Metering Pumps Market by Type (Diaphragm pump, Pistons/Plungers), End-Use Industry (Water Treatment, Petrochemicals and Oil & Gas, Chemical Processing, Pharmaceuticals), Pump drive (Motor, Solenoid, Pneumatic) and Region - Global Forecast to 2028

Metering Pumps Market Overview

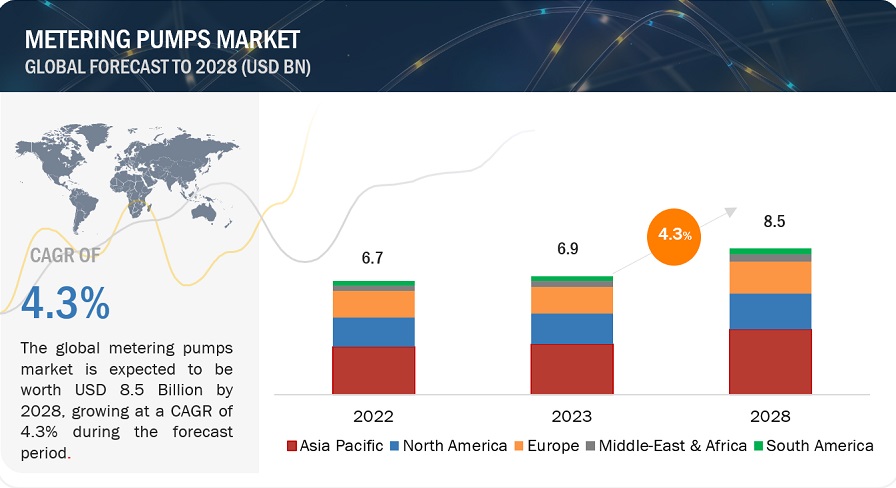

The metering pumps market size is estimated to be USD 6.9 billion in 2023 and is projected to reach USD 8.5 Billion by 2028, at a CAGR of 4.3%. Owing to significant growth due to increasing demand from end-use industries such as water-treatment, petrochemicals-and-oil & gas, chemical processing, pharmaceuticals, paper-&-pulp, textiles, automotive, and food & beverages, the market for metering pumps is expected to increase significantly in the forecast period. Additionally, rising stringent regulations for wastewater treatment by regulatory bodies such as the UN World Water Development and Environmental Protection Agency (EPA) will support market growth. For example, the Water Infrastructure Finance and Innovation Act (WIFIA), under which the authority funded up to USD 6.5 billion in total funding in 2022 to support USD 13 billion in water infrastructure projects, in turn, such developments will boost the demand for metering pumps.

The rising need for freshwater across Africa and the Middle East will drive the market for metering pumps. For instance, 27 water-poor countries in Africa hold only 0.63% of freshwater (UNESCO Regional Office for Eastern Africa, 2020). Also, according to the United Nations (UN), 2.2 billion people have no access to safe drinking access to safe drinking water, and water use is increasing by 1% yearly. Additionally, rising health awareness and chemical production will increase the demand for diaphragm pumps and other types of metering pumps across the chemical and pharmaceutical industries. Moreover, the growing industrial sector and rising demand for digital pumping solutions (DPS) and advanced technologies will provide immense opportunities for the growth of the metering pumps market in the forecast period.

Attractive Opportunities in the Metering Pumps Market

To know about the assumptions considered for the study, Request for Free Sample Report

Metering pumps Market Dynamics

Driver: Increasing pharmaceutical production capacity in different regions

In the recent past, there has been a substantial rise in the production of pharmaceuticals across the world. This is mainly attributed to the growing disease prevalence, increasing patient pool, rising health awareness, technological developments, and increasing healthcare spending. Also, the pharmaceutical industry in China and India has witnessed double-digit growth in production in the past few years. As the global pharmaceutical industry grows, the need for highly precise metering pumps for manufacturing pharmaceutical products will also grow significantly. Diaphragm, peristaltic, and syringe, among other pumps, are widely used in the pharmaceutical industry as they prevent the contamination of fluids, enabling safer transport of media. Companies manufacturing biological & medicinal products, processing botanical drugs & herbs, and isolating active medicinal extracts use peristaltic pumps. These pumps are mainly used in the formulation industry to manufacture pellets, tablets, and granules.

Restraint: Requirement of frequent maintenance

One of the majorly restraining factors in this market is that metering pump needs lot of maintenance on regular basis. These positive displacement pumps serve an important role in supplying precise fluid control, and as such play a key part within many influential industries including water treatment, chemical processing and pharmaceuticals. But they require constant maintenance and calibration - as well as regular cleaning or a need to replace parts, chalking up in downtime for companies.

