Microdisplay Market by Product (NTE Devices, HUDs, Projectors), Technology (OLED, LCoS, MicroLED), Vertical (Consumer, Industrial and Enterprise, Automotive, Retail & Hospitality, Medical), Resolution and Brightness & Region - Global Forecast to 2029

Updated on : October 23, 2024

Microdisplay Market Size & Share

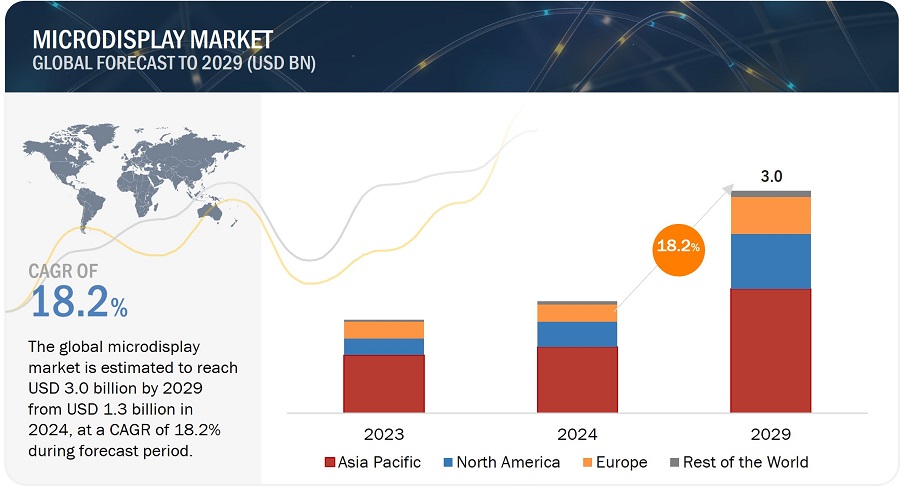

[244 Pages Report] The global microdisplay market size is projected to grow from USD 1.3 billion in 2024 to USD 3.0 billion by 2029, growing at a CAGR of 18.2% during the forecast period from 2024 to 2029. The increasing demand of microdisplays in wearable devices and near-to-eye devices, growing deployment of head-mounted displays in automotive application, rising adoption of head-mounted displays (HMDs) in various sectors, and growing demand for advanced microdisplays such as MicroLED and OLEDoS are the major factors propelling the growth of the microdisplay market. MicroLEDs can propel the microdisplay business by providing higher brightness, contrast, and energy efficiency than standard display technologies. Their ability to provide high resolution and endurance makes them suitable for use in AR/VR headsets, wearables, and automotive head-up displays, pushing the limits of performance and user experience.

Impact of AI/Gen AI on microdisplay market

The major use cases of AI/Gen AI in the microdisplay market size include content creation, image processing and quality, user interaction, and personalized recommendations. AI-generated content can enhance the immersive experience and provide highly detailed virtual environments in head-mounted displays by enabling adaptive storytelling and real-time rendering. AI-driven content creation for HMDs enables the construction of immersive and highly detailed virtual environments, which improves applications in gaming, training, and virtual tourism. Image processing and quality enhancement utilize AI algorithms to provide clearer, more colorful graphics, which are critical for compact, high-resolution displays. Furthermore, AI improves user engagement by creating intuitive, responsive interfaces that adapt to user habits and preferences in smartwatches and wearables. Personalized recommendations employ AI to evaluate user data and provide tailored content and suggestions, resulting in increased satisfaction and engagement across various cutting-edge devices.

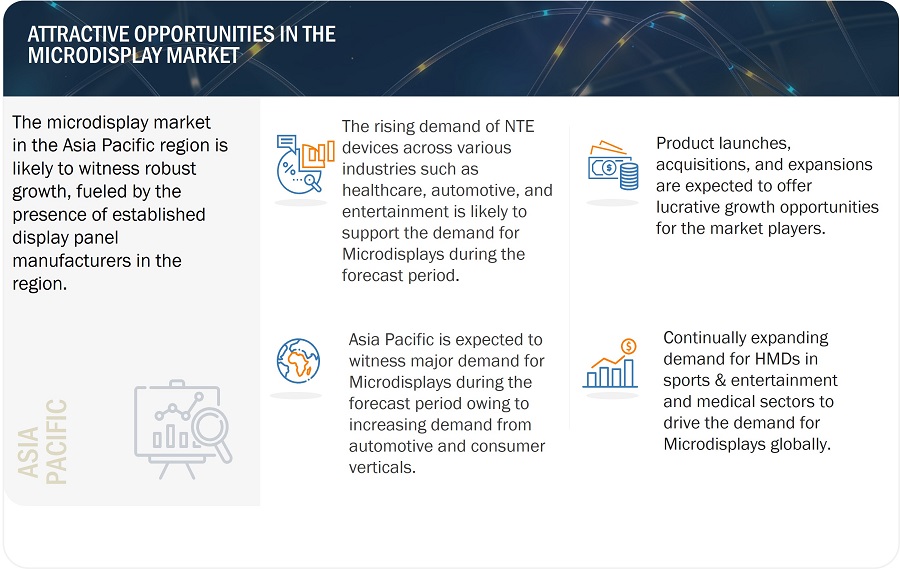

Attractive opportunities in the microdisplay market

Microdisplay Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Micodisplay Market Trends & Dynamics:

Driver: Growing demand for micro displays in wearable devices

Wearable devices are IoT-enabled devices used for data transfer. Increased global demand for these devices has led to the development of improved and efficient microdisplays for use in them to increase their consumer traction. For instance, in early 2023, Samsung Display initiated a new project to create microLED wearable displays. The company intended to supply these displays to leading wearable manufacturers like Apple and Samsung Electronics. Concurrently, Samsung Electronics has begun developing a microLED-powered Galaxy Watch device, with an anticipated launch targeted for 2025.

