Marble Market by Color (White, Black, Yellow, Red, and Others), Application (Building & Construction, Statues & Monuments, Furniture), and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) - Global Forecast to 2025

Updated on : June 18, 2024

Marble Market

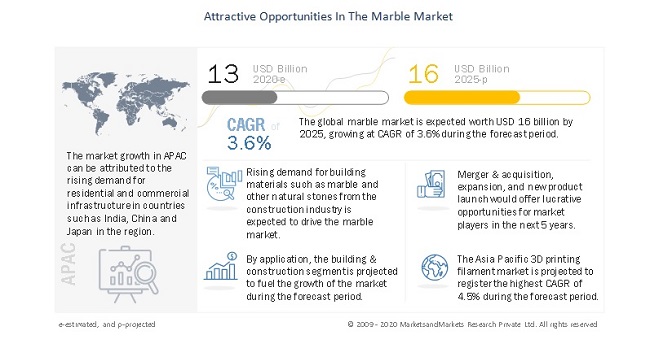

The global marble market was valued at USD 13 billion in 2020 and is projected to reach USD 16 billion by 2025, growing at 3.6% cagr from 2020 to 2025. Marble is metamorphosed limestone, which are composed of recrystallized carbonate minerals such as calcite or dolomite. Marble has physical properties such as strength, hardness, variation in color, texture, and pattern among others, which makes it highly suitable for luxurious and aesthetical application in construction industry. Hence, rising demand for infrastructure development in developing economies and growth of construction industry in Asia Pacific region is a major driving factor for the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 outbreak on the marble market

The COVID-19 outbreak started from Wuhan in China has spread across all the major economies in the world. The marble market has been slightly impacted due to the outbreak of COVID-19 as most of the marble quarries and production units are located in the countries that are highly impacted due to coronavirus. Also, major manufacturers of marble have their headquarters and principal subsidiaries in the impacted countries. The disruption caused by the COVID-19 outbreak has impacted the supply chain of the marble market due to low demand from construction industry. Temporary halt in construction activities in the first half of 2020 in many countries has slowed down the operation in the marble market. However, marble manufacturer are offering their products for residential and commercial infrastructure development following the rapid demand from emerging economies such as China and India.

Marble Market Dynamics

Driver: Easy and bulk availability of marble

Marble is a very common natural stone composed of calcite mineral. Marble quarries are widely available across the world. There are huge and high-quality quarries of marble in countries such as the US, Italy, Turkey, and Spain, which meet the global demand for good quality marble for residential, industrial, and commercial infrastructures. In each country, there are huge marble quarries that lead to easy availability and logistics of marble for further processing into the final product. Marble is extracted from open-pit mines that range from small to very large scale. Marble mining is a capital-intensive process, and due to the availability of a large number of quarries around the world, the cost of transportation and logistics are minimized.

Restraint: Availability of cost-effective substitutes

Marble is principally used in the construction industry for various applications. However, marble is being replaced by natural stones, such as granite and kaolin. Granite and kaolin are widely used in the construction industry as a replacement of marble due to their comparatively low cost. They also offer similar features. Kaolin has been readily adopted as a building material, particularly in decorative infrastructure and has diversified applications as compared to marble. It is widely used in the production of paper, ceramics & sanitary wares, plastics, rubbers, and pharmaceuticals, among others. Granite is mostly used in the construction of residential and commercial infrastructure, and it is a direct substitute of marble at a comparatively low price. Granite and kaolin are strong, yet lightweight materials and are easy to cut, process, sculpt, and carve, whereas marble is brittle and heavy. Thus, the availability of alternative materials, such as kaolin and granite, is acting as a restraint to the growth of the marble market. Artificial marble is also replacing the use of natural marble as the former can be developed in any desired designs, colors, and texture, which cannot be found in natural marbles. It is also inexpensive in comparison to natural marble.

