Omega-3 Market by Type (DHA, EPA, AND ALA), Application (Dietary Supplements, Functional Foods & Beverages, Pharmaceuticals, Infant Formula, and Pet Food & Feed), Source (Marine and Plant), and Region - Global Forecast to 2029

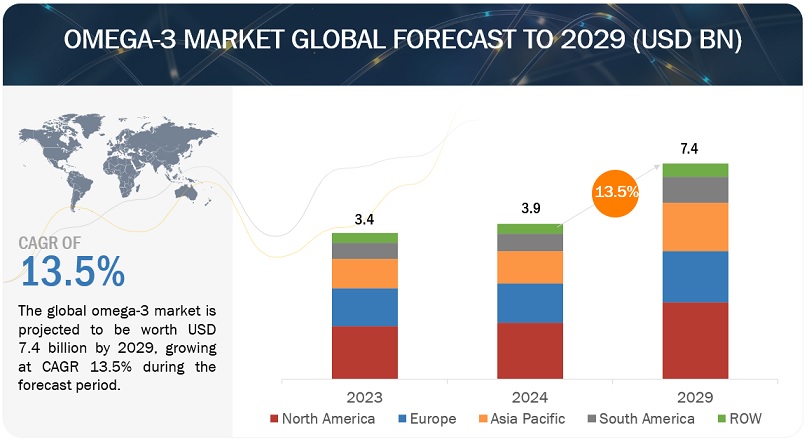

[318 Pages Report] According to MarketsandMarkets, the omega-3 market is projected to reach USD 7.4 billion by 2029 from USD 3.9 billion by 2024, at a CAGR of 13.5% during the forecast period in terms of value. Conventional fish oil sources are no longer the sole choice. Sustainable and plant-based substitutes such as algae, flaxseed, and chia seed oil are becoming increasingly popular, addressing dietary limitations and ethical considerations. Furthermore, novel formats like micro-emulsified supplements and fortified food items are enhancing convenience and attractiveness, appealing to a broader demographic. As individuals increasingly adopt proactive approaches to uphold well-being and stave off chronic ailments, Omega-3 supplements and fortified foods emerge as promising solutions, attracting those striving for good health and preemptive care.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver : Innovative product technologies

Innovative technologies such as encapsulation and flavoring systems play a pivotal role as drivers for the Omega-3 market by masking the natural taste of plant-based Omega-3s, rendering them more palatable and appealing to a broader audience. This is crucial for boosting adoption rates and ensuring compliance with regular consumption. Additionally, the implementation of smart packaging and tracking systems facilitates the monitoring of Omega-3 product quality and potency throughout the supply chain, thereby safeguarding product integrity and offering consumers transparency and confidence. Moreover, advancements in technologies like microencapsulation and phospholipid delivery systems are enhancing the bioavailability of Omega-3s and mitigating unpleasant aftertastes commonly associated with traditional fish oil supplements. These innovations ultimately make Omega-3s more effective and enjoyable, driving market growth.

Restraint : Lower fish oil supply due to sustainability issues among fisheries

The constraint of lower fish oil supply due to sustainability issues among fisheries poses a significant challenge for the Omega-3 market. This limitation stems from the depletion of fish stocks caused by overfishing and unsustainable fishing practices, leading to reduced availability of fish oil, a primary source of Omega-3 fatty acids. As fisheries struggle to maintain sustainable practices, there is a decline in the quantity of fish oil extracted, consequently impacting the production of Omega-3 supplements and fortified foods. This scarcity in the supply chain not only hinders the ability of manufacturers to meet consumer demand but also raises concerns about the long-term viability of sourcing fish oil as a sustainable Omega-3 solution. As a result, the Omega-3 market faces constraints in maintaining adequate supply levels to satisfy market demand, potentially leading to increased prices and reduced accessibility for consumers.