Display manufacturers worldwide are also focusing on developing and launching displays for wearable devices such as AR/VR, owing to their growing demand. For instance, in April 2023, AUO Corporation announced its plan to transform its LCD 5A fab located in Taiwan's Longtan District into a microLED production facility. This initiative aims to commence microLED manufacturing by 2025 or 2026, focusing on applications such as wearable displays, automotive displays, TVs, and signage displays.

Restraint: High capital investment and manufacturing costs

Though microdisplays have better performance and utility than conventional direct-view displays such as LCD or OLEDs, there are still multiple manufacturing challenges that require to be addressed to enable cost-effective and high-volume manufacturing of microdisplays. These displays require high-quality components and expensive equipment that increase the manufacturing costs of microdisplays. Though LCD and LCoS microdisplays are economical, OLED and high-end microdisplays are still expensive. The complexity of manufacturing high-quality microdisplays results in significant production costs. For example, the cost of producing Micro-LED displays, a promising microdisplay technology, is currently 10 times higher than that of traditional LED displays, limiting mass-market adoption.

Opportunity: Advancements in Micro LED technology

Advancements in Micro-LED technology represent a significant opportunity for the microdisplay market share , presenting significant opportunities across diverse industries. Microdisplays utilize advanced silicon backplanes, and microLED microdisplays can be manufactured using a monolithic process. This method allows LEDs to be directly fabricated on the silicon wafer or transferred to it, which is simpler compared to the TFT-glass transfer process. Micro-LEDs, known for their small size and individual light-emitting diodes, offer superior display characteristics such as enhanced brightness, energy efficiency, faster response times, and extended lifespans compared to traditional LCDs and OLEDs. These attributes position Micro-LEDs as ideal solutions for applications requiring high-resolution displays in compact formats, including augmented reality (AR) glasses, virtual reality (VR) headsets, smartwatches, and automotive displays.

Challenge: Reduction in display latency

One of the primary challenges for manufacturers of NTE (Near-To-Eye) devices and applications lies in delivering displays with low latency. Latency-induced errors often result in image lag, which significantly impacts user experience. In gaming, high input lag can make gameplay feel sluggish and unresponsive. Lower input lag levels are crucial for enabling gamers to enjoy seamless control experiences where screen movements respond instantly to commands. This challenge is particularly critical in sectors like healthcare, aerospace, and defense, where delayed responses can have serious consequences. Despite efforts, all microdisplay-equipped devices inherently face latency thresholds influenced by factors such as content frame rate, display refresh rate, and input lag.

Microdisplay Market Ecosystem

Key companies in this market include well-established, financially stable providers of microdisplay products. These companies have been operating in the market for several years and possess a diversified portfolio of microdisplay which caters to a wide range of applications. Prominent companies in this market include Seiko Epson Corporation (Japan), SeeYA Technology (China), Sony Group Corporation (Japan), Kopin Corporation (US), Himax Technologies, Inc. (Taiwan), and HOLOEYE Photonics AG (Germany) among others.

Microdisplay Market Segmentation

By Offering, Software segment likely to exhibit the highest CAGR during the forecast period

Advances in technology and the subsequent use of technologies such as the internet of things (IoT), the growing demand for real-time content management, and the expanding use of smart signage have all contributed significantly to the global rise of the microdisplay software market. The advantages of microdisplay software have resulted in a significant growth in its adoption in recent years. Furthermore, the development and popularity of system-on-chip displays has boosted the demand for microdisplay software. Regular software license purchases and updates are expected to have a significant impact on the growth of the microdisplay software industry.

By Application, commercial application is expected to account for largest share between 2024 and 2029.

Microdisplays displays are commonly used in the retail industry due to their capacity to attract customers and improve the customer experience in businesses. Kiosks, video walls, menu boards, automated teller machines (ATMs), billboards, interactive displays, and system-on-chip displays are all examples of digital signage utilized in retail, healthcare, business, broadcasting, hotel, and government sectors. Microdisplay: displays are used in the healthcare sector to display health-related information and stimulate patient participation via interactive kiosks. Wayfinding screens in hospitals and other business settings can also assist reduce hallway traffic. Furthermore, interactive displays are becoming increasingly popular in the retail industry due to the growing demand for enhanced consumer involvement. Furthermore, interactive displays are useful for information distribution and navigation.

By technology, OLED microdisplays to account for the largest market share during the forecast period

The OLED segment of the microdisplay market size is predicted to grow significantly throughout the forecasted period. The segment's rise can be ascribed to the rapid acceptance of these displays with enhanced capabilities and their application in HMDS. OLED microdisplays are rapidly being employed in AR-HMDs due to its higher power, faster response times, and wider color palette. Several manufacturers of microdisplays, including Kopin Corporation (US), Samsung Electronics (South Korea), and Yunnan OLIGHTEK Opto-Electronic Technology Co. Ltd. (China), have introduced OLED microdisplays for HMDs.

Higher FHD segment is projected to grow at higher CAGR during forecast period

Higher FHD segment is projected to expand at the highest CAGR during the estimated period. Displays with typical FHD resolution have a horizontal resolution of 1920 pixels and a vertical resolution of 1080 pixels. Fraunhofer-FEP demonstrated a curved OLED microdisplay panel at the 2018 US Society for Information Display (SID). This 1-inch-diameter curved OLED microdisplay has a resolution of 1200 x 1920. The panel was constructed as part of the EU-funded LOMID project.

