Multi-Factor Authentication Market by Authentication Type (Password-Based Authentication, Passwordless Authentication), Component (Hardware, Software, Services), Model Type, End User Industry and Region - Global Forecast to 2028

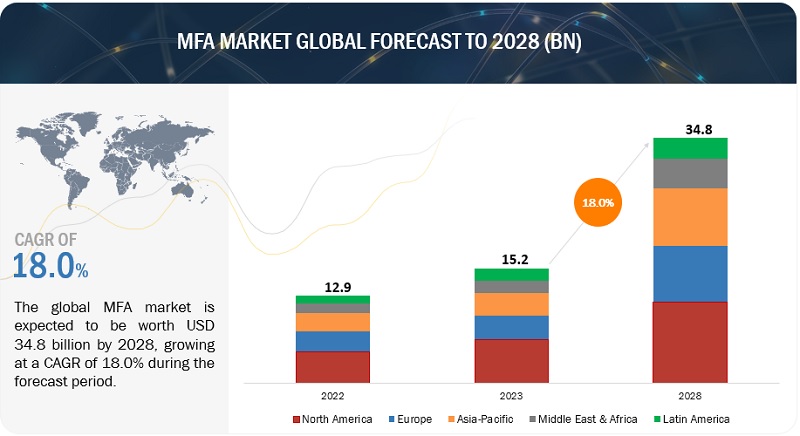

[298 Pages Report] The global MFA market size is projected to grow from USD 15.2 billion in 2023 to USD 34.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.0% during the forecast period. The expansion of the MFA market can be attributed to stringent government regulations to increase the adoption of MFA solutions.

Moreover, the MFA market is experiencing growth due to the proliferation of cloud-based MFA solutions and services. These factors contribute to the market’s promising growth potential, providing organizations with enhanced security measures.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

MFA Market Dynamics

Driver: Stringent government regulations to increase the adoption of MFA solutions

Various regulatory compliances are designed for industries to provide a standard for data protection in industries. These compliances assure organizations of their data safety and enable them to tackle security-related issues effectively. PCI DSS v4.0 was released in March 2022 and differs significantly from its predecessor, v3.2.1, in many important ways. One of the most significant changes in the most recent edition is the requirement for MFA for all accounts that can access cardholder data. Earlier versions of the PCI DSS had considered MFA to be a best practice.

Similarly, the Federal Trade Commission (FTC) published updates to the FTC Safeguards Rule on October 27, 2021. There are new technological requirements, which are the most significant modifications in this amendment. The regulation explicitly mentions multi-factor authentication (MFA) as a necessary feature. These government mandates and regulatory compliances are pushing organizations to deploy MFA solutions and services to ensure information security, which is expected to drive the growth of the MFA market.

Restraint: Increasing response time in higher-order authentication models.

Two-factor authentication systems require less time to handle a single query than three-, four-, and five-factor authentication. This added layer of security requires users to invest a few extra seconds in the authentication process, which may seem like a minor inconvenience in high-stress or fast-paced business environments. An authentication system has to be simple and perfect to implement it successfully. Authentication systems with multiple factors are being designed and prototyped with the advancement of technology. However, this would increase the time required to handle a single query as it would involve multiple processes for the authentication of data or users. As a result, this would result in long queues and increase the service/response time. The impact of this restraint is currently high but will be reduced in the future because of the ease of access techniques.

Opportunity: Rising adoption of interconnected devices in the IoT environment

As organizations integrate an array of IoT devices into their operations, they become potential entry points for cyber threats. MFA steps in as a critical security measure to safeguard against unauthorized access and potential breaches. These devices, ranging from smart thermostats to industrial sensors, are diverse in their applications but share a common vulnerability: the potential for exploitation. By implementing MFA, organizations add a layer of protection, requiring not just knowledge of a password but also the possession of an authorized device or biometric data for authentication. This multi-layered approach mitigates the risks associated with IoT devices. It enhances the overall security posture, assuring businesses that their IoT investments are not compromising their data integrity or customer trust. Thus, interconnected devices in the IoT environment will create more opportunities for MFA.

Challenge: Lack of awareness related to MFA among enterprises

The major limitation to the growth of the MFA market is the lack of awareness about the correct use of MFA solutions. The growing threat to on-premises and cloud data has increased the overall IT spending for on-premises and cloud security. The inability of in-house enterprise security teams to safeguard on-premises data has forced enterprises to move their data to the cloud. Lack of adequate MFA knowledge may lead to errors and enormous business losses. Chief information security officers are essential in ensuring that enterprises are well-equipped with the best-in-class MFA solutions and that employees do not fall prey to adversaries, such as malware, phishing, spoofing, ransomware, and APT. With changes in the business environment, security requirements are also evolving with the rise in zero-day threats and phishing attacks. This lack of awareness about advanced security threats has put businesses at risk and is hindering the growth of the MFA market.

