Motor Soft Starter Market by Voltage (Low and Medium), Rated Power (Up to 750 W, 751 W75 kW, Above 75 kW), Application (Pumps, Fans, Compressors), Industry (Oil & Gas, Water and Wastewater, Power Generation, Mining), and Region - Global Forecast to 2024

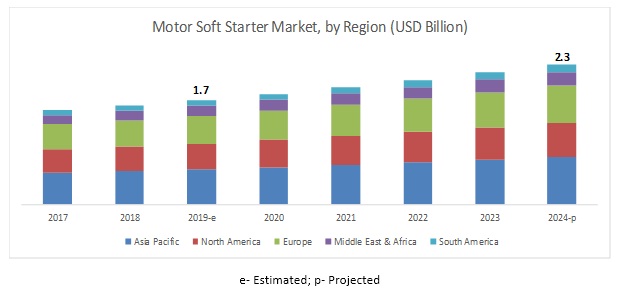

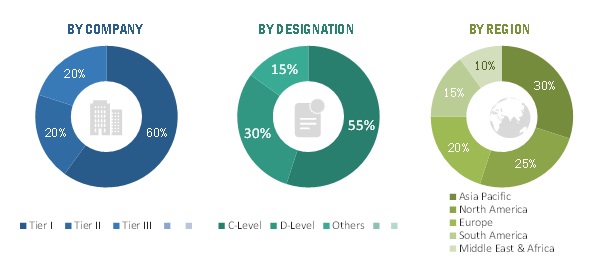

[176 Pages Report] The global motor soft starter market is projected to reach USD 2.3 billion by 2024 from an estimated market size of USD 1.7 billion in 2019, at a CAGR of 6.0% during the forecast period. The growth is attributed to the growing demand for industrial pumps, increased use of electric motors in key industries, rising investments in oil & gas, water & wastewater treatment projects globally.

The low voltage segment is expected to be the largest market during the forecast period

The motor soft starter market, by voltage, is segmented into low voltage and medium voltage. Low voltage motor soft starter is expected to grow owing to their widespread adoption in various process industries across the globe. Global greenfield industrial investments, especially in Asia Pacific, have been on the rise, which is likely to boost demand for the low voltage motor soft starters during the forecast period.

The 751 W75 kW motor soft starter segment is expected to be the largest contributor to the motor soft starter market, by rated power, during the forecast period

The motor soft starter, by rated power, is segmented into Up to 750 W, 751 W75 kW, and Above 75 kW segments. Motor soft starters in 751 W75 kW segment are projected to hold the largest market share by 2024. Rising investments in oil & gas and desalination projects are expected to contribute to the growth of motor soft starter market in this segment.

The motor soft starter market for pump applications is expected to be the fastest-growing market, by application, during the forecast period

The motor soft starter has been categorized, based on application, into pumps, fans, compressors, and others (conveyors, crushers, mills, and bow thrusters). Pumps are used widely in process industries such as oil & gas, water & wastewater, power generation, chemical & petrochemicals, cement, and paper & pulp, among others. The demand for oil and increased investments in water & wastewater projects, the two major end-users for pump applications are expected to drive the growth of motor soft starter market for pump applications.

The oil & gas industry is expected to lead the motor soft starter market during the forecast period

The motor soft starter, by industry, is segmented into oil & gas, water & wastewater, power generation, mining, and others which includes chemical & petrochemical, cement & manufacturing, food & beverage, pulp & paper, and public construction industries. The increase in upstream spending in response to rising oil prices is expected to drive the growth of motor soft starter market in the oil & gas industry.

Asia Pacific is expected to be the largest market for motor soft starter during the forecast period

In this report, the motor soft starter market has been analyzed with respect to 5 regions, namely, Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Asia Pacific is estimated to be the largest market from 2019 to 2024. It is expected to see high demand for motor soft starters owing to increased investments in construction, power generation, and industrialization projects. Also, the increasing power generation capacity additions and electricity demand are further expected to boost the motor soft starter market in this region.

Key Market Players

The major players in the motor soft starter market are ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Eaton (Ireland), Fuji Electric (Japan), WEG (Brazil), Rockwell Automation (US), and Mitsubishi Electric (Japan).