NTE Devices to register growth at higher CAGR

NTE devices are projected to expand at the highest CAGR between 2024 and 2029. OLED-based microdisplays are increasingly being used in NTE devices because to their higher power efficiency, faster response times, and wider color range. The eMagin Corporation's SVGA+-Rev3-OLED XL- microdisplay is a power-efficient OLED-microdisplay solution for near-eye personal view applications. Because of the presence of major EVF vendors in Japan, Asia-Pacific is expected to continue to have the highest demand for microdisplays for usage in NTE devices during the estimated period.

Microdisplay Market Regional Analysis

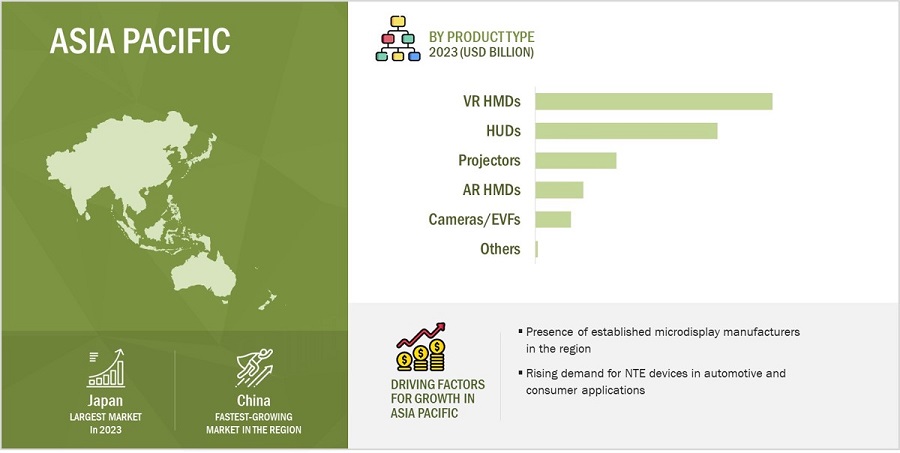

Asia Pacific likely to hold the largest share of microdisplay market during forecast period

Asia Pacific is expected to dominate the microdisplay market share from 2024 to 2029. In addition to the fact that Japan is home to several prominent EVF vendors, Asia Pacific is expected to continue to have the highest demand for microdisplays for usage in NTE devices during the forecast period. The vast majority of camera manufacturers are concentrated in Asia Pacific. Canon Inc., Nikon Corporation, and Sony Group Corporation together account for more than 90% of the camera market. As a result, Japan's demand for microdisplays soars, propelling expansion in the microdisplay sector across the region. Furthermore, Asia Pacific is predicted to account for the majority of the LCD microdisplay market from 2024 to 2029. LCD microdisplays are in high demand in cameras/EVFs and projectors, and the majority of vendors are located in this region.

Microdisplay Market Size by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Microdisplay Companies: Key Market Players

- Sony Group Corporation (Japan),

- Seiko Epson Corporation (Japan),

- Kopin Corporation (US),

- Himax Technologies, Inc.,(Taiwan),

- SeeYA Technology (China) are some of the key players in the microdisplay companies.

Microdisplay Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 1.3 billion in 2024 |

| Projected Market Size | USD 3.0 billion by 2029 |

| Growth Rate | At CAGR of 18.2% |

|

Market Size Availability for Years |

2020–2029 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2029 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

|

|

Geographies Covered |

|

|

Companies Covered |

Seiko Epson Corporation (Japan), SeeYA Technology (China), Sony Group Corporation (Japan), Kopin Corporation (US), Himax Technologies, Inc. (Taiwan), and HOLOEYE Photonics AG (Germany), eMagin Corporation (US), WiseChip Semiconductor Inc. (Taiwan), Raystar Optronics (Taiwan), WINSTAR Display Co., Ltd. (Taiwan) 25 companies profiled |

Microdisplay Market Highlights

|

Segment |

Subsegment |

|

Microdisplay Market Size , By Product |

|

|

Microdisplay Market Share, By Resolution and Brightness |

|

|

By Vertical |

|

|

Microdisplay Market Share, By Technology |

|

|

By Geography |

|

Recent Developments in Microdisplay Industry :

- In April 2024, Kopin Corporation increased its customer base by winning the third production order for their Organic Light-Emitting Diode (OLED) microdisplays. These screens will be used in the Indian Army's mounted and handheld thermal imaging vision systems. According to the terms of the most recent production order, which comprises approximately 1,200 units, deliveries will take place over a six-month period.

- In February 2024, -Kopin Corporation received a new Small Business Innovation Research (SBIR) contract from the Naval Air Warfare Center. Under this contract, Kopin will use its over 30-years of experience in US-based microdisplay research to produce superior microdisplays for lens less computational imaging.

- In August 2023, Sony Semiconductor Solutions Corporation (SSS) launched the ECX344A, high-definition 1.3-type OLED microdisplay with 4K resolution that is intended to give more realistic space recreations which are designed specifically for AR/VR applications.

- In January 2023, Seiko Epson and Universal Display entered into an agreement for researching OLEDs. Universal Display will provide Epson with its unique phosphorescent OLED materials and technology for AR/VR (augmented reality/virtual reality) display applications under the terms of the agreement.

Frequently Asked Questions (FAQ’s):

What is the current size of the global microdisplay market?

Companies such as Sony Group Corporation, Seiko Epson Corporation, Kopin Corporation, SeeYA Technology, and Himax Technologies, Inc.

Who are the global isostatic pressing market winners?

Companies such as KOBE STEEL, LTD., Bodycote, Kennametal, Inc., Nikkiso., Ltd., DORST Technologies GmbH & Co. KG, American Isostatic Presses, Inc. fall under the winners’ category.

Which region is expected to hold the highest market share?

