MOSFET Relay Market by Voltage (Below 200V, 200-500V, 500-1kV, 1-7.5kV, 7.5-10kV, Above 10 kV), Application (Industrial, Household Appliances, Test & Measurements, Mining, Automotive, Medical, Renewables, Charging Stations) - Global Forecast to 2030

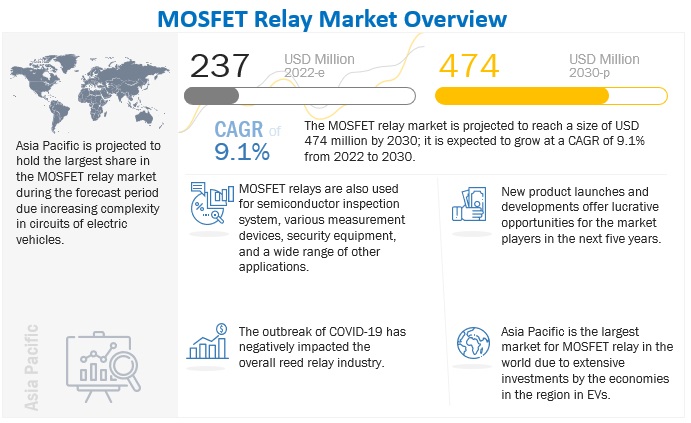

[196 Pages Report] The MOSFET relay market is expected to grow from an estimated USD 237 million in 2022 to USD 474 million by 2030, at a CAGR of 9.1% during the forecast period. Increase in overall revenue projection of semiconductor industry despite covid-19 crisis, growing adoption of high-tech electronics and automation in consumer electronics industry, increasing complexity in circuits in electric vehicles, and robust features of SSR, is likely to propel the growth of MOSFET relay market.

MOSFET relay market Dynamics

To know about the assumptions considered for the study, Request for Free Sample Report

Driver: Increasing demand for instrumentation devices

MOSFET relays are mainly utilized in test & measurement/instrumentation devices. Increasingly sophisticated testing and measuring devices are in demand for the electronics, medical, healthcare, and automotive sectors, among others. These complex applications require a high density of assembled components along with high reliability and the utmost accuracy. They are suitable for applications like Automated Test Equipment (ATE), multimeters, semiconductor test boards, oscilloscopes, data loggers, and other measurement instruments. As mentioned earlier for reed relays, as the demand for electronic devices increases, the need for test and measurement instruments will also increase.

According to the statistics shared by the National Investment Promotion & Facilitation Agency (INVEST INDIA), the global electronics market is estimated to be over USD 2 trillion in the next ten years (by 2030). As different industries, including automotive, aerospace & defense, and healthcare, have started adopting electronic devices on a large scale, testing of such devices has also become a prime concern for manufacturers worldwide. Hence, as the demand for electronic devices increases, the need for test and measurement instruments will also increase. This will further boost the demand for reed relays. Furthermore, the advent of advanced communication technologies like 5G and wireless is increasing the demand for testing equipment further.

Restraint: Higher cost and requirement of higher initial investment as compared to EMR

About 70% of end-user industries still use electromechanical relays (EMRs), considering their low cost, reliability, and simple construction. EMR operates on the principle of electromagnetic attraction. In this relay, an electromagnetic field is created as the current passes through the circuit that attracts the nodes and closes the circuit. The working of an EMR is based on mechanical, electrical, and magnetic operations. EMRs are used for functions such as control, automation, and protection of electrical equipment. They are used in applications such as electric fuel pumps, audio amplifiers, lighting control systems, telecommunications, industrial process controllers, motor drive controls, protection systems, HVACs, automobiles, and home appliances.

MOSFET relays exhibit features such as high switching frequency, resistance to shock, long operating life, low noise while operating, small size, and less maintenance. However, the use of MOSFET relays requires the use of heat sinks, which increases their overall cost. The average cost of MOSFET relays is almost double the cost of an EMR. The advanced features of MOSFET relays over EMR come with a higher cost. In the long run, the total ownership of MOSFET relays is beneficial over EMR. However, the high initial investment acts as a restraining factor for the growth of the MOSFET relays market.

Opportunity: Strong growth from enterprises shift towards cloud applications

Cloud-based computing, networking and storage infrastructure, and cloud-native applications are trending in all business verticals. With the growing need for a truly connected world through cloud computing systems, the demand for cloud-based applications is rising. The construction of data centers and deployment of data warehousing are still vital for data storage, computation, and information management.

However, the transfer of data to-and-fro from a centralized data center system is costly and delayed. Thus, the industrial end-users are moving toward cloud platforms such as Microsoft Azure, Google Cloud, Amazon Web Services, IBM Bluemix, and SaaS. The growth trends show the fast deployment of cloud-based applications across end-users. This, in turn, creates opportunities for smart and compact MOSFET relays that can meet the rising power demand for operating such platforms.

