Precision Fermentation Ingredients Market by Ingredient (Whey & Casein Protein, Egg White, Collagen Protein, Heme Protein), Microbe (Yeast, Algae, Fungi, Bacteria) End User, Food & Beverage Application, and Region - Global Forecast to 2030

Precision Fermentation Ingredients Market Size

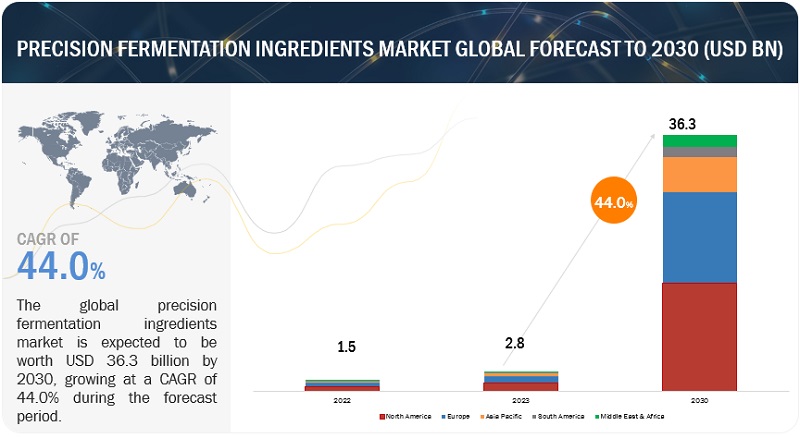

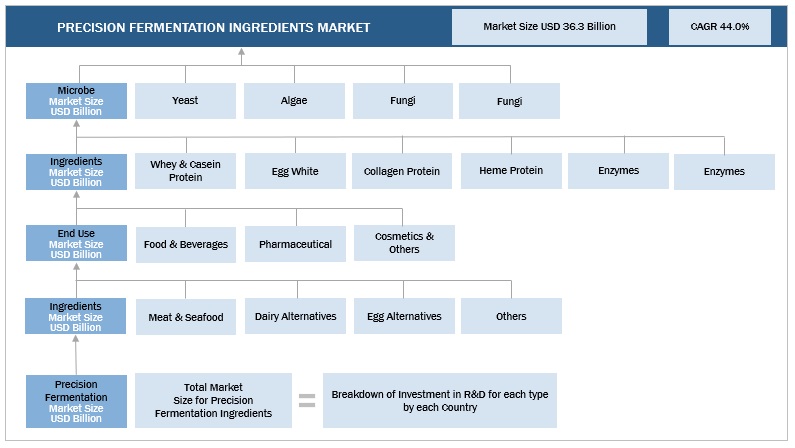

The global precision fermentation ingredients market size is estimated to be valued at USD 2.8 billion in 2023 and is projected to reach USD 36.3 billion by 2030, recording a CAGR of 44.0% by value. Changing consumer preferences towards veganism, increasing protein consumption, and rising investments in innovations are the major factors for market growth. Substantial breakthroughs in the genetic engineering space have enabled the cost-effective and sustainable reprogramming of microorganisms (synthetic biology) through precision fermentation to create a wide range of specialized food protein constituents.

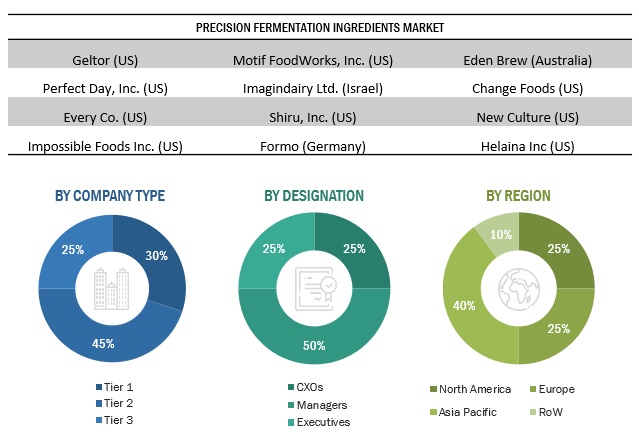

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, in May 2023, Geltor introduces CAVIANCE™, a vegan type of Il collagen polypeptide offering remarkable skin rejuvenating benefits. This innovative product stimulates six different types of collagens, exhibits potent antioxidant properties, and aids in wound healing. Other key players like MycoTechnology established a “groundbreaking” collaborative venture with Oman Investment Authority (OIA) to produce mushroom-based protein using locally cultivated dates. This joint venture will be named Vital Foods Technologies LLC. The overall Precision fermentation ingredients market is classified as a competitive market, with the top five key players, namely Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, and INC. (US) occupying 25-50% of the market share.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Precision Fermentation Ingredients Market Dynamics

Drivers: Growing adoption of vegan as well as meat-free lifestyles

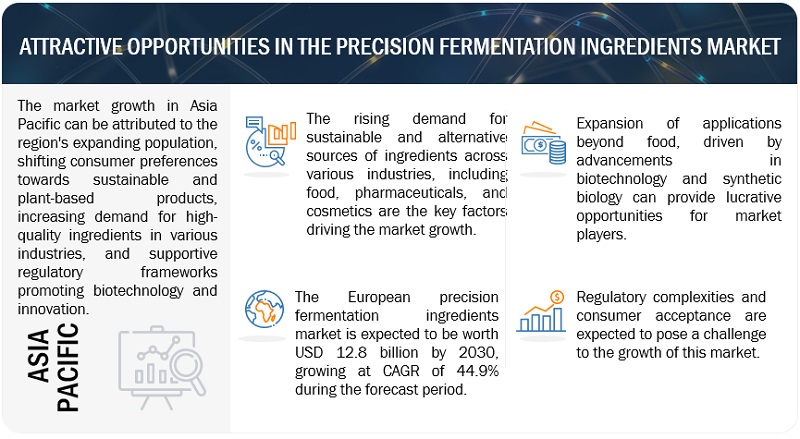

According to research conducted by The Hartman Group, the landscape of the North American precision fermentation ingredients market is poised for a transformative shift Around 40% of U.S. adults, over 90 million individuals, are ready to embrace precision fermentation products, projected to reach 132 million consumers by 2027. Younger generations are receptive due to environmental concerns and sustainability, with the second most influential factor being the positive impact on the environment. This aligns with their preference for sustainable consumption. The link between precision fermentation and sustainability, including reduced greenhouse gas emissions, natural farming, and sustainable packaging, offers innovation potential. Millennials and Gen Z are willing to pay up to 10% more for such products. This technology serves as a catalyst for a more sustainable and technologically advanced market landscape shaped by evolving consumer preferences and environmental consciousness. This trend invariably is supporting the precision fermentation ingredients market growth.

