTERS AND ASSISTED LIVING FACILITIES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 122 TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 123 TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 125 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 PUBLIC PAYERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 130 PRIVATE PAYERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 131 TELEHEALTH & TELEMEDICINE MARKET FOR PATIENTS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 135 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PATIENTS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 TELEHEALTH & TELEMEDICINE MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 138 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 139 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 141 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 143 TELEHEALTH & TELEMEDICINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 146 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 148 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 NORTH AMERICA: TELEHEALTH & TELEMEDICINE HARDWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 155 US: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 156 US: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 US: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 158 US: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 159 US: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 US: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 161 US: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 162 US: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 163 US: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 164 US: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 165 CANADA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 166 CANADA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 CANADA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 168 CANADA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 CANADA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 170 CANADA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 171 CANADA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 172 CANADA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 173 CANADA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 174 CANADA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 175 EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 176 EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 177 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 179 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 EUROPE: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 181 EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 182 EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 183 EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 184 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 185 EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 186 GERMANY: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 187 GERMANY: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 GERMANY: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 189 GERMANY: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 GERMANY: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 GERMANY: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 192 GERMANY: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 193 GERMANY: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 GERMANY: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 195 GERMANY: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 196 FRANCE: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 197 FRANCE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 198 FRANCE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 199 FRANCE: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 FRANCE: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 FRANCE: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 202 FRANCE: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 203 FRANCE: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 204 FRANCE: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 205 FRANCE: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 206 UK: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 207 UK: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 UK: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 209 UK: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 210 UK: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 211 UK: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 212 UK: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 213 UK: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 214 UK: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 215 UK: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 216 ITALY: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 217 ITALY: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 218 ITALY: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 219 ITALY: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 ITALY: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 221 ITALY: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 222 ITALY: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 223 ITALY: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 224 ITALY: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 225 ITALY: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 226 SPAIN: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 227 SPAIN: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 SPAIN: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 229 SPAIN: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 SPAIN: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 SPAIN: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 232 SPAIN: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 233 SPAIN: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 234 SPAIN: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 235 SPAIN: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 236 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 237 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 239 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 240 REST OF EUROPE: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 241 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 242 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 243 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 244 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 245 REST OF EUROPE: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 246 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 247 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 248 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 250 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 251 ASIA PACIFIC: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 252 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 253 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 254 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 255 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 256 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 257 CHINA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 258 CHINA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 CHINA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 260 CHINA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 261 CHINA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 CHINA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 263 CHINA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 264 CHINA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 265 CHINA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 266 CHINA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 267 JAPAN: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 268 JAPAN: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 269 JAPAN: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 270 JAPAN: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 271 JAPAN: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 272 JAPAN: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 273 JAPAN: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 274 JAPAN: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 275 JAPAN: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 276 JAPAN: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 277 INDIA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 278 INDIA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 INDIA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 280 INDIA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 281 INDIA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 282 INDIA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 283 INDIA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 284 INDIA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 285 INDIA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 286 INDIA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 287 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 288 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 289 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 290 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 291 AUSTRALIA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 292 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 293 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 294 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 295 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 296 AUSTRALIA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 297 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 298 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 299 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 300 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 301 REST OF ASIA PACIFIC: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 302 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 303 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 304 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 305 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 306 REST OF ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 307 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 308 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 309 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 310 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 311 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 312 LATIN AMERICA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 313 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 314 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 315 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 316 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 317 LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 318 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 319 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 320 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 321 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 322 BRAZIL: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 323 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 324 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 325 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 326 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 327 BRAZIL: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 328 MEXICO: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 329 MEXICO: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 330 MEXICO: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 331 MEXICO: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 332 MEXICO: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 333 MEXICO: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 334 MEXICO: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 335 MEXICO: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 336 MEXICO: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 337 MEXICO: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 338 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 339 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 340 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 341 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 342 REST OF LATIN AMERICA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 343 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 344 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 345 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 346 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 347 REST OF LATIN AMERICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 348 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 349 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 350 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 351 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 352 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 353 MIDDLE EAST & AFRICA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 354 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 355 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 356 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 357 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 358 MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 359 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 360 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 361 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 362 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 363 GCC COUNTRIES: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 364 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 365 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 366 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 367 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 368 GCC COUNTRIES: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 369 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2021–2028 (USD MILLION)

- TABLE 370 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 371 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR SOFTWARE & SERVICES, BY REVENUE MODEL, 2021–2028 (USD MILLION)

- TABLE 372 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR HARDWARE, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 373 REST OF MIDDLE EAST & AFRICA: MEDICAL PERIPHERAL DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 374 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2021–2028 (USD MILLION)

- TABLE 375 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 376 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 377 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PROVIDERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 378 REST OF MIDDLE EAST & AFRICA: TELEHEALTH & TELEMEDICINE MARKET FOR PAYERS, BY TYPE 2021–2028 (USD MILLION)

