Night Vision Device Market by Product Type (Cameras, Goggles, Scopes, Binoculars & Monoculars), Technology (Thermal Imaging, Image Intensifier, Infrared, Digital), Mounting Type (Stationary, Portable), Application & Region - Global Forecast to 2028

Updated on : Sep 12, 2024

Night Vision Devices Market Size

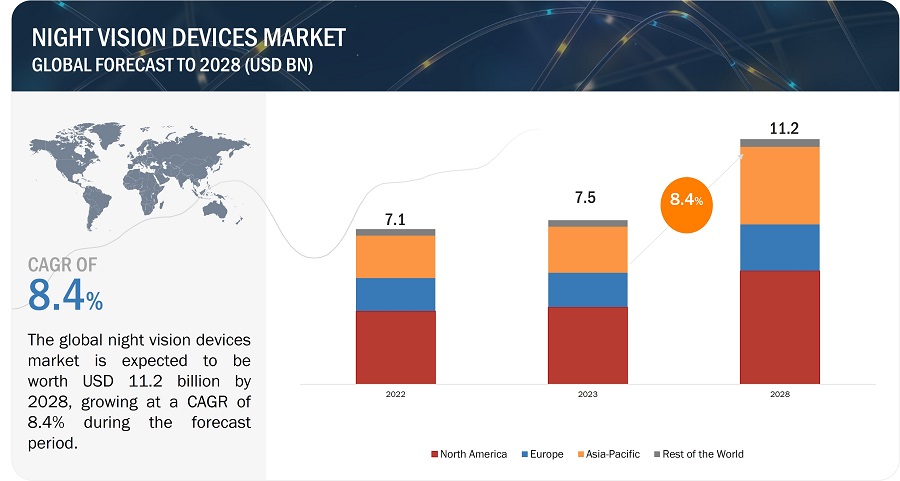

[216 Pages Report] The global night vision devices market was valued at USD 7.5 billion in 2023 and is estimated to reach USD 11.2 billion by 2028, registering a CAGR of 8.4% during the forecast period. The increasing demand for security and surveillance in law enforcement, commercial surveillance and navigation application, demand for advanced technologies and optical innovations is also expected to drive the market for night vision devices. Advances in night vision technology, such as improved image quality, reduced size and weight, and enhanced durability, have made these devices more accessible and appealing to a broader range of users are the major driving factors for the growth of the night vision devices market.

Night Vision Devices Market Growth

Night Vision Device Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Night Vision Devices Market Trends Dynamics:

Driver: Rising need for situational awareness and target identification in military & defense operations

The extensive use of night vision devices in military & defense and law enforcement applications is driven by the need for heightened situational awareness, target identification, and operational effectiveness in low-light and nighttime conditions. Military forces heavily rely on night vision technology, with special forces using night vision goggles (NVGs) in covert missions, such as the US Navy SEALs during high-stakes raids. Law enforcement agencies also depend on night vision devices, employing them for surveillance, search & rescue operations, and crowd control. For instance, police surveillance teams use night vision equipment for criminal investigations, while helicopter-mounted night vision systems aid in locating missing persons during nighttime search & rescue missions. Companies, such as Thales, Teledyne FLIR LLC, BAE Systems, and L3Harris Technologies, Inc., are renowned providers of advanced night vision technology, catering to the specialized needs of military and law enforcement agencies worldwide.

Restraint: Low budget allocation for developing innovative technology-powered night vision devices

Night vision devices, particularly advanced ones with cutting-edge technology, such as thermal imaging and high-resolution image intensifiers, can be quite expensive. This high cost poses a significant barrier to widespread adoption, especially for smaller law enforcement agencies, security firms, and individuals.

Additionally, governments and organizations may find it challenging to allocate substantial budgets for large-scale procurement, limiting the deployment of night vision technology in critical areas. The high cost of maintenance, including battery replacement and regular calibration, further adds to the overall ownership expenses. As a result, cost considerations can hinder the broader accessibility and adoption of night vision devices, particularly in regions or sectors with limited financial resources. Efforts to reduce manufacturing costs or develop more affordable alternatives are essential to mitigate this restraint. As an illustration, American Technologies Network Corp., a prominent industry player, provides a versatile night vision monocular device with pricing spanning from around USD 4,000 to USD 5,000.

Opportunity: Increasing government spending on security and surveillance systems to prevent terrorism

The night vision devices market is experiencing a favorable and opportunistic environment due to the increasing allocation of government budgets for security and surveillance purposes. Governments worldwide are recognizing the imperative need to enhance their security measures in the face of evolving threats, including terrorism and criminal activities. Consequently, substantial financial investments are being made to equip defense and law enforcement agencies with advanced night vision technology, such as night vision goggles and thermal imaging systems.