Restraints: Higher manufacturing costs associated with the production of ingredients utilizing precision fermentation ingredients

Demand for microbe-based precision fermented proteins or fats has gained momentum lately due to the increasing demand for animal-free products by the rising vegan population. In addition, precision fermentation provides several benefits: it reduces land and water usage, greenhouse gas emissions, and health problems associated with animal-based products. However, higher manufacturing costs have acted as the major restraint for the industry to scale up. Specific growth media for microorganisms, large-scale fermenters, and specialized purification processes combinedly increase the production cost exponentially. Also, the risk of yield failure or contamination is high as microorganisms need a stable and sterile environment for growth.

Opportunities: Lower production and supply chain cost

Precision fermentation is expected to become a low-cost technology generating huge opportunities in the alternative protein space. The industry will reach cost parity with most animal-derived protein molecules by 2023-25. By 2030, the cost of precision fermentation-based protein is expected to be lesser than that of animal-based counterparts. Modern food developed through this method will also pave way for a new food production system- moving from farms to fermentation tanks. This sustainable production method is expected to generate more opportunities for manufactureurs for commercially launching animal-free products.

Challenges: Customer acceptance of precision fermented based products

Though exhibiting huge scope to scale-up, precision fermentation-based outputs still have knowledge gaps. Bioavailability, allergenicity, digestibility, and bioequivalence of products are all factors that must be considered when evaluating products and ingredients. This is an essential factor if customers are switching from nutritional wholesome food products to modified food products that have some specific added proteins. Therefore, accepting precision-fermented food products is projected to be one of the challenging factors for the market. This challenge can be overcome by bringing consumer awareness regarding precision-fermented food products, which will drive the precision fermentation ingredients market growth in the coming years.

Precision Fermentation Ingredients Market Ecosystem

By end-use industries, the pharmaceuticals segment is projected to grow with the second-highest CAGR in the precision fermentation ingredients market during the forecast period.

This growth is supported by pioneering strides in biotechnology, where precision fermentation serves as a cornerstone to produce complex pharmaceutical compounds. The tailored manipulation of microorganisms enables the cost-effective synthesis of intricate APIs, propelling drug development. Moreover, this approach curtails reliance on traditional extraction methods, streamlining production, reducing environmental impact, and ensuring consistent product quality. As the pharmaceutical industry seeks efficient avenues for sustainable and regulated drug manufacturing, precision fermentation emerges as a pivotal driver in reshaping pharmaceutical landscapes.

By food & beverage application, the egg alternatives segment is projected to grow with the second-highest CAGR in the precision fermentation ingredients market during the forecast period.

The rising inclination toward vegan food has led manufacturers to introduce a variety of egg alternatives. Precision fermentation derived egg alternatives find use in baking, cooking, and food formulation. The Every Company introduced an egg protein called ClearEgg via precision fermentation in collaboration with Pressed Juicery in November 2021. In April 2021, the company increased its production capacity of egg alternatives further. In 2022, Shiru streamlined animal-free egg prototype creation using AI and machine learning. This innovative method accelerated the replication of egg properties within a plant-based framework.

By ingredient type, the whey & casein protein segment accounted for the second largest share.

The burgeoning awareness of animal-free options, veganism, and plant-based lifestyles has driven manufacturers to introduce an array of dairy-free ingredients. In the precision fermentation ingredients market, whey and casein play pivotal roles with versatile applications across industries. Companies like Modern Kitchen, based in the US, utilize precision fermentation-based whey protein from Perfect Day to produce animal-free cream cheese. Brazilian company Up Dairy specializes in precision fermentation to create dairy ingredients, with a focus on whey protein and casein. Up Dairy employs advanced technologies such as Cell Line Development, Host Strain Development, Target Molecule Selection, Bioprocess Design, and Ingredient Optimization. Formo Bio's approach to crafting animal-free cheese through precision fermentation showcases the intersection of traditional practices and innovative technology. By sourcing whey and casein from microorganisms inspired by cow DNA, they tap into both heritage and innovation, providing a sustainable alternative to traditional dairy cheese.

By microbe type, the fungi segment constitutes around one-fourth of the global demand.

Extensive research and development activities in the field of precision fermentation helped food producers in evolving the landscape of animal-free protein alternatives using microbes such as bacteria, yeast, and fungi. One advantage of utilizing fungi metabolic engineering is that their eukaryotic origin allows them to tolerate and functionally express heterologous eukaryotic proteins and enzymes, resulting in proper protein folding and post-translational modifications. Better Meat Co., a US based company, developed a process for biomass protein from the filamentous fungi Neurospora crass In February 2022, VTT Technical Research Centre of Finland developed egg white protein (ovalbumin) from fungi using precision fermentation.

North America: Precision Fermentation Ingredients Market Snapshot

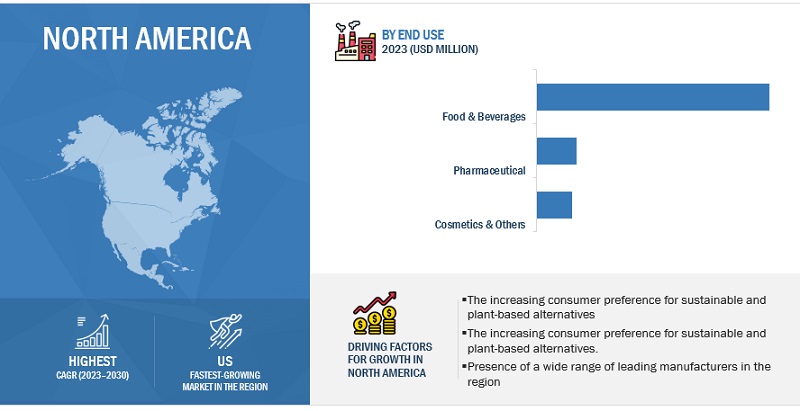

North America holds the highest market share during the forecast period.