ABB (Switzerland) is a key player in this market. The companys recent Mergers & Acquisitions as part of its inorganic business strategy is expected to increase its clientele base globally. ABB has recently acquired GEs Electrification solution business which also has motor soft starter product offerings. Another recent acquisition by ABB, Bernecker + Rainer Industrie-Elektronik is expected to strengthen ABBs place as a leader in motor soft starter.

Siemens (Germany) is another major player in motor soft starter. The company opts for new product launches as its organic business strategy to strengthen its position in the global market. For instance, Siemens has introduced SIRIUS 3RW5, 3-phase soft starters for asynchronous motors, in the South African market.

Want to explore hidden markets that can drive new revenue in Motor Soft Starter Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Motor Soft Starter Market?

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Voltage, rated power, application, industry, and region |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, and the Middle East & Africa |

|

Companies covered |

ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Eaton (Ireland), Rockwell Automation (US), Crompton Greaves (India), Emerson Electric (US), WEG (Brazil), Danfoss (Denmark), Carlo Gavazzi (Italy), Toshiba (Japan), Larsen & Toubro (India), Motortronics (US), Solcon (Israel), Nolta (Germany), Lovato Electric (Italy), Gozuk (China), Minilec (India), Sinova (China), Benshaw (US) |

This research report categorizes the market by voltage, rated power, application, industry, and region.

By voltage:

- Low Voltage

- Medium Voltage

By rated power:

- Up to 750 W

- 751 W75 kW

- Above 75 kW

By Application:

- Pump

- Fan

- Compressor

- Others ( includes conveyors, crushers, mills, and blow thrusters)

By industry:

- Oil & Gas

- Water & Wastewater

- Power generation

- Mining

- Others (chemical & petrochemical, cement & manufacturing, food & beverage, pulp & paper, and public construction industries.)

By region:

- Asia Pacific

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments

- In June 2019, Crompton Greaves launched new Emotron VSX and Emotron VSM series variable speed drives aimed at serving constant torque appllications such as pumps, fans, and compressors.

Key Questions Addressed by the Report

- Which revolutionary technology trends are expected over the next five years?

- Which elements of the motor soft starter market are expected to lead by 2024?

- Which type of motor soft starter is likely to get the maximum opportunity to grow during the forecast period?

- Which region is expected to lead with the highest market share by 2024?

- How are companies implementing organic and inorganic strategies to gain an increase in the market share?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Definition

1.2.1 Motor Soft Starter Terminology, By Voltage: Inclusions & Exclusions

1.2.2 Motor Soft Starter Terminology, By Industry: Inclusions & Exclusions

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Break-Up of Primaries

2.2 Scope

2.3 Market Size Estimation

2.3.1 Demand-Side Analysis

2.3.1.1 Calculation

2.3.1.2 Assumptions

2.3.2 Supply-Side Analysis

2.3.2.1 Assumptions

2.3.2.2 Calculation

2.3.3 Forecast

2.4 Data Triangulation

2.5 Primary Insights

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 39)

4.1 Attractive Opportunities in the Motor Soft Starter Market During the Forecast Period

4.2 Motor Soft Starter, By Voltage

4.3 Motor Soft Starter, By Rated Power

4.4 Motor Soft Starter, By Application

4.5 Motor Soft Starter, By Industry

4.6 Motor Soft Starter, By Region

5 Market Overview (Page No. - 42)

5.1 Introduction

5.1.1 Yc Shift Analysis:

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Demand for Industrial Pumps

5.2.1.2 Rising Demand for Heating, Ventilation, and Air Conditioning (HVAC) Applications

5.2.1.3 Adoption of High-Efficiency Motors

5.2.2 Restraints

5.2.2.1 Functional Superiority and Competitive Pricing of Variable Frequency Drives (VFDS)

5.2.3 Opportunities

5.2.3.1 Investments in Non-Oil Sectors of the Middle East

5.2.3.2 Increased Automation and Reliability Concerns

5.2.4 Challenges

5.2.4.1 Decline in Investments in Conventional Power Generation Plants

6 Motor Soft Starter Market, By Voltage (Page No. - 47)

6.1 Introduction

6.2 Low Voltage

6.2.1 Increased Installations of Low Voltage Motors for Industrial Usage are Driving Demand for Low Voltage Motor Soft Starters

6.3 Medium Voltage

6.3.1 Investments in Large Water Treatment Plants and Oil & Gas Globally are Expected to Increase Demand for Medium Voltage Motor Soft Starters

