Managed Detection and Response (MDR) Market by Security Type (Network, Endpoint, Cloud), Deployment Mode (On-Premises and Cloud), Organization Size (SMEs and Large Enterprises), Vertical and Region - Global Forecast to 2029

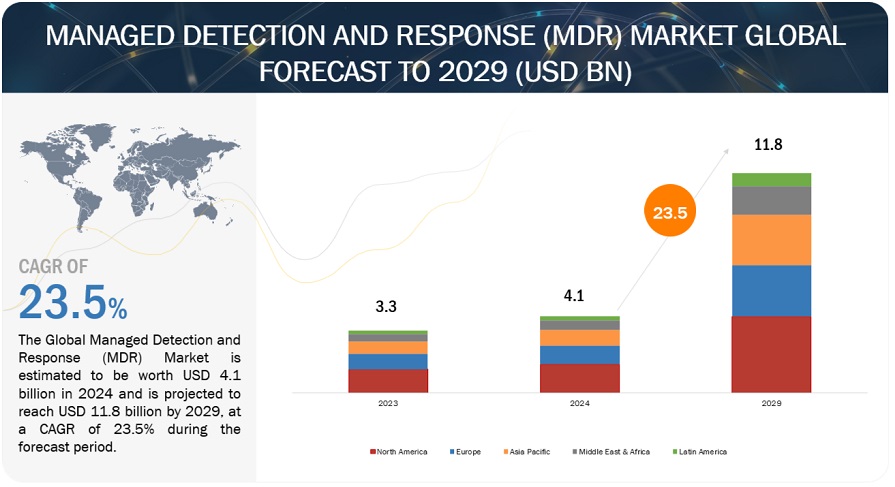

[300 Pages Report] The global Managed Detection and Response (MDR) is estimated to be worth USD 4.1 billion in 2024 and is projected to reach USD 11.8 billion by 2029, at a CAGR of 23.5% during the forecast period.

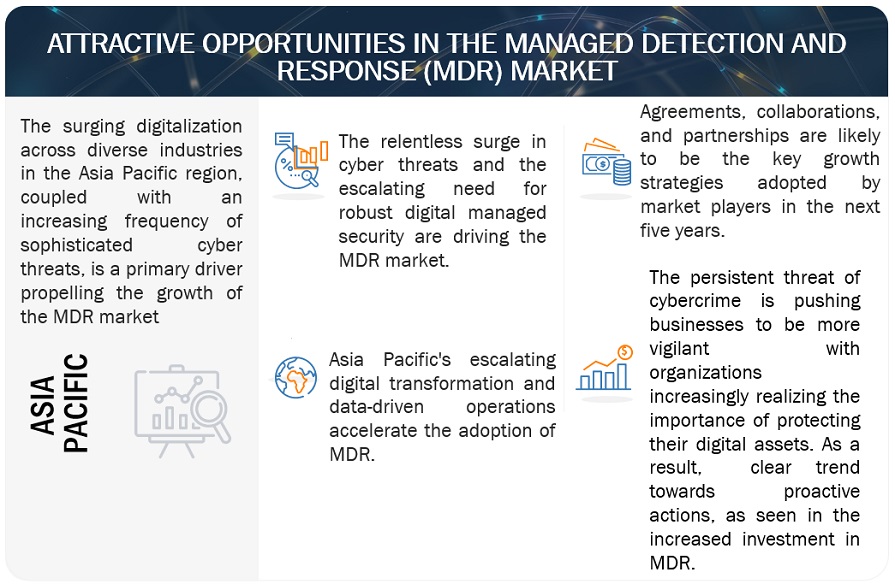

The Managed Detection and Response (MDR) market is experiencing dynamic growth, propelled by several key factors shaping the modern cybersecurity landscape. One significant driver is the evolving nature of cyber threats, with attackers becoming increasingly sophisticated and agile in their methods. Organizations face diverse threats, including ransomware, phishing attacks, and supply chain compromises, necessitating a proactive and multi-layered approach to defense. MDR services offer a comprehensive solution by combining advanced threat detection technologies with expert analysis and rapid incident response capabilities. This holistic approach enables organizations to detect and respond to threats in real time, minimizing the risk of data breaches and operational disruptions.

The global shift towards remote work and digital transformation initiatives has amplified the demand for MDR solutions. With the proliferation of cloud-based services, IoT devices, and interconnected systems, the attack surface has expanded exponentially, presenting new challenges for cybersecurity professionals. MDR services provide organizations with the scalability and flexibility to protect their distributed environments effectively. By leveraging cloud-native architectures and automation capabilities, MDR solutions can adapt to dynamic environments and scale resources based on demand, ensuring continuous protection against emerging threats. As businesses prioritize resilience and agility in the face of evolving cyber risks, the MDR market is poised for sustained growth, driven by the imperative to safeguard digital assets and maintain trust in an increasingly interconnected world.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Driver: Cyber Threats and Industry Demand

The Managed Detection and Response (MDR) market is propelled by the escalating sophistication of cyber threats, with attackers leveraging advanced techniques such as ransomware and phishing to breach organizational defenses. Stringent regulatory compliance requirements, including GDPR and HIPAA, are compelling businesses to adopt comprehensive security solutions like MDR to safeguard sensitive data and ensure compliance. The persistent shortage of skilled cybersecurity professionals drives organizations to seek outsourced security expertise through MDR services, which offer continuous monitoring, threat detection, and rapid incident response capabilities.