North America remained the largest market for precision fermentation ingredients due to the increasing consumer awareness, consumption of healthy food ingredients, and veganism trend etc. The landscape of North American precision fermentation ingredients market is poised for a transformative shift; around 40% of U.S. adults, over 90 million individuals, are ready to embrace precision fermentation products, projected to reach 132 million consumers by 2027 (The Hartman Group). Younger generations are receptive due to environmental concerns and sustainability, with the second most influential factor being the positive impact on the environment. This aligns with their preference for sustainable consumption. The link between precision fermentation ingredients and sustainability, including reduced greenhouse gas emissions, natural farming, and sustainable packaging, offers innovation potential. Millennials and Gen Z are willing to pay up to 10% more for such products. This technology serves as a catalyst for a more sustainable and technologically advanced market landscape shaped by evolving consumer preferences and environmental consciousness.

Precision Fermentation Ingredients Market Trends

Here are some key trends shaping the precision fermentation ingredients market:

- Growing Demand for Sustainable Ingredients: With increasing awareness about environmental sustainability and concerns over traditional agricultural practices, there's a rising demand for sustainable alternatives. Precision fermentation offers a promising solution by providing ingredients that are produced with minimal environmental impact, such as reduced land and water usage and lower greenhouse gas emissions.

- Expansion in Food and Beverage Industry: The food and beverage industry is one of the primary sectors driving the adoption of precision fermentation ingredients. Companies are incorporating these ingredients into a wide range of products, including meat substitutes, dairy alternatives, flavors, and nutritional supplements. This trend is driven by consumer preferences for healthier, plant-based options and innovative flavors.

- Technological Advancements: Advances in biotechnology, genetic engineering, and fermentation processes are driving the development of new and improved precision fermentation techniques. These advancements enable more efficient production processes, higher yields, and the customization of ingredients to meet specific requirements, such as taste, texture, and nutritional profile.

- Investment and Collaboration: The precision fermentation industry has attracted significant investment from both traditional food and beverage companies and venture capital firms. Additionally, collaborations between startups, research institutions, and established players are becoming increasingly common. These partnerships facilitate knowledge sharing, access to resources, and the development of innovative products.

- Regulatory Landscape: As precision fermentation ingredients gain traction in the market, regulatory frameworks governing their production, labeling, and safety are evolving. Regulatory agencies are working to establish clear guidelines to ensure the safety and quality of these ingredients while addressing consumer concerns and promoting transparency in labeling.

- Diversification of Applications: Precision fermentation ingredients are finding applications beyond the food and beverage industry, including in pharmaceuticals, cosmetics, and animal feed. This diversification of applications opens up new opportunities for market growth and innovation as companies explore novel uses for these ingredients.

- Consumer Awareness and Acceptance: Consumer awareness of precision fermentation and acceptance of products containing these ingredients are increasing. As more information becomes available about the benefits of precision fermentation, consumers are becoming more open to trying products made with these ingredients, further driving market demand.

Precision Fermentation Ingredients Market Share

Key players in this market include Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, INC. (US), Formo (Germany), Eden Brew (Australia), Mycorena (Sweden), Change Foods (US), and MycoTechnology (US).

Want to explore hidden markets that can drive new revenue in Precision Fermentation Ingredients Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Precision Fermentation Ingredients Market?

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 2.8 billion |

|

Revenue Forecast in 2028 |

USD 36.3 billion |

|

Growth Rate |

CAGR of 44.0% from 2023-2028 |

|

Market size estimation |

2023–2030 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2030 |

|

Units considered |

Value (USD), Volume (Billion Units) |

|

Segments Covered |

Microbe, Ingredients, End-use, Food & beverage application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Growth Drivers |

|

|

Key Companies Profiled |

|

Precision fermentation ingredients market Report Scope:

By Microbe

- Yeast

- Algae

- Fungi

- Bacteria

By Ingredients

- Whey & Casein Protein

- Egg White

- Collagen Protein

- Heme Protein

- Enzymes

- Others

By End Use

- Food & Beverages

- Pharmaceutical

- cosmetics & Others

By Food & Beverage Application

- Meat & seafood

- Dairy alternatives

- Egg alternatives

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Precision Fermentation Ingredients Market Industry News

- In May 2023, The EVERY Company and Alpha Foods officially entered into a Joint Development Agreement with the shared objective of bringing next-generation alt-meat products to the market. This collaboration aims to leverage EVERY's trailblazing expertise in animal-free protein production and Alpha Foods' renowned chef-crafted plant-based foods to accelerate advancements in taste and texture for non-animal products.

- In March 2023, the partnership between The Hartman Group, Perfect Day, and Cargill enabled Perfect Day to gain valuable insights into consumer attitudes and preferences related to precision fermentation ingredients. This data has helped Perfect Day strengthen its position in the market, spearhead the Precision fermentation Alliance

- In October 2022, Impossible Foods' collaboration with Domino's Australia, introducing Impossible™ Beef on their pizzas, strategically expands their market presence, boosts brand exposure, and appeals to environmentally conscious consumers.

Frequently Asked Questions (FAQ):

What is the projected market value of the global precision fermentation ingredients market?

The global precision fermentation ingredients market size is estimated to be valued at USD 2.8 billion in 2023 and is projected to reach USD 36.3 billion by 2030

What is the estimated growth rate (CAGR) of the global precision fermentation ingredients market for the next five years?

The precision fermentation ingredients market is expected to record a CAGR of 44.0 % during the period 2023-2030.

Which are the major companies in the precision fermentation ingredients market?

Key players in this market include Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, INC. (US), Formo (Germany), Eden Brew (Australia), Mycorena (Sweden), Change Foods (US), and MycoTechnology (US).

What is the future growth potential of precision fermentation ingredients market?

North America remained the largest market for precision fermentation ingredients due to the increasing consumer awareness, consumption of healthy food ingredients, and veganism trend etc.

What kind of information is provided in the competitive landscape section?