MFA Market Ecosystem

By end-user industry, the media & entertainment industry is expected to grow at the highest CAGR during the forecast period.

The media and entertainment industry is at the cusp of transformation, with digital media expanding rapidly across TV, films, radio, advertising, animation, gaming, Out-Of-Home (OOH) advertising, and music. With the introduction of several digital technologies, content creation and production have given rise to numerous copyright-, patent-, and fraud-related activities. The media and entertainment sectors are essential in forming public opinion and the nation’s image, making them a tempting target for cybercriminal organizations. Government-sponsored APT groups frequently target sensitive information from media organizations, such as press releases, intellectual property, partnerships, country operations, and sources. Mobile apps and linked TVs are now in high demand for online video streaming. Cybercriminals have started to entice customers into using fraudulent streaming sites due to the sharp increase in traffic to online streaming services.

By Two-factor authentication, the smart card with biometric technology segment is to grow at the highest CAGR during the forecast period.

The adoption of “Smart card with biometric technology” Two-Factor Authentication is gaining momentum in the business landscape, driven by several compelling factors. It combines two distinct factors: something the user possesses (the smart card) and a unique biological trait (biometric data like fingerprints or facial features) to offer an exceptionally high level of security. This dual-factor approach significantly bolsters security, ensuring that only authorized individuals with the physical card and the matching biometric data can access sensitive systems and data. Electronics identification technology is widely adopted for its better performance and reliability. Smart cards are highly secure and reliable. Also, biometric technology is the safest to identify and authenticate genuine users. Many biometrics and other data can be stored in smart cards, which can be used to verify and identify the person. When the combination of biometrics and the smart card is employed, it creates a very secure environment, as no external database is required to access the guarded system. The complete biometrics template data is stored on the smart card, and the data comparison is made locally.

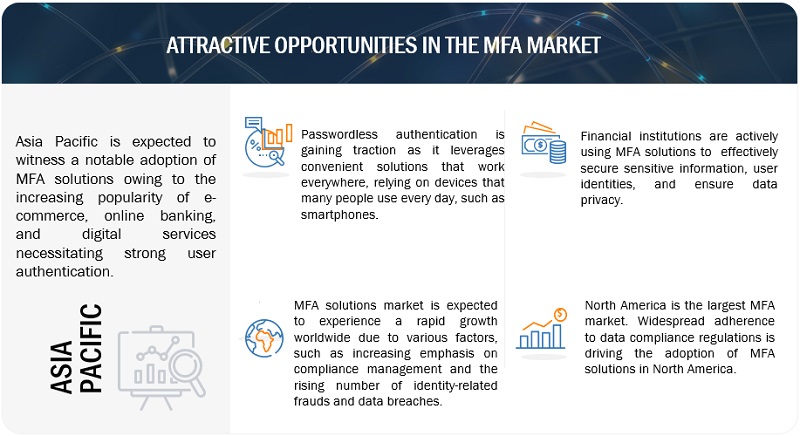

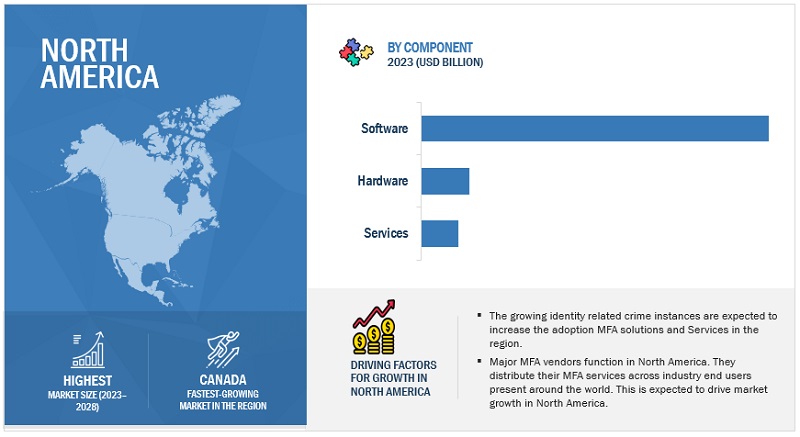

By region, North America accounts for the highest market size during the forecast period.

North America is one of the most affected regions in the world by cyberattacks, especially identity-related crimes. Cybersecurity is identified as the most severe economic and national security challenge by governments in North America. According to the US Federal Trade Commission (FTC), more than 5.88 million fraud reports were received on their portal in 2021. With 1,434,695 complaints, identity theft complaints topped the list of fraud reports received by the FTC. The rising threat of identity fraud is a compelling driver for adopting MFA across various industries. As organizations and individuals recognize the limitations of traditional authentication methods, MFA offers a powerful means to enhance security and protect against unauthorized access and identity theft. Moreover, North America is home to major MFA vendors such as Microsoft, Broadcom, OneSpan, OKTA, and Micro Focus. The presence of such prominent vendors drives the adoption of MFA solutions and services in the region.