For example, in September 2023, BAE Systems was granted a contract by the UK Ministry of Defence (MOD) to enhance its Striker II Helmet Mounted Display (HMD) for the Royal Air Force (RAF) Typhoon aircraft. The Striker II HMD integrates an all-digital night vision system and a daylight-readable color display..

Challenge: Need for substantial investments in R&D of night vision devices for SMEs.

Night vision device manufacturers face constant pressure to innovate and develop new products that offer improved performance, better image quality, increased durability, and enhanced features. Staying at the forefront of technology requires substantial investments in research & development (R&D), which can strain resources. For instance, companies, such as Teledyne FLIR LLC, a leading provider of thermal imaging and night vision technology, have to invest in R&D to develop cutting-edge thermal imaging solutions. They must adapt to the evolving demands of military and commercial markets for thermal imaging technology. Companies, such as Yukon Advanced Optics Worldwide, L3Harris Technologies, Inc., and Teledyne FLIR LLC, in the night vision devices market must strike a balance between staying competitive through technological advancements and ensuring that their products are accessible and relevant to a broad range of customers. Large-scale players have the potential to invest and develop solutions related to the said market. However, SMEs have comparatively lower potential, which, in turn, acts as a challenge in the market. The development of night vision devices involves complex research in various areas, including optics, electronics, materials science, and image processing. Conducting this research and translating it into practical devices is time-consuming and costly.

Night Vision Devices Market Ecosystem

The Night vision devices market is competitive, with major companies such Teledyne FLIR LLC, L3Harries Technologies Inc, RTX, BAE Systems, Elbit Systems Ltd, Leonardo S.P.A, and Thales are the significant manufacturers of night vision devices, and numerous small- and medium-sized enterprises. Many players offer both night vision devices and their components, while many players and components offer integration services. These integration services are widely required in commercial, navigation, wildlife applications, among others.

Based on device type , the cameras segment is expected to account for the largest market share during the forecast period.

The cameras segment is projected to account for a significant market share during the forecast period. Night vision cameras are specialized imaging devices widely utilized across diverse sectors. They excel in capturing clear images and videos in low-light conditions and total darkness. Their applications are extensive, including security and surveillance for homes, businesses, and public spaces, enhancing law enforcement’s nighttime operations, supporting military reconnaissance and navigation, aiding search & rescue missions, and enabling wildlife observation without disturbing natural behavior.

Based on technology , the thermal imaging segment is projected to grow with the highest CAGR during the forecast period.

The thermal imaging segment is projected to account for a significant market share in 2028. This is propelled by various factors, including its ability to detect heat signatures and provide visibility in complete darkness or adverse weather conditions. It is often used in military applications, surveillance, and search & rescue operations, fueling the growth of the thermal imaging segment. Thermal imaging devices can detect and display temperature differences, allowing users to see objects and living beings in complete darkness or low-light conditions where traditional night vision devices may struggle. Thermal cameras can detect heat signatures, making them highly effective for identifying concealed threats, tracking wildlife, and locating individuals in search & rescue operations. Thermal imaging is unaffected by adverse weather conditions, such as fog, rain, or smoke, which can degrade the performance of other night vision technologies. It enables precise temperature measurement, which is valuable in industrial and military applications for identifying overheating components or monitoring the environment.

Based on region, Asia Pacific is projected to grow fastest for the night vision devices market.

The scope of the night vision devices market in Asia Pacific includes China, Japan, South Korea, India, and the Rest of Asia Pacific. The night vision devices market in Asia Pacific is expected to record the highest CAGR during the forecast period. China, Japan, and India are among the major countries driving the night vision devices market in the region. The increasing population and the need for investments in night vision technologies to enhance military capabilities and border security in countries, such as India, China, South Korea, and Japan, are expected to drive the market. China and India stand among 10 countries escalating their military spending for security, surveillance, and counter-terrorism purposes.

Night Vision Device Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies Night Vision Devices - Key Market Players

The night vision devices companies is dominated by a few globally established players such

- Teledyne FLIR LLC,

- L3Harries Technologies Inc,

- RTX, BAE Systems,

- Elbit Systems Ltd,

- Leonardo S.P.A, and

- Thales and so on.

Scope of the Night Vision Devices Market Size Report

|

Report Metric |

Details |

| Estimated Market Size | USD 7.5 billion in 2023 |

| Projected Market Size | USD 11.2 billion by 2028 |

| Market Growth Rate | registering a CAGR of 8.4% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

Device Type, Technology, Mounting Type, Application and Region. |

|

Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the world |

|

Companies Covered |

Teledyne FLIR, LLC, L3Harries Technologies Inc, RTX, BAE Systems, Elbit Systems Ltd, Leonardo S.P.A, and Thales, etc |

Night Vision Device Market Highlights

This research report categorizes the night vision devices market based on type, pitch, and application, and region

|

Segment |

Subsegment |

|

Based on device Type: |

|

|

Based on Technology: |

|

|

Based on Mounting Type: |

|

|

Based on Application: |

|

|

Based on Region: |

|

Recent Developments

- In February 2023, Teledyne FLIR, LLC introduced a Prism AI release with a smaller AI model for easier deployment on embedded systems. This update empowers perception engineers to rapidly incorporate thermal cameras into advanced driver assistance systems (ADAS) and autonomous vehicle (AV) systems. This boosts object tracking performance by up to 24% in daytime and nighttime or low-light conditions.