For the list of the below-mentioned players, company profiles provide insights such as a business overview covering information on the company’s business segments, funding status, geographic presence, and business mix. The section also provides information on product offerings, key developments associated with the company, strategy analysis, and MnM view to elaborate analyst view on the company. Some of the key players in the market include Geltor (US), Perfect Day, Inc. (US), The Every Co. (US), Impossible Foods Inc. (US), Motif FoodWorks, INC. (US), and Formo (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACRO INDICATORSFERMENTATION TO DEVELOP SUSTAINABLE FOOD SYSTEM

-

5.3 MARKET DYNAMICSDRIVERS- Heavy investments and funding in precision fermentation space- Growing adoption of vegan and meat-free lifestyles- Production of precision-fermented ingredients to yield lower carbon footprintRESTRAINTS- High manufacturing costs associated with production of ingredients utilizing precision fermentationOPPORTUNITIES- Development of novel protein production systems- Lower production and supply chain costs- Competitive product costing against animal-based and other alternative proteinsCHALLENGES- Lack of commercialization and cost-effective production at scale- Low customer acceptance of precision-fermented products

- 6.1 INTRODUCTION

-

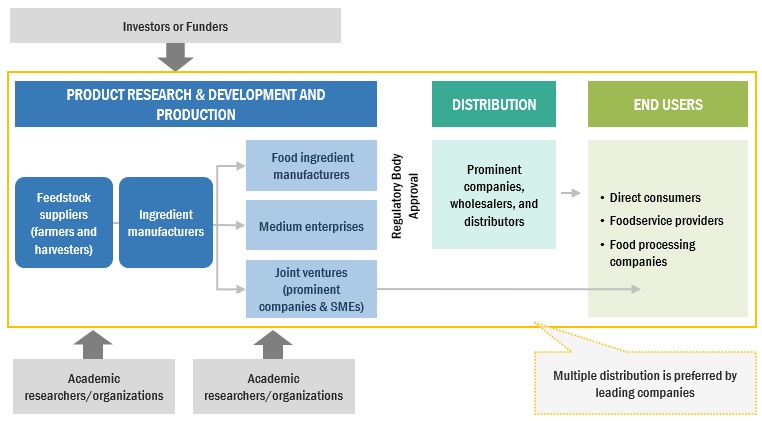

6.2 VALUE CHAIN ANALYSISTARGET METABOLITE IDENTIFICATION & SELECTIONMICROBIAL STRAIN DEVELOPMENTFEEDSTOCK DISCOVERY & OPTIMIZATIONBIOPROCESSING DESIGN & MANUFACTURINGEND PRODUCT & INGREDIENT COMMERCIALIZATION

-

6.3 VALUE CHAIN ANALYSIS OF PROTEIN ALTERNATIVE PRODUCTSRESEARCH & DEVELOPMENTRAW MATERIAL SOURCINGPRODUCTION AND PROCESSINGPACKAGINGMARKETING & DISTRIBUTION AND END USE

- 6.4 SUPPLY CHAIN ANALYSIS OF PROTEIN ALTERNATIVE PRODUCTS

-

6.5 TECHNOLOGY ANALYSISGENOMIC REVOLUTION AND ARTIFICIAL INTELLIGENCEMACHINE LEARNINGMEMBRANE SEPARATION TECHNOLOGYBIOINFORMATICS

- 6.6 PRICING ANALYSIS

-

6.7 MARKET MAP AND ECOSYSTEM ANALYSISDEMAND-SIDE COMPANIESSUPPLY-SIDE COMPANIES

- 6.8 TRENDS IMPACTING BUYERS IN PRECISION FERMENTATION INGREDIENTS MARKET

-

6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 CASE STUDY ANALYSISEXPANSION OF IMPOSSIBLE FOODS' PLANT-BASED PRODUCT LINEREVOLUTIONIZING PROTEIN FUNCTION PREDICTION WITH AIDEVELOPMENT OF ALTERNATIVE PROTEIN PRODUCT BY IMPOSSIBLE FOODSLAUNCHING OF DAIRY-FREE ICE CREAM BY PERFECT DAY TO COMBAT LACTOSE INTOLERANCE

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.14 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.15 REGULATORY FRAMEWORKINTRODUCTIONREGULATIONS, BY COUNTRY/REGION- US- Canada- European Union- Australia- Singapore- India- China

- 7.1 INTRODUCTION

-

7.2 FOOD & BEVERAGESRAPID PRODUCT LAUNCHES TO ADDRESS CONSUMERS’ DEMAND TO DRIVE GROWTH

-

7.3 PHARMACEUTICALSGROWING ADVANCEMENTS IN MEDICAL RESEARCH TO DRIVE MARKET

- 7.4 COSMETICS & OTHERS

- 8.1 INTRODUCTION

-

8.2 MEAT & SEAFOODINCREASING VEGAN POPULATION TO DRIVE DEMAND FOR ANIMAL-FREE MEAT AND SEAFOOD

-

8.3 DAIRY ALTERNATIVESRISING SHIFT TOWARD DAIRY-FREE PRODUCTS TO DRIVE GROWTH

-

8.4 EGG ALTERNATIVESINCREASING ALLERGIES TO SHIFT CUSTOMERS TOWARD EGG ALTERNATIVES TO BOOST GROWTH

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 WHEY & CASEIN PROTEININCREASING DEMAND FOR NUTRITIONAL FOOD AND BEVERAGES TO DRIVE MARKET

-

9.3 EGG WHITEGROWING ADOPTION OF FLEXITARIAN DIETS TO BOOST MARKET

-

9.4 COLLAGEN PROTEINRISING PLANT-BASED MOVEMENT TO SUPPORT MARKET GROWTH

-

9.5 HEME PROTEINNEED FOR USE OF HEME PROTEIN TO REPLICATE MEATY TASTE IN ALTERNATIVES TO BOOST GROWTH

-

9.6 ENZYMESGROWTH IN ANIMAL-FREE PROTEIN SECTOR TO DRIVE MARKET DEMAND

- 9.7 OTHER INGREDIENTS

- 10.1 INTRODUCTION

-

10.2 YEASTINCREASING USE OF ADVANCED APPLICATIONS OF YEAST TO DRIVE GROWTH

-

10.3 ALGAEEMERGENCE OF ALGAE-BASED PRODUCTS TO PROVIDE FUNCTIONAL BENEFITS TO PROSPER GROWTH

-

10.4 FUNGIDEVELOPMENT OF FOOD PRODUCTS FROM FERMENTATION-BASED ALTERNATIVE PROTEINS TO BOOST GROWTH

-

10.5 BACTERIAINCREASING USE OF BACTERIA TO PRODUCE SUSTAINABLE FOOD PRODUCTS TO DRIVE GROWTHARCHAEA BACTERIA

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Increasing demand for high-protein formulations to drive marketCANADA- Rise in shift toward lower-cost and nutrition-rich plant-based dairy alternatives to drive marketMEXICO- Growth in demand for animal-free alternatives to drive growth