Restraint: Remote Work and Technology Advancements

Despite the benefits of MDR solutions, implementation challenges such as integration complexities and resource constraints may hinder adoption rates. The initial investment and ongoing subscription costs associated with MDR services can be prohibitive for some organizations and small- and medium-sized enterprises. Data privacy and confidentiality concerns may deter organizations from entrusting sensitive data to third-party MDR providers, especially in highly regulated industries.

Opportunity: Evolving Threats and Competition

The expanding remote work landscape after the COVID-19 pandemic presents significant opportunities for MDR providers to offer tailored solutions addressing the security challenges of remote work environments. Advancements in artificial intelligence, machine learning, and automation technologies enhance the capabilities of MDR solutions, enabling proactive threat detection and response. The increasing awareness of cybersecurity threats and regulatory requirements in emerging markets presents untapped opportunities for MDR providers to expand their customer base and geographic reach.

Challenge: Resource Constraints and Budget Limitations

MDR providers face challenges in keeping pace with the constantly evolving threat landscape, requiring continuous innovation and adaptation to emerging tactics and techniques threat actors use. Talent acquisition and retention pose additional challenges, as recruiting and retaining skilled cybersecurity professionals are crucial for delivering high-quality MDR services. The competitive landscape of the MDR market is intensifying, with numerous vendors vying for market share, leading to increased competition and pricing pressures.

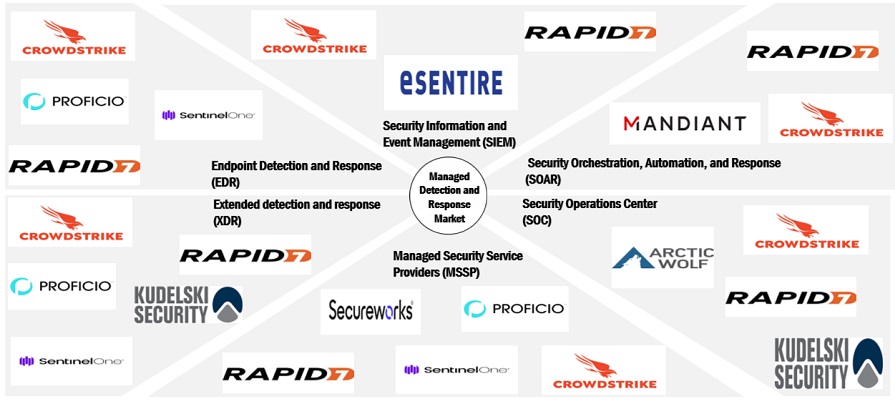

Managed detection and response (MDR) Market Ecosystem

The Managed Detection and Response (MDR) market ecosystem involves key players like IT security vendors, MSSPs, regulators, and end-user organizations across sectors. They work together to create and implement advanced AI and machine learning solutions. Continuous innovation is driven by evolving threats and regulations, aiming to strengthen defenses against attacks in the cybersecurity domain.

Key players like CrowdStrike (US), Rapid7 (US), Red Canary (US), and Arctic Wolf (US) offer comprehensive solutions covering various application areas. These offerings reflect the industry's commitment to enhancing cybersecurity across diverse technological domains to safeguard against evolving cyber risks.

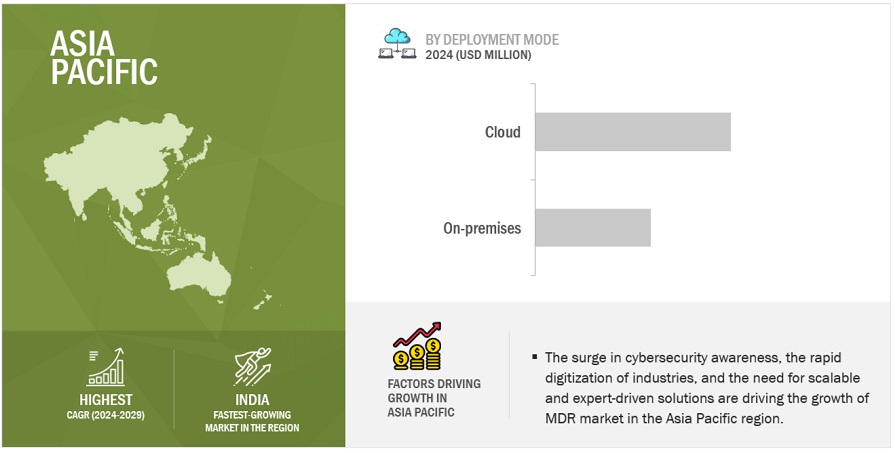

“The cloud segment will experience the highest growth rate during the forecast period by deployment mode.”

As organizations increasingly migrate their operations and data to the cloud, they seek robust security solutions to protect their digital assets effectively. Managed Detection and Response (MDR) services delivered through the cloud offer organizations scalability, flexibility, and centralized management, ensuring comprehensive protection against evolving cyber threats. The cloud's inherent resilience and redundancy enhance the reliability and availability of MDR services, further driving the adoption of cloud-based deployment models. As businesses prioritize cloud technologies to drive innovation and efficiency, the cloud segment is poised to experience substantial growth during the forecast period, cementing its position as a preferred deployment mode for MDR solutions.