- In May 2023, Leonardo DRS, Inc. secured a contract worth over USD 94 million from the US Army to manufacture advanced infrared weapon sights for infantry snipers. The company will produce the Family of Weapon Sights – Sniper, Improved Night/Day Observation Device Block III, designed to meet the needs of snipers and reconnaissance operatives who require extended-range target detection, environmental observation, and bullet trajectory tracking capabilities.

- In May 2023, Teledyne FLIR showcased progress in its Thermal by FLIR program for small, unmanned aircraft systems (sUAS). This includes integrating the Hadron 640R dual visible-thermal payload into the Teal 2 drone and incorporating the Lepton 3.5 thermal micro camera into the BRINC LEMUR 2. The Hadron 640R enhances the Teal 2’s capabilities for defense and public safety operations, providing essential situational awareness for night missions across diverse environments.

- In October 2022, L3Harris Technologies, Inc. entered a partnership with Merlinhawk Aerospace, a certified aerospace and defense design and manufacturing company in India, to establish a service center for WESCAM MX-Series electro-optical and infrared (EO/IR) systems.

Frequently Asked Questions (FAQs):

Which are the major companies in the night vision devices market? What are their significant strategies to strengthen their market presence?

The major companies in the night vision devices market are – Teledyne FLIR LLC, L3Harries Technologies Inc, RTX, BAE Systems, Elbit Systems Ltd, Leonardo S.P.A, and Thales and so on The significant strategies adopted by these players are product launches and developments,contracts, collaborations, acquisitions, and expansions.

What is the potential market for night vision devices in the region?

The North American region is expected to dominate the night vision devices market due to the presence of leading players from the night vision devices market, such as Teledyne FLIR LLC and L3Harris Tchnologies Inc, etc.

What are the opportunities for new market entrants?

Opportunities in the night vision devices market arise from the growth of military and defense spendings, increasing demand for night vision devices in commercial and so on.

What are the drivers and opportunities for the night vision devices market?

Factors such as increasing demand for law enforcement and navigation applications fuel the need to grow the night vision devices market.

Who are the major end users of the night vision devices expected to drive the market’s growth in the next 5 years?

The significant consumers for the night vision devices are law enforcements agencies, military and defense users and others. They are expected to have a substantial share in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for situational awareness and target identification in military & defense operations- Rapid advancements in optics and thermal imaging technologies- Heightened emphasis on enhancing security and surveillance of critical infrastructureRESTRAINTS- Low budget allocation for developing innovative night vision devicesOPPORTUNITIES- Increasing government spending on security and surveillance systems to prevent terrorism- Rising adoption of night vision devices in commercial applicationsCHALLENGES- Lack of substantial investments in R&D of night vision devices by SMEs

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM MAPPING

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TREND, BY APPLICATIONAVERAGE SELLING PRICE OF NIGHT VISION DEVICES OFFERED BY TOP 3 PLAYERSINDICATIVE SELLING PRICE TREND, BY DEVICE TYPE

-

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.7 TECHNOLOGY ANALYSISMINIATURIZATION AND WEIGHT REDUCTIONCONNECTIVITY AND DATA SHARINGAUGMENTED REALITY (AR) OVERLAYLASER ILLUMINATION

- 5.8 PORTER’S FIVE FORCES ANALYSIS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

-

5.11 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

- 5.14 TARIFF ANALYSIS

-

5.15 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS

- 6.1 INTRODUCTION

-

6.2 EVOLUTION OF NIGHT VISION DEVICESGEN 1GEN 2GEN 3GEN 4

- 6.3 RISING INTEGRATION OF NIGHT VISION DEVICES WITH DIGITAL AND AUGMENTED REALITY TECHNOLOGIES

- 6.4 SHIFTING PREFERENCE TOWARD WEARABLE AND COMPACT DEVICES

- 6.5 INCREASING CYBERSECURITY CONCERNS

- 7.1 INTRODUCTION

-

7.2 CAMERASINCREASING USE OF NIGHT VISION CAMERAS IN SURVEILLANCE AND MILITARY APPLICATIONS TO FUEL SEGMENTAL GROWTH

-

7.3 GOGGLESESCALATING ADOPTION OF NIGHT VISION GOGGLES TO ENHANCE SITUATIONAL AWARENESS IN LOW-LIGHT ENVIRONMENTS TO DRIVE MARKET