Opportunity : Research for development of alternative sources to obtain omega-3

The research for the development of alternative sources to obtain Omega-3 presents a significant opportunity for the Omega-3 market. This initiative focuses on exploring and harnessing alternative sources such as algae, flaxseed, chia seeds, and marine microorganisms to extract Omega-3 fatty acids. These alternative sources offer several advantages, including sustainability, scalability, and reduced environmental impact compared to traditional fish oil extraction methods. Additionally, advancements in technology and biotechnology have enabled the production of Omega-3 supplements and fortified foods from these alternative sources, ensuring consistent quality and potency. By diversifying the sources of Omega-3 production, the market becomes less reliant on finite marine resources and mitigates the risks associated with overfishing and environmental degradation. Moreover, the availability of plant-based and sustainable Omega-3 options appeals to environmentally conscious consumers and those with dietary restrictions, expanding the consumer base and driving market growth. Therefore, the research for the development of alternative Omega-3 sources presents a promising opportunity to innovate and meet the growing demand for Omega-3 products in a sustainable and responsible manner.

Challenge: Instability of fish oils

The instability of fish oils represents a significant challenge for the Omega-3 market. Fish oils, which are a primary source of Omega-3 fatty acids, are susceptible to oxidation and rancidity due to their high levels of unsaturated fats. This instability can lead to a reduction in product quality, potency, and shelf life, negatively impacting consumer confidence and market acceptance. Additionally, the development of off-flavors and unpleasant odors in fish oil supplements further diminishes their appeal to consumers. Manufacturers face difficulties in maintaining the stability of fish oil-based Omega-3 products throughout the production, storage, and distribution processes. This challenge necessitates the implementation of stringent quality control measures, including the use of antioxidants, specialized packaging, and storage conditions, to minimize oxidation and preserve product integrity. However, despite these efforts, the instability of fish oils remains a persistent challenge for the Omega-3 market, requiring ongoing research and innovation to overcome.

OMEGA-3 Market Ecosystem

Key players within this market consist of reputable and financially robust omega-3 manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, cutting-edge technologies, and robust global sales and marketing networks. Prominent companies in this market BASF SE (Germany), Cargill, Incorporated. (US), dsm-firmenich (Netherlands), ADM (US), Kerry Group Plc (Ireland), Croda International Plc (UK), Orkla. (Norway), Corbion (Netherlands), GC Rieber (Norway), Pelagia AS (Norway), KD Pharma Group SA (Switzerland), Cooke Aquaculture Inc. (Canada), AlgiSys Biosciences, Inc. (US), Golden Omega (Chile), AKER BIOMARINE (Norway), and Polaris (France).

Plant source segment is expected to maintain consistent growth in omega-3 market during the forecast period.

Plant-powered Omega-3s are surging, fueled by ethically-conscious consumers seeking sustainable alternatives. Vegan, vegetarian, and allergy-friendly, these innovative options like algae oil and chia seed extracts boast potential unique health benefits and wider accessibility. Affordability and government initiatives promoting sustainable practices add further momentum. While ensuring potency and educating consumers remain key hurdles, the future of Omega-3 looks green, with this segment poised to shape a more responsible and inclusive market landscape.

The DHA segment is expected to hold the largest market share in the type segment of omega-3 market.

Research strongly supports the health benefits of DHA, from its crucial role in brain development to its potential for heart and eye health. Technology advancements have made DHA more accessible through refined extraction and processing methods. This increased accessibility has led to targeted applications, including pregnancy supplements and infant formula, promoting healthy development from early stages. DHA's influence extends to functional foods like dairy products and beverages, providing convenient ways to incorporate it into daily diets. Effective marketing strategies have solidified DHA's position by highlighting its unique benefits. While DHA leads the Omega-3 market, other players like EPA and ALA are also growing, offering diverse benefits and applications. This diversity ensures that the market can cater to various consumer needs, fostering a thriving landscape focused on individual well-being and holistic health.

North America to dominate the omega-3 market during the forecast period.

In North America, the demand for Omega-3 is increasing, particularly in dietary supplement applications, driven by the recognition of Omega-3's benefits health. Omega-3 fatty acids are among the most popular dietary supplements, known for their potential benefits for heart health, brain function, and overall well-being. The demand for omega-3 supplements in North America has been steadily increasing due to rising awareness about their health benefits and the inclusion of omega-3 in various health recommendations.

