Modular Instruments Market by Platform Type (PXI, AXIe, VXI), Application (R&D, Manufacturing & Installation), Vertical (Telecommunications, Aerospace & Defense, Automotive, Electronics & Semiconductor), and Geography - Global Forecast to 2023

The modular instruments market was valued at USD 1.12 billion in 2017 and is expected to reach USD 2.11 billion by 2023, at a CAGR of 9.6% during the forecast period. The base year considered for the study is 2017 and the forecast period is from 2018 to 2023.

Market Dynamics

Increased demand for deployment of LTE from telecommunications sector

The demand for wireless technologies is fueled by developments in the wireless communications industry, such as long-term evolution (LTE), increased adoption of smart devices, higher mobility, and the explosive growth of mobile data traffic. Despite lesser power requirements, newly evolving smart devices transmit large amounts of rich data that demand latency and responsiveness of LTE networks.

The need for accuracy and the drive to deliver best possible results to customers have led to the creation of new modular instruments. In the communication and networking sector, an orbital shift from providing primarily voice-based services to offering integrated voice, video, and data services has necessitated the need for solutions to test performance and capacity of undergirding networks. The transition to fourth-generation (4G) network, with advanced modulation and antenna techniques, has improved services and quality. Ongoing R&D activities in cellular technologies such as for LTE, long term evolution advanced (LTE-A), and wired technologies, such as Ethernet and fiber optics, are the major factors driving this market.

Deployment of LTE is providing substantial opportunities for modular instruments manufacturers to capitalize upon. In order to achieve this, huge and technologically more advanced infrastructure is required; this is eventually expected to increase the use of modular instruments for testing LTE gateways and access points, especially in the wireless communication industry.

Objectives of the Study:

- To describe the modular instruments market segmented based on platform type, application, vertical, and geography

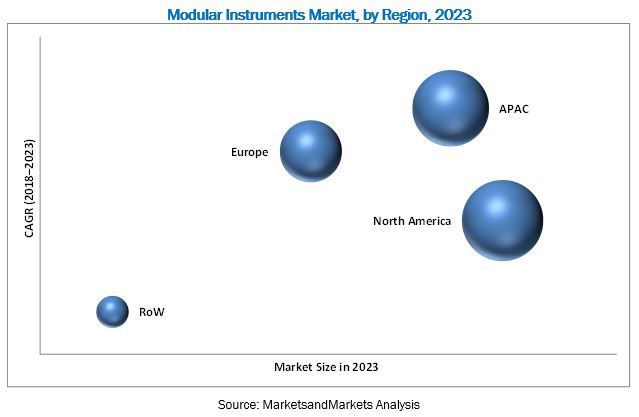

- To estimate and forecast market size, in terms of value, with respect to 4 major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

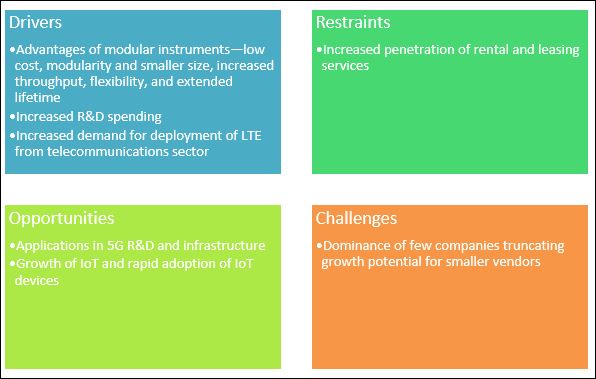

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze opportunities for various stakeholders by identifying high-growth segments of the market

- To strategically profile key players and comprehensively analyze their market positions, in terms of their market rankings and core competencies, and to analyze the competitive landscape across the ecosystem

Research Methodology:

This research study involves systematically gathering, recording, and analyzing data pertaining to customers, competitors, technology, and market trends in the modular instruments market. The research study on the market is a result of thorough secondary and primary research, followed by various data triangulation methods and proprietary market estimation models. The idea is to enable companies to learn about current and potential customers and demand in the market, and also to make them aware about their competitors and respective business strategies.