Moreover, operational costs also rise with retention of skilled technicians. This constant need for maintenance can discourage customers about purchasing and encourage them to search another substitutes or technology which in turn is expected to impede the growth of metering pumps market. Training times can be lengthened if maintenance procedures are time-consuming, subsequently leading to unplanned downtime.

Opportunities: Growing preference for digital pumping solutions and advanced pumps

The end-use industries of metering pumps are advancing their technologies and process systems. For this purpose, end users need a metering system capable of monitoring the flow control, ensuring reliability, and operating efficiently. Unreliable mechanical instrumentation, remote locations, and multiple pump configurations are significant factors that necessitate the digitization of metering pumps.

End users are demanding mechanical systems with digital pumping solutions (DPS). DPS are built-in process controllers, diagnostic capabilities, and variable speed drives. These built-in diagnostics enable DPS to automatically detect abnormal pumping conditions, such as dry run, cavitation, and deadhead; subsequently, react accordingly to prevent damage to the pump or the system. These advantages of digital metering systems drive a new generation of digital metering pumps. These pumps offer increased accuracy, process control, and significant cost savings with digital monitoring technologies.

To monitor and achieve high performance, digitalization in metering pumps is growing, including operation at a full-length stroke and adjustment in stroke speed for better accuracy. These pumps have a better turndown ratio than traditional metering pumps.

Challenge: Rising Demand for Customization

One of the challenges in the metering pump market is the growing need for customization. As industries evolve and demand more specialized solutions, manufacturers are under pressure to tailor their metering pumps to meet unique requirements. This trend towards customization can be demanding in terms of engineering, production, and resources. It often leads to increased complexities in design, manufacturing, and supply chain management. Meeting these customization needs while maintaining cost-effectiveness and reliability poses a significant challenge for market players. Balancing standard product offerings with bespoke solutions becomes crucial in addressing this challenge and ensuring sustained market growth.

ECOSYSTEM

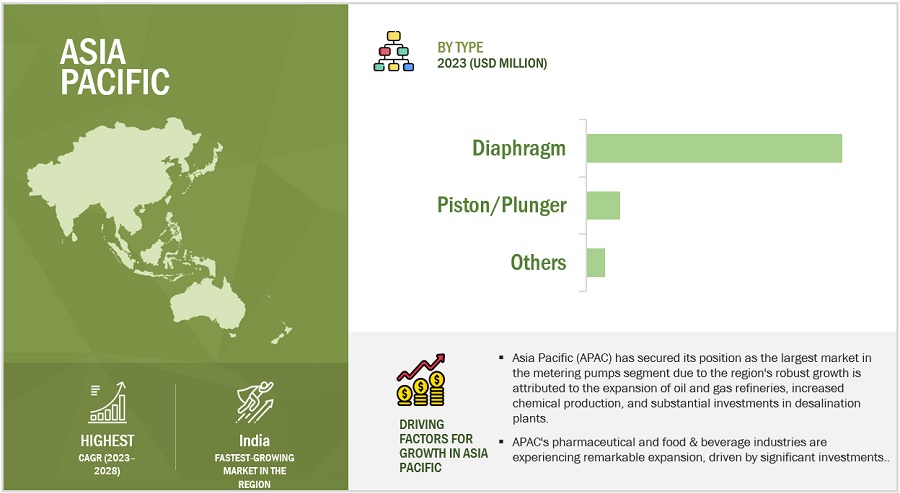

Diaphragm Pumps were the largest type in the metering pump market

The largest share in 2022 is for diaphragm pumps which has helped the metering pump market to grow because of its operating efficiency as well as safety and precision. Optimized for pumping various fluids including corrosive, slightly abrasive, and viscous liquids, diaphragm pumps enable high performance with minimum energy consumption which makes them cost-effective solutions that are well-suited to sectors such as water treatment - pharmaceuticals, or chemical industry. The product being conveyed also benefits from its rugged construction changing hands with minimal maintenance required, contributing to the ability to maintain its purity and stringent quality standards longer.

The calculated development of diaphragm pumps is even more driven by technical improvements such as electronic surveillance and also control systems, boosting their capability plus use. These pumps offer exact coupled with constant application necessary for exact chemical handling in different applications. Additionally, the rising need for efficient water therapy services plus the development of the pharmaceutical and chemical markets add to their market supremacy. With their placement to more stringent ecological guidelines coupled with the capability to lower discharges, diaphragm pumps stay vital in crucial markets, guaranteeing their proceeded market management.

The water treatment industry segment emerged as the dominant end-use industry in the metering pump market.

Water treatment arose as the leading end-use industry in the metering pump market in 2022. This prominence is tactically driven by the important role water treatment plays in ensuring tidy as well as secure water products for both commercial as well as residential usage. Metering pumps are crucial in water treatment procedures for their capacity to give accurate application of chemicals which is essential for keeping water high quality as well as conference strict regulative requirements.

