Security Screening Market by Technology (X-ray Screening (Body Scanners, Handheld Screening Systems, Baggage Scanners), Electromagnetic Metal Detection, Biometrics, Spectrometry & Spectroscopy), End Use, Application, Region - Global forecast to 2029

Updated on : October 23, 2024

Security Screening Market Size

The global security screening market size is valued at USD 9.4 billion in 2024 and is expected to reach USD 13.2 billion by 2029, growing at a CAGR of 7.1% from 2024 to 2029. Factors such Growing concern about terrorism and illegal immigration, increasing emphasis on modern security solutions to curb radiological attacks, and surging adoption of trace detectors to combat drug trafficking provide market growth opportunities for the security screening industry .

Security Screening Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Security Screening Market Trends & Dynamics

Driver: Growing concern about terrorism and illegal immigration

The global security screening market is experiencing significant growth due to increasing concerns about terrorism and illegal immigration. Governments, organizations, and institutions are adopting stringent security measures to protect their assets, citizens, and borders. As a result, the demand for advanced security screening technologies, such as X-ray scanners, metal detectors, and biometric systems, is increasing to effectively detect and deter potential threats. These solutions are adopted at critical locations, including airports, transportation hubs, government buildings, and public venues.

The average number of deaths per attack also increased from 1.3 in 2021 to 1.7 in 2022. The Sahel region in sub-Saharan Africa had the highest terrorism death toll in 2022, surpassing South Asia and the Middle East and North Africa (MENA) combined.

In addition, the issue of illegal migration adds another layer of complexity to the security landscape. Countries worldwide are dealing with challenges posed by unauthorized border crossings and undocumented immigrants. Therefore, there has been a growing emphasis on implementing robust border security measures to control and monitor the flow of people across borders. Advanced security screening technologies enable authorities to identify and intercept individuals who pose security risks.

Restraint: High installation and maintenance costs

Security screening systems are widely used to ensure safety at various public places, including transit facilities, hospitals, government organizations, banks, commercial buildings, educational institutions, and critical infrastructure. However, these systems can be quite expensive to install and maintain. Many places require costly equipment, such as explosive detectors, trace detectors, scanners, and radiation detectors, which incur high operational costs. For example, full-body X-ray scanners require a significant initial investment, and the maintenance cost of explosive detectors can also be high.

These factors can lead to a declining adoption of security measures at facilities. In creating X-ray images, X-rays are emitted from full-body scanners and pass through the body being examined. The detector measures the relative intensity of the X-rays that pass directly through the object in transmission imaging. The amount of X-rays transmitted through a body depends on the energy of the X-ray source and the composition and quantity of the material in the path of the X-ray beam. This setup requires a significant initial investment, and the price of full-body scanners is also high compared with metal detectors.

In addition, scanners require regular maintenance, which incurs additional costs. Multi-factor authentication is required for high-security applications, while low-security applications only require single-factor biometric systems. The cost of implementing multi-factor biometric applications may increase depending on the type of sensor used in the device. Therefore, the high installation and maintenance costs associated with security screening solutions may restrict the market’s growth.

Opportunity: Increased requirement for automatic explosive detection in airports

The imperative drives the increase in demand for automatic explosive detection in airports to bolster aviation security and enhance passenger safety. As global travel continues to rise, the need for robust screening technologies that can efficiently and accurately identify potential threats has also increased. Automatic explosives detection systems employ advanced technologies, such as computed tomography (CT) scanning and artificial intelligence (AI), to identify explosive materials automatically within luggage and cargo. This automation improves the speed and efficiency of security screening processes and enhances the precision of threat detection, reducing the likelihood of human error.

The heightened focus on terrorism prevention and the evolving nature of security threats contribute to the growing demand for automatic explosives detection. As critical transit points, airports prioritize implementing cutting-edge technologies to prevent potential threats. The deployment of these systems aligns with regulatory requirements and international standards, ensuring a uniform and high level of security across the aviation industry. Ultimately, the surge in demand for automatic explosives detection reflects a commitment to safeguarding air travel by leveraging advanced, automated solutions that provide thorough and efficient screening capabilities.

Challenge: Legal consequences due to false positives in security screening

False positives and negatives pose a significant market challenge in the security screening market due to their impact on operational efficiency and the potential for legal consequences. False positives, where non-threat items are incorrectly identified as risks, can lead to disruptions, delays, and unnecessary escalations, causing operational inefficiencies. On the other hand, false negatives, where actual threats go undetected, pose severe risks to security, potentially leading to incidents with substantial consequences.