7 Motor Soft Starter Market, By Rated Power (Page No. - 52)

7.1 Introduction

7.2 Up to 750 W

7.2.1 Asia Pacific is Expected to Lead the Up to 750 W Motor Soft Starter

7.3 751 W75 kW

7.3.1 Significant Global Investments in Oil & Gas and Desalination Projects are Expected to Increase Demand for 751 W75 kW Motor Soft Starters

7.4 Above 75 kW

7.4.1 Above 75 kW Motor Soft Starter Segment is Expected to Gain Impetus Owing to Rising Global Mining Investments

8 Motor Soft Starter Market, By Application (Page No. - 57)

8.1 Introduction

8.2 Pump

8.2.1 Rising Demand for Oil and Increased Investments in Water & Wastewater Sector are Expected to Drive Motor Soft Starter for Pump Applications

8.3 Fan

8.3.1 Investments in Power Generation Globally are Expected to Increase Demand for Motor Soft Starters for Fan Applications

8.4 Compressor

8.4.1 Investments in Oil & Gas and Industrial Sector Globally are Anticipated to Increase Demand for Motor Soft Starters for Compressor Applications

8.5 Others

8.5.1 Investments in Mining and Industrial Sector Globally are Expected to Increase Demand for Motor Soft Starters for Other Applications

9 Motor Soft Starter Market, By Industry (Page No. - 64)

9.1 Introduction

9.2 Oil & Gas

9.2.1 Increased Oil & Gas Investments in North America are Expected to Drive Market in Oil & Gas Industry

9.3 Water & Wastewater

9.3.1 Investments in Water & Wastewater Projects and Desalination Projects Globally are Expected to Increase Demand for Motor Soft Starters in Water & Wastewater Industry

9.4 Power Generation

9.4.1 Demand for Motor Soft Starters in Power Generation is Expected to Increase With Rise in Energy Sector Investments

9.5 Mining

9.5.1 Increase in Capital Expenditure of Major Mining Companies is Expected to Drive the Market

9.6 Others

9.6.1 Investments in Food & Beverage and Chemical & Petrochemical Globally are Expected to Drive Demand for Motor Soft Starters in Others Industry

10 Motor Soft Starter Market, By Region (Page No. - 72)

10.1 Introduction

10.2 Asia Pacific

10.2.1 By Voltage

10.2.2 By Rated Power

10.2.3 By Application

10.2.4 By Industry

10.2.5 By Country

10.2.5.1 China

10.2.5.1.1 Strong Economic Growth and Supportive Government Policies for Growing Industrialization are Expected to Drive the Chinese Motor Soft Starter Industry

10.2.5.2 India

10.2.5.2.1 Increased Manufacturing and Industrialization Along With Need for Enhanced Efficiency of the Manufacturing Plants are Driving the Market During the Forecast Period

10.2.5.3 Japan

10.2.5.3.1 Thriving Construction Industry and Investments Toward Industrial Wastewater Treatment are Expected to Drive the Japanese Motor Soft Starter Industry

10.2.5.4 Rest of Asia Pacific

10.2.5.4.1 Increase in Generation of Electricity From Coal and Fossil Fuels Along With an Increase in Mining Sector is Expected to Increase Demand for Motor Soft Starters

10.3 Europe

10.3.1 By Voltage

10.3.2 By Rated Power

10.3.3 By Application

10.3.4 By Industry

10.3.5 By Country

10.3.5.1 UK

10.3.5.1.1 Need for Processing Wastewater for Sustainability is Expected to Help the Market Grow

10.3.5.2 Germany

10.3.5.2.1 Increasing Automation and Construction in the Region Would Lead to an Increased Demand for Motor Soft Starters

10.3.5.3 Russia

10.3.5.3.1 Increase in the Export of Crude Oil and Mineral & Metal Contributing A Huge Portion to Gdp is Expected to Increase Demand for Motor Soft Starters

10.3.5.4 France

10.3.5.4.1 Growth in Investments in Water & Wastewater Treatment is Likely to Increase Motor Soft Starter Market

10.3.5.5 Rest of Europe

10.3.5.5.1 Increased Investments in Manufacturing Sector With Increased Automation Would Drive the Motor Soft Starter Market