Key Market Players

The key players in this market include BASF SE (Germany), Cargill, Incorporated. (US), dsm-firmenich (Netherlands), ADM (US), Kerry Group Plc (Ireland), Croda International Plc (UK), Orkla. (Norway), Corbion (Netherlands), GC Rieber (Norway), Pelagia AS (Norway), KD Pharma Group SA (Switzerland), Cooke Aquaculture Inc. (Canada), AlgiSys Biosciences, Inc. (US), Golden Omega (Chile), AKER BIOMARINE (Norway), and Polaris (France). These market participants are emphasizing the expansion of their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, supported by manufacturing facilities and well-established distribution networks spanning across these regions.

Want to explore hidden markets that can drive new revenue in Omega-3 Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Omega-3 Market?

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD) |

|

Segments Covered |

By Type, Source, Application, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies studied |

|

This research report categorizes the omega-3 market based on type, source, application, and region.

Target Audience

- Omega-3 traders, retailers, and distributors

- Omega-3 manufacturers & suppliers

- Related government authorities, commercial research & development (R&D) institutions.

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions.

- Government and research organizations.

- Venture capitalists and investors.

- Technology providers to omega-3 and omega-3 companies.

- Associations and industry bodies.

Omega-3 Market:

By Type

- Docosahexaenoic Acid (DHA)

- Eicosapentaenoic Acid (EPA)

- Alpha-Linolenic Acid (ALA)

By Source

- Marine Source

- Plant Source

By Application

- Dietary Supplements

- Functional Foods & Beverages

- Pharmaceuticals

- Infant Formula

- Pet Food & Feed

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In February 2023, GC Rieber VivoMega has introduced VivoMega Algae Oils, a line of high-concentration vegan Omega-3 sourced from microalgae and sourced from the ocean.

- In March 2023, Pelagia has invested USD 40 million in the facility of Epax which is subsidiary of Pelagia in Aalesund. This facility will help the company to implement new technology known as EOP+Tech for EPA & DHA products.

- In November 2021, AlgiSys BioSciences, Inc. Raised funding of USD 45 Million. This funding will fuel the company's initial commercial strategies, which are propelled by increasing global demand for EPA omega-3 fish oil substitutes.

- In September 2023, in a collaborative effort, Aker BioMarine and Swisse introduced a groundbreaking product within Australia's Listed Assessed medicine category. Swisse Ultiboost High Strength Krill Oil, incorporating Aker BioMarine's Superba Boost Krill oil, received approval and is now listed on the Australia Register of Therapeutic Goods (ARTG) under AUST L(A) 417392.

Frequently Asked Questions (FAQ):

Which are the major companies in the omega-3 market? What are their major strategies to strengthen their market presence?

The key players in this include BASF SE (Germany), Cargill, Incorporated. (US), dsm-firmenich (Netherlands), ADM (US), Kerry Group Plc (Ireland), Croda International Plc (UK), Orkla. (Norway), Corbion (Netherlands), GC Rieber (Norway), Pelagia AS (Norway), KD Pharma Group SA (Switzerland), Cooke Aquaculture Inc. (Canada), AlgiSys Biosciences, Inc. (US), Golden Omega (Chile), AKER BIOMARINE (Norway), and Polaris (France). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

What are the drivers and opportunities for the omega-3 market?

Increasing consumer awareness of the health advantages associated with omega-3 fatty acids, particularly in promoting heart health, cognitive function, and overall wellness, is a key factor propelling market growth. With a growing emphasis on health, individuals are actively seeking out omega-3 enriched products such as supplements, functional foods, and fortified beverages. Emerging markets, notably in Asia-Pacific and Latin America, offer promising avenues for expansion in the omega-3 market. Factors such as rising incomes, shifting dietary habits, and heightened health consciousness in these regions are fueling demand for omega-3 fortified goods. Concerns surrounding overfishing and environmental sustainability have spurred a heightened interest in responsibly sourced omega-3 products. Companies that can showcase sustainable sourcing practices and a commitment to environmental preservation stand to gain a competitive edge in this market.

Which region is expected to hold the highest market share?

North America has a large and mature dietary supplements market. Omega-3 supplements, including fish oil capsules and other formulations, are widely consumed by individuals looking to maintain their health and prevent chronic diseases. The popularity of dietary supplements contributes to the growth of the omega-3 market. There's a strong awareness of the health benefits of omega-3 fatty acids among consumers in North America. This awareness has been fueled by extensive marketing efforts, health education campaigns, and widespread availability of information about the benefits of omega-3s in maintaining heart health, reducing inflammation, and supporting brain function.

