Pharmaceutical Contract Manufacturing Market by Service (Drug Development, Pharmaceutical (API, FDF - Parenteral, Tablet, Capsule, Oral Liquid), Biologics (API, FDF), Packaging & Labelling, Fill-finish), End Users - Global Forecasts to 2029

Market Growth Outlook Summary

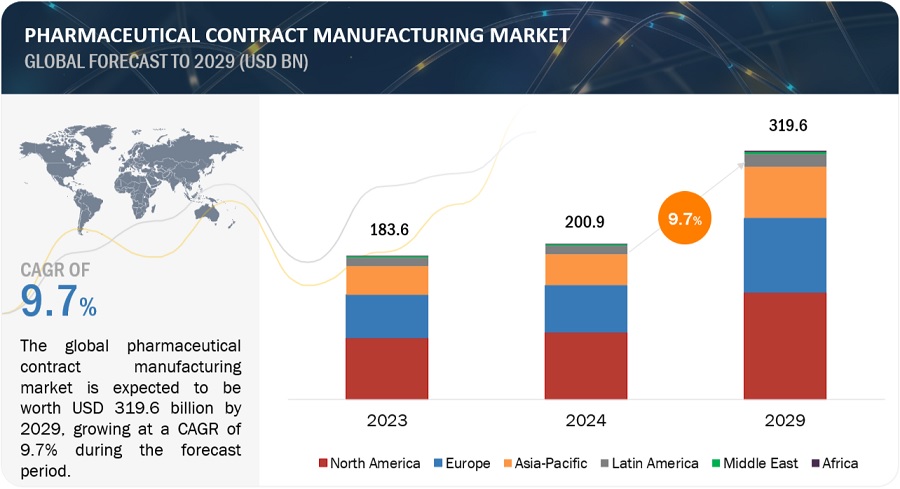

The global pharmaceutical contract manufacturing market growth forecasted to transform from USD 200.9 billion in 2024 to USD 319.6 billion by 2029, driven by a CAGR of 9.7%. Increasing use of generic drugs and funding, developments in the field of CMOs technology, the high cost of in-house drug discovery, and regulatory filing by the CMOs drive the growth of the pharmaceutical contract manufacturing market. Pharma CMOs using Al in drug development and manufacturing will bring efficiency and quality. In April 2024, Lonza launched its AI-powered Route Scouting Service: This service integrates Lonza's global expertise in the chemical supply chain with Elsevier Al technology (Reaxys) for the fast-tracking of artificial route identification for new APIs. Strict rules may limit the growth of the market. Moreover, applies AI in predictive analytics for supply chain management, planning efficient production schedules, and inventory levels. AI also optimizes clinical trials through incidental candidate identification, predictions of clinical trial results, and patient compliance monitoring4 which will lower the costs and raise success rates of clinical trials. It paves the way for further innovations and developments, as bringing Al to pharmaceutical contract manufacturing transforms the whole industry in terms of efficiency, guarantees the quality, and accelerates development processes.

Pharmaceutical Contract Manufacturing Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Pharmaceutical Contract Manufacturing Market

Pharmaceutical Contract Manufacturing Market Dynamics

DRIVER: Expensive In-House drug development

Drug research and development is very expensive and long for a small and medium size pharmaceutical company. Pharmaceutical companies find another cost effective and efficient way to outsource their drug development activities to the contract development and research organisations. Furthermore, medication development requires compliance rigorous FDA criteria, and maintaining standards of quality regarding formulation development. This, in turn, adds to the internal cost of expenses on research and production of the therapeutic formulation. As a result of the rise in costs incurred in developing drugs, including discovery and pre-clinical development, clinical development, capital, and the limited funding with high rates faced with the failure of drugs in human trials, the pharmaceuticals have sought to outsource their drug development processes to contract development and manufacturing organizations.

RESTRAINT: Varying regulatory requirements across regions

The failure of the respective authority to adhere to standards and regulations, as well as the production of substandard pharmaceuticals, have significant repercussions for the business and its brand reputation. Therefore, adherence to regulatory rules is of utmost importance in the pharmaceutical industry. CDMOs sell the drug substance/formulation that they manufacture on a contract basis under their own brand. The medication development and clinical trial process necessitates the submission of substantial quantities of data to the regulatory body. Therefore, the management of the data and the submission of diverse formulations in different countries provide challenges for COMOS and heighten the likelihood of errors in regulatory filings. This aspect is expected to impede the market expansion of pharmaceutical Contract Development and Manufacturing Organizations (CDMOs) in the foreseeable future.