Key Market Players

The key players in the MFA market are Microsoft (US), Thales (France), Okta (US), Broadcom (US), OneSpan (US), Micro Focus (UK), HID Global (US), Cisco (US), Ping Identity (US), RSA Security (US), ESET (Slovakia), Yubico (US0, ForgeRock (US), CyberArk (US), OneLogin (US), SecureAuth (US), Oracle (US), SalesForce (US), Secret Double Octopus (Israel), Silverfort (Israel), Trusona (US), FusionAuth (US), HYPR (US), Keyless (US), Luxchain (China).

Want to explore hidden markets that can drive new revenue in Multi-Factor Authentication Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Multi-Factor Authentication Market?

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

Authentication type, components, model type, end users industry, and regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global MFA market include Microsoft (US), Thales (France), Okta (US), Broadcom (US), OneSpan (US), Micro Focus (UK), HID Global (US), Cisco (US), Ping Identity (US), RSA Security (US), ESET (Slovakia), Yubico (US0, ForgeRock (US), CyberArk (US), OneLogin (US), SecureAuth (US), Oracle (US), SalesForce (US), Secret Double Octopus (Israel), Silverfort (Israel), Trusona (US), FusionAuth (US), HYPR (US), Keyless (US), Luxchain (China). |

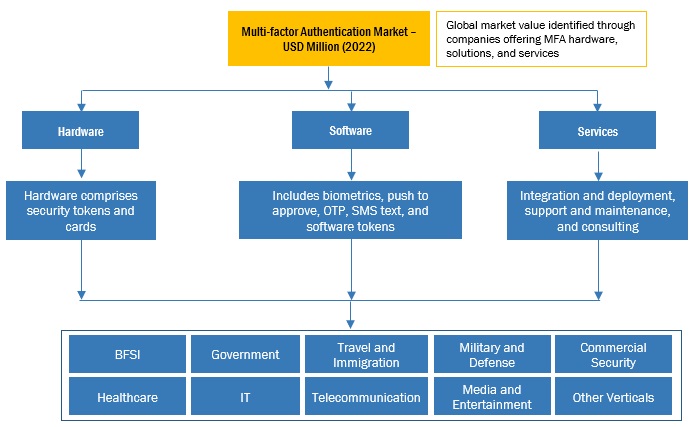

The study categorizes the MFA market by authentication type, components, model type, end-user industry, and regions.

By Authentication type:

- Password-Based Authentication

- Passwordless Authentication

By Components:

- Hardware

- Software

- Services

By Model Type:

- Two Factor Authentication

- Three Factor Authentication

- Four Factor Authentication

- Five-Factor Authentication

By End-user Industry

- Banks Financial Services and Insurance

- Government

- Travel & Immigration

- Military & Defense

- Commercial Security

- Healthcare

- Information Technology

- Telecommunication

- Media & Entertainment

- Other End-user Industry

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2023, Thales launched the SafeNet eToken Fusion series, a new set of USB tokens. With the help of the SafeNet eToken Fusion Series, businesses may use passwordless authentication techniques resistant to phishing attacks, enhancing the security of company resources used on any device.

- In November 2022, Okta launched Okta Customer Identity Cloud, an easy-to-implement and customizable customer identity solution. The Okta Customer Identity Cloud for Consumer Apps helps any organization with advanced security features like Adaptive MFA.

- In September 2022, Microsoft partnered with Silverfort to bring unified identity protection to on-premises and cloud. Silverfort developed a suitable identity protection system with the aid of Microsoft’s MFA.

- In April 2022, HID Global partnered with Microsoft to Improve Certificate-Based Authentication. This partnership will combine HID’s smart credentials and credential management capabilities with Azure AD.

- In May 2021, OneSpan announced that Belfius Bank had incorporated OneSpan Mobile Security Suite (MSS) into its mobile application. For the 1.5 million mobile customers of the bank, OneSpan’s technology offers biometric authentication, risk analysis, and other best practices for app security in the background.

Frequently Asked Questions (FAQ):

What are the opportunities in the global MFA market?

Opportunities in the MFA market include the proliferation of cloud-based MFA solutions and services, the rising adoption of interconnected devices in the IoT environment, and the high volume of online transactions.

What is the definition of the MFA market?

According to MarketsandMarkets, MFA is an authentication method that requires the user to provide two or more verification factors to access resources, such as an application, online account, or a Virtual Private Network (VPN).

Which region is expected to show the highest market share in the MFA market?

North America is expected to hold the highest market share during the forecast period.

What are the major market players covered in the report?

Major vendors in the MFA market, namely, include Microsoft (US), Thales (France), Okta (US), Broadcom (US), OneSpan (US), Micro Focus (UK), HID Global (US), Cisco (US), Ping Identity (US), RSA Security (US).

What is the current size of the global MFA market?

