Nuclear Medicine Market by Type (Diagnostic (SPECT-Technetium, PET-F-18), Therapeutic (Beta Emitters-Y-90, Alpha Emitters, Brachytherapy), Application (Neurology, Thyroid, Oncology), Procedures, End User - Global Forecast to 2028

Market Growth Outlook Summary

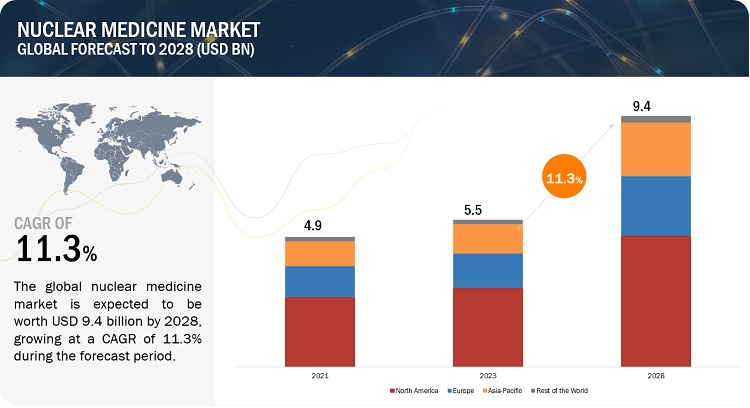

The global nuclear medicine market growth forecasted to transform from USD 5.5 billion in 2023 to USD 9.4 billion by 2028, driven by a CAGR of 11.3%. Market growth in this market are driven by the factors such as the technology advancement in radioisotope production and rising occurrence of cancer and CVD. However, the short half-life of radiopharmaceuticals decreases their possible adoption, while hospital cost cuts and continued revelation that results further health problems are expected to restrain market growth to a certain extent.

Nuclear Medicine Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Nuclear Medicine Market Opportunities

Nuclear Medicine Market Dynamics

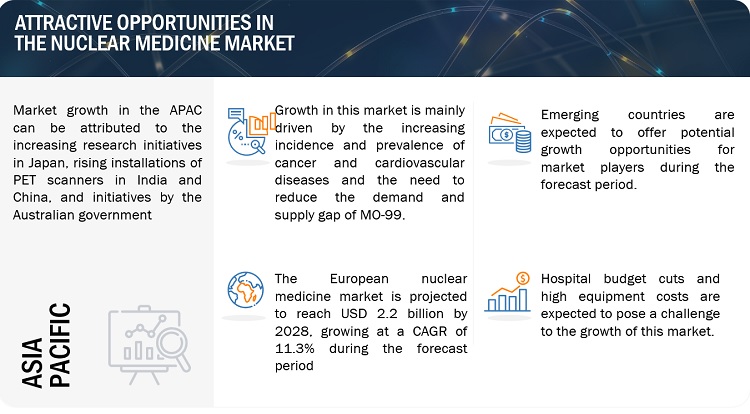

Driver: Increasing incidence and prevalence of target conditions

The increasing prevalence of cancer and cardiovascular disease is a key reason encouraging market growth. The majority cases can be prevented through quick detection and treatment; nuclear medicine plays a substantial role in these areas. According to American Heart Association 2022, approximately 19.1 million deaths were attributed to CVD globally in 2020. The age-adjusted death rate per 100,000 population was 239.8 and age-adjusted prevalence rate was 7354.1 per 100,000. As nuclear medicine shows a substantial role in disease diagnosis and treatment, the growing prevalence of these diseases is projected to drive the growth of the market during the forecast period.

Restraint: Short half-life of radiopharmaceuticals

The expiry of a radiopharmaceutical primarily varies on the half-life of the radioisotope and the substance of the radionuclide. For example,in SPECT diagnosis, the radioactivity of Tc-99m is decreased after 6 hours, while I-123 and In-111 isotopes should be used within 13 and 67 hours, respectively. The non-utilization of radioisotopes within the given shelf life causes radiation and chemical decomposition, lowering radiochemical purity to an unacceptable form, which may prove lethal during diagnosis and therapy. Additionally, the shorter half-life of radiopharmaceuticals creates a need for in-house radiopharmaceutical production in cyclotrons/generators within hospital premises, further increasing the capital expenditure for hospitals.

Opportunity: Use of radiopharmaceuticals in neurological applications

Nuclear medicine is mainly used to diagnose various neurological disorders like Alzheimer’s disease, Parkinson's disease (PD) as well as CVD and cancers. The increasing disease burden has prompted a number of companies and stakeholders to focus on expanding the overall applications of radiopharmaceuticals. In April 2022, Curium (France) announced that the US Food and Drug Administration (FDA) approved DaTscan (Ioflupane I 123 Injection) to assist in the evaluation of adult patients with suspected Parkinsonian Syndromes. This shows an opportunity for players to raise their offerings and market shares by catering to the demand for radiopharmaceuticals in neurological applications.

Challenge: Hospital budget cuts and high equipment costs

The COVID-19 pandemic has made destruction globally; the outbreak has interrupted operations of healthcare systems worldwide. As a result, hospitals have ramped up testing efforts in an struggle to save lives and decrease the spread of the virus. The financial challenges caused by COVID-19 forced governments across the world to implement budget cuts.

