Mobile Video Surveillance Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Cameras, Monitors, Storage Devices, Accessories, Software, VSaaS), System (IP, Analog), Application (Public Transit, Fleet Management, Emergency Vehicles, Drones), Vertical & Region - Global Forecast to 2029

Updated on : October 23, 2024

Mobile Video Surveillance Market Size & Growth

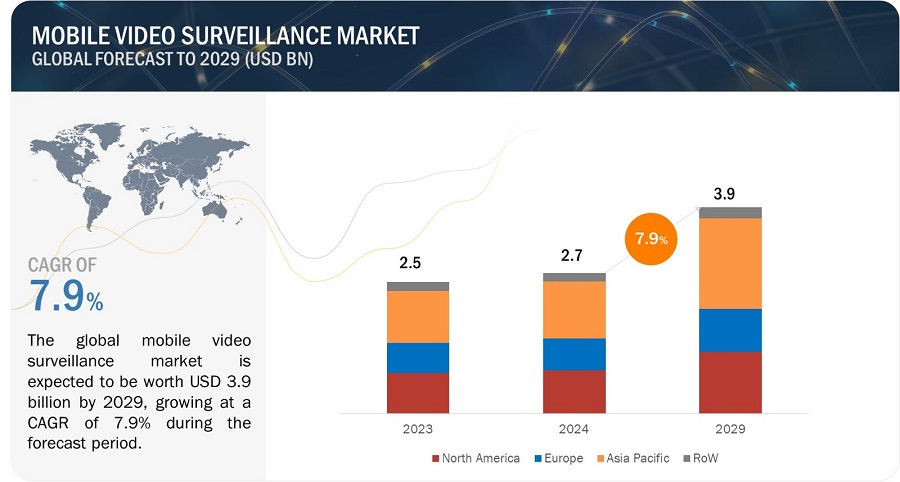

[250 Pages Report] The global Mobile Video Surveillance Market Size is expected to be valued at USD 2.7 Billion in 2024 and is projected to reach USD 3.9 Billion by 2029; it is expected to growing at a CAGR of 7.9% from 2024 to 2029.

Industries are undergoing digital transformations to enhance efficiency and competitiveness. Advances in camera technologies, video analytics, artificial intelligence (AI), and connectivity have significantly improved the capabilities of mobile video surveillance systems. High-resolution cameras, real-time analytics, and intelligent features contribute to the effectiveness of surveillance. The demand for real-time monitoring capabilities and remote management of video feeds contributes to the growth of mobile video surveillance industry.

Mobile Video Surveillance Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Mobile Video Surveillance Market Trends & Dynamics

Driver: Rising security concerns

The escalating global security concerns, characterized by increasing threats such as terrorism, crime, and public safety issues, are a pivotal driver for the mobile surveillance market. Organizations and authorities must deploy mobile surveillance solutions to address evolving security challenges, providing real-time monitoring, enhanced situational awareness, and rapid response capabilities. The flexibility and mobility offered by mobile surveillance cater to dynamic security needs, making these systems indispensable for bolstering security measures across various sectors.

Restraint: Privacy and security concerns regarding video data in wireless cameras

Privacy and security concerns surrounding video data in wireless cameras significantly restrain the mobile surveillance market. Users and organizations must be more cautious of potential breaches and unauthorized access to sensitive video footage, leading to hesitancy in adopting mobile surveillance solutions. The need for robust encryption, secure data transmission, and adherence to stringent privacy regulations becomes paramount to alleviate these concerns. Striking a delicate balance between effective surveillance and safeguarding individual privacy is essential for overcoming this restraint and fostering broader acceptance of mobile surveillance technologies in wireless camera systems.

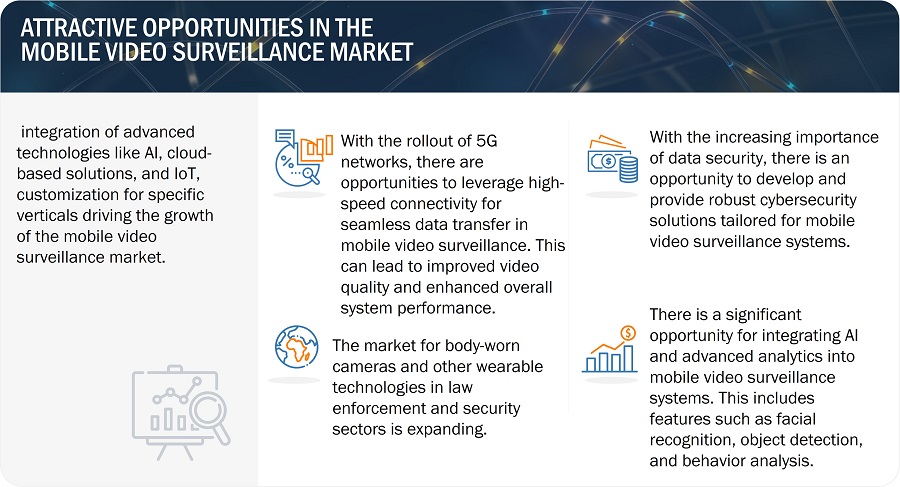

Opportunity: Increasingly applications in law enforcement and emergency services

The growing applications of mobile surveillance in law enforcement and emergency services present a compelling opportunity for the market. Mobile surveillance technologies, including body-worn cameras, in-vehicle systems, and drones, are pivotal in enhancing situational awareness, evidence collection, and operational efficiency for law enforcement agencies and emergency responders. The demand for real-time video feeds, remote monitoring capabilities, and integrating these solutions into comprehensive command and control centers creates a favorable landscape for expanding mobile surveillance applications, addressing the evolving needs of public safety and crisis management.