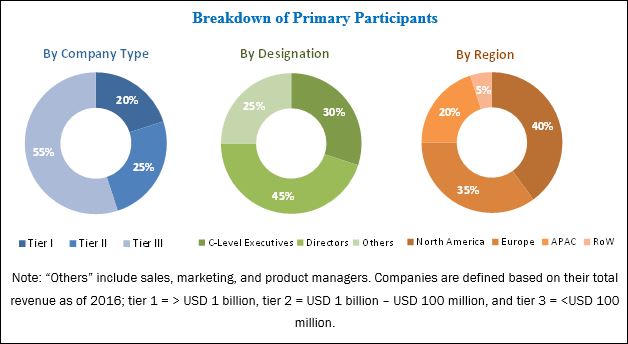

Various secondary sources such as annual reports, investor presentations, directories, and databases (Hoovers, Bloomberg Businessweek, Factiva, and OneSource) have been referred to for identifying and collecting pertinent information for an extensive technical, market-oriented, and commercial study of the modular instruments market. Key market players have been identified through secondary research, and they have been ranked based on both primary and secondary research. Primary sources mainly comprise experts from core and related industries, along with preferred suppliers, manufacturers, technology developers, alliances, standards, and certification organizations relevant to different parts of the industry’s value chain. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), C-level executives, and consultants, have been conducted to obtain and verify critical qualitative and quantitative information and assess prospects. The breakdown of the profiles of primaries has been depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights on the ecosystem of the modular instruments market. Keysight Technologies (US), National Instruments (US), Fortive Corporation (US), Viavi Solutions (US), Astronics Corporation (US), Teledyne Technologies (US) (Teledyne Lecroy (Germany)), Rohde & Schwarz (Germany), Ametek (VTI Instruments) (US), Teradyne (US), and Pickering Interfaces (UK) are some of the leading players in the market.

Some of the other prominent players in the market include Giga-tronics (US), Elma Electronic (Switzerland), Asis Pro (Israel), Guzik technical Enterprises (US), Test Evolution Corporation (US), Adlink Technology (Taiwan), Chroma ATE (Taiwan), GOEPEL Electronic (Germany), Marvin Test Solutions (US), and Bustec (UK).

Key Questions

- How much growth is expected from different platform types of modular instruments and what would be their impact on different applications/industry?

- Which are the top applications/verticals in market to invest in and what are the untapped opportunities?

- Who are the major current and potential competitors in the market and what are their top priorities, strategies, and developments?

Key Target Audience:

- Research organizations

- Communication service providers (CSPS), mobile network operators (MNOs), and network service providers

- Antenna manufacturers and consumer electronics chip manufacturers

- Network installation and maintenance service providers, wireless service providers, cable providers

- ODM and OEM technologies solution providers

- Governments, financial institutions, and investor communities

- Consultants, channel partners, distributors, and resellers of equipment

- Analysts and strategic business planners

- Technology standard organizations, investors, developers, forums, alliances, and associations

- Software and support service providers

- End users industries

Want to explore hidden markets that can drive new revenue in Modular Instruments Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Modular Instruments Market?

The study answers several questions for the target audience; this primarily includes the market segments to focus on over the next two to five years for prioritizing efforts and investments. The research report segments the market into the following subsegments:

Modular Instruments Market, by Platform Type

- PXI

- AXIe

- VXI

Modular Instruments Market, by Application

- R&D

- Manufacturing & Installation

Modular Instruments Market, by Vertical

- Telecommunications

- Aerospace & Defense

- Automotive & Transportation

- Electronics & Semiconductor

- Others

Modular Instruments Market, by Geography

- North America

- Europe

- APAC

- RoW

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players

Opportunity Identification

- Detailed analyses of specific industries and respective use cases or applications of modular instruments

- Opportunities for payers in modular instruments market w.r.t. investments in different industries and countries

Company Profiles:

- Detailed analysis of the major companies in the market.

Get more insight on other verticals of Semiconductor and Electronics Market Research Reports & Consulting

Modular instruments are defined in software residing in host PCs, which makes it possible to define measurements and analysis in real time. Modular instruments generally use computer–user interfaces instead of displays and controls embedded in the instrument’s frames or packages. To increase flexibility, an engineer can deploy algorithms on field-programmable gate arrays (FPGA). So, instead of a fixed or vendor-defined software architecture, a user can make changes in modular instrumentation according to his/her requirements.

The global modular instruments market is estimated to be USD 1.33 billion in 2018; it is expected to reach USD 2.11 billion by 2023, at a CAGR of 9.6% from 2018 to 2023. The overall market is segmented based on platform type (PXI, AXIe, and VXI); application (R&D and manufacturing & installation); vertical (aerospace & defense, telecommunications, automotive & transportation, electronics and semiconductor, and others); and geography (North America, Europe, Asia Pacific, and Rest of the World).