“Based on organization size, the SMEs segment accounts for the largest market size.”

The SME segment is poised to claim the largest market size in the Managed Detection and Response (MDR) landscape, reflecting the increasing awareness among smaller organizations of the critical importance of cybersecurity. As SMEs become more digitally integrated and interconnected, they confront various cyber threats, including malware, phishing, and ransomware attacks. Many SMEs need more resources and expertise to implement comprehensive cybersecurity measures internally. MDR services offer a viable solution by providing SMEs with access to advanced threat detection, continuous monitoring, and expert incident response capabilities on a subscription basis. This enables SMEs to enhance their security posture without needing significant upfront investment or dedicated cybersecurity personnel. As cybersecurity continues to emerge as a top priority for SMEs aiming to protect their operations and data, the SME segment is poised to dominate the MDR market landscape.

"The Asia Pacific region is projected to exhibit the highest growth rate during the forecast period."

The Asia Pacific region is expected to showcase the most robust growth rate, underpinned by burgeoning digital transformation initiatives and a rapidly expanding digital ecosystem. As countries across Asia increasingly embrace digitalization, fueled by rising internet penetration, smartphone adoption, and cloud service utilization, the region becomes a focal point for technological innovation and economic development. The evolving threat landscape and growing awareness of cybersecurity risks drive organizations in the Asia Pacific region to prioritize investments in robust security solutions like Managed Detection and Response (MDR). With governments and businesses alike recognizing the imperative of safeguarding digital assets against cyber threats, the Asia Pacific region emerges as a key growth engine in the MDR market, poised to drive innovation and resilience in cybersecurity strategies.

Key Market Players:

The major players in the Managed Detection and Response (MDR) market are CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland),SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US).

Want to explore hidden markets that can drive new revenue in Managed Detection and Response (MDR) Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Managed Detection and Response (MDR) Market?

|

Report Metrics |

Details |

|

Market size available for years |

2018-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By security type, deployment mode, organization size, vertical and region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Managed detection and response Companies |

CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland), SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US) |

This research report categorizes the managed detection and response market to forecast revenues and analyze trends in each of the following submarkets:

Based on the Security type:

- Endpoint Security

- Network Security

- Cloud Security

- Other Security Types

Based on Deployment mode:

- On-premises

- Cloud

Based on Organization size:

- Large Enterprises

- SMES

Based on the vertical:

- BFSI

- IT and ITeS

- Government

- Energy and Utilities

- Manufacturing

- Healthcare

- Retail

- Other Verticals

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Australia and New Zealand

- India

- Rest of Asia Pacific

-

Middle East and Africa

-

Gulf Cooperation Council (GCC)

- KSA

- UAE

- Rest of GCC Countries

- South Africa

- Rest of Middle East and Africa

-

Gulf Cooperation Council (GCC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- March 2023 - Dell Technologies expanded its MDR platform to address the needs of the mid-market and customers facing skills shortages. It also added CrowdStrike as a partner to further enhance its threat management capabilities. Dell's MDR Pro Plus offers breach and attack simulations, penetration testing, continuous security training, and Incident Recovery Care.

- March 2023—Rapid7 has acquired Minerva Labs, Ltd., a leading anti-evasion and ransomware prevention technology provider. This acquisition will further extend Rapid7's MDR capabilities, enabling it to orchestrate advanced ransomware prevention.

- March 2023 - SentinelOne and Wiz have partnered to offer a cloud security solution that detects, prevents, investigates, and responds to cloud security threats. The partnership will enable customers to gain complete visibility into their infrastructure hosted in the cloud, quickly identify and remediate attack paths, and prevent threats with comprehensive runtime protection.

- January 2023 - Red Canary integrates with Microsoft Sentinel and Microsoft Defender for Cloud, detecting attacks early and stopping them more quickly for Microsoft clients. This increased integration will effectively defend against identity-based attacks, enhance cloud security coverage, and operationalize Microsoft's security capabilities. Additionally, this integration with Microsoft 365 helps to create custom detections to identify business email compromises.

- February 2022 - Arctic Wolf has completed the acquisition of Tetra Defense. With Tetra Defense’s capabilities, Arctic Wolf will further expand its Security Operations platform to confidently deliver on many critical outcomes across the security operations framework, proactively protecting existing customers from threats and helping new customers who have been breached get back to business faster.

Frequently Asked Questions (FAQ):

What is a market guide for Managed Detection and Response (MDR) services?

The Managed Detection and Response (MDR) market encompasses a range of cybersecurity services and solutions aimed at proactively monitoring, detecting, investigating, and responding to cyber threats within organizations' IT environments. MDR offerings typically include continuous threat monitoring, threat hunting, incident detection and response, forensic analysis, and remediation support. Leveraging advanced technologies such as artificial intelligence, machine learning, behavioral analytics, and expert human oversight, MDR solutions aim to provide organizations with comprehensive, real-time protection against cyber threats. The primary objective of the MDR market is to enhance organizations' security posture by mitigating risks, minimizing potential impact, and maintaining operational continuity in the face of evolving cyber threats.

What is the market size of the managed detection and response market?

The global Managed Detection and Response (MDR) is estimated to be worth USD 4.1 billion in 2024 and is projected to reach USD 11.8 billion by 2029, at a CAGR of 23.5% during the forecast period.

