Security Cameras Market (IR Illuminator) by System (Analog, IP Based), Resolution (NON HD, HD, Full HD), Type (Indoor, Outdoor), Feature (PTZ, Fixed), Application (City Infrastructure, Commercial, Institutional) and Geography - Global Forecast to 2020

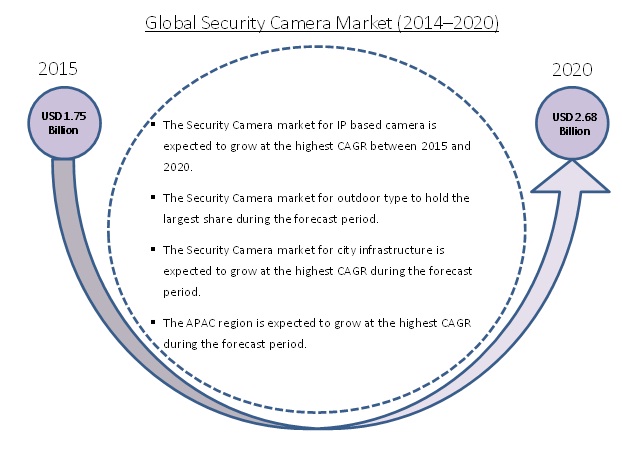

The global security cameras market was valued at USD 1.75 billion in 2015 and is estimated to reach USD 2.68 billion by 2020, at a CAGR of 8.8% during the forecast period.

Increased Government spending on security systems to fuel security camera market growth

Government is increasing spending capacity over public spaces and facilities, as a crime prevention measure. It will surge the demand for cameras. Increasing number of security breaches is also driving the Government for investment in video surveillance system. Recently, Guangdong Province, China Govt. has installed 1.1 million cameras and is expected to install 2 million more by 2015.

Market Dynamics

Drivers

- Developing countries are main attraction for security market.

- Increased Government spending on security systems

- Reduction in ASP for IP based cameras

- Acceptance of IR illumination for better vision in major consumer applications, especially in retail sector

Restraints

- Difficult configuration system of IP based cameras

- Rise in number of inferior quality products by local players

Opportunities

- HD resolution imaging

- Cloud based analytic services

The objectives of the study are as follows:

- To study security cameras with IR illuminator market -statistics with detailed classification and splits by market size

- To analyze the market structure by identifying various sub-segments that include system technology, types of camera, resolution types , and applications

- To determine and forecast the global revenue of security cameras with IR illuminator with respect to Americas, Europe, APAC, and Rest of the World

- To weigh the impact analysis of the market dynamics with factors that currently drive and restrain the growth of the security cameras market, their impact in the short, medium, and long term landscapes, along with trends of the market

- To identify opportunities in the security cameras with IR illuminator market

- To estimate the future of security cameras with IR illuminator market with respect to various sectors, from both-technical and market-oriented perspectives

- To study the competitive intelligence from the company profiles, developments, upcoming trends & technologies, revenue growth strategies, and industry activities

- To analyze key players in the market, which include an analysis of key developments and product portfolio

The base year used for this study is 2014, and the forecast period considered is 2015–2020.

Research Methodology

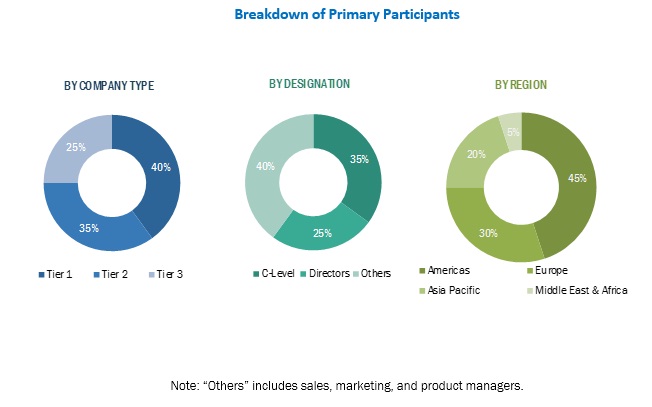

The research methodology used to estimate and forecast the security camera market begins with obtaining data through secondary research from secondary sources such as encyclopedia, directories, and databases such as OneSource and Factiva, and white papers of leading players in the security cameras market. The bottom-up procedure has been employed to arrive at the overall size of the security camera market from the revenues of key players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have been verified through primary research by conducting extensive interviews with officials such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall security cameras market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primaries has been depicted in the following figure.