The rising cost of prescription drugs and a sharp decline in the proposed budget allocations for Health and Human Services in the US have significantly reduced hospital budgets. A study by the American Hospital Association estimates that federal payment cuts to hospitals would amount to USD 218 billion by 2028, forcing hospitals to allocate smaller budgets annually.

Nuclear Medicine Market Ecosystem Analysis

By type, the diagnostic nuclear medicine segment is projected to lead the market of the nuclear medicine market.

By type, the market is divided into diagnostic and therapeutic nuclear medicine. The diagnostic nuclear medicine segment is further divided as SPECT and PET radiopharmaceuticals, while the therapeutic radiopharmaceuticals is divided into beta emitters, alpha emitters and brachytherapy isotopes. The diagnostic segment is projected to lead the global market in 2023 due to the increasing use of SPECT and PET imaging, and advances in radiotracers.

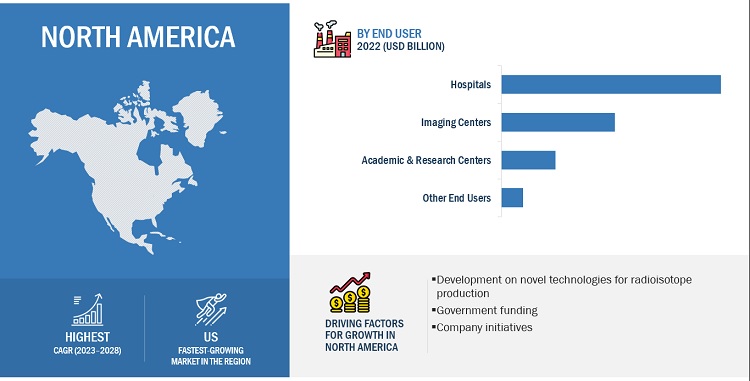

The hospitals segment of nuclear medicine market, is projected to grow at a highest CAGR during the forecast period, by end user

By end user, the market is divided into hospitals, imaging centers, academic & research centers and other end users, which comprise pharma/biotech companies and contract research organizations. In 2022, the hospital segment dominated the market, due to growing number of diagnostic imaging procedures performed in hospitals and increasing demand for early disease diagnosis.

North America region of nuclear medicine market, to witness significant growth from 2023 to 2028

On the basis of region, the market is divided into North America, Europe, Asia Pacific, and Rest of the World. In 2023, North America projected to lead market share of the market. This can be attributed to the advancement of novel technologies for radioisotope production, government funding, growing R&D expenditure and increasing company initiatives in the region.

Nuclear Medicine Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Prominent players operational in the nuclear medicine market include GE HealthCare (US),Cardinal Health (US), Curium (France), Bayer AG (Germany), Lantheus Holdings, Inc.(US), Bracco Imaging S.p.A. (Italy), PharmaLogic Holdings Corp. (US), Eczacibasi-Monrol Nuclear Products (Turkey), NTP Radioisotopes SOC Ltd (South Africa), Nordion Inc.(Canada), Advanced Accelerator Applications (France), NorthStar Medical Radioisotopes (US), Eckert & Ziegler (Germany), Isotope JSC (Russia), Siemens Healthineers (Germany), Jubilant DraxImage,Inc. (Canada).

Nuclear Medicine Market Report Scope

|

Report Metric |

Details |

|

Market Size in 2023 |

USD 5.5 billion |

|

Forecasted Size by 2028 |

USD 9.4 billion |

|

Market Growth Rate |

Poised to Grow at a CAGR of 11.3% |

|

Market Driver |

Increasing incidence and prevalence of target conditions |

|

Market Opportunity |

Use of radiopharmaceuticals in neurological applications |

This study categorizes the global nuclear medicine market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Diagnostic Nuclear Medicine

-

SPECT Radiopharmaceuticals

- Tc-99m

- I-123

- Tl-201

- Ga-67

- Other SPECT Isotopes

-

PET Radiopharmaceuticals

- F-18

- Rb-82

- Other PET Isotopes

-

SPECT Radiopharmaceuticals

-

Therapeutic Nuclear Medicine

-

Alpha Emitters

- Ra-223

-

Beta Emitters

- I-131

- Y-90

- Sm-153

- Lu-177

- Re-186

- Other Beta Emitters

-

Alpha Emitters

-

Brachytherapy Isotopes

-

- I-125

- Ir-192

- Pd-103

- Cs-131

- Other Brachytherapy Isotopes

-

By Applications

-

Diagnostic Applications

-

SPECT Applications

- Cardiology

- Bone Scans

- Thyroid Applications

- Pulmonary Scans

- Other SPECT Applications

-

PET Applications

- Oncology

- Cardiology

- Neurology

- Other PET Applications

-

Therapeutic Applications

- Thyroid Indications

- Bone Metastasis

- Lymphoma

- Endocrine Tumors

- Other Indications

-

SPECT Applications

By Procedural Volume Assessment

-

Diagnostic Procedures

- SPECT Procedures

- PET Procedures

- Therapeutic Procedures

By End User

- Hospitals

- Imaging Centers

- Academic & Research Centers

- Other end users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- Rest of APAC (RoAPAC)

- RoW

Recent Developments of Nuclear Medicine Market

- In January 2023, NorthStar Medical Radioisotopes (US) achieved a major milestone in advancing its new technology for non-uranium-based production of the critical medical radioisotope, molybdenum-99 (Mo-99).