What are the major drivers in the managed detection and response market?

The escalating sophistication and frequency of cyber threats, including ransomware, phishing attacks, and insider threats, create a pressing need for proactive security measures. Stringent regulatory requirements, such as GDPR and HIPAA, mandate organizations to implement robust cybersecurity solutions like MDR to protect sensitive data and ensure compliance. The shortage of skilled cybersecurity professionals further drives the demand for MDR services as organizations seek outsourced security expertise to augment their defenses against evolving threats. The increasing adoption of cloud services and remote work arrangements amplifies the demand for MDR solutions as businesses strive to secure digital assets and maintain operational resilience in dynamic and distributed environments. These drivers collectively underscore the critical role of MDR in mitigating cyber risks and safeguarding organizations' digital infrastructure and data.

Who are the major players in the managed detection and response market?

The major players in the Managed Detection and Response (MDR) market are CrowdStrike (US), Rapid7 (US), Red Canary (US), Arctic Wolf (US), Kudelski Security (Switzerland), SentinelOne (US), Proficio (US), Expel (US), Secureworks (US), Alert Logic (US), Trustwave (US), Mandiant (US), Binary Defense (US), Sophos (UK), eSentire (Canada), Deepwatch (US), Netsurion (US), GoSecure (Canada), LMNTRIX (Australia), UnderDefense (US), Ackcent (Spain), Cybereason (US), Critical Start (US), Forescout (US), and Critical Insight (US).

Which key technology trends prevail in the managed detection and response market?

Several key technology trends in the managed detection and response (MDR) market are driving innovation and shaping the cybersecurity landscape. One significant trend is the increasing adoption of AI and ML algorithms to enhance threat detection and response capabilities. These technologies enable MDR solutions to analyze large volumes of data in real time, identify patterns indicative of cyber threats, and automate response actions, thereby reducing detection and response times. There is a growing emphasis on integrating threat intelligence feeds and advanced analytics to provide context-rich insights into emerging threats and enable proactive threat hunting. The shift towards cloud-native architectures and automation and orchestration tools is streamlining MDR operations, improving scalability, and enhancing the efficiency of security operations centers (SOCs). These technology trends highlight the evolving nature of MDR solutions and their crucial role in defending organizations against increasingly sophisticated cyber threats. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing incidents of business email compromise, ransomware, and crypto-jacking threats- Addressing gap in cybersecurity skills and overwhelming alert volumes- Government regulations and need for compliance to drive adoption of MDR services- Technological proliferation and increasing penetration of IoTRESTRAINTS- Lack of trust in third-party applications- Cost of MDR services to be inhibitor for organizations- False positives to hinder effectiveness of MDR servicesOPPORTUNITIES- Introduction of ML/AI-powered MDR services- Increasing adoption of MDR across SMEs- The benefits of scalability for MDR servicesCHALLENGES- Lack of modern IT infrastructure- Potential cyberattacks on MDR service provider's infrastructure

-

5.3 USE CASESTOP INSURANCE ANNUITY COMPANY BENEFITS FROM ESENTIRE’S 24/7 THREAT DETECTION, RESPONSE AND CLOUD SECURITY POSTURE MANAGEMENTCANADIAN FINANCIAL SERVICES FIRM USES ARCTIC WOLF’S MDR SERVICES TO MONITOR IT ENVIRONMENTALERT LOGIC HELPS IODINE SOFTWARE SECURE IN-PATIENT HEALTHCARE DATA AND MEET COMPLIANCE MANDATESSECUREWORKS TO SUPPORT IN STRENGTHENING CYBERSECURITY FOR GKN WHEELS AND STRUCTURESGLOBAL INVESTMENT FIRM USES MDR SERVICES TO PROTECT PROPRIETARY INFORMATION AND PRIVATE DATA

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.7 PRICING MODEL ANALYSISSELLING PRICES OF KEY PLAYERS, BY TEAM SIZE AND ENDPOINT

-

5.8 TECHNOLOGY ANALYSISEXPANSION IN API SECURITY MONITORINGINTEGRATION WITH EDGE SECURITYENDPOINT DETECTION AND RESPONSE (EDR) TOOLSNETWORK TRAFFIC ANALYSIS (NTA) TOOLSARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS BUSINESS

-

5.11 TARIFF AND REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI–DSS)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)FEDERAL INFORMATION SECURITY MANAGEMENT ACT (FISMA)GRAMM-LEACH-BLILEY ACT (GLBA)SARBANES-OXLEY ACT (SOX)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001EUROPEAN UNION GENERAL DATA PROTECTION REGULATION (EU GDPR)FFIEC CYBERSECURITY ASSESSMENT TOOLNIST CYBERSECURITY FRAMEWORKDEFENSE FEDERAL ACQUISITION REGULATION SUPPLEMENT (DFARS)INFORMATION TECHNOLOGY INFRASTRUCTURE LIBRARY (ITIL)CSA STARREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS, 2022–2023

- 6.1 INTRODUCTION

- 6.2 PROTECTIVE MONITORING

- 6.3 PRIORITIZATION OF THREATS AND ALERTS

- 6.4 THREAT HUNTING

- 6.5 MANAGED INVESTIGATION SERVICES

- 6.6 GUIDED RESPONSE

- 6.7 MANAGED REMEDIATION

- 7.1 INTRODUCTION

-

7.2 ENDPOINT SECURITYRISING DEMAND TO CURB THEFTS USING IIOT SECURITY MEASURESENDPOINT SECURITY: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

