Revenue Cycle Management Market by Product & Services (Eligibility Verification, Clinical Coding, CDI Solutions, Claims Processing, Denial Management, Outsourcing Services), Delivery (Cloud), End Users (Payers, Hospitals) & Region - Global Forecast to 2028

Market Growth Outlook Summary

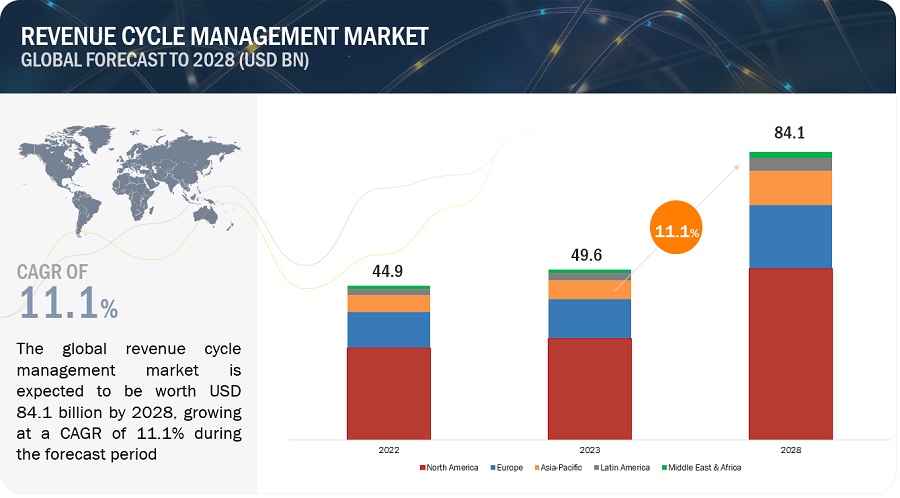

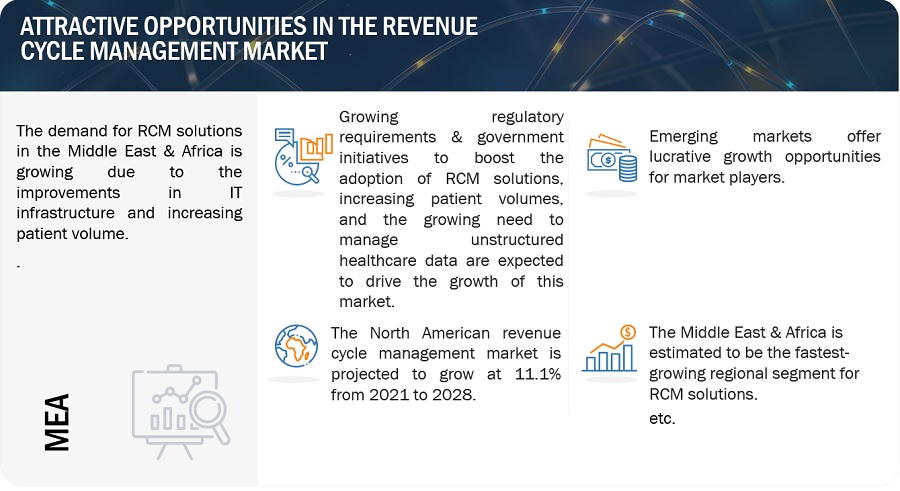

The global revenue cycle management market growth forecasted to transform from USD 49.6 billion in 2023 to USD 84.1 billion by 2028, driven by a CAGR of 11.1%. The growth of this market is majorly attributed to the growing regulatory requirements & government initiatives to boost the adoption of RCM solutions, increasing patient volumes, and the growing need to manage unstructured healthcare data. However, the deployment of RCM software and the associated infrastructure requires significant investments, owing to which the adoption of RCM is low among small healthcare organizations. This, along with a dearth of skilled personnel, is expected to challenge market growth in the coming years.

Revenue Cycle Management Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Revenue cycle management Market Dynamics

Driver: Growing need to manage unstructured healthcare data

In the last few years, the volume of electronic data produced in the healthcare industry, primarily due to rising patient volumes and the digitization of administrative, clinical, and financial information, has expanded to terabytes and petabytes. This generates an imperative need to use revenue cycle management solutions. According to industry experts, by using natural language processing (NLP) and optical character recognition (OCR) technology, organizations can transform unstructured data from files, such as medical records, scanned documents, and audio recordings, into structured and normalized data. Other significant factors contributing to this trend are the sheer diversity of data in healthcare and the rising prominence and usage of HCIT tools.

Restraint: Deployment costs include licensing and subscription costs, hardware infrastructure, customization costs, and implementation services cost.