Based on color, white segment is projected to lead the marble market, during the forecast period

White colored marble are the widely used marble in the construction industry, and it is estimated to lead the market during the forecast period as well. A wide range of white marbles with different textures and patterns are most widely used in the construction of decorative or architectural infrastructures and sculptures. White marbles are majorly the facing stone in exterior applications such as flooring, walls, and columns. Asia Pacific region is the largest consumer of white colored marbles in the market market. Countries such as China, India, Japan, and South Korea are the major consumers of white colored marble in the Asia Pacific region.

Based on application, the building & construction segment is projected to witness the highest growth in the marble market during the forecast period

The building & construction segment is estimated to register highest growth in the marble market during the forecast period, owing to the increasing demand for residential and non-residential infrastructure development. In building & construction application, marble is highly preferred building material for application areas such as flooring, columns, and walls owing to its physical properties. Rising demand for infrastructure development in developing countries such as China and India is fuelling the growth of building & construction application segment in the marble market. The construction industry is slightly impacted following the outbreak COVID-19, that has led to a temporary halt in the construction activities in the first half of 2020. However, construction industry is expected to recover and resume from the second half of 2020.

To know about the assumptions considered for the study, download the pdf brochure

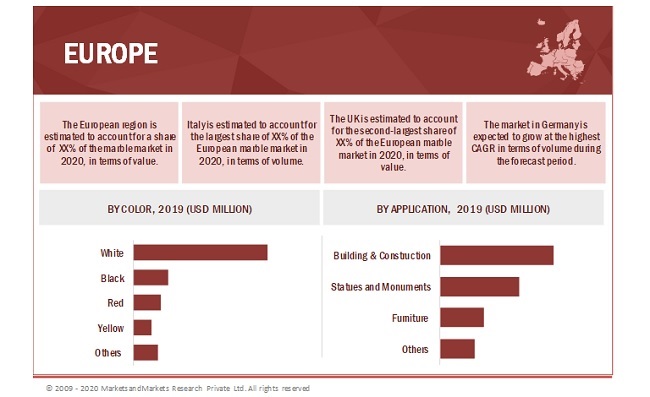

Europe is projected to lead the marble market, during the forecast period

The European region is expected to lead the marble market during the forecast period. The growth can be attributed to the high demand for marble in countries such as the Italy, the UK, and Spain across the application areas such as building & construction, statues and monuments, and furniture. The region being the largest consumer of marble in the building & construction application area, offers high growth opportunities for marbles in residential and commercial infrastructure development. In addition, the region is the largest market for marbles in furniture application. Also, a large cluster of marble key manufacturers is headquartered in the region that operate in the market by adopting organic and inorganic strategies to stay competitive in the market.

Marble Market Players

Levantina y Asociados de Minerales, S.A. (Spain), Temmer Marble (Turkey), Hellenic Granite Company (Greece), Fox Marble Holdings plc (UK), California Crafted Marble, Inc. (US), Topalidis S.A. (Greece), Dimpomar - Rochas Portuguesas Lda (Portugal), Polycor Inc. (Canada), Asian Granito India Limited (India), NAMCO CO. srl (Italy), Dal-Tile Corporation (US), Kangli Stone Group (China), Hilltop Granites (India), First Marble & Granite (Qatar), Santucci Group (Italy), Classic Marble Company (India), and DELTA Marble, Mining, Construction Import and Export Inc. (Turkey) among others, are the major players in the marble market. These players have been focusing on strategies such as partnerships, collaborations, new product launches, new product developments, acquisitions, agreements, joint ventures, and expansions, which have helped them expand their businesses in untapped and potential markets. They have also been adopting various organic and inorganic growth strategies, such as merger & acquisition, expansion, and new product launch, to enhance their current position in the marble market.