7.3 NETWORK SECURITYINCREASING BYOD TREND TO GENERATE GREATER DEMAND FOR CYBERSECURITY SOLUTIONSNETWORK SECURITY: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

7.4 CLOUD SECURITYINCREASED DEMAND FROM SMES FOR CLOUD-BASED HEALTHCARE SOLUTIONSCLOUD SECURITY: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 7.5 OTHER SECURITY TYPES

- 8.1 INTRODUCTION

-

8.2 ON-PREMISESCUSTOMIZATION OF ON-PREMISES SOLUTION DEPLOYMENT TO BOOST DEMANDON-PREMISES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

8.3 CLOUDCOST OPTIMIZATION, SCALABILITY, AND FLEXIBILITY OF CLOUD DEPLOYMENT TO DRIVE DEMANDCLOUD: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 SMALL AND MEDIUM-SIZED ENTERPRISESFLEXIBILITY AND AFFORDABILITY TO BOOST SALES OF SECURITY SOLUTIONSSMALL AND MEDIUM-SIZED ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET DRIVERSCUSTOMIZATION: SMALL AND MEDIUM-SIZED ENTERPRISES SUB TYPES

-

9.3 LARGE ENTERPRISESRISING CONCERNS ABOUT REGULATORY COMPLIANCE TO FUEL ADOPTION OF MDR SERVICESLARGE ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 BFSIRISING DEMAND FOR DATA PROTECTION SERVICES IN BANKING COMPANIES TO DRIVE MARKETBFSI: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

10.3 IT AND ITESGROWING CONCERNS OF FRAUD AND COMPLIANCE TO PROPEL MARKETIT AND ITES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

10.4 GOVERNMENT AND DEFENSERISING CONCERNS ABOUT IDENTITY THEFT AND BUSINESS FRAUD TO FUEL MARKET GROWTHGOVERNMENT AND DEFENSE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

10.5 ENERGY AND UTILITIESNEED TO SECURE CRITICAL INFRASTRUCTURE TO FUEL SEGMENT GROWTHENERGY AND UTILITIES: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

10.6 MANUFACTURINGMOBILE SECURITY TO BOOST MANAGED SECURITY INFRASTRUCTUREMANUFACTURING: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

10.7 HEALTHCARENEED TO SECURE CRITICAL PATIENT DATA ACROSS CLOUD ENVIRONMENT TO BOOST SEGMENT GROWTHHEALTHCARE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

-

10.8 RETAIL AND ECOMMERCEAUTOMATION ACROSS RETAIL CHANNELS FOR CURBING DATA THEFT TO PROPEL MARKETRETAIL AND ECOMMERCE: MANAGED DETECTION AND RESPONSE MARKET DRIVERS

- 10.9 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Presence of major solution vendors and expensive cyberattacks to drive marketCANADA- Technological advancements and stringent regulations

-

11.3 EUROPEEUROPE: MANAGED DETECTION AND RESPONSE MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Initiatives by government to prevent attacksGERMANY- Robust economy and digitalization of healthcare industry by governmentFRANCE- Highly digital and technologically advanced country with rampant cybersecurity attacksREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Managed security services to boost manufacturing verticalJAPAN- Innovative initiatives to be taken by governmentAUSTRALIA AND NEW ZEALAND- Excellent infrastructure to support endpoint security measuresINDIA- Fastest-developing country with increased digitalizationREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEKSA- Increased investment and modernization of security systemsUAE- Digitalization and modernization to lead to growth of MDR servicesSOUTH AFRICA- Weak networks and lack of robust cybersecurity policiesREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Early adopter of technology and hotspot for cybercrimeMEXICO- Rise in digitization and increased internet penetration to boost marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 REVENUE ANALYSIS OF LEADING PLAYERS

- 12.3 MARKET SHARE ANALYSIS OF THE TOP MARKET PLAYERS

- 12.4 HISTORICAL REVENUE ANALYSIS

- 12.5 RANKING OF KEY PLAYERS

-

12.6 EVALUATION MATRIX FOR KEY PLAYERSDEFINITIONS AND METHODOLOGYSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 COMPETITIVE BENCHMARKINGKEY COMPANY EVALUATION CRITERIASME/STARTUP COMPANY EVALUATION CRITERIA

-

12.8 SME/STARTUP COMPANY EVALUATION QUADRANTDEFINITIONS AND METHODOLOGYPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

12.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES AND PRODUCT ENHANCEMENTSDEALS

-

13.1 KEY PLAYERSCROWDSTRIKE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAPID7- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRED CANARY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewARCTIC WOLF- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKUDELSKI SECURITY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSENTINELONE- Business overview- Products/Solutions/Services offeredPROFICIO- Business overview- Products/Solutions/Services offered- Recent developmentsEXPEL- Business overview- Products/Solutions/Services offered- Recent developmentsSECUREWORKS- Business overview- Products/Solutions/Services offered- Recent developmentsALERT LOGIC- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSTRUSTWAVEMANDIANTBINARY DEFENSESOPHOSESENTIREDEEPWATCHNETSURIONGOSECURELMNTRIXUNDERDEFENSEACKCENTCYBEREASONCRITICAL STARTCYSIVCRITICAL INSIGHT