-

7.4 SCOPESRISING INTEGRATION OF INFRARED ILLUMINATORS INTO NIGHT VISION SCOPES TO ACCELERATE MARKET GROWTH

-

7.5 BINOCULARS & MONOCULARSSURGING DEMAND FOR BINOCULARS AND MONOCULARS FOR WILDLIFE OBSERVATION TO BOOST SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 IMAGE INTENSIFICATIONADOPTION OF IMAGE IDENTIFICATION-BASED NIGHT VISION DEVICES IN LAW ENFORCEMENT AND COMMERCIAL SURVEILLANCE OPERATIONS TO PROPEL MARKET

-

8.3 THERMAL IMAGINGIMPLEMENTATION OF THERMAL IMAGING NIGHT VISION DEVICES FOR DETECTING HEAT SIGNATURES TO CONTRIBUTE TO SEGMENTAL GROWTH

-

8.4 INFRARED ILLUMINATIONUTILIZATION OF NIGHT VISION DEVICES WITH BUILT-IN INFRARED ILLUMINATORS TO CAPTURE CLEAR IMAGES TO DRIVE MARKET

-

8.5 DIGITAL IMAGINGDEPLOYMENT OF DIGITAL NIGHT VISION TECHNOLOGY IN WILDLIFE SURVEILLANCE AND HUNTING APPLICATIONS TO BOOST SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 STATIONARYIMPLEMENTATION OF STATIONARY NIGHT VISION SYSTEMS TO ENSURE UNINTERRUPTED VISIBILITY AND SITUATIONAL AWARENESS TO FUEL SEGMENTAL GROWTH

-

9.3 PORTABLERELIANCE ON LIGHTWEIGHT AND PORTABLE NIGHT VISION SYSTEMS FOR HUNTING AND WILDLIFE OBSERVATION APPLICATIONS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 LAW ENFORCEMENTUSE OF NIGHT VISION DEVICES TO MONITOR CRIMINAL ACTIVITIES AND GATHER INTELLIGENCE IN LOW-LIGHT SETTINGS TO FUEL SEGMENTAL GROWTH

-

10.3 COMMERCIAL SURVEILLANCEEMPLOYMENT OF NIGHT VISION CAMERAS TO ENHANCE SECURITY OF CRITICAL INFRASTRUCTURE TO CONTRIBUTE TO MARKET GROWTH

-

10.4 NAVIGATIONADOPTION OF NIGHT VISION DEVICES TO FACILITATE NAVIGATION DURING NIGHTTIME OPERATIONS TO SUPPORT SEGMENTAL GROWTH

-

10.5 WILDLIFE SURVEILLANCERELIANCE ON NIGHT VISION DEVICES TO OBSERVE WILDLIFE AND PROTECT ENDANGERED SPECIES TO ACCELERATE SEGMENTAL GROWTH

- 10.6 OTHER APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAIMPACT OF RECESSION ON MARKET IN NORTH AMERICA- US- Canada- Mexico

-

11.3 EUROPEIMPACT OF RECESSION ON MARKET IN EUROPE- Germany- France- UK- Rest of Europe

-

11.4 ASIA PACIFICIMPACT OF RECESSION ON MARKET IN ASIA PACIFIC- China- Japan- India- South Korea- Rest of Asia Pacific

-

11.5 ROWIMPACT OF RECESSION ON MARKET IN ROW- South America- Middle East & Africa

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2022–2023

- 12.3 REVENUE ANALYSIS OF TOP 5 COMPANIES, 2018–2022

- 12.4 MARKET SHARE ANALYSIS, 2022

-

12.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 START-UPS/SMES EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

13.1 KEY COMPANIESTELEDYNE FLIR LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRTX- Business overview- Products/Solutions/Services offered- MnM viewELBIT SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEONARDO S.P.A- Business overview- Products/Solutions/Services offered- Recent developmentsTHALES- Business overview- Products/Solutions/Services offered- Recent developmentsATN- Business overview- Products/Solutions/Services offeredLYNRED USA- Business overview- Products/Solutions/Services offeredEOTECH, LLC- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSSATIRLUNA OPTICS, INC.SIGHTMARK.EUEXCELITAS TECHNOLOGIES CORPMEOPTANIVISYS, LLCTAK TECHNOLOGIES PVT. LTD.YUKON ADVANCED OPTICS WORLDWIDEPHOTONISINFIRAY TECHNOLOGIES CO., LTDNIGHT VISION DEVICES, INC.RONGLAND LTDFENN NIGHT VISION LIMITEDKYOCERA CORPORATIONNVTS NIGHT VISION TECHNOLOGY SOLUTIONS INC.