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Increase in health awareness and growing vegetarian and vegan population to drive growthFRANCE- Growing demand for animal-free ingredients from cosmetics industry to propel marketUK- Greater demand for dairy alternatives to bolster growthITALY- Rise in consumption of cheese to drive marketSPAIN- Launch of animal-free ingredients by startups to drive growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Availability of limited meat alternatives to boost growthJAPAN- Adoption of plant-based food options by older people to drive market expansionINDIA- Rising demand for dairy-free substitutes to drive marketAUSTRALIA & NEW ZEALAND- High involvement in R&D activities to develop animal-free dairy to drive marketSINGAPORE- Growing requirement for microbial-based alternative proteins to boost adoption of precision fermentationREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTARGENTINA- Focus on enhancing clean-label food products to propel growthBRAZIL- Adoption of bio-based products to drive marketREST OF SOUTH AMERICA

-

11.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTISRAEL- Rising demand for major players to contribute to market expansionUAE- Growing acceptance of vegan food to boost growthAFRICA- Rise in urbanization and increasing disposable income to promote market growth

- 12.1 OVERVIEW

- 12.2 MARKET RANKING ANALYSIS

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.5 MARKET SHARE ANALYSIS

-

12.6 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSKEY PLAYER PRODUCT FOOTPRINT

-

12.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHES

-

13.1 KEY PLAYERSGELTOR- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPERFECT DAY, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE EVERY CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIMPOSSIBLE FOODS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMOTIF FOODWORKS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIMAGINDAIRY LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHIRU INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFORMO BIO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEDEN BREW- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHANGE FOODS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNEW CULTURE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHELAINA INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMYCORENA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMYCOTECHNOLOGY, INC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFYBRAWORKS FOODS- Business overview- Products/Solutions/Services offered- MnM viewREMILK LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRITON ALGAE INNOVATIONS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMELT&MARBLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewREVYVE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOURISH INGREDIENTS PTY LTD.- Business overview- Products offered Products/Solutions/Services offered- Recent developments- MnM view

- 14.1 INTRODUCTION

-

14.2 DAIRY ALTERNATIVES MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWDAIRY ALTERNATIVES MARKET, BY SOURCEDAIRY ALTERNATIVES MARKET, BY REGION

-

14.3 CULTURED MEAT MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWCULTURED MEAT MARKET, BY SOURCE

-

14.4 MEAT SUBSTITUTES MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWMEAT SUBSTITUTES MARKET, BY PRODUCTCOVID-19 IMPACT ON MEAT SUBSTITUTES MARKET, BY PRODUCT- Optimistic scenario- Realistic scenario- Pessimistic scenario

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 PRECISION FERMENTATION INGREDIENTS MARKET SNAPSHOT, 2023 VS. 2030

- TABLE 3 PRECISION FERMENTATION INGREDIENTS AVERAGE SELLING PRICE, BY MICROBE TYPE, 2019–2022 (USD/KG)

- TABLE 4 PRECISION FERMENTATION INGREDIENTS AVERAGE SELLING PRICE, BY REGION, 2019–2022 (USD/KG)

- TABLE 5 PRECISION FERMENTATION INGREDIENTS MARKET: SUPPLY CHAIN ECOSYSTEM ANALYSIS

- TABLE 6 PATENTS PERTAINING TO PRECISION FERMENTATION, 2012–2022

- TABLE 7 DETAILED LIST OF KEY CONFERENCES & EVENTS, 2023–2024

- TABLE 8 PORTER’S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP END USERS

- TABLE 10 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2019–2022 (USD MILLION)

- TABLE 15 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 16 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2019–2022 (THOUSAND TONS)

- TABLE 17 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2023–2030 (THOUSAND TONS)

- TABLE 18 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2023–2030 (USD MILLION)

- TABLE 19 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2023–2030 (THOUSAND TONS)

- TABLE 20 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 22 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 23 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 24 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY REGION, 2023–2030 (USD MILLION)

- TABLE 25 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 26 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 27 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 28 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY APPLICATION TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 29 FOOD & BEVERAGES: PRECISION FERMENTATION INGREDIENTS MARKET, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 30 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 31 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 32 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 34 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 35 MEAT & SEAFOOD: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 36 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 38 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 39 DAIRY ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 40 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 42 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 43 EGG ALTERNATIVES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 44 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 46 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 47 OTHER APPLICATIONS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 48 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 49 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 50 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 51 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 52 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 53 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 54 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 56 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 57 WHEY & CASEIN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 58 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 60 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 61 EGG WHITE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 62 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 64 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 65 COLLAGEN PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 66 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 68 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 69 HEME PROTEIN: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 70 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 71 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 72 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 73 ENZYMES: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 74 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 75 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 76 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 77 OTHER INGREDIENTS: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 78 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (USD MILLION)

- TABLE 79 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 80 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 81 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 82 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 83 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 84 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 85 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 86 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 87 YEAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 88 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 89 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 90 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 91 ALGAE: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 92 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 93 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 94 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 95 FUNGI: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 96 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 97 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 98 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 99 BACTERIA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 100 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 101 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 102 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 103 PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 104 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 105 OPTIMISTIC SCENARIO: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 106 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 108 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (THOUSAND TONS)

- TABLE 109 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (THOUSAND TONS)

- TABLE 110 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 113 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 114 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 116 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 117 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 118 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 121 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 122 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 123 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 124 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (THOUSAND TONS)

- TABLE 125 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (THOUSAND TONS)

- TABLE 126 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 127 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 128 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 129 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 130 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 131 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 132 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 133 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 134 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (USD MILLION)

- TABLE 135 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 136 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 137 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 138 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (THOUSAND TONS)

- TABLE 141 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (THOUSAND TONS)

- TABLE 142 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 145 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 146 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 149 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 150 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 153 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 154 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 155 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 156 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (THOUSAND TONS)

- TABLE 157 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (THOUSAND TONS)

- TABLE 158 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 159 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 160 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 161 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 162 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 164 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 165 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 166 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (USD MILLION)

- TABLE 167 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 168 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 169 SOUTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 170 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2019–2022 (THOUSAND TONS)

- TABLE 173 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY REGION, 2023–2030 (THOUSAND TONS)

- TABLE 174 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 175 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 176 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2019–2022 (THOUSAND TONS)

- TABLE 177 MIDDLE EAST: PRECISION FERMENTATION INGREDIENTS MARKET, BY COUNTRY, 2023–2030 (THOUSAND TONS)

- TABLE 178 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 181 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET IN FOOD & BEVERAGE APPLICATIONS, BY APPLICATION TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 182 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 185 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 186 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2019–2022 (THOUSAND TONS)