Marble Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 13 billion |

|

Revenue Forecast in 2025 |

USD 16 billion |

|

CAGR |

3.6% |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (Million Ton) and Value (USD Million) |

|

Segments covered |

Color, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and Middle East & Africa |

|

Companies covered |

Levantina y Asociados de Minerales, S.A. (Spain), Temmer Marble (Turkey), Hellenic Granite Company (Greece), Fox Marble Holdings plc (UK), California Crafted Marble, Inc. (US), Topalidis S.A. (Greece), Dimpomar - Rochas Portuguesas Lda (Portugal), Polycor Inc. (Canada), Asian Granito India Limited (India), NAMCO CO. srl (Italy), Dal-Tile Corporation (US), Kangli Stone Group (China), Hilltop Granites (India), First Marble & Granite (Qatar), Santucci Group (Italy), Classic Marble Company (India), and DELTA Marble, Mining, Construction Import and Export Inc. (Turkey) among others. |

On the basis of color, the marble market is segmented as follows:

- White

- Black

- Yellow

- Red

- Others (Pink, Brown, and Grey)

On the basis of application, the marble market is segmented as follows:

- Building & Construction

- Statues and Monuments

- Furniture

- Others (Cemetery Markers, Public Infrastructure, and Crockeries)

On the basis of region, the marble market is segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In October 2019, Polycor Inc. acquired Elliott Stone Company Inc. (US), a leading quarrier and fabricator of Indiana limestone. The acquisition will reinforce the company’s leading position as the global natural stone quarrier and further strengthen its portfolio of hardscapes and masonry products.

- In October 2018, Polycor Inc. completed merger with Indiana Limestone Company (Indiana), a leading dimensional limestone quarrier and building products producer. This merger positioned the company as a global leader in the natural stone industry.

- In March 2018, California Crafted Marble Inc. installed top-of-the-line machinery, BACA Robo Waterjet, to cut the marble stones straight and curved. This machinery helped the company improve the quality of its marble products and to meet the demand effectively.

Frequently Asked Questions (FAQ):

What is a marble and what is its use?

A marble is a granular limestone, which has been recrystallized under the influence of heat, pressure, and aqueous solutions. Famous for its rich and aesthetical appeal, marble is highly preferred building material in interior and extreriors applications in the construction industry.

Can marbles be used for large scale construction activities?

Yes, marbles can be used for large scale construction activities as they offer effective physical strength and aethtical appeal to the structures. For example, monuments such as Taj Mahal (india), The Supreme Court Building (US), and The Pantheon (Italy) are huge ancient structures built with the use of marble in the interiors and extreriors.

Which countries are the major producers of marble?

Countries such as Italy, Turkey, China, Turkey, Philippines, France, and Brazil among others are some of the leading producers of marble across the world. Italian marble is renowned and widely used in construction industry.

Who are the leading marble provider in the world?

Key players such as includes as Levantina y Asociados de Minerales, S.A. (Spain), Temmer Marble (Turkey), Hellenic Granite Company (Greece), Fox Marble Holdings plc (UK), California Crafted Marble, Inc. (US), Topalidis S.A. (Greece), Dimpomar - Rochas Portuguesas Lda (Portugal), Polycor Inc. (Canada), Asian Granito India Limited (India), NAMCO CO. srl (Italy), are engaged in mining/quarrying, processing, and distribution of marble.

Which countries have the major quarries of marble?

Italy and Turkey have the most number of marble quarries in the world and these countries are engaged in exporting marble worldwide. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET SCOPE

1.2.2 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 UNIT CONSIDERED

1.5 STAKEHOLDERS

1.6 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 MARKET DEFINITION AND SCOPE

2.2 MARKET ENGINEERING PROCESS

2.2.1 TOP-DOWN APPROACH

FIGURE 1 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.2.2 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 ASSUMPTIONS