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 NIGHT VISION DEVICES MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 NIGHT VISION DEVICES MARKET: PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON NIGHT VISION DEVICES MARKET

- TABLE 3 COMPANIES AND THEIR ROLES IN NIGHT VISION DEVICES ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE OF NIGHT VISION DEVICES OFFERED BY TOP 3 PLAYERS

- TABLE 5 INDICATIVE SELLING PRICE TREND, BY DEVICE TYPE, 2022

- TABLE 6 NIGHT VISION DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 8 NIGHT VISION DEVICES MARKET: KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 9 SIGHTMARK INTEGRATES RIFLESCOPE IN ALESSANDRO’S SABATTI ROVER SCOUT .308 TO DEMONSTRATE EXCEPTIONAL PERFORMANCE

- TABLE 10 BRAZILIAN PARANÁ STATE POLICE ENHANCES SECURITY AND SURVEILLANCE WITH WESCAM MX-SERIES ELECTRO-OPTICAL INFRARED SENSOR SYSTEMS

- TABLE 11 INDIAN ARMY UTILIZES AI-POWERED PERSONALIZED NIGHT VISION UNITS AND WRISTBANDS TO STRENGTHEN BORDER SECURITY

- TABLE 12 HARMAN INTERNATIONAL TO REVAMP TRADITIONAL NIGHT VISION CAMERAS FOR MILITARY AND BORDER SECURITY APPLICATIONS

- TABLE 13 NIGHT VISION DEVICES MARKET: TOP 20 PATENT OWNERS IN US, 2013–2023

- TABLE 14 NIGHT VISION DEVICES MARKET: LIST OF PATENTS RELATED TO NIGHT VISION DEVICES

- TABLE 15 NIGHT VISION DEVICES MARKET: LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 16 MFN TARIFF FOR HS CODE 900490-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 17 MFN TARIFF FOR HS CODE 900490-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 STANDARDS RELATED TO NIGHT VISION DEVICES

- TABLE 23 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE, 2019–2022 (THOUSAND UNITS)

- TABLE 24 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE, 2023–2028 (THOUSAND UNITS)

- TABLE 25 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 26 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 27 NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (MILLION UNITS)

- TABLE 28 NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (MILLION UNITS)

- TABLE 29 NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 30 NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 31 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 32 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 34 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 35 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 36 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 37 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 38 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 39 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 40 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 41 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 42 IMAGE INTENSIFICATION: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 43 THERMAL IMAGING: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 44 THERMAL IMAGING: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 45 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 46 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 47 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 48 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 49 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 50 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 51 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 52 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 53 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 54 THERMAL IMAGING: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 55 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 56 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 57 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 58 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 59 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 60 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 61 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 62 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 63 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 64 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 65 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 66 INFRARED ILLUMINATION: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 67 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 70 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 71 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 72 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 73 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 74 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR NAVIGATION, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 75 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 76 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR WILDLIFE SURVEILLANCE, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 77 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2019–2022 (USD MILLION)

- TABLE 78 DIGITAL IMAGING: NIGHT VISION DEVICES MARKET FOR OTHER APPLICATIONS, BY DEVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 79 NIGHT VISION DEVICES MARKET, BY MOUNTING TYPE, 2019–2022 (USD MILLION)

- TABLE 80 NIGHT VISION DEVICES MARKET, BY MOUNTING TYPE, 2023–2028 (USD MILLION)

- TABLE 81 NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (THOUSAND UNITS)

- TABLE 82 NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (THOUSAND UNITS)

- TABLE 83 NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 LAW ENFORCEMENT: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 86 LAW ENFORCEMENT: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 87 LAW ENFORCEMENT: NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 88 LAW ENFORCEMENT: NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 COMMERCIAL SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 90 COMMERCIAL SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 91 COMMERCIAL SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 92 COMMERCIAL SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 93 NAVIGATION: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 94 NAVIGATION: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 95 NAVIGATION: NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 NAVIGATION: NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 WILDLIFE SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 98 WILDLIFE SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 99 WILDLIFE SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 100 WILDLIFE SURVEILLANCE: NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 101 OTHER APPLICATIONS: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 102 OTHER APPLICATIONS: NIGHT VISION DEVICES MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 103 OTHER APPLICATIONS: NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 OTHER APPLICATIONS: NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 106 NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: NIGHT VISION DEVICES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: NIGHT VISION DEVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 EUROPE: NIGHT VISION DEVICES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 112 EUROPE: NIGHT VISION DEVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 113 EUROPE: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 EUROPE: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: NIGHT VISION DEVICES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: NIGHT VISION DEVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 ROW: NIGHT VISION DEVICES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 120 ROW: NIGHT VISION DEVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 121 ROW: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 ROW: NIGHT VISION DEVICES MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2022–2023