- In November 2022, Curium (France) announced that the US Food and Drug Administration (FDA) approved DaTscan (Ioflupane I 123 Injection) to assist in evaluating adult patients with suspected Parkinsonian Syndromes.

- In October 2022, Blue Earth Diagnostics (UK) signed a data-sharing agreement with Siemens Healthineers (Germany) and the University Hospital of the Technical University of Munich (TUM) for 18F-rhPSMA-7.3, an investigational PET imaging agent, to support AI-based algorithms development.

- In January 2021, Advanced Accelerator Applications (France) signed a multi-year exclusive supply agreement for lutetium-177 with the University of Missouri Research Reactor (MURR). Through this agreement, MURR will supply AAA with GMP-quality lutetium-177 chloride, the precursor for developing Lutathera and other Lu-177-based therapeutics.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global nuclear medicine market between 2023 and 2028?

The global nuclear medicine market is projected to grow from USD 5.5 billion in 2023 to USD 9.4 billion by 2028, demonstrating a robust CAGR of 11.3%.

What are the key factors driving the nuclear medicine market?

The primary factors driving the nuclear medicine market include the increasing prevalence of cancer and cardiovascular diseases, technological advancements in radioisotope production, and the demand for quick detection and treatment of these conditions.

What are the challenges faced by the nuclear medicine market?

Challenges include the short half-life of radiopharmaceuticals, which complicates their use in diagnostics and treatment, along with hospital budget cuts and high equipment costs that may limit market growth.

Which regions are expected to show growth in the nuclear medicine market?

The North America region is projected to lead the nuclear medicine market, driven by advancements in radioisotope production technology, government funding, and increasing R&D expenditure. Emerging economies are also expected to provide growth opportunities.

What types of radiopharmaceuticals are available in the nuclear medicine market?

The nuclear medicine market includes diagnostic radiopharmaceuticals (like SPECT and PET) and therapeutic radiopharmaceuticals (such as alpha emitters, beta emitters, and brachytherapy isotopes), each serving different medical applications.

How does the rising incidence of cancer impact the nuclear medicine market?

The increasing incidence of cancer drives the demand for nuclear medicine, particularly in diagnostics and treatment, as nuclear techniques provide valuable tools for early detection and monitoring of disease progression.

What recent developments are shaping the nuclear medicine market?

Recent developments include the FDA approval of new radiopharmaceuticals for neurological applications and advancements in production technologies, such as non-uranium-based methods for the critical medical radioisotope, molybdenum-99.

What role do hospitals play in the nuclear medicine market?

Hospitals are the primary end-users in the nuclear medicine market, performing the majority of diagnostic imaging procedures and driving demand for radiopharmaceuticals through their diagnostic and therapeutic applications.

How is the geriatric population influencing the nuclear medicine market?

The rising geriatric population is contributing to an increased incidence of conditions like cancer and cardiovascular diseases, thereby driving the demand for nuclear medicine for effective diagnosis and treatment options in older adults.

What technological advancements are affecting the nuclear medicine market?

Technological advancements, including improvements in imaging techniques such as SPECT and PET, are enhancing the accuracy and speed of nuclear medicine diagnostics, thus fostering market growth and innovation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing incidence and prevalence of target conditions- Development of alpha-radioimmunotherapy-based targeted cancer treatments- Initiatives to reduce demand and supply gap of Mo-99RESTRAINTS- Short half-life of radiopharmaceuticalsOPPORTUNITIES- Use of radiopharmaceuticals in neurological applications- Growth opportunities in emerging economiesCHALLENGES- Hospital budget cuts and high equipment costs

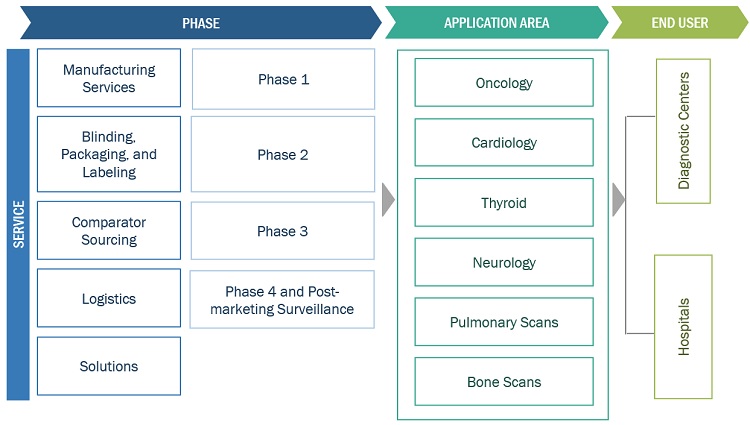

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM COVERAGE

-

5.5 REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEAN UNIONASIA PACIFIC- Australia- India- ChinaREST OF THE WORLD- Turkey- UAE- South Africa

-

5.6 PORTER’S FIVE FORCES ANALYSISPORTER’S FIVE FORCES ANALYSIS: NUCLEAR MEDICINE MARKETDEGREE OF COMPETITIONBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT FROM SUBSTITUTESTHREAT FROM NEW ENTRANTS