Cost of licensing and implementation is substantially high. Moreover, the price associated with maintaining revenue cycle management software has also significantly increased. Furthermore, IT support and maintenance services, including modifying and upgrading software per changing user requirements and maintaining an efficient IT infrastructure, represent a recurring expenditure. This accounts for a large share of the total cost of ownership. Also, post-sale custom interface development for device integration requires additional verification and validation to ensure solution accuracy and completeness. In 2021, many healthcare providers and their revenue cycle management (RCM) departments faced challenges. Operational costs outpaced revenue growth leading to months and quarters in the red. At the end of 2022, the American Hospital Association anticipated that between 53% and 68% of hospitals would be in deficit, compared to 34% in 2019. This further increases the total cost of ownership for healthcare providers. As a result of the high costs involved, small healthcare facilities, especially in emerging countries, are reluctant to replace their legacy systems with RCM solutions.

Opportunity: Growing demand for AI & cloud-based deployment

The combination of data and artificial intelligence (AI) has the potential to improve outcomes and reduce costs by applying machine learning algorithms and predictive analytics to reduce drug discovery times, provide virtual assistance to patients, and reduce the diagnosing time for ailments by processing medical images. The adoption of AI in healthcare is rising due to its ability to optimize clinical as well as non-clinical processes, thereby solving a variety of problems for patients, providers, and the overall healthcare industry. According to MarketsandMarkets estimates, AI in Healthcare market is predicted to grow at a double-digit rate. AI has experienced high demand for RCM solutions to overcome the load on human resources. Manual and redundant tasks that occur during patient access, coding, billing, collections, and denials can be automated with the help of AI. AI integrated with RCM can perform these functions more accurately by imitating intelligent human behavior through algorithms that find patterns and plan future actions to produce a positive outcome.

Challenge: Issues related to data security and confidentiality

The increased use of automated technologies such as EHRs, healthcare integration, and health information exchanges have helped expand the healthcare privacy and security landscape. Electronic patient data exchange offers greater reach and efficiency in healthcare delivery but has high-security risks due to the broader access. The Anthem Inc. Data breach, Ransomware attack, and Accellion FTA Hack have been the most significant cyberattacks in recent years, jeopardizing USD 47.76 million patient records altogether, causing USD 81.5 million loss. Concerns over the security of proprietary data and applications form a significant challenge to the growth of the market.

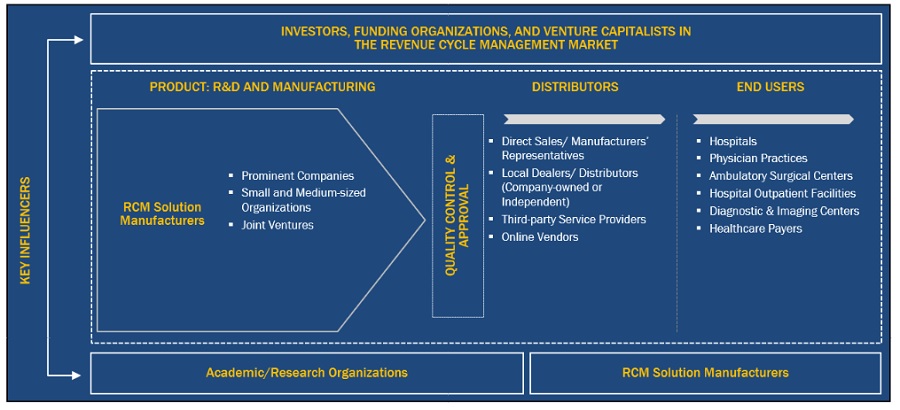

Revenue Cycle Management Market Ecosystem

The aspects present in this market are included in the ecosystem market map of the overall revenue cycle management market, and each element is defined with a list of the organizations involved. Products and services are included. The manufacturers of various products include the organizations involved in the entire process of research, product development, optimization, and launch. Vendors provide the services to end users either directly or through a collaboration with a third party.

In-house research facilities, contract research organizations, and contract development and manufacturing companies are all part of research and product development and are essential for outsourcing product development services.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

By product & services segment, the outsourcing services segment of revenue cycle management industry is expected to grow at the highest growth rate during the forecast period

The outsourcing services segment of revenue cycle management market is expected to grow at the highest CAGR during the forecast period among the product & services. RCM services are outsourced to improve financial performance, navigate complex regulatory landscapes, access specialized expertise, leverage advanced technology, and focus on core healthcare operations. Outsourcing RCM allows organizations to optimize revenue cycles, enhance financial outcomes, and streamline processes in a rapidly changing healthcare environment. Therefore, due to the above-mentioned benefits, the segment is predicted to have a significant growth rate.

The on-premise segment is expected to account for the largest revenue cycle management industry share by delivery mode.

The on-premise segment accounted for the largest share of the revenue cycle management market in 2022. On-premise RCM software provides organizations with greater customization and flexibility. Since the software is deployed locally, it can be tailored to specific workflows, processes, and reporting requirements. This allows organizations to align the RCM software more closely with their unique needs, providing a more personalized and efficient solution thereby, elevating the segment share.