Such inaccuracies hinder the effectiveness of security screening processes and have legal implications. Instances of wrongful identifications or missed threats can result in legal actions, damaging the reputation of security providers and creating liabilities. Striking a balance between minimizing false alarms and ensuring accurate threat detection becomes imperative for security screening companies to maintain operational efficiency, comply with regulations, and mitigate legal risks in a dynamic and evolving security landscape.

Security Screening Market Ecosystem

The security screening market is competitive. It is marked by the presence of a few tier-1 companies, such as OSI Systems, Inc. (US), Smiths Detection Group Ltd. (UK), Leidos (US), Thales (France), and NEC Corporation (Japan). These companies have created a competitive ecosystem by focusing on partnership, collaboration, and acquisition to achieve competitive advantage.

Security Screening Market Segmentation

Security Screening Market Share

Biometrics segment to hold the largest share of market during the forecast period

Biometric systems for security screening have emerged as powerful tools for verifying and authenticating individuals’ identities, enhancing security protocols across various sectors. These systems utilize unique physical or behavioral characteristics, such as facial features, fingerprints, or iris patterns, to accurately identify individuals. One of the key factors driving the adoption of biometric systems is technological advancements, which have led to the development of more sophisticated algorithms and sensors, enabling biometric systems to achieve higher accuracy, reliability, and speed in identity verification. This progress has made biometric systems increasingly viable for use in security screening applications, ranging from access control at airports and government buildings to time and attendance tracking in workplaces.

Baggage & Cargo Screening segment to display highest CAGR during forecast period

The delivery of mail and parcels is witnessing a boom, especially due to the extensive growth of the e-commerce industry. With many parcels and small packages moving around owing to the rise in e-commerce sales, parcel screening has become critical. While convenient for consumers and companies, the huge flow of post and package deliveries to homes and businesses represents a growing security vulnerability. This vulnerability demands the screening of mail and parcels and, hence, could create a huge demand for security screening systems and solutions.

Retail Stores & Malls segment to grow at the second highest CAGR during the forecast period

Retail stores & shopping malls have a large footfall, are open to the public, and have multiple entry and exit gates. Due to these factors, they are vulnerable to security threats. Criminals can use large boxes to conceal the bombs or any other weapon to harm people. Malls and retail stores have always been soft targets for terrorists. Automatic weapons, car bombs, and biological, chemical, and radioactive agents are among the types of weapons used to target crowds at malls and retail stores. Malls and large organized retail outlets hire private security agencies to screen people entering the establishment to prevent attacks or illegal activities. Advanced security screening systems are used in retail stores and malls; for instance, metal detectors are used for people screening, and X-ray screening systems are deployed for baggage screening.

With the rising concerns over terrorism, theft, and violence, retailers and mall operators have increasingly invested in robust security measures to protect customers, employees, and assets. As a result, the demand for advanced security screening technologies has surged.

Security Screening Market Regional Analysis

Asia Pacific to grow at the fastest CAGR during the forecast period.

Asia Pacific is one of the world’s emerging markets, with many social gatherings, tourism activities, events, and sports, which result in the gathering and movement of huge crows. Thus, the scope of growth for the security screening market is high in the region. This region mainly consists of India, China, Japan, and South Korea. Other countries, such as includes Singapore, Australia, the Philippines, and Thailand, are covered under the Rest of Asia Pacific. The frequency of public events where people gather in huge numbers is higher in Asia Pacific than in other regions.

The security screening market is experiencing growth driven by several factors, including the rise in air traffic, investments in new airport construction, and the imperative to enhance airport security measures. The Asia-Pacific region particularly sees a surge in air travel due to factors like affordable airfares, increasing business and leisure travel, rising living standards, and the expanding middle-class population. This uptick in air travel necessitates more efficient airport baggage-handling systems, driving the demand for advanced technologies in this sector. Furthermore, the ongoing construction of new airports and expansion projects for existing terminals present additional opportunities for manufacturers of airport baggage handling systems to capitalize on during the forecast period.

Security Screening Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Security Screening Companies - Key Market Players:

The security screening companies is dominated by globally established players such as

- OSI Systems, Inc. (US),

- Smiths Detection Group Ltd. (UK),

- Leidos (US), Thales (France),

- NEC Corporation (Japan),

- Teledyne Technologies Incorporated. (US),

- Bruker (US),

- Analogic Corporation (US),

- Astrophysics Inc. (US),

- LINEV Group UK),

- Nuctech (China),

- 3DX-RAY (UK),

- Metrasens (England),

- Gilardoni S.p.A. (Italy),

- Westminster Group Plc (England),

- Garrett Metal Detectors (US),

- Autoclear (US),

- Vidisco Ltd. (Israel),

- Neurotechnology (Lithuania),

- DERMALOG Identification Systems GmbH (Germany),

- Daon (US), C.E.I.A. S.p.A. (Italy),

- Aware Inc. (US),

- Scanna (UK), and

- Precise Biometrics (Sweden). These players have adopted product launches/developments, contracts, collaborations, agreements, and acquisitions for growth in the market.