2.4 RESEARCH DATA

2.4.1 SECONDARY DATA

2.4.1.1 Key data from secondary sources

2.4.2 PRIMARY DATA

2.4.2.1 Key data from primary sources

2.4.2.2 Breakdown of primary interviews

2.4.2.3 Key industry insights

2.5 BASE NUMBER CALCULATION

3 EXECUTIVE SUMMARY (Page No. - 30)

FIGURE 3 WHITE SEGMENT TO DOMINATE THE MARBLE MARKET FROM 2020 TO 2025

FIGURE 4 BUILDING & CONSTRUCTION SEGMENT TO LEAD THE MARBLE MARKET FROM 2020 TO 2025

FIGURE 5 MARBLE MARKET IN ASIA PACIFIC TO REGISTER THE HIGHEST CAGR

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 ATTRACTIVE OPPORTUNITIES IN MARBLE MARKET

FIGURE 6 GROWTH OF CONSTRUCTION INDUSTRY TO DRIVE THE MARBLE MARKET

4.2 MARBLE MARKET, BY COLOR AND APPLICATION, 2019

FIGURE 7 BUILDING & CONSTRUCTION AND WHITE MARBLE SEGMENTS ACCOUNTED FOR LARGEST SHARES

4.3 MARBLE MARKET, BY COUNTRY

FIGURE 8 MARBLE MARKET IN INDIA TO REGISTER THE HIGHEST CAGR

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 9 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARBLE MARKET

5.2.1 DRIVERS

5.2.1.1 Growth of construction industry leading to high demand for building materials

5.2.1.2 Easy and bulk availability of marble

5.2.2 RESTRAINTS

5.2.2.1 Availability of cost-effective substitutes

5.2.2.2 Damage due to acid reaction

5.2.3 OPPORTUNITIES

5.2.3.1 Potential applications of marble in various industries

5.2.4 CHALLENGES

5.2.4.1 Health hazards caused by exposure to marble and marble dust

5.2.4.2 Environmental risks related to marble mining activities

5.3 VALUE CHAIN ANALYSIS

5.4 PORTER'S FIVE FORCES ANALYSIS

FIGURE 10 PORTER'S FIVE FORCES ANALYSIS OF MARBLE MARKET

5.4.1 BARGAINING POWER OF BUYERS

5.4.2 BARGAINING POWER OF SUPPLIERS

5.4.3 THREAT OF NEW ENTRANTS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 ENVIRONMENTAL AND SOCIAL RISKS

5.5.1 SOCIAL RISKS

5.5.2 ENVIRONMENTAL RISKS

5.6 IMPACT OF COVID-19 ON MARBLE MARKET

5.6.1 DISRUPTION IN APPLICATIONS OF MARBLE

5.6.2 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY

6 MARBLE MARKET, BY COLOR (Page No. - 47)

6.1 INTRODUCTION

TABLE 1 MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 2 MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

6.2 MARBLE, BY COLOR

6.2.1 WHITE

TABLE 3 WHITE MARBLE MARKET SIZE, BY REGION, 2018-2025 (MILLION TON)

TABLE 4 WHITE MARBLE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

6.2.2 BLACK

TABLE 5 BLACK MARBLE MARKET SIZE, BY REGION, 2018-2025 (MILLION TON)

TABLE 6 BLACK MARBLE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

6.2.3 YELLOW

TABLE 7 YELLOW MARBLE MARKET SIZE, BY REGION, 2018-2025 (MILLION TON)

TABLE 8 YELLOW MARBLE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

6.2.4 RED

TABLE 9 RED MARBLE MARKET SIZE, BY REGION, 2018-2025 (MILLION TON)

TABLE 10 RED MARBLE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

6.2.5 OTHERS

TABLE 11 OTHER COLORS: MARBLE MARKET SIZE, BY REGION, 2018-2025 (MILLION TON)

TABLE 12 OTHER COLORS: MARBLE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7 MARBLE MARKET, BY APPLICATION (Page No. - 53)

7.1 INTRODUCTION

TABLE 13 MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 14 MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

7.2 BUILDING & CONSTRUCTION

7.2.1 RISING CONSUMPTION OF ARTIFICIAL MARBLE IN RESIDENTIAL AND COMMERCIAL INFRASTRUCTURE TO FUEL THE MARKET

TABLE 15 MARBLE MARKET SIZE IN BUILDING & CONSTRUCTION APPLICATION, BY REGION, 2018-2025 (MILLION TON)