OPPORTUNITY: Emerging Markets

Emerging countries offer a trained labor and cost advantages, hence they become hubs of bioprocess outsourcing. Furthermore, the increasing interest of pharmaceutical companies in outsourcing medications discovery is ascribed to the growing need for vaccines, declining availability of antibiotics, and rising research and development costs fueling the increase of pharmaceutical contract development and manufacturing activities in developing countries. Moreover, the use of contemporary manufacturing technology and the availability of low-cost manufacturing and labor in underdeveloped nations are motivating market players to invest in Asia Pacific over the expected horizon. Given their growth as growing economies, India and China are expected to present significant opportunities for the near future expansion of the pharmaceutical contract manufacturing and development market based on their features. Furthermore, Biosecure Act seeks to limit technology transfer and reduce the reliance on China for biopharmaceuticals. It basically forbids US federal government agencies from purchasing goods or services from Chinese drug businesses. Under this Act, growing nations like India would have great chances in the pharmaceutical industry. As production moves from China to India against present trends, India's contract manufacturing sector will expand dramatically in the next three years. The segment of contract research in India will also grow noticeably during the same time. US companies are already posing more questions to Indian pharmaceutical companies. Though there is a chance that nations like Ireland or maybe Singapore could possibly present some fierce competition, the Act has no short-term financial advantage due of the common contracts with China. All things considered, the Act speeds India's expansion in the pharmaceutical industry, therefore strengthening its role as one of the main participants in contract manufacturing and research markets.

CHALLENGE: Introduction of Serialization

Serialization—that is, coding every service or product item—allows each one to have a distinct identity. The special identity helps to trace and follow the feet around the supply chain. For companies all around and regulatory authorities, counterfeiting is a major problem. For contract manufacturing, CDMOs all over need a practical pharmaceutical serialization solution. Software, hardware, training, implementation, manufacturing lines—all of which the pharmaceutical sector must make a major capital investment in—all of which need for software handling competent employees spread over multiple locations. This is challenging for a COMO as well. One of the more challenging tasks the pharmaceutical contract research and manufacturing company has ahead of it.

Global Pharmaceutical Contract Manufacturing Market Ecosystem Analysis

The pharmaceutical contract manufacturing market ecosystem comprises pharmaceutical contract manufacturing service providers, big pharmaceutical companies, small & medium-sized pharmaceutical companies, generic pharmaceutical companies, academic institutes, CROs, and others.

The pharmaceutical manufacturing services segment dominated pharmaceutical contract manufacturing industry in 2023.

Based on service the pharmaceutical contract manufacturing market is segmented into drug development services, pharmaceutical manufacturing services, biologics manufacturing services, packaging & labelling services, fill-finish services, and other services. Rising demand for biologics and biosimilars in the region and variables such the growing biopharmaceuticals and pharmaceutical markets worldwide help to attain the dominating share that pharmaceutical manufacturing services account for in 2023. Moreover, important participants in the market are funding drug development, which would probably help the growth of segment.

The big pharmaceutical companies segment of the pharmaceutical contract manufacturing industry is expected to grow at the highest CAGR during the forecast period.

Based on end user, the pharmaceutical contract manufacturing market is segmented into big pharmaceutical companies, small & mid-sized pharmaceutical companies, generic pharmaceutical companies, and other end users (Academic Institutes, Small CDMOs, and CROs). Over the projected period, the big pharmaceutical companies segment is expected to show the highest CAGR. Rising demand for targeted medication therapies, more biologics now under pipeline research, and more investment in the development of cell and gene therapies are responsible for this significant growth of the segment.

North America was the largest regional market for the pharmaceutical contract manufacturing industry in 2023.

The global pharmaceutical contract manufacturing market is segmented into six major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. North America was the largest segment in 2023 in the pharmaceutical contract manufacturing market, followed by Europe and the Asia Pacific. Factors such as the presence of a large number of pharmaceutical companies and the growing demand for generics, increased research funding for pharmaceutical contract manufacturing and thus supporting the pharmaceutical contract manufacturing growth.