- TABLE 189 MIDDLE EAST & AFRICA: PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023–2030 (THOUSAND TONS)

- TABLE 190 PRECISION FERMENTATION INGREDIENTS MARKET: DEGREE OF COMPETITION

- TABLE 191 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 192 MARKET SHARE ANALYSIS OF PRECISION FERMENTATION INGREDIENTS MARKET, 2022

- TABLE 193 COMPANY FOOTPRINT, BY INGREDIENT TYPE

- TABLE 194 COMPANY FOOTPRINT, BY MICROBE TYPE

- TABLE 195 COMPANY FOOTPRINT, BY END USE

- TABLE 196 COMPANY FOOTPRINT, BY FOOD & BEVERAGE APPLICATION

- TABLE 197 COMPANY FOOTPRINT, BY REGION

- TABLE 198 OVERALL COMPANY FOOTPRINT

- TABLE 199 PRECISION FERMENTATION INGREDIENTS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 200 PRECISION FERMENTATION INGREDIENTS MARKET: PRODUCT LAUNCHES, 2019–2023

- TABLE 201 PRECISION FERMENTATION INGREDIENTS MARKET: DEALS, 2019–2023

- TABLE 202 PRECISION FERMENTATION INGREDIENTS MARKET: OTHER DEVELOPMENTS, 2017–2023

- TABLE 203 GELTOR: BUSINESS OVERVIEW

- TABLE 204 GELTOR: FUNDING OVERVIEW

- TABLE 205 GELTOR: PRODUCTS OFFERED

- TABLE 206 GELTOR: PRODUCT LAUNCHES

- TABLE 207 GELTOR: DEALS

- TABLE 208 GELTOR: OTHERS

- TABLE 209 PERFECT DAY, INC.: BUSINESS OVERVIEW

- TABLE 210 PERFECT DAY, INC.: FUNDING OVERVIEW

- TABLE 211 PERFECT DAY, INC.: PRODUCTS OFFERED

- TABLE 212 PERFECT DAY, INC.: PRODUCT LAUNCHES

- TABLE 213 PERFECT DAY, INC.: DEALS

- TABLE 214 PERFECT DAY, INC.: OTHERS

- TABLE 215 THE EVERY CO.: BUSINESS OVERVIEW

- TABLE 216 THE EVERY CO.: FUNDING OVERVIEW

- TABLE 217 THE EVERY CO.: PRODUCTS OFFERED

- TABLE 218 THE EVERY CO.: PRODUCT LAUNCHES

- TABLE 219 THE EVERY CO.: DEALS

- TABLE 220 THE EVERY CO.: OTHERS

- TABLE 221 IMPOSSIBLE FOODS INC.: BUSINESS OVERVIEW

- TABLE 222 IMPOSSIBLE FOODS INC.: FUNDING OVERVIEW

- TABLE 223 IMPOSSIBLE FOODS INC.: PRODUCTS OFFERED

- TABLE 224 IMPOSSIBLE FOODS INC.: PRODUCT LAUNCHES

- TABLE 225 IMPOSSIBLE FOODS INC.: DEALS

- TABLE 226 IMPOSSIBLE FOODS INC.: OTHERS

- TABLE 227 MOTIF FOODWORKS, INC.: BUSINESS OVERVIEW

- TABLE 228 MOTIF FOODWORKS, INC.: FUNDING OVERVIEW

- TABLE 229 MOTIF FOODWORKS, INC.: PRODUCTS OFFERED

- TABLE 230 MOTIF FOODWORKS, INC.: PRODUCT LAUNCHES

- TABLE 231 MOTIF FOODWORKS, INC.: DEALS

- TABLE 232 MOTIF FOODWORKS, INC.: OTHERS

- TABLE 233 IMAGINDAIRY LTD.: BUSINESS OVERVIEW

- TABLE 234 IMAGINDAIRY LTD.: FUNDING OVERVIEW

- TABLE 235 IMAGINDAIRY LTD.: PRODUCTS OFFERED

- TABLE 236 IMAGINDAIRY LTD.: PRODUCT LAUNCHES

- TABLE 237 IMAGINDAIRY LTD.: OTHERS

- TABLE 238 SHIRU, INC.: BUSINESS OVERVIEW

- TABLE 239 SHIRU, INC.: FUNDING OVERVIEW

- TABLE 240 SHIRU, INC.: PRODUCTS OFFERED

- TABLE 241 SHIRU, INC.: PRODUCT LAUNCHES

- TABLE 242 SHIRU, INC.: DEALS

- TABLE 243 SHIRU, INC.: OTHERS

- TABLE 244 FORMO BIO: BUSINESS OVERVIEW

- TABLE 245 FORMO BIO: FUNDING OVERVIEW

- TABLE 246 FORMO BIO: PRODUCTS OFFERED

- TABLE 247 FORMO BIO: DEALS

- TABLE 248 FORMO BIO: OTHERS

- TABLE 249 EDEN BREW: BUSINESS OVERVIEW

- TABLE 250 EDEN BREW: FUNDING OVERVIEW

- TABLE 251 EDEN BREW: PRODUCTS OFFERED

- TABLE 252 EDEN BREW: PRODUCT LAUNCHES

- TABLE 253 EDEN BREW: DEALS

- TABLE 254 EDEN BREW: OTHERS

- TABLE 255 CHANGE FOODS: BUSINESS OVERVIEW

- TABLE 256 CHANGE FOODS: FUNDING OVERVIEW

- TABLE 257 CHANGE FOODS: PRODUCTS OFFERED

- TABLE 258 CHANGE FOODS: OTHERS

- TABLE 259 NEW CULTURE: BUSINESS OVERVIEW

- TABLE 260 NEW CULTURE: FUNDING OVERVIEW

- TABLE 261 NEW CULTURE: PRODUCTS OFFERED

- TABLE 262 NEW CULTURE: PRODUCT LAUNCHES

- TABLE 263 NEW CULTURE: DEALS

- TABLE 264 NEW CULTURE: OTHERS

- TABLE 265 HELAINA INC.: BUSINESS OVERVIEW

- TABLE 266 HELAINA INC: FUNDING OVERVIEW

- TABLE 267 HELAINA INC: PRODUCTS OFFERED

- TABLE 268 HELAINA INC: OTHERS

- TABLE 269 MYCORENA: BUSINESS OVERVIEW

- TABLE 270 MYCORENA: FUNDING OVERVIEW

- TABLE 271 MYCORENA: PRODUCTS OFFERED

- TABLE 272 MYCORENA: PRODUCT LAUNCHES

- TABLE 273 MYCORENA: DEALS