10.4 North America

10.4.1 By Voltage

10.4.2 By Rated Power

10.4.3 By Application

10.4.4 By Industry

10.4.5 By Country

10.4.5.1 US

10.4.5.1.1 Increased Investments in the Field of Automation in Manufacturing Plants and Oil & Gas Exploration are Expected to Drive the US Motor Soft Starter Industry

10.4.5.2 Canada

10.4.5.2.1 High Growth in Construction and Oil & Gas Industries is Expected to Drive the Canadian Motor Soft Starter Industry

10.4.5.3 Mexico

10.4.5.3.1 Rising Investments in Petroleum Industry Along With Increased Industrialization are Driving the Motor Soft Starter Industry During the Forecast Period

10.5 Middle East & Africa

10.5.1 By Voltage

10.5.2 By Rated Power

10.5.3 By Application

10.5.4 By Industry

10.5.5 By Country

10.5.5.1 Saudi Arabia

10.5.5.1.1 Oil & Gas Exploration & Production Along With A Growing Number of Wastewater Plants are Likely to Drive the Motor Soft Starter Industry in the Country

10.5.5.2 UAE

10.5.5.2.1 Augmented Operations in Petroleum Industry Along With Construction Industry are Helping the Motor Soft Starter Industry to Grow During TheForecast Period

10.5.5.3 South Africa

10.5.5.3.1 Augmented Operations in the Petroleum Industry Along With the Construction Industry are Helping the Motor Soft Starter to Grow During the Forecast Period

10.5.5.4 Rest of Middle East & Africa

10.5.5.4.1 Huge Investments in Oil & Gas Sector are Expected to Drive the Motor Soft Starter Industry in the Region

10.6 South America

10.6.1 By Voltage

10.6.2 By Rated Power

10.6.3 By Application

10.6.4 By Industry

10.6.5 By Country

10.6.5.1 Brazil

10.6.5.1.1 Augmented Investments in Utilities and Oil & Gas Sectors are Expected to Drive the Motor Soft Starter Industry in the Country

10.6.5.2 Chile

10.6.5.2.1 Upcoming Investments in Mining Sector Would Increase the Demand for Motor Soft Starters in the Country

10.6.5.3 Argentina

10.6.5.3.1 Growing Power Generation Sector in the Country is Expected to Increase the Need for Soft Starters

10.6.5.4 Rest of South America

10.6.5.4.1 Investments in Oil & Gas and Power Sectors are Expected to Drive the Motor Soft Starter Industry in the Region

11 Competitive Landscape (Page No. - 122)

11.1 Overview

11.2 Competitive Leadership Mapping (Overall Market)

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging

11.3 Market Share, 2018

11.4 Competitive Scenario

11.4.1 Contracts & Agreements

11.4.2 New Product Launches

11.4.3 Mergers & Acquisitions

11.4.4 Investments & Expansions

11.4.5 Others

12 Company Profiles (Page No. - 129)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 ABB

12.2 Eaton

12.3 Siemens

12.4 Schneider Electric

12.5 RockWell Automation

12.6 Emerson Electric

12.7 Crompton Greaves

12.8 Danfoss

12.9 Larsen & Toubro

12.1 WEG

12.11 Toshiba International Corporation Pty

12.12 Motortronics

12.13 Solcon

12.14 Carlo Gavazzi

12.15 Nolta

12.16 Gozuk

12.17 Lovato Electric

12.18 Minilec

12.19 Sinova

12.20 Benshaw

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 169)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (111 Tables)

Table 1 Motor Soft Starter Market Snapshot

Table 2 Market Size, By Voltage, 20172024 (USD Million)

Table 3 Low Voltage: Market Size, By Region, 20172024 (USD Million)

Table 4 Medium Voltage: Market Size, By Region, 20172024 (USD Million)

Table 5 Market Size, By Rated Power, 20172024 (USD Million)

Table 6 Up to 750 W: Market Size, By Region, 20172024 (USD Million)

Table 7 751 W75 kW: Market Size, By Region, 20172024 (USD Million)

Table 8 Above 75 kW: Market Size, By Region, 20172024 (USD Million)

Table 9 Motor Soft Starter Market Size, By Application, 20172024 (USD Million)

Table 10 Pump: Market Size, By Application, 20172024 (USD Million)

Table 11 Fan: Market Size, By Application, 20172024 (USD Million)