- TABLE 124 NIGHT VISION DEVICES MARKET: DEGREE OF COMPETITION

- TABLE 125 OVERALL COMPANY FOOTPRINT

- TABLE 126 COMPANY DEVICE TYPE FOOTPRINT

- TABLE 127 COMPANY APPLICATION FOOTPRINT

- TABLE 128 COMPANY REGIONAL FOOTPRINT

- TABLE 129 NIGHT VISION DEVICES MARKET: LIST OF KEY START-UPS/SMES

- TABLE 130 NIGHT VISION DEVICES MARKET: PRODUCT LAUNCHES, 2022−2023

- TABLE 131 NIGHT VISION DEVICES MARKET: DEALS, 2022–2023

- TABLE 132 NIGHT VISION DEVICES MARKET: OTHERS, 2021–2023

- TABLE 133 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 134 TELEDYNE FLIR LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 136 TELEDYNE FLIR LLC: OTHERS

- TABLE 137 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 138 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 140 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 141 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- TABLE 142 RTX: COMPANY OVERVIEW

- TABLE 143 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 144 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 145 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 ELBIT SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 147 ELBIT SYSTEMS LTD.: DEALS

- TABLE 148 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 149 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 151 BAE SYSTEMS: DEALS

- TABLE 152 BAE SYSTEMS: OTHERS

- TABLE 153 LEONARDO S.P.A: COMPANY OVERVIEW

- TABLE 154 LEONARDO S.P.A: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 LEONARDO S.P.A: DEALS

- TABLE 156 THALES: COMPANY OVERVIEW

- TABLE 157 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 THALES: PRODUCT LAUNCHES

- TABLE 159 THALES: DEALS

- TABLE 160 ATN: COMPANY OVERVIEW

- TABLE 161 ATN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 LYNRED USA: COMPANY OVERVIEW

- TABLE 163 LYNRED USA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 EOTECH, LLC: COMPANY OVERVIEW

- TABLE 165 EOTECH, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 EOTECH, LLC: DEALS

- TABLE 167 SATIR: BUSINESS OVERVIEW

- TABLE 168 LUNA OPTICS, INC.: BUSINESS OVERVIEW

- TABLE 169 SIGHTMARK.EU: BUSINESS OVERVIEW

- TABLE 170 EXCELITAS TECHNOLOGIES CORP: BUSINESS OVERVIEW

- TABLE 171 MEOPTA: BUSINESS OVERVIEW

- TABLE 172 NIVISYS, LLC: BUSINESS OVERVIEW

- TABLE 173 TAK TECHNOLOGIES PVT. LTD.: BUSINESS OVERVIEW

- TABLE 174 YUKON ADVANCED OPTICS WORLDWIDE: BUSINESS OVERVIEW

- TABLE 175 PHOTONIS: BUSINESS OVERVIEW

- TABLE 176 INFIRAY TECHNOLOGIES CO., LTD: BUSINESS OVERVIEW

- TABLE 177 NIGHT VISION DEVICES, INC.: BUSINESS OVERVIEW

- TABLE 178 RONGLAND LTD: BUSINESS OVERVIEW

- TABLE 179 FENN NIGHT VISION LIMITED: BUSINESS OVERVIEW

- TABLE 180 KYOCERA CORPORATION: BUSINESS OVERVIEW

- TABLE 181 NVTS NIGHT VISION TECHNOLOGY SOLUTIONS INC.: BUSINESS OVERVIEW

- FIGURE 1 NIGHT VISION DEVICES MARKET SEGMENTATION

- FIGURE 2 NIGHT VISION DEVICES MARKET: RESEARCH DESIGN

- FIGURE 3 NIGHT VISION DEVICES MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 NIGHT VISION DEVICES MARKET: DATA TRIANGULATION

- FIGURE 7 CAMERAS SEGMENT TO DOMINATE NIGHT VISION DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 8 PORTABLE SEGMENT TO EXHIBIT HIGHER CAGR IN NIGHT VISION DEVICES MARKET FROM 2023 TO 2028

- FIGURE 9 LAW ENFORCEMENT SEGMENT TO DEPICT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 10 NORTH AMERICA HELD LARGEST SHARE OF NIGHT VISION DEVICES MARKET IN 2022

- FIGURE 11 RISING CONCERNS ABOUT CRITICAL INFRASTRUCTURE SECURITY TO FUEL MARKET GROWTH FROM 2023 TO 2028

- FIGURE 12 THERMAL IMAGING SEGMENT TO ACCOUNT FOR LARGEST SHARE OF NIGHT VISION DEVICES MARKET IN 2023

- FIGURE 13 STATIONARY SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 14 LAW ENFORCEMENT SEGMENT TO HOLD LARGEST SHARE OF NIGHT VISION DEVICES MARKET IN 2028

- FIGURE 15 CHINA TO EXHIBIT HIGHEST CAGR IN NIGHT VISION DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 16 NIGHT VISION DEVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 NIGHT VISION DEVICES MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 18 NIGHT VISION DEVICES MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 19 NIGHT VISION DEVICES MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 20 NIGHT VISION DEVICES MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 21 NIGHT VISION DEVICES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 KEY PLAYERS IN NIGHT VISION DEVICES ECOSYSTEM