- TABLE 274 MYCORENA: OTHERS

- TABLE 275 MYCOTECHNOLOGY, INC: BUSINESS OVERVIEW

- TABLE 276 MYCOTECHNOLOGY, INC: FUNDING OVERVIEW

- TABLE 277 MYCOTECHNOLOGY, INC: PRODUCTS OFFERED

- TABLE 278 MYCOTECHNOLOGY, INC: PRODUCT LAUNCHES

- TABLE 279 MYCOTECHNOLOGY, INC: DEALS

- TABLE 280 MYCOTECHNOLOGY, INC: OTHERS

- TABLE 281 FYBRAWORKS FOODS: BUSINESS OVERVIEW

- TABLE 282 FYBRAWORKS FOODS: FUNDING OVERVIEW

- TABLE 283 FYBRAWORKS FOODS: PRODUCTS OFFERED

- TABLE 284 REMILK LTD.: BUSINESS OVERVIEW

- TABLE 285 REMILK LTD.: FUNDING OVERVIEW

- TABLE 286 REMILK LTD.: PRODUCTS OFFERED

- TABLE 287 REMILK LTD.: DEALS

- TABLE 288 REMILK LTD.: OTHERS

- TABLE 289 TRITON ALGAE INNOVATIONS: BUSINESS OVERVIEW

- TABLE 290 TRITON ALGAE INNOVATIONS: FUNDING OVERVIEW

- TABLE 291 TRITON ALGAE INNOVATIONS: PRODUCTS OFFERED

- TABLE 292 TRITON ALGAE INNOVATIONS: PRODUCT LAUNCHES

- TABLE 293 TRITON ALGAE INNOVATIONS: DEALS

- TABLE 294 MELT&MARBLE: BUSINESS OVERVIEW

- TABLE 295 MELT&MARBLE: FUNDING OVERVIEW

- TABLE 296 MELT&MARBLE: PRODUCTS OFFERED

- TABLE 297 MELT&MARBLE: PRODUCT LAUNCHES

- TABLE 298 MELT&MARBLE: OTHERS

- TABLE 299 REVYVE: BUSINESS OVERVIEW

- TABLE 300 REVYVE: FUNDING OVERVIEW

- TABLE 301 REVYVE: PRODUCTS OFFERED

- TABLE 302 REVYVE: DEALS

- TABLE 303 REVYVE: OTHERS

- TABLE 304 NOURISH INGREDIENTS PTY LTD: BUSINESS OVERVIEW

- TABLE 305 NOURISH INGREDIENTS PTY LTD: FUNDING OVERVIEW

- TABLE 306 NOURISH INGREDIENTS PTY LTD: PRODUCTS OFFERED

- TABLE 307 NOURISH INGREDIENTS PTY LTD: DEALS

- TABLE 308 NOURISH INGREDIENTS PTY LTD: OTHERS

- TABLE 309 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2016–2021 (USD MILLION)

- TABLE 310 DAIRY ALTERNATIVES MARKET, BY SOURCE, 2022–2027 (USD MILLION)

- TABLE 311 DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 312 DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 313 DAIRY ALTERNATIVES MARKET, BY REGION, 2016–2021 (MILLION LITERS)

- TABLE 314 DAIRY ALTERNATIVES MARKET, BY REGION, 2022–2027 (MILLION LITERS)

- TABLE 315 OPTIMISTIC SCENARIO: CULTURED MEAT MARKET, BY SOURCE, 2021–2032 (USD MILLION)

- TABLE 316 OPTIMISTIC SCENARIO: CULTURED MEAT MARKET, BY SOURCE, 2021–2032 (TONS)

- TABLE 317 REALISTIC SCENARIO: CULTURED MEAT MARKET, BY SOURCE, 2021–2032 (USD MILLION)

- TABLE 318 REALISTIC SCENARIO: CULTURED MEAT MARKET, BY SOURCE, 2021–2032 (TONS)

- TABLE 319 PESSIMISTIC SCENARIO: CULTURED MEAT MARKET, BY SOURCE, 2021–2032 (USD MILLION)

- TABLE 320 PESSIMISTIC SCENARIO: CULTURED MEAT MARKET, BY SOURCE, 2021–2032 (TONS)

- TABLE 321 MEAT SUBSTITUTES MARKET, BY PRODUCT, 2017–2020 (USD MILLION)

- TABLE 322 MEAT SUBSTITUTES MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

- TABLE 323 OPTIMISTIC SCENARIO: MEAT SUBSTITUTES MARKET, BY PRODUCT, 2019–2022 (USD MILLION)

- TABLE 324 REALISTIC SCENARIO: MEAT SUBSTITUTES MARKET, BY PRODUCT, 2019–2022 (USD MILLION)

- TABLE 325 PESSIMISTIC SCENARIO: MEAT SUBSTITUTES MARKET, BY PRODUCT, 2019–2022 (USD MILLION)

- FIGURE 1 PRECISION FERMENTATION INGREDIENTS MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY VALUE CHAIN, DESIGNATION, AND REGION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION METHODOLOGY

- FIGURE 6 INDICATORS OF RECESSION

- FIGURE 7 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 8 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 9 RECESSION INDICATORS AND THEIR IMPACT ON PRECISION FERMENTATION INGREDIENTS MARKET

- FIGURE 10 PRECISION FERMENTATION INGREDIENTS MARKET: EARLIER VS. RECESSION FORECAST

- FIGURE 11 PRECISION FERMENTATION INGREDIENTS MARKET, BY END USE, 2023 VS. 2030 (USD MILLION)

- FIGURE 12 PRECISION FERMENTATION INGREDIENTS MARKET, BY FOOD & BEVERAGE APPLICATION, 2023 VS. 2030 (USD MILLION)

- FIGURE 13 PRECISION FERMENTATION INGREDIENTS MARKET, BY INGREDIENT TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 14 PRECISION FERMENTATION INGREDIENTS MARKET, BY MICROBE TYPE, 2023 VS. 2030 (USD MILLION)