- TABLE 379 OVERALL FOOTPRINT

- TABLE 380 PRODUCT FOOTPRINT

- TABLE 381 REGIONAL FOOTPRINT

- TABLE 382 DETAILED LIST OF KEY START-UPS/SMES

- TABLE 383 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 384 KEY PRODUCT LAUNCHES, JANUARY 2020–SEPTEMBER 2023

- TABLE 385 KEY DEALS, JANUARY 2020–SEPTEMBER 2023

- TABLE 386 OTHER KEY DEVELOPMENTS, JANUARY 2020–SEPTEMBER 2023

- TABLE 387 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW

- TABLE 388 MEDTRONIC: COMPANY OVERVIEW

- TABLE 389 GE HEALTHCARE: COMPANY OVERVIEW

- TABLE 390 SIEMENS HEALTHINEERS GMBH: COMPANY OVERVIEW

- TABLE 391 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 392 ORACLE: COMPANY OVERVIEW

- TABLE 393 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- TABLE 394 IRON BOW TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 395 AMERICAN WELL: COMPANY OVERVIEW

- TABLE 396 TELADOC HEALTH, INC.: COMPANY OVERVIEW

- TABLE 397 AMC HEALTH: COMPANY OVERVIEW

- TABLE 398 TELESPECIALISTS: COMPANY OVERVIEW

- TABLE 399 DOCTOR ON DEMAND, INC.: COMPANY OVERVIEW

- TABLE 400 EVERNORTH HEALTH, INC.: COMPANY OVERVIEW

- TABLE 401 GLOBAL MEDIA GROUP: COMPANY OVERVIEW

- TABLE 402 MEDVIVO GROUP LTD.: COMPANY OVERVIEW

- FIGURE 1 RESEARCH METHODOLOGY: TELEHEALTH & TELEMEDICINE MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY CATEGORY, DESIGNATION, AND REGION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 5 ESTIMATION OF MARKET SIZE FOR REMOTE PATIENT MONITORING SOFTWARE & SERVICES THROUGH ADOPTION-BASED APPROACH

- FIGURE 6 ESTIMATION OF MARKET SIZE FOR REAL-TIME INTERACTION SOFTWARE & SERVICES THROUGH ADOPTION-BASED APPROACH

- FIGURE 7 ESTIMATION OF MARKET SIZE FOR STORE-AND-FORWARD SOFTWARE & SERVICES THROUGH ADOPTION-BASED APPROACH

- FIGURE 8 ESTIMATION OF GLOBAL TELEHEALTH & TELEMEDICINE MARKET SIZE THROUGH ADOPTION-BASED APPROACH

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 TELEHEALTH & TELEMEDICINE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 TELEHEALTH & TELEMEDICINE MARKET, BY MODE OF DELIVERY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 TELEHEALTH & TELEMEDICINE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 TELEHEALTH & TELEMEDICINE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 REGIONAL SNAPSHOT: TELEHEALTH & TELEMEDICINE MARKET

- FIGURE 15 SHORTAGE OF MEDICAL STAFF, RISE IN CHRONIC DISEASES, AND INCREASED GERIATRIC POPULATION TO DRIVE MARKET

- FIGURE 16 SOFTWARE & SERVICES SEGMENT AND US DOMINATED NORTH AMERICAN MARKET IN 2022

- FIGURE 17 CHINA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING STUDY PERIOD

- FIGURE 19 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: TELEHEALTH & TELEMEDICINE MARKET

- FIGURE 21 ECOSYSTEM MARKET MAP: TELEHEALTH & TELEMEDICINE MARKET

- FIGURE 22 VALUE CHAIN ANALYSIS: TELEHEALTH & TELEMEDICINE MARKET

- FIGURE 23 PATENT PUBLICATION TRENDS, 2014–2023

- FIGURE 24 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR TELEHEALTH & TELEMEDICINE PATENTS, JANUARY 2013– NOVEMBER 2023

- FIGURE 25 TOP APPLICANT COUNTRIES/REGIONS FOR TELEHEALTH & TELEMEDICINE PATENTS, JANUARY 2014–OCTOBER 2023

- FIGURE 26 IMPORTS OF PRODUCTS UNDER HSN CODE 90189099, BY COUNTRY, 2022 (USD THOUSAND)

- FIGURE 27 EXPORTS OF PRODUCTS UNDER HSN CODE 90189099, BY COUNTRY, 2022 (USD THOUSAND)

- FIGURE 28 INVESTOR DEALS AND FUNDING IN TELEHEALTH & TELEMEDICINE DROPPED IN 2022

- FIGURE 29 TOP FUNDED GLOBAL DIGITAL HEALTH CATEGORIES IN 2021

- FIGURE 30 MOST VALUED TELEHEALTH & TELEMEDICINE FIRMS IN 2022 (USD BILLION)

- FIGURE 31 REVENUE SHIFT IN TELEHEALTH & TELEMEDICINE MARKET

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA

- FIGURE 34 GEOGRAPHIC SNAPSHOT: TELEHEALTH & TELEMEDICINE MARKET, 2022

- FIGURE 35 NORTH AMERICA: TELEHEALTH & TELEMEDICINE MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: TELEHEALTH & TELEMEDICINE MARKET SNAPSHOT