The enhancing international need for fresh water driven by population development, commercial development as well as urbanization, has actually dramatically enhanced the requirement for innovative water treatment remedies. The water treatment industry's dependence on metering pumps for accurate and also effective chemical application emphasizes its leading market share as these pumps ensure the efficiency along integrity of water therapy procedures. This industry's fundamental function in dealing with water deficiency as well as top quality concerns highlights its dominance in the metering pump market.

The Motor-Driven Segment Accounted for the Largest Share in 2022

This segment's importance is recognized for the reliability, performance along accuracy of motor-driven metering pumps. Created for both reduced and also high-pressure applications, these pumps provide flexible stroke prices along with sizes enabling them to fulfill varied functional demands throughout numerous markets.

The need for motor-driven pumps is mostly driven by the chemical and water treatment industry where accurate chemical application is essential for procedure optimization together with regulative conformity. Their convenience as well as flexibility make motor-driven pumps important for these fields making sure regular and also exact liquid handling. In addition, the technical improvements in motor-driven pumps such as boosted automation together with control attributes, have better reinforced their market setting. These attributes not only just enhance functional effectiveness but also lower upkeep prices together with downtime supplying considerable calculated benefits to end-users. As markets proceed to look for dependable along with effective pumping remedies, the motor-driven segment is anticipated to keep its leading position out there.

Asia Pacific is estimated to account for the largest market share during the forecast period.

In 2022 the Asia Pacific (APAC) region arose as the major region in the metering pump market safeguarding the greatest market share. This region has seen a considerable rise in popularity as a result of the quick industrialization and also the expansion of essential fields such as oil & gas refineries as well as chemical manufacturing. Substantial financial investments in desalination plants to deal with water lack concerns have additionally reinforced the marketplace.

In addition, the pharmaceutical together with the food & beverage industry in APAC is experiencing durable development propelled by enhanced healthcare investment plus increasing customer need for refined foods. This has resulted in better fostering of metering pumps for accurate chemical application and also process optimization. Urbanization and also population development have better intensified the requirement for clean water driving the need for innovative water treatment solutions where metering pumps play a critical role.

Strategically APAC's market prominence is sustained by the region's infrastructural growth coupled with technical advancements in metering pump services. Federal governments are spending greatly in boosting water administration systems together making persistent development for the metering pump market in the region. This thorough growth method guarantees that APAC stays at the center of the international metering pump market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Metering pumps market comprises key manufacturers such as IDEX Corporation (US), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), Grundfos HoldingA/S (Denmark), SEKO S.P.A. (Italy), and others. Expansions, mergers & acquisitions, new product launches, and deals were some of the major strategies adopted by these key players to enhance their positions in the metering pumps market. A major focus was given to the expansions and deals.

Read More: Metering Pumps Companies

Want to explore hidden markets that can drive new revenue in Metering Pumps Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Metering Pumps Market?

|

Report Metric |

Details |

|

Market size available for years |

2021–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) and Volume (Units) |

|

Segments covered |

Type, End-Use industry, Pump Drive, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, South America, and Middle East & Africa. |

|

Companies covered |

IDEX Corporation (US), Ingersoll Rand (US), Dover Corporation (US), ProMinent (Germany), SEKO S.P.A (Italy), Grundfos Holding A/S (Denmark) are the top manufacturers covered in the metering pumps market. |

This research report categorizes the metering pumps market based on type, end-use industry, pump drive, and region.

Metering pumps Market, By Type

- Diaphragm Pumps

- Piston/Plunger Pumps

- Other Types

Metering pumps Market, By End Use Industry

- Water Treatment

- Petrochemicals, & Oil & Gas

- Chemical Processing

- Pharmaceuticals

- Food & Beverages

- Pulp & Paper

- Automotive

- Textile

- Other End-use Industries

Metering pumps Market, By Pump Drive

- Motor-driven

- Pneumatic-driven

- Solenoid-driven

- Other Pump drives

Metering pumps Market, By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In September 2022, Idex Corporation acquired Muon BV and its subsidiaries (Muon Group).

- In March 2022, Idex Corporation acquired KZValve which specializes in manufacturing electric valves and controllers for several end markets.

- In January 2021, Idex Corporation acquired Abel Pumps, L.P., and its affiliates (ABEL) in a USD 103.5 million deal.

- In March 2022, Graco expanded its business in the hose pump line. The Solo Tech range included models for hygienic applications and additional sizes for industrial installations.

- In August 2022, Graco Inc. announced the purchase of approximately twenty acres of land adjacent to the company's existing Anoka facility for future expansion of business.