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in the security cameras market are Arecont Vision LLC (US), Avigilon Corporation (Canada), Axis Communications (Sweden), Bosch Security Systems (Germany), Canon Inc. (Japan), Cisco Systems Inc. (US), Dahua Technology (China), Hikvision Digital Technology Co. Ltd. (China), Honeywell International Inc. (US), JVCKENWOOD (Japan), Mitsubishi Electric (Japan), Panasonic Corporation (Japan), Samsung Techwin (South Korea), Schneider Electric (France), Sony Electronics Inc. (Japan), Tyco International (Ireland), Vicon Industries Inc. (US).

Key questions

- Most of the suppliers have adopted product launch & development and collaboration & agreement as key strategies, as could be seen from recent developments. Where will it take the industry in the mid to long term?

- Which are the key players in the market, and how intense is the competition?

Target Audience

- Raw material vendors

- Original Device Manufacturers (ODMs) (Image Sensor Manufacturers)

- Original Equipment Manufacturers (OEMs)–PCB, Camera Module makers

- Assembly, testing, and packaging vendors

- Video surveillance solution providers

- Sensors chip traders and distributors

- Sensors module, electronic instrument, equipment, and system-traders & distributors

- Research organizations

This study answers several questions for stakeholders, primarily regarding the market segments to focus on in the next 2–5 years for prioritizing efforts and investments.

Report Scope

This research report categorizes the overall security camera market based on system, application, feature, camera resolution, type, and geography.

Security Cameras Market, by System

- Analog based

- IP based

Security Cameras Market, by Application

- Border security

- City Infrastructure

- Commercial

- Institutional

- Industrial

- Residential

Security Cameras Market, by Feature

- PTZ

- Fixed

- Other

Security Cameras Market, by Camera Resolution

- Non HD Resolution

- HD Resolution

- Full HD Resolution

- UHD Resolution

Security Cameras Market, by Type

- Indoor

- Outdoor

Security Cameras Market, by Region

- Americas

- Europe

- Asia Pacific (APAC)

- Middle East & Africa

The security cameras market is expected to reach USD 2.68 billion by 2020 from USD 1.75 billion in 2015, at a CAGR of 8.8% from 2015 to 2020. Developing countries are main attraction for the security market, increased government spending on security systems, reduction in ASP for IP based cameras and acceptance of IR illumination for better vision in major consumer applications,

especially in retail sector are few of the factors driving the growth of security cameras market. Investment in infrastructure projects in private and public sector leads to increasing need of surveillance system in the APAc as well as MENA region. For instance, L&T Company had received a contract for the installation of 6,000 CCTV cameras in 2016 in Greater Mumbai, India.

In this report, the security cameras market has been segmented based on system, application, feature, camera resolution, type, and geography. The outdoor camera is expected to grow at the highest CAGR during forecast period. Due to availability of advanced technology at low cost and entry of many manufacturers, the bargaining power of customers has increased. This has increased the market of outdoor network surveillance cameras around the world in the coming years.

The market for fixed cameras to hold the largest share during the forecast period. Fixed cameras are used in the applications where continuous monitoring is required. It is less expensive as compared to other types of cameras. The application of the fixed cameras extends city infrastructure surveillance, construction site and process monitoring, surveillance at ATM center, indoor Retail surveillance and in business organizations.

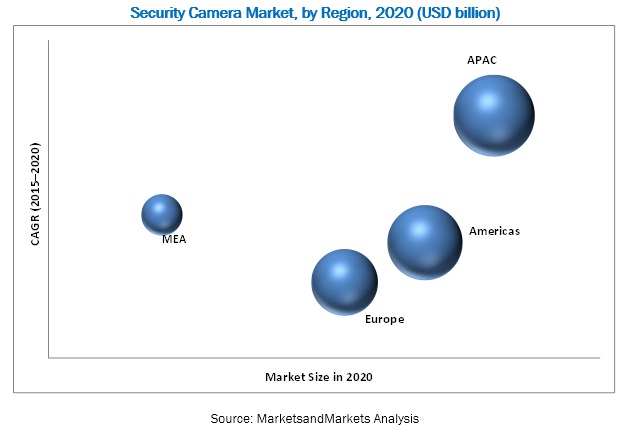

By region, the security cameras market has been segmented into North America, Europe, APAC, and RoW. APAC is expected to account for the largest size of the overall security camera market during the forecast period. Asia Pacific is the largest manufacturer and consumer of surveillance cameras with IR illuminators. The competitive market in the region is the main reason for lower ASP of the products. The lower price product with high technologies like HD videos and PTZ features has created the trend of installing the video surveillance cameras in domestic applications.