The global MFA market size is projected to grow from USD 15.2 billion in 2023 to USD 34.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 18.0% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing adoption of BYOD, CYOD, and WFH trends- Rising security breaches and sophisticated cyberattacks to lead to financial and reputational loss- Stringent government regulations to increase adoption of MFA solutions- Rising instances of identity theft and fraudRESTRAINTS- High cost and technical complexities- More time-consuming than two-factor authentication systemsOPPORTUNITIES- Proliferation of cloud-based MFA solutions and services- Growing adoption of interconnected devices in IoT environment- Increasing digital banking and online transactionsCHALLENGES- Lack of awareness regarding MFA solutions- Scarcity of skilled cybersecurity professionals

-

5.3 CASE STUDY ANALYSISPING IDENTITY IMPROVED BOOKING RECONCILIATION PROCESS OF PAMEIJER ACROSS ALL BUSINESS UNITSAMERIGAS DEPLOYED DUO SECURITY’S MFA TO ACHIEVE PCI-DSS COMPLIANCEBROWARD COLLEGE IMPLEMENTED ONELOGIN MULTI-FACTOR AUTHENTICATION TO OFFER ACCESS MANAGEMENTOKTA DELIVERED BLACKHAWK NETWORK CENTRALIZED, SCALABLE PLATFORM AND SAFEGUARDED BACKEND BY EXTENDING SSO AND MFA

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYER, BY OFFERINGINDICATIVE PRICING ANALYSIS, BY OFFERING

-

5.8 TECHNOLOGY ANALYSISOUT-OF-BAND AUTHENTICATIONBUILT-IN FINGERPRINT READERSBAKED-IN AUTHENTICATION

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS/CLIENTS’ BUSINESSES

- 5.11 TECHNOLOGY ROADMAP

- 5.12 BUSINESS MODEL ANALYSIS

- 5.13 EVOLUTION OF MULTI-FACTOR AUTHENTICATION

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCRIMINAL JUSTICE INFORMATION SYSTEM SECURITY POLICYPAYMENT CARD INDUSTRY DATA SECURITY STANDARDFFIEC AUTHENTICATION IN AN INTERNET BANKING ENVIRONMENTFAIR AND ACCURATE CREDIT TRANSACTION ACTIDENTITY THEFT RED FLAGSHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACTSARBANES-OXLEY ACTGRAMM-LEACH-BLILEY ACT

- 5.15 HS CODES

-

5.16 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.17 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.1 INTRODUCTIONAUTHENTICATION TYPE: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

-

6.2 PASSWORD-BASED AUTHENTICATIONEASY INTEGRATION OF PASSWORD-BASED AUTHENTICATION INTO VARIOUS SYSTEMS, APPLICATIONS, AND DEVICES TO DRIVE ITS ADOPTION

-

6.3 PASSWORDLESS AUTHENTICATIONPASSWORDLESS AUTHENTICATION TO USE UNIQUE BIOMETRIC ATTRIBUTES AND ELIMINATE ISSUE OF REMEMBERING PASSWORDS

-

7.1 INTRODUCTIONCOMPONENT: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

-

7.2 HARDWAREHARDWARE-BASED MFA METHODS TO PROVIDE ROBUST AUTHENTICATION AND SIGNIFICANTLY REDUCE RISK OF UNAUTHORIZED ACCESS

-

7.3 SOFTWAREMFA SOFTWARE TO HELP BUSINESSES COMPLY WITH REGULATORY NORMS WHILE SECURING THEIR CONFIDENTIAL DATA

-

7.4 SERVICESMFA SERVICES TO DEPLOY, EXECUTE, AND MAINTAIN MFA PLATFORMS IN ORGANIZATIONS

-

8.1 INTRODUCTIONMODEL TYPE: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

-

8.2 TWO-FACTOR AUTHENTICATIONNEED FOR ADDITIONAL LAYER OF SECURITY AND REMAIN COMPLIANT TO DRIVE ADOPTION OF TWO-FACTOR AUTHENTICATIONSMART CARD WITH PIN- Need for high level of security and protect sensitive consumer and company data with smart cards and PINs to drive marketSMART CARD WITH BIOMETRIC TECHNOLOGY- Smart cards with biometric technology to control access to buildings, secure areas, and IT systemsBIOMETRIC TECHNOLOGY WITH PIN- Biometric technology with PIN to be used for various financial applicationsTWO-FACTOR BIOMETRIC TECHNOLOGY- Two-factor biometric technology to safeguard assets and maintain trustONE-TIME PASSWORD WITH PIN- OTP with PIN to secure access to corporate systems and mobile apps