The growth of the modular instruments market is driven by increased R&D spending; benefits such as low cost, modularity, compact size, increased throughput, flexibility, and extended lifetime offered by modular instruments. Increased demand for the deployment of LTE from the telecommunications sector is boosting the adoption of modular instruments. Additionally, end users are now motivated to adopt modular instruments in 5G R&D activities; growth of IoT and rapid adoption of IoT devices present tremendous opportunities for the market to thrive in the coming years.

The PXI platform held the largest share of the modular instruments market in 2017. This platform is based on PCI, and hence, it inherently brings the advantages of reduced cost, improved performance, and a mainstream software model to end users. The need for a modern computer-based modular architecture that can integrate traditional measurement capabilities with machine vision, motion control, and automation has resulted in the quick adoption of PXI as an industry standard. Some of the major companies that provide PXI-based modular instruments are National Instruments, Keysight Technologies, Teradyne, Rohde&Schwarz, Viavi Solutions, Fortive, and Teledyne Lecroy.

The market for R&D applications is expected to grow at a higher CAGR than manufacturing & installation applications during the forecast period. Increasing research on the 5G technology is a major factor fueling the demand for modular instruments in R&D applications.

Telecommunications vertical is expected to create the highest demand for modular instruments market during the forecast period. Widespread demand for wireless technologies is currently driving the market for the telecommunications sector. The market is expected to grow substantially during the forecast period with the increasing subscriber base for different advanced technologies, such as WiMax, 3G, 4G, LTE, LTE-A, and 5G.

North America is expected to account for the largest share of the modular instruments market during the forecast period. North America commands the biggest share owing to demands from telecommunications and aerospace & defense sectors. Furthermore, the shift toward connected cars and intelligent transportation systems along with an increasing demand from the electronics & semiconductor sector is expected to drive the market in the region.

Applications in telecommunications, electronics & semiconductor, and aerospace & defense to drive the growth of modular instruments market

Telecommunications

The demand for wireless technologies is fuelled by developments in the wireless communications industry, such as imminent long-term evolution (LTE), increased adoption of smart devices, higher mobility, and the explosive growth of mobile data traffic. At the same time, companies are slowly incorporating enhanced capabilities of the LTE-Advanced standard, which is considered as the bridge to 5G communications. Modular instruments solution vendors provide test cases during initial development of mobile devices, which help in reducing issues at the conformance validation stage. Given the growth of and demand for telecommunications, it is exigent that the underlying infrastructure is rejigged to handle increased load and buttress newer technologies such as LTE, LTE-A, 4G, and 5G.

Electronics & Semiconductor

Electronics manufacturing is a highly competitive industry with challenging standards for reliability and performance. The reliability of an overall electronic system is affected by the reliability of its components and the way they are interconnected to serve the intended purpose. This subsequently eventuates the need for testing these components and devices at different stages of the manufacturing cycle, which provides significant opportunities for modular instruments market.

Aerospace & Defense

Modular instruments are vital for the aerospace & defense sector; instruments used in the aerospace & defense application include automatic test equipment, machine vision systems, network analyzers, spectrum analyzers, and signal generators. They are used for ensuring safety and security by means of checking various components, sub-systems, and systems for tracking, communications, detection, etc. The primary reason for using modular instruments for aerospace & defense application is their features such as quick measurement and low power consumption.

Critical questions the report answers:

- Where will the current developments take the industry in the mid to long term?

- What are the upcoming opportunities for modular instruments in different industry applications?

One of the major challenges faced by players in the market is the dominance of a few large companies, which truncates growth potential for smaller vendors. Factors restraining market growth include increased penetration of rental and leasing services.

Product developments and partnerships are the major strategies adopted by leading players to grow in the modular instruments market. Approaches such as partnerships and collaborations are also adopted by various players in this market. A few leading players have also adopted acquisition as a tool to consolidate their market positions.

Keysight Technologies (US), National Instruments (US), Fortive Corporation (US), Viavi Solutions (US), Astronics Corporation (US), Teledyne Technologies (US) (Teledyne Lecroy (Germany)), Rohde & Schwarz (Germany), Ametek (VTI Instruments) (US), Teradyne (US), and Pickering Interfaces (UK) are some of the leading players in the modular instruments market.

Some of the other prominent players in the market include Giga-tronics (US), Elma Electronic (Switzerland), Asis Pro (Israel), Guzik technical Enterprises (US), Test Evolution Corporation (US), Adlink Technology (Taiwan), Chroma ATE (Taiwan), GOEPEL Electronic (Germany), Marvin Test Solutions (US), and Bustec (UK).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Segmentation

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities for Market’s Growth

4.2 Market, By Platform Type, 2017–2023

4.3 Market, By Platform and Geography, 2017

4.4 Market, By Geography, 2017 vs 2023

5 Market Overview (Page No. - 35)

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Advantages of Modular Instruments—Low Cost, Modularity and Smaller Size, Increased Throughput, Flexibility, and Extended Lifetime

5.1.1.2 Increased R&D Spending

5.1.1.3 Increased Demand for Deployment of Lte From Telecommunications Sector

5.1.1.4 Increasing Demand From Aerospace & Defense Sectors

5.1.2 Restraints

5.1.2.1 Increased Penetration of Rental and Leasing Services

5.1.3 Opportunities

5.1.3.1 Applications in 5G R&D and Infrastructure

5.1.3.2 Growth of IoT and Rapid Adoption of IoT Devices

5.1.4 Challenges

5.1.4.1 Dominance of Few Companies Truncating Growth Potential for Smaller Vendors

5.2 Value Chain Analysis

5.2.1 R&D

5.2.2 Manufacturing and Assembly

5.2.3 Distribution and End Users

5.2.4 Post-Sale Services

6 Modular Instruments Market, By Platform Type (Page No. - 43)

6.1 Introduction

6.2 PXI

6.3 AXIE

6.4 VXI

7 Modular Instruments Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Research & Development

7.3 Manufacturing & Installation

8 Modular Instruments Market, By Vertical (Page No. - 53)

8.1 Introduction

8.2 Telecommunications

8.3 Electronics & Semiconductor

8.4 Aerospace & Defense

8.5 Automotive & Transportation

8.6 Others

9 Geographic Analysis (Page No. - 71)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Rest of Europe

9.4 APAC

9.4.1 China & Taiwan

9.4.2 Japan

9.4.3 South Korea

9.4.4 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.2 Africa & South America

10 Competitive Landscape (Page No. - 96)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Situations and Trends

10.3.1 Product Development and Launches

10.3.2 Collaborations & Partnerships

10.3.3 Expansions

10.3.4 Acquisitions

11 Company Profiles (Page No. - 102)

11.1 Introduction

(Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.2 Key Players

11.2.1 Keysight Technologies

11.2.2 National Instruments

11.2.3 Viavi Solutions

11.2.4 Fortive Corporation

11.2.5 Astronics Corporation

11.2.6 Teledyne Lecroy

11.2.7 Rohde & Schwarz

11.2.8 Ametek (VTI Instruments)

11.2.9 Teradyne

11.2.10 Pickering Interfaces

11.3 Other Important Players

11.3.1 Giga-Tronics

11.3.2 ELMA Electronic

11.3.3 Asis Pro

11.3.4 Guzik Technical Enterprises

11.3.5 Test Evolution Corporation

11.3.6 Adlink Technology

11.3.7 Chroma ATE

11.3.8 Goepel Electronic

11.3.9 Marvin Test Solutions

11.3.10 Bustec

*Details on Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 139)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customization

12.4 Related Reports

12.5 Author Details

List of Tables (66 Tables)

Table 1 Market, By Platform Type, 2015–2023 (USD Million)

Table 2 PXI-Based Modular Instruments Market, By Region, 2015–2023 (USD Million)

Table 3 PXI-Based Market, By Vertical, 2015–2023 (USD Million)

Table 4 AXIE-Based Market, By Region, 2015–2023 (USD Million)

Table 5 AXIE-Based Market, By Vertical, 2015–2023 (USD Million)

Table 6 VXI-Based Modular Instruments Market, By Region, 2015–2023 (USD Million)

Table 7 VXI-Based Market, By Vertical, 2015–2023 (USD Million)

Table 8 Market, By Application, 2015–2023 (USD Million)

Table 9 Market for R&D Applications, By Region, 2015–2023 (USD Million)

Table 10 Market for Manufacturing & Installation Applications, By Region, 2015–2023 (USD Million)

Table 11 Market, By Vertical, 2015–2023 (USD Million)

Table 12 Market for Telecommunications, By Platform Type, 2015–2023 (USD Million)

Table 13 Market for PXI-Based Modular Instruments for Telecommunications, By Geography, 2015–2023 (USD Million)

Table 14 Market for AXIE-Based Modular Instruments for Telecommunications, By Geography, 2015–2023 (USD Million)

Table 15 Market for VXI-Based Modular Instruments for Telecommunications, By Geography, 2015–2023 (USD Million)

Table 16 Market for Telecommunications, By Geography, 2015–2023 (USD Million)

Table 17 Market for Electronics & Semiconductor, By Platform Type, 2015–2023 (USD Million)

Table 18 Market for PXI-Based Modular Instruments for Electronics & Semiconductor, By Geography, 2015–2023 (USD Million)

Table 19 Market for AXIE-Based Modular Instruments for Electronics & Semiconductor, By Geography, 2015–2023 (USD Million)

Table 20 Market for VXI-Based Modular Instruments for Electronics & Semiconductor, By Geography, 2015–2023 (USD Million)

Table 21 Market for Electronics & Semiconductor, By Geography, 2015–2023 (USD Million)

Table 22 Market for Aerospace & Defense, By Platform Type, 2015–2023 (USD Million)

Table 23 Market for PXI-Based Modular Instruments for Aerospace & Defense, By Geography, 2015–2023 (USD Million)

Table 24 Market for AXIE-Based Modular Instruments for Aerospace & Defense, By Geography, 2015–2023 (USD Million)

Table 25 Market for VXI-Based Modular Instruments for Aerospace & Defense, By Geography, 2015–2023 (USD Million)

Table 26 Market for Aerospace & Defense, By Geography, 2015–2023 (USD Million)

Table 27 Market for Automotive & Transportation, By Platform Type, 2015–2023 (USD Million)

Table 28 Market for PXI-Based Modular Instruments for Automotive & Transportation, By Geography, 2015–2023 (USD Million)

Table 29 Market for AXIE-Based Modular Instruments for Automotive & Transportation, By Geography, 2015–2023 (USD Million)

Table 30 Market for VXI-Based Modular Instruments for Automotive & Transportation, By Geography, 2015–2023 (USD Million)

Table 31 Market for Automotive & Transportation, By Geography, 2015–2023 (USD Million)

Table 32 Market for Other Verticals, By Platform Type, 2015–2023 (USD Million)

Table 33 Market for PXI-Based Modular Instruments for Other Verticals, By Geography, 2015–2023 (USD Million)

Table 34 Market for AXIE-Based Modular Instruments for Other Verticals, By Geography, 2015–2023 (USD Million)

Table 35 Market for VXI-Based Modular Instruments for Other Verticals, By Geography, 2015–2023 (USD Million)

Table 36 Market for Other Verticals, By Geography, 2015–2023 (USD Million)

Table 37 Market, By Region, 2015–2023 (USD Million)

Table 38 Market in North America, By Platform Type, 2015–2023 (USD Million)

Table 39 Market in North America, By Vertical, 2015–2023 (USD Million)

Table 40 PXI-Based Modular Instruments Market in North America, By Vertical, 2015–2023 (USD Million)

Table 41 AXIE-Based Market in North America, By Vertical, 2015–2023 (USD Million)

Table 42 VXI-Based Market in North America, By Vertical, 2015–2023 (USD Million)

Table 43 Market in North America, By Country, 2015–2023 (USD Million)

Table 44 PXI-Based Modular Instruments Market in Us, By Vertical, 2015–2023 (USD Million)

Table 45 Market in Europe, By Platform Type, 2015–2023 (USD Million)

Table 46 Market in Europe, By Vertical, 2015–2023 (USD Million)

Table 47 PXI-Based Modular Instruments Market in Europe, By Vertical, 2015–2023 (USD Million)

Table 48 AXIE-Based Market in Europe, By Vertical, 2015–2023 (USD Million)

Table 49 VXI-Based Market in Europe, By Vertical, 2015–2023 (USD Million)

Table 50 Market in Europe, By Country, 2015–2023 (USD Million)

Table 51 PXI-Based Modular Instruments Market in Germany, By Vertical, 2015–2023 (USD Million)

Table 52 Market in APAC, By Platform Type, 2015–2023 (USD Million)

Table 53 Market in APAC, By Vertical, 2015–2023 (USD Million)

Table 54 PXI-Based Market in APAC, By Vertical, 2015–2023 (USD Million)

Table 55 AXIE-Based Market in APAC, By Vertical, 2015–2023 (USD Million)

Table 56 VXI-Based Modular Instruments Market in APAC, By Vertical, 2015–2023 (USD Million)

Table 57 Market in APAC, By Country, 2015–2023 (USD Million)

Table 58 PXI-Based Modular Instruments Market in China & Taiwan, By Vertical, 2015–2023 (USD Million)

Table 59 PXI-Based Market in Japan, By Vertical, 2015–2023 (USD Million)

Table 60 Market in RoW, By Platform Type, 2015–2023 (USD Million)

Table 61 Market in RoW, By Vertical, 2015–2023 (USD Million)

Table 62 PXI-Based Modular Instruments Market in RoW, By Vertical, 2015–2023 (USD Million)

Table 63 AXIE-Based Market in RoW, By Vertical, 2015–2023 (USD Million)

Table 64 VXI-Based Modular Instruments Market in RoW, By Vertical, 2015–2023 (USD Million)

Table 65 Market in RoW, By Region, 2015–2023 (USD Million)

Table 66 Key Player Market Ranking, 2017

List of Figures (49 Figures)

Figure 1 Market Segmentation

Figure 2 Market: Process Flow of Market Size Estimation

Figure 3 Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 Market, 2015–2023 (USD Billion)

Figure 9 Market, By Platform Type, 2015–2023 (USD Million)

Figure 10 Market, By Application, 2018 vs 2023 (USD Million)

Figure 11 Market, By Vertical, 2015–2023 (USD Million)

Figure 12 Market in APAC to Grow at Highest CAGR From 2018 to 2023

Figure 13 Market to Witness Significant Growth From 2018 to 2023

Figure 14 PXI-Based Modular Instruments to Dominate Market Till 2023

Figure 15 Market, By Vertical (Opportunity Analysis), 2023

Figure 16 PXI Platform and North American Region Held Largest Shares of Market in 2017

Figure 17 North America to Hold Largest Share of Market By 2023

Figure 18 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Increase in Mobile Data Traffic From 2016 to 2021

Figure 20 5G Infrastructure Value Chain

Figure 21 5G Infrastructure Market, By Communication Infrastructure, 2020–2026 (USD Million)

Figure 22 Market: Value Chain Analysis

Figure 23 PXI-Based Modular Instruments to Hold Largest Share of Market During Forecast Period

Figure 24 Market for R&D Applications to Grow at Higher CAGR During Forecast Period

Figure 25 Market, By Vertical

Figure 26 Market for Telecommunications to Register Highest CAGR During Forecast Period

Figure 27 Market for PXI-Based Modular Instruments for Telecommunications in APAC to Grow at Highest CAGR During Forecast Period

Figure 28 North America to Hold Largest Share of Market for PXI-Based Modular Instruments for Electronics & Semiconductor During Forecast Period

Figure 29 North America to Hold Largest Share of Market for PXI-Based Modular Instruments for Aerospace & Defense During Forecast Period

Figure 30 Market for PXI-Based Modular Instruments for Automotive & Transportation in APAC to Grow at Highest CAGR During Forecast Period

Figure 31 Geographic Snapshot of Market

Figure 32 APAC Expected to Register Highest CAGR Globally During Forecast Period

Figure 33 North America: Market Snapshot

Figure 34 US to Hold the Major Share of North American Market

Figure 35 Europe: Market Snapshot

Figure 36 Germany Expected to Register Highest CAGR in European Market

Figure 37 Asia Pacific: Market Snapshot

Figure 38 China & Taiwan Expected to Hold Largest Share of Market in APAC

Figure 39 Middle East Expected to Register Higher CAGR in Market in RoW

Figure 40 Key Strategies of Leading Players in Market From 2015 to 2018

Figure 41 Keysight Technologies: Company Snapshot

Figure 42 National Instruments: Company Snapshot

Figure 43 Viavi Solutions: Company Snapshot

Figure 44 Fortive Corp.: Company Snapshot

Figure 45 Astronics Corp.: Company Snapshot

Figure 46 Teledyne Technologies: Company Snapshot

Figure 47 Rohde & Schwarz: Company Snapshot

Figure 48 Ametek: Company Snapshot

Figure 49 Teradyne: Company Snapshot

Growth opportunities and latent adjacency in Modular Instruments Market