Offshore Pipeline Market by Diameter (Greater Than 24 Inches), Product (Oil, Gas, Refined Products), Line Type (Transport Lines, Export Lines), Installation Type (S LAY, J LAY, TOW IN), Depth of Operation and Region - Forecast to 2027

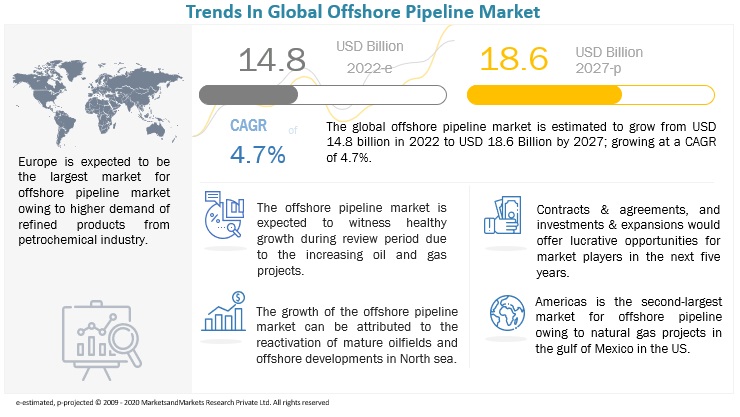

[211 Pages Report] The global offshore pipeline market in terms of revenue was estimated to be worth $14.8 billion in 2022 and is poised to reach $18.6 billion by 2027, growing at a CAGR of 4.7% from 2022 to 2027. The factors driving the market include the demand for natural gas from green energy producers and the power generation sector.

To know about the assumptions considered for the study, Request for Free Sample Report

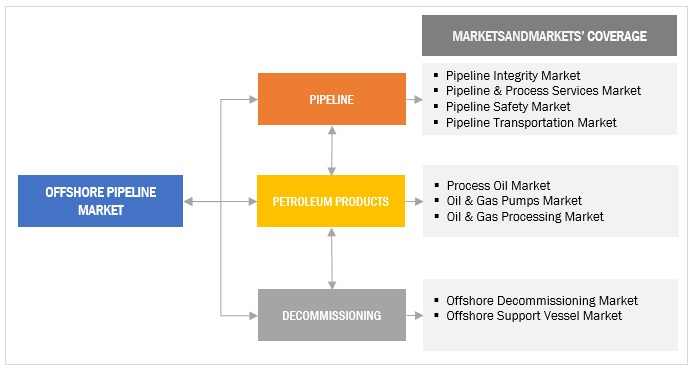

Market Map

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Rising demand for refined products

Petroleum is the primary material to manufacture several chemicals, such as pharmaceuticals, fertilizers, solvents, and plastics. Several companies are planning to significantly raise their oil refining capacity to meet the growing demand for refined products such as gasoline and diesel. Key companies such as Exxon Mobil, BP, Rosneft, and Total are likely to invest more than USD 385 billion in refinery capacity addition or new refinery development projects. A few key projects include Sasol’s 1.5 million ton/annum petrochemical plant, Shell’s 1.5 million ton/annum polyethylene plant, and Dow DuPont’s polyethylene and elastomer plant in the US. Thus, the enhancement of refining capacity to meet the demand for refined products is expected to lead to a rise in the need for the construction of new pipeline networks, which, in turn, will drive the growth of the pipeline and process services market.

Restraints: Different geopolitical conflicts, from municipalities to counties to states

There have been major terrorist activities and cybercrimes in the Middle East and Asia Pacific in the last two decades. Military adversaries, organized oil smugglers, and armed rebels also create threatening situations. Political unrest, internal disputes, and governmental instabilities in the Middle Eastern and countries in Asia Pacific have significantly hampered the overall production of oil and gas and have created potential threats to oil and gas plants and pipelines carrying these media.

The South Stream Offshore Pipeline project covering offshore pipe laying of Line 1 and construction of offshore crossings for all four lines and landfall facilities in Russia and Bulgaria was scrapped by Russia owing to the EU objections and obstacles from Bulgaria. A few more cases that resulted in similar legal issues are Iran–Pakistan–India (IPI) gas pipeline, Galsi gas pipeline—EL kata to Cagliari section, and KoRus Gas Pipeline—5th section - Pusan to Gotru.

Opportunities: Increasing number of offshore oil and gas projects

North America is expected to witness significant investments in pipeline infrastructure. After an increase in shale oil and gas production in the US, the country focused more on new pipeline construction projects to meet the growing demand for oil and gas. Pipeline integrity services are essential to reduce transportation risks, ensure structural integrity, and safeguard personnel and assets. These services are of paramount importance to avoid geo-hazardous situations along the pipeline route and protect the pipeline against corrosion. All such critical factors create immense opportunities for assessment activities during the construction phase.