-

8.3 THREE-FACTOR AUTHENTICATIONINCREASING CLOUD COMPUTING USAGE TO DRIVE ADOPTION OF THREE-FACTOR AUTHENTICATIONSMART CARD WITH PIN AND BIOMETRIC TECHNOLOGY- High resilience to various forms of attacks, including phishing, credential theft, and identity fraud, to drive marketSMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY- Need for handling sensitive data in healthcare and finance and preventing data breaches to drive demand for smart cardPIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY- Need for superior security, compliance with legal requirements, and durability against online threats to drive marketTHREE-FACTOR BIOMETRIC TECHNOLOGY- Three-factor biometric technology to impersonate legitimate users and reduce risk of identity theft

-

8.4 FOUR-FACTOR AUTHENTICATIONNEED TO LEVERAGE FOUR DISTINCT AUTHENTICATION FACTORS TO VERIFY USER IDENTITY AND ENHANCE SECURITY TO UNPRECEDENTED LEVELS

-

8.5 FIVE-FACTOR AUTHENTICATION5FA TO OFFER HIGH LEVEL OF SECURITY TO SAFEGUARD DATA AND TECHNOLOGY

-

9.1 INTRODUCTIONEND-USE INDUSTRY: MULTI-FACTOR AUTHENTICATION MARKET DRIVERS

-

9.2 BFSINEED TO PROTECT HIGHLY CONFIDENTIAL INFORMATION AND HELP SECURE GOVERNMENT DATA TO DRIVE MARKET

-

9.3 GOVERNMENTDIGITALIZATION OF GOVERNMENT AND DEFENSE PROCESSES AND SAFEGUARD GOVERNMENT DATA FROM BREACHES TO DRIVE MARKET

-

9.4 TRAVEL & IMMIGRATIONMULTI-FACTOR AUTHENTICATION TO CAPTURE, MANAGE, AND APPLY IDENTITY DATA ACROSS DIGITAL CHANNELS

-

9.5 MILITARY & DEFENSEDEFENSE SEGMENT TO UTILIZE BIOMETRICS TO TACKLE CYBERATTACKS

-

9.6 COMMERCIAL SECURITYORGANIZATIONS TO SAFEGUARD CLIENT DATA AND ASSETS WITH MULTI-FACTOR AUTHENTICATION

-

9.7 HEALTHCAREMULTI-FACTOR AUTHENTICATION SOLUTIONS TO ADDRESS DATA SECURITY, PATIENT SAFETY, AND PRODUCTIVITY

-

9.8 IT & ITESRAPID ADOPTION IN WFH POLICY AND FOCUS ON MAINTAINING SECURITY OF HYBRID IT ENVIRONMENTS TO DRIVE MARKET

-

9.9 TELECOMADVENT OF 5G TECHNOLOGY AND INTERNET OF THINGS TO DRIVE MARKET

-

9.10 MEDIA & ENTERTAINMENTMULTI-FACTOR AUTHENTICATION TO SECURE VALUABLE INTELLECTUAL PROPERTY

- 9.11 OTHER END-USE INDUSTRIES

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Presence of stringent laws, growing internet penetration, and government initiatives to adopt MFA to drive marketCANADA- Increased occurrence of online fraud, terrorist attacks, and bad bot attacks to drive market

-

10.3 EUROPEEUROPE: MULTI-FACTOR AUTHENTICATION MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Increasing identity fraud to boost adoption of MFAGERMANY- Rising innovative technologies and need to combat financial crimes to drive marketFRANCE- Guidelines of French Data Protection Authority to adopt MFA to drive marketITALY- Consistent growth in cybersecurity and need to comply with GDPR to drive marketREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPEAUSTRALIA- Need to safeguard data, websites, and mobile applications and focus of Australian TPB to enhance its online portal with MFA to drive marketINDIA- Personal Data Protection Act to strengthen data privacy across all FIs to drive demand for MFACHINA- Surge in mobile commerce and digital payment platforms to drive growth of MFAJAPAN- Strong technological base and focus on data protection and government support to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEUAE- Need to adopt modern low-friction authentication techniques to safeguard mixed workforces to drive marketKSA- Need to secure digital identities to fuel adoption of MFA solutionsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Rising adoption of digital penetration and social media to propel marketMEXICO- Rising social media and digital penetration to fuel demand for MFA solutionsREST OF LATIN AMERICA

- 11.1 KEY PLAYERS STRATEGIES

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 RANKING OF TOP MARKET PLAYERS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 11.7 GLOBAL SNAPSHOTS OF KEY MARKET PLAYERS AND THEIR HEADQUARTERS

- 11.8 VALUATION AND FINANCIAL METRICS OF VENDORS

-

11.9 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOKTA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBROADCOM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewONESPAN- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICRO FOCUS- Business overview- Products/Solutions/Services offered- Recent developmentsHID GLOBAL- Business overview- Products/Solutions/Services offered- Recent developmentsCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsPING IDENTITY- Business overview- Products/Solutions/Services offered- Recent developmentsRSA SECURITY- Business overview- Products/Solutions/Services offered- Recent developmentsESETYUBICOFORGEROCKCYBERARKONELOGINSECUREAUTHORACLESALESFORCE