Table 12 Compressor: Market Size, By Application, 20172024 (USD Million)

Table 13 Others: Market Size, By Application, 20172024 (USD Million)

Table 14 Motor Soft Starter Market Size, By Industry, 20172024 (USD Million)

Table 15 Oil & Gas: Market Size, By Region, 20172024 (USD Million)

Table 16 Water & Wastewater: Market Size, By Region, 20172024 (USD Million)

Table 17 Power Generation: Market Size, By Region, 20172024 (USD Million)

Table 18 Mining: Market Size, By Region, 20172024 (USD Million)

Table 19 Others: Market Size, By Region, 20172024 (USD Million)

Table 20 Motor Soft Starter Market Size, By Region, 20172024 (USD Million)

Table 21 Asia Pacific: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 22 Asia Pacific: Low Voltage Market Size, By Country, 20172014 (USD Million)

Table 23 Asia Pacific: Medium Voltage Market Size, By Country, 20172014 (USD Million)

Table 24 Asia Pacific: Market Size, By Rated Power, 20192024 (USD Million)

Table 25 Asia Pacific: Up to 750 W Market Size, By Country, 20172014 (USD Million)

Table 26 Asia Pacific: 751 W75 kW Market Size, By Country, 20172014 (USD Million)

Table 27 Asia Pacific: Above 75 kW Market Size, By Country, 20172014 (USD Million)

Table 28 Asia Pacific: Market Size, By Application, 20192024 (USD Million)

Table 29 Asia Pacific: Market Size, By Industry, 20172024 (USD Million)

Table 30 Asia Pacific: Market Size, By Country, 20172024 (USD Million)

Table 31 China: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 32 China: Market Size, By Rated Power, 20172024 (USD Million)

Table 33 India: Market Size, By Voltage, 20172024 (USD Million)

Table 34 India: Market Size, By Rated Power, 20172024 (USD Million)

Table 35 Japan: Market Size, By Voltage, 20172024 (USD Million)

Table 36 Japan: Market Size, By Rated Power, 20172024 (USD Million)

Table 37 Rest of Asia Pacific: Market Size, By Voltage, 20172024 (USD Million)

Table 38 Rest of Asia Pacific: Market Size, By Rated Power, 20172024 (USD Million)

Table 39 Europe: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 40 Europe: Low Voltage Market Size, By Country, 20172014 (USD Million)

Table 41 Europe: Medium Voltage Motor starter Market Size, By Country, 20172014 (USD Million)

Table 42 Europe: Market Size, By Rated Power, 20172024 (USD Million)

Table 43 Europe: Up to 750 W Market Size, By Country, 20172014 (USD Million)

Table 44 Europe: 751 W75 kW Motor starter Market Size, By Country, 20172014 (USD Million)

Table 45 Europe: Above 75 kW Market Size, By Country, 20172014 (USD Million)

Table 46 Europe: Market Size, By Application, 20172024 (USD Million)

Table 47 Europe: Market Size, By Industry, 20172024 (USD Million)

Table 48 Europe: Market Size, By Country, 20172024 (USD Million)

Table 49 UK: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 50 UK: Market Size, By Rated Power, 20172024 (USD Million)

Table 51 Germany: Market Size, By Voltage, 20172024 (USD Million)

Table 52 Germany: Market Size, By Rated Power, 20172024 (USD Million)

Table 53 Russia: Market Size, By Voltage, 20172024 (USD Million)

Table 54 Russia: Market Size, By Rated Power, 20172024 (USD Million)

Table 55 France: Market Size, By Voltage, 20172024 (USD Million)

Table 56 France: Market Size, By Rated Power, 20172024 (USD Million)

Table 57 Rest of Europe: Market Size, By Voltage, 20172024 (USD Million)

Table 58 Rest of Europe: Market Size, By Rated Power, 20172024 (USD Million)

Table 59 North America: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 60 North America: Low Voltage Motor starter Market Size, By Country, 20172014 (USD Million)

Table 61 North America: Medium Voltage Market Size, By Country, 20172014 (USD Million)

Table 62 North America: Market Size, By Rated Power, 20172024 (USD Million)

Table 63 North America: Up to 750w Motor starter Market Size, By Country, 20172014 (USD Million)

Table 64 North America: 751 W75 kW Market Size, By Country, 20172014 (USD Million)