Security Screening Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size |

USD 9.4 billion in 2024

|

| Projected Market Size | USD 13.2 billion by 2029 |

| Growth Rate | CAGR of 7.1% |

|

Market size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value and Volume (USD Million/Billion) |

|

Segments Covered |

|

|

Region covered |

|

|

Companies covered |

The key players in the security screening market are OSI Systems, Inc. (US), Smiths Detection Group Ltd. (UK), Leidos (US), Thales (France), NEC Corporation (Japan), Teledyne Technologies Incorporated. (US), Bruker (US), Analogic Corporation (US), Astrophysics Inc. (US), LINEV Group UK), Nuctech (China), 3DX-RAY (UK), Metrasens (England), Gilardoni S.p.A. (Italy), Westminster Group (England), Garrett Metal Detectors (US), Autoclear (US), Vidisco Ltd. (Israel), Neurotechnology (Lithuania), DERMALOG Identification Systems GmbH (Germany), Daon (US), C.E.I.A. S.p.A. (Italy), Aware Inc. (US), Scanna (UK), and Precise Biometrics (Sweden). |

Security Screening Market Highlights

The study categorizes the security screening market based on Technology, Application, End Use, and Region

|

Segment |

Subsegment |

|

By Technology: |

|

|

By Application: |

|

|

By End Use: |

|

|

By Region: |

|

Recent Developments in Security Screening Industry :

- In January 2024, OSI Systems, Inc.(US) received a USD 4 million contract from a leading global air cargo logistics provider for advanced security inspection systems. The order includes the Rapiscan RTT110 CT-based explosive detection system, the Rapiscan Orion 927DX and 935DX for large package screening, and the Rapiscan Orion 920CX for small parcel screening.

- In November 2023, Mastercard (US), a payment technology corporation, partnered with NEC Corporation (Japan) to increase the adoption of facial recognition technology for in-store payments in Asia Pacific.

- In July 2023, Leidos (US) annouched to establish a new security system manufacturing facility in North Charleston, South Carolina. With a USD 31.7 million investment, the facility will create up to 170 new jobs and focus on producing security systems for Leidos’ Security Enterprise Solutions (SES) operations.

Frequently Asked Questions(FAQs):

Which are the major companies in the security screening market? What are their major strategies to strengthen their market presence?

OSI Systems, Inc. (US), Smiths Detection Group Ltd. (UK), Leidos (US), Thales (France), and NEC Corporation (Japan) are some of the major companies operating in the security screening market. Partnerships, and acquisitions were the key strategies these companies adopted to strengthen their security screening market presence.

What are the drivers for the security screening market?

Drivers for the security screening market are:

- Rising investment in advanced security screening technologies to enhance travel experience

- Growing concern about terrorism and illegal immigration

- Increasing emphasis on modern security solutions to curb radiological attacks

- Surging adoption of trace detectors to combat drug trafficking

- Rising popularity of biometric security systems

What are the challenges in the security screening market?

Legal consequences due to false positives in security screening, and enforcement of stringent data protection standards are among the challenges faced by the security screening market.

What are the technological trends in the security screening market?

Credential Authentication Technology (CAT), biometrics and touchless technologies are a few of the key technology trends in the security screening market.

What is the total CAGR expected to be recorded for the security screening market from 2024 to 2029?

The CAGR is expected to record a CAGR of 7.1% from 2024-2029.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