Asia Pacific is forecasted to dominate the microdisplay market between 2024 and 2029. The presence of established microdisplay component providers and burgeoning automotive sector are the major factors contributing to the market growth in Asia Pacific.

What are the major drivers and opportunities related to the microdisplay market?

Growing deployment of OLED microdisplays in commercial applications, increasing usage of microdisplay in HUDs for automotive applications, and technological advancements related to displays such as MicroLED are some of the major drivers and opportunities related to the microdisplay market.

What are the major strategies adopted by market players?

The key players have adopted product launches, acquisitions, and partnerships to strengthen their position in the microdisplay market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for microdisplays in wearable devices- Technological advancements in microdisplays- Growing popularity of AR devices in healthcare sector- Growing adoption of HMDs in various verticals- Rising popularity of OLED microdisplays for increased brightness and efficiency- Emerging applications in military, defense, and aerospaceRESTRAINTS- Saturation of markets for digital cameras and projectors- High capital investment and manufacturing costsOPPORTUNITIES- Advancements in microLED technology- Rising demand for medical displays- Presence of leading microdisplay manufacturers in Asia PacificCHALLENGES- Stringent regulations, particularly in medical and automotive applications- Reduction in display latency

- 5.3 SUPPLY CHAIN ANALYSIS

-

5.4 DISPLAY MARKET: ECOSYSTEM

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.6 INVESTMENT AND FUNDING SCENARIO

-

5.7 TYPES OF MICRODISPLAYSREFLECTIVETRANSMISSIVE

-

5.8 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- MicroLED- LCoSCOMPLEMENTARY TECHNOLOGY- Touchscreen technologyADJACENT TECHNOLOGY- AR/VR

-

5.9 IMPACT OF AI/GEN AIINTRODUCTIONTOP USE CASES- AI-powered head-up displays in automotive- Smart glasses with AI assistants- Enhanced and personalized content creation with Gen AI in AR/VR applicationsCASE STUDIES OF IMPLEMENTATION OF AI/GEN AI- Meta enhances Ray-Ban smart glasses with integrated AI assistant- Panasonic Automotive Systems of America introduces AR HUDs integrated with AIINTERCONNECTED ADJACENT ECOSYSTEMS WORKING ON AI/GEN AI AND THEIR IMPACT ON MICRODISPLAY MARKET- Semiconductor industry- Software development ecosystem

-

5.10 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.12 PATENT ANALYSIS

-

5.13 TRADE ANALYSISIMPORT SCENARIO (HS CODE 8537)EXPORT SCENARIO (HS CODE 8537)

-

5.14 CASE STUDIES, BY VERTICALMICRODISPLAYS FOR CONSUMERSMICRODISPLAYS FOR AEROSPACEMICRODISPLAYS FOR HEALTHCAREMICRODISPLAYS FOR MILITARY AND DEFENSE- OLED microdisplay- Advanced prism subsystemMICRODISPLAYS IN AUTOMOTIVEMICRODISPLAYS IN SPORTS & ENTERTAINMENT

-

5.15 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TECHNOLOGYAVERAGE SELLING PRICE TREND, BY REGION

- 5.16 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.17 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS AND REGULATIONS- Regulations- Standards

- 6.1 INTRODUCTION

-

6.2 NTE DEVICESCAMERAS/ELECTRONIC VIEWFINDERS- Increasing use of EVF in mirrorless cameras to drive growthHEAD-MOUNTED DISPLAYS- AR HMDs- Virtual reality HMDs

-

6.3 HEAD-UP DISPLAYSRISING DEPLOYMENT IN AUTOMOTIVE SECTOR TO FUEL DEMAND

-

6.4 PROJECTORSPICO PROJECTORS- Reduction of size with microdisplays in pico projectors to drive demandDATA PROJECTORS- High-resolution image quality to boost market

- 6.5 OTHERS

-

7.1 BY RESOLUTIONINTRODUCTIONLOWER THAN HD- Rising demand from HUDs and EVFs to drive growthHD- AR HMDs to boost segmental growthFHD- Segment to hold significant share by 2029HIGHER THAN FHD- Growing need for high-quality displays to drive segment