Challenge: Robust features and benefits of MOSFET relays

MOSFET relays rely on an electronic circuit to fulfill the desired input and output characteristics. The output of MOSFET relays can be either AC or DC, which is dependent upon the input current rating. The AC load-switching SSRs turn the circuit off when the AC wave passes through the zero point. Similarly, the response time for DC loads is in the millisecond range. MOSFET relays can be made to switch at high frequencies, serving as interfaces for high-speed counting and high-frequency applications. MOSFET relays are an ideal option to be used in harsh environments as they can withstand shocks and vibrations needed to work under erratic and unreliable operating conditions. For instance, an EMR typically has a functional shock resistance of about 50 G and functional vibration resistance of only 20 G, whereas MOSFET relays have a functional shock resistance of up to 500 G and a time duration is 0.5 milliseconds, making it highly resistible.

The typical life expectancy of MOSFET relays is 50 times that of an EMR. The life of an EMR is calculated based on the number of switching cycles, whereas the life of a MOSFET relay is calculated by time-in-operation. The life of MOSFET relays is further increased by the use of a heat sink. The heat sink protects MOSFET relays from overheating and causing a meltdown, thus having a long operating life.

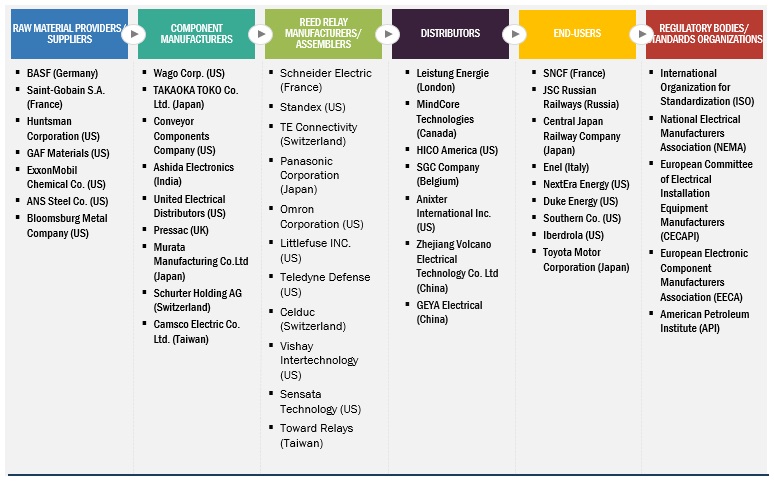

MOSFET relay Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Test & Measurements is the second largest growing segment of the MOSFET relay market

For the spread of microcomputer chips, the latest instruments are required to measure a variety of signals at high speeds under various conditions. MOSFET relays are used for measurement scanning functions, automatic zero-point compensation to eliminate zeropoint error, and measurement sequence interfaces (e.g., alarm interface). They offer a substantial advantage over an electromechanical relay because they significantly reduce the test time in a production environment due to their fast-switching speed. MOSFET relays are used in many parts of the test & measurement market to route high voltage signals and charge/discharge and isolate different parts of test circuits and systems.

Above 1kV voltage rating is the third largest segment by voltage rating in MOSFET relay market

High-voltage MOSFET relays in this segment have a voltage range of up to 7.5 kV. It is specifically designed for high-current applications commonly found in industrial equipment. The relay is a solid-state replacement for single-pole, normally open, electromechanical relays. They are prominent in providing highly efficient performance characteristics in insulation resistance and stand-off voltage.

These types of MOSFET relays feature very high isolation voltages (7.5 kV–10 kV) and high vacuum switches with either rhodium or tungsten contacts. They also have PCB or panel mounting and excellent AC characteristics. Rhodium contact relays have low contact resistance, while tungsten contact relays can switch at higher voltages. These relay applications include cardiac defibrillators, test equipment, and high-voltage power supplies.

This MOSFET relay features high-voltage switching and high-load current. The relay provides a surface mount option when the application requires it. Both configurations are ideally suited to test & measurement, solar, and battery management applications. These relay applications include telecommunications, measuring and testing equipment, industrial controls, automatic meter reading devices, and high-inspection arc-free machines with no snubbing circuits.