Which are the key technology trends prevailing in the omega-3 market?

Microencapsulation is a technology that encloses Omega-3 oils within tiny particles, shielding them from degradation and bolstering stability. This process heightens the bioavailability and extends the shelf life of Omega-3 supplements, guaranteeing uniform quality and effectiveness. Similarly, nanotechnology is increasingly employed to enhance the delivery of Omega-3 fatty acids, amplifying their absorption and efficacy. Nano emulsions and nanostructured lipid carriers facilitate the creation of Omega-3 supplements with minute particle dimensions, resulting in enhanced solubility and bioavailability.

What is the total CAGR expected to be recorded for the omega-3 market during 2024-2029?

The CAGR is expected to record as of 13.5% from 2024-2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

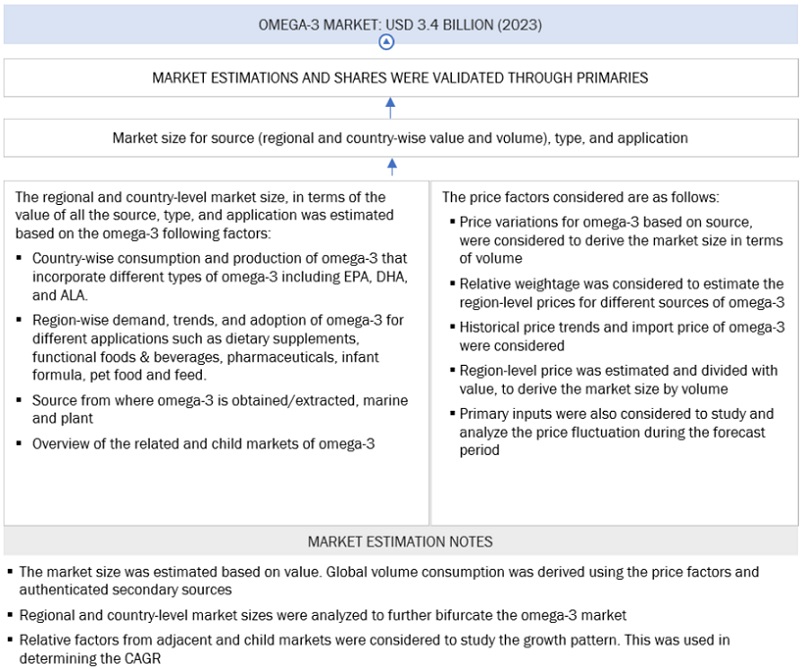

The study involved four major activities in estimating the current size of the omega-3 market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the omega-3 market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the omega-3 market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

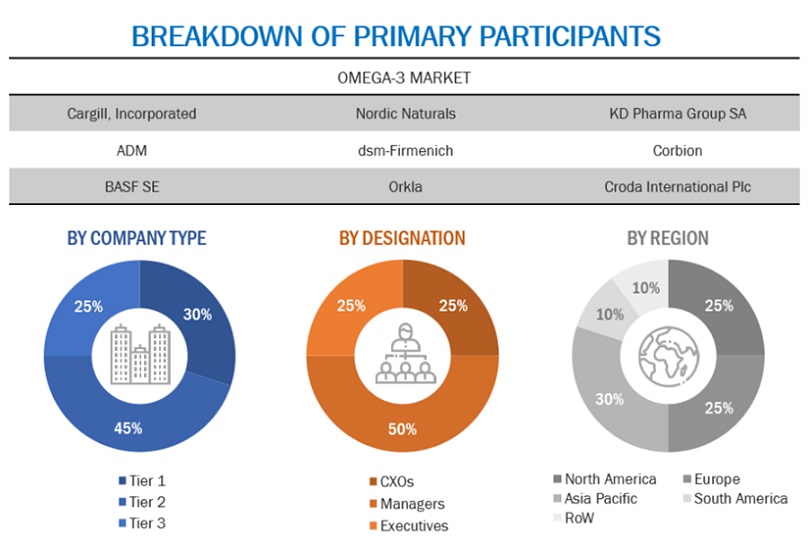

Primary Research

Extensive primary research was conducted after obtaining information regarding the omega-3 market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors, and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, source, application, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