-

7.2 BY BRIGHTNESSINTRODUCTIONLESS THAN 500 NITS500 TO 1,000 NITSMORE THAN 1,000 NITS

- 8.1 INTRODUCTION

-

8.2 CONSUMERINCREASING DEMAND FOR WEARABLES SUCH AS SMART GLASSES TO DRIVE SEGMENT GROWTH

-

8.3 AUTOMOTIVEGROWING PENETRATION OF HUDS AND HMDS TO BOOST MARKET GROWTH

-

8.4 INDUSTRIAL & ENTERPRISEINCREASED DEMAND FOR DEPLOYMENT IN PROJECTORS AND AR HMDS TO DRIVE GROWTH

-

8.5 MILITARY, DEFENSE, AND AEROSPACEINCREASING DEMAND FOR HEAD-MOUNTED DISPLAYS TO DRIVE MARKET

-

8.6 RETAIL & HOSPITALITYUSE OF AR & VR IN STORES FOR VIRTUAL DESIGNING TO FAVOR MARKET EXPANSION

-

8.7 MEDICALUSE FOR TRAINING, SIMULATION, DATA DISPLAY, AND MICROSURGERY TO DRIVE MARKET

-

8.8 EDUCATIONINTERACTIVE LEARNING EXPERIENCE TO BOOST DEMAND

-

8.9 SPORTS & ENTERTAINMENTINCREASING USE IN TRAINING OF PLAYERS TO FUEL DEMAND FOR AR AND VR HMDS

- 8.10 OTHERS

- 9.1 INTRODUCTION

-

9.2 LIQUID CRYSTAL DISPLAYLOW VOLTAGE & POWER CONSUMPTION WITH HIGH RESOLUTION AND CONTRAST – KEY DRIVERS

-

9.3 LIQUID CRYSTAL ON SILICONABILITY TO USE NARROWBAND LIGHT SOURCES FOR ILLUMINATION TO PROPEL MARKET GROWTH

-

9.4 ORGANIC LIGHT-EMITTING DIODETECHNOLOGICAL ADVANCEMENTS SUCH AS OLEDOS EXPECTED TO DRIVE SEGMENT GROWTH

-

9.5 DIGITAL LIGHT PROCESSINGHIGH BRIGHTNESS, LOW COST, AND HIGH OPTICAL EFFICIENCY – KEY GROWTH DRIVERS

-

9.6 MICROLEDSUPERIOR CHARACTERISTICS AND EFFICIENCY TO DRIVE SEGMENT GROWTH

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Technological advancements and growing popularity of HMDs to drive growthCANADA- Rising infrastructure sector to boost demand for AR devicesMEXICO- Growing demand for consumer electronics to fuel market growth

-

10.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEGERMANY- Rising deployment of HUDs in automobiles to fuel marketFRANCE- Increased demand for military weapons to contribute to market growthUK- Government initiatives to drive growth and transformation of microdisplay manufacturing ecosystemREST OF EUROPE

-

10.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Increasing demand for consumer electronics to fuel market growthJAPAN- Presence of established key vendors of cameras/EVFs and projectors to boost market growthSOUTH KOREA- Increase in demand for wearables, HMDs, and mirrorless cameras to fuel market growthTAIWAN- Growing AR and VR startups to drive market growthREST OF ASIA PACIFIC

-

10.5 ROWMACROECONOMIC OUTLOOK FOR ROWSOUTH AMERICA- Rise in adoption of AR and VR HMDs in agriculture sector boost marketMIDDLE EAST & AFRICA- Surge in adoption of HMDs in oil & gas industry to drive market- GCC Countries- Rest of Middle East & Africa

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS, 2023

- 11.4 HISTORICAL REVENUE ANALYSIS, 2019–2023

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Product footprint- Technology footprint- Vertical footprint

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING- Detailed list of key startups/SMEs, 2023

-

11.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSEXPANSIONSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSSONY GROUP CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSEIKO EPSON CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSEEYA TECHNOLOGY- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKOPIN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEMAGIN- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHIMAX TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsHOLOEYE PHOTONICS AG- Business overview- Products/Services/Solutions offered- Recent developmentsWISECHIP SEMICONDUCTOR INC.- Business overview- Products/Services/Solutions offeredRAYSTAR OPTRONICS, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsWINSTAR DISPLAY CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsYUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSOMNIVISIONSYNDIANTMICROOLED TECHNOLOGIESVUEREALMICROVISIONJBDBOE TECHNOLOGY GROUP CO., LTD.RAONTECHSILICON MICRO DISPLAYENMESI.COM (SHENZHEN ANPO INTELLIGENCE TECHNOLOGY CO., LTD.)MOJO VISIONCINOPTICSLUMIODEPLAYNITRIDE INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 DISPLAY TECHNOLOGIES USED IN POPULAR AR AND VR DEVICES

- TABLE 4 COMPARISON OF DIFFERENT DISPLAY TECHNOLOGIES

- TABLE 5 MICRODISPLAY MARKET: COMPANIES AND THEIR ROLE

- TABLE 6 MICRODISPLAY TECHNOLOGY COMPARISON

- TABLE 7 MICRODISPLAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 10 KEY PATENTS RELATED TO MICRODISPLAYS

- TABLE 11 INDICATIVE PRICING TREND OF OLED MICRODISPLAYS PROVIDED BY KEY PLAYERS, 2020–2023

- TABLE 12 MICRODISPLAY MARKET: CONFERENCES AND EVENTS, 2024–2025

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 18 MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 19 MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (MILLION UNITS)

- TABLE 20 MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (MILLION UNITS)

- TABLE 21 NTE DEVICES: MICRODISPLAY MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 22 NTE DEVICES: MICRODISPLAY MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 23 NTE DEVICES: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 24 NTE DEVICES: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 25 CAMERAS/EVFS: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 26 CAMERAS/EVFS: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 27 CAMERAS/EVFS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 28 CAMERAS/EVFS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 29 CAMERAS/EVFS: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 30 CAMERAS/EVFS: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 31 HMDS: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 32 HMDS: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 33 HMDS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 34 HMDS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 35 HMDS: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 36 HMDS: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 37 HMDS: MICRODISPLAY MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 38 HMDS: MICRODISPLAY MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 39 AR HMD: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 40 AR HMD: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 41 AR HMD: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 42 AR HMD: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 43 AR HMD: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 44 AR HMD: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 45 VR HMD: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 46 VR HMD: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 47 VR HMD: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 48 VR HMD: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 49 VR HMD: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 50 VR HMD: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 51 HEAD-UP DISPLAYS: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 52 HEAD-UP DISPLAYS: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 53 HEAD-UP DISPLAYS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 54 HEAD-UP DISPLAYS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 55 HEAD-UP DISPLAYS: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 56 HEAD-UP DISPLAYS: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 57 PROJECTORS: MICRODISPLAY MARKET, BY TYPE, 2020–2023 (USD MILLION)

- TABLE 58 PROJECTORS: MICRODISPLAY MARKET, BY TYPE, 2024–2029 (USD MILLION)

- TABLE 59 PROJECTORS: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 60 PROJECTORS: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 61 PROJECTORS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 62 PROJECTORS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 63 PROJECTORS: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 64 PROJECTORS: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 65 OTHER PRODUCTS: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 66 OTHER PRODUCTS: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 67 OTHER PRODUCTS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 68 OTHER PRODUCTS: MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 69 OTHER PRODUCTS: MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 70 OTHER PRODUCTS: MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 71 MICRODISPLAY MARKET, BY RESOLUTION, 2020–2023 (USD MILLION)

- TABLE 72 MICRODISPLAY MARKET, BY RESOLUTION, 2024–2029 (USD MILLION)

- TABLE 73 MICRODISPLAY MARKET, BY VERTICAL, 2020–2023 (USD MILLION)

- TABLE 74 MICRODISPLAY MARKET, BY VERTICAL, 2024–2029 (USD MILLION)

- TABLE 75 CONSUMER: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 76 CONSUMER: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 77 AUTOMOTIVE: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 78 AUTOMOTIVE: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 79 INDUSTRIAL & ENTERPRISE: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 80 INDUSTRIAL & ENTERPRISE: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 81 MILITARY, DEFENSE, AND AEROSPACE: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 82 MILITARY, DEFENSE, AND AEROSPACE: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 83 RETAIL & HOSPITALITY: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 84 RETAIL & HOSPITALITY: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 85 MEDICAL: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 86 MEDICAL: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 87 EDUCATION: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 88 EDUCATION: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 89 SPORTS & ENTERTAINMENT: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 90 SPORTS & ENTERTAINMENT: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 91 OTHER VERTICALS: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 92 OTHER VERTICALS: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 93 MICRODISPLAY MARKET, BY TECHNOLOGY, 2020–2023 (USD MILLION)

- TABLE 94 MICRODISPLAY MARKET, BY TECHNOLOGY, 2024–2029 (USD MILLION)

- TABLE 95 LCD: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 96 LCD: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 97 LCOS: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 98 LCOS: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 99 OLED: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 100 OLED: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 101 DLP: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 102 DLP: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 103 MICROLED: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 104 MICROLED: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 105 MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 106 MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 107 NORTH AMERICA: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 108 NORTH AMERICA: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 109 NORTH AMERICA: MICRODISPLAY MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 110 NORTH AMERICA: MICRODISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 111 EUROPE: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 112 EUROPE: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 113 EUROPE: MICRODISPLAY MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 114 EUROPE: MICRODISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 115 ASIA PACIFIC: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MICRODISPLAY MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MICRODISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 119 ROW: MICRODISPLAY MARKET, BY PRODUCT, 2020–2023 (USD MILLION)

- TABLE 120 ROW: MICRODISPLAY MARKET, BY PRODUCT, 2024–2029 (USD MILLION)

- TABLE 121 ROW: MICRODISPLAY MARKET, BY REGION, 2020–2023 (USD MILLION)

- TABLE 122 ROW: MICRODISPLAY MARKET, BY REGION, 2024–2029 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: MICRODISPLAY MARKET, BY COUNTRY, 2020–2023 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MICRODISPLAY MARKET, BY COUNTRY, 2024–2029 (USD MILLION)

- TABLE 125 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN MICRODISPLAY MARKET

- TABLE 126 MICRODISPLAY MARKET: DEGREE OF COMPETITION, 2023

- TABLE 127 COMPANY PRODUCT FOOTPRINT

- TABLE 128 COMPANY TECHNOLOGY FOOTPRINT

- TABLE 129 COMPANY VERTICAL FOOTPRINT

- TABLE 130 COMPANY REGION FOOTPRINT

- TABLE 131 MICRODISPLAY MARKET: KEY STARTUPS/SMES

- TABLE 132 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 133 MICRODISPLAY MARKET: PRODUCT LAUNCHES, 2020–2024

- TABLE 134 MICRODISPLAY MARKET: DEALS, 2020–2023

- TABLE 135 MICRODISPLAY MARKET: EXPANSIONS, 2020–2023

- TABLE 136 MICRODISPLAY MARKET: OTHER DEVELOPMENTS, 2020–2023

- TABLE 137 SONY GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 138 SONY GROUP CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 139 SONY GROUP CORPORATION: PRODUCT LAUNCHES

- TABLE 140 SONY GROUP CORPORATION: DEALS

- TABLE 141 SONY GROUP CORPORATION: EXPANSIONS

- TABLE 142 SEIKO EPSON CORPORATION: COMPANY OVERVIEW

- TABLE 143 SEIKO EPSON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 144 SEIKO EPSON CORPORATION: PRODUCT LAUNCHES

- TABLE 145 SEIKO EPSON CORPORATION: DEALS

- TABLE 146 SEEYA TECHNOLOGY: COMPANY OVERVIEW

- TABLE 147 SEEYA TECHNOLOGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 148 SEEYA TECHNOLOGY: PRODUCT LAUNCHES

- TABLE 149 KOPIN CORPORATION: COMPANY OVERVIEW

- TABLE 150 KOPIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 151 KOPIN CORPORATION: PRODUCT LAUNCHES

- TABLE 152 KOPIN CORPORATION: DEALS

- TABLE 153 KOPIN CORPORATION: OTHER DEVELOPMENTS

- TABLE 154 KOPIN CORPORATION: EXPANSIONS

- TABLE 155 EMAGIN: COMPANY OVERVIEW

- TABLE 156 EMAGIN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 157 EMAGIN: PRODUCT LAUNCHES

- TABLE 158 EMAGIN: DEALS

- TABLE 159 EMAGIN: OTHER DEVELOPMENTS

- TABLE 160 HIMAX TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 161 HIMAX TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 HIMAX TECHNOLOGIES, INC.: DEALS

- TABLE 163 HIMAX TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 164 HOLOEYE PHOTONICS AG: COMPANY OVERVIEW

- TABLE 165 HOLOEYE PHOTONICS AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 166 HOLOEYE PHOTONICS AG: DEALS

- TABLE 167 WISECHIP SEMICONDUCTOR INC.: COMPANY OVERVIEW

- TABLE 168 WISECHIP SEMICONDUCTOR INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 169 RAYSTAR OPTRONICS, INC.: COMPANY OVERVIEW

- TABLE 170 RAYSTAR OPTRONICS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 RAYSTAR OPTRONICS, INC.: PRODUCT LAUNCHES

- TABLE 172 WINSTAR DISPLAY CO., LTD.: COMPANY OVERVIEW

- TABLE 173 WINSTAR DISPLAY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 174 WINSTAR DISPLAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 175 WINSTAR DISPLAY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 176 YUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 177 YUNNAN OLIGHTEK OPTO-ELECTRONIC TECHNOLOGY CO., LTD.: PRODUCTS/ SERVICES/SOLUTIONS OFFERED

- FIGURE 1 MICRODISPLAY MARKET SEGMENTATION

- FIGURE 2 MICRODISPLAY MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 3 MICRODISPLAY MARKET: RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 5 DEMAND-SIDE ANALYSIS: MICRODISPLAY MARKET

- FIGURE 6 TOP-DOWN APPROACH TO ARRIVE AT MARKET SIZE

- FIGURE 7 SUPPLY-SIDE ANALYSIS: MICRODISPLAY MARKET

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 MICRODISPLAY MARKET SIZE, 2020–2029

- FIGURE 10 MICROLED SEGMENT TO PROGRESS AT HIGHEST CAGR BETWEEN 2024 AND 2029

- FIGURE 11 CONSUMER SEGMENT TO HOLD LARGEST SHARE OF MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 12 NTE DEVICES TO GROW FASTEST FROM 2024 TO 2029

- FIGURE 13 HD RESOLUTION TO LEAD MICRODISPLAY MARKET THROUGH FORECAST PERIOD

- FIGURE 14 MICRODISPLAY MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 GROWING APPLICATIONS OF NTE DEVICES ACROSS INDUSTRIES TO DRIVE MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 16 NTE DEVICES SEGMENT TO DOMINATE MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 17 OLED SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MICRODISPLAY MARKET BY 2029

- FIGURE 18 CONSUMER SEGMENT TO HOLD LARGEST SHARE OF MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 19 HD SEGMENT TO HOLD LARGEST SHARE OF MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 20 MICRODISPLAY MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 MICRODISPLAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MICRODISPLAY MARKET: SUPPLY CHAIN

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 IMPACT OF AI/GEN AI ON MICRODISPLAY MARKET

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 27 IMPACT OF PORTER'S FIVE FORCES ON MICRODISPLAY MARKET, 2023

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 30 PATENT ANALYSIS, 2014–2023

- FIGURE 31 IMPORT DATA FOR HS CODE 8537, BY KEY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 32 EXPORT DATA FOR HS CODE 8537, BY KEY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 33 AVERAGE SELLING PRICE OF MICRODISPLAY PANELS OFFERED BY KEY PLAYERS

- FIGURE 34 AVERAGE SELLING PRICE TREND OF OLED MICRODISPLAYS, BY REGION

- FIGURE 35 NTE DEVICES TO DOMINATE MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO LEAD MICRODISPLAY MARKET FOR HMDS DURING FORECAST PERIOD

- FIGURE 37 HD SEGMENT TO DOMINATE MARKET BETWEEN 2024 AND 2029

- FIGURE 38 CONSUMER SEGMENT TO LEAD MARKET THROUGH FORECAST PERIOD

- FIGURE 39 OLED SEGMENT TO DOMINATE MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 40 MICRODISPLAY MARKET, BY REGION

- FIGURE 41 ASIA PACIFIC TO COMMAND MICRODISPLAY MARKET DURING FORECAST PERIOD

- FIGURE 42 CHINA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: MICRODISPLAY MARKET SNAPSHOT

- FIGURE 44 EUROPE: MICRODISPLAY MARKET SNAPSHOT

- FIGURE 45 ASIA PACIFIC: MICRODISPLAY MARKET SNAPSHOT

- FIGURE 46 ROW: MICRODISPLAY MARKET SNAPSHOT

- FIGURE 47 MARKET SHARE ANALYSIS, 2023

- FIGURE 48 HISTORICAL REVENUE ANALYSIS OF MAJOR COMPANIES IN MICRODISPLAY MARKET, 2019–2023 (USD MILLION)

- FIGURE 49 COMPANY VALUATION (USD BILLION), 2023

- FIGURE 50 FINANCIAL METRICS (EV/EBITDA), 2023

- FIGURE 51 BRAND/PRODUCT COMPARISON

- FIGURE 52 MICRODISPLAY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 53 MICRODISPLAY MARKET: COMPANY FOOTPRINT

- FIGURE 54 MICRODISPLAY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 55 SONY GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 SEIKO EPSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 KOPIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 58 HIMAX TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 59 WINSTAR DISPLAY CO., LTD.: COMPANY SNAPSHOT

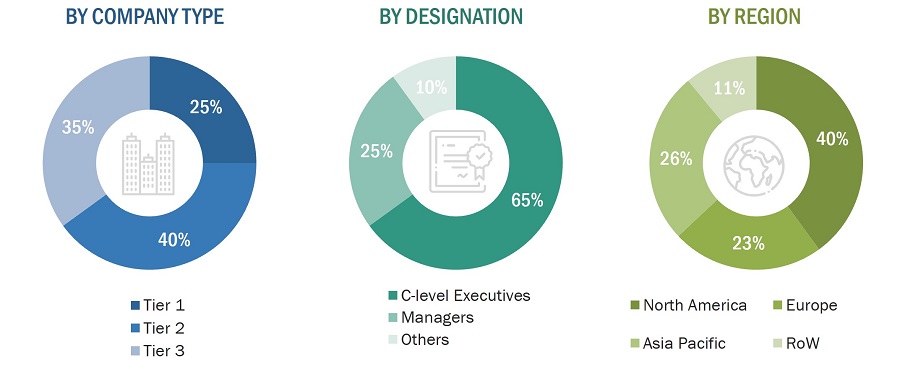

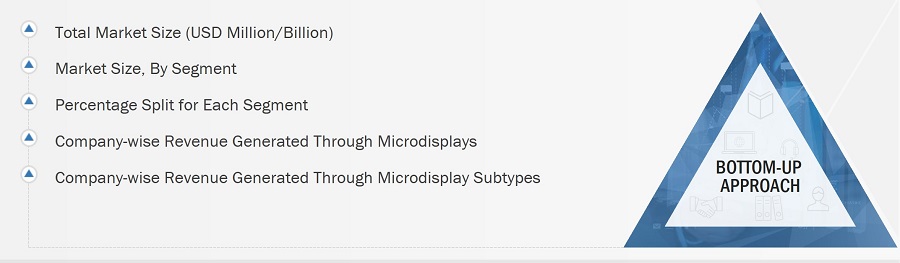

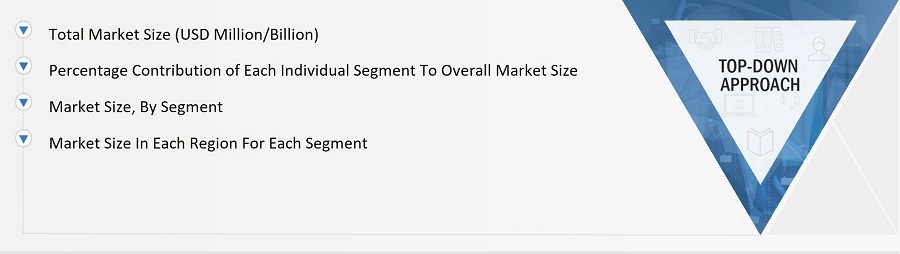

The study involved four major activities in estimating the microdisplay market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the microdisplay market. The secondary sources included the Consumer Technology Association (CES), Integrated Systems Europe, and Camera & Imaging Products Association (CIPA)); white papers, display-based marketing-related journals, certified publications, and articles by recognized authors; gold and silver standard websites; directories; and databases, annual reports, press releases, and investor presentations of companies.

The global size of the microdisplay market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the microdisplay market or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall microdisplay market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players’ annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Microdisplay Market Size: Bottom-Up Approach

Global Microdisplay Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. Data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

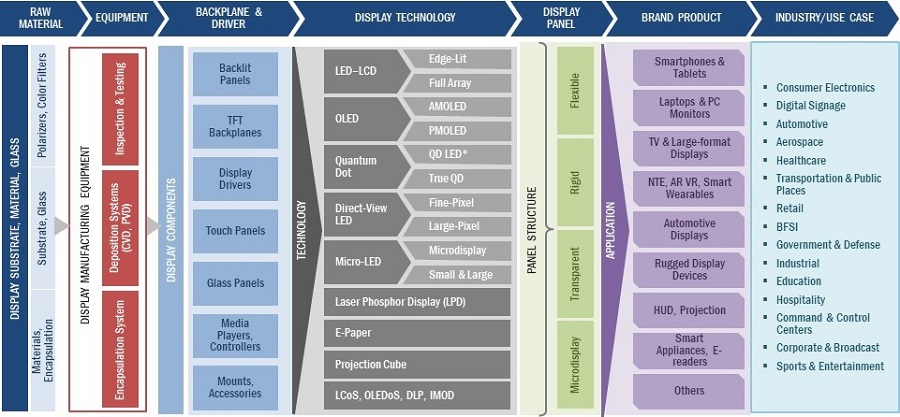

Microdisplays are microminiaturized displays with a diagonal screen size of less than 2 inch. They are manufactured using 4 key technologies—OLED, LCD, LCoS, MicroLED, and DLP. The small size, high resolution, and low power consumption of these displays make them ideal for use in head-mounted displays (HMDs), head-up displays (HUDs), electronic viewfinders (EVFs), and several other devices.

Key Stakeholders

- Raw material suppliers

- Brand Product Manufacturers/Original Equipment Manufacturers (OEMs)/Original Device Manufacturers (ODMs)

- Microdisplay Product Manufacturers

- Microdisplay Panel Manufacturers

- Semiconductor Component Suppliers/Foundries

- Manufacturing Equipment Suppliers

- Research organizations

- Technology investors

- Distributors and resellers

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users

Report Objectives

- To define, describe, estimate, and forecast the microdisplay market, in terms of value, on the basis of product, technology, resolution, brightness, and industry.

- To define, analyze and forecast the microdisplay market size, by product, in terms of volume

- To forecast the market size of concerned segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide a detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the value chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; regulations related to the microdisplay market; and investment and funding scenario.

- To profile key players and comprehensively analyze their market ranks and core competencies, along with detailing the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To track and analyze competitive developments such as product launches and acquisitions, and research and development (R&D) activities in the microdisplay market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape to the market leaders

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microdisplay Market

I want more details on the end-use application section of Microdisplay Market.

I am specifically interested in OLED technology market by product and region, is this covered in the report?

Looking for information relating specifically to near to eye device like Electronic viewfinder (EVF)/Camera and HMD. Overall market value and major players into this business.

Our company is interested in know more about microdisplay applications in industrial application, can you provide a dedicated study on this application.