Enbridge has selected Metegrity’s Pipeline Enterprise software as its Construction Quality Management System (CQMS) for its upcoming pipeline project—Enbridge Line 3 Replacement Pipeline—in North America. Enbridge has spent USD 4.4 billion to enhance its pipelines. Some portion has been invested in improving the capability of “smart pigs,” which the company uses to monitor its pipelines. The pigs are monitored from a central control room in Alberta, Canada.

Challenges: Delays in issuing permits by statutory government bodies

Regulations outline the basic features and requirements for developing and implementing an assessment plan for the pipeline system. These regulations are intended to evaluate the risk associated with pipelines. Also, it effectively allocates resources for inspection, prevention, detection, and mitigation activities before issuing any permit for the commencement of pipeline operation to ensure the safety of pipelines. It is necessary to comply with all statutory rules, regulations and acts in force as applicable to obtain requisite approvals from the relevant competent authorities for the pipeline. For instance, in North America, delays in issuing permits from a statutory authority such as AOPL (Association of Oil Pipelines), PHMSA (Pipeline and Hazardous Material Safety Administration), and NEB (National Energy Board) have been observed as they must perform pipeline integrity and viability before commissioning any pipeline to avoid disaster. Moreover, the operator must explain the reason for the replacement of the existing pipeline and the introduction of a new one.

By diameter, greater than 24 inches segment to witness fastest growth rate during the forecast period

The greater than 24 inches segment is expected to witness the fastest rate from 2022 to 2027, as it witnesses higher demand for crude oil pipeline construction in the Middle East, which drives the growth of the greater than 24 inches segment during the forecasted period.

By product, gas segment is expected to hold the largest share during the forecast period

The gas segment is expected to continue to hold the largest share of the market during the forecast period. The growth of the gas segment is driven largely due to the increasing number of projects for natural gas in the Gulf of Mexico, US.

By line type, transport line segment to witness fastest CAGR during the forecast period

By line type, the offshore pipeline market has been segmented into transport lines, export lines, and other lines. The high growth rate of the transport line is because it resolves issues of long-distance transportation of crude oil and natural gas.

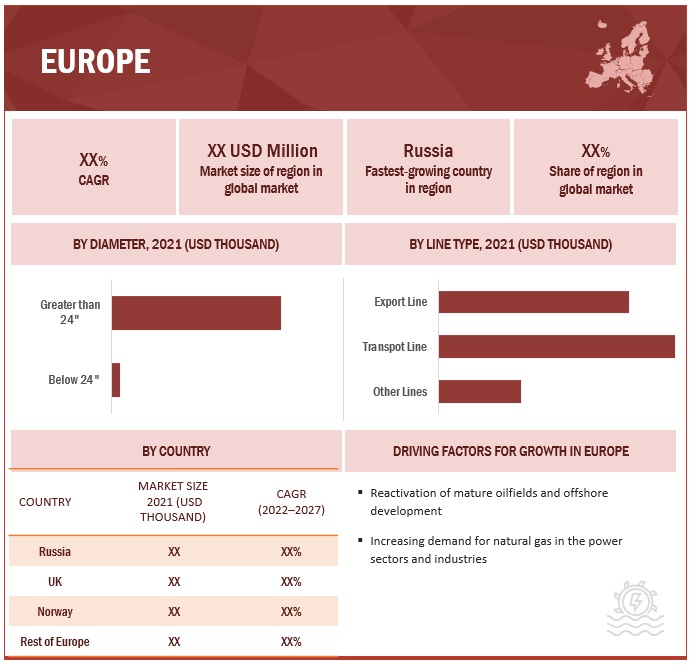

Europe is expected to be the largest market during the forecast period.

Europe is the largest and fastest-growing region in the offshore pipeline market during the forecast period. The growth of the European market is characterized by the increase in the production of refined products due to higher demand from the petrochemical industry.

Key Market Players

The major players in the global offshore pipeline market are Saipem (Italy), SUBSEA7 (UK), McDermott (US), John Wood Group PLC (UK), TechnipFMC plc (US), Sapura Energy Berhad (Malaysia), and Fugro (Netherlands).

Want to explore hidden markets that can drive new revenue in Offshore Pipeline Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Offshore Pipeline Market?

|

Report Metrics |

Details |

| Market size available for years | 2020–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast unit | Value (USD Million/USD Billion) |

| Segments covered | Diameter, Product, Line Type, Installation Type, Depth of Operation |

| Geographies covered | Americas, Europe, Asia Pacific, Middle East, and Africa |

| Companies covered | Saipem (Italy), SUBSEA7 (UK), McDermott (US), John Wood Group PLC (UK), TechnipFMC plc (UK), Sapura Energy Berhad (Malaysia), Fugro (Netherlands), Atteris (Australia), Penspen (UK), Petrofac Limited (UK), Enbridge Inc.(Canada), L&T Hydrocarbon Engineering (India), SoluForce B.V. (Netherlands), Bourbon (France), Allseas (Switzerland), National Petroleum Construction Company (NPCC) (UAE), Cortez Subsea (UK), Ramboll Group A/S (Denmark), Jesco (Saudi Arabia), and DEME (Belgium) |

This research report categorizes the market by technology, power rating, connectivity type, ownership type, operation type, and region.