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 MANAGED DETECTION AND RESPONSE ECOSYSTEM AND ADJACENT MARKETS

-

14.4 MANAGED SECURITY SERVICES MARKETADJACENT MARKET: MANAGED SECURITY SERVICES, BY ORGANIZATION SIZE

-

14.5 CYBERSECURITY MARKETADJACENT MARKET: CYBERSECURITY MARKET, BY ORGANIZATION SIZE

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATIONS AVAILABLE

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MANAGED DETECTION AND RESPONSE MARKET SIZE AND GROWTH RATE, 2017–2022 (USD MILLION, Y-O-Y %)

- TABLE 4 MANAGED DETECTION AND RESPONSE MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y %)

- TABLE 5 PORTER’S FIVE FORCES IMPACT ANALYSIS

- TABLE 6 SELLING PRICES OF KEY PLAYERS (USD)

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 9 CONFERENCES AND EVENTS, 2023

- TABLE 10 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 11 MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 12 ENDPOINT SECURITY: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 13 ENDPOINT SECURITY: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 NETWORK SECURITY: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 15 NETWORK SECURITY: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 CLOUD SECURITY: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 CLOUD SECURITY: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 OTHER SECURITY TYPES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 19 OTHER SECURITY TYPES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 21 MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 22 ON-PREMISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 ON-PREMISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CLOUD: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 CLOUD: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 27 MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 MANAGED DETECTION AND RESPONSE MARKET, BY SMALL AND MEDIUM-SIZED ENTERPRISES SUB TYPE, 2017–2022 (USD MILLION)

- TABLE 31 MANAGED DETECTION AND RESPONSE MARKET, BY SMALL AND MEDIUM-SIZED ENTERPRISES SUB TYPE, 2023–2028 (USD MILLION)

- TABLE 32 SMALL-SIZED ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 SMALL-SIZED ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 MEDIUM-SIZED ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 MEDIUM-SIZED ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 LARGE ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 37 LARGE ENTERPRISES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 39 MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 40 BFSI: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 BFSI: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 IT AND ITES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 IT AND ITES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 GOVERNMENT AND DEFENSE: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 GOVERNMENT AND DEFENSE: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 ENERGY AND UTILITIES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 ENERGY AND UTILITIES: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MANUFACTURING: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 MANUFACTURING: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 HEALTHCARE: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 HEALTHCARE: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 RETAIL AND ECOMMERCE: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 RETAIL AND ECOMMERCE: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 OTHER VERTICALS: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 55 OTHER VERTICALS: MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 MANAGED DETECTION AND RESPONSE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 US: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 69 US: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 70 US: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 71 US: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 72 US: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 73 US: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 74 US: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 75 US: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 77 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 79 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 81 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 82 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 83 CANADA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 85 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 87 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 89 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 91 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 93 EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 UK: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 95 UK: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 UK: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 97 UK: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 98 UK: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 99 UK: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 100 UK: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 101 UK: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 102 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 103 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 105 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 107 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 108 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 109 GERMANY: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 111 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 112 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 113 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 114 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 115 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 116 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 117 FRANCE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 121 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 122 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 123 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 124 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 125 REST OF EUROPE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 137 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 139 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 140 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 141 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 142 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 143 CHINA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 144 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 145 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 147 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 148 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 149 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 150 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 151 JAPAN: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 152 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 153 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 154 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 155 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 156 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 157 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 158 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 159 AUSTRALIA AND NEW ZEALAND: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 160 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 161 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 162 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 163 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 164 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 165 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 166 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 167 INDIA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 186 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 187 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 188 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 189 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 190 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 191 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 192 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 193 KSA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 194 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 195 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 196 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 197 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 198 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 199 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 200 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 201 UAE: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 202 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 203 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 204 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 205 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 206 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 207 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 208 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 209 SOUTH AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 227 LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 228 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 229 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 230 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 231 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 232 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 233 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 234 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 235 BRAZIL: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 236 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 237 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 238 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 239 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 240 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 241 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 242 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 243 MEXICO: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2017–2022 (USD MILLION)

- TABLE 245 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY SECURITY TYPE, 2023–2028 (USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 247 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 248 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 249 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 250 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 251 REST OF LATIN AMERICA: MANAGED DETECTION AND RESPONSE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 252 MANAGED DETECTION AND RESPONSE MARKET: DEGREE OF COMPETITION

- TABLE 253 KEY COMPANY SERVICE FOOTPRINT

- TABLE 254 KEY COMPANY INDUSTRY FOOTPRINT

- TABLE 255 KEY COMPANY REGION FOOTPRINT

- TABLE 256 KEY COMPANY OVERALL FOOTPRINT

- TABLE 257 DETAILED LIST OF SME/STARTUP

- TABLE 258 SME/STARTUP COMPANY SERVICE FOOTPRINT

- TABLE 259 SME/STARTUP COMPANY INDUSTRY FOOTPRINT

- TABLE 260 SME/STARTUP COMPANY REGION FOOTPRINT

- TABLE 261 MANAGED DETECTION AND RESPONSE MARKET: PRODUCT/SOLUTION LAUNCHES, 2020–2023

- TABLE 262 MANAGED DETECTION AND RESPONSE MARKET: DEALS, 2020–2023

- TABLE 263 CROWDSTRIKE: BUSINESS OVERVIEW

- TABLE 264 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 CROWDSTRIKE: PRODUCT LAUNCHES