- In August 2022, Grundfos launched an expansion of the range of extra-large CR pumps, taking current energy efficiency and performance standards for vertical multi-stage in-line pumps to the next level.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the metering pump market?

The major drivers influencing the growth of the metering pump market are increasing capacity additions and stringent regulations regarding wastewater treatment. Increasing pharmaceutical production is also major driver.

What are the major challenges in the metering pump market?

The major challenge in the metering pump market is the growing demand for customization of products and very little scope for product differentiation.

What are the restraining factors in the metering pump market?

The major restraining factors faced by the metering pump market are rising oil prices, economic slowdown, raw material price fluctuations, and stringent environmental regulations and compliance requirements.

What is the key opportunity in the metering pump market?

The increasing capacity expansions, joint ventures, and growing preference for digital solutions in pumping are major opportunities that can be explored further.

What are the different types of metering pumps considered in the metering pumps market?

The metering pumps are of different types like – Diaphragm pumps, pistons/plungers and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

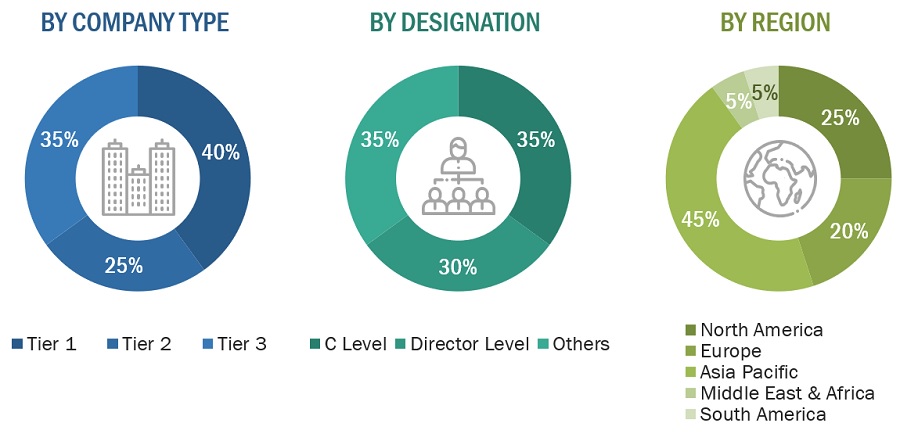

The study involved four major activities for estimating the current size of the global metering pumps market. Exhaustive secondary research was carried out to collect information on the market, the peer product market, and the parent product group market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of metering pumps through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the metering pumps market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the metering pumps market. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; regulatory bodies, trade directories, and databases.

Primary Research

The metering pumps market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the metering pumps market. Primary sources from the supply side include associations and institutions involved in the metering pumps industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents

Notes: Other designations include product, sales, and marketing managers.

Tiers of the companies are classified based on their annual revenues as of 2022, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3= <USD 1 Billion.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the size of the global metering pumps market. These approaches were also used extensively to estimate the size of various segments of the market. The research methodology used to estimate the market size included the following details:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments of the metering pumps market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

In addition, the market size was validated by using both the top-down and bottom-up approaches. Then, it was verified through primary interviews. Hence, for every data segment, there are three sources—top-down approach, bottom-up approach, and expert interviews. The data were assumed to be correct when the values arrived at from the three sources matched.

Market Definition

Metering pumps, in the context of industrial equipment and fluid handling systems, are specialized devices designed for precise and controlled delivery of fluids at predetermined flow rates and volumes. These pumps are primarily used for accurate chemical injection or dosing of liquids into various processes, often in industries such as water treatment, chemical manufacturing, pharmaceuticals, petrochemicals, food and beverage, and pulp and paper production. Metering pumps play a crucial role in ensuring the consistent and reliable addition of chemicals, additives, or reagents into fluid streams, maintaining optimal process conditions, and complying with strict quality and environmental standards.

Key Stakeholders

- Raw material suppliers

- Metering pumps manufacturers

- Government & regulatory bodies

- Research organizations

- Associations and industry bodies

- End users

- Traders and distributors

Report Objectives

- To define, analyze, and project the size of the metering pumps market in terms of value and volume based on type, end-use industry and region.

- To project the size of the market and its segments with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders.

- To analyze the competitive developments, such as new product launches, expansions, and acquisitions, in the metering pumps market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC market

- Further breakdown of Rest of Europe market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metering Pumps Market

Information on Metering pumps market size in the water treatment application.

Competative profiles needed for europe and america

Metering Pumps market report

Information on Metering pumps, disinfection techniques such as UV, Ozone, ClO2 and electrolysis for water treatment applications.

Interested in Dosing Pump market

General information on the growth of metering pumps market