-

12.2 OTHER KEY PLAYERSSECRET DOUBLE OCTOPUSSILVERFORTTRUSONAFUSIONAUTHHYPRKEYLESSLUXCHAIN

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- 13.2 LIMITATIONS

-

13.3 ADJACENT MARKETSIDENTITY AND ACCESS MANAGEMENT MARKETDIGITAL IDENTITY SOLUTIONS MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MULTI-FACTOR AUTHENTICATION MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MULTI-FACTOR AUTHENTICATION MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 OKTA: PRICING ANALYSIS

- TABLE 7 ONELOGIN: PRICING ANALYSIS

- TABLE 8 LIST OF PATENTS IN MULTI-FACTOR AUTHENTICATION MARKET, 2023

- TABLE 9 MULTI-FACTOR AUTHENTICATION MARKET: TECHNOLOGY ROADMAP

- TABLE 10 MULTI-FACTOR AUTHENTICATION MARKET: BUSINESS MODEL ANALYSIS

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EXPORT SCENARIO FOR HS CODE 8301, BY COUNTRY, 2022 (KG)

- TABLE 13 IMPORT SCENARIO FOR HS CODE 8301, BY COUNTRY, 2022 (KG)

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 16 MULTI-FACTOR AUTHENTICATION MARKET: LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 17 MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 18 MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 19 PASSWORD-BASED AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 PASSWORD-BASED AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 PASSWORDLESS AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 PASSWORDLESS AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 24 MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 25 HARDWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 HARDWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 SOFTWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 SOFTWARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 SERVICES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 SERVICES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 32 MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 33 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 36 TWO-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 37 TWO-FACTOR AUTHENTICATION: SMART CARD WITH PIN MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 TWO-FACTOR AUTHENTICATION: SMART CARD WITH PIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 TWO-FACTOR AUTHENTICATION: SMART CARD WITH BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 TWO-FACTOR AUTHENTICATION: SMART CARD WITH BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 TWO-FACTOR AUTHENTICATION: BIOMETRIC TECHNOLOGY WITH PIN MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 TWO-FACTOR AUTHENTICATION: BIOMETRIC TECHNOLOGY WITH PIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 TWO-FACTOR AUTHENTICATION: TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 TWO-FACTOR AUTHENTICATION: TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 TWO-FACTOR AUTHENTICATION: ONE-TIME PASSWORD WITH PIN MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 TWO-FACTOR AUTHENTICATION: ONE-TIME PASSWORD WITH PIN MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 50 THREE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 51 THREE-FACTOR AUTHENTICATION: SMART CARD WITH PIN AND BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 THREE-FACTOR AUTHENTICATION: SMART CARD WITH PIN AND BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 THREE-FACTOR AUTHENTICATION: SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 THREE-FACTOR AUTHENTICATION: SMART CARD WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 THREE-FACTOR AUTHENTICATION: PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 THREE-FACTOR AUTHENTICATION: PIN WITH TWO-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 THREE-FACTOR AUTHENTICATION: THREE-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 THREE-FACTOR AUTHENTICATION: THREE-FACTOR BIOMETRIC TECHNOLOGY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 FOUR-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 60 FOUR-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 FIVE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 FIVE-FACTOR AUTHENTICATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 64 MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 BFSI: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 BFSI: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 GOVERNMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 GOVERNMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 TRAVEL & IMMIGRATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 TRAVEL & IMMIGRATION: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 MILITARY & DEFENSE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 MILITARY & DEFENSE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 COMMERCIAL SECURITY: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 74 COMMERCIAL SECURITY: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 HEALTHCARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 HEALTHCARE: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 IT & ITES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 78 IT & ITES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 TELECOM: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 80 TELECOM: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 MEDIA & ENTERTAINMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 82 MEDIA & ENTERTAINMENT: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 OTHER END-USE INDUSTRIES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 84 OTHER END-USE INDUSTRIES: MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 86 MULTI-FACTOR AUTHENTICATION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 101 US: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 102 US: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 103 US: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 104 US: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 105 US: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 106 US: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 107 US: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 108 US: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 109 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 110 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 111 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 112 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 113 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 114 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 115 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 116 CANADA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 117 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 118 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 119 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 120 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 121 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 122 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 123 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 124 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 126 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 128 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 130 EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 131 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 132 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 133 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 134 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 135 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 136 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 137 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 138 UK: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 140 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 141 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 142 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 143 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 144 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 145 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 146 GERMANY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 147 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 148 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 149 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 150 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 151 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 152 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 153 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 154 FRANCE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 156 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 157 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 158 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 159 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 160 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 161 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 162 ITALY: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 164 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 166 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 168 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 169 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 170 REST OF EUROPE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 185 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 186 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 187 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 188 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 189 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 190 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 191 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 192 AUSTRALIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 193 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 194 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 195 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 196 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 197 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 198 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 199 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 200 INDIA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 201 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 202 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 203 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 204 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 205 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 206 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 207 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 208 CHINA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 209 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 210 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 211 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 212 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 213 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 214 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 215 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 216 JAPAN: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 217 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 218 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 219 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 220 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 221 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 222 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 239 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 240 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 241 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 242 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 243 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 244 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 245 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 246 UAE: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 247 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 248 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 249 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 250 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 251 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 252 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 253 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 254 KSA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 264 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 266 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 268 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 270 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY TWO-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2017–2022 (USD MILLION)