Based on diameter, the offshore pipeline market has been segmented as follows:

- Below 24 inches

- Greater than 24 inches

Based on product, the market has been segmented as follows:

- Oil

- Gas

- Refined Products

Based on line type, the market has been segmented as follows:

- Transport Line

- Export Line

- Other Lines

Based on installation type, the market has been segmented as follows:

- S LAY

- J LAY

- TOW IN

Based on depth of operation, the market has been segmented as follows:

- Shallow water

- Deepwater

Based on region, the market has been segmented as follows:

- Americas

- Europe

- Asia Pacific

- Middle East

- Africa

Recent Developments

- In September 2022, TotalEnergies made a contract with McDermott for their Begonia project, which is located offshore Angola. This contract was for engineering, procurement, supply, construction, installation, pre-commissioning, and assistance to commissioning and start-up (EPSCI) on the project.

- In August 2022, Subsea 7 contracted with Aker BP for the Trell & Trine field development, located in the Alvheim area of the North Sea. The contract included the engineering, procurement, construction, and installation (EPCI) of the pipelines, spools, protection covers, and tie-ins using key vessels from Subsea 7’s fleet. The production pipeline is a pipe-in-pipe design.

- In August 2022, Johnwood Group plc entered into a contract with Equinor ASA for the development of Equinor’s Halten Øst project. Under this contract, Wood Group plc will deliver the engineering services and detailed design of the subsea pipeline for the Halten Øst project offshore Norway.

- In September 2021, SAIPEM SpA signed a Memorandum of Understanding with Saudi Aramco for the engineering and construction activities in the industrial sector. The agreement mainly focused on the execution of activities regarding sustainability and advanced materials from onshore and offshore engineering and construction to drilling activities.

Frequently Asked Questions (FAQ):

What is the current size of the offshore pipeline market?

The current market size of the global offshore pipeline market is estimated at USD 14.8 Billion in 2022.

What are the major drivers for the offshore pipeline market?

Rising demand for refined products

Which is the fastest-growing region during the forecasted period in the offshore pipeline market?

The European offshore pipeline market is estimated to be the largest and the fastest-growing region, during the forecast period.

Which is the fastest-growing segment, by diameter during the forecasted period in the offshore pipeline market?

The greater than 24 inches segment is estimated to be the largest and the fastest-growing segment, by location. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 OFFSHORE PIPELINE MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 OFFSHORE PIPELINES MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

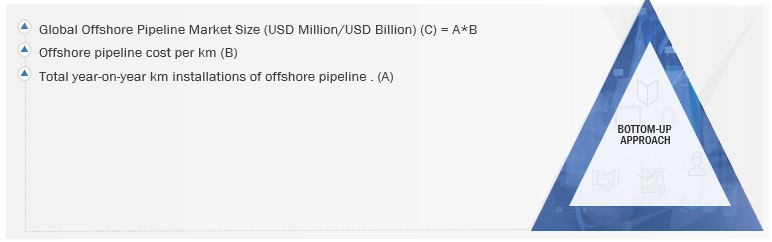

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 OFFSHORE PIPELINE MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 OFFSHORE PIPELINES MARKET: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE METRICS

FIGURE 6 OFFSHORE PIPELINES MARKET: DEMAND-SIDE ANALYSIS

2.3.3.1 Assumptions

2.3.3.2 Calculation

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF OFFSHORE PIPELINE SOLUTIONS

FIGURE 8 OFFSHORE PIPELINES MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Assumptions

2.3.4.2 Calculation

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 1 OFFSHORE PIPELINE MARKET: SNAPSHOT

FIGURE 9 EUROPE DOMINATED MARKET IN 2021

FIGURE 10 GREATER THAN 24″ SEGMENT TO LEAD MARKET, BY DIAMETER, DURING FORECAST PERIOD

FIGURE 11 GAS SEGMENT TO HOLD LARGEST MARKET SHARE, BY PRODUCT, DURING FORECAST PERIOD

FIGURE 12 TRANSPORT LINES EXPECTED TO DOMINATE MARKET, BY LINE TYPE, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OFFSHORE PIPELINE MARKET