To know about the assumptions considered for the study, download the pdf brochure

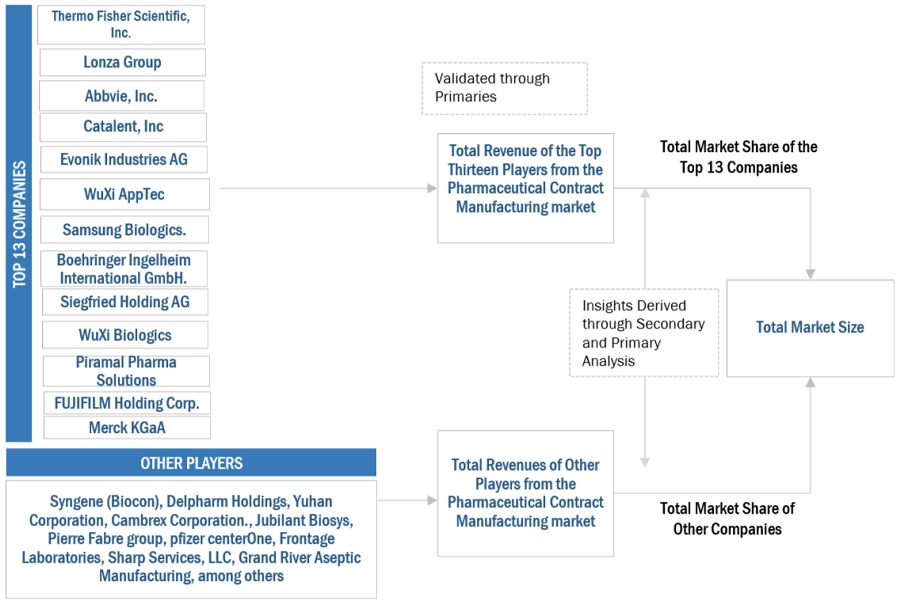

Key players in the pharmaceutical contract manufacturing market include Thermo Fisher Scientific, Inc. (US), Lonza Group (Switzerland), WuXi Apptec (China), WuXi Biologics (China), AbbVie, Inc. (US), Catalent, Inc. (US), Samsung Biologics (South Korea), Evonik Industries AG (Germany), FUJIFILM Holding Corporation (Japan), Siegfried Holding AG (Switzerland), Boehringer Ingelheim International (Germany), Merck KGaA (Germany), Almac Group (UK), Charles River Laboratories (US), Asychem Inc. (China), Vetter Pharma (Germany), and Alcami Corporation (US).

Pharmaceutical Contract Manufacturing Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$200.9 billion |

|

Projected Revenue by 2029 |

$319.6 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 9.7% |

|

Market Driver |

Expensive In-House drug development |

|

Market Opportunity |

Emerging Markets |

This report categorizes the pharmaceutical contract manufacturing market to forecast revenue and analyze trends in each of the following submarkets:

By Service

- Drug Development Services

-

Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

-

Biologics Manufacturing Services

- Biologics API Manufacturing Services

- Biologics FDF Manufacturing Services

- Packaging & Labelling Services

- Fill-finish Services

- Other Services (Storage, Quality Control)

By End User

- Big Pharmaceutical Companies

- Small & Mid Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users (Academic Institutes, Small CDMOs, and CROs)

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- Poland

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia Pacific (RoAPAC)

-

Latin America

- Brazil

- Mexico

- RoLATAM

-

Middle East

- GCC Countries

- Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of GCC Countries

- Rest of Middle East

- Africa

Recent Developments of Pharmaceutical Contract Manufacturing Market

- In May 2024, Siren Biotechnology and Catalent, Inc. entered in partnership for manufacturing of AAV Gene Therapies for cancer.

- In March 2024, Lonza has signed an agreement to acquire the Genentech manufacturing facility in Vacaville (US) from Roche for USD 1.2 billion in cash.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global pharmaceutical contract manufacturing market between 2024 and 2029?

The global pharmaceutical contract manufacturing market is projected to grow from USD 200.9 billion in 2024 to USD 319.6 billion in 2029, demonstrating a robust CAGR of 9.7%.

What are the key drivers of the pharmaceutical contract manufacturing market?

Key drivers include the high cost of in-house drug development, the need for compliance with stringent FDA criteria, and the increasing trend of outsourcing drug development activities to contract development and manufacturing organizations (CDMOs).

What are the main challenges facing the pharmaceutical contract manufacturing market?

The main challenges include varying regulatory requirements across regions, the complexity of managing regulatory filings, and the significant investment required for serialization solutions to combat counterfeiting in the supply chain.

Which regions are expected to experience significant growth in the pharmaceutical contract manufacturing market?

Emerging markets, especially in Asia-Pacific countries like India and China, are expected to see significant growth due to their cost advantages, skilled labor, and increasing interest in outsourcing drug development.

What role does AI play in the pharmaceutical contract manufacturing market?