- TABLE 266 CROWDSTRIKE: DEALS

- TABLE 267 RAPID7: BUSINESS OVERVIEW

- TABLE 268 RAPID7: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 RAPID7: PRODUCT LAUNCHES

- TABLE 270 RAPID7: DEALS

- TABLE 271 RED CANARY: BUSINESS OVERVIEW

- TABLE 272 RED CANARY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 RED CANARY: PRODUCT LAUNCHES

- TABLE 274 RED CANARY: DEALS

- TABLE 275 ARCTIC WOLF: BUSINESS OVERVIEW

- TABLE 276 ARCTIC WOLF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ARCTIC WOLF: PRODUCT LAUNCHES

- TABLE 278 ARCTIC WOLF: DEALS

- TABLE 279 KUDELSKI SECURITY: BUSINESS OVERVIEW

- TABLE 280 KUDELSKI SECURITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 KUDELSKI SECURITY: PRODUCT LAUNCHES

- TABLE 282 KUDELSKI SECURITY: DEALS

- TABLE 283 SENTINELONE: BUSINESS OVERVIEW

- TABLE 284 SENTINELONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 SENTINELONE: DEALS

- TABLE 286 PROFICIO: BUSINESS OVERVIEW

- TABLE 287 PROFICIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 PROFICIO: PRODUCT LAUNCHES

- TABLE 289 PROFICIO: DEALS

- TABLE 290 EXPEL: BUSINESS OVERVIEW

- TABLE 291 EXPEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 EXPEL: PRODUCT LAUNCHES

- TABLE 293 SECUREWORKS: BUSINESS OVERVIEW

- TABLE 294 SECUREWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 SECUREWORKS: PRODUCT LAUNCHES

- TABLE 296 SECUREWORKS: DEALS

- TABLE 297 ALERT LOGIC: BUSINESS OVERVIEW

- TABLE 298 ALERT LOGIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 ALERT LOGIC: PRODUCT LAUNCHES

- TABLE 300 ALERT LOGIC: DEALS

- TABLE 301 ADJACENT MARKETS AND FORECASTS

- TABLE 302 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 303 MANAGED SECURITY SERVICES MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 304 SMALL AND MEDIUM-SIZED ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 305 SMALL AND MEDIUM-SIZED ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 306 LARGE ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 307 LARGE ENTERPRISES: MANAGED SECURITY SERVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 308 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 309 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 310 SMALL AND MEDIUM-SIZED ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2016–2021 (USD THMILLION)

- TABLE 311 SMALL AND MEDIUM-SIZED ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 312 LARGE ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 313 LARGE ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 GLOBAL MANAGED DETECTION AND RESPONSE MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1—BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOLUTIONS AND SERVICES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2—BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 8 LIMITATIONS

- FIGURE 9 GLOBAL MANAGED DETECTION AND RESPONSE MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 10 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 11 MANAGED SERVICES TO ADDRESS SHORTAGE OF SKILLED CYBERSECURITY PROFESSIONALS

- FIGURE 12 BFSI SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES

- FIGURE 13 ENDPOINT SECURITY SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- FIGURE 14 CLOUD SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

- FIGURE 17 BENEFITS GAINED BY ORGANIZATION USING MANAGED DETECTION AND RESPONSE SERVICES

- FIGURE 18 MANAGED DETECTION AND RESPONSE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 VALUE CHAIN: MDR MARKET

- FIGURE 20 ECOSYSTEM: MDR MARKET

- FIGURE 21 PORTER’S FIVE FORCES ANALYSIS: MDR MARKET

- FIGURE 22 PATENT ANALYSIS: MDR MARKET

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS BUSINESS: MDR MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 25 CLOUD SECURITY SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 26 CLOUD DEPLOYMENT MODE SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 27 SMALL AND MEDIUM-SIZED ENTERPRISES TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 28 BFSI TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 32 MANAGED DETECTION AND RESPONSE MARKET: REVENUE ANALYSIS

- FIGURE 33 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY PUBLIC SECTOR-MANAGED DETECTION AND RESPONSE PROVIDERS

- FIGURE 34 KEY PLAYERS RANKING

- FIGURE 35 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 36 EVALUATION MATRIX FOR KEY PLAYERS, 2023