- 5.7 PIPELINE ANALYSIS

-

5.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR NUCLEAR MEDICINE MARKET

-

5.9 INDUSTRY TRENDSINCREASING PARTNERSHIPS & COLLABORATIONS FOR INNOVATIONGROWING DEMAND FOR PET RADIOPHARMACEUTICALS IN ONCOLOGY AND NEUROLOGY APPLICATIONSADVANCES IN RESEARCH & DEVELOPMENT OF RADIOPHARMACEUTICALS IN EMERGING COUNTRIES

-

5.10 PRICING ANALYSISAVERAGE SELLING PRICE TREND ANALYSIS

- 5.11 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 DIAGNOSTIC NUCLEAR MEDICINESPECT RADIOPHARMACEUTICALS- Tc-99m- I-123- Tl-201- Ga-67- Other SPECT isotopesPET RADIOPHARMACEUTICALS- F-18- Rb-82- Other PET isotopes

-

6.3 THERAPEUTIC NUCLEAR MEDICINEALPHA EMITTERS- Ra-223BETA EMITTERS- I-131- Y-90- Sm-153- Lu-177- Re-186- Other beta emittersBRACHYTHERAPY ISOTOPES- I-125- Ir-192- Pd-103- Cs-131- Other brachytherapy isotopes

- 7.1 INTRODUCTION

-

7.2 DIAGNOSTIC APPLICATIONSSPECT APPLICATIONS- Cardiology- Bone scans- Thyroid- Pulmonary scans- Other SPECT applicationsPET APPLICATIONS- Oncology- Cardiology- Neurology- Other PET applications

-

7.3 THERAPEUTIC APPLICATIONSTHYROID INDICATIONS- Increasing prevalence of thyroid disorders to boost marketBONE METASTASIS- Introduction of novel therapies for bone metastasis to positively impact market growthENDOCRINE TUMORS- US to dominate therapeutic nuclear medicine market for endocrine tumor applicationsLYMPHOMA- Development of new isotopes for treatment of lymphoma to present huge growth opportunitiesOTHER THERAPEUTIC APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 DIAGNOSTIC PROCEDURESHIGH PREVALENCE OF CANCER AND CARDIAC DISEASES TO DRIVE MARKET GROWTH

-

8.3 THERAPEUTIC PROCEDURESGROWING DEMAND FOR NON-INVASIVE METHODS TO SUPPORT MARKET GROWTH

- 9.1 INTRODUCTION

-

9.2 HOSPITALSRISING TREND OF MODERNIZING IMAGING WORKFLOW TO DRIVE ADOPTION OF IMAGING SYSTEMS IN HOSPITALS

-

9.3 IMAGING CENTERSGROWING NUMBER OF PRIVATE IMAGING CENTERS TO SUPPORT MARKET GROWTH

-

9.4 ACADEMIC & RESEARCH CENTERSINCREASING COLLABORATIONS BETWEEN NUCLEAR IMAGING COMPANIES AND ACADEMIA TO PROPEL MARKET GROWTH

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: IMPACT OF ECONOMIC RECESSIONUS- US to dominate North American nuclear medicine market during forecast periodCANADA- Increasing initiatives for medical isotope development to support market growth

-

10.3 EUROPEEUROPE: IMPACT OF ECONOMIC RECESSIONGERMANY- Well-established healthcare system to drive market growthFRANCE- Rising incidence of diseases such as cancer, Alzheimer’s, and Parkinson’s disease to favor market growthUK- Growing demand for diagnostic imaging and growing awareness to drive market growthITALY- Rising geriatric population to support market growthSPAIN- Increasing initiatives by SEMNIM to drive growthREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: IMPACT OF ECONOMIC RECESSIONJAPAN- Japan to dominate APAC nuclear medicine marketCHINA- Increasing nuclear medicine infrastructure and growing prevalence of chronic diseases to augment marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLDREST OF THE WORLD: IMPACT OF ECONOMIC RECESSION

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET RANKING ANALYSIS

- 11.4 REVENUE ANALYSIS OF KEY MARKET PLAYERS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE BENCHMARKINGOVERALL FOOTPRINT OF KEY PLAYERS

-

11.8 COMPETITIVE SCENARIOPRODUCT APPROVALS & ENHANCEMENTSDEALSOTHER DEVELOPMENTS

-

12.1 MAJOR PLAYERSGE HEALTHCARE- Business overview- Products offered- Recent developments- MnM viewCARDINAL HEALTH- Business overview- Products offered- Recent developments- MnM viewCURIUM- Business overview- Products offered- Recent developments- MnM viewBAYER AG- Business overview- Products offered- Recent developments- MnM viewLANTHEUS HOLDINGS, INC.- Business overview- Products offered- Recent developments- MnM viewBRACCO IMAGING S.P.A.- Business overview- Products offered- Recent developmentsPHARMALOGIC HOLDINGS CORP.- Business overview- Products offered- Recent developmentsECZACIBASI-MONROL NUCLEAR PRODUCTS- Business overview- Products offered- Recent developmentsNTP RADIOISOTOPES SOC LTD. (A SUBSIDIARY OF SOUTH AFRICAN NUCLEAR ENERGY CORPORATION)- Business overview- Products offeredNORDION INC.- Business overview- Products offered- Recent developmentsADVANCED ACCELERATOR APPLICATIONS (A NOVARTIS COMPANY)- Business overview- Products offered- Recent developmentsNORTHSTAR MEDICAL RADIOISOTOPES- Business overview- Products offered- Recent developmentsECKERT & ZIEGLER- Business overview- Products offered- Recent developmentsISOTOPE JSC- Business overview- Products offered- Recent developmentsSIEMENS HEALTHINEERS- Business overview- Products offered- Recent developmentsJUBILANT DRAXIMAGE, INC. (A SUBSIDIARY OF JUBILANT PHARMA)- Business overview- Products offered- Recent developments