By end user, the healthcare providers segment is expected to account for the largest revenue cycle management industry share.

Healthcare payers and providers are the two segments of the global revenue cycle management market based on end users. The healthcare providers segment accounted for the largest market share 2022. The significant market share of this sector can be ascribed to the effective RCM processes and technologies that provide healthcare providers with improved financial performance, streamlined workflows, enhanced compliance, and a better overall patient experience. By leveraging RCM solutions, healthcare organizations can optimize revenue cycles, increase efficiency, and allocate resources more effectively to deliver high-quality patient care. The aforementioned factors have positively impacted segmental growth.

To know about the assumptions considered for the study, download the pdf brochure

During the forecast period, the Asia Pacific region had a substantial growth rate in the revenue cycle management market. The regional growth can be attributed to the rising penetration of digital healthcare technologies along with improving infrastructure. Moreover, medical tourism is increasing especially in the South East Countries that has further elevated the regional market growth to a certain extent.

The major players in the global revenue cycle management market are R1 RCM (US), Oracle (US), Optum (US). Other prominent players in the market include AdvantEdge Healthcare (US), McKesson Corporation (US), Change Healthcare (US), 3M (US), Experian plc (Ireland), Conifer Health Solutions (US), Veradigm (US), GE Healthcare (US), Cognizant (US), athenahealth (US), SSI Group LLC (US), and Huron Consulting Group (US).

Revenue Cycle Management Market Report Scope

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$49.6 billion |

|

Projected Revenue Size by 2028 |

$84.1 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 11.1% |

|

Market Driver |

Technological advancements and increasing R&D investments |

|

Market Opportunity |

Improvisation of healthcare infrastructure across emerging countries |

The research report categorizes the revenue cycle management market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Services

-

Solutions

-

Patient Access Solutions

- Eligibility Verification Solutions

- Pre-certification & Authorization Solutions

- Other Patient Access Solutions

-

Mid-Revenue cycle Solutions

- Clinical Coding Solutions

- Clinical Documentation Improvement Solutions

- Other Mid-revenue cycle Solutions

-

Back-end Revenue cycle Solutions

- Claims Processing Solutions

- Denial Management Solutions

- Other Back-end Revenue cycle Solutions

-

Outsourcing Services

- Patient Access Outsourcing Services

- Mid-revenue cycle Outsourcing Services

- Back-end Revenue cycle Outsourcing Services

-

Patient Access Solutions

By Delivery Mode

- On-premise Solutions

- Cloud-based Solutions

By End User

-

Healthcare Providers

-

Inpatient Facilities

- Hospitals

- Others

-

Outpatient Facilities

- Physicians Practices

- Ambulatory Surgical Centers (ASCs)

- Hospital Outpatient Facilities

- Diagnostic & Imaging Centers

- Other Outpatient Facilities

-

Inpatient Facilities

- Healthcare Payers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East and Africa

Recent Developments of Revenue Cycle Management Market

- In 2023, Optum partnered with Owensboro Health to manage revenue cycle and information technology and improve patient outcomes and safety.

- In 2022, the R1 RCM announced 10-year end-to-end RCM partnerships with Scion Health, Sutter Health, and St. Clair Health to streamline workflow standardization and improve patient access platforms.

- In 2022, McKesson signed a definitive agreement to acquire Rx Savings Solutions to offer medication therapy more affordable and increase medication adherence to improve outcomes.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global revenue cycle management market between 2023 and 2028?

The global revenue cycle management market is expected to grow from USD 49.6 billion in 2023 to USD 84.1 billion by 2028, at a CAGR of 11.1%, driven by the shift towards patient-centric RCM solutions and increasing patient volumes.

What are the key factors driving the revenue cycle management market?

The major factors driving the RCM market include the growing need to manage unstructured healthcare data, regulatory requirements, government initiatives to promote RCM solutions, and the increasing demand for patient-centric services.

What are the main challenges facing the revenue cycle management market?

Challenges in the RCM market include high deployment costs, which encompass licensing, infrastructure, and ongoing maintenance, as well as issues related to data security and confidentiality.

Which regions are expected to show growth in the revenue cycle management market?

The Asia Pacific region is anticipated to experience substantial growth in the RCM market due to increased adoption of digital healthcare technologies, improving healthcare infrastructure, and rising medical tourism.

What products and services are included in revenue cycle management?

Key products in revenue cycle management include patient access solutions, mid-revenue cycle solutions, back-end revenue cycle solutions, and outsourcing services tailored to enhance financial performance and streamline processes.

How is the rise of artificial intelligence affecting the revenue cycle management market?