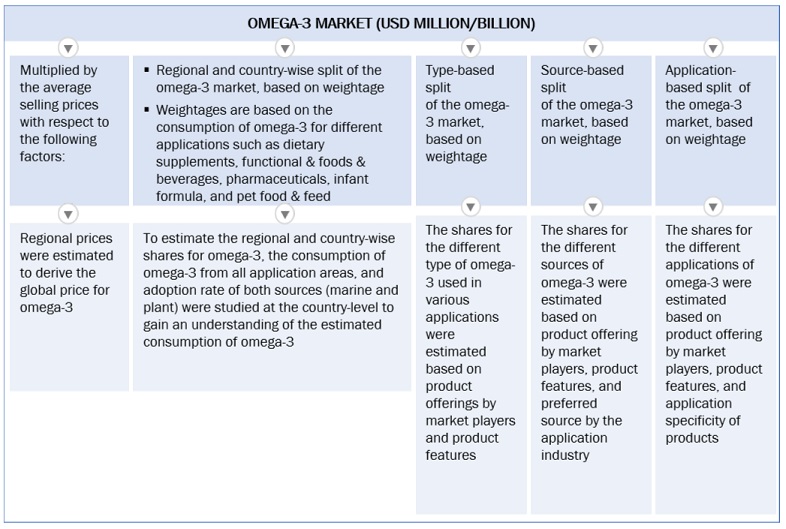

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Omega-3 Market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- Primary and secondary research determined the industry’s value chain and market size.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the omega-3 market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Global Omega-3 Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Omega-3 Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To estimate the overall omega-3 market and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to the US Department of Health & Human Services, “Omega-3 fatty acids (omega-3s) have a carbon-carbon double bond located three carbons from the methyl end of the chain. Omega-3s, sometimes referred to as “n-3s,” are present in certain foods, such as flaxseed and fish, as well as dietary supplements, such as fish oil. Several different omega-3s exist, but the majority of scientific research focuses on three: alpha-linolenic acid (ALA), eicosapentaenoic acid (EPA), and docosahexaenoic acid (DHA). ALA contains 18 carbon atoms, whereas EPA and DHA are considered “long-chain” (LC) omega-3s because EPA contains 20 carbons, and DHA contains 22. ALA is found mainly in plant oils, such as flaxseed, soybean, and canola oils. DHA and EPA are found in fish and other seafood.”

Key Stakeholders

- Manufacturers, dealers, and suppliers of omega-3

- Government bodies

- API, pharmaceutical products, and fortified food manufacturers

- Fisheries and farms

- Intermediate suppliers, such as retailers, wholesalers, and distributors

- Raw material suppliers

- Technology providers

- Industry associations

-

Regulatory bodies and institutions

- World Health Organization (WHO)

- Code of Federal Regulations (CFR)

- US Food and Drug Administration (FDA)

- Codex Alimentarius Commission (CAC)

- EUROPA

- United States Department of Agriculture (USDA)

- Food Processing Suppliers Association (FPSA)

- Logistic providers & transporters

- Research institutes and organizations

- Consulting companies/consultants in the agricultural and animal farming technology sectors

Report Objectives

Market Intelligence

- Determining and projecting the size of the omega-3 market with respect to type, source, application, and region.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework and market entry process related to the omega-3 market.

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market.

Competitive Intelligence

- Identifying and profiling the key players in the omega-3 market

- Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies players across the country adopt.

- Providing insights on key product innovations and investments in the omega-3 market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Belgium, Poland, Sweden, and other EU & non-EU countries

- Further breakdown of the Rest of Asia Pacific into Taiwan, South Korea, Indonesia, Malaysia, Thailand, the Philippines, Bangladesh, Singapore, and Vietnam.

- Further breakdown of the Rest of South America into Chile, Peru, Uruguay, Venezuela, Colombia, and other South American countries

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Omega-3 Market

Our company requires an Omega-3 market forecast till 2026, along with other global market metrics.

I would like to understand more about the potential opportunities for entering the omega-3 market. Is it included in the report?

I am working on omega-3 market and would require data related to its application in infant foods and pet food supplements.