Challenge: Highly competitive environment

The highly competitive environment poses a challenge for the mobile surveillance market as numerous vendors vie for market share. Intense competition fosters rapid technological advancements, requiring companies to innovate to stay ahead continually. This environment can lead to pricing pressures and increased costs associated with research and development, making it essential for market participants to differentiate their offerings through unique features, performance, and comprehensive solutions to maintain a competitive edge in the dynamic and evolving mobile surveillance landscape.

Mobile Video Surveillance Market Ecosystem

Leading and financially robust manufacturers with significant industry expertise dominate the mobile video surveillance market. These companies boast diverse product portfolios, advanced technologies, and robust global sales and marketing networks. Leading players in the market include Hikvision Digital Technology Co., Ltd. from China, Zhejiang Dahua Technology Co., Ltd. from China, Axis Communications AB from Sweden, Robert Bosch GmbH from Germany, Hanwha Vision Co., Ltd. from South Korea.

Mobile Video Surveillance Market Share

Based on offering, cameras for the mobile video surveillance market to hold the highest market share during the forecast period.

The mobile video surveillance market for camera offerings is experiencing significant growth due to several key factors. Firstly, technological advancements in camera technology, including higher resolutions, improved image sensors, and enhanced video analytics capabilities, contribute to the increased demand for advanced camera systems. Additionally, the rising security and public safety concerns have led to greater adoption of mobile video surveillance solutions across various sectors, further driving the need for high-quality and feature-rich cameras. The integration of artificial intelligence (AI) and machine learning in cameras, facilitating functions such as facial recognition and object detection, also plays a crucial role in the market's growth.

Based on the system, the mobile video surveillance market for IP systems to hold the highest market share during the forecast period.

The mobile video surveillance market for IP (Internet Protocol) systems is experiencing substantial growth due to the advantages of IP-based solutions. IP systems provide higher resolution, scalability, and flexibility than traditional analog systems, meeting the increasing demand for more precise and detailed video footage. The convergence of video surveillance with IT infrastructure allows for seamless integration, enabling remote monitoring and real-time access to video feeds. Additionally, the adoption of advanced analytics, cloud storage options, and compatibility with mobile devices further enhances the appeal of IP-based mobile video surveillance systems, contributing to their accelerated growth in the market.

Based on application, the mobile video surveillance market for public transit applications to hold the highest market share during the forecast period.

The mobile video surveillance market for public transit applications is experiencing significant growth due to a heightened emphasis on passenger safety, security, and operational efficiency within the public transportation sector. Mobile video surveillance systems play a crucial role in deterring criminal activities, investigating incidents, and ensuring the overall well-being of passengers. The integration of advanced technologies, such as high-resolution cameras, real-time monitoring capabilities, and analytics, not only enhances security measures but also contributes to optimizing transit operations. As transit authorities globally prioritize implementing comprehensive security solutions, the demand for mobile video surveillance in public transit applications continues to rise.

Based on vertical, mobile video surveillance for transportation to hold the highest market share during the forecast period.

The mobile video surveillance market for the transportation vertical is experiencing substantial growth driven by the increasing need for enhanced safety, security, and operational efficiency. Mobile surveillance solutions, deployed in vehicles, trains, and other transportation modes, provide real-time monitoring, incident investigation capabilities, and deterrence against criminal activities. With advancements in camera technologies, connectivity, and analytics, transportation authorities seek comprehensive surveillance systems to address evolving security challenges and improve overall transit management. The heightened focus on passenger safety, asset protection, and regulatory compliance fuels continued the mobile video surveillance market growth within the transportation sector.

Mobile Video Surveillance Market Regional Analysis

Mobile video surveillance market in Asia Pacific to hold the highest market share during the forecast period.

The mobile video surveillance market in the Asia-Pacific region is experiencing robust growth due to a convergence of factors. Rapid urbanization, increasing concerns about public safety, and the expansion of smart city initiatives drive the demand for mobile video surveillance solutions. Additionally, the region's growing transportation infrastructure, technological advancements, and rising security awareness further accelerate adoption. As governments and industries in the Asia-Pacific prioritize comprehensive security measures, the mobile video surveillance market witnesses increased deployment across various sectors, contributing to its notable growth in the region.

Mobile Video Surveillance Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Mobile Video Surveillance Companies: Key players

The mobile video surveillance companies is dominated by players such as

- Hikvision Digital Technology Co., Ltd. (China),

- Zhejiang Dahua Technology Co., Ltd. (China),

- Axis Communications AB (Sweden),

- Robert Bosch GmbH (Germany),

- Hanwha Vision Co., Ltd. (South Korea), and others.