Table 65 North America: Above 75 kW Market Size, By Country, 20172014 (USD Million)

Table 66 North America: Market Size, By Type, 20172024 (USD Million)

Table 67 North America: Market Size, By Industry, 20172024 (USD Million)

Table 68 North America: Market Size, By Country, 20172024 (USD Million)

Table 69 US: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 70 US: Market Size, By Rated Power, 20172024 (USD Million)

Table 71 Canada: Market Size, By Voltage, 20172024 (USD Million)

Table 72 Canada: Market Size, By Rated Power, 20172024 (USD Million)

Table 73 Mexico: Market Size, By Voltage, 20172024 (USD Million)

Table 74 Mexico: Market Size, By Rated Power, 20172024 (USD Million)

Table 75 Middle East & Africa: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 76 Middle East & Africa: Low Voltage Motor starter Market Size, By Country, 20172014 (USD Million)

Table 77 Middle East & Africa: Medium Voltage Market Size, By Country, 20172014 (USD Million)

Table 78 Middle East & Africa: Market Size, By Rated Power, 20172024 (USD Million)

Table 79 Middle East & Africa: Up to 750 W Motor starter Market Size, By Country, 20172014 (USD Million)

Table 80 Middle East & Africa: 751 W75 kW Market Size, By Country, 20172014 (USD Million)

Table 81 Middle East & Africa: Above 75 kW Market Size, By Country, 20172014 (USD Million)

Table 82 Middle East & Africa: Market Size, By Application, 20172024 (USD Million)

Table 83 Middle East & Africa: Market Size, By Industry, 20172024 (USD Million)

Table 84 Middle East & Africa: Market Size, By Country, 20172024 (USD Million)

Table 85 Saudi Arabia: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 86 Saudi Arabia: Market Size, By Rated Power, 20172024 (USD Million)

Table 87 UAE: Market Size, By Voltage, 20172024 (USD Million)

Table 88 UAE: Market Size, By Rated Power, 20172024 (USD Million)

Table 89 South Africa: Market Size, By Voltage, 20172024 (USD Million)

Table 90 South Africa: Market Size, By Rated Power, 20172024 (USD Million)

Table 91 Rest of Middle East & Africa: Market Size, By Voltage, 20172024 (USD Million)

Table 92 Rest of Middle East & Africa: Market Size, By Rated Power, 20172024 (USD Million)

Table 93 South America: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 94 South America: Low Voltage Motor starter Market Size, By Country, 20172014 (USD Million)

Table 95 South America: Medium Voltage Market Size, By Country, 20172014 (USD Million)

Table 96 South America: Market Size, By Rated Power, 20172024 (USD Million)

Table 97 South America: Up to 750 W Motor starter Market Size, By Country, 20172014 (USD Million)

Table 98 South America: 751 W75 kW Market Size, By Country, 20172014 (USD Million)

Table 99 South America: Above 75 kW Market Size, By Country, 20172014 (USD Million)

Table 100 South America: Market Size, By Application, 20172024 (USD Million)

Table 101 South America: Market Size, By Industry, 20172024 (USD Million)

Table 102 South America: Market Size, By Country, 20172024 (USD Million)

Table 103 Brazil: Motor Soft Starter Market Size, By Voltage, 20172024 (USD Million)

Table 104 Brazil: Market Size, By Rated Power, 20172024 (USD Million)

Table 105 Chile: Market Size, By Voltage, 20172024 (USD Million)

Table 106 Chile: Market Size, By Rated Power, 20172024 (USD Million)

Table 107 Argentina: Market Size, By Voltage, 20172024 (USD Million)

Table 108 Argentina: Market Size, By Rated Power, 20172024 (USD Million)

Table 109 Rest of South America: Market Size, By Voltage, 20172024 (USD Million)

Table 110 Rest of South America: Market Size, By Rated Power, 20172024 (USD Million)

Table 111 Solcon to Be the Most Active Player in the Market Between 2016 and 2019

List of Figures (48 Figures)

Figure 1 Motor Soft Starter Market: Research Design

Figure 2 Main Metrics Considered While Constructing and Assessing the Demand for the Motor Soft Starter Market

Figure 3 Installation of Electric Motors is the Determining Factor for the Global Motor Soft Starter Market

Figure 4 Installation of Electric Motors is the Determining Factor for the Global Market