- TABLE 272 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY THREE-FACTOR AUTHENTICATION, 2023–2028 (USD MILLION)

- TABLE 273 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 274 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 275 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 276 LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 277 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 278 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 279 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 280 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 281 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 282 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 283 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 284 BRAZIL: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 285 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 286 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 287 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 288 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 289 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 290 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 291 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 292 MEXICO: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 293 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2017–2022 (USD MILLION)

- TABLE 294 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY AUTHENTICATION TYPE, 2023–2028 (USD MILLION)

- TABLE 295 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 296 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 297 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2017–2022 (USD MILLION)

- TABLE 298 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY MODEL TYPE, 2023–2028 (USD MILLION)

- TABLE 299 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2017–2022 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: MULTI-FACTOR AUTHENTICATION MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 301 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 302 LIST OF START-UPS/SMES

- TABLE 303 MULTI-FACTOR AUTHENTICATION MARKET: PRODUCT LAUNCHES, 2023–2021

- TABLE 304 MULTI-FACTOR AUTHENTICATION MARKET: DEALS, 2023–2021

- TABLE 305 MICROSOFT: COMPANY OVERVIEW

- TABLE 306 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 MICROSOFT: PRODUCT LAUNCHES

- TABLE 308 MICROSOFT: DEALS

- TABLE 309 THALES GROUP: COMPANY OVERVIEW

- TABLE 310 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 THALES GROUP: PRODUCT LAUNCHES

- TABLE 312 THALES GROUP: DEALS

- TABLE 313 OKTA: COMPANY OVERVIEW

- TABLE 314 OKTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 OKTA: PRODUCT LAUNCHES

- TABLE 316 OKTA: DEALS

- TABLE 317 BROADCOM: COMPANY OVERVIEW

- TABLE 318 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 BROADCOM: DEALS

- TABLE 320 ONESPAN: COMPANY OVERVIEW

- TABLE 321 ONESPAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 ONESPAN: PRODUCT LAUNCHES

- TABLE 323 ONESPAN: DEALS

- TABLE 324 MICRO FOCUS: COMPANY OVERVIEW

- TABLE 325 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 MICRO FOCUS: DEALS

- TABLE 327 HID GLOBAL: COMPANY OVERVIEW

- TABLE 328 HID GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 HID GLOBAL: PRODUCT LAUNCHES

- TABLE 330 HID GLOBAL: DEALS

- TABLE 331 CISCO: COMPANY OVERVIEW

- TABLE 332 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 CISCO: PRODUCT LAUNCHES

- TABLE 334 CISCO: DEALS

- TABLE 335 PING IDENTITY: COMPANY OVERVIEW

- TABLE 336 PING IDENTITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 PING IDENTITY: PRODUCT LAUNCHES

- TABLE 338 PING IDENTITY: DEALS

- TABLE 339 RSA SECURITY: COMPANY OVERVIEW

- TABLE 340 RSA SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 RSA SECURITY: DEALS

- TABLE 342 ADJACENT MARKETS AND FORECASTS

- TABLE 343 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 344 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 345 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 346 IDENTITY AND ACCESS MANAGEMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 347 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 348 DIGITAL IDENTITY SOLUTIONS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 349 DIGITAL IDENTITY SOLUTIONS MARKET, BY SOLUTION TYPE, 2017–2022 (USD MILLION)

- TABLE 350 DIGITAL IDENTITY SOLUTIONS MARKET, BY SOLUTION TYPE, 2023–2028 (USD MILLION)

- FIGURE 1 MULTI-FACTOR AUTHENTICATION MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MULTI-FACTOR AUTHENTICATION MARKET: DATA TRIANGULATION

- FIGURE 4 MULTI-FACTOR AUTHENTICATION MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS: REVENUE OF HARDWARE, SOLUTIONS, AND SERVICES FROM VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL HARDWARE, SOLUTIONS, AND SERVICES OF VENDORS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND SIDE)

- FIGURE 9 LIMITATIONS

- FIGURE 10 GLOBAL MULTI-FACTOR AUTHENTICATION MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 11 NORTH AMERICA TO DOMINATE MARKET IN 2023

- FIGURE 12 GROWING INSTANCES OF DATA BREACHES, RISING ADOPTION OF BYOD TRENDS, AND STRINGENT REGULATIONS TO DRIVE MARKET