FIGURE 13 INCREASING DEMAND FOR OFFSHORE PIPELINES FROM OIL & GAS PROJECTS

4.2 OFFSHORE PIPELINE MARKET, BY REGION

FIGURE 14 MARKET IN EUROPE TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET IN EUROPE, BY DIAMETER AND COUNTRY

FIGURE 15 GREATER THAN 24” SEGMENT AND RUSSIA DOMINATED MARKET IN EUROPE IN 2021

4.4 MARKET, BY DIAMETER

FIGURE 16 GREATER THAN 24” SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

4.5 MARKET, BY PRODUCT

FIGURE 17 GAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2027

4.6 MARKET, BY LINE TYPE

FIGURE 18 TRANSPORT LINES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

FIGURE 19 OFFSHORE PIPELINE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increase in number of oil & gas exploration and production projects

FIGURE 20 HISTORIC AND EXPECTED GLOBAL OIL CONSUMPTION, 2019–2026

5.1.1.2 Rise in demand for refined products

5.1.2 RESTRAINTS

5.1.2.1 Diverse geopolitical and geoeconomic scenarios

5.1.2.2 Delays in issuing permits by statutory government bodies

5.1.3 OPPORTUNITIES

5.1.3.1 Rapid expansion of midstream infrastructure across multiple regions

5.1.3.2 Growing inclination toward development of software for pipelines

TABLE 2 KEY CONCERNS DURING PIPELINE ASSESSMENT

5.1.4 CHALLENGES

5.1.4.1 Severe climatic conditions and high construction costs

5.1.4.2 Adverse effects of offshore oil & gas activities on marine environment

TABLE 3 TYPES OF IMPACTS FROM OFFSHORE OIL & GAS ACTIVITIES

5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.2.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR CUSTOMERS

FIGURE 21 REVENUE SHIFT FOR OFFSHORE PIPELINE SERVICE PROVIDERS

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 22 OFFSHORE PIPELINE MARKET: SUPPLY CHAIN ANALYSIS

5.3.1 EPC COMPANIES

5.3.2 PRE-COMMISSIONING COMPANIES

5.3.3 OPERATORS

5.3.4 OWNERS

5.4 ECOSYSTEM ANALYSIS/MARKET MAP

5.4.1 MARKET MAP

FIGURE 23 OFFSHORE PIPELINE: MARKET MAP

5.5 TECHNOLOGY ANALYSIS

5.5.1 S-LAY

5.5.2 J-LAY

5.5.3 TOW IN

5.6 KEY CONFERENCES & EVENTS, 2022–2023

5.7 PATENT ANALYSIS

5.7.1 LIST OF MAJOR PATENTS

TABLE 4 OFFSHORE PIPELINE SYSTEMS: INNOVATIONS AND PATENT REGISTRATIONS, JUNE 2020–AUGUST 2022

5.8 PRICING ANALYSIS

5.8.1 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS, BY REGION

5.8.2 AVERAGE SELLING PRICE TREND

TABLE 5 CAPEX OF OFFSHORE PIPELINE PROJECTS, BY DIAMETER

FIGURE 24 CAPEX BREAKDOWN OF COSTS FOR DIFFERENT COST CENTERS

5.9 TARIFF AND REGULATORY LANDSCAPE

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 AMERICAS: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 REGULATORY FRAMEWORK

TABLE 10 OFFSHORE PIPELINES MARKET: REGULATORY FRAMEWORK

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 25 OFFSHORE PIPELINE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 11 OFFSHORE PIPELINE SYSTEMS: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 BARGAINING POWER OF BUYERS

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 THREAT OF SUBSTITUTES

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DIAMETER

TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DIAMETER (%)

5.11.2 BUYING CRITERIA

FIGURE 27 KEY BUYING CRITERIA FOR DIAMETER-BASED OFFSHORE PIPELINE

TABLE 13 KEY BUYING CRITERIA, BY TECHNOLOGY

6 OFFSHORE PIPELINE MARKET, BY DEPTH OF OPERATION (Page No. - 72)

6.1 INTRODUCTION

6.2 SHALLOW WATER

6.2.1 TOW IN INSTALLATION TECHNIQUE PRIMARILY USED IN SHALLOW WATER

6.3 DEEP WATER

6.3.1 RISING DEMAND FOR S-LAY AND J-LAY INSTALLATION TECHNIQUES IN WATER DEPTH EXCEEDING 1000 METERS

7 OFFSHORE PIPELINE MARKET, BY INSTALLATION TYPE (Page No. - 74)

7.1 INTRODUCTION

7.2 S-LAY

7.2.1 DEEP WATER DISCOVERIES TO HELP S-LAY TECHNIQUE GROW

7.3 J-LAY

7.3.1 J-LAY INSTALLATION TYPE IN HIGH DEMAND FOR INSTALLING PIPELINES IN DEEP WATER

7.4 TOW IN

7.4.1 EASY INSTALLATION OF TOW IN TECHNIQUE TO BOOST MARKET GROWTH

8 OFFSHORE PIPELINE MARKET, BY DIAMETER (Page No. - 76)

8.1 INTRODUCTION

FIGURE 28 MARKET: BY DIAMETER, 2021

TABLE 14 OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 15 MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