City Infrastructure

The surveillance camera with IR illuminator market for City infrastructure has the highest market share for the application of the products. Due to increasing installation of camera for surveillance of highways, railways, airways, public stadium, parks, energy supply infrastructure is expected to increase the market of security camera in the coming years.

Commercial

The Players in retail sector like Walmart stores, Tesco, Metro Group, Kroger, Schwarz Group and Safeway are expanding their business across world. The increasing investment has supplemented the installation of surveillance camera for security and safety of the shops and products.

Critical questions that the report answers:

- Where will all these developments take the industry in the mid to long term?

- Will the suppliers continue to explore new avenues for security market?

- What are the upcoming industrial applications for security market?

There is no standard regulation on video surveillance system market and products are available on cheapest prices. Indian security market majorly has inferior quality products from Taiwan, China and South East Asia. Due to which rise in number of inferior quality products by local players is hindrance to the growth of security camera.

The key players operating in the security cameras market are Arecont Vision LLC (US), Avigilon Corporation (Canada), Axis Communications (Sweden), Bosch Security Systems (Germany), Canon Inc. (Japan), Cisco Systems Inc. (US), Dahua Technology (China), Hikvision Digital Technology Co. Ltd. (China), Honeywell International Inc. (US), JVCKENWOOD (Japan), Mitsubishi Electric (Japan), Panasonic Corporation (Japan), Samsung Techwin (South Korea), Schneider Electric (France), Sony Electronics Inc. (Japan), Tyco International (Ireland), Vicon Industries Inc. (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of Study