- FIGURE 13 PASSWORD-BASED AUTHENTICATION SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 15 TWO-FACTOR AUTHENTICATION TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 16 BFSI END-USE INDUSTRY AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MULTI-FACTOR AUTHENTICATION MARKET

- FIGURE 19 MULTI-FACTOR AUTHENTICATION MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 MULTI-FACTOR AUTHENTICATION MARKET: ECOSYSTEM

- FIGURE 21 MULTI-FACTOR AUTHENTICATION MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 LIST OF MAJOR PATENTS FOR MULTI-FACTOR AUTHENTICATION MARKET

- FIGURE 23 MULTI-FACTOR AUTHENTICATION MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS/CLIENTS’ BUSINESSES

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 26 PASSWORDLESS AUTHENTICATION SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 SOFTWARE SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 28 TWO-FACTOR AUTHENTICATION SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 29 BFSI SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 33 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020–2022 (USD BILLION)

- FIGURE 34 MARKET SHARE ANALYSIS, 2022

- FIGURE 35 RANKING OF TOP MARKET PLAYERS

- FIGURE 36 COMPANY EVALUATION MATRIX, 2023

- FIGURE 37 OVERALL COMPANY FOOTPRINT

- FIGURE 38 START-UP/SMES EVALUATION MATRIX, 2023

- FIGURE 39 REGIONAL SNAPSHOT

- FIGURE 40 VALUATION AND FINANCIAL METRICS OF MULTI-FACTOR AUTHENTICATION VENDORS

- FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 42 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 43 OKTA: COMPANY SNAPSHOT

- FIGURE 44 BROADCOM: COMPANY SNAPSHOT

- FIGURE 45 ONESPAN: COMPANY SNAPSHOT

- FIGURE 46 CISCO: COMPANY SNAPSHOT

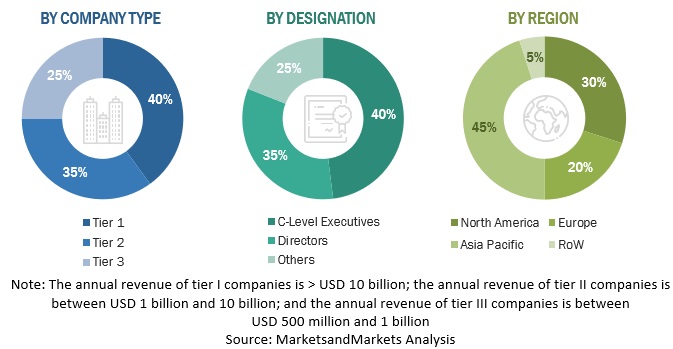

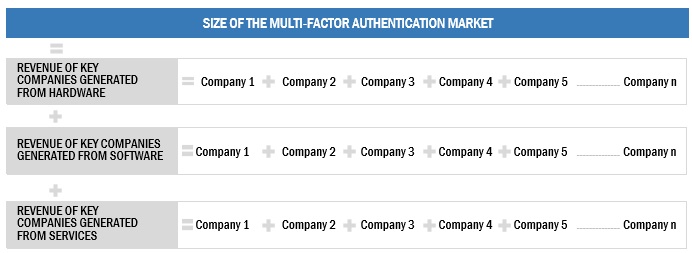

The study involved significant activities in estimating the current market size for the MFA market. Exhaustive secondary research was done to collect information on the MFA industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the MFA market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of MFA solution and service vendors, forums, certified publications, and whitepapers. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both needs- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the MFA market.

In the market engineering process, top-down and bottom-up approaches and several data triangulation methods were extensively used to perform market estimation and market forecasting for the overall market segments and subsegments listed in this report. The complete market engineering process was extensive qualitative and quantitative analysis to record key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global MFA market and the size of various other dependent sub-segments in the overall MFA market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Approach 1:

Approach 2:

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, MFA is an authentication method that requires the user to provide two or more verification factors to access resources, such as an application, online account, or a Virtual Private Network (VPN). Similarly, according to OneLogin, MFA is an authentication method that requires the user to provide two or more verification factors to gain access to a resource such as an application, online account, or a VPN.

Key Stakeholders

- MFA vendors

- Consulting firms

- Third-party vendors

- Mobile application developers

- Cloud platform providers

- Investors and venture capitalists

- System Integrators (SIs)

- Technology providers

- Suppliers, distributors, and contractors

Report Objectives

- To describe and forecast the global Multi-Factor Authentication (MFA) market by offering, software type, deployment mode, application, vertical, and region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information on significant factors (drivers, restraints, opportunities, and challenges) influencing the market’s growth

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the MFA market and comprehensively analyze their market shares and core competencies

- Track and analyze competitive developments, such as mergers and acquisitions (M&A), new product developments, and partnerships and collaborations in the market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multi-Factor Authentication Market