8.2 GREATER THAN 24″

8.2.1 HIGH DEMAND FROM OIL & GAS PROJECTS TO BOOST MARKET

TABLE 16 GREATER THAN 24″: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 17 GREATER THAN 24″: MARKET, BY REGION, 2021–2027 (USD MILLION)

8.3 BELOW 24″

8.3.1 RISING DEMAND FOR BELOW 24″ NATURAL GAS PIPELINES EXPECTED TO DRIVE MARKET

TABLE 18 BELOW 24″: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 BELOW 24″: MARKET, BY REGION, 2021–2027 (USD MILLION)

9 OFFSHORE PIPELINE MARKET, BY LINE TYPE (Page No. - 80)

9.1 INTRODUCTION

FIGURE 29 MARKET, BY LINE TYPE, 2021 (USD MILLION)

TABLE 20 OFFSHORE PIPELINE MARKET, BY LINE TYPE, 2018–2020 (USD MILLION)

TABLE 21 MARKET, BY LINE TYPE, 2021–2027 (USD MILLION)

9.2 TRANSPORT LINES

9.2.1 EUROPE TO BE MOST ATTRACTIVE MARKET FOR TRANSPORT LINES

TABLE 22 TRANSPORT LINES: OFFSHORE PIPELINES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 TRANSPORT LINES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.3 EXPORT LINES

9.3.1 ASIA PACIFIC EXPECTED TO BE LARGEST MARKET FOR EXPORT LINES

TABLE 24 EXPORT LINES: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 EXPORT LINES: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.4 OTHER LINES

TABLE 26 OTHER LINES: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 27 OTHER LINES: MARKET, BY REGION, 2021–2027 (USD MILLION)

10 OFFSHORE PIPELINE MARKET, BY PRODUCT (Page No. - 86)

10.1 INTRODUCTION

FIGURE 30 MARKET, BY PRODUCT, 2021 (USD MILLION)

TABLE 28 OFFSHORE PIPELINE MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 29 MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

10.2 OIL

10.2.1 DEMAND AND INDUSTRIAL PRODUCTION TO BOOST OIL MARKET

TABLE 30 OIL: OFFSHORE PIPELINES MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 31 OIL: MARKET, BY REGION, 2021–2027 (USD MILLION)

10.3 GAS

10.3.1 GAS EXPECTED TO DOMINATE MARKET IN EUROPE

TABLE 32 GAS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 GAS: MARKET, BY REGION, 2021–2027 (USD MILLION)

10.4 REFINED PRODUCTS

10.4.1 ASIA PACIFIC EXPECTED TO BE LARGEST MARKET FOR REFINED PRODUCTS

TABLE 34 REFINED PRODUCTS: MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 REFINED PRODUCTS: MARKET, BY REGION, 2021–2027 (USD MILLION)

11 OFFSHORE PIPELINE MARKET, BY REGION (Page No. - 92)

11.1 INTRODUCTION

FIGURE 31 EUROPE EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 32 MARKET SHARE (VALUE), BY REGION, 2021

TABLE 36 MARKET, BY REGION, 2018–2020 (KILOMETERS)

TABLE 37 OFFSHORE PIPELINE MARKET, BY REGION, 2021–2027 (KILOMETERS)

TABLE 38 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 MARKET, BY REGION, 2021–2027 (USD MILLION)

11.2 EUROPE

FIGURE 33 EUROPE: OFFSHORE PIPELINES MARKET SNAPSHOT

TABLE 40 OFFSHORE PIPELINE IN EUROPE: KEY FUTURE PROJECT LIST

11.2.1 BY DIAMETER

TABLE 41 EUROPE: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 42 EUROPE: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

11.2.2 BY PRODUCT

TABLE 43 EUROPE: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 44 EUROPE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.2.3 BY LINE TYPE

TABLE 45 EUROPE: MARKET, BY LINE TYPE, 2018–2020 (USD MILLION)

TABLE 46 EUROPE: MARKET, BY LINE TYPE, 2021–2027 (USD MILLION)

11.2.4 BY COUNTRY

TABLE 47 EUROPE: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 48 EUROPE: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.2.4.1 Russia

11.2.4.1.1 Gas segment expected to dominate Russian market

TABLE 49 RUSSIA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 50 RUSSIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 51 RUSSIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 52 RUSSIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.2.4.2 UK