TABLE 16 MARBLE MARKET SIZE IN BUILDING & CONSTRUCTION APPLICATION, BY REGION, 2018-2025 (USD MILLION)

7.3 STATUES AND MONUMENTS

7.3.1 ABILITY TO WITHSTAND HIGH POLISHING BOOSTING THE DEMAND FOR NATURAL MARBLE IN THIS SEGMENT

TABLE 17 MARBLE MARKET SIZE IN STATUES AND MONUMENTS APPLICATION, BY REGION, 2018-2025 (MILLION TON)

TABLE 18 MARBLE MARKET SIZE IN STATUES AND MONUMENTS APPLICATION, BY REGION, 2018-2025 (USD MILLION)

7.4 FURNITURE

7.4.1 WIDE USE OF MARBLE IN FURNITURE TO DRIVE THE MARKET

TABLE 19 MARBLE MARKET SIZE IN FURNITURE APPLICATION, BY REGION, 2018-2025 (MILLION TON)

TABLE 20 MARBLE MARKET SIZE IN FURNITURE APPLICATION, BY REGION, 2018-2025 (USD MILLION)

7.5 OTHERS

TABLE 21 MARBLE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (MILLION TON)

TABLE 22 MARBLE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

8 MARBLE MARKET, BY REGION (Page No. - 59)

8.1 INTRODUCTION

FIGURE 11 ASIA PACIFIC TO REGISTER THE HIGHEST CAGR

TABLE 23 MARBLE MARKET SIZE, BY REGION, 2018-2025 (MILLION TON)

TABLE 24 MARBLE MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.2 EUROPE

FIGURE 12 EUROPE: MARBLE MARKET SNAPSHOT

8.2.1 EUROPE: MARBLE MARKET, BY COUNTRY

TABLE 25 EUROPE: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION TON)

TABLE 26 EUROPE: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

8.2.2 EUROPE: MARBLE MARKET, BY COLOR

TABLE 27 EUROPE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 28 EUROPE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.3 EUROPE: MARBLE MARKET, BY APPLICATION

TABLE 29 EUROPE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 30 EUROPE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.2.4 GERMANY

8.2.4.1 Germany to lead the market in Europe

8.2.4.2 By color

TABLE 31 GERMANY: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 32 GERMANY: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.4.3 By application

TABLE 33 GERMANY: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 34 GERMANY: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.2.5 UK

8.2.5.1 Growth of construction sector to drive the demand for marble

8.2.5.2 By color

TABLE 35 UK: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 36 UK: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.5.3 By application

TABLE 37 UK: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 38 UK: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.2.6 FRANCE

8.2.6.1 Increasing demand for marble in building & construction application to fuel the market

8.2.6.2 By color

TABLE 39 FRANCE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 40 FRANCE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.6.3 By application

TABLE 41 FRANCE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 42 FRANCE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.2.7 ITALY

8.2.7.1 Largest producer of marbles in the world

8.2.7.2 By color

TABLE 43 ITALY: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 44 ITALY: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.7.3 By application

TABLE 45 ITALY: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 46 ITALY: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.2.8 SPAIN

8.2.8.1 Growing infrastructural activities to drive the market

8.2.8.2 By color

TABLE 47 SPAIN: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 48 SPAIN: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.8.3 By application

TABLE 49 SPAIN: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 50 SPAIN: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.2.9 REST OF EUROPE

8.2.9.1 By color

TABLE 51 REST OF EUROPE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 52 REST OF EUROPE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.2.9.2 By application

TABLE 53 REST OF EUROPE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 54 REST OF EUROPE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.3 ASIA PACIFIC

FIGURE 13 ASIA PACIFIC: MARBLE MARKET SNAPSHOT

8.3.1 ASIA PACIFIC: MARBLE MARKET, BY COUNTRY

TABLE 55 ASIA PACIFIC: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION TON)

TABLE 56 ASIA PACIFIC: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

8.3.2 ASIA PACIFIC: MARBLE MARKET, BY COLOR

TABLE 57 ASIA PACIFIC: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 58 ASIA PACIFIC: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.3.3 ASIA PACIFIC: MARBLE MARKET, BY APPLICATION