- FIGURE 15 ASIA PACIFIC PROJECTED TO BE FASTEST-GROWING MARKET

- FIGURE 16 INCREASING DEMAND FOR SUSTAINABLE FOOD TO DRIVE MARKET FOR PRECISION FERMENTATION INGREDIENTS

- FIGURE 17 US TO BE LARGEST MARKET FOR PRECISION FERMENTATION INGREDIENTS IN 2023

- FIGURE 18 ENZYMES SEGMENT AND GERMANY ACCOUNTED FOR SIGNIFICANT SHARE IN EUROPEAN MARKET IN 2022

- FIGURE 19 NORTH AMERICA AND DAIRY ALTERNATIVES SEGMENTS PROJECTED TO DOMINATE MARKET

- FIGURE 20 ENZYMES SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 YEAST SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 FOOD & BEVERAGES SEGMENT TO ACCOUNT FOR LARGEST SHARE

- FIGURE 23 MEAT & SEAFOOD TO BE FASTEST-GROWING SEGMENT

- FIGURE 24 INCREASING DEMAND FOR ALTERNATIVE PROTEINS TO DRIVE GROWTH

- FIGURE 25 INVESTMENTS IN FERMENTATION, BY TYPE, 2013–2022 (USD MILLION)

- FIGURE 26 INVESTMENTS IN FERMENTATION, BY REGION, 2022 (USD MILLION)

- FIGURE 27 PURCHASE INTENT AMONG NON-MILK ALLERGIC INDIVIDUALS

- FIGURE 28 PURCHASE LIKELIHOOD FOR THOSE FAMILIAR WITH PRODUCT WITHOUT MILK ALLERGY

- FIGURE 29 GREENHOUSE GAS EMISSIONS FROM ANIMAL AGRICULTURE (MILLION METRIC TONS)

- FIGURE 30 PF COSTS: HISTORICAL AND FORECAST

- FIGURE 31 COST REDUCTION ESTIMATES FOR GROWTH FACTORS & RECOMBINANT PROTEINS

- FIGURE 32 LIKELY ROLE OF PRECISION FERMENTATION PRODUCTS WITHIN CONSUMERS’ OVERALL FOOD AND BEVERAGE PORTFOLIO

- FIGURE 33 VALUE CHAIN ANALYSIS OF PRECISION FERMENTATION INGREDIENTS MARKET

- FIGURE 34 VALUE CHAIN ANALYSIS OF PROTEIN ALTERNATIVE PRODUCTS

- FIGURE 35 SUPPLY CHAIN ANALYSIS OF PROTEIN ALTERNATIVE PRODUCTS

- FIGURE 36 PRECISION FERMENTATION: MARKET MAP

- FIGURE 37 PRECISION FERMENTATION INGREDIENTS MARKET: TRENDS IMPACTING BUYERS

- FIGURE 38 PATENT ANALYSIS, 2012–2022

- FIGURE 39 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PRECISION FERMENTATION INGREDIENTS, 2012–2022

- FIGURE 40 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FOOD & BEVERAGE APPLICATIONS

- FIGURE 41 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 42 COSMETICS & OTHERS SEGMENT TO REGISTER FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 43 MEAT & SEAFOOD SEGMENT TO REGISTER HIGHEST GROWTH BY 2030

- FIGURE 44 ENZYMES SEGMENT TO LEAD MARKET BY 2030

- FIGURE 45 YEAST SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 46 CHINA TO REGISTER HIGHEST CAGR IN PRECISION FERMENTATION INGREDIENTS MARKET

- FIGURE 47 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET SNAPSHOT

- FIGURE 48 NORTH AMERICA: PRECISION FERMENTATION INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

- FIGURE 49 EUROPE: PRECISION FERMENTATION INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

- FIGURE 50 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: PRECISION FERMENTATION INGREDIENTS MARKET, RECESSION IMPACT ANALYSIS

- FIGURE 52 SOUTH AMERICAN PRECISION FERMENTATION INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 53 MIDDLE EAST & AFRICA PRECISION FERMENTATION INGREDIENTS MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 54 PRECISION FERMENTATION INGREDIENTS MARKET: SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 55 PRECISION FERMENTATION INGREDIENTS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 56 PRECISION FERMENTATION INGREDIENTS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

This research involves the extensive use of secondary sources, directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Precision fermentation ingredients market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as Good Food Institute (GFI), Precision fermentation Alliance, RethinkX, Commonwealth Scientific and Industrial Research Organization (CSIRO), Institute of Food Technologists (IFT), Food and Agricultural Organization (FAO), Plant Based Foods Association (PBFA), Alternative Proteins Association (APA), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), and other associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Precision fermentation ingredients market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of Precision fermentation ingredients. On the demand side, key opinion leaders, executives, and CEOs of companies in the Precision fermentation ingredients industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Precision fermentation ingredients market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

Precision Fermentation Ingredients Market Size Estimation

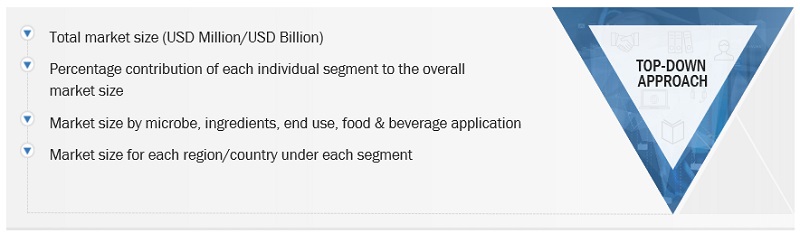

The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Precision fermentation ingredients market size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Precision fermentation ingredients market size: Top-Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Precision fermentation uses microbial host cells as factories for producing specific functional ingredients that can enhance and enable end products predominantly made of plant proteins, cultivated animal cells, or even other microbial biomass.

Stakeholders

- Food & beverage manufacturers, suppliers, and processors

- Research & development institutions Bakery product manufacturers

- Traders & Retailers

- Distributors, importers, and exporters

-

Regulatory bodies

- Organizations such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, Food Safety Australia New Zealand (FSANZ) American Bakers Association (ABA)

- Government agencies

- Intermediary suppliers

- Universities and industry bodies

- End users

Report Objectives

- To define, segment, and project the global market for precision fermentation ingredients market on the basis of microbe, ingredients, end-use, food & beverage application, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the precision fermentation ingredients market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Precision fermentation ingredients market, by key country

- Further breakdown of the Rest of the Asia Pacific Precision fermentation ingredients market, by key country

- Further breakdown of the Rest of South America Precision fermentation ingredients market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Precision Fermentation Ingredients Market