11.2.4.2.1 Upstream activities in oil & gas market to boost market

TABLE 53 UK: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 54 UK: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 55 UK: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 56 UK: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.2.4.3 Norway

11.2.4.3.1 Increasing investments and activities in offshore expected to drive market

TABLE 57 NORWAY: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 58 NORWAY: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 59 NORWAY: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 60 NORWAY: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.2.4.4 Rest of Europe

TABLE 61 REST OF EUROPE: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 62 REST OF EUROPE: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 63 REST OF EUROPE: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 64 REST OF EUROPE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: OFFSHORE PIPELINES MARKET SNAPSHOT

TABLE 65 OFFSHORE PIPELINES MARKET: KEY FUTURE PROJECTS LIST, ASIA PACIFIC

11.3.1 BY DIAMETER

TABLE 66 ASIA PACIFIC: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

11.3.2 BY PRODUCT

TABLE 68 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3.3 BY LINE TYPE

TABLE 70 ASIA PACIFIC: MARKET, BY LINE TYPE, 2018–2020 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET, BY LINE TYPE, 2021–2027 (USD MILLION)

11.3.4 BY COUNTRY

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.3.4.1 China

11.3.4.1.1 Strong investments in pipeline projects likely to boost market

TABLE 74 CHINA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 75 CHINA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 76 CHINA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 77 CHINA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3.4.2 India

11.3.4.2.1 Redevelopment of oilfields and modification of existing pipeline systems expected to boost market

TABLE 78 INDIA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 79 INDIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 80 INDIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 81 INDIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3.4.3 Australia

11.3.4.3.1 Expansion of LNG industry expected to drive market

TABLE 82 AUSTRALIA: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 83 AUSTRALIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 84 AUSTRALIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 85 AUSTRALIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3.4.4 Indonesia

11.3.4.4.1 Growing investments in gas pipeline networks likely to propel market growth

TABLE 86 INDONESIA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 87 INDONESIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 88 INDONESIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 89 INDONESIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3.4.5 Malaysia

11.3.4.5.1 Increasing oil & gas activities to boost market

TABLE 90 MALAYSIA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 91 MALAYSIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 92 MALAYSIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 93 MALAYSIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.3.4.6 Rest of Asia Pacific

11.3.4.6.1 Increasing pipeline infrastructure and its systems expected to boost market

TABLE 94 REST OF ASIA PACIFIC: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 95 REST OF ASIA PACIFIC: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 96 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 97 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.4 MIDDLE EAST

TABLE 98 MIDDLE EAST: KEY PIPELINE PROJECTS, 2019–2024

11.4.1 BY DIAMETER

TABLE 99 MIDDLE EAST: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 100 MIDDLE EAST: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

11.4.2 BY PRODUCT

TABLE 101 MIDDLE EAST: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 102 MIDDLE EAST: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.4.3 BY LINE TYPE

TABLE 103 MIDDLE EAST: MARKET, BY LINE TYPE, 2018–2020 (USD MILLION)

TABLE 104 MIDDLE EAST: MARKET, BY LINE TYPE, 2021–2027 (USD MILLION)

11.4.4 BY COUNTRY

TABLE 105 MIDDLE EAST: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 106 MIDDLE EAST: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.4.4.1 Saudi Arabia

11.4.4.1.1 Growing investments and projects in offshore activities expected to foster market growth

TABLE 107 SAUDI ARABIA: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 108 SAUDI ARABIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 109 SAUDI ARABIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 110 SAUDI ARABIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.4.4.2 UAE

11.4.4.2.1 State-owned companies dominate market in partnership with international players

TABLE 111 UAE: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 112 UAE: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 113 UAE: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 114 UAE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.4.4.3 Iran

11.4.4.3.1 Growing efforts to increase transport and export lines to boost market

TABLE 115 IRAN: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 116 IRAN: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 117 IRAN: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 118 IRAN: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.4.4.4 Turkey

11.4.4.4.1 Increasing offshore gas projects to boost market

TABLE 119 TURKEY: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 120 TURKEY: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 121 TURKEY: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 122 TURKEY: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.4.4.5 Rest of Middle East

TABLE 123 REST OF MIDDLE EAST: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 124 REST OF MIDDLE EAST: , BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 125 REST OF MIDDLE EAST: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 126 REST OF MIDDLE EAST: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.5 AMERICAS

TABLE 127 OFFSHORE PIPELINES MARKET: KEY FUTURE PROJECTS LIST, AMERICAS

11.5.1 BY DIAMETER

TABLE 128 AMERICAS: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 129 AMERICAS: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

11.5.2 BY PRODUCT

TABLE 130 AMERICAS: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 131 AMERICAS: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.5.3 BY LINE TYPE

TABLE 132 AMERICAS: MARKET, BY LINE TYPE, 2018–2020 (USD MILLION)