- FIGURE 37 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, JANUARY 2020– NOVEMBER 2023

- FIGURE 38 REVENUE SHARE ANALYSIS, 2018–2022

- FIGURE 39 MARKET SHARE ANALYSIS, 2022

- FIGURE 40 COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 42 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 43 MEDTRONIC: COMPANY SNAPSHOT (2022)

- FIGURE 44 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 45 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2022)

- FIGURE 46 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 47 ORACLE: COMPANY SNAPSHOT (2022)

- FIGURE 48 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 49 TELADOC HEALTH, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 50 EVERNORTH HEALTH, INC.: COMPANY SNAPSHOT (2022)

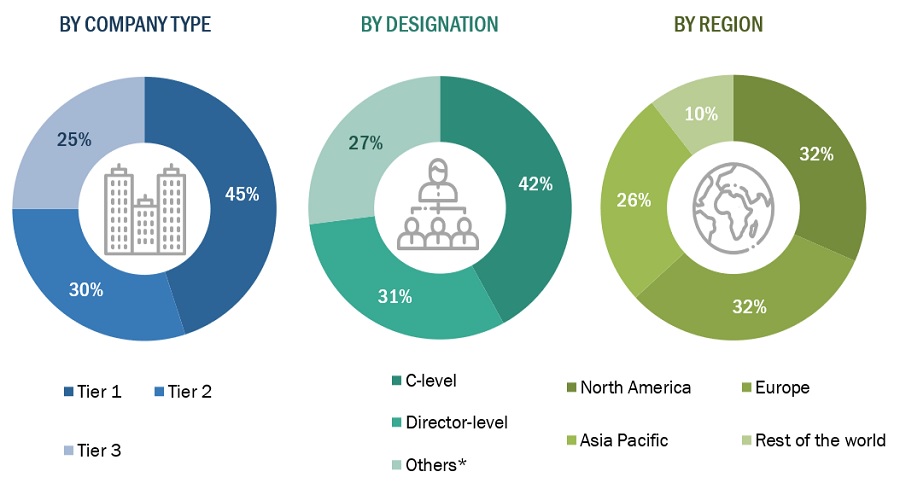

This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the Telehealth and Telemedicine market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the Telehealth and Telemedicine market. Primary sources from the demand side included personnel from hospitals (small, medium-sized, and large hospitals), primary care clinics, and stakeholders in corporate & government bodies.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the Telehealth and Telemedicine was arrived at after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

The size of the Telehealth and Telemedicine was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below:

- Shares of leading players in the Telehealth and Telemedicine market were gathered from secondary sources to the extent available. In some instances, shares of Telehealth and Telemedicine have been ascertained after a detailed analysis of various parameters, including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

The total revenue in the Telehealth and Telemedicine was determined by extrapolating the Market share data of major companies.

Global Telehealth and Telemedicine market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Definition

TELEHEALTH

Telehealth involves short-term clinical and nonclinical (medical education, administration, and research) services that allow the remote interaction between parties (doctor-patient and doctor-doctor) to monitor vital signs, enabling medical practitioners to evaluate and diagnose patients with common (less critical) medical conditions, e-prescribe medicines and treatments for the same, and detect fluctuations in the medical status of patients remotely. It includes short-term therapeutic and preventive health services.

TELEMEDICINE

Telemedicine involves long-term (chronic care) services between parties (general/specialty physician-physician or physician-patient) using telecommunication technologies to diagnose, evaluate, monitor, and treat specific medical conditions. It includes detailed video/virtual consultations and remote monitoring deployed for diagnostic and therapeutic purposes.

Key Stakeholders

- Telehealth and telemedicine equipment manufacturers

- Suppliers and distributors of telehealth and telemedicine equipment

- Healthcare IT service providers

- Healthcare insurance companies/payers

- Healthcare institutions/providers (hospitals, clinics, medical groups, physicians’ practices, diagnostic centers, and outpatient clinics)

- Venture capitalists

- Government bodies/regulatory bodies

- Corporate entities

- Accountable care organizations

- Telehealth resource centers

- Research and consulting firms

- Technology partners

- Medical research institutes

- Clinical departments

- Ministries of health

Objectives of the Study

- To define, describe, and forecast the telehealth and telemedicine market based on component, application, mode of delivery, end user, and region

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall telehealth and telemedicine market

- To analyze opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World

- To profile key players and analyze their market shares and core competencies

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, collaborations, and expansions in the overall market

- To benchmark players within the market using the proprietary “Competitive Leadership Mapping” framework, which analyzes market players on various parameters within the broad categories of business and product strategies

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Telehealth and Telemedicine market into Denmark, Norway, and others

- Further breakdown of the Rest of Asia Pacific Telehealth and Telemedicine market into Vietnam, New Zealand, Australia, South Korea, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Telehealth & Telemedicine Market