AI is transforming pharmaceutical contract manufacturing by improving efficiency and quality through predictive analytics, optimizing supply chain management, and fast-tracking route identification for new APIs. AI also plays a role in optimizing clinical trials, improving success rates, and reducing costs.

What are the opportunities for growth in the pharmaceutical contract manufacturing market?

The emerging markets, particularly in Asia-Pacific, offer significant growth opportunities due to lower manufacturing and labor costs, increasing investments in bioprocessing, and the shifting of manufacturing activities from China to countries like India, driven by the Biosecure Act.

What is the impact of regulatory requirements on the pharmaceutical contract manufacturing market?

Varying regulatory requirements across different regions create challenges for CDMOs, especially when managing data submissions for diverse formulations. Adherence to regulations is critical to maintaining quality standards, which can be a major barrier to market expansion.

How is the rise in biologics impacting the pharmaceutical contract manufacturing market?

The increasing demand for biologics and biosimilars is driving the pharmaceutical manufacturing services segment of the market. Many major pharmaceutical companies are investing heavily in biologics API and FDF manufacturing services, supporting the growth of this market segment.

What are the recent developments in the pharmaceutical contract manufacturing market?

Recent developments include Lonza's launch of its AI-powered Route Scouting Service and the acquisition of Genentech's manufacturing facility in Vacaville by Lonza for USD 1.2 billion, as well as the partnership between Siren Biotechnology and Catalent, Inc. for manufacturing AAV gene therapies.

Which companies are the key players in the pharmaceutical contract manufacturing market?

Key players in the pharmaceutical contract manufacturing market include Thermo Fisher Scientific (US), Lonza Group (Switzerland), WuXi Apptec (China), WuXi Biologics (China), AbbVie, Inc. (US), Catalent, Inc. (US), and Samsung Biologics (South Korea).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

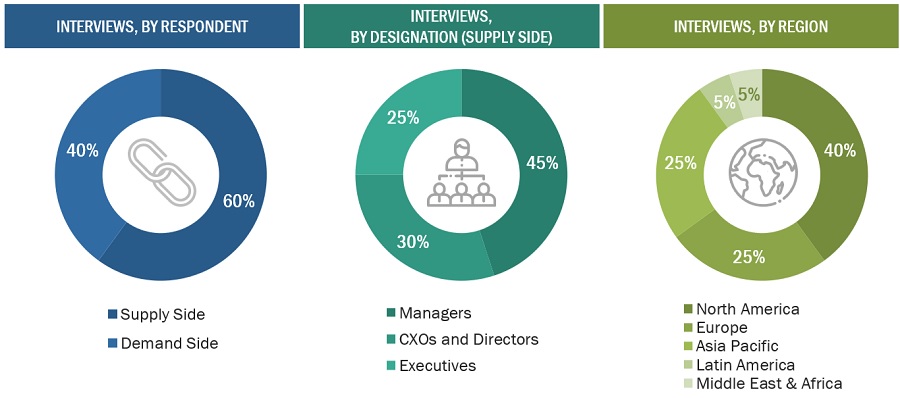

This research study extensively utilized secondary sources, directories, and databases to discover and gather relevant information for the examination of the worldwide pharmaceutical contract manufacturing. Extensive interviews were carried out with primary respondents, such as key industry participants, subject-matter experts (SMEs), C-level executives of major market players, and industry consultants. The purpose was to gather and confirm essential qualitative and quantitative information, as well as evaluate the market's potential for growth. The final market size was determined by triangulating the worldwide market size estimated from secondary research with inputs from primary research.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the pharmaceutical contract manufacturing market. The secondary sources used for this study include Indian Pharmaceutical Association (IPA), Pharmaceutical Research and Manufacturers of America (PhRMA), European Federation of Pharmaceutical Industries and Associations (EFPIA), Central Drugs Standard Control Organization (CDSCO), Indian Brand Equity Foundation (IBEF), European Medicines Agency (EMA), Pharma & Biopharma Outsourcing Association (PBOA), Generics and Biosimilars Initiative (GaBI), Pharma Times, Parenteral Drug Association (PDA), Indian Drug Manufacturers’ Association (IDMA), American Association of Pharmaceutical Scientists (AAPS), Global Cancer Observatory, American Chemical Society, National Center for Biotechnology Information, Eurostat, Food and Drug Administration (FDA), Biotechnology and Biological Sciences Research Council (BBSRC), Pharmaceutical Research and Manufacturers of America (PhRMA), World Journal of Pharmaceutical Sciences, research journals; corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global pharmaceutical contract manufacturing market scenario through secondary research. Market experts from the demand side—big pharmaceutical companies, small and medium-sized pharmaceutical companies, generic pharmaceutical companies, CROs, C-level and D-level executives, product managers, marketing and sales managers of major manufacturers, distributors, and channel partners—as well as experts from the supply side—C-level and D-level executives, product managers, marketing and sales managers of key manufacturers, distributors, and channel partners. Six main areas—Asia Pacific, North America, Europe, Latin America, Middle East, and Africa—were the sites of these interviews. Approximately 60% and 40% of the primary interviews were conducted with supply-side and demand side participants, respectively. Questionnaires, emails, web surveys, personal interviews, and phone calls gathered this main data.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