TABLE 133 AMERICAS: MARKET, BY LINE TYPE, 2021–2027 (USD MILLION)

11.5.4 BY COUNTRY

TABLE 134 AMERICAS: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 135 AMERICAS: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.5.4.1 US

11.5.4.1.1 Increasing shale gas activities likely to foster market growth

TABLE 136 US: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 137 US: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 138 US: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 139 US: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.5.4.2 Canada

11.5.4.2.1 Growing oil & gas activities in Atlantic region expected to boost market

TABLE 140 CANADA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 141 CANADA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 142 CANADA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 143 CANADA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.5.4.3 Mexico

11.5.4.3.1 Increase in pipeline projects expected to drive market

TABLE 144 MEXICO: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 145 MEXICO: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 146 MEXICO: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 147 MEXICO: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.5.4.4 Brazil

11.5.4.4.1 Investments in oil reserves expected to dominate market

TABLE 148 BRAZIL: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 149 BRAZIL: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 150 BRAZIL: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 151 BRAZIL: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.5.4.5 Rest of Americas

TABLE 152 REST OF AMERICAS: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 153 REST OF AMERICAS: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 154 REST OF AMERICAS: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 155 REST OF AMERICAS: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.6 AFRICA

11.6.1 BY DIAMETER

TABLE 156 AFRICA: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 157 AFRICA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

11.6.2 BY PRODUCT

TABLE 158 AFRICA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 159 AFRICA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.6.3 BY LINE TYPE

TABLE 160 AFRICA: MARKET, BY LINE TYPE, 2018–2020 (USD MILLION)

TABLE 161 AFRICA: MARKET, BY LINE TYPE, 2021–2027 (USD MILLION)

11.6.4 BY COUNTRY

TABLE 162 AFRICA: MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 163 AFRICA: MARKET, BY COUNTRY, 2021–2027 (USD MILLION)

11.6.5 NIGERIA

11.6.5.1 Increasing focus on natural gas pipeline projects to boost market

TABLE 164 NIGERIA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 165 NIGERIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 166 NIGERIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 167 NIGERIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.6.6 MOZAMBIQUE

11.6.6.1 Increasing investments in oil & gas industry to drive market

TABLE 168 MOZAMBIQUE: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 169 MOZAMBIQUE: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 170 MOZAMBIQUE: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 171 MOZAMBIQUE: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.6.7 EGYPT

11.6.7.1 Upcoming opportunities in gas pipelines construction to propel market growth

TABLE 172 EGYPT: OFFSHORE PIPELINE MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 173 EGYPT: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 174 EGYPT: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 175 EGYPT: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.6.8 NAMIBIA

11.6.8.1 New and upcoming opportunities for offshore pipelines market expected to drive market

TABLE 176 NAMIBIA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 177 NAMIBIA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 178 NAMIBIA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 179 NAMIBIA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

11.6.9 REST OF AFRICA

TABLE 180 REST OF AFRICA: MARKET, BY DIAMETER, 2018–2020 (USD MILLION)

TABLE 181 REST OF AFRICA: MARKET, BY DIAMETER, 2021–2027 (USD MILLION)

TABLE 182 REST OF AFRICA: MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 183 REST OF AFRICA: MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 146)

12.1 OVERVIEW

FIGURE 35 KEY DEVELOPMENTS IN OFFSHORE PIPELINES MARKET, 2017–2021

12.2 SHARE ANALYSIS OF KEY PLAYERS, 2021

FIGURE 36 SHARE ANALYSIS OF TOP PLAYERS IN OFFSHORE PIPELINES MARKET, 2021

12.3 MARKET EVALUATION FRAMEWORK

TABLE 184 MARKET EVALUATION FRAMEWORK, 2018–2022

12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2017 -2021

FIGURE 37 TOP PLAYERS DOMINATING MARKET IN LAST 5 YEARS, 2017–2021

12.5 RECENT DEVELOPMENTS

12.5.1 DEALS

TABLE 185 OFFSHORE PIPELINES MARKET: DEALS, JULY 2020–NOVEMBER 2021

12.5.2 OTHERS

TABLE 186 MARKET: OTHERS, SEPTEMBER 2020–AUGUST 2021

12.6 COMPETITIVE LEADERSHIP MAPPING

12.6.1 STARS

12.6.2 EMERGING LEADERS

12.6.3 PERVASIVE PLAYERS

12.6.4 PARTICIPANTS

FIGURE 38 OFFSHORE PIPELINES MARKET: COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 187 COMPANY DIAMETER FOOTPRINT