The integration of AI in RCM is enhancing the efficiency of clinical and non-clinical processes, reducing manual tasks, and improving financial outcomes by automating billing, collections, and coding functions.

What recent developments are shaping the revenue cycle management market?

Recent developments include partnerships like Optum with Owensboro Health for RCM management, and acquisitions such as McKesson's purchase of Rx Savings Solutions to improve patient outcomes and reduce costs.

How are healthcare providers impacted by revenue cycle management solutions?

Healthcare providers benefit from RCM solutions through improved financial performance, streamlined workflows, enhanced compliance, and better overall patient experience, ultimately optimizing their revenue cycles.

What role does data security play in the revenue cycle management market?

Data security is a critical concern in the RCM market due to the increased risk of cyberattacks and breaches, which threaten patient confidentiality and pose significant financial risks to healthcare organizations.

What is the future outlook for the revenue cycle management market?

The future outlook for the RCM market appears strong, with anticipated growth driven by ongoing technological advancements, increasing demand for AI integration, and the push for improved healthcare delivery and financial outcomes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing regulatory requirements and government initiatives- Increasing patient volume and subsequent growth in health insurance- Loss of revenue due to billing errors and declining reimbursements- Growing need to manage unstructured healthcare data- Rising demand for robust process improvements in healthcare sectorRESTRAINTS- High deployment costs- IT infrastructural constraints in emerging economiesOPPORTUNITIES- Increasing outsourcing services in emerging economies- Growing demand for AI and cloud-based deploymentCHALLENGES- Issues related to data security and confidentiality- Reluctance to switch from conventional methods

- 6.1 GREATER FOCUS ON PATIENT FINANCIAL EXPERIENCE

- 6.2 USE OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 6.3 PIVOTAL ROLE OF DATA ANALYSIS IN MANAGING HEALTHCARE REVENUE CYCLES

-

6.4 INCREASING NUMBER OF PARTNERSHIPS AND COLLABORATIONS TO DRIVE INNOVATIONTECHNOLOGY ANALYSIS

-

6.5 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

6.6 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7 VALUE CHAIN ANALYSIS

-

6.8 ECOSYSTEM/MARKET MAP

-

6.9 PATENT ANALYSIS

- 6.10 ADJACENT MARKET ANALYSIS

- 6.11 CASE STUDY ANALYSIS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.13 KEY CONFERENCES AND EVENTS IN 2023–2024

- 6.14 PRICING ANALYSIS

-

6.15 TRENDS/DISRUPTIONS IMPACTING BUYERS

- 7.1 INTRODUCTION

-

7.2 SOLUTIONSPATIENT ACCESS SOLUTIONS- Eligibility verification solutions- Pre-certification & authorization solutions- Other patient access solutionsMID-REVENUE CYCLE SOLUTIONS- Clinical coding solutions- Clinical documentation improvement solutions- Other mid-revenue cycle solutionsBACK-END REVENUE CYCLE SOLUTIONS- Claims processing solutions- Denial management solutions- Other back-end revenue cycle solutions

-

7.3 OUTSOURCING SERVICESPATIENT ACCESS OUTSOURCING SERVICES- Patient access outsourcing services segment to account for largest share of outsourcing services marketMID-REVENUE CYCLE OUTSOURCING SERVICES- Increasing losses due to billing errors, scarcity of IT professionals, and infrastructure limitations to drive marketBACK-END REVENUE CYCLE OUTSOURCING SERVICES- Shortage of skilled HCIT professionals to drive market

- 8.1 INTRODUCTION

-

8.2 ON-PREMISES SOLUTIONSABILITY TO REUSE EXISTING SERVERS AND STORAGE HARDWARE TO DRIVE DEMAND FOR ON-PREMISES SOLUTIONS

-

8.3 CLOUD-BASED SOLUTIONSDEMAND FOR AFFORDABLE CLOUD-BASED REVENUE CYCLE MANAGEMENT SOLUTIONS FROM SMALL AND MEDIUM-SIZED HEALTHCARE FACILITIES TO DRIVE MARKET

- 9.1 INTRODUCTION

-

9.2 HEALTHCARE PROVIDERSINPATIENT FACILITIES- Hospitals- Other inpatient facilitiesOUTPATIENT FACILITIES- Physician practices- Ambulatory surgical centers (ASCs)- Hospital outpatient facilities- Diagnostic & imaging centers- Other outpatient facilities

-

9.3 HEALTHCARE PAYERSINCREASING PRODUCTIVITY AND PROFITABILITY OF CODING OPERATIONS TO DRIVE ADOPTION OF RCM SOLUTIONS BY HEALTHCARE PAYERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Growing focus of healthcare providers on improving care quality and reducing medical errors & healthcare expenses to drive marketCANADA- Need for healthcare cost containment and financial management of healthcare organizations to support market growth