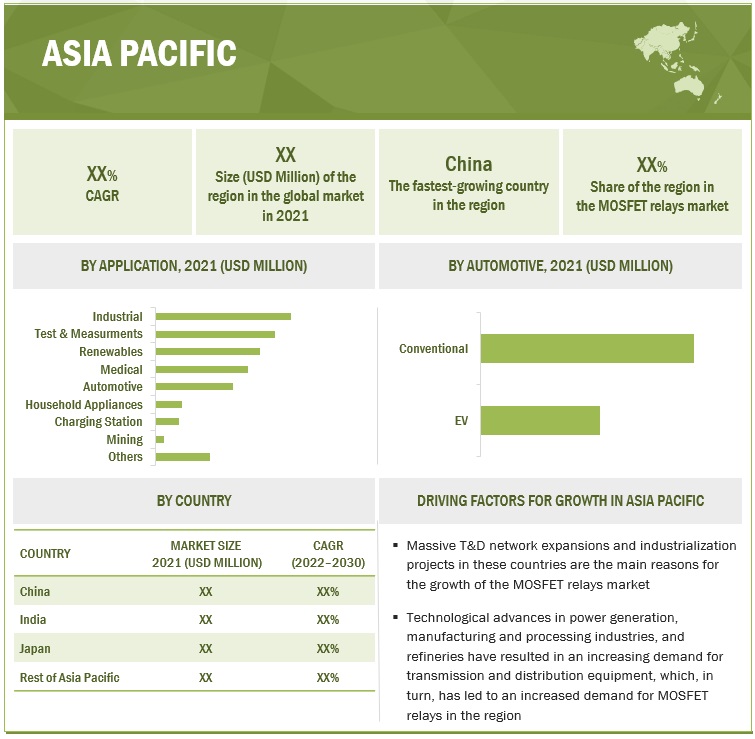

Asia Pacific is expected to account for the largest market size during the forecast period.

The growth of the market in this region can be attributed to the tremendous growth of the automotive, test & measurement, and medical industries in emerging economies such as Japan, India, New Zealand, and the Philippines. India is a key contributor to the growth of the MOSFET relay market in Asia Pacific owing to the expanding industrial and manufacturing sectors. It is also the second fastest-growing market for MOSFET relays in Asia Pacific. Japan is also witnessing steady growth in the MOSFET relay market owing to the presence of key manufacturers such as OMRON and Panasonic.

Key Players

Key Players include TE Connectivity (Switzerland), Standex Electronics Inc. (US), Panasonic Corporation (Japan), Schneider Electric (France), and Omron Corporation (US), Wago (US), Relpol S.A (Poland), Broadcom (US), Vishay Intertechnology (US), Sensata Technology (US), Toward Relays (Taiwan), Littlefuse INC. (US), Toshiba (Japan), Teledyne Defense (US), Celduc (Switzerland), Chordn Electric (Switzerland), Carlo Gavazzi (Switzerland).

Want to explore hidden markets that can drive new revenue in MOSFET Relay Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in MOSFET Relay Market?

|

Report Metrics |

Details |

| Market Size available for years | 2020–2030 |

| Base year considered | 2021 |

| Forecast period | 2022–2030 |

| Forecast units | Value (USD Million) |

| Segments covered | By Voltage, By Application |

| Geographies covered | Asia Pacific, North America, Europe, Rest of the World (RoW) |

| Companies covered | Panasonic Corporation (Japan), TE Connectivity (Switzerland), Omron Corporation (Japan), Schneider Electric (France), and Standex Electronics Inc. (US), Wago (US), Relpol S.A (Poland), Broadcom (US), Vishay Intertechnology (US), Sensata Technology (US), Toward Relays (Taiwan), Littlefuse INC. (US), Toshiba (Japan), Teledyne Defense (US), Celduc (Switzerland), Chordn Electric (Switzerland), Carlo Gavazzi (Switzerland). |

This research report categorizes the MOSFET relay market based on type, phase, voltage range, end user, and geography.

By Voltage

- Basic200 V

- 200 V–500 V

- 500 V–1 kV

- above 1 kV

By Application

- Industrial

- Household Appliances

- Test & Measurement

- Mining

- Automotive

- Medical

- Renewables

- Charging Station

- Others

By Geography

- North America

- Asia Pacific

- Europe

- RoW

Recent Developments

- In April 2022, Panasonic Corporation introduced PhotoMOS CC TSON 1 Form B Semiconductor Relays which have a small TSON package, built-in capacitor coupled isolation driver IC, and an oscillation circuit.

- In May 2021, Standex International Corporation acquired photo MOSFET switch-based relay company American Relays, Inc. This acquisition helps Standex International Corporation to strengthen its position in the test and measurement application in the North American relay market.

- In March 2022, Omron Corporation introduced the G3VM-201WR MOSFET relay which has a voltage of 200V with a current carrying capacity of up to 0.35A. It comes with P-SON four-pin terminal pad package, and it is used in test and measurement applications.

Frequently Asked Questions (FAQ):

What is the current size of the MOSFET relay market?

The current market size of the MOSFET relay market is estimated to be USD 237 million in 2022.

What is the major drivers for MOSFET relay market?