-

12.2 OTHER PLAYERSGLOBAL MEDICAL SOLUTIONSSHINE TECHNOLOGIES, LLCISOTOPIA MOLECULAR IMAGING LTD.BWXT MEDICAL LTD.INSTITUTE OF ISOTOPESCHINA ISOTOPE & RADIATION CORPORATIONYANTAI DONGCHENG PHARMACEUTICAL GROUP CO., LTD.CYCLOPHARMIRE ELIT

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT: NUCLEAR MEDICINE MARKET

- TABLE 2 PHYSICAL HALF-LIFE OF RADIOPHARMACEUTICALS

- TABLE 3 NUCLEAR MEDICINE MARKET: REGULATORY LANDSCAPE

- TABLE 4 PIPELINE ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF RADIOPHARMACEUTICALS, BY TYPE

- TABLE 6 AVERAGE SELLING PRICE OF RADIOPHARMACEUTICALS IN EASTERN EUROPE, BY TYPE

- TABLE 7 AVERAGE SELLING PRICE OF RADIOPHARMACEUTICALS IN MENAT REGION, BY TYPE

- TABLE 8 NUCLEAR MEDICINE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 10 KEY BUYING CRITERIA FOR END USERS

- TABLE 11 NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 15 EUROPE: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 ASIA PACIFIC: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ALTERNATIVES TO COMMON TC-99M-BASED DIAGNOSTIC PROCEDURES DUE TO SEVERE TC-99M SHORTAGES

- TABLE 18 SPECT RADIOPHARMACEUTICALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 SPECT RADIOPHARMACEUTICALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: SPECT RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 EUROPE: SPECT RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: SPECT RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 TC-99M MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: TC-99M MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 EUROPE: TC-99M MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 ASIA PACIFIC: TC-99M MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 I-123 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: I-123 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 EUROPE: I-123 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: I-123 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 TI-201 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: TI-201 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 33 EUROPE: TI-201 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: TI-201 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 GA-67 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: GA-67 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 EUROPE: GA-67 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: GA-67 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 OTHER SPECT ISOTOPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: OTHER SPECT ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 EUROPE: OTHER SPECT ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: OTHER SPECT ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 PET RADIOPHARMACEUTICALS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 PET RADIOPHARMACEUTICALS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: PET RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: PET RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: PET RADIOPHARMACEUTICALS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 F-18 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: F-18 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: F-18 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: F-18 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 RB-82 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: RB-82 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: RB-82 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: RB-82 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 OTHER PET ISOTOPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: OTHER PET ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: OTHER PET ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: OTHER PET ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 THERAPEUTIC NUCLEAR MEDICINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 RA-223 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: RA-223 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: RA-223 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: RA-223 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 BETA EMITTERS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 70 BETA EMITTERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: BETA EMITTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: BETA EMITTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: BETA EMITTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 I-131 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: I-131 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: I-131 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: I-131 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 Y-90 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: Y-90 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: Y-90 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: Y-90 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 SM-153 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: SM-153 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 EUROPE: SM-153 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: SM-153 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 86 LU-177 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: LU-177 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 88 EUROPE: LU-177 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 89 ASIA PACIFIC: LU-177 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 90 RE-186 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: RE-186 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 92 EUROPE: RE-186 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: RE-186 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 94 OTHER BETA EMITTERS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: OTHER BETA EMITTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: OTHER BETA EMITTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: OTHER BETA EMITTERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 98 BRACHYTHERAPY ISOTOPES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 BRACHYTHERAPY ISOTOPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: BRACHYTHERAPY ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 101 EUROPE: BRACHYTHERAPY ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: BRACHYTHERAPY ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 103 I-125 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: I-125 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 105 EUROPE: I-125 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: I-125 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 107 IR-192 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: IR-192 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 109 EUROPE: IR-192 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: IR-192 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 111 PD-103 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: PD-103 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 113 EUROPE: PD-103 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: PD-103 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 115 CS-131 MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: CS-131 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 EUROPE: CS-131 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: CS-131 MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 119 OTHER BRACHYTHERAPY ISOTOPES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: OTHER BRACHYTHERAPY ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 121 EUROPE: OTHER BRACHYTHERAPY ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: OTHER BRACHYTHERAPY ISOTOPES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 123 NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 127 EUROPE: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 129 NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 130 NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 132 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 134 NUCLEAR MEDICINE MARKET FOR SPECT CARDIOLOGY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT CARDIOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 136 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT CARDIOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT CARDIOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 138 NUCLEAR MEDICINE MARKET FOR SPECT BONE SCAN APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 139 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT BONE SCAN APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 140 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT BONE SCAN APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT BONE SCAN APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 142 NUCLEAR MEDICINE MARKET FOR SPECT THYROID APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 143 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT THYROID APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 144 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT THYROID APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 145 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT THYROID APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 146 NUCLEAR MEDICINE MARKET FOR SPECT PULMONARY SCAN APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT PULMONARY SCAN APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 148 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT PULMONARY SCAN APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 149 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT PULMONARY SCAN APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 150 NUCLEAR MEDICINE MARKET FOR OTHER SPECT APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR OTHER SPECT APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 152 EUROPE: NUCLEAR MEDICINE MARKET FOR OTHER SPECT APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR OTHER SPECT APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 154 NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 155 NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 157 EUROPE: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 159 NUCLEAR MEDICINE MARKET FOR PET ONCOLOGY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 160 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR PET ONCOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 161 EUROPE: NUCLEAR MEDICINE MARKET FOR PET ONCOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET ONCOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 163 NUCLEAR MEDICINE MARKET FOR PET CARDIOLOGY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 164 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR PET CARDIOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 165 EUROPE: NUCLEAR MEDICINE MARKET FOR PET CARDIOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET CARDIOLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 167 NUCLEAR MEDICINE MARKET FOR PET NEUROLOGY APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 168 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR PET NEUROLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 169 EUROPE: NUCLEAR MEDICINE MARKET FOR PET NEUROLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET NEUROLOGY APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 171 NUCLEAR MEDICINE MARKET FOR OTHER PET APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 172 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR OTHER PET APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 173 EUROPE: NUCLEAR MEDICINE MARKET FOR OTHER PET APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR OTHER PET APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 175 NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 176 NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 177 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 178 EUROPE: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 180 NUCLEAR MEDICINE MARKET FOR THYROID INDICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 181 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR THYROID INDICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 182 EUROPE: NUCLEAR MEDICINE MARKET FOR THYROID INDICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR THYROID INDICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 184 NUCLEAR MEDICINE MARKET FOR BONE METASTASIS APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 185 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR BONE METASTASIS APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 186 EUROPE: NUCLEAR MEDICINE MARKET FOR BONE METASTASIS APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR BONE METASTASIS APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 188 NUCLEAR MEDICINE MARKET FOR ENDOCRINE TUMOR APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 189 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR ENDOCRINE TUMOR APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 190 EUROPE: NUCLEAR MEDICINE MARKET FOR ENDOCRINE TUMOR APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 191 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR ENDOCRINE TUMOR APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 192 NUCLEAR MEDICINE MARKET FOR LYMPHOMA APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 193 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR LYMPHOMA APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 194 EUROPE: NUCLEAR MEDICINE MARKET FOR LYMPHOMA APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 195 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR LYMPHOMA APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 196 NUCLEAR MEDICINE MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 197 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 198 EUROPE: NUCLEAR MEDICINE MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 199 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 200 NUCLEAR MEDICINE MARKET, BY PROCEDURE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 201 NUCLEAR MEDICINE MARKET, BY REGION, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 202 NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC PROCEDURES, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 203 NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC PROCEDURES, BY REGION, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 204 NUCLEAR MEDICINE MARKET FOR THERAPEUTIC PROCEDURES, BY TYPE, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 205 NUCLEAR MEDICINE MARKET FOR THERAPEUTIC PROCEDURES, BY REGION, 2021–2028 (THOUSAND PROCEDURES)