-

10.3 EUROPEGERMANY- Increasing patient volume to boost adoption of RCM solutionsFRANCE- Government investments to increase demand for effective RCM solutionsUK- Growing patient pool to boost demand for RCM solutions & servicesITALY- Initiatives toward digitalizing patient records to drive marketSPAIN- IT infrastructural improvements to boost marketREST OF EUROPE

-

10.4 ASIA PACIFICJAPAN- Government mandates to boost adoption of RCM solutionsCHINA- Digitalization and improving infrastructure to support market growthINDIA- Growing patient pool to support market growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAHEALTHCARE INFRASTRUCTURAL DEVELOPMENTS TO SUPPORT MARKET GROWTH

-

10.6 MIDDLE EAST & AFRICAGOVERNMENT FUNDING & INITIATIVES TO SUPPORT MARKET GROWTH

- 11.1 OVERVIEW

- 11.2 MARKET RANKING ANALYSIS

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 REVENUE CYCLE MANAGEMENT MARKET: R&D EXPENDITURE

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 COMPANY EVALUATION MATRIX FOR START-UPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

-

11.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSOPTUM, INC.- Business overview- Products & Services offered- Recent developments- MnM viewR1 RCM, INC.- Business overview- Products & Services offered- Recent developments- MnM viewORACLE- Business overview- Products & Services offered- Recent developments- MnM viewCHANGE HEALTHCARE- Business overview- Products & Services offered- Recent developments- MnM viewMCKESSON CORPORATION- Business overview- Products & Services offered- Recent developments- MnM view3M- Business overview- Products & Services offered- Recent developmentsEXPERIAN PLC- Business overview- Products & Services offered- Recent developmentsCONIFER HEALTH SOLUTIONS, LLC- Business overview- Products & Services offered- Recent developmentsVERADIGM LLC- Business overview- Products & Services offered- Recent developmentsGE HEALTHCARE- Business overview- Products & Services offeredCOGNIZANT- Business overview- Products & Services offered- Recent developmentsATHENAHEALTH, INC.- Business overview- Products & Services offered- Recent developmentsTHE SSI GROUP, LLC- Business overview- Products & Services offered- Recent developmentsADVANTEDGE HEALTHCARE SOLUTIONS- Business overview- Products & Services offered- Recent developmentsHURON CONSULTING GROUP INC.- Business overview- Products & Services offered- Recent developmentsFINTHRIVE- Business overview- Products & Services offered- Recent developmentsPLUTUS HEALTH- Business overview- Products & Services offeredQUEST DIAGNOSTICS INCORPORATED- Business overview- Products & Services offeredGEBBS- Business overview- Products & Services offered- Recent developmentsEPIC SYSTEMS CORPORATION- Business overview- Products & Services offered

-

12.2 OTHER PLAYERSOMEGA HEALTHCARETRUBRIDGECARECLOUD, INC.CONSTELLATION SOFTWARE INC.VEE TECHNOLOGIES

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: REVENUE CYCLE MANAGEMENT MARKET

- TABLE 2 REVENUE CYCLE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 3 REVENUE CYCLE MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REVENUE CYCLE MANAGEMENT MARKET: REGULATORY STANDARDS

- TABLE 9 KEY PATENTS IN REVENUE CYCLE MANAGEMENT MARKET (2020–2023)

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 11 KEY BUYING CRITERIA FOR REVENUE CYCLE MANAGEMENT COMPONENTS

- TABLE 12 REVENUE CYCLE MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 13 REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 14 SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 15 SOLUTIONS: REVENUE CYCLE MANAGEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 16 PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 17 PATIENT ACCESS SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 18 ELIGIBILITY VERIFICATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 19 ELIGIBILITY VERIFICATION SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 20 PRE-CERTIFICATION & AUTHORIZATION SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 21 PRE-CERTIFICATION & AUTHORIZATION SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 22 OTHER PATIENT ACCESS SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 23 OTHER PATIENT ACCESS SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 24 MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 MID-REVENUE CYCLE SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 26 CLINICAL CODING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 27 CLINICAL CODING SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 28 CLINICAL DOCUMENTATION IMPROVEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 29 CLINICAL DOCUMENTATION IMPROVEMENT SOLUTIONS MARKET, BY COUNTRY/ REGION, 2021–2028 (USD MILLION)

- TABLE 30 OTHER MID-REVENUE CYCLE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 31 OTHER MID-REVENUE CYCLE SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 32 BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 33 BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 34 CLAIMS PROCESSING SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 35 CLAIMS PROCESSING SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 36 DENIAL MANAGEMENT SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 37 DENIAL MANAGEMENT SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 38 OTHER BACK-END REVENUE CYCLE SOLUTIONS OFFERED BY KEY MARKET PLAYERS