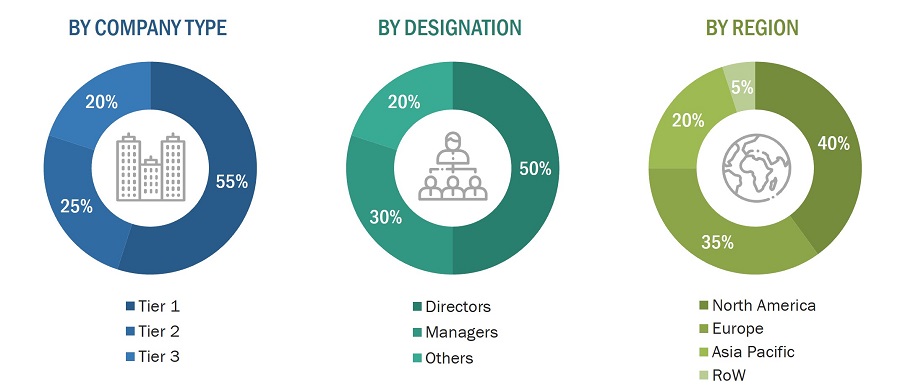

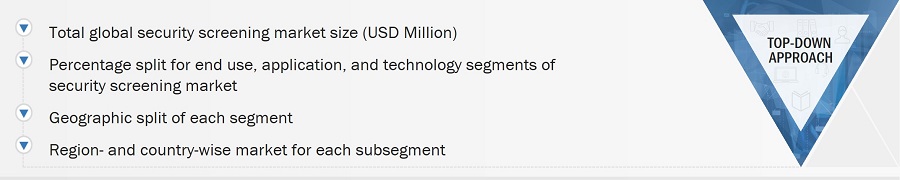

The study involved four major activities in estimating the size of the security screening market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

Various secondary sources were used to identify and collect relevant information. These include corporate filings such as annual reports, press releases, investor presentations, and financial statements; trade, business, and professional associations; white papers, journals, and articles from recognized authors; certified publications related to security screening; directories; and databases.

Secondary research was conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of key players, the segmentation of the market according to industry trends to the bottommost level, geographic markets, and key developments from the market-oriented perspective. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources, from both supply and demand sides, were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included experts such as chief executive officers (CEOs), vice presidents, marketing directors, technology and innovation directors, SMEs, consultants, and related key executives from the major companies and organizations operating in the security screening market.

After the complete market engineering process (which includes market statistics calculations, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical market numbers.

Several primary interviews were conducted with experts from both the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. Approximately 25% of the primary interviews were conducted with demand respondents and 75% with supply respondents. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

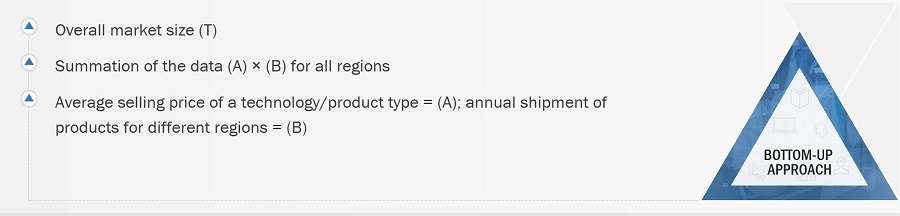

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the security screening market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying the number of players in the security screening market offering products such as X-ray scanners, electromagnetic metal detectors, biometric systems, spectrometry and spectroscopy, and others

- Identifying the annual shipment of X-ray systems, biometric systems, electromagnetic metal detectors, spectrometry and spectroscopy solutions, and other security screening products

- Identifying the average price of the abovementioned products for different companies

- Identifying various current end uses of security screening solutions

- Analyzing each end use segment and application, along with the related major companies in the market

- Understanding the demand generated by different end use for various applications

- Tracking the ongoing and upcoming installation of security screening systems across end use segments, and forecasting the market based on these developments and other parameters

- Conducting multiple discussions with primary respondents to understand the types of OEMs, resellers, manufacturers, and assembling units developed for end use segments; the discussions help analyze the breakdown of the scope of work carried out by each major company in the market

- Arriving at the market estimates through country-wise analysis of security screening companies; thereafter, combining country-wise data to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level via discussions with key opinion leaders, including CXOs, directors, and operation managers, and, finally, with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases, for this process

Market Size Estimation Methodology-Bottom-Up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. Where applicable, data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides.

Market Definition

Security screening involves scanning individuals, luggage, cargo, and vehicles using X-ray imaging systems, electromagnetic detectors, biometric systems, and spectrometers to ensure security at airports, government offices, prisons, border checkpoints, educational institutes, and several other establishments. Security screening safeguards individuals, assets, and infrastructure from illicit activities, such as smuggling of weapons, explosives, drugs, and other prohibited items, as well as the infiltration of unauthorized personnel into secure locations.

Stakeholders

- Suppliers of raw materials and manufacturing equipment

- Vendors of semiconductor wafers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM) and OEM solutions providers

- Government and financial institutions

- Distributors and retailers

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors

- End users (airport authorities, railway station authorities, private and government offices, educational institutions, and sports stadiums)

Research Objectives

- To define and forecast the security screening market based on technology, end use, application, and region in terms of value and volume

- To forecast the market size, in terms of value, for various segments with respect to four main regions: North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies2

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges, value chain, ecosystem, patents, case studies, trade, regulatory landscape, investment, and funding data influencing the market growth

- To analyze the growth strategies such as partnerships, collaborations, product launches, acquisitions, expansions, and contracts adopted by the major market players

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Security Screening Market