- FIGURE 23 AVERAGE SELLING PRICE OF NIGHT VISION DEVICES OFFERED BY TOP 3 PLAYERS

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 25 NIGHT VISION DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 27 NIGHT VISION DEVICES MARKET: KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 28 IMPORT DATA FOR KEY COUNTRIES, 2018–2022 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR KEY COUNTRIES, 2018–2022 (USD MILLION)

- FIGURE 30 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013–2023

- FIGURE 31 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2023

- FIGURE 32 NIGHT VISION DEVICES MARKET, BY DEVICE TYPE

- FIGURE 33 CAMERAS SEGMENT TO DOMINATE NIGHT VISION DEVICES MARKET DURING FORECAST PERIOD

- FIGURE 34 NIGHT VISION DEVICES MARKET, BY TECHNOLOGY

- FIGURE 35 THERMAL IMAGING SEGMENT TO DEPICT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 36 NIGHT VISION DEVICES MARKET, BY MOUNTING TYPE

- FIGURE 37 STATIONARY SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2028

- FIGURE 38 NIGHT VISION DEVICES MARKET, BY APPLICATION

- FIGURE 39 LAW ENFORCEMENT SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2023 AND 2028

- FIGURE 40 THERMAL IMAGING SEGMENT TO DEPICT HIGHEST CAGR IN NIGHT VISION DEVICES MARKET FOR LAW ENFORCEMENT DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF NIGHT VISION DEVICES MARKET FOR COMMERCIAL SURVEILLANCE IN 2028

- FIGURE 42 NIGHT VISION DEVICES MARKET, BY REGION

- FIGURE 43 NORTH AMERICA: NIGHT VISION DEVICES MARKET SNAPSHOT

- FIGURE 44 EUROPE: NIGHT VISION DEVICES MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: NIGHT VISION DEVICES MARKET SNAPSHOT

- FIGURE 46 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2018–2022

- FIGURE 47 NIGHT VISION DEVICES MARKET SHARE ANALYSIS, 2022

- FIGURE 48 NIGHT VISION DEVICES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 49 NIGHT VISION DEVICES MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- FIGURE 50 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- FIGURE 51 L3HARRIS TECHNOLOGIES, INC: COMPANY SNAPSHOT

- FIGURE 52 RTX: COMPANY SNAPSHOT

- FIGURE 53 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 54 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 55 LEONARDO S.P.A: COMPANY SNAPSHOT

- FIGURE 56 THALES: COMPANY SNAPSHOT

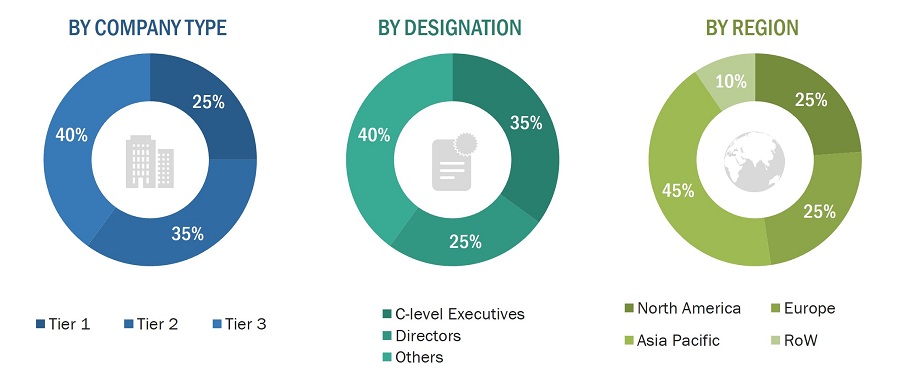

To estimate the size of the night vision devices market, the study utilized four major activities. Exhaustive secondary research was conducted to gather information on the market, as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Finally, market breakdown and data triangulation methods were utilized to estimate the market size for different segments and subsegments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the night vision devices market. Secondary sources for this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of key secondary sources

|

SOURCE |

WEB LINK |

|

International Trade Centre (ITC) |

|

|

US Department of Defense |

|

|

World Economic Forum |

|

|

The North Atlantic Treaty Organization (NATO) |

|

|

World Trade Organization |

Primary Research

To gather insights on market statistics, revenue data, market breakdowns, size estimations, and forecasting, primary interviews were conducted. Additionally, primary research was used to comprehend the various technology, application, vertical, and regional trends. Interviews with stakeholders from the demand side, including CIOs, CTOs, CSOs, and customer/end-user installation teams using night vision devices, were also conducted to understand their perspective on suppliers, products, component providers, and their current and future use of night vision devices, which will impact the overall market. Several primary interviews were conducted across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

To know about the assumptions considered for the study, download the pdf brochure