- TABLE 39 OTHER BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 40 OUTSOURCING SERVICES: REVENUE CYCLE MANAGEMENT MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 41 OUTSOURCING SERVICES: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY/REGION, 2021–2028(USD MILLION)

- TABLE 42 PATIENT ACCESS OUTSOURCING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 43 PATIENT ACCESS OUTSOURCING SERVICES MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 44 MID-REVENUE CYCLE OUTSOURCING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 45 MID-REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 46 BACK-END REVENUE CYCLE OUTSOURCING SERVICES OFFERED BY KEY MARKET PLAYERS

- TABLE 47 BACK-END REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 48 REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 49 ON-PREMISES SOLUTIONS: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 50 CLOUD-BASED SOLUTIONS: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 51 REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 52 REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 53 REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 54 REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 56 REVENUE CYCLE MANAGEMENT MARKET FOR HOSPITALS, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 57 REVENUE CYCLE MANAGEMENT MARKET FOR OTHER INPATIENT FACILITIES, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 58 REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 59 REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 60 REVENUE CYCLE MANAGEMENT MARKET FOR PHYSICIAN PRACTICES, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 61 REVENUE CYCLE MANAGEMENT MARKET FOR AMBULATORY SURGICAL CENTERS, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 62 REVENUE CYCLE MANAGEMENT MARKET FOR HOSPITAL OUTPATIENT FACILITIES, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 63 REVENUE CYCLE MANAGEMENT MARKET FOR DIAGNOSTIC & IMAGING CENTERS, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 64 REVENUE CYCLE MANAGEMENT MARKET FOR OTHER OUTPATIENT FACILITIES, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 65 REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PAYERS, BY COUNTRY/REGION, 2021–2028 (USD MILLION)

- TABLE 66 REVENUE CYCLE MANAGEMENT MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 79 US: KEY MACRO INDICATORS

- TABLE 80 US: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 81 US: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 82 US: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 83 US: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 84 US: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 85 US: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 US: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 87 US: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 US: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 89 US: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 US: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: KEY MACRO INDICATORS

- TABLE 92 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 CANADA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 CANADA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 96 CANADA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 97 CANADA: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 98 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 99 CANADA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 CANADA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 CANADA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 102 CANADA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 104 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 106 EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 EUROPE: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 EUROPE: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 110 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 111 EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 114 EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 GERMANY: KEY MACRO INDICATORS

- TABLE 116 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 117 GERMANY: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 118 GERMANY: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 GERMANY: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 GERMANY: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 121 GERMANY: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 122 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 123 GERMANY: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 124 GERMANY: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 GERMANY: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 126 GERMANY: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 127 FRANCE: KEY MACRO INDICATORS

- TABLE 128 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 129 FRANCE: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 FRANCE: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 FRANCE: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 FRANCE: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 FRANCE: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 134 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 135 FRANCE: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 136 FRANCE: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 FRANCE: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 138 FRANCE: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 UK: KEY MACRO INDICATORS

- TABLE 140 UK: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 141 UK: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 142 UK: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 143 UK: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 144 UK: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 UK: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 146 UK: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 147 UK: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 148 UK: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 149 UK: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 150 UK: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 ITALY: KEY MACRO INDICATORS

- TABLE 152 ITALY: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 153 ITALY: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 154 ITALY: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 ITALY: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 156 ITALY: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 ITALY: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 158 ITALY: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 159 ITALY: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 160 ITALY: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 161 ITALY: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 162 SPAIN: KEY MACRO INDICATORS

- TABLE 163 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 164 SPAIN: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 165 SPAIN: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 166 SPAIN: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 167 SPAIN: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 168 SPAIN: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 170 SPAIN: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 171 SPAIN: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 172 SPAIN: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 173 SPAIN: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 174 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 175 REST OF EUROPE: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 REST OF EUROPE: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 177 REST OF EUROPE: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 178 REST OF EUROPE: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 179 REST OF EUROPE: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 180 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 181 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 182 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 184 REST OF EUROPE: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 193 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 196 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 197 JAPAN: KEY MACRO INDICATORS

- TABLE 198 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 199 JAPAN: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 200 JAPAN: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 JAPAN: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 202 JAPAN: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 203 JAPAN: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 204 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 205 JAPAN: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 206 JAPAN: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 207 JAPAN: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 208 JAPAN: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE 2021–2028 (USD MILLION)

- TABLE 209 CHINA: KEY MACRO INDICATORS

- TABLE 210 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 211 CHINA: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 212 CHINA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 213 CHINA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 214 CHINA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 215 CHINA: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 216 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 217 CHINA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 218 CHINA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 219 CHINA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 220 CHINA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE 2021–2028 (USD MILLION)