- TABLE 206 NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 207 NUCLEAR MEDICINE MARKET FOR HOSPITALS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 208 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 209 EUROPE: NUCLEAR MEDICINE MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 210 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR HOSPITALS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 211 NUCLEAR MEDICINE MARKET FOR IMAGING CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 212 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR IMAGING CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 213 EUROPE: NUCLEAR MEDICINE MARKET FOR IMAGING CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR IMAGING CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 215 NUCLEAR MEDICINE MARKET FOR ACADEMIC & RESEARCH CENTERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 216 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 217 EUROPE: NUCLEAR MEDICINE MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR ACADEMIC & RESEARCH CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 219 NUCLEAR MEDICINE MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 220 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 221 EUROPE: NUCLEAR MEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 222 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 223 NUCLEAR MEDICINE MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 224 NORTH AMERICA: NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 225 NORTH AMERICA: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 226 NORTH AMERICA: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 227 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 228 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 229 NORTH AMERICA: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 230 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 231 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 232 NORTH AMERICA: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 233 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 234 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 235 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 236 NORTH AMERICA: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 237 NORTH AMERICA: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 238 US: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 239 US: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 240 US: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 241 US: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 242 US: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 243 US: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 244 US: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 245 US: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 246 US: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 247 US: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 248 US: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 249 US: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 250 US: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 251 US: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 252 CANADA: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 253 CANADA: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 254 CANADA: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 255 CANADA: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 256 CANADA: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 257 CANADA: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 258 CANADA: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 259 CANADA: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 260 CANADA: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 261 CANADA: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 262 CANADA: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 263 CANADA: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 264 CANADA: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 265 CANADA: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 266 EUROPE: NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 267 EUROPE: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 268 EUROPE: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 269 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 270 EUROPE: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 271 EUROPE: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 272 EUROPE: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 273 EUROPE: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 274 EUROPE: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 275 EUROPE: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 276 EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 277 EUROPE: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 278 EUROPE: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 279 EUROPE: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 280 GERMANY: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 281 GERMANY: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 282 GERMANY: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 283 GERMANY: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 284 GERMANY: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 285 GERMANY: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 286 GERMANY: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 287 GERMANY: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 288 GERMANY: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 289 GERMANY: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 290 GERMANY: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 291 GERMANY: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 292 GERMANY: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 293 FRANCE: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 294 FRANCE: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 295 FRANCE: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 296 FRANCE: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 297 FRANCE: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 298 FRANCE: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 299 FRANCE: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 300 FRANCE: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 301 FRANCE: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 302 FRANCE: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 303 FRANCE: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 304 FRANCE: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 305 FRANCE: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 306 FRANCE: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 307 UK: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 308 UK: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 309 UK: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 310 UK: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 311 UK: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 312 UK: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 313 UK: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 314 UK: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 315 UK: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 316 UK: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 317 UK: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 318 UK: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 319 UK: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 320 ITALY: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 321 ITALY: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 322 ITALY: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 323 ITALY: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 324 ITALY: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 325 ITALY: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 326 ITALY: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 327 ITALY: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 328 ITALY: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 329 ITALY: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 330 ITALY: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 331 ITALY: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 332 ITALY: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 333 ITALY: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 334 SPAIN: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 335 SPAIN: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 336 SPAIN: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 337 SPAIN: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 338 SPAIN: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 339 SPAIN: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 340 SPAIN: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 341 SPAIN: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 342 SPAIN: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 343 SPAIN: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 344 SPAIN: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 345 SPAIN: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 346 SPAIN: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 347 REST OF EUROPE: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 348 REST OF EUROPE: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 349 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 350 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 351 REST OF EUROPE: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 352 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 353 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 354 REST OF EUROPE: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 355 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 356 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 357 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 358 REST OF EUROPE: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 359 REST OF EUROPE: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 360 ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 361 ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 362 ASIA PACIFIC: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 363 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 364 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 365 ASIA PACIFIC: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 366 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 367 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 368 ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 369 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 370 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 371 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 372 ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 373 ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 374 JAPAN: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 375 JAPAN: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 376 JAPAN: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 377 JAPAN: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 378 JAPAN: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 379 JAPAN: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 380 JAPAN: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 381 JAPAN: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 382 JAPAN: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 383 JAPAN: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 384 JAPAN: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 385 JAPAN: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 386 JAPAN: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 387 CHINA: CANCER INCIDENCE, BY CANCER TYPE, 2020 VS. 2040