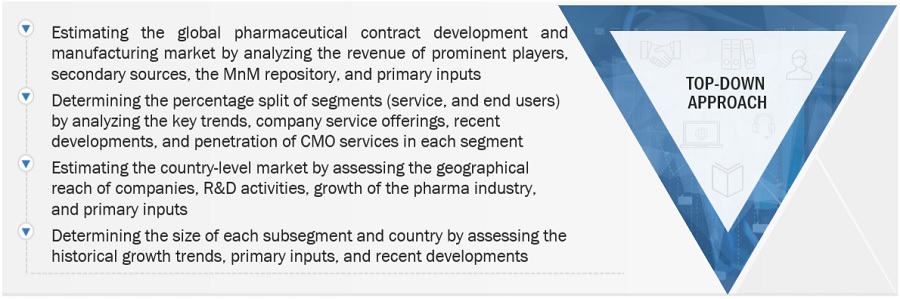

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the pharmaceutical contract manufacturing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues generated from the pharmaceutical contract manufacturing business of leading players have been determined through primary and secondary research to arrive at the overall pharmaceutical contract manufacturing market.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- Additionally, to arrive at the pharmaceutical contract manufacturing market for each service, the pharmaceutical contract manufacturing business shares of leading players for each service category were also gathered from secondary sources to the extent available. In some instances, the shares of pharmaceutical contract manufacturing businesses were ascertained through a detailed analysis of various parameters, including service portfolios and market positioning.

- Individual shares or revenue estimates were validated through expert interviews.

To know about the assumptions considered for the study, Request for Free Sample Report

Top-down Approach

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Pharmaceutical contract manufacturing organizations (CMOs) provide contract-based, comprehensive services, such as drug development and manufacturing. CMOs offer manufacturing services for active pharmaceutical ingredients (APIs) and finished dosage formulations (FDFs). Different aspects of contract manufacturing, such as drug development & manufacturing, formulation development, and commercial pharmaceutical & biopharmaceutical manufacturing, have been considered in this report.

Stakeholders

- Corporate Entities

- Venture Capitalists

- Regulatory Agencies

- Government Agencies

- Private Research Firms

- Academic and Research Institutions

- Pharmaceutical Distributors and Suppliers

- Biotechnology and Pharmaceutical Companies

- Business Research and Consulting Service Providers

- Contract Research Organizations and Contract Development Manufacturing Organizations

Report Objectives

- To define, describe, and forecast the global pharmaceutical contract manufacturing market based on the service, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall pharmaceutical contract manufacturing market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to six main regions: North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa

- To profile the key players in the pharmaceutical contract manufacturing market and comprehensively analyze their service portfolios, market positions, and core competencies

- To track and analyze competitive developments in the pharmaceutical contract manufacturing market, such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations

- To benchmark players within the pharmaceutical contract manufacturing market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business strategy and product strategy

1 Micro markets are the further segments and subsegments of the pharmaceutical contract manufacturing market included in the report

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Portfolio Assessment

- Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies.

Company Information

- Detailed analysis and profiling of additional market players (up to three).

Geographical Analysis

- A further breakdown of the Rest of Asia Pacific pharmaceutical contract manufacturing market into countries

- A further breakdown of the Rest of European pharmaceutical contract manufacturing market into countries

- A further breakdown of the Rest of Latin American pharmaceutical contract manufacturing market into countries

- A further breakdown of the Rest of Middle East pharmaceutical contract manufacturing market into countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pharmaceutical Contract Manufacturing Market

What will be the key challenges for business in the pharmaceutical contract manufacturing market in the near future?

Key players in pharmaceutical contract manufacturing industry for North America region include:

Who are the top key players in the pharmaceutical contract manufacturing market in North America?