The MOSFET relay market considers data centers as its major application segment. Data centers would continue to grow owing to trends such as a billion more people coming online across developing countries, the Internet of Things (IoT), automation in the automotive industry, robotics, and artificial intelligence (AI). The data production is expected to reach 175 zettabytes by 2025. To cope with the growing demand, companies such as Google, Amazon, and Microsoft, are all expanding their data centers in regions such as North America and Asia Pacific. Moreover, the growth in data centers is leading to increasing power consumption. According to research studies, about 5% of the global power is consumed by electronics, and more automation requires more power. Traditional data centers had higher operating expenses because of the lack of electricity efficient devices. In recent years, intelligent MOSFET relays and data center management software have come up as power management solutions for data centers. This is another factor leading the demand scenario of the power distribution market. According to the IEA, global internet traffic surged by over 40% in 2020, driven by increased video streaming, video conferencing, online gaming, and social networking. This growth is in addition to the past decade’s already high demand for digital services; since 2010, the number of internet users worldwide has doubled, while global internet traffic has increased ~30% per year.

Which is the largest-growing region during the forecasted period in MOSFET relay market?

Asia Pacific is expected to grow at the highest CAGR during the forecast period. China accounted for the maximum share of the Asia Pacific market in 2021. China is the key production base of all types of relays in the world, with its output holding more than 50% of the global total. Driven by the expanding demand from downstream markets, The industrial segment is expected to be the fastest-growing market for MOSFET relay relays in the country. The country plans to pump up the spending on infrastructure to boost economic growth.

Which is the fastest-growing segment, by application during the forecasted period in MOSFET relay market?

By application, the renewables segment is estimated to be the fastest growing segment of the MOSFET relay market from 2022 to 2030. A global tendency towards efficient energy consumption and the expansion of renewables have boosted interest in energy storage solutions. Renewable energy technology projects are typically large-scale, but they are also suited to rural and remote areas and developing countries, where energy is often crucial in human development. In most countries, photovoltaic solar or onshore wind are the cheapest new-build electricity. MOSFET relays find extensive application in renewable energy storage systems, and an increase in adoption of renewables energy technologies is expected to drive their fast growth.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

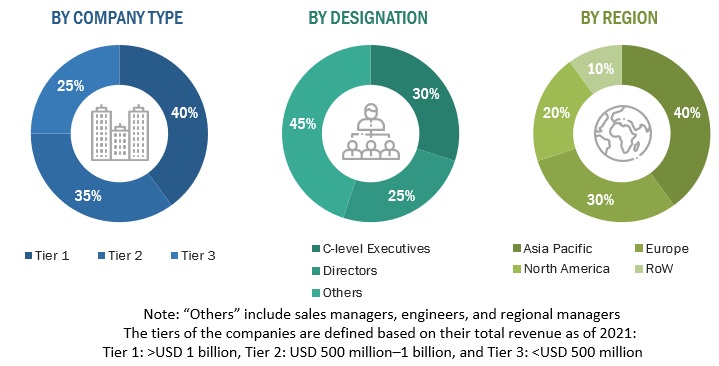

This study involved major activities in estimating the current size of the MOSFET relay market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was the validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the MOSFET relay market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The MOSFET relay market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by industrial end-users. Moreover, the demand is also fueled by the growing demand of automotive and renewables sector. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report

The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

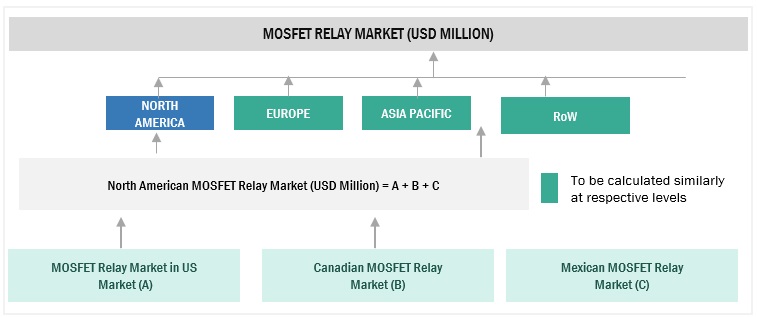

The bottom-up approach has been used to estimate and validate the size of the MOSFET relay market.

- In this approach, the MOSFET relay production statistics for each product type have been considered at a geographical level.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various types of MOSFET relays.

- Several primary interviews have been conducted with key opinion leaders related to MOSFET relay system development, including key OEMs and Tier I suppliers.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

MOSFET relay Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the MOSFET relay market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the MOSFET relay market by voltage, by application, and geography, in terms of value

- To estimate and forecast the MOSFET relay market for various segments with respect to 4 main geograpies, namely, North America, Europe, Asia Pacific, Rest of the World (RoW), in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To provide a detailed overview of the MOSFET relay value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the MOSFET relay market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the MOSFET relay market size in terms of value.

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MOSFET Relay Market