TABLE 188 COMPANY PRODUCT FOOTPRINT

TABLE 189 COMPANY LINE TYPE FOOTPRINT

TABLE 190 COMPANY REGION FOOTPRINT

13 COMPANY PROFILES (Page No. - 158)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

13.1 KEY COMPANIES

13.1.1 SAIPEM

TABLE 191 SAIPEM: BUSINESS OVERVIEW

TABLE 192 SAIPEM: DEALS

13.1.2 SUBSEA7

TABLE 193 SUBSEA7: BUSINESS OVERVIEW

FIGURE 40 SUBSEA7: COMPANY SNAPSHOT

TABLE 194 SUBSEA7: DEALS

13.1.3 MCDERMOTT

TABLE 195 MCDERMOTT: BUSINESS OVERVIEW

TABLE 196 MCDERMOTT: DEALS

13.1.4 JOHN WOOD GROUP PLC

TABLE 197 JOHN WOOD GROUP PLC: BUSINESS OVERVIEW

FIGURE 41 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

TABLE 198 JOHN WOOD GROUP PLC: DEALS

13.1.5 TECHNIPFMC PLC

TABLE 199 TECHNIPFMC PLC: BUSINESS OVERVIEW

FIGURE 42 TECHNIPFMC PLC: COMPANY SNAPSHOT

TABLE 200 TECHNIPFMC PLC: DEALS

13.1.6 SAPURA ENERGY BERHAD

TABLE 201 SAPURA ENERGY BERHAD: BUSINESS OVERVIEW

TABLE 202 SAPURA ENERGY BERHAD: DEALS

13.1.7 FUGRO

TABLE 203 FUGRO: BUSINESS OVERVIEW

TABLE 204 FUGRO: DEALS

TABLE 205 FUGRO: OTHERS

13.1.8 PETROFAC LIMITED

TABLE 206 PETROFAC LIMITED: BUSINESS OVERVIEW

TABLE 207 PETROFAC: DEALS

13.1.9 ENBRIDGE INC.

TABLE 208 ENBRIDGE INC.: BUSINESS OVERVIEW

13.1.10 L&T HYDROCARBON ENGINEERING

TABLE 209 L&T HYDROCARBON ENGINEERING: BUSINESS OVERVIEW

TABLE 210 L&T HYDROCARBON ENGINEERING: DEALS

13.1.11 SOLUFORCE B.V.

TABLE 211 SOLUFORCE B.V.: BUSINESS OVERVIEW

TABLE 212 SOLUFORCE B.V.: DEALS

13.1.12 ATTERIS

TABLE 213 ATTERIS: BUSINESS OVERVIEW

13.1.13 PENSPEN

TABLE 214 PENSPEN: BUSINESS OVERVIEW

TABLE 215 PENSPEN: DEALS

13.1.14 BOURBON

TABLE 216 BOURBON: BUSINESS OVERVIEW

13.1.15 ALLSEAS

TABLE 217 ALLSEAS: BUSINESS OVERVIEW

TABLE 218 ALLSEAS: DEALS

13.2 OTHER PLAYERS

13.2.1 NATIONAL PETROLEUM CONSTRUCTION COMPANY (NPCC)

13.2.2 CORTEZ SUBSEA

13.2.3 RAMBOLL GROUP A/S

13.2.4 JESCO (JUBAIL ENERGY SERVICES COMPANY)

13.2.5 DEME

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 202)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the offshore pipeline market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as industry publications, several newspaper articles, Statista Industry Journal, and UNESCO Institute of Statistics to identify and collect information useful for a technical, market-oriented, and commercial study of the utility communication market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

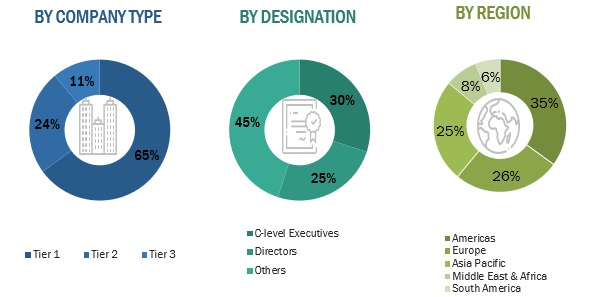

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, service providers, technology developers, and organizations related to all segments of the nuclear industry. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts (SME), C-level executives of the key market players, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess the prospects of the market. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global offshore pipeline market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Offshore Pipeline Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the offshore pipelines market.

Report Objectives

- To forecast and describe the offshore pipeline market size, by technology, power rating, connectivity type, ownership type, operation type, and region, in terms of value

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To estimate the size of the market in terms of value

- To strategically analyze micro markets with respect to individual growth trends, prospects, future expansions, and contributions to the overall market

- To provide post-pandemic estimation for the market and analyze the impact of the pandemic on the overall market and value chain

- To forecast the growth of the offshore pipeline market with respect to five major regions, namely, North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Offshore Pipeline Market