- TABLE 221 INDIA: KEY MACRO INDICATORS

- TABLE 222 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 223 INDIA: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 224 INDIA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 225 INDIA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 INDIA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 INDIA: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 229 INDIA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 230 INDIA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 INDIA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 INDIA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE 2021–2028 (USD MILLION)

- TABLE 233 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 234 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 REST OF ASIA PACIFIC: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 236 REST OF ASIA PACIFIC: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 238 REST OF ASIA PACIFIC: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 244 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 LATIN AMERICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 248 LATIN AMERICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 250 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 253 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 LATIN AMERICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2021–2028 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: PATIENT ACCESS SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: MID-REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: BACK-END REVENUE CYCLE SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: REVENUE CYCLE OUTSOURCING SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2021–2028 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR HEALTHCARE PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR INPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: REVENUE CYCLE MANAGEMENT MARKET FOR OUTPATIENT FACILITIES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 266 COMPANY FOOTPRINT ANALYSIS

- TABLE 267 COMPANY PRODUCT AND SERVICES FOOTPRINT

- TABLE 268 COMPANY END USER FOOTPRINT

- TABLE 269 COMPANY REGIONAL FOOTPRINT

- TABLE 270 REVENUE CYCLE MANAGEMENT MARKET: PRODUCT LAUNCHES, JANUARY 2020–JUNE 2023

- TABLE 271 REVENUE CYCLE MANAGEMENT MARKET: DEALS, JANUARY 2020–MAY 2023

- TABLE 272 OPTUM, INC.: BUSINESS OVERVIEW

- TABLE 273 R1 RCM, INC.: BUSINESS OVERVIEW

- TABLE 274 ORACLE: BUSINESS OVERVIEW

- TABLE 275 CHANGE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 276 MCKESSON CORPORATION: BUSINESS OVERVIEW

- TABLE 277 3M: BUSINESS OVERVIEW

- TABLE 278 EXPERIAN PLC: BUSINESS OVERVIEW

- TABLE 279 CONIFER HEALTH SOLUTIONS, LLC: BUSINESS OVERVIEW

- TABLE 280 VERADIGM LLC: BUSINESS OVERVIEW

- TABLE 281 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 282 COGNIZANT: BUSINESS OVERVIEW

- TABLE 283 ATHENAHEALTH: BUSINESS OVERVIEW

- TABLE 284 THE SSI GROUP, LLC: BUSINESS OVERVIEW

- TABLE 285 ADVANTEDGE HEALTHCARE SOLUTIONS: BUSINESS OVERVIEW

- TABLE 286 HURON CONSULTING GROUP INC.: BUSINESS OVERVIEW

- TABLE 287 FINTHRIVE: BUSINESS OVERVIEW

- TABLE 288 PLUTUS HEALTH: BUSINESS OVERVIEW

- TABLE 289 QUEST DIAGNOSTICS INCORPORATED: BUSINESS OVERVIEW

- TABLE 290 GEBBS: BUSINESS OVERVIEW

- TABLE 291 EPIC SYSTEMS CORPORATION: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

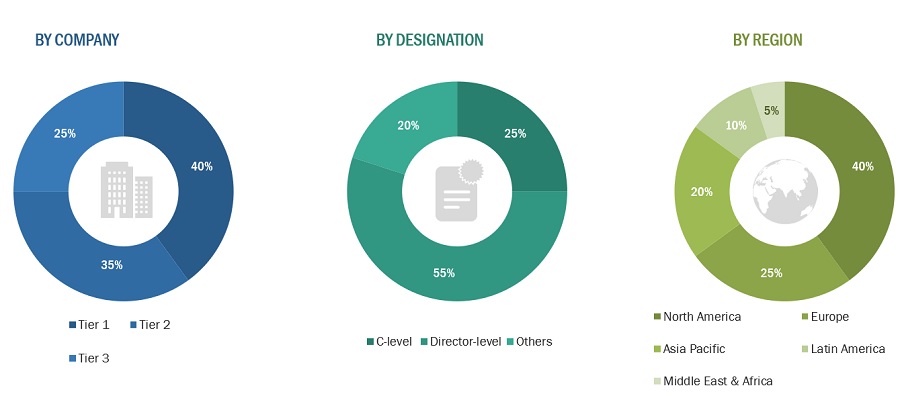

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION

- FIGURE 5 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 6 CAGR PROJECTIONS: OVERALL REVENUE CYCLE MANAGEMENT MARKET

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 REVENUE CYCLE MANAGEMENT MARKET, BY PRODUCT & SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 REVENUE CYCLE MANAGEMENT MARKET, BY DELIVERY MODE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 REVENUE CYCLE MANAGEMENT MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 12 GROWING REGULATORY REQUIREMENTS AND GOVERNMENT INITIATIVES TO DRIVE MARKET