Figure 5 Data Triangulation Methodology

Figure 6 Key Service Providers Point of View:

Figure 7 Low Voltage Segment is Expected to Hold the Largest Share of Motor Soft Starter, By Voltage, During the Forecast Period

Figure 8 751 W75 kW Segment is Expected to Hold the Largest Share of Motor Soft Starter, By Rated Power, During the Forecast Period

Figure 9 Pump Segment is Expected to Lead the Motor Soft Starter Market, By Application, During the Forecast Period

Figure 10 Asia Pacific Dominated the Motor Soft Starter Industry in 2018

Figure 11 Rise in Demand for Industrial Pumps With Increasing Demand for HVAC Applications is Expected to Drive Motor Soft Starter Market, 20192024

Figure 12 Low Voltage Segment Dominated the Motor Soft Starter Industry, By Voltage, in 2018

Figure 13 751 W75 kW Segment Dominated the Motor Soft Starter Industry, By Rated Power, in 2018

Figure 14 Pump Segment Dominated the Motor Soft Starter Industry, By Application, in 2018

Figure 15 Oil & Gas Segment Dominated the Motor Soft Starter Industry, By Industry, in 2018

Figure 16 Asia Pacific Motor Soft Starter Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Motor Soft Starter Market: Drivers, Restraints, Opportunities, and Challenges

Figure 18 Global Chemical Market Size, 20172030

Figure 19 Coal Power Generation Investments, 20102018

Figure 20 Motor Soft Starter Market (Value), By Voltage, 2018

Figure 21 Motor Soft Starter (Value), By Rated Power, 2018

Figure 22 Motor Soft Starter (Value), By Application, 2019

Figure 23 Motor Soft Starter (Value), By Industry, 2018

Figure 24 Regional Snapshot: Asia Pacific Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 25 Motor Soft Starter Market Share (Value), By Region, 2018

Figure 26 Asia Pacific: Regional Snapshot

Figure 27 Europe: Regional Snapshot

Figure 28 Key Developments in the Motor Soft Starter Market, 20162019

Figure 29 Motor Soft Starter (Global) Competitive Leadership Mapping, 2018

Figure 30 ABB Led the Motor Soft Starter Industry in 2018

Figure 31 ABB: Company Snapshot

Figure 32 ABB: SWOT Analysis

Figure 33 Eaton: Company Snapshot

Figure 34 Eaton: SWOT Analysis

Figure 35 Siemens: Company Snapshot

Figure 36 Siemens: SWOT Analysis

Figure 37 Schneider Electric: Company Snapshot

Figure 38 Schneider Electric: SWOT Analysis

Figure 39 Rockwell Automation: Company Snapshot

Figure 40 Rockwell Automation: SWOT Analysis

Figure 41 Emerson Electric: Company Snapshot

Figure 42 Emerson Electric: SWOT Analysis

Figure 43 Crompton Greaves: Company Snapshot

Figure 44 Crompton Greaves: SWOT Analysis

Figure 45 Danfoss: Company Snapshot

Figure 46 Larsen & Toubro: Company Snapshot

Figure 47 WEG: Company Snapshot

Figure 48 Carlo Gavazzi: Company Snapshot

This study involved four major activities in estimating the current size of the motor soft starter market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as UNCTAD data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and motor soft starter journals to identify and collect information useful for a technical, market-oriented, and commercial study of the motor soft starter market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The motor soft starter comprises several stakeholders such as companies related to the oil & gas and metals & mining industries, consulting companies in the energy & power sector, power generation companies, government & research organizations, organizations, forums, alliances & associations, motor soft starter providers, state & national utility authorities, motor soft starter manufacturers, dealers & suppliers, and vendors. The demand side of the market is characterized by utilities and industrial companies, investments in key industries such as oil & gas, water & wastewater, power generation, mining, food & beverage, cement & manufacturing, and others. Moreover, demand is also driven by the rising demand for industrial pumps across the globe. The supply side is characterized by the increase in contracts & agreements and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global motor soft starter market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the motor soft starter sector.

Report Objectives

- To define, describe, and forecast the global motor soft starter market based on voltage, rated power, application, industry, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the motor soft starter market with respect to individual growth trends, future prospects, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Vendor DIVE framework, which analyzes the market players on various parameters within the broad categories of business and product strategies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Motor Soft Starter Market