- TABLE 388 CHINA: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 389 CHINA: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 390 CHINA: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 391 CHINA: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 392 CHINA: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 393 CHINA: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 394 CHINA: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 395 CHINA: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 396 CHINA: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 397 CHINA: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 398 CHINA: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 399 CHINA: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 400 CHINA: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 401 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 402 REST OF ASIA PACIFIC: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 403 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 404 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 405 REST OF ASIA PACIFIC: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 406 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 407 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 408 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 409 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 410 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 411 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 412 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 413 REST OF ASIA PACIFIC: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 414 REST OF THE WORLD: NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 415 REST OF THE WORLD: DIAGNOSTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 416 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR SPECT RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 417 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR PET RADIOPHARMACEUTICALS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 418 REST OF THE WORLD: THERAPEUTIC NUCLEAR MEDICINE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 419 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR BETA EMITTERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 420 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR BRACHYTHERAPY ISOTOPES, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 421 REST OF THE WORLD: NUCLEAR MEDICINE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 422 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR DIAGNOSTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 423 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 424 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 425 REST OF THE WORLD: NUCLEAR MEDICINE MARKET FOR THERAPEUTIC APPLICATIONS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 426 REST OF THE WORLD: NUCLEAR MEDICINE MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 427 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 428 OVERALL FOOTPRINT OF KEY PLAYERS

- TABLE 429 REGIONAL FOOTPRINT OF KEY PLAYERS

- TABLE 430 TYPE FOOTPRINT OF KEY PLAYERS

- TABLE 431 KEY PRODUCT APPROVALS & ENHANCEMENTS

- TABLE 432 KEY DEALS

- TABLE 433 KEY OTHER DEVELOPMENTS

- TABLE 434 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 435 CARDINAL HEALTH: BUSINESS OVERVIEW

- TABLE 436 CURIUM: BUSINESS OVERVIEW

- TABLE 437 BAYER AG: BUSINESS OVERVIEW

- TABLE 438 LANTHEUS HOLDINGS, INC.: BUSINESS OVERVIEW

- TABLE 439 BRACCO IMAGING S.P.A.: BUSINESS OVERVIEW

- TABLE 440 PHARMALOGIC HOLDINGS CORP.: BUSINESS OVERVIEW

- TABLE 441 ECZACIBASI-MONROL NUCLEAR PRODUCTS: BUSINESS OVERVIEW

- TABLE 442 NTP RADIOISOTOPES SOC LTD.: BUSINESS OVERVIEW

- TABLE 443 NORDION INC.: BUSINESS OVERVIEW

- TABLE 444 ADVANCED ACCELERATOR APPLICATIONS: BUSINESS OVERVIEW

- TABLE 445 NORTHSTAR MEDICAL RADIOISOTOPES: BUSINESS OVERVIEW

- TABLE 446 ECKERT & ZIEGLER: BUSINESS OVERVIEW

- TABLE 447 JOINT STOCK COMPANY ISOTOPE (ISOTOPE JSC): BUSINESS OVERVIEW

- TABLE 448 SIEMENS HEALTHINEERS: BUSINESS OVERVIEW

- TABLE 449 JUBILANT DRAXIMAGE, INC.: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH METHODOLOGY: NUCLEAR MEDICINE MARKET