- FIGURE 13 INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 14 MIDDLE EAST & AFRICA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 15 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 16 REVENUE CYCLE MANAGEMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS (2022)

- FIGURE 18 REVENUE CYCLE MANAGEMENT MARKET: ECOSYSTEM

- FIGURE 19 NUMBER OF PATENTS PUBLISHED, JANUARY 2013 TO JUNE 2023

- FIGURE 20 TOP REVENUE CYCLE MANAGEMENT PATENT OWNERS

- FIGURE 21 POPULATION HEALTH MANAGEMENT MARKET: MARKET OVERVIEW

- FIGURE 22 HEALTHCARE ANALYTICS MARKET: MARKET OVERVIEW

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 24 KEY BUYING CRITERIA FOR REVENUE CYCLE MANAGEMENT COMPONENTS

- FIGURE 25 REVENUE CYCLE MANAGEMENT MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 26 NORTH AMERICA: REVENUE CYCLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: REVENUE CYCLE MANAGEMENT MARKET SNAPSHOT

- FIGURE 28 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2020 AND JUNE 2023

- FIGURE 29 REVENUE CYCLE MANAGEMENT, BY PLAYER, 2022

- FIGURE 30 REVENUE CYCLE MANAGEMENT: REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 31 R&D EXPENDITURE OF KEY PLAYERS (2021 VS. 2022)

- FIGURE 32 REVENUE CYCLE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (2022)

- FIGURE 33 REVENUE CYCLE MANAGEMENT: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- FIGURE 34 OPTUM, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 35 ORACLE: COMPANY SNAPSHOT (2022)

- FIGURE 36 CHANGE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 37 MCKESSON CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 38 3M: COMPANY SNAPSHOT (2022)

- FIGURE 39 EXPERIAN PLC: COMPANY SNAPSHOT (2022)

- FIGURE 40 CONIFER HEALTH SOLUTIONS, LLC: COMPANY SNAPSHOT (2022)

- FIGURE 41 VERADIGM LLC: COMPANY SNAPSHOT (2021)

- FIGURE 42 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 43 COGNIZANT: COMPANY SNAPSHOT (2022)

- FIGURE 44 HURON CONSULTING GROUP INC.: COMPANY SNAPSHOT (2022)

- FIGURE 45 QUEST DIAGNOSTICS INCORPORATED: COMPANY SNAPSHOT (2022)

This study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial revenue cycle management market study. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the revenue cycle management market. The primary sources from the demand side include clinicians, cardiologists, hospital managers, professors, and and stakeholders in corporate & government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

A breakdown of the primary respondents is provided below:

Tiers are defined based on a company’s total revenue. As of 2022: Tier 1= >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3= <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the revenue cycle management market was arrived at after data triangulation from four different approaches. After each course, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Method for calculating the revenue of different players in revenue cycle management. Annual reports, SEC filings, online publications, and in-depth primary interviews were used to determine the size of the worldwide revenue cycle management market. The market segment sizes were determined using a percentage split. In order to determine the size for each sub-segment, additional splits were used. Primary participants verified these percentage splits. The country-level market numbers from yearly reports, SEC filings, online publications, and in-depth primary interviews were summed up to determine the total market size for regions. The global revenue cycle management market was calculated by adding the market sizes for each region.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Global revenue cycle management market size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was divided into a number of segments and sub-segments after the overall market size was estimated through the above-described market size estimation processes. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Revenue cycle management (RCM) is the process used to track the revenue from patients, from their initial appointment or encounter with the healthcare system to their final payment of the balance. This process helps streamline the business operations of healthcare organizations and private practices. RCM solutions help providers manage and enhance revenue cycle functions such as medical coding & billing, patient insurance eligibility verification, electronic health records, clinical documentation, and claims & denials management.

Key Stakeholders

- Healthcare Providers

- Healthcare Vendors

- Technology Developers

- Patients

- Regulators and Policy makers

- Insurance companies and payers

- Government Institutions

- Market Research and Consulting Firms

- Venture Capitalists and Investors

Objectives of the Study

- To define, describe, and forecast the global revenue cycle management market by product & services, delivery mode, end-user, and region

- To provide detailed information about the significant factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall revenue cycle management market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the revenue cycle management market in five major regions along with their respective key countries (North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa)

- To profile the key players in the global revenue cycle management market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as mergers, acquisitions, developments, expansions, partnerships, alliances, and R&D activities of leading players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of the Asia Pacific market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe market into Belgium, Russia, Switzerland, and others

- Further breakdown of the Rest of the Latin America market into Brazil, Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Revenue Cycle Management Market

Which are the major growth driving factors for the End User segment of the Global Revenue Cycle Management Market?

How the healthcare providers segment holds the largest share of the Revenue Cycle Management Market?

Which are the fastest growing economies in the global Revenue Cycle Management Market?