1.2 Market Definition and Scope

1.2.1 Company Profiles and Market Share

1.2.2 Market, By Systems

1.2.3 Market, By Resolution

1.2.4 Market, By Geography

1.2.5 Market, By Feature

1.2.6 Market, By Types

1.2.7 Market, By Application

1.3 Market Covered

1.4 Stakeholders

1.5 Currency & Years Considered for Study

2 Research Methodology

2.1 Security Cameras Market Size Estimation

2.2 Market Crackdown & Data Triangulations

2.3 Demand and Supply Side Analysis

2.4 Bottom Up and Top Down Factors Considered for Study

2.5 Market Share Estimation

2.6 Report Assumptions

2.6.1 General Assumptions

2.6.2 Year-Wise & Forecast Assumptions

3 Premium Insights

3.1 Key Industry Trends

3.2 Evolution of Surveillance Camera With IR Illuminator

3.3 Security Camera With IR Illuminator: Market Snapshot

4 Market Overview

4.1 Introduction

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

5 Industry Trends

5.1 Value Chain Analysis

5.2 Market Entry Options in Developing Countries

5.3 Distribution Process

5.4 Business Model

5.5 Segment Wise Purchase Profile

5.6 Trends in IR Illuminator Camera

6 Security Cameras Market, By System

6.1 Introduction

6.2 Analog System

6.3 IP Based System

6.4 Region Wise Market for Analog and IP Based Systems

7 Security Cameras Market, By Resolution

7.1 Market Overview

7.2 Expected Growth Opportunities

7.3 Camera Resolution, By Application

7.3.1 Non HD

7.3.2 HD

7.3.3 Full HD

7.3.4 Ultra HD

8 Security Cameras Market, By Type

8.1 Market Overview

8.2 Indoor

8.3 Outdoor

9 Market, By Features

9.1 Introduction

9.2 Application Impact Analysis

9.3 Camera Feature, By Application

9.3.1 PTZ

9.3.2 Fixed

9.3.3 Others

10 Market, By Applications

10.1 Introduction

10.2 Market Overview

10.3 City Infrastructure

10.4 Commercial

10.5 Institutional

11 Market, By Geography

11.1 Introduction

11.2 Americas

11.3 Europe

11.4 APAC

11.5 MEA

12 Competitive Landscape

12.1 Introduction

12.2 Company Product Matrix

12.3 New Product Developments

12.4 Agreements, Partnerships, Joint Ventures and Collaborations

12.5 Acquisitions

12.6 Contracts

12.7 Expansions

12.8 Awards & Recognitions

12.9 MnM View

13 Company Profiles

13.1 Arecont Vision LLC

13.2 Avigilon Corporation

13.3 Axis Communication

13.4 Bosch Security Systems

13.5 Canon Inc.

13.6 Cisco System Inc.

13.7 Dahua Technology

13.8 Hikvision Digital Technology Co. Ltd.

13.9 Honeywell International Inc.

13.10 Jvckenwood

13.11 Mitsubishi Electric

13.12 Panasonic Corporation

13.13 Samsung Techwin

13.14 Schneider Electric

13.15 Sony Electronics Inc.

13.16 Tyco International

13.17 Vicon Industries Inc.

List of Tables (20 Tables)

Table 1 Key Data Taken From Secondary Sources

Table 2 Key Data Taken From Primary Sources

Table 3 General Assumptions

Table 4 Year-Wise & Forecast Assumptions

Table 5 Year-Wise & Forecast Assumptions

Table 6 Market Size for 2015 ($Million)

Table 7 Impact Analysis of Drivers

Table 8 Impact Analysis of Restraints

Table 9 Impact Analysis of Opportunities

Table 10 Business Model

Table 11 Segment Wise Purchase Profile

Table 12 Trends in Security Cameras With IR Illuminator

Table 13 Application Market By Geography

Table 14 Key Players Product Mapping

Table 15 New Product Development

Table 16 Agreement, Partnership, Joint Venture and Collaboration

Table 17 Contracts

Table 18 Expansion

Table 19 Awards & Recognition

Table 20 MnM View for Companies

List of Figures (45 Figures)

Figure 1 Influencing Factors and Market Data Estimation for Security Cameras Market (IR Illuminator)

Figure 2 Demand and Supply Infor Graph

Figure 3 Security Cameras Market Snapshot Info Graph

Figure 4 Drivers, Restraints, and Opportunity

Figure 5 Value Chain Analysis

Figure 6 Market Entry Analysis

Figure 7 Distribution Process

Figure 8 Market By System (Size and Volume)

Figure 9 Market By Region for Analog and IP Systems

Figure 10 Market By Resolution (Size and Volume)

Figure 11 Growth Opportunity Analysis By Applications

Figure 12 Market Size By Application (For Non HD, HD 720p, Full HD 1080p, and Ultra HD)

Figure 13 Market Size By Type

Figure 14 Indoor Market Size By System

Figure 15 Outdoor Market Size By System

Figure 16 Market Size By Feature

Figure 17 Application Impact Analysis

Figure 18 Camera Feature Market By Application

Figure 19 Bubble Graph for Application Market

Figure 20 Application Market (Size and Volume)

Figure 21 City Infrastructure Market

Figure 22 Commercial Application Market

Figure 23 Institutional Application Market

Figure 24 Security Cameras With IR Illuminator Market By Geography

Figure 25 Security Cameras With IR Illuminator Market for Americas

Figure 26 Security Cameras With IR Illuminator Market for Europe

Figure 27 Security Cameras With IR Illuminator Market for APAC

Figure 28 Security Cameras With IR Illuminator Market for MEA

Figure 29 Arecont Vision LLC: Company Snapshot

Figure 30 Avigilon Corporation: Company Snapshot

Figure 31 Axis Communication: Company Snapshot

Figure 32 Bosch Security Systems: Company Snapshot

Figure 33 Canon Inc.: Company Snapshot

Figure 34 Cisco System Inc.: Company Snapshot

Figure 35 Dahua Technology Co. Ltd.: Company Snapshot

Figure 36 Hikvision Digital Technology Co., Ltd.: Company Snapshot

Figure 37 Honeywell International Inc.: Company Snapshot

Figure 38 Jvckenwood Corporation: Company Snapshot

Figure 39 Mitsubishi Electric Corporation: Company Snapshot

Figure 40 Panasonic Corporation: Company Snapshot

Figure 41 Samsung Techwin Co. Ltd.: Company Snapshot

Figure 42 Schneider Electric: Company Snapshot

Figure 43 Sony Corporation: Company Snapshot

Figure 44 Tyco International: Company Snapshot

Figure 45 Vicon Industries Inc.: Company Snapshot

Growth opportunities and latent adjacency in Security Cameras Market