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

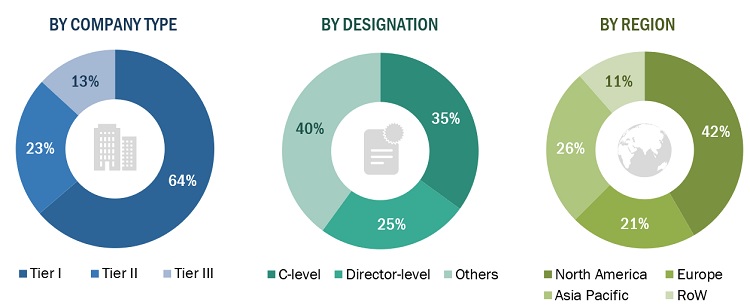

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 REVENUE SHARE ANALYSIS: CARDINAL HEALTH

- FIGURE 7 REVENUE ANALYSIS OF TOP FIVE COMPANIES: NUCLEAR MEDICINE MARKET (2022)

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NUCLEAR MEDICINE MARKET (2023–2028)

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 TOP-DOWN APPROACH

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- FIGURE 12 NUCLEAR MEDICINE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 NUCLEAR MEDICINE MARKET FOR SPECT APPLICATIONS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 NUCLEAR MEDICINE MARKET FOR PET APPLICATIONS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 NUCLEAR MEDICINE MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF NUCLEAR MEDICINE MARKET

- FIGURE 17 HIGH PREVALENCE OF CANCER TO DRIVE MARKET GROWTH

- FIGURE 18 US ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN NUCLEAR MEDICINE MARKET IN 2022

- FIGURE 19 SPECT PROCEDURES TO CONTINUE TO DOMINATE DIAGNOSTIC PROCEDURES MARKET IN 2028

- FIGURE 20 CHINA TO WITNESS HIGHEST GROWTH IN NUCLEAR MEDICINE MARKET DURING FORECAST PERIOD

- FIGURE 21 DIAGNOSTIC APPLICATIONS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 NUCLEAR MEDICINE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 VALUE CHAIN ANALYSIS OF NUCLEAR MEDICINE MARKET

- FIGURE 24 PATENT PUBLICATION TRENDS (JANUARY 2015–DECEMBER 2022)

- FIGURE 25 TOP 9 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- FIGURE 28 NORTH AMERICA: NUCLEAR MEDICINE MARKET SNAPSHOT

- FIGURE 29 ASIA PACIFIC: NUCLEAR MEDICINE MARKET SNAPSHOT (2022)

- FIGURE 30 NUCLEAR MEDICINE MARKET: MARKET RANKING, 2022

- FIGURE 31 REVENUE SHARE ANALYSIS OF KEY PLAYERS

- FIGURE 32 NUCLEAR MEDICINE MARKET: COMPANY EVALUATION MATRIX (2021)

- FIGURE 33 NUCLEAR MEDICINE MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES

- FIGURE 34 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 35 CARDINAL HEALTH: COMPANY SNAPSHOT (2022)

- FIGURE 36 BAYER AG: COMPANY SNAPSHOT (2021)

- FIGURE 37 LANTHEUS HOLDINGS, INC.: COMPANY SNAPSHOT (2021)

- FIGURE 38 ECKERT & ZIEGLER: COMPANY SNAPSHOT (2021)

- FIGURE 39 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2022)

This study involved four major activities in estimating the size of the nuclear medicine market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the Organisation for Economic Co-operation and Development (OECD), European Association of Nuclear Medicine (EANM), National Institutes of Health (NIH), World Nuclear Association (WNA), International Atomic Energy Agency (IAEA), Nuclear Regulatory Commission (NRC), Society of Nuclear Medicine and Molecular Imaging (SNMMI), Nuclear Energy Agency (NEA), Australian Nuclear Science and Technology Organisation (ANSTO), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the clinical decision support system market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

Note 1: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Tiers of companies are defined on the basis of their total revenue in 2022; Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

Report Metric |

Details |

|

Siemens Healthineers |

Sr.Sales Manager |

|

Curium |

General Manager |

|

Cardinal Health |

Product Sales Specialist |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the nuclear medicine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Radiopharmaceuticals are drugs that contain radionuclide-emitting ionizing radiation and are used in nuclear imaging to diagnose and treat diseases. The nuclear medicine market is bifurcated into diagnostic and therapeutic segments. Radiopharmaceuticals in the diagnostics market are categorized as SPECT and PET, while radiopharmaceuticals in the therapeutics market are categorized as beta emitters, alpha emitters, and brachytherapy isotopes.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the nuclear medicine market on the basis of type, application, procedure volume,end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions—North America, Europe, the Asia Pacific, and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as partnerships, collaborations, agreements, product approval & enhancements, expansions, and acquisitions in the nuclear medicine market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the nuclear medicine market.

- Profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nuclear Medicine Market

Which segment accounted for the largest nuclear medicine market share?

Which region has highest growth rate in Nuclear Medicine Market / Radiopharmaceuticals Market ?

Keen to get the updates on Nuclear Medicine Market Size Report, 2022 - 2030