TABLE 59 ASIA PACIFIC: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 60 ASIA PACIFIC: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.3.4 CHINA

8.3.4.1 China to lead the Asia Pacific marble market

8.3.4.2 By color

TABLE 61 CHINA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 62 CHINA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.3.4.3 By application

TABLE 63 CHINA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 64 CHINA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.3.5 INDIA

8.3.5.1 Residential, commercial, and industrial infrastructural development to fuel the market in India

8.3.5.2 By color

TABLE 65 INDIA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 66 INDIA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.3.5.3 By application

TABLE 67 INDIA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 68 INDIA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.3.6 JAPAN

8.3.6.1 One of the developed markets for marble

8.3.6.2 By color

TABLE 69 JAPAN: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 70 JAPAN: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.3.6.3 By application

TABLE 71 JAPAN: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 72 JAPAN: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.3.7 SOUTH KOREA

8.3.7.1 Increase in marble imports to propel the market

8.3.7.2 By color

TABLE 73 SOUTH KOREA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 74 SOUTH KOREA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.3.7.3 By application

TABLE 75 SOUTH KOREA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 76 SOUTH KOREA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.3.8 REST OF ASIA PACIFIC

8.3.8.1 By color

TABLE 77 REST OF ASIA PACIFIC: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 78 REST OF ASIA PACIFIC: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.3.8.2 By application

TABLE 79 REST OF ASIA PACIFIC: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 80 REST OF ASIA PACIFIC: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.4 NORTH AMERICA

FIGURE 14 NORTH AMERICA: MARBLE MARKET SNAPSHOT

8.4.1 NORTH AMERICA: MARBLE MARKET SIZE, BY COUNTRY

TABLE 81 NORTH AMERICA: MARBLE MARKET, BY COUNTRY, 2018-2025 (MILLION TON)

TABLE 82 NORTH AMERICA: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

8.4.2 NORTH AMERICA: MARBLE MARKET, BY COLOR

TABLE 83 NORTH AMERICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 84 NORTH AMERICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.4.3 NORTH AMERICA: MARBLE MARKET, BY APPLICATION

TABLE 85 NORTH AMERICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 86 NORTH AMERICA: MARBLE MARKET SIZE, APPLICATION, 2018-2025 (USD MILLION)

8.4.4 US

8.4.4.1 The US to lead the North American marble market

8.4.4.2 By color

TABLE 87 US: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 88 US: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.4.4.3 By application

TABLE 89 US: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 90 US: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.4.5 CANADA

8.4.5.1 Growth of non-residential construction sector to fuel the market

8.4.5.2 By color

TABLE 91 CANADA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 92 CANADA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.4.5.3 By application

TABLE 93 CANADA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 94 CANADA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.4.6 MEXICO

8.4.6.1 Increasing demand from construction industry to boost the market

8.4.6.2 By color

TABLE 95 MEXICO: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 96 MEXICO: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.4.6.3 By application

TABLE 97 MEXICO: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 98 MEXICO: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

FIGURE 15 MIDDLE EAST & AFRICA: MARBLE MARKET SNAPSHOT

8.5.1 MIDDLE EAST & AFRICA: MARBLE MARKET, BY COUNTRY

TABLE 99 MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION TON) 92

TABLE 100 MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION) 93

8.5.2 MIDDLE EAST & AFRICA: MARBLE MARKET, BY COLOR

TABLE 101 MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON) 93

TABLE 102 MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION) 93

8.5.3 MIDDLE EAST & AFRICA: MARBLE MARKET, BY APPLICATION

TABLE 103 MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION) 94

TABLE 104 MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON) 94

8.5.4 TURKEY

8.5.4.1 Increase in marble exports to propel the market

8.5.4.2 By color

TABLE 105 TURKEY: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 106 TURKEY: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.5.4.3 By application