- FIGURE 37 EVALUATION QUADRANT FOR SME/STARTUP: CRITERIA WEIGHTAGE

- FIGURE 38 EVALUATION MATRIX FOR SME/STARTUP, 2023

- FIGURE 39 CROWDSTRIKE: COMPANY SNAPSHOT

- FIGURE 40 RAPID7: COMPANY SNAPSHOT

- FIGURE 41 SENTINELONE: COMPANY SNAPSHOT

- FIGURE 42 SECUREWORKS: COMPANY SNAPSHOT

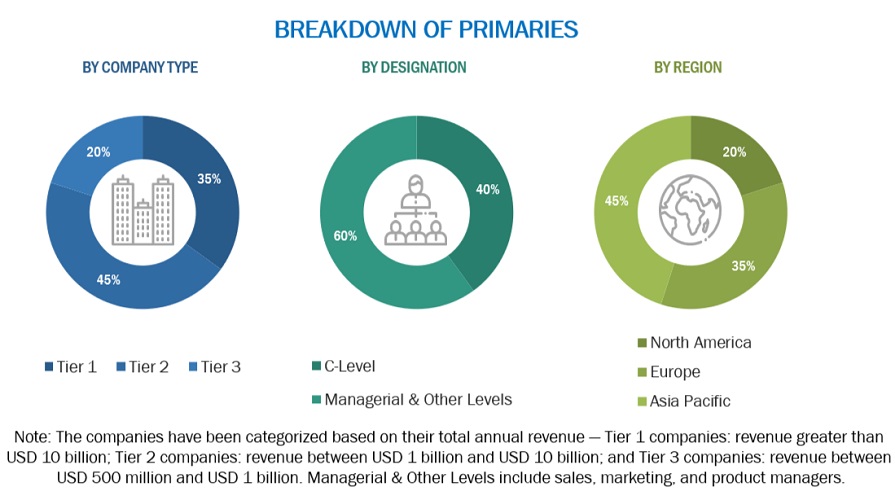

The research study involved significant activities in estimating the managed detection and response market size. Exhaustive secondary research utilized various secondary sources about the market and peer markets. To gather information for analyzing the managed detection and response market. The next step has been to validate these findings and assumptions and size them with the help of primary research with industry experts across the value chain. Primary sources included interviews with industry experts, suppliers, manufacturers, and other stakeholders across the market's value chain. These interviews with key industry figures and subject matter experts aimed to gather qualitative and quantitative data, ensuring accuracy and reliability in assessing market trends and prospects. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain critical information about industry insights, the market's monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the managed detection and response market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

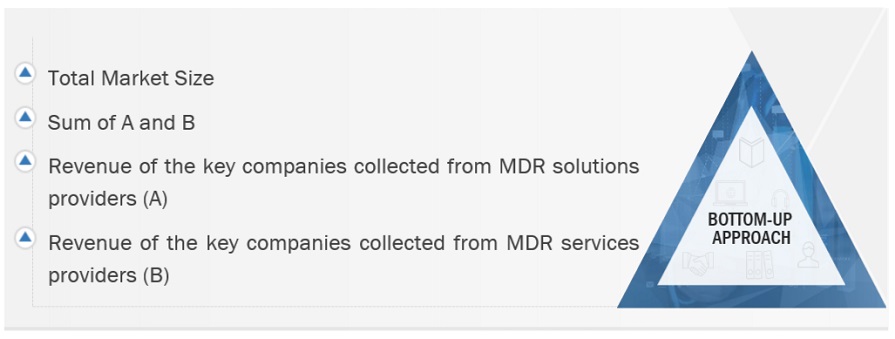

Multiple approaches were adopted to estimate and forecast the managed detection and response market. The first approach involved estimating the market size by summating companies' revenue generated through managed detection and response solutions.

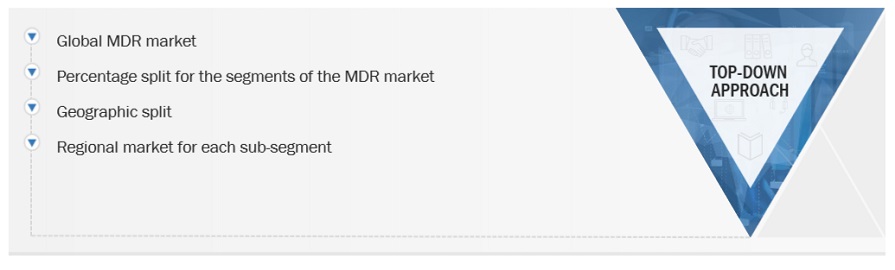

Both top-down and bottom-up approaches were used to estimate and validate the total size of the managed detection and response market. The research methodology used to estimate the market size includes the following:

- Key players in managed detection and response were identified through secondary research, and their revenue contributions in the respective regions were determined through primary and secondary research

- Regarding value, primary and secondary research have determined the industry's supply chain and market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

All the possible parameters that impact the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The Managed Detection and Response (MDR) market encompasses a range of cybersecurity services and solutions designed to proactively monitor, detect, investigate, and respond to cyber threats within an organization's IT environment. MDR offerings typically include continuous threat monitoring, threat hunting, incident detection and response, forensic analysis, and remediation support. These services are often delivered through advanced technologies like machine learning, artificial intelligence, behavioral analytics, and expert human oversight. The primary objective of the MDR market is to provide organizations with comprehensive, real-time protection against cyber threats, helping them mitigate risks, minimize potential impact, and maintain operational continuity.

Key Stakeholders

- Government bodies and public safety agencies

- Project managers

- Developers

- Business analysts

- Quality Assurance (QA)/test engineers

- Consulting firms

- Third-party vendors

- Investors and venture capitalists

- Technology providers

The main objectives of this study are as follows:

- To describe and forecast the global managed detection and response market by security type, deployment mode, organization size, vertical, and region

- To forecast the market size of five central regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the managed detection and response market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as Mergers and Acquisitions (M&A), new product developments, and partnerships and collaborations in the market

- To track and analyze the impact of the recession on the managed detection and response market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Managed Detection and Response (MDR) Market