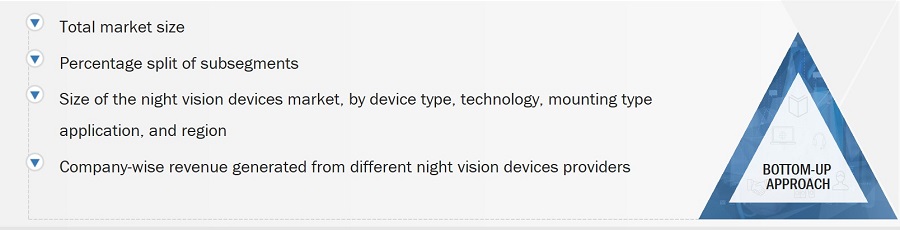

Market Size Estimation

To estimate and validate the size of the night vision devices market and its submarkets, both top-down and bottom-up approaches were utilized. Secondary research was conducted to identify the key players in the market, and primary and secondary research was used to determine their market share in specific regions. The entire process involved studying the annual and financial reports of top players and conducting extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives. Secondary sources were used to determine all percentage shares and breakdowns, which were then verified through primary sources. All parameters that could impact the markets covered in this research study were accounted for, analyzed in detail, verified through primary research, and consolidated to obtain the final quantitative and qualitative data.

Global Night vision devices Market Size: Botton Up Approach

- Identifying various night vision devices manufacturers

- Analyzing the penetration of each component through secondary and primary research

- Analyzing integration of night vision devices in different applications through secondary and primary research

- Conducting multiple discussions with key opinion leaders to understand the detailed working of night vision devices and their implementation in multiple industries; this helped analyze the break-up of the scope of work carried out by each major company

- Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with the domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

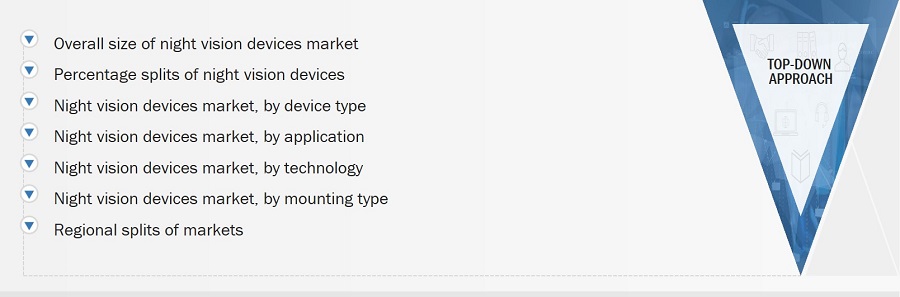

Global Night vision devices Market Size: Top Down Approach

The top-down approach has been used to estimate and validate the total size of the night vision devices market.

- Focusing initially on the R&D investments and expenditures being made in the ecosystem of the night vision devices market; further splitting the market on the basis of component, interface, focus type, pixel, application, and region and listing the key developments

- Identifying leading players in the night vision devices market through secondary research and verifying them through brief discussions with industry experts

- Analyzing revenue, product mix, geographic presence, and key applications for which products are served by all identified players to estimate and arrive at percentage splits for all key segments

- Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

- Breaking down the total market based on verified splits and key growth pockets across all segments

Data Triangulation

Once the overall size of the night vision devices market was determined using the methods described above, it was divided into multiple segments and subsegments. Market engineering was performed for each segment and subsegment using market breakdown and data triangulation methods, as applicable, to obtain accurate statistics. To triangulate the data, various factors and trends from the demand and supply sides were studied. The market was validated using both top-down and bottom-up approaches.

Market Definition

A night vision device is an electro-optic instrument designed to enhance a person’s ability to see in low-light or nighttime conditions, where natural light is insufficient for human vision. These devices work by capturing and amplifying available light or other forms of electromagnetic radiation, such as infrared or thermal radiation, to make objects and scenes visible in the dark. They utilize various technologies, including image intensification, thermal imaging, and digital and infrared illumination, to capture and amplify existing ambient light or thermal radiation, making objects visible in the dark. Common examples of night vision devices include night vision goggles, monoculars, binoculars, scopes, and cameras. They are used in various fields, such as night driving or flying, night security & surveillance, law enforcement, military, navigation, entertainment, hidden-object detection, wildlife observation, and search & rescue.

Key Stakeholders

- Suppliers of raw materials

- Technology investors

- Original equipment manufacturers (OEMs)

- Third-party service providers

- Government labs

- In-house testing labs

- System integrators

- Distributors, resellers, and traders

- Research institutions and organizations

- Night vision devices forums, alliances, consortiums, and associations

- Market research and consulting firms

- End users

Report Objectives

- To define, describe, and forecast the night vision devices market based on device type, technology, mounting type, application and region.

- To forecast the shipment data of night vision devices market based on offerings.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market.

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the night vision devices market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the night vision devices market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the night vision devices market.

Growth opportunities and latent adjacency in Night Vision Device Market