TABLE 107 TURKEY: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON) 95

TABLE 108 TURKEY: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION) 96

8.5.5 UAE

8.5.5.1 Growth in consumption of marble in non-residential infrastructure to fuel the market

8.5.5.2 By color

TABLE 109 UAE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 110 UAE: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.5.5.3 By application

TABLE 111 UAE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 112 UAE: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.5.6 IRAN

8.5.6.1 Increase in demand for housing units to drive the market

8.5.6.2 By color

TABLE 113 IRAN: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 114 IRAN: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.5.6.3 By application

TABLE 115 IRAN: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 116 IRAN: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.5.7 REST OF MIDDLE EAST & AFRICA

8.5.7.1 By color

TABLE 117 REST OF MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 118 REST OF MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.5.7.2 By application

TABLE 119 REST OF MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 120 REST OF MIDDLE EAST & AFRICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

8.6 SOUTH AMERICA

FIGURE 16 SOUTH AMERICA: MARBLE MARKET SNAPSHOT

8.6.1 SOUTH AMERICA: MARBLE MARKET, BY COUNTRY

TABLE 121 SOUTH AMERICA: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (MILLION TON) 101

TABLE 122 SOUTH AMERICA: MARBLE MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION) 102

8.6.2 SOUTH AMERICA: MARBLE MARKET, BY COLOR

TABLE 123 SOUTH AMERICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON) 102

TABLE 124 SOUTH AMERICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION) 102

8.6.3 SOUTH AMERICA: MARBLE MARKET, BY APPLICATION

TABLE 125 SOUTH AMERICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON) 102

TABLE 126 SOUTH AMERICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION) 103

8.6.4 BRAZIL

8.6.4.1 Largest producer as well as consumer of natural stones in the region

8.6.4.2 By color

TABLE 127 BRAZIL: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON)

TABLE 128 BRAZIL: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION)

8.6.4.3 By application

TABLE 129 BRAZIL: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON) 104

TABLE 130 BRAZIL: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION) 104

8.6.5 REST OF SOUTH AMERICA

8.6.5.1 By color

TABLE 131 REST OF SOUTH AMERICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (MILLION TON) 105

TABLE 132 REST OF SOUTH AMERICA: MARBLE MARKET SIZE, BY COLOR, 2018-2025 (USD MILLION) 105

8.6.5.2 By application

TABLE 133 REST OF SOUTH AMERICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (MILLION TON)

TABLE 134 REST OF SOUTH AMERICA: MARBLE MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 107)

9.1 INTRODUCTION

9.2 COMPETITIVE LEADERSHIP MAPPING

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING COMPANIES

FIGURE 17 MARBLE MARKET COMPETITIVE LEADERSHIP MAPPING, 2019

9.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 18 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARBLE MARKET

9.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 19 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARBLE MARKET