Mobile Video Surveillance Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 2.7 Billion in 2024 |

| Projected Market Size | USD 3.9 Billion by 2029 |

| Growth Rate | At CAGR of 7.9% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Offering, By System, By Application, and By Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include Hangzhou Hikvision Digital Technology Co., Ltd. (China), Zhejiang Dahua Technology Co., Ltd. (China), Axis Communications AB (Sweden), Robert Bosch GmbH (Germany), Hanwha Vision Co., Ltd. (South Korea), Vivotek Inc. (Taiwan), Motorola Solutions, Inc. (US), Teledyne FLIR LLC (US), BriefCam Ltd (US), Zhejiang Uniview Technologies Co., Ltd. (China). (Total 25 players are profiled) |

Mobile Video Surveillance Market Highlights

The study categorizes the Mobile video surveillance market based on the following segments:

|

Segment |

Subsegment |

|

By Offering |

|

|

By System |

|

|

By Application |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Mobile Video Surveillance Industry

- In November 2023, Dahua launched the Dahua Wireless Series, which offers flexible, compact, and wireless cameras ideal for small and medium-sized applications. They can be managed and operated over cell phone networks using the Dahua Mobile Security Surveillance (DMSS) app or via WiFi via the Dahua Security System (DSS) video management system, providing end-users with professional remote surveillance management platforms.

- In November 2023, Axis Communications announced a new series of next-generation bullet cameras: AXIS Q18 Series. These cameras detect and classify moving objects using AXIS Object Analytics.

- In November 2023, Hanwha Vision announced the release of its latest innovation, the NDAA-compliant X Series NVRs. NVR supports AI search features, allowing users to search for specific individuals based on gender, age, hat, bag, clothing color, and vehicles based on vehicle types and colors.

- In November 2023, Motorola Solutions unveiled the LTE-enabled V500 body camera, the newest addition to the company’s mobile video portfolio that brings critical real-time field intelligence to emergency response. The V500 integrates with Motorola Solutions’ ecosystem of technologies, from radio and in-car video systems to control room solutions.

- In October 2023, Teledyne FLIR announced the release of its new FLIR FC-Series AI, the latest model in its signature fixed camera (FC) series. The FC-Series AI is a thermal security camera with onboard AI analytics that accurately classifies humans and vehicles for early intrusion detection for perimeter protection and remote site monitoring.

- In October 2023, BriefCam announced the release of bundled software and hardware offerings that unlock the value of video surveillance for companies and communities of all sizes. The BriefCam Compact and BriefCam Grow hardware and software bundles are packaged for easy implementation by BriefCam’s extensive channel partner network and optimized for BriefCam Insights video analytics software, which drives video search, alerting, and data visualization through a complete and comprehensive video analysis platform.

- In April 2023, Hikvision released five new cameras leveraging its Colorvu technology designed for effective high-quality color images day or night. This camera line offers outstanding 24/7 color imaging paired with Hikvision’s AI-driven intelligent event detection that can trigger visible, audible, and network alarms in response to events of interest.

Frequently Asked Questions:

What are the major driving factors and opportunities in the mobile video surveillance market?

Some of the major driving factors for the growth of this market include Rising security concerns, Rapid urbanization and the expansion of smart cities, Increasing demand for real-time monitoring, Rise in remote monitoring and cloud-based solutions. Moreover, Increased use of smart devices for wireless remote monitoring, Integration of mobile video surveillance with access control and alarm systems, and Increasing applications in law enforcement and emergency services are some of the critical opportunities for the mobile video surveillance market.

Which region is expected to hold the highest market share?

Rapid urbanization in the Asia Pacific region, coupled with the implementation of smart city initiatives, is driving the demand for mobile video surveillance. These solutions ensure public safety, traffic management, and overall urban security. Advances in camera technologies, connectivity options, and cost-effective solutions make mobile video surveillance more accessible to a broader range of industries and applications in the Asia Pacific region.

Who are the leading players in the global mobile video surveillance market?

Companies such as Hikvision Digital Technology Co., Ltd. (China), Zhejiang Dahua Technology Co., Ltd. (China), Axis Communications AB (Sweden), Robert Bosch GmbH (Germany), Hanwha Vision Co., Ltd. (South Korea) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Technological advancements in the mobile video surveillance market have been transformative, marked by integrating cutting-edge technologies such as high-resolution cameras, artificial intelligence (AI), and advanced analytics. These innovations enable real-time video analysis, object recognition, and facial identification, enhancing the accuracy and efficiency of surveillance systems. Additionally, the adoption of 5G connectivity ensures faster data transfer, enabling seamless remote monitoring and quicker response times. The convergence of mobile video surveillance with Internet of Things (IoT) devices further contributes to creating intelligent, interconnected ecosystems, making these systems more sophisticated, versatile, and effective in addressing evolving security challenges across various sectors.

What is the impact of the global recession on the market?

The anticipated economic downturn and escalating inflation in 2023 are likely to have a negative effect on the mobile video surveillance sector. The industry's growth is closely tied to the manufacturing and sale of various semiconductor devices, such as image sensors, processors, and memory storage, essential components of mobile video surveillance systems. As inflation, interest rates, and unemployment rates rise, the demand for mobile video surveillance solutions among both consumers and enterprises is expected to decrease. This, in turn, will impact production and investment on a global scale. Due to the recession, verticals such as industrial, military & defense, and transportation using mobile video surveillance would have low CAPEX spending for mobile video surveillance-based solution development.

Inflation can also affect the cost of raw materials and components used to produce Mobile video surveillance. For example, suppose the cost of certain metals or plastics in manufacturing increases. In that case, the cost of producing Mobile video surveillance will also increase, leading to higher consumer prices. This may lead to a decline in demand, particularly among budget-conscious consumers who may opt for cheaper alternatives or delay purchasing a Mobile video surveillance altogether.

The adoption of mobile video surveillance across various industries hinges largely on the capital expenditures (CAPEX) allocated by organizations for the construction, renovation, or enhancement of their technological solutions. The recession exerts an impact on both the extent of CAPEX spending and a company's sales and profitability. There is no guarantee that ongoing capital spending will persist, and there is a possibility of a reduction in spending amid the economic downturn. This, in turn, is likely to impede the uptake of devices based on mobile video surveillance in industrial and transportation settings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for mobile video surveillance in various sectors with growing security concerns- Rapid urbanization and development of smart cities- Increasing requirement for real-time monitoring- Increased use of remote monitoring and cloud-based solutions by several businesses and organizationsRESTRAINTS- Privacy and security concerns associated with video data in wireless cameras- Bandwidth limitations associated with mobile video surveillance- Integration of mobile video surveillance with existing security systemsOPPORTUNITIES- Use of smart devices for wireless remote monitoring- Integration of mobile video surveillance with access control and alarm systems- Increasing applications of mobile video surveillance in law enforcement and emergency servicesCHALLENGES- Cost constraints in implementing and maintaining mobile video surveillance systems- Highly competitive environment for companies offering mobile video surveillance solutions

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) OF MOBILE VIDEO SURVEILLANCE CAMERAS OFFERED BY THREE KEY PLAYERS, BY VERTICALAVERAGE SELLING PRICE (ASP) OF IP AND ANALOG CAMERAS OFFERED BY THREE KEY PLAYERS, BY VERTICALAVERAGE SELLING PRICE (ASP) OF IP AND ANALOG CAMERAS, BY REGIONAVERAGE SELLING PRICE (ASP) OF MOBILE CAMERAS OFFERED BY LEADING COMPANIES

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 ECOSYSTEM MAPPING

-

5.7 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Edge computing- GPS tracking- Telematics integration- Video analyticsCOMPLEMENTARY TECHNOLOGIES- LiDAR technology- Augmented reality (AR)- Predictive analytics- Cloud-based AI processingADJACENT TECHNOLOGIES- Mobile networking technologies- Energy storage solutions- In-vehicle computing platforms- Geographic information system (GIS)

-

5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.10 TARIFF ANALYSIS

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 CASE STUDY ANALYSISNOBINA COLLABORATED WITH AXIS COMMUNICATIONS TO INCREASE SAFETY AND SECURITY FOR BOTH PASSENGERS AND STAFFINDONESIAN TRAFFIC POLICE IMPLEMENTED INNOVATIVE AIOT SOLUTION FROM HIKVISIONHANWHA TECHWIN’S WISENET VIDEO SURVEILLANCE CAMERAS HELPED CITY OF BOLOGNA CREATE SMART TRAFFIC SYSTEMSYSTEM TRUCK COLLABORATED WITH STT AND AXIS COMMUNICATIONS FOR RELIABLE AND COMPLETE PERIMETER DEFENSE SYSTEMHANWHA TECHWIN INSTALLED WISENET CAMERAS GO MOBILE ON HULL TRAINS TO INVESTIGATE ANY SIGNALING IRREGULARITIES

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS RELATED TO MOBILE VIDEO SURVEILLANCE- ANSI/SIA CP-01- Federal Law on Protection of Personal Data held by Private Parties- Information Technology (IT) Act, 2000- IEC 62676GOVERNMENT REGULATIONS RELATED TO MOBILE VIDEO SURVEILLANCE- US- Canada- Europe- UK- Japan- India

- 5.15 KEY CONFERENCES AND EVENTS, 2024–2025

- 6.1 INTRODUCTION

-

6.2 CAMERASGROWING DEMAND FOR MOBILE VIDEO SURVEILLANCE CAMERAS TO GATHER REAL-TIME VISUAL DATA, ENHANCE SITUATIONAL AWARENESS, AND IMPROVE SECURITY IN DYNAMIC ENVIRONMENTS TO DRIVE MARKET- Camera market, by component- Camera market, by connectivity- Camera market, by form factor- Camera market, by resolution

-

6.3 MONITORSADVANCEMENTS IN DISPLAY TECHNOLOGY TO DRIVE DEMAND- Monitor market, by screen size

-

6.4 STORAGE DEVICESGROWING NEED FOR EXTENDED FOOTAGE RETENTION AND HIGH-RESOLUTION VIDEO STORAGE CAPABILITIES TO DRIVE DEMAND- Digital video recorders (DVRs)- Network video recorders (NVRs)- Hybrid video recorders (HVRs)- IP storage area networks (IP SANs)- Direct-attached storage (DAS) devices- Network-attached storage (NAS) devices

-

6.5 ACCESSORIESRISING ADOPTION TO ENHANCE CONNECTIVITY, DATA TRANSMISSION EFFICIENCY, AND VIDEO PROCESSING CAPABILITIES TO DRIVE MARKET- Cables- Encoders

-

6.6 SOFTWARERISING INTEGRATION FOR ADVANCED ANALYTICS, REMOTE MONITORING, AND ENHANCING INTELLIGENCE AND EFFICIENCY OF SURVEILLANCE SYSTEMS TO DRIVE MARKET- Software market, by type- Software market, by deployment mode

-

6.7 SERVICESGROWING USE TO ENSURE OPTIMAL PERFORMANCE AND LONGEVITY OF MOBILE VIDEO SURVEILLANCE SYSTEMS TO FUEL MARKET GROWTH- Video surveillance-as-a-service (VSaaS)- Installation and maintenance services

- 7.1 INTRODUCTION

-

7.2 INTERNET PROTOCOL (IP)CAPABILITY TO SEAMLESSLY INTEGRATE WITH CLOUD SERVICES AND OFFER ENHANCED FUNCTIONALITIES TO DRIVE DEMAND

-

7.3 ANALOGSIMPLE INSTALLATION AND HIGH RELIABILITY TO DRIVE DEMAND

- 8.1 INTRODUCTION

-

8.2 PUBLIC TRANSITINCREASING FOCUS OF TRANSIT AUTHORITIES ON IMPROVING SECURITY, SAFETY, AND OPERATIONAL EFFICIENCY TO DRIVE MARKET- Buses- Railways- Taxi/Ridesharing

-

8.3 FLEET MANAGEMENTGROWING DEMAND FOR LIVE VIDEO FEEDS TO MAKE REAL-TIME DECISIONS TO DRIVE MARKET- Trucks- Delivery vans

-

8.4 EMERGENCY VEHICLESINCREASING REQUIREMENT FOR REAL-TIME MONITORING CAPABILITIES IN CRITICAL RESPONSE SCENARIOS TO ACCELERATE MARKET GROWTH- Police cars- Ambulances

-

8.5 DRONESGROWING ADOPTION OF DRONES FOR REAL-TIME AERIAL MONITORING AND DATA COLLECTION TO BOOST MARKET GROWTH- Commercial drones- Military drones

- 9.1 INTRODUCTION

-

9.2 TRANSPORTATIONINCREASED CRIMINAL ACTIVITIES, LIABILITY SUITS, AND VANDALISM- AND TERRORISM-RELATED THREATS TO DRIVE DEMAND

-

9.3 LAW ENFORCEMENTRISING ADOPTION OF MOBILE VIDEO SURVEILLANCE FOR COLLECTING EVIDENCE AND FACIAL RECOGNITION AND OBJECT DETECTION TO BOOST MARKET GROWTH- City surveillance- Prisons and correctional facilities

-

9.4 INDUSTRIALINCREASING DEMAND FOR REAL-TIME MONITORING AND ANOMALY DETECTION TO FUEL MARKET GROWTH- Mining- Energy & power- Manufacturing- Construction- Marine

-

9.5 FIRST RESPONDERSGROWING USE OF REAL-TIME VISUAL DATA TO ENHANCE SITUATIONAL AWARENESS AND ENSURE SAFETY OF PERSONNEL IN CRITICAL SITUATIONS TO DRIVE DEMAND

-

9.6 MILITARY & DEFENSEINCREASING ILLEGAL TRESPASSING OF IMMIGRANTS, SMUGGLING, AND OTHER BORDER SECURITY ISSUES TO DRIVE DEMAND- Border surveillance- Coastal surveillance

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICAN MOBILE VIDEO SURVEILLANCE MARKET: RECESSION IMPACTUS- Government-led efforts to improve security in public places to drive demandCANADA- Increasing government funding for developing security and surveillance systems to drive marketMEXICO- Rising demand for security and safety across cities to fuel demand

-

10.3 EUROPEEUROPEAN MOBILE VIDEO SURVEILLANCE MARKET: RECESSION IMPACTUK- Growing adoption of intelligent surveillance systems to create lucrative opportunities for market playersGERMANY- Strategic collaborations for developing new video surveillance products to create lucrative opportunities for market playersFRANCE- Increasing investments in smart infrastructure development to drive demandREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC MOBILE VIDEO SURVEILLANCE MARKET: RECESSION IMPACTCHINA- High adoption of video surveillance cameras for security and surveillance applications to drive marketJAPAN- Growing investments by government and private entities in mobile video surveillance industry to drive marketSOUTH KOREA- Growing adoption of advanced technologies in smart city projects to create lucrative opportunities for market playersREST OF ASIA PACIFIC

-

10.5 ROWROW MOBILE VIDEO SURVEILLANCE MARKET: RECESSION IMPACTMIDDLE EAST & AFRICA- Increasing use of mobile video surveillance for proactive threat detection, crowd management, and traffic monitoring to drive marketSOUTH AMERICA- Rapid urbanization and increasing crime rate to fuel demand

- 11.1 INTRODUCTION

- 11.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 REVENUE ANALYSIS, 2018–2022

-

11.5 COMPANY EVALUATION MATRIX, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.6 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALS

-

12.1 KEY PLAYERSHANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewZHEJIANG DAHUA TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMOTOROLA SOLUTIONS, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewROBERT BOSCH GMBH- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHANWHA VISION CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewVIVOTEK INC.- Business overview- Products/Services/Solutions offered- Recent developmentsAXIS COMMUNICATION AB- Business overview- Products/Services/Solutions offered- Recent developmentsTELEDYNE FLIR LLC- Business overview- Products/Services/Solutions offered- Recent developmentsBRIEFCAM- Business overview- Products/Services/Solutions offered- Recent developmentsZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments

-

12.2 OTHER PLAYERSSOLITON SYSTEMS KKCP PLUS INTERNATIONALGENETEC INC.SEONPRO-VIGILROSCO, INC.MOBOTIXWIRELESS CCTV LLCSTROPS TECHNOLOGIES LTD.DTI GROUPIVIDEONAPOLLO VIDEO TECHNOLOGYMARCH NETWORKSIDIS LTD.VERKADA INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE (ASP) OF IP AND ANALOG CAMERAS OFFERED BY THREE KEY PLAYERS, BY REGION (USD)

- TABLE 2 AVERAGE SELLING PRICE (ASP) OF IP CAMERAS AND ANALOG CAMERAS, BY REGION (USD)

- TABLE 3 AVERAGE SELLING PRICE (ASP) OF MOBILE CAMERAS OFFERED BY LEADING COMPANIES (USD)

- TABLE 4 COMPANIES AND THEIR ROLES IN MOBILE VIDEO SURVEILLANCE ECOSYSTEM

- TABLE 5 LIST OF FEW PATENTS RELATED TO MOBILE VIDEO SURVEILLANCE, 2020–2022

- TABLE 6 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 8 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 9 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 10 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY JAPAN

- TABLE 11 MOBILE VIDEO SURVEILLANCE MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 MOBILE VIDEO SURVEILLANCE MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 19 MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 20 MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 21 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 22 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 23 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY CONNECTIVITY, 2020–2023 (USD MILLION)

- TABLE 24 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY CONNECTIVITY, 2024–2029 (USD MILLION)

- TABLE 25 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY FORM FACTOR, 2020–2023 (USD MILLION)

- TABLE 26 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY FORM FACTOR, 2024–2029 (USD MILLION)

- TABLE 27 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY FORM FACTOR, 2020–2023 (THOUSAND UNITS)

- TABLE 28 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY FORM FACTOR, 2024–2029 (THOUSAND UNITS)

- TABLE 29 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 30 CAMERAS: MOBILE VIDEO SURVEILLANCE MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 31 MONITORS: MOBILE VIDEO SURVEILLANCE MARKET, BY SCREEN SIZE, 2020–2023 (USD MILLION)

- TABLE 32 MONITORS: MOBILE VIDEO SURVEILLANCE MARKET, BY SCREEN SIZE, 2024–2029 (USD MILLION)

- TABLE 33 MONITORS: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 34 MONITORS: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 35 STORAGE DEVICES: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 36 STORAGE DEVICES: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 37 ACCESSORIES: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 38 ACCESSORIES: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 39 SOFTWARE: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 40 SOFTWARE: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 41 SOFTWARE: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 42 SOFTWARE: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 43 SOFTWARE: MOBILE VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT MODE, 2020–2023 (USD MILLION)

- TABLE 44 SOFTWARE: MOBILE VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT MODE, 2024–2029 (USD MILLION)

- TABLE 45 SERVICES: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 46 SERVICES: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 47 SERVICES: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 48 SERVICES: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 49 MOBILE VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2020–2023 (USD MILLION)

- TABLE 50 MOBILE VIDEO SURVEILLANCE MARKET, BY SYSTEM, 2024–2029 (USD MILLION)

- TABLE 51 MOBILE VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2020–2023 (USD MILLION)

- TABLE 52 MOBILE VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2024–2029 (USD MILLION)

- TABLE 53 PUBLIC TRANSIT: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 54 PUBLIC TRANSIT: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 55 FLEET MANAGEMENT: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 56 FLEET MANAGEMENT: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 57 EMERGENCY VEHICLES: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 58 EMERGENCY VEHICLES: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 59 DRONES: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 60 DRONES: MOBILE VIDEO SURVEILLANCE MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 61 MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 62 MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 63 TRANSPORTATION: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 64 TRANSPORTATION: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 65 LAW ENFORCEMENT: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 66 LAW ENFORCEMENT: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 INDUSTRIAL: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 68 INDUSTRIAL: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 69 FIRST RESPONDERS: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 70 FIRST RESPONDERS: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 71 MILITARY & DEFENSE: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 72 MILITARY & DEFENSE: MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 73 MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 74 MOBILE VIDEO SURVEILLANCE MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 75 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 76 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 77 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 78 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 79 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 80 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 81 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 82 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 83 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 84 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 85 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 86 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 87 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 89 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 91 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 93 ROW: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 94 ROW: MOBILE VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 95 ROW: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2020–2023 (USD MILLION)

- TABLE 96 ROW: MOBILE VIDEO SURVEILLANCE MARKET, BY OFFERING, 2024–2029 (USD MILLION)

- TABLE 97 ROW: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 98 ROW: MOBILE VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 99 MOBILE VIDEO SURVEILLANCE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MAJOR COMPANIES, 2022–2023

- TABLE 100 MOBILE VIDEO SURVEILLANCE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 101 OVERALL COMPANY FOOTPRINT

- TABLE 102 OFFERING: COMPANY FOOTPRINT

- TABLE 103 APPLICATION: COMPANY FOOTPRINT

- TABLE 104 VERTICAL: COMPANY FOOTPRINT

- TABLE 105 SYSTEM: COMPANY FOOTPRINT

- TABLE 106 REGION: COMPANY FOOTPRINT

- TABLE 107 MOBILE VIDEO SURVEILLANCE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 108 MOBILE VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 109 MOBILE VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY OFFERING

- TABLE 110 MOBILE VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY APPLICATION

- TABLE 111 MOBILE VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY VERTICAL

- TABLE 112 MOBILE VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY SYSTEM

- TABLE 113 MOBILE VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY REGION

- TABLE 114 MOBILE VIDEO SURVEILLANCE MARKET: PRODUCT LAUNCHES, 2021–2023

- TABLE 115 MOBILE VIDEO SURVEILLANCE MARKET: DEALS, 2021–2023

- TABLE 116 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 117 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 118 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 119 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: DEALS

- TABLE 120 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 121 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 122 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES

- TABLE 123 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 124 MOTOROLA SOLUTIONS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 125 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES

- TABLE 126 MOTOROLA SOLUTIONS, INC.: DEALS

- TABLE 127 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 128 ROBERT BOSCH GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 129 ROBERT BOSCH GMBH: PRODUCT LAUNCHES

- TABLE 130 HANWHA VISION CO., LTD.: COMPANY OVERVIEW

- TABLE 131 HANWHA VISION CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 HANWHA VISION CO., LTD.: PRODUCT LAUNCHES

- TABLE 133 VIVOTEK INC.: COMPANY OVERVIEW

- TABLE 134 VIVOTEK INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 135 VIVOTEK INC.: PRODUCT LAUNCHES

- TABLE 136 VIVOTEK INC.: DEALS

- TABLE 137 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 138 AXIS COMMUNICATIONS AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- TABLE 140 AXIS COMMUNICATIONS AB: DEALS

- TABLE 141 TELEDYNE FLIR LLC: COMPANY OVERVIEW

- TABLE 142 TELEDYNE FLIR LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 143 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 144 TELEDYNE FLIR LLC: DEALS

- TABLE 145 BRIEFCAM: COMPANY OVERVIEW

- TABLE 146 BRIEFCAM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 BRIEFCAM: PRODUCT LAUNCHES

- TABLE 148 BRIEFCAM: DEALS

- TABLE 149 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 150 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 151 ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES

- TABLE 152 SOLITON SYSTEMS KK: COMPANY OVERVIEW

- TABLE 153 CP PLUS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 154 GENETEC INC.: COMPANY OVERVIEW

- TABLE 155 SOEN: COMPANY OVERVIEW

- TABLE 156 PRO-VIGIL: COMPANY OVERVIEW

- TABLE 157 ROSCO, INC.: COMPANY OVERVIEW

- TABLE 158 MOBOTIX: COMPANY OVERVIEW

- TABLE 159 WIRELESS CCTV LLC: COMPANY OVERVIEW

- TABLE 160 STROPS TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 161 DTI GROUP: COMPANY OVERVIEW

- TABLE 162 IVIDEON: COMPANY OVERVIEW

- TABLE 163 APOLLO VIDEO TECHNOLOGY: COMPANY OVERVIEW

- TABLE 164 MARCH NETWORKS: COMPANY OVERVIEW

- TABLE 165 IDIS LTD.: COMPANY OVERVIEW

- TABLE 166 VERKADA INC.: COMPANY OVERVIEW

- FIGURE 1 MOBILE VIDEO SURVEILLANCE MARKET SEGMENTATION

- FIGURE 2 MOBILE VIDEO SURVEILLANCE MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF MOBILE VIDEO SURVEILLANCE SOFTWARE AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 CAMERAS SEGMENT TO HOLD LARGEST SHARE OF MOBILE VIDEO SURVEILLANCE MARKET IN 2024

- FIGURE 9 IP SEGMENT TO HOLD HIGHER SHARE OF MOBILE VIDEO SURVEILLANCE MARKET IN 2024

- FIGURE 10 TRANSPORTATION SEGMENT TO HOLD LARGEST SHARE OF MOBILE VIDEO SURVEILLANCE MARKET IN 2024

- FIGURE 11 PUBLIC TRANSIT SEGMENT TO HOLD LARGEST SHARE OF MOBILE VIDEO SURVEILLANCE MARKET IN 2024

- FIGURE 12 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF MOBILE VIDEO SURVEILLANCE MARKET IN 2024

- FIGURE 13 TECHNOLOGICAL ADVANCEMENTS AND INTEGRATION OF AI INTO MOBILE VIDEO SURVEILLANCE SYSTEMS TO DRIVE MARKET

- FIGURE 14 CHINA AND CAMERAS SEGMENT TO HOLD LARGEST SHARES OF ASIA PACIFIC MOBILE VIDEO SURVEILLANCE MARKET IN 2024

- FIGURE 15 US TO HOLD LARGEST SHARE OF NORTH AMERICAN MOBILE VIDEO SURVEILLANCE MARKET IN 2029

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN MOBILE VIDEO SURVEILLANCE MARKET FROM 2024 TO 2029

- FIGURE 17 MOBILE VIDEO SURVEILLANCE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 MOBILE VIDEO SURVEILLANCE MARKET: DRIVERS AND THEIR IMPACT

- FIGURE 19 MOBILE VIDEO SURVEILLANCE MARKET: RESTRAINTS AND THEIR IMPACT

- FIGURE 20 MOBILE VIDEO SURVEILLANCE MARKET: OPPORTUNITIES AND THEIR IMPACT

- FIGURE 21 MOBILE VIDEO SURVEILLANCE MARKET: CHALLENGES AND THEIR IMPACT

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 23 AVERAGE SELLING PRICE (ASP) OF DIFFERENT MOBILE VIDEO SURVEILLANCE CAMERAS, 2020–2029 (USD)

- FIGURE 24 AVERAGE SELLING PRICE (ASP) OF MOBILE VIDEO SURVEILLANCE CAMERAS OFFERED BY THREE KEY PLAYERS, BY VERTICAL (USD)

- FIGURE 25 MOBILE VIDEO SURVEILLANCE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 MOBILE VIDEO SURVEILLANCE MARKET: ECOSYSTEM MAPPING

- FIGURE 27 NUMBER OF PATENTS GRANTED RELATED TO MOBILE VIDEO SURVEILLANCE SYSTEMS, 2012–2022

- FIGURE 28 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 30 MOBILE VIDEO SURVEILLANCE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 33 CAMERAS SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 34 IP SEGMENT TO HOLD LARGER MARKET SHARE IN 2029

- FIGURE 35 DRONES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 TRANSPORTATION SEGMENT TO REGISTER HIGHEST CAGR IN MOBILE VIDEO SURVEILLANCE MARKET FROM 2023 TO 2028

- FIGURE 37 ASIA PACIFIC MOBILE VIDEO SURVEILLANCE MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 NORTH AMERICA: MOBILE VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 39 EUROPE: MOBILE VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 40 ASIA PACIFIC: MOBILE VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 41 MOBILE VIDEO SURVEILLANCE MARKET SHARE ANALYSIS, 2023

- FIGURE 42 MOBILE VIDEO SURVEILLANCE MARKET: REVENUE ANALYSIS OF THREE KEY PLAYERS, 2018–2022

- FIGURE 43 MOBILE VIDEO SURVEILLANCE MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 44 MOBILE VIDEO SURVEILLANCE MARKET: STARTUPS/SMES EVALUATION MATRIX, 2023

- FIGURE 45 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 ZHEJIANG DAHUA TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 48 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- FIGURE 49 VIVOTEK INC.: COMPANY SNAPSHOT

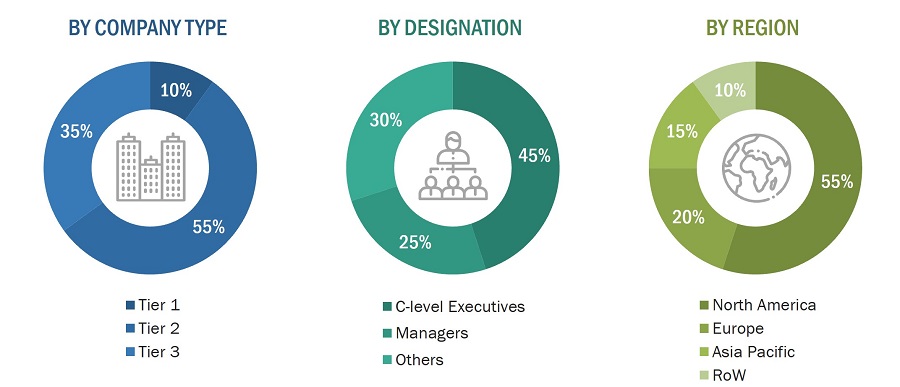

The study involved four major activities in estimating the current size of the mobile video surveillance market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the Mobile video surveillance market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Mobile video surveillance market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

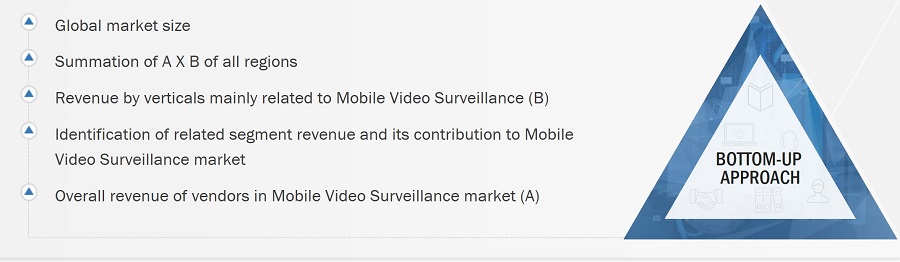

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the Mobile video surveillance market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various applications using or expected to implement Mobile video surveillance

- Analyzing each vertical, along with the major related companies and Mobile video surveillance providers

- Estimating the Mobile video surveillance market for verticals

- Understanding the demand generated by companies operating across different verticals

- Tracking the ongoing and upcoming implementation of projects based on Mobile video surveillance technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of Mobile video surveillance products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the Mobile video surveillance market

- Arriving at the market estimates by analyzing Mobile video surveillance companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

- Building and developing the information related to the market revenue generated by key Mobile video surveillance manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of Mobile video surveillance products in various applications

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of Mobile video surveillance, and the level of solutions offered in verticals

- The impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Mobile video surveillance refers to a diverse set of specialized activities and support functions that facilitate the smooth functioning, maintenance, and enhancement of industrial processes and facilities. These services are integral to optimizing operational efficiency, ensuring compliance with regulatory standards, and addressing the complex needs of industrial sectors.

Key Stakeholders

- Manufacturers and Suppliers

- Technology Providers

- System Integrators

- Installers and Service Providers

- Government Agencies

- Transportation Authorities

- Private Security Firms

- Fleet Management Companies

- Regulatory Authorities

- End-User Industries

Report Objectives

- To define, describe, and forecast the mobile video surveillance market based on offering, system, vertical, application, and region.

- To forecast the shipment data of the mobile video surveillance market.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the mobile video surveillance market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the Mobile video surveillance market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Mobile video surveillance market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mobile Video Surveillance Market

Decongestion of road traffic , Safety & Security of travelers on Road , Smart Transportation Solutions are the part of this report? If yes, then what could be there market sizing?

Hi could I obtain the pdf brochure/ sample of this Mobile Video Surveillance market research?