9.5 MARKET SHARE OF KEY PLAYERS

FIGURE 20 SHARE OF KEY PLAYERS IN MARBLE MARKET, 2019

10 COMPANY PROFILES (Page No. - 112)

(Business Overview, Products Offered, SWOT Analysis, and Mnm View)*

10.1 LEVANTINA Y ASOCIADOS DE MINERALES, S.A.

FIGURE 21 LEVANTINA Y ASOCIADOS DE MINERALES, S.A.: SWOT ANALYSIS

10.2 TEMMER MARBLE

FIGURE 22 TEMMER MARBLE: SWOT ANALYSIS

10.3 TOPALIDIS S.A.

FIGURE 23 TOPALIDIS S.A.: SWOT ANALYSIS

10.4 HELLENIC GRANITE COMPANY

FIGURE 24 HELLENIC GRANITE COMPANY: SWOT ANALYSIS

10.5 NAMCO CO. SRL

FIGURE 25 NAMCO CO. SRL: SWOT ANALYSIS

10.6 CALIFORNIA CRAFTED MARBLE INC.

FIGURE 26 CALIFORNIA CRAFTED MARBLE, INC.: SWOT ANALYSIS

10.7 FOX MARBLE HOLDINGS PLC

FIGURE 27 FOX MARBLE HOLDINGS PLC: COMPANY SNAPSHOT

10.8 ASIAN GRANITO INDIA LIMITED

FIGURE 28 ASIAN GRANITO INDIA LIMITED: COMPANY SNAPSHOT

10.9 DAL-TILE CORPORATION

10.10 POLYCOR INC.

10.11 DIMPOMAR - ROCHAS PORTUGUESAS LDA

10.12 KANGLI STONE GROUP

10.13 FIRST MARBLE & GRANITE

10.14 SANTUCCI GROUP

10.15 HILLTOP GRANITES

10.16 CLASSIC MARBLE COMPANY (CMC)

10.17 DELTA MARBLE, MINING, CONSTRUCTION IMPORT AND EXPORT INC.

10.18 OTHER KEY PLAYERS

10.18.1 VETTER STONE COMPANY

10.18.2 EUROPEAN MARBLE & GRANITE

10.18.3 THE MARBLE FACTORY

10.18.4 LASA MARMO LTD. (LAASER MARMORINDUSTRIE LTD.)

10.18.5 MUMAL MARBLES PVT. LTD.

10.18.6 RK MARBLES INDIA

10.18.7 CAMPOLONGHI GROUP

10.18.8 STONEX NATURAL STONE LLC (DBA TIRMAR)

*Details on Business Overview, Products Offered, SWOT Analysis, and Mnm View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 138)

11.1 EXCERPTS FROM EXPERT INTERVIEWS

11.2 DISCUSSION GUIDE

11.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

11.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for marble. Exhaustive secondary research was carried out to collect information on the market, peer markets, and the parent market. The next step was to validate the findings obtained from secondary sources, assumptions, and sizing with industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. Other secondary sources included annual reports, press releases & investor presentations of companies, whitepapers, certified publications, articles by recognized authors, gold standard & silver standard websites, associations, regulatory bodies, trade directories, and databases.

Primary Research

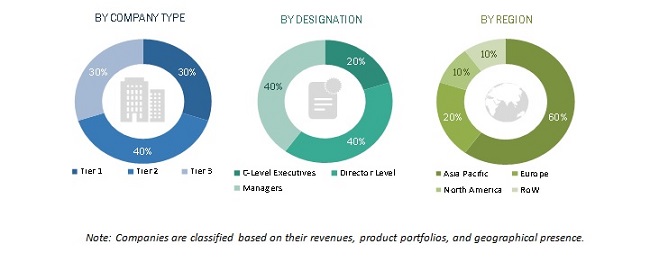

The marble market comprises stakeholders such as quarriers, producers, suppliers, and distributors, and end-users in the supply chain. The demand side of this market is characterized by developments in building materials. The supply side is characterized by market consolidation activities undertaken by marble producers. Several primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

Breakdown of Primary Participants

To know about the assumptions considered for the study, download the pdf brochure

Note: Companies are classified based on their revenues, product portfolios, and geographical presence.

Market Size Estimation:

Both, the top-down and bottom-up approaches were used to estimate and validate the total size of the marble market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of volume and value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation:

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives:

- To estimate and forecast the size of the marble market in terms of volume (Million Ton) and value (USD Million)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market across the globe

- To define, describe, and forecast the market based on color, application, and region

- To forecast the size of various segments of the market based on five main regions—Asia Pacific, North America, Europe, the Middle East & Africa, and South America, along with major countries in each region

- To identify and profile key market players and analyze their core competencies

- To map competitive intelligence on the basis of company profiles, key strategies, and developments, such as agreements, acquisitions, new product launches, joint ventures, and expansions in the market

Available Customizations:

Along with the market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis

- A further breakdown of the regional marble market to the country level by application and color

Country Information

- Regional market split by major countries

Company Information

- Detailed analysis and profiles of additional market players (up to 5)

Growth